In today’s fast-paced world, maintaining an organized financial timetable is crucial for businesses and employees alike. Effective planning not only ensures timely compensation but also enhances overall productivity and satisfaction within the workforce.

This guide aims to explore various methods for structuring your payment periods, providing you with valuable insights to streamline your processes. By employing a well-thought-out approach, you can ultimately simplify the complexities of remuneration and improve fiscal management.

Whether you are a small business owner or part of a larger organization, understanding the nuances of financial planning can significantly impact your operations. Join us as we delve into the best practices for crafting a seamless schedule that aligns with your organizational goals.

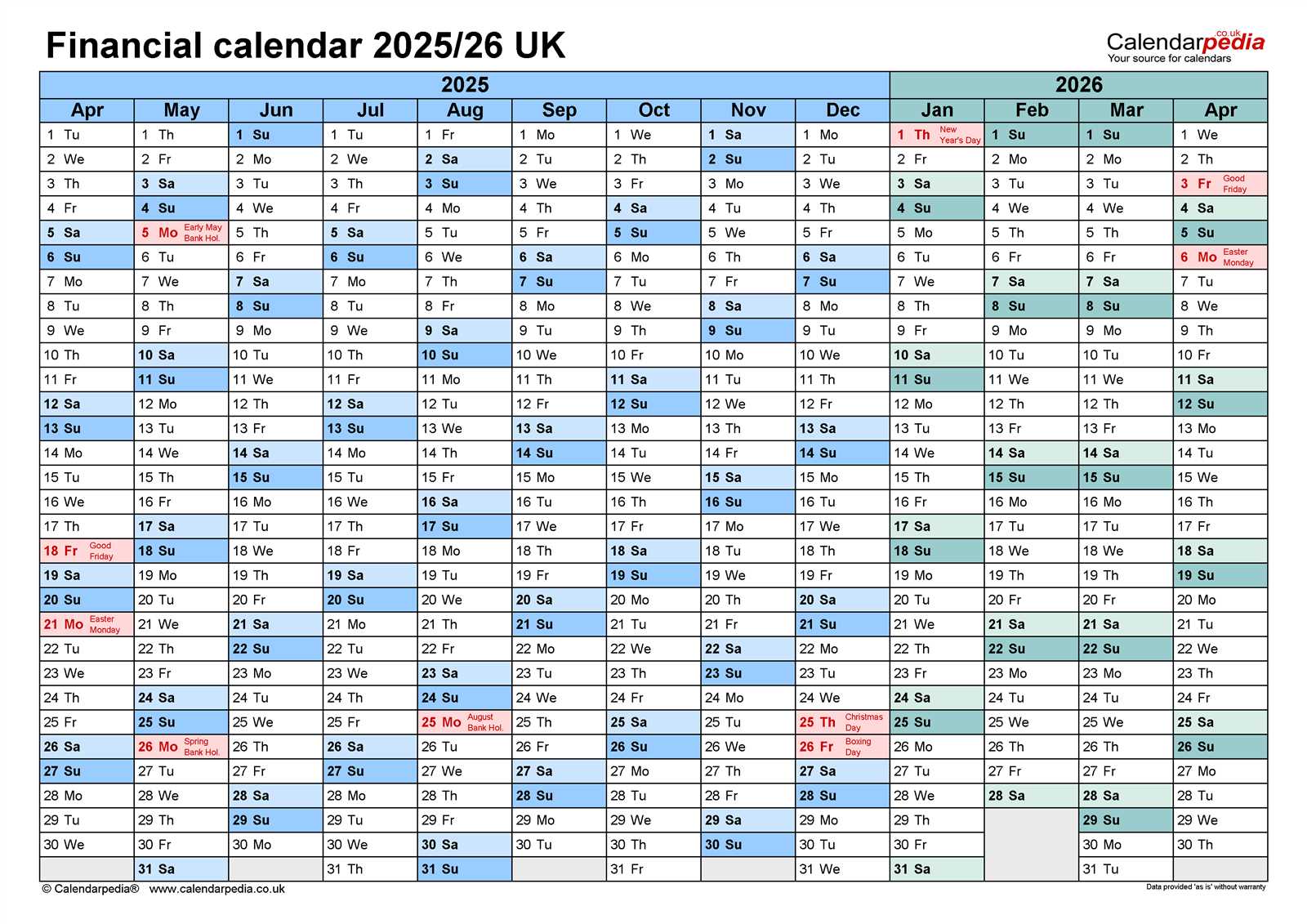

Understanding the 2026 Payroll Calendar

Planning financial disbursements for employees involves a systematic approach that ensures timely payments throughout the year. This framework helps organizations manage their budgeting and forecasting effectively, aligning payroll cycles with operational needs.

