Planning a comprehensive schedule for employee compensation is crucial for any organization. A well-structured timeline not only ensures timely payments but also helps in managing cash flow effectively. By establishing clear intervals for remuneration, businesses can enhance employee satisfaction and streamline financial operations.

In this article, we will explore the intricacies of crafting a reliable and organized framework for regular pay cycles. With careful attention to detail, you can create a system that meets the needs of both your workforce and your financial objectives. Understanding the benefits of a systematic approach will empower you to optimize your payroll processes.

From establishing payment intervals to ensuring compliance with relevant regulations, this guide aims to provide you with valuable insights. Whether you are an HR professional or a business owner, mastering this aspect of financial management is key to fostering a productive work environment.

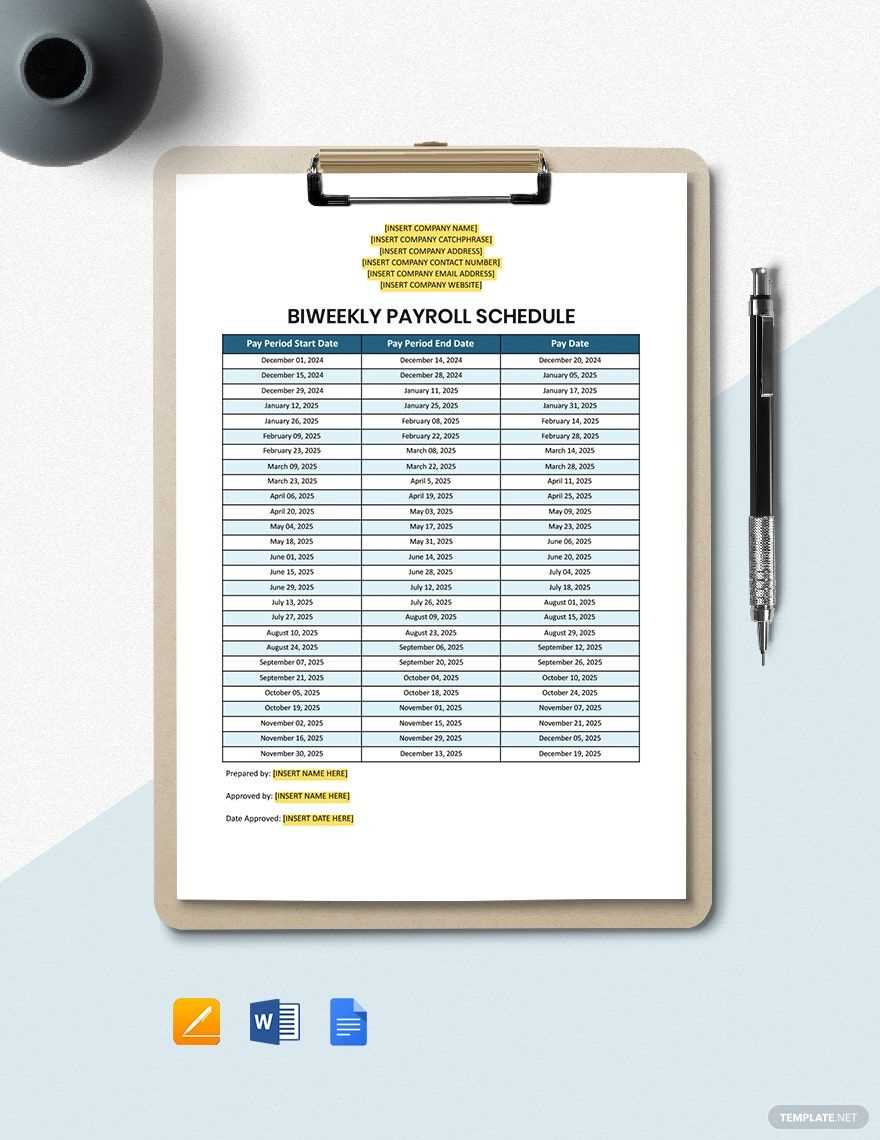

Understanding the 2026 Payroll Calendar

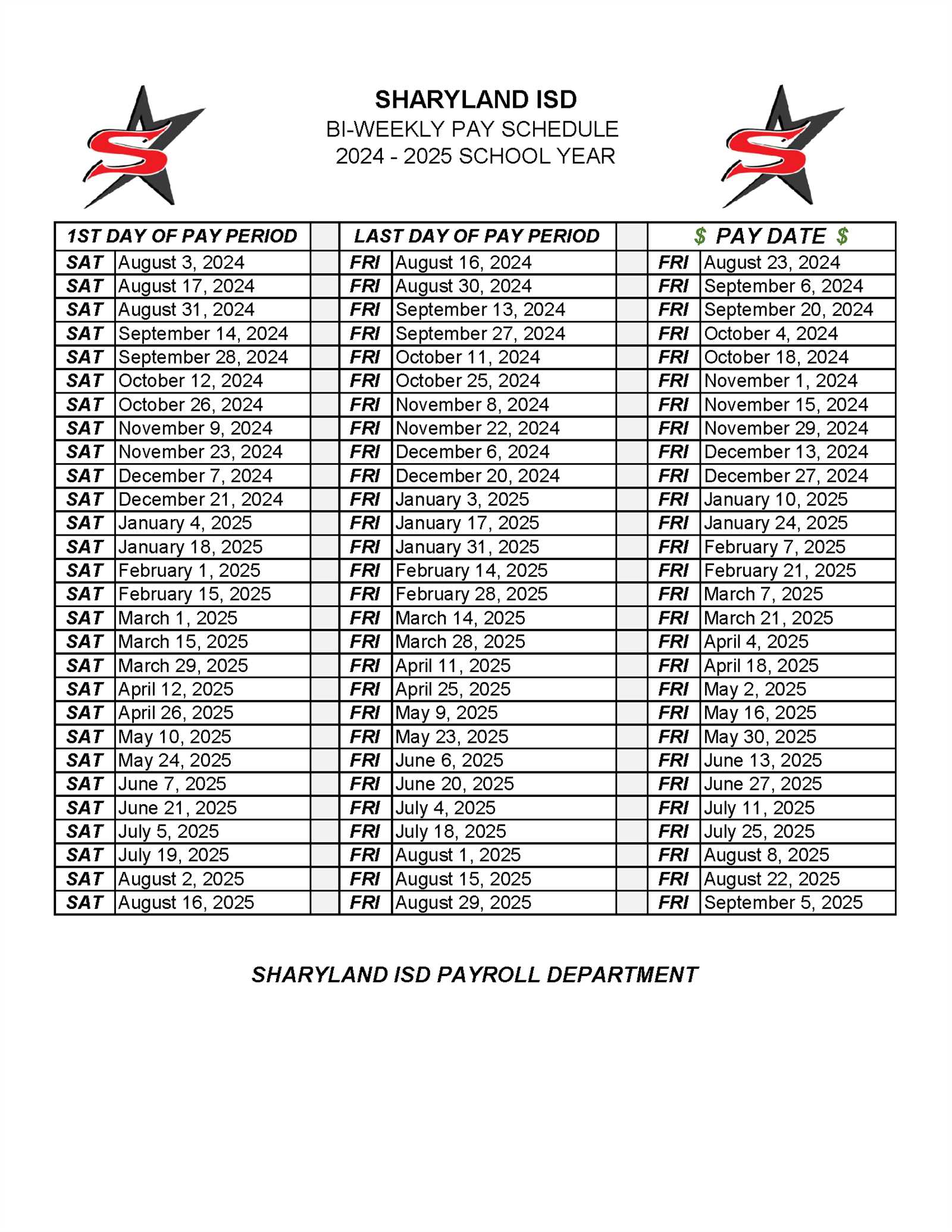

Having a clear structure for managing employee compensation is crucial for any organization. It ensures that all individuals receive their earnings in a timely manner, while also facilitating proper budgeting and financial planning for the company. The framework for disbursing wages is often laid out in an organized format that helps both employers and employees stay informed.

This framework is typically divided into several key periods throughout the year. Each of these intervals is significant as it marks the time frame within which earnings are calculated, deductions are made, and payments are issued. Understanding how these periods align with the overall business cycle can greatly enhance operational efficiency.

| Period | Start Date | End Date | Payment Date |

|---|---|---|---|

| First Pay Period | January 1 | January 14 | January 15 |

| Second Pay Period | January 15 | January 28 | January 29 |

| Third Pay Period | January 29 | February 11 | February 12 |

| Fourth Pay Period | February 12 | February 25 | February 26 |

By breaking down the year into these manageable intervals, businesses can maintain a systematic approach to compensating their workforce. This not only promotes clarity but also helps in adhering to compliance and financial regulations. Understanding this framework is essential for effective human resource management.

Benefits of a Biweekly Payroll Schedule

Implementing a regular payment system can significantly enhance the financial experience for both employers and employees. This approach not only fosters improved cash flow management but also aligns with the budgeting cycles of most individuals, creating a harmonious balance in financial planning.

Consistency in Payments: A regular payment interval offers employees predictability regarding their income. This stability allows for better financial management, as workers can plan their expenses and savings with greater accuracy.

Increased Employee Satisfaction: When employees receive their earnings more frequently, it can lead to higher job satisfaction. This regular influx of funds helps in reducing financial stress, making employees feel more secure and valued.

Streamlined Administrative Processes: For organizations, a fixed payment schedule can simplify accounting practices. Regular intervals mean less frequent calculations and reconciliations, allowing payroll departments to operate more efficiently and effectively.

Enhanced Budgeting Capabilities: With a consistent disbursement schedule, businesses can better manage their cash flow. This predictability aids in financial forecasting and planning, ensuring that funds are available when needed.

Attracting Talent: Offering a well-structured payment system can serve as a competitive advantage in attracting top talent. Candidates often view this as a benefit, which can improve recruitment efforts and overall employee retention.

In summary, adopting a regular payment frequency can yield numerous advantages for both organizations and their workforce, fostering a more stable and positive financial environment.

Key Dates for 2026 Payroll Processing

Effective management of employee compensation requires careful attention to specific timeframes throughout the year. Identifying these critical periods helps ensure timely and accurate distribution of wages, which is essential for maintaining staff satisfaction and compliance with regulations. Below are important dates to keep in mind for smooth operations.

Important Dates Overview

- Start of New Period: This is when the accounting cycle resets, marking the beginning of a new time frame for processing compensation.

- Midpoint Review: A crucial date for evaluating hours worked and adjustments that may be needed.

- End of Period Submission: The final deadline for submitting all necessary information to facilitate accurate calculations.

- Distribution Day: When employees receive their payments, ensuring they are informed of any discrepancies.

Monthly Reminders

- Document submission deadline: Employees must submit their timecards and any relevant documentation by this date.

- Audit and reconciliation period: Ensure all records are checked for accuracy before final calculations.

- Final payment processing: Confirm that all payments are processed and distributed as scheduled.

Staying organized and aware of these key dates will facilitate a seamless experience for both administrators and employees. Regular updates and reminders can further enhance efficiency and mitigate potential issues related to compensation management.

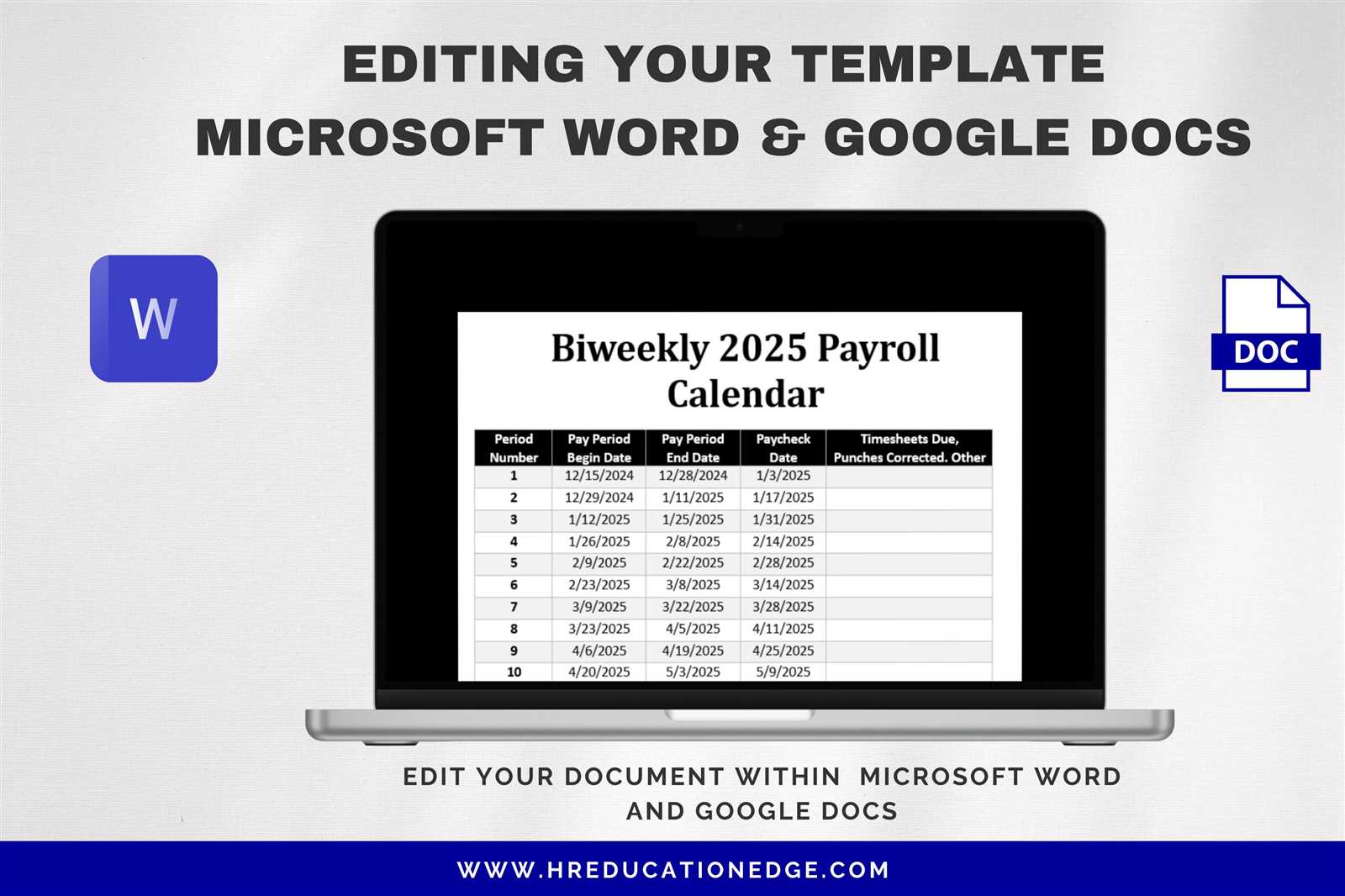

How to Create a Payroll Template

Designing a systematic structure for managing employee compensation can greatly enhance efficiency and accuracy. A well-organized format allows for streamlined calculations, ensures compliance with regulations, and simplifies record-keeping. This guide will walk you through the essential steps to construct an effective outline for processing wages.

Step 1: Define Your Structure

Begin by determining the key components you need in your outline. This may include sections for employee details, compensation rates, deduction categories, and payment dates. A clear structure helps maintain organization and clarity.

Step 2: Build Your Outline

Once you have your components, it’s time to create your document. Below is a sample layout to consider:

| Employee Name | Position | Hours Worked | Rate per Hour | Total Compensation | Deductions | Net Pay |

|---|---|---|---|---|---|---|

| John Doe | Developer | 80 | $25 | $2000 | $300 | $1700 |

| Jane Smith | Designer | 75 | $30 | $2250 | $350 | $1900 |

This table format allows for easy input of information and calculation of totals, making it a practical choice for managing employee earnings and deductions.

Essential Components of Payroll Templates

Effective financial management in any organization hinges on well-structured documentation that simplifies the process of compensating employees. A comprehensive framework should incorporate key elements that ensure accuracy, compliance, and clarity, facilitating smoother operations for both human resources and staff members.

Key Elements to Include

To create a functional framework, certain fundamental components must be present. These elements contribute to the reliability and usability of the documentation, enabling seamless integration into the existing administrative systems.

| Component | Description |

|---|---|

| Employee Information | Details such as names, identification numbers, and positions to accurately identify each individual. |

| Payment Period | Clearly defined time frames indicating when payments are processed, ensuring timely compensation. |

| Gross Earnings | Total earnings before deductions, providing transparency in compensation calculations. |

| Deductions | Items such as taxes, benefits, and other withholdings that reduce the total amount received by employees. |

| Net Pay | The final amount employees receive after all deductions, critical for personal budgeting. |

Importance of Customization

Every organization has unique requirements, making it vital to tailor these documents to meet specific needs. Customization enhances functionality, ensures compliance with local regulations, and addresses particular internal policies, ultimately leading to greater efficiency in managing employee compensation.

Comparing Biweekly and Monthly Payrolls

When it comes to employee compensation, organizations often choose between different payment schedules, each with its own advantages and challenges. The frequency of disbursement can significantly affect both the company’s cash flow and employees’ financial management. Understanding these variations is crucial for employers and employees alike.

Benefits of Frequent Payments

More regular disbursements can enhance financial liquidity for employees, allowing them to manage their expenses more effectively. This option often leads to increased satisfaction, as workers receive their earnings sooner, which can help in budgeting for bills and daily costs. Additionally, organizations that adopt a more frequent payment approach may find it easier to attract and retain talent.

Advantages of Less Frequent Payments

On the other hand, less frequent disbursements can simplify administrative processes. Organizations may experience reduced payroll processing costs and fewer transactions, leading to less overhead. This method also enables better long-term financial planning for both the organization and its employees, as larger sums are distributed less often. It can be particularly beneficial for businesses that have irregular cash flow or operate in seasonal markets.

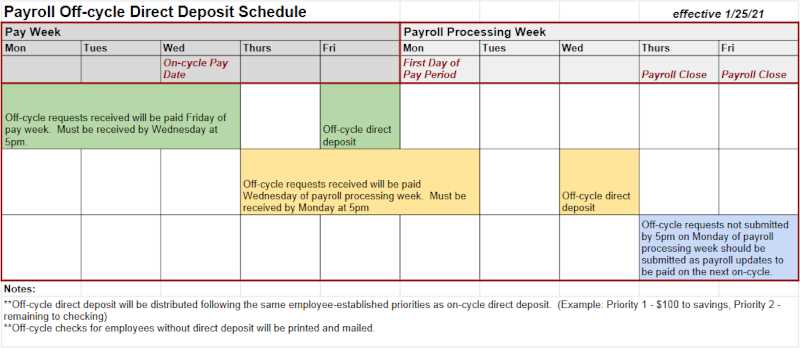

Impact of Holidays on Payroll Dates

The presence of holidays can significantly influence the scheduling of employee compensation disbursements. When a designated payment day coincides with a public holiday, it often necessitates adjustments to ensure that workers receive their earnings on time. This can lead to confusion if employees are not adequately informed about changes in the regular routine.

Additionally, certain holidays may prompt organizations to implement early payment schedules. This proactive approach helps maintain employee satisfaction and avoids potential cash flow issues that could arise from delayed transactions. Employers need to consider these factors to effectively manage their financial operations while keeping their workforce content.

Furthermore, the frequency and types of holidays observed can vary by region and industry. As such, it’s crucial for companies to stay aware of local regulations and cultural practices, as these can affect how and when salaries are processed. By carefully planning around these occasions, organizations can ensure compliance and foster a positive work environment.

Legal Considerations for Payroll Scheduling

Establishing a regular compensation cycle is essential for any organization, yet it comes with a range of legal obligations that must be carefully navigated. Understanding the various regulations and compliance requirements can help mitigate risks and ensure smooth financial operations. Below are key points to consider when setting up a compensation timetable.

Compliance with Labor Laws

Organizations must adhere to federal and state labor laws that dictate payment frequency. Non-compliance can lead to legal repercussions and penalties. Key considerations include:

- Minimum wage laws

- Overtime regulations

- Payment deadlines and grace periods

- Recordkeeping requirements

Employee Classification

Accurate classification of workers is crucial, as it impacts compensation scheduling. Misclassifying employees can result in significant liabilities. Important classifications include:

- Exempt vs. non-exempt employees

- Full-time vs. part-time workers

- Temporary and contract labor

Properly addressing these legal aspects helps organizations maintain compliance and fosters trust with employees, ultimately supporting a healthy work environment.

Tips for Accurate Payroll Calculations

Ensuring precise calculations for employee compensation is crucial for maintaining trust and efficiency within any organization. Accurate remuneration not only reflects the value of work performed but also helps to comply with legal obligations. Here are some essential strategies to enhance accuracy in compensation computations.

- Maintain Up-to-Date Records: Regularly update employee information, including changes in status, salary adjustments, and deductions. Accurate records are the foundation for correct calculations.

- Utilize Reliable Software: Invest in robust software designed for financial management. This can automate many aspects of the process, reducing the likelihood of human error.

- Double-Check Calculations: Implement a system of checks where calculations are verified by another team member. This additional layer of scrutiny can catch mistakes before they impact employees.

- Stay Informed on Regulations: Keep abreast of local and national regulations affecting compensation. Changes in tax laws or benefits can significantly impact calculations.

- Educate Staff: Provide training for those involved in compensation processes. Ensuring that all team members understand the system will lead to more consistent and accurate results.

By following these strategies, organizations can foster a more reliable environment for employee compensation, ultimately leading to higher satisfaction and productivity.

Using Software for Payroll Management

In today’s fast-paced business environment, leveraging technology for financial operations has become essential. Software solutions designed for managing employee compensation streamline processes, reduce errors, and enhance overall efficiency. By automating calculations and record-keeping, organizations can focus more on strategic initiatives rather than mundane administrative tasks.

Benefits of Automation

Employing automated systems can significantly minimize the risk of inaccuracies in financial records. These tools often feature built-in compliance updates, ensuring that businesses adhere to current regulations without constant manual oversight. Additionally, they provide real-time data access, enabling better decision-making and resource allocation.

Choosing the Right Solution

When selecting a software program for managing employee compensation, it’s crucial to consider factors such as scalability, user-friendliness, and integration capabilities with existing systems. A tailored solution can accommodate specific organizational needs, enhancing productivity and ensuring that all financial operations run smoothly.

Common Payroll Mistakes to Avoid

Managing employee compensation can be complex, and errors can lead to significant issues for both the organization and its staff. Awareness of frequent pitfalls is essential for maintaining accuracy and compliance in compensation processes.

One common mistake is miscalculating hours worked. Whether due to manual entry errors or improper tracking methods, inaccuracies can result in employees being underpaid or overpaid, which may lead to dissatisfaction and legal complications.

Another frequent issue involves failing to stay updated on tax regulations. Tax laws can change frequently, and not being aware of these changes can lead to incorrect withholding amounts and potential penalties.

Additionally, neglecting to maintain clear records can create problems during audits or when addressing employee inquiries. Proper documentation ensures transparency and facilitates smoother operations.

Lastly, overlooking communication with employees about their compensation details can result in misunderstandings and a lack of trust. Regular updates and clear explanations foster a better workplace environment and encourage open dialogue.

Updating Employee Information for 2026

As we approach the upcoming cycle, it’s crucial to ensure that all personnel details are current and accurate. Keeping employee records up-to-date facilitates smooth operations and enhances overall efficiency within the organization. Accurate information helps in managing various processes effectively and ensures compliance with regulations.

To streamline the update process, consider the following key steps:

- Review Current Information

- Communicate with Staff

- Utilize Technology

- Establish Deadlines

- Implement Regular Audits

By implementing these steps, organizations can create a systematic approach to maintain employee records. Regular updates not only benefit the company but also enhance employee satisfaction and trust.

Ensure that every member of the team is aware of the importance of providing accurate information and understands the procedure for making necessary changes. Clear communication will lead to a more organized and responsive work environment.

Best Practices for Payroll Record Keeping

Effective management of employee financial documentation is crucial for any organization. Maintaining accurate and organized records ensures compliance with regulations and facilitates smooth operations. Adopting sound practices can help minimize errors and streamline processes, ultimately benefiting both the workforce and management.

Organizing Documentation

Establish a systematic approach to storing records. Utilize digital tools for archiving important files, which can enhance accessibility and security. Create a standardized naming convention and folder structure to ensure all documents are easy to locate. Regularly review and update these records to reflect any changes in employee status or compensation.

Regular Audits and Backups

Conduct periodic reviews of your documentation to identify discrepancies and ensure accuracy. Regular audits can help catch errors before they become significant issues. Additionally, implement a backup strategy to protect against data loss. Keeping multiple copies in different formats or locations can safeguard against unforeseen events.

Adjusting for Overtime in Payrolls

Effectively managing additional hours worked by employees is crucial for any organization. Accurate calculations ensure that staff members are compensated fairly while maintaining compliance with labor regulations. This section explores the key aspects of adjusting compensation for those extra hours.

To achieve precise calculations for overtime, consider the following factors:

- Understanding Overtime Rates: Familiarize yourself with the different rates applicable, typically 1.5 times the regular hourly wage for hours exceeding the standard workweek.

- Tracking Work Hours: Implement reliable systems for monitoring when employees clock in and out, including any breaks taken.

- Account for Different Pay Structures: Recognize variations in pay for different roles, which may require specific calculations for overtime based on job classification.

- State Regulations: Be aware of local laws that may impose stricter requirements than federal guidelines.

Steps for Calculating Overtime:

- Determine the regular hourly wage.

- Calculate total hours worked during the designated period.

- Identify hours that qualify as overtime.

- Apply the appropriate overtime rate to the qualifying hours.

- Add the overtime compensation to the regular earnings for total pay.

By incorporating these practices, organizations can enhance their compensation processes and foster a more motivated workforce.

Employee Access to Payroll Information

Access to financial details is crucial for employees to manage their personal finances effectively. Providing transparent and readily available information empowers individuals to understand their earnings, deductions, and overall compensation. This section explores the various methods through which employees can obtain and review their financial records.

Methods of Access

- Online Portals

- Mobile Applications

- Printed Statements

Utilizing these methods enhances convenience and allows employees to stay informed about their financial situations. Organizations should ensure these resources are user-friendly and secure.

Importance of Transparency

- Builds Trust: Open access fosters a trusting relationship between employees and management.

- Encourages Financial Literacy: Employees become more aware of their earnings and expenses.

- Supports Compliance: Easy access to information helps organizations adhere to legal requirements.

By prioritizing clear access to financial details, companies can create a more engaged and informed workforce, ultimately benefiting the overall organizational culture.

Integrating Payroll with Other HR Functions

Effective management of employee compensation goes beyond mere calculations; it intersects with various human resource activities, creating a cohesive approach that enhances overall organizational efficiency. By harmonizing the compensation processes with other HR functions, organizations can ensure that they meet compliance standards, improve employee satisfaction, and streamline operations.

One key area of integration is with recruitment. When hiring new talent, understanding compensation structures allows HR professionals to offer competitive packages that attract top candidates. This collaboration helps in:

- Establishing clear salary ranges for different positions.

- Creating transparent communication about benefits and bonuses.

- Aligning hiring strategies with budgetary constraints.

Another significant function is performance management. Linking compensation with employee performance evaluations fosters a culture of accountability and motivation. This integration can include:

- Implementing merit-based increases tied to performance reviews.

- Utilizing data analytics to assess the impact of rewards on employee productivity.

- Aligning organizational goals with individual performance metrics.

Additionally, integrating compensation processes with employee development programs ensures that workforce training and promotions are aligned with compensation strategies. This can involve:

- Identifying skill gaps and aligning training budgets with compensation structures.

- Providing pathways for career advancement linked to compensation incentives.

- Fostering a culture of continuous improvement through targeted training.

Finally, compliance and reporting are critical components that benefit from integration. Ensuring that compensation practices meet regulatory requirements not only protects the organization but also enhances trust among employees. This can be achieved by:

- Regular audits of compensation practices for compliance with labor laws.

- Maintaining accurate records to facilitate transparent reporting.

- Implementing technology solutions that streamline data sharing across departments.

In conclusion, a well-integrated approach to compensation within the broader HR framework not only optimizes processes but also creates a supportive environment where employees feel valued and motivated.

Future Trends in Payroll Processing

As organizations evolve, so too do the methods of managing employee compensation. The landscape is shifting towards more innovative solutions that enhance efficiency, accuracy, and user experience. Emerging technologies and changing workforce dynamics are driving this transformation, ensuring that compensation systems are more adaptable and responsive to the needs of both employers and employees.

Technological Advancements

Automation and artificial intelligence are leading the charge in revolutionizing how compensation is calculated and distributed. With these tools, companies can streamline operations, reduce human error, and free up resources for strategic initiatives. Real-time data analytics will empower businesses to make informed decisions regarding employee remuneration, enabling a more personalized approach to financial management.

Focus on Employee Experience

As the workforce becomes increasingly diverse and remote, the emphasis on employee satisfaction is paramount. Flexible payment options, such as instant payments and mobile access, are gaining traction. Organizations are recognizing the importance of offering user-friendly systems that enhance engagement and transparency. This shift not only fosters loyalty but also attracts top talent in a competitive market.

Resources for Payroll Professionals

In the ever-evolving landscape of financial management, having access to reliable tools and information is crucial for those involved in employee compensation management. A variety of resources can significantly enhance the efficiency and accuracy of handling wage distribution and related tasks.

One essential resource is professional associations that offer a wealth of knowledge, training, and networking opportunities. These organizations often provide access to industry best practices, compliance updates, and workshops tailored to current trends and technologies.

Additionally, there are numerous online platforms featuring articles, webinars, and forums where practitioners can share experiences and solutions. These digital communities foster collaboration and keep professionals informed about new developments that could impact their work.

Finally, utilizing software solutions designed for managing compensation processes can streamline operations. Many of these tools come equipped with features that automate calculations and ensure adherence to regulations, ultimately saving time and reducing errors.