Effective financial management relies on a well-organized approach to employee compensation. One crucial aspect of this process is establishing a clear timeline for remuneration, which facilitates both employer planning and employee satisfaction. Having a structured framework for payment periods helps streamline administrative tasks and enhances transparency within the organization.

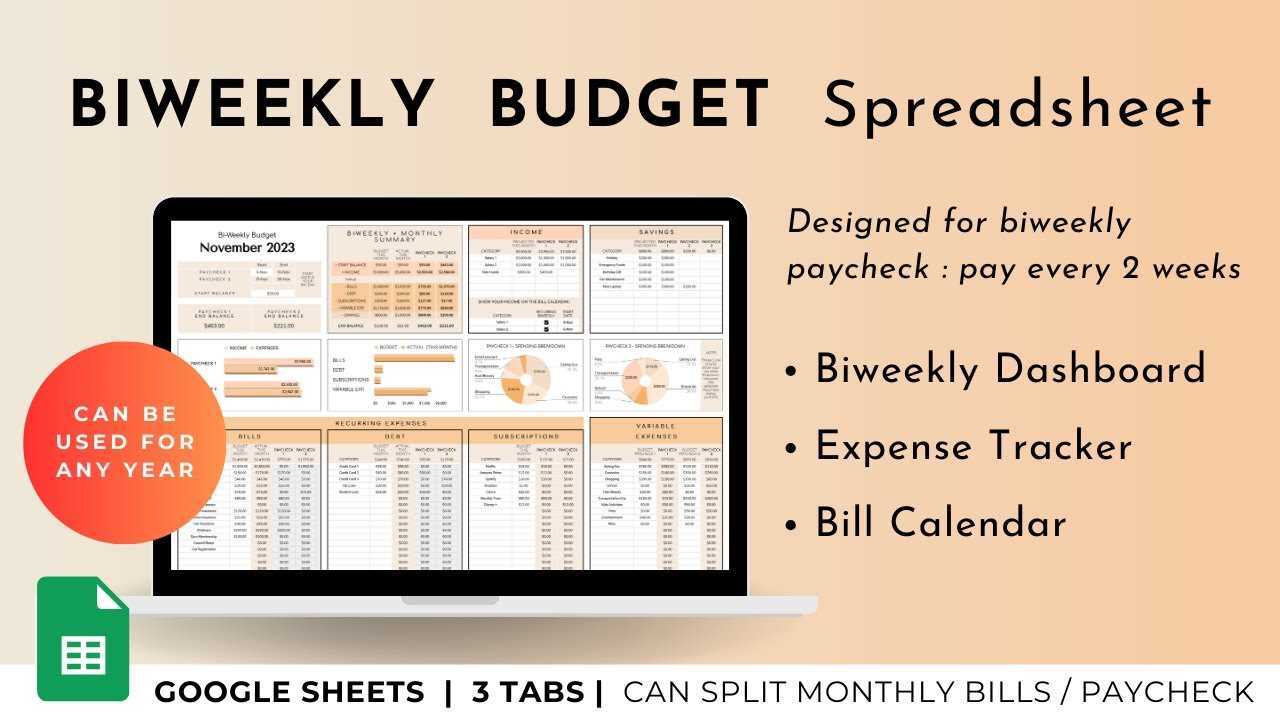

In this discussion, we will explore an organized framework that outlines payment intervals, ensuring that all parties are aware of their responsibilities and expectations. This systematic approach not only aids in budgeting but also supports employees in managing their personal finances more effectively. By understanding the nuances of these schedules, organizations can foster a more productive work environment.

Moreover, utilizing a specific format for detailing these timelines can significantly improve clarity and accessibility for both HR departments and staff. With the right tools in place, tracking payments and aligning them with financial planning becomes much simpler. Let’s delve deeper into how you can implement an effective system for periodic compensation distribution.

Understanding Biweekly Payroll Basics

The concept of a regular payment schedule is crucial for both employers and employees. It ensures that workers receive their earnings consistently, which aids in personal financial planning. Understanding the frequency and structure of these payment cycles can help clarify expectations and enhance financial stability.

Key Features of Regular Payment Cycles

- Frequency: Payments occur at set intervals, typically every two weeks, providing a predictable income stream.

- Budgeting: Regular receipts allow individuals to create more effective budgets, aligning expenses with income.

- Overtime Calculations: Understanding how extra hours are compensated is vital, as different organizations may apply varying policies.

Benefits of a Structured Payment Schedule

- Improved cash flow management for employees, aiding in timely bill payments.

- Enhanced employee satisfaction due to predictable income, contributing to overall morale.

- Streamlined administrative processes for employers, simplifying accounting and tax reporting.

Benefits of Biweekly Pay Periods

Opting for a regular payment schedule offers numerous advantages for both employees and employers. This approach enhances financial planning for workers, providing them with consistent cash flow. For companies, it streamlines administrative processes and contributes to employee satisfaction.

One significant benefit is the predictability it provides. Employees can anticipate their earnings, making it easier to budget for expenses such as rent, utilities, and groceries. This regularity can reduce financial stress, leading to improved focus and productivity at work.

Additionally, this system can help companies manage their cash flow more effectively. By aligning payment cycles with revenue generation, organizations can maintain a healthier financial position. Moreover, it can lead to reduced payroll processing costs and time efficiency.

| Advantages | Impact on Employees | Impact on Employers |

|---|---|---|

| Predictable cash flow | Easier budgeting and financial planning | Improved financial management |

| Reduced financial stress | Enhanced job satisfaction and focus | Increased employee retention |

| Streamlined processes | Less administrative burden | Cost-effective payroll management |

In summary, adopting this structure not only fosters a better financial environment for employees but also supports organizations in achieving their operational goals. Embracing such a strategy can yield substantial benefits for all parties involved.

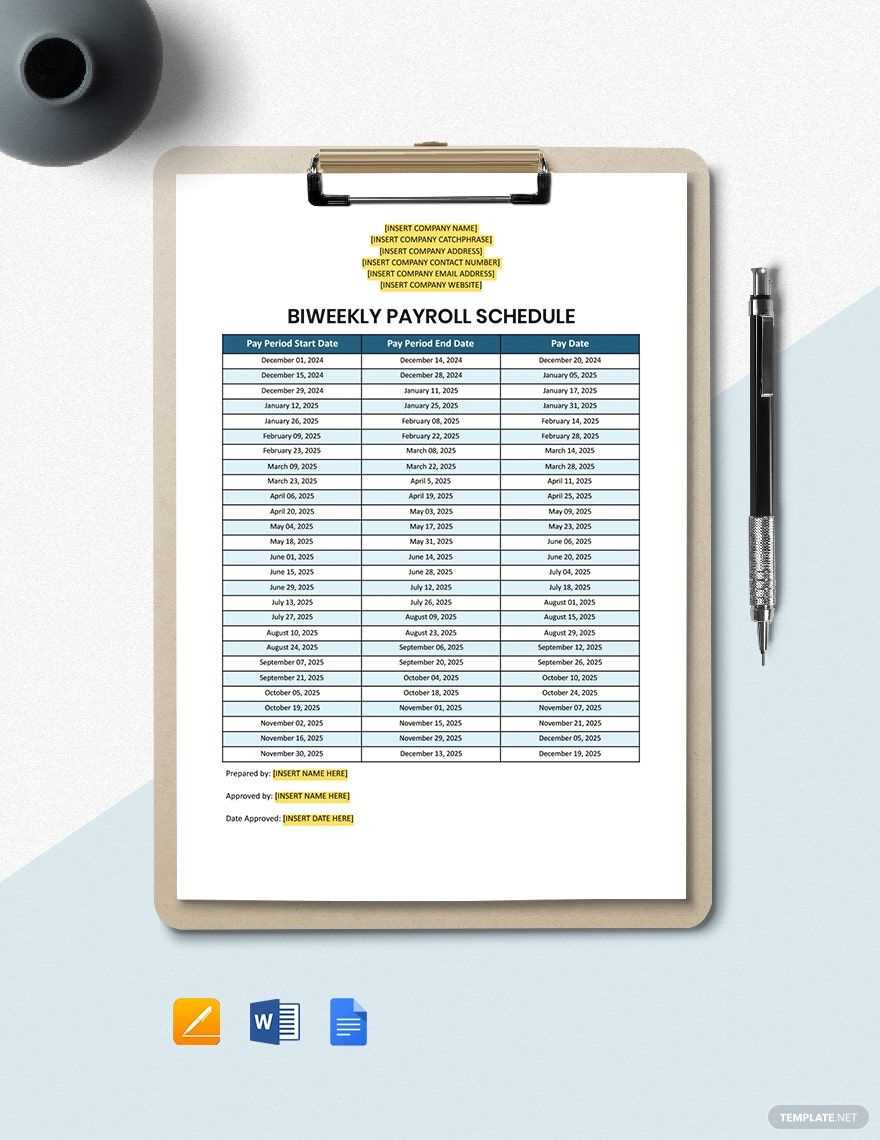

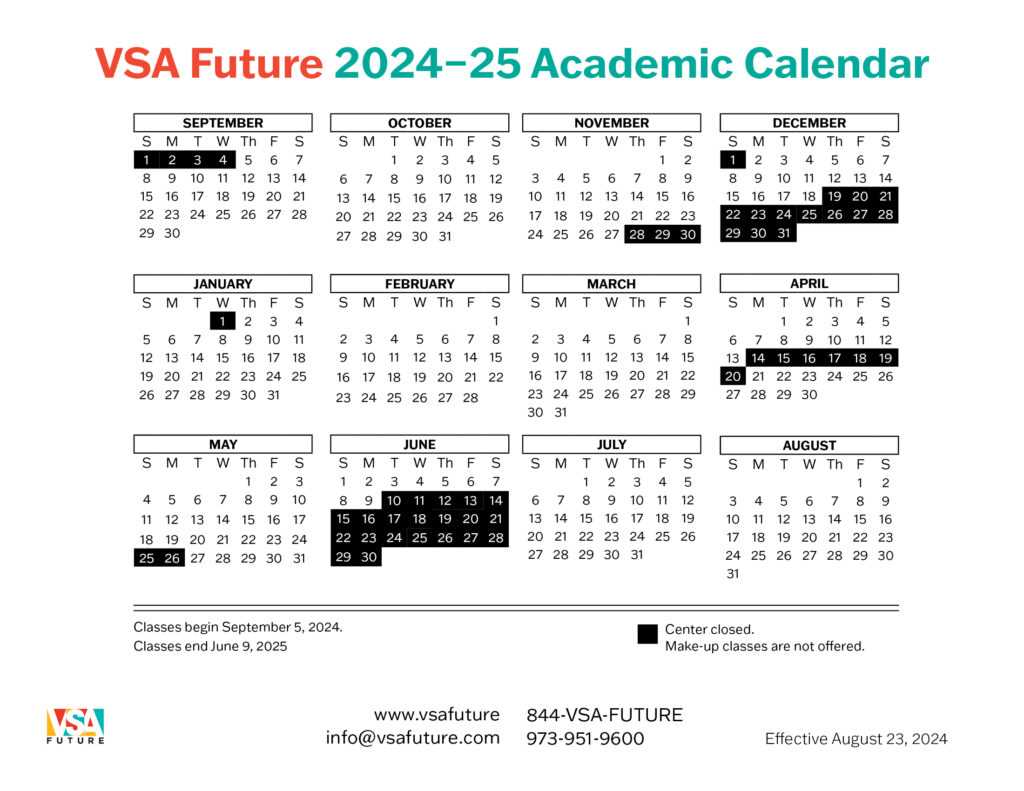

Creating a 2026 Payroll Calendar

Establishing a structured timetable for compensation disbursement is crucial for any organization. This process not only ensures employees receive their earnings on time but also helps in maintaining accurate financial records. By carefully planning the distribution intervals, businesses can enhance their operational efficiency and employee satisfaction.

Understanding the Key Elements

To create an effective schedule, it’s essential to consider several factors. Firstly, determine the frequency of disbursements that best suits your organization’s needs. Next, outline the specific dates for each payment cycle, taking into account any public holidays or potential delays. Additionally, involving relevant stakeholders in the planning phase can provide valuable insights and help avoid conflicts.

Implementation Tips

Once the structure is defined, ensure clear communication with all employees regarding the new schedule. Providing a visual representation of the payment intervals can aid in comprehension. Regularly reviewing and adjusting the timetable as necessary will help address any unforeseen challenges, ensuring a smooth process throughout the year. Emphasizing transparency in these practices fosters trust and loyalty among staff members.

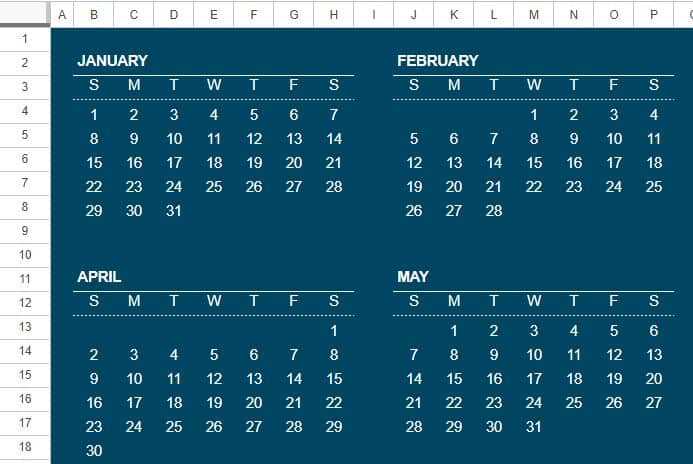

How to Use a Payroll Template

Utilizing a structured document for managing employee compensation can significantly streamline the financial operations of a business. This organized approach helps ensure that all necessary data is captured accurately and efficiently, facilitating timely payments and compliance with regulations.

Step 1: Begin by gathering all relevant information about your workforce, including names, roles, hourly rates, and any applicable deductions. Having this data readily available will simplify the process of filling out the form.

Step 2: Input the gathered information into the designated fields of your document. Ensure that each entry is correct to avoid discrepancies that could lead to payment delays.

Step 3: Once the data is entered, double-check all calculations. Most documents include automated functions to help with this, but it’s wise to verify accuracy manually.

Step 4: After confirming that all entries are accurate, proceed to distribute the completed document to your finance team or directly to the responsible personnel for processing payments.

Step 5: Finally, maintain a copy of the finalized document for your records. This not only aids in future references but also supports compliance during audits.

By following these steps, you can effectively manage the financial aspects of employee compensation, ensuring that all team members are paid correctly and on time.

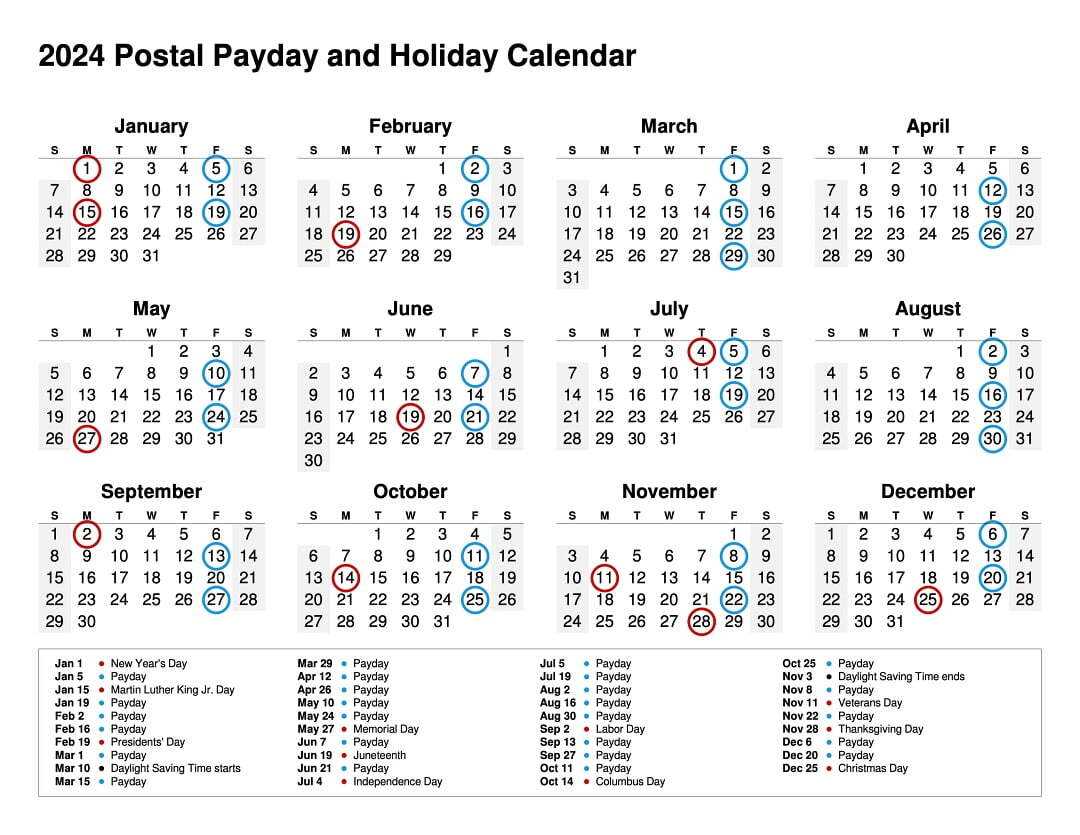

Essential Dates in 2026 Payroll Schedule

Keeping track of key dates for salary distribution is crucial for both employees and employers. Proper awareness of these moments ensures timely compensation, adherence to financial planning, and overall organizational efficiency. Below are significant dates that everyone involved should note.

Key Distribution Periods

Understanding the primary periods for remuneration helps in budgeting and financial management. The following table outlines the notable pay cycles for the upcoming year:

| Period Start | Period End | Payment Date |

|---|---|---|

| January 1 | January 14 | January 15 |

| January 15 | January 28 | January 29 |

| January 29 | February 11 | February 12 |

| February 12 | February 25 | February 26 |

| February 26 | March 11 | March 12 |

Important Considerations

Awareness of holidays and other potential disruptions is vital for effective financial management. Any changes in distribution timing due to such events should be communicated clearly to all involved parties to maintain transparency and trust.

Comparing Payroll Frequencies: Weekly vs. Biweekly

When it comes to compensating employees, organizations often face the choice between different payment schedules. Each approach has its unique characteristics, impacting both the workforce and the company’s operations. Understanding these distinctions can help in making an informed decision that aligns with organizational needs and employee preferences.

A weekly disbursement means that staff receive their earnings every seven days. This frequency can provide workers with a consistent flow of income, making it easier to manage expenses. On the other hand, a less frequent approach typically involves payments every two weeks, offering a larger sum at once, which might assist in budgeting for larger expenditures or savings.

Both methods have advantages and drawbacks. While weekly payments may enhance employee satisfaction due to their immediacy, they can also lead to higher administrative costs for the employer due to the increased frequency of processing. Conversely, a longer interval between payments can streamline administrative tasks but may leave employees waiting longer for their earnings. Weighing these factors is crucial for selecting the best option for both the organization and its staff.

Common Mistakes in Payroll Processing

Effective management of employee compensation can be a complex task, often prone to errors that can lead to significant repercussions for both staff and the organization. Understanding typical pitfalls in this process is essential for ensuring accuracy and compliance.

Frequent Errors

- Data Entry Mistakes: Simple typing errors can result in incorrect payment amounts or misallocated deductions.

- Misclassification of Workers: Failing to properly categorize employees versus independent contractors can lead to compliance issues.

- Neglecting Overtime Regulations: Ignoring laws regarding extra hours can create legal challenges and employee dissatisfaction.

- Overlooking Benefit Deductions: Failing to account for benefits can distort net pay calculations.

- Inconsistent Payment Dates: Variability in payment schedules can confuse employees and disrupt financial planning.

Strategies to Avoid Errors

- Implement a robust verification process for all data entered.

- Regularly update training for staff involved in compensation management.

- Utilize software solutions that minimize human error.

- Conduct periodic audits to ensure compliance and accuracy.

- Establish clear communication channels for addressing employee inquiries regarding compensation.

Tools for Payroll Management Efficiency

Effective administration of employee compensation is crucial for any organization. Implementing the right instruments can significantly enhance the accuracy and speed of financial processes, ensuring timely remuneration for staff while minimizing errors. Various resources are available to facilitate smooth operations and optimize the overall management experience.

Key Instruments for Streamlined Operations

- Automated Software Solutions: Utilizing comprehensive programs can help manage all aspects of employee compensation, from calculations to reporting. These tools often integrate with other business systems to provide seamless data transfer and reduce manual entries.

- Time Tracking Systems: Accurate recording of hours worked is essential for fair compensation. Implementing digital timekeeping solutions can help monitor attendance and productivity, thus providing precise data for compensation calculations.

- Data Analytics Tools: Analyzing compensation data can uncover trends and insights that inform better decision-making. Utilizing advanced analytics can lead to improved budgeting and forecasting capabilities.

Benefits of Implementing Efficient Tools

- Enhanced Accuracy: Reduces the likelihood of mistakes in calculations and record-keeping.

- Time Savings: Automates routine tasks, allowing staff to focus on more strategic initiatives.

- Improved Compliance: Helps ensure adherence to regulations and reduces the risk of penalties.

- Better Employee Satisfaction: Timely and accurate compensation fosters trust and morale among employees.

Adjusting Payroll for Holidays and Vacations

Managing compensation during holiday seasons and time off is crucial for any organization. When employees take leave for festivities or personal reasons, adjustments must be made to ensure fairness and compliance with labor regulations. A well-structured approach to these modifications helps maintain morale and satisfaction among the workforce.

Here are some key considerations for adapting remuneration practices:

- Understand Local Laws: Familiarize yourself with relevant legislation governing time off and compensation in your area. Different jurisdictions may have specific rules regarding paid holidays and vacation entitlements.

- Communicate Policies Clearly: Ensure all staff are aware of the organization’s policies regarding leave and compensation. This transparency helps manage expectations and avoids misunderstandings.

- Track Leave Accurately: Maintain precise records of all leave taken by employees. This will facilitate accurate calculations when making adjustments to their compensation.

- Plan for Seasonal Fluctuations: Anticipate periods of increased absenteeism during holidays and prepare accordingly. This may involve staffing adjustments or temporary hires to ensure smooth operations.

By implementing these strategies, organizations can effectively manage compensation during periods of leave, fostering a supportive and compliant work environment.

Legal Requirements for Payroll Timing

Timely compensation is essential for maintaining employee satisfaction and adherence to regulations. Organizations must navigate a landscape of statutory obligations that dictate when wages should be disbursed. These mandates are designed to protect workers’ rights and ensure they receive their earnings without undue delay.

Understanding the Framework

Various jurisdictions have established specific rules regarding the frequency of wage distribution. Employers must familiarize themselves with local, state, and federal laws to avoid penalties. Many regions stipulate a minimum pay frequency, while others may require immediate payment upon termination. Compliance is not only a legal obligation but also fosters trust between employers and their staff.

Consequences of Non-Compliance

Failure to adhere to the prescribed timing of remuneration can lead to significant repercussions. Employers may face fines, lawsuits, and damage to their reputation. Moreover, consistent delays in payment can result in lower morale and productivity among employees. Thus, understanding and implementing these legal requirements is crucial for any business aiming to maintain a positive work environment.

Employee Perspectives on Pay Frequency

The timing of financial compensation has a significant impact on employees’ satisfaction and financial management. Perspectives on how often one receives payment can vary widely based on individual circumstances and preferences. Some employees may appreciate a regular influx of funds to manage everyday expenses, while others might prefer a different arrangement that aligns better with their financial planning.

One common viewpoint is that receiving funds more frequently allows for better control over daily costs. For many, the immediacy of funds helps alleviate the stress associated with budgeting. This can be particularly true for those living paycheck to paycheck, where each dollar counts, and timely payments are crucial for meeting immediate financial obligations.

Conversely, some individuals advocate for less frequent distributions. They argue that longer intervals between payments can promote better financial discipline, encouraging them to save more and spend wisely. Such a perspective often stems from a desire for stability, where employees can plan larger expenditures with the assurance of accumulated funds over time.

Overall, the discussion surrounding payment frequency reflects diverse priorities and lifestyles among the workforce. Understanding these perspectives can assist organizations in creating compensation structures that align with employee needs, ultimately contributing to greater job satisfaction and retention.

Setting Up Direct Deposit for Employees

Establishing a seamless payment method for staff members enhances efficiency and satisfaction. Direct deposit is a convenient solution that ensures timely and secure transfer of funds directly into employees’ bank accounts. This method minimizes paperwork and streamlines the entire process, making it beneficial for both employers and workers.

Benefits of Direct Deposit

Implementing direct deposit offers numerous advantages. Employees appreciate the convenience of receiving their earnings automatically, eliminating the need for physical checks. This not only saves time but also reduces the risk of lost or stolen payments. Additionally, organizations can decrease administrative burdens associated with check processing and distribution.

Steps to Set Up Direct Deposit

To initiate direct deposit for your workforce, begin by selecting a reliable financial institution that supports this service. Gather the necessary banking information from your employees, such as account numbers and routing numbers. Once you have this data, coordinate with your payroll system to ensure proper integration. Finally, communicate clearly with your staff about the new process, highlighting its benefits and addressing any concerns.

Tracking Hours Worked for Payroll Accuracy

Ensuring precise compensation for employees relies heavily on the accurate documentation of hours contributed. A systematic approach to recording time can significantly reduce errors, fostering trust between staff and management. By implementing effective tracking methods, organizations can guarantee that every minute worked is accounted for, leading to fair and equitable remuneration.

Establishing Clear Guidelines is essential for effective time tracking. Providing employees with specific instructions on how to log their hours can minimize discrepancies. Whether utilizing digital tools or traditional methods, clarity in expectations promotes consistent and reliable entries.

Regular Audits play a crucial role in maintaining accuracy. Periodically reviewing recorded hours helps identify patterns and rectify any issues before they escalate. Engaging employees in this process can also enhance accountability, as they become more aware of their time management practices.

Investing in technology can further streamline the tracking process. Modern solutions offer features that automate calculations and simplify the recording of hours, significantly reducing the potential for human error. By leveraging these advancements, organizations can ensure that compensation reflects the true effort of their workforce.

Impact of Payroll Taxes on Employees

The deductions taken from employees’ earnings play a significant role in shaping their overall financial situation. These mandatory contributions are designed to fund various social programs and government initiatives. Understanding how these withholdings affect take-home pay is crucial for individuals as they plan their budgets and financial goals.

Financial Implications

One of the most immediate effects of these deductions is the reduction in net income. When employees receive their compensation, the amounts deducted for taxes can substantially lower their disposable income, impacting their ability to save and spend. This reduction can lead to tighter budgets and may require individuals to adjust their spending habits to accommodate their new financial reality.

Long-Term Considerations

Moreover, these contributions are not just short-term impacts; they can have long-lasting effects on future benefits. The funds collected are often allocated to retirement, healthcare, and unemployment benefits. Thus, while employees may feel the strain of reduced earnings now, their contributions may provide essential support during retirement or times of need. It is vital for individuals to recognize the dual nature of these deductions: immediate financial pressure balanced by potential future security.

Communicating Payroll Changes to Staff

Effectively conveying updates regarding compensation structures is essential for maintaining transparency and trust within an organization. Clear communication ensures that employees are well-informed about any modifications, which can alleviate confusion and foster a positive work environment.

Importance of Timely Notifications

Providing staff with timely updates is crucial, as it allows individuals to plan their finances accordingly. When changes are implemented, employees appreciate advance notice so they can adjust their budgeting and expectations. This practice not only demonstrates consideration for their needs but also enhances overall job satisfaction.

Methods of Communication

There are various effective methods to share important information about changes in compensation. Utilizing multiple channels can help reach all employees effectively. Below are some recommended approaches:

| Communication Method | Description |

|---|---|

| Email Notifications | Direct emails can be sent to all employees, outlining the specific changes and their implications. |

| Staff Meetings | Organizing meetings provides an opportunity for face-to-face discussions, allowing staff to ask questions and express concerns. |

| Intranet Announcements | Posting updates on the company’s internal website ensures easy access for all employees at any time. |

| Printed Notices | Distributing printed materials can be effective for employees who may not have regular access to digital communication. |

By choosing the right communication methods and timing, organizations can ensure that staff feel valued and informed during periods of change, ultimately promoting a supportive workplace culture.

Integrating Payroll with Accounting Systems

Connecting compensation management with financial tracking tools is crucial for any organization aiming for streamlined operations and enhanced accuracy in their financial reporting. This integration ensures that employee remuneration data flows seamlessly into the accounting framework, reducing the potential for errors and improving overall efficiency. By synchronizing these systems, businesses can achieve better visibility into their financial health and simplify their operational processes.

Benefits of Integration

Establishing a connection between these two essential systems offers numerous advantages:

- Improved data accuracy through automated updates

- Streamlined financial reporting

- Reduced manual entry, saving time and effort

- Enhanced compliance with regulations

Implementation Strategies

To successfully merge compensation processing with financial systems, consider the following approaches:

| Strategy | Description |

|---|---|

| Choose Compatible Software | Select tools that are designed to work together for seamless data transfer. |

| Establish Clear Protocols | Define the data flow processes to ensure accuracy and consistency. |

| Regularly Update Systems | Keep software up-to-date to leverage new features and maintain security. |

| Train Staff | Ensure employees are knowledgeable about both systems to maximize efficiency. |

Evaluating Payroll Software Options

Choosing the right software solution for managing employee compensation is crucial for any organization. The effectiveness of such systems can significantly impact overall efficiency and employee satisfaction. When assessing various software options, it’s essential to consider features that align with the specific needs of your business.

First, analyze the range of functionalities offered by each program. Look for solutions that facilitate not just calculations but also time tracking, tax compliance, and reporting capabilities. A comprehensive suite can streamline processes, reducing manual errors and saving valuable time.

Next, examine the user interface and experience. A well-designed system enhances usability, making it easier for staff to navigate and access necessary information. Training requirements should also be minimal to ensure a smooth transition and quicker adaptation by your team.

Lastly, consider the level of customer support and updates provided by the software vendor. Reliable assistance can prove invaluable when unexpected issues arise. Regular updates are essential to keep up with regulatory changes and to enhance security measures, safeguarding sensitive information.

Preparing for Year-End Payroll Reporting

As the conclusion of the financial year approaches, it’s crucial for businesses to ensure that all financial records are accurate and up to date. This period marks a time of reflection and preparation, as organizations gather the necessary data for comprehensive reporting. Proper organization can help streamline the process, minimize errors, and ensure compliance with regulatory requirements.

Key Steps for Effective Preparation

To facilitate a smooth reporting experience, consider the following essential actions:

- Review employee records for accuracy, including names, addresses, and social security numbers.

- Confirm that all earnings and deductions are correctly recorded in the system.

- Communicate with team members regarding any changes in employment status, such as terminations or new hires.

- Ensure that all tax withholdings and benefits contributions are accurately reflected.

Compliance and Deadlines

Understanding the necessary compliance standards and upcoming deadlines is vital. Here are some important points to remember:

- Familiarize yourself with the reporting requirements specific to your region and industry.

- Schedule internal deadlines to complete data collection and review to allow for adequate time for corrections.

- Stay updated on any changes in tax laws that may impact your reporting obligations.