Key Components of the Payment Schedule

Several elements contribute to a successful payment structure:

- Frequency of Payments: Knowing how often employees receive their compensation–weekly, bi-weekly, or monthly–affects financial planning.

- Cut-off Dates: These are critical for processing payments and ensuring accuracy in financial records.

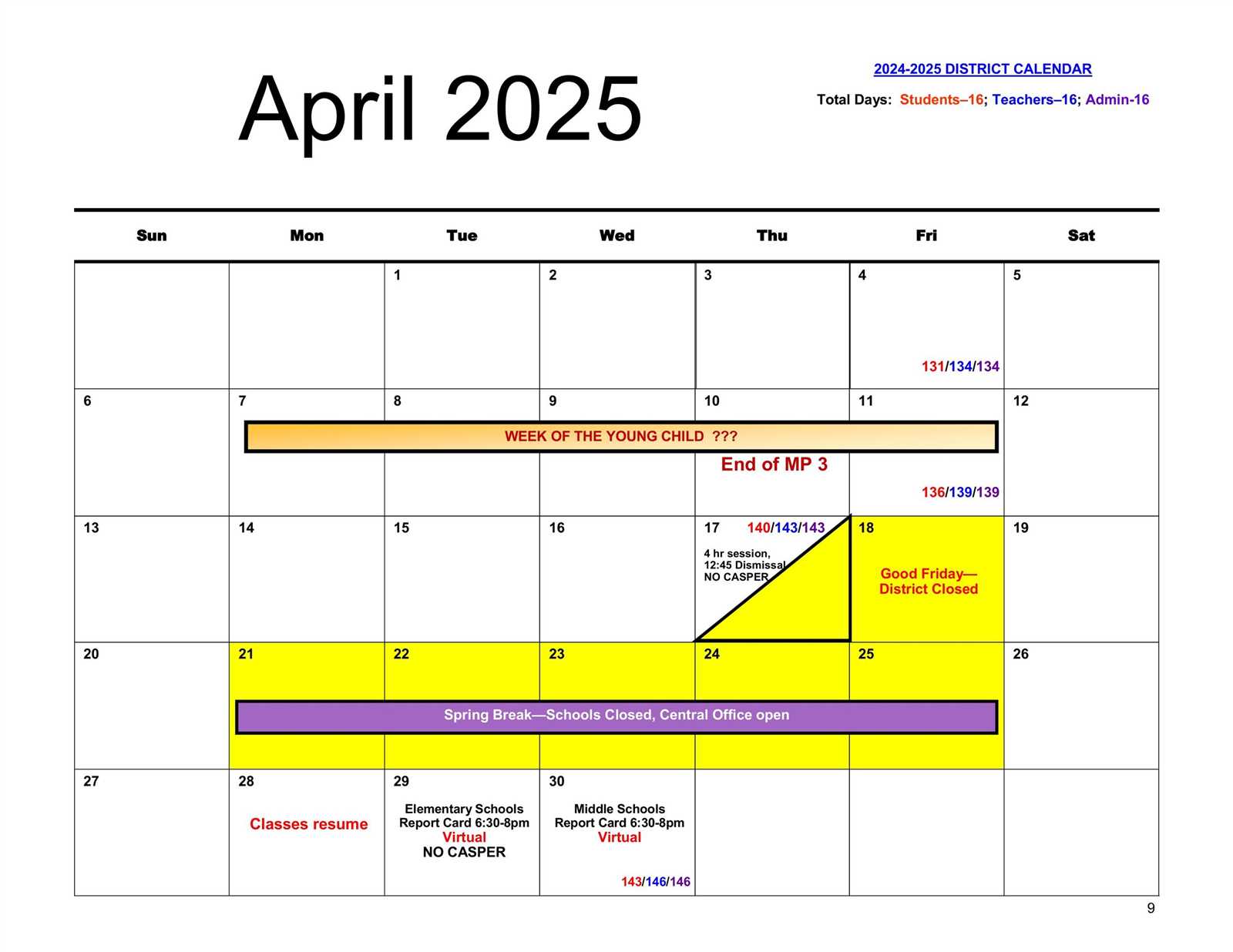

- Holidays and Non-Working Days: Recognizing public holidays is essential to avoid delays in payment processing.

Benefits of an Organized Payment System

A well-defined approach to managing disbursements offers several advantages:

- Enhanced Accuracy: Reduces the risk of errors, ensuring employees are paid correctly and on time.

- Improved Employee Satisfaