Effective financial planning is crucial for both employees and employers, especially when it comes to organizing compensation cycles. Establishing a structured approach to remuneration not only enhances clarity but also ensures timely payments. A systematic framework allows businesses to maintain order while catering to the diverse needs of their workforce.

For many organizations, adopting a consistent rhythm for disbursing earnings helps streamline administrative tasks and improves employee satisfaction. By delineating periods for remuneration, companies can foster transparency and build trust with their staff. This article delves into the essential components of a payment framework that operates on a bi-monthly basis, offering insights into its implementation and benefits.

Moreover, understanding this structure enables better budgeting and financial forecasting. Workers can plan their expenses more effectively, leading to a more stable economic environment both at home and within the company. As we explore this concept further, we will outline practical strategies for creating an effective schedule that meets the needs of all stakeholders involved.

Understanding Bi-Weekly Payroll Schedules

A bi-weekly structure for compensation involves a consistent interval that facilitates efficient financial planning for both employees and organizations. This system enables individuals to anticipate their earnings and manage expenses more effectively. It also streamlines the administrative tasks associated with remuneration processing.

Benefits of a Bi-Weekly Payment Structure

One of the primary advantages of this arrangement is the regularity it provides. Employees receive their earnings every two weeks, which can enhance their budgeting capabilities. Additionally, this frequency often aligns with many bills and recurring expenses, allowing for smoother cash flow management.

Considerations for Employers

For organizations, adopting this payment cycle can simplify accounting practices. It establishes a predictable rhythm for processing compensations and helps in maintaining accurate financial records. However, employers should also consider the implications on overall labor costs and employee satisfaction when implementing such a system.

Benefits of a Bi-Weekly Payroll System

A bi-weekly compensation approach offers numerous advantages for both employers and employees. This method promotes efficiency and satisfaction in financial management, making it a popular choice for many organizations.

One significant benefit is the regularity it provides to workers, allowing them to better plan their personal budgets. This predictable schedule can enhance employee morale, as team members feel more secure with their finances. Additionally, businesses can streamline their administrative processes, reducing the time and resources spent on payment processing.

| Advantages | Description |

|---|---|

| Improved Financial Planning | Employees can manage their finances more effectively with consistent pay periods. |

| Increased Employee Satisfaction | Regular paychecks can lead to higher morale and loyalty among staff. |

| Operational Efficiency | Employers can optimize their financial operations, saving time and costs associated with payment processing. |

| Enhanced Cash Flow Management | Businesses can better forecast cash flow needs, aligning expenses with incoming revenue. |

Key Dates for 2025 Payroll Processing

Understanding crucial timelines is essential for effective financial management. Timely processing ensures employees receive their compensation without delays, contributing to overall satisfaction and organizational efficiency. Below are important dates to keep in mind throughout the year.

- Start of Each Pay Period: Mark the beginning of the cycle when hours worked should be recorded.

- End of Each Pay Period: Identify the final day for time entry, allowing for calculations and reviews.

- Review Period: Allocate time for supervisors to approve submitted hours and rectify any discrepancies.

- Payment Processing Date: The day when funds are transferred to employee accounts, ensuring timely deposits.

- Reporting Deadlines: Keep track of dates for submitting necessary tax documentation and other compliance forms.

Adhering to these significant milestones helps maintain a smooth operation and keeps all parties informed throughout the financial cycle.

How to Create a Payroll Calendar

Establishing a schedule for employee compensation is a crucial aspect of effective financial management within any organization. A well-structured timeline not only ensures timely payments but also aids in budgeting and planning for both the company and its staff. This guide outlines the steps to develop an efficient timeline for remuneration cycles.

Steps to Develop a Payment Schedule

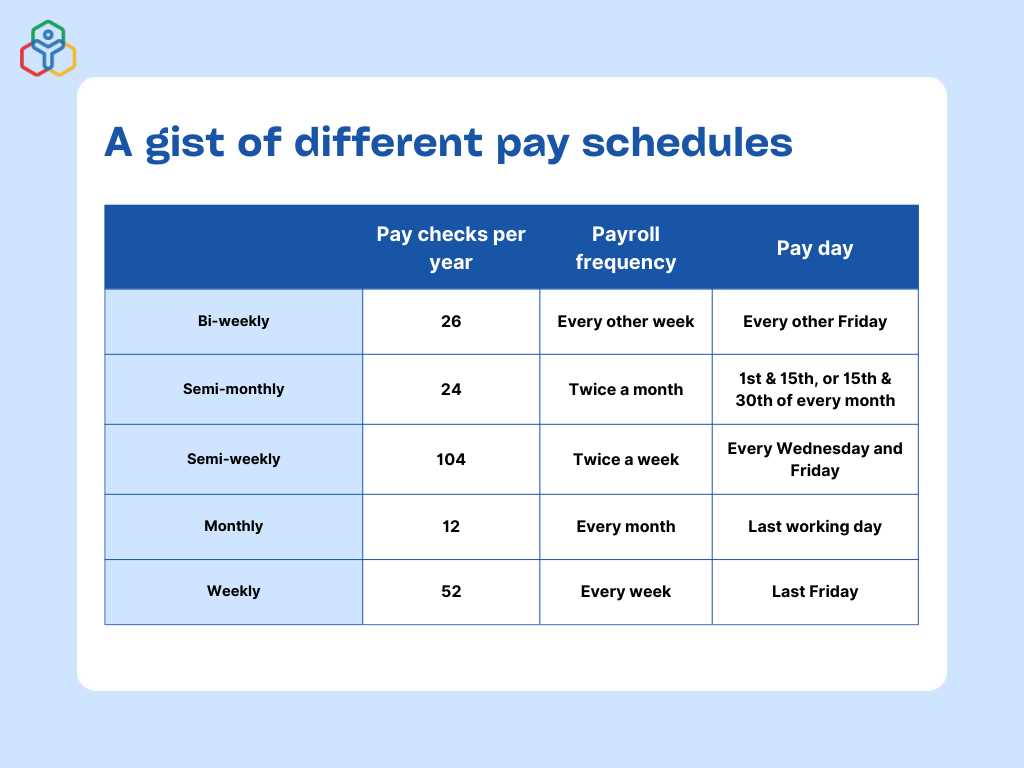

- Determine the Pay Frequency

- Choose between monthly, bi-monthly, or other suitable intervals.

- Consider the needs of your workforce and industry standards.

- Identify Key Dates

- Mark the start and end dates for each payment cycle.

- Include any holidays that may affect payment processing.

- Create a Draft

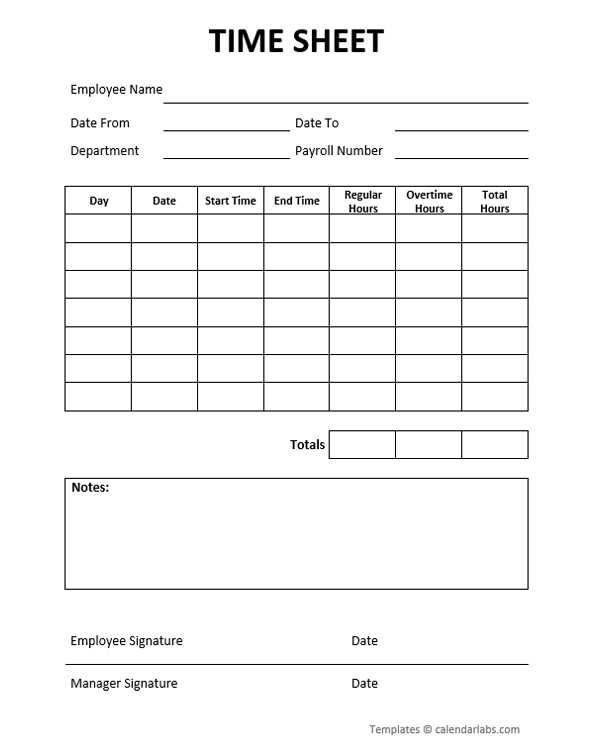

- Use a spreadsheet or other tools to map out the timeline visually.

- Ensure clarity by using color codes or different formats for various pay periods.

- Review and Adjust

- Consult with stakeholders to gather feedback on the draft.

- Make necessary adjustments based on input received.

- Finalize and Distribute

- Confirm the final version of the schedule.

- Share it with employees and relevant departments for awareness.

Best Practices for Maintenance

- Regularly review the payment timeline to ensure it remains aligned with any changes in company policy or employee needs.

- Keep clear communication channels open for any concerns regarding payment timing or processes.

- Document any modifications made to the schedule for future reference.

Essential Payroll Terminology Explained

Understanding key terms in compensation processing is crucial for effective financial management. Familiarity with this vocabulary can enhance communication within a business and streamline administrative tasks. Below are some important concepts that anyone involved in employee remuneration should know.

Key Terms

- Gross Earnings: The total amount earned by an employee before any deductions are made.

- Net Pay: The amount received by the employee after all deductions, including taxes and benefits, are subtracted from gross earnings.

- Deductions: Amounts subtracted from gross earnings for taxes, retirement contributions, and other benefits.

- Withholding: The portion of an employee’s earnings withheld by the employer for tax obligations.

- Overtime: Additional compensation for hours worked beyond the standard work schedule.

Additional Concepts

- Pay Period: The duration for which compensation is calculated, often influencing how often payments are made.

- Benefits: Non-wage compensations provided to employees, such as health insurance, retirement plans, and paid leave.

- Compensation Rate: The agreed-upon amount paid to an employee for their services, typically expressed as an hourly wage or salary.

- Compliance: Adhering to laws and regulations regarding employee compensation and taxation.

Impact of Payroll Frequency on Employees

The regularity of financial disbursements can significantly influence employee satisfaction, motivation, and overall well-being. Understanding how often team members receive their compensation can lead to better planning and improved workplace dynamics.

Financial Stability

Receiving remuneration at different intervals affects employees’ financial planning and security. Here are some key points to consider:

- More frequent payments can help employees manage their day-to-day expenses more effectively.

- Longer intervals might lead to difficulties in budgeting, especially for those living paycheck to paycheck.

- Employees may feel more in control of their finances with regular inflows, reducing stress and anxiety.

Job Satisfaction and Engagement

The timing of earnings can also impact how engaged and satisfied employees feel in their roles. Consider the following:

- Consistent and timely payments foster trust and loyalty towards the organization.

- Delayed compensation may result in frustration and decreased motivation, leading to potential turnover.

- Employees who feel secure financially are likely to be more productive and committed to their work.

Common Payroll Errors to Avoid

Managing employee compensation can be complex, and mistakes can lead to significant issues for both workers and organizations. Identifying and avoiding common pitfalls is essential to ensure a smooth compensation process and maintain employee trust.

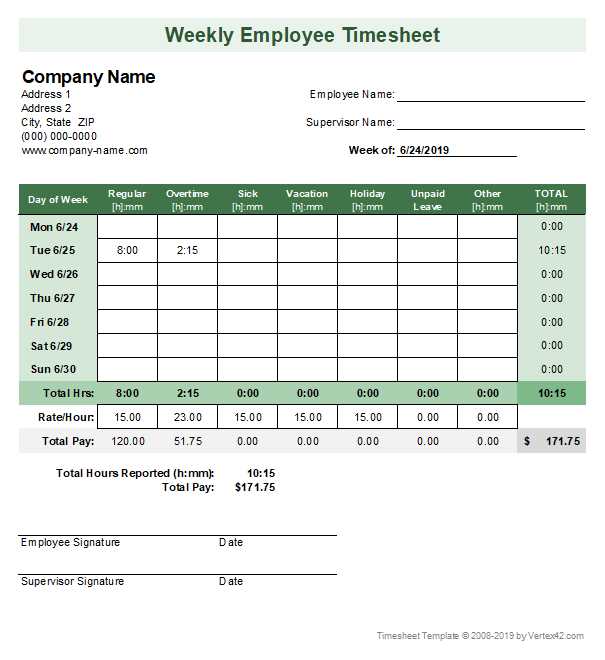

One frequent mistake is miscalculating hours worked, which can occur due to manual entry errors or misunderstandings regarding overtime rules. It’s crucial to implement accurate tracking systems to minimize discrepancies.

Another common issue is failing to update employee information promptly, such as changes in tax status or benefits enrollment. This oversight can result in incorrect deductions and affect overall earnings.

Inadequate record-keeping also poses a risk. It’s important to maintain comprehensive documentation of all transactions and adjustments to facilitate audits and compliance with regulations.

Finally, neglecting to communicate effectively with employees about their earnings and any changes can lead to confusion and dissatisfaction. Regular updates and transparency are vital to maintaining a positive workplace atmosphere.

Tools for Payroll Management Efficiency

Efficient management of employee compensation is crucial for any organization. The right instruments can streamline processes, minimize errors, and enhance overall productivity. By leveraging various resources, businesses can ensure that their compensation systems run smoothly, allowing them to focus on growth and employee satisfaction.

Automation Software

Implementing automation software can drastically reduce the time spent on manual calculations and data entry. These platforms can manage tasks such as time tracking, tax calculations, and report generation, ensuring accuracy and compliance with regulations. Furthermore, automation allows for real-time updates, enabling managers to monitor and adjust processes promptly.

Cloud-Based Solutions

Utilizing cloud-based solutions provides flexibility and accessibility for all stakeholders involved. Such platforms allow employees to access their information anytime, facilitating transparency and engagement. Additionally, cloud systems often offer robust security measures, protecting sensitive data from unauthorized access.

Incorporating these tools not only enhances operational efficiency but also fosters a more engaged workforce, ultimately contributing to the success of the organization.

Compliance with Labor Laws and Regulations

Adhering to labor laws and regulations is essential for any organization aiming to foster a fair and equitable work environment. Understanding the legal framework governing employment practices helps ensure that workers are treated justly, their rights are protected, and that businesses operate within the law. This not only mitigates the risk of legal disputes but also enhances the company’s reputation and employee satisfaction.

Key Legal Considerations

Organizations must navigate a variety of legal requirements that influence how they manage their workforce. These can include wage and hour laws, benefits entitlements, and workplace safety standards. It is crucial to stay informed about federal, state, and local regulations, as they can vary significantly and impact operational practices.

Implementation Strategies

To effectively comply with labor regulations, businesses should establish robust policies and procedures. Regular training sessions for management and employees on legal obligations are vital. Furthermore, maintaining accurate records and conducting audits can help identify potential compliance issues before they escalate.

| Compliance Area | Key Regulations | Best Practices |

|---|---|---|

| Wages | Fair Labor Standards Act (FLSA) | Regular audits of pay practices |

| Benefits | Employee Retirement Income Security Act (ERISA) | Clear communication of benefit options |

| Workplace Safety | Occupational Safety and Health Administration (OSHA) | Regular safety training and inspections |

Customizing Your Payroll Calendar Template

Adapting your scheduling framework to meet specific organizational needs can greatly enhance efficiency and clarity. Personalization allows businesses to align the timing of payments and reporting cycles with operational goals, ensuring a smoother workflow.

Identify Key Requirements: Begin by evaluating the unique demands of your organization. Consider factors such as employee payment preferences, reporting obligations, and seasonal workload variations. This assessment will guide your customization process.

Incorporate Flexibility: It’s essential to design a structure that accommodates changes. Including adjustable intervals or allowing for special pay periods can help manage unexpected circumstances without disruption.

Utilize Technology: Leveraging software solutions can streamline the creation of your framework. Many digital tools offer customizable options that can automatically calculate periods, minimizing the risk of human error.

Engage Employees: Gathering feedback from your team can provide valuable insights. Understanding their perspectives on timing and frequency can help you create a more effective and satisfying system.

Review and Adjust: Regularly revisit your design to ensure it remains aligned with evolving business needs. Periodic evaluations can highlight areas for improvement and keep the structure relevant and efficient.

Tips for Effective Payroll Planning

Efficient financial management within an organization is crucial for maintaining employee satisfaction and ensuring compliance with regulations. By adopting strategic approaches, businesses can streamline their financial processes, minimize errors, and foster a positive workplace environment.

Understand Your Obligations

It is essential to have a clear understanding of all legal responsibilities regarding employee compensation. Familiarize yourself with local labor laws, tax requirements, and benefits regulations to ensure timely and accurate payments. Staying informed will help avoid costly penalties and build trust with your workforce.

Utilize Technology

Incorporating software solutions can significantly enhance the accuracy and efficiency of financial operations. Automated systems reduce the risk of human error, provide valuable insights through data analysis, and save time on repetitive tasks. Embracing digital tools allows for better planning and a more organized approach to managing employee compensation.

Integrating Payroll with Accounting Systems

Seamlessly connecting compensation management with financial frameworks is crucial for any organization aiming for efficiency and accuracy. This integration not only streamlines operations but also enhances the overall reliability of financial reporting. By aligning these two essential components, businesses can achieve a more cohesive workflow that minimizes errors and improves data accessibility.

Benefits of Integration

Linking compensation processes to accounting systems provides numerous advantages. First and foremost, it reduces manual data entry, thereby decreasing the likelihood of human error. Additionally, automated synchronization of information ensures that financial records reflect real-time data, which is vital for informed decision-making. Moreover, organizations can gain insights into labor costs and their impact on overall financial health, facilitating better budget management.

Best Practices for Effective Integration

To ensure a successful alignment of these systems, it is essential to establish clear communication channels between departments. Regular training for staff on both systems enhances understanding and usage efficiency. Furthermore, choosing compatible software solutions that support data sharing can simplify the integration process. Regular audits and updates of the systems will also help maintain accuracy and security over time.

Employee Access to Payroll Information

In today’s fast-paced work environment, transparency in financial matters is crucial for fostering trust between employers and their staff. Employees should have the ability to access their financial records easily, enabling them to stay informed about their earnings and deductions. This accessibility not only enhances their understanding of their compensation but also promotes a sense of ownership over their financial well-being.

Providing digital access to earnings details allows individuals to view their financial statements at their convenience. This can significantly reduce confusion and inquiries directed at human resources, as employees can find the information they need independently. Moreover, when employees can readily access their data, they are more likely to engage with their financial planning and budgeting.

Employers must ensure that access is secure and user-friendly, implementing robust systems that protect sensitive information while still allowing employees to retrieve necessary data. Regular updates and clear communication about how to access this information are vital. By prioritizing these elements, organizations can create an environment where employees feel empowered and informed regarding their financial status.

Future Trends in Payroll Processing

As organizations evolve, the methods and technologies used for compensating employees are also undergoing significant transformations. The integration of innovative solutions aims to enhance efficiency, improve accuracy, and adapt to the dynamic needs of the workforce. This evolution reflects a shift towards more flexible and transparent approaches, influenced by advancements in technology and changing employee expectations.

One of the most notable trends is the increasing adoption of automation tools. By streamlining repetitive tasks, companies can minimize errors and free up human resources for more strategic activities. Moreover, real-time data access allows for quicker decision-making, enabling organizations to respond promptly to financial fluctuations and employee inquiries.

| Trend | Description |

|---|---|

| Automation | Utilization of software to handle routine functions, reducing manual input and potential errors. |

| Data Analytics | Leveraging analytics tools to gain insights into compensation trends and employee satisfaction. |

| Employee Self-Service | Providing platforms for staff to access and manage their information independently. |

| Flexible Payment Options | Offering various methods for employees to receive their earnings, enhancing convenience and satisfaction. |

In addition to these advancements, the focus on compliance and security continues to grow. Organizations are increasingly investing in technologies that ensure adherence to regulations and safeguard sensitive information. As the landscape becomes more complex, the ability to navigate these challenges will be essential for maintaining trust and efficiency.

Ultimately, the future of employee compensation is leaning towards more adaptive, user-friendly systems that prioritize both organizational needs and employee welfare. The ongoing innovation in this sector promises a more responsive and engaging experience for all parties involved.

Resources for Payroll Professionals

In the dynamic landscape of financial management, it is essential for experts in this field to have access to a variety of tools and information that streamline their processes. From software solutions to industry publications, the right resources can enhance efficiency and ensure compliance with regulations. This section highlights some valuable materials and platforms that can support specialists in their daily tasks.

Software Solutions

Innovative tools play a crucial role in managing compensation systems. Platforms that automate calculations and track hours can significantly reduce errors and save time. Many options are available, ranging from comprehensive enterprise solutions to user-friendly applications suitable for smaller organizations. Selecting the appropriate software depends on the specific needs and scale of the operation.

Industry Publications and Online Communities

Staying informed about trends and changes in regulations is vital. Subscribing to relevant journals and participating in online forums can provide insights and updates that are crucial for maintaining compliance. Engaging with a network of peers allows professionals to share experiences and solutions, fostering a collaborative environment for continuous improvement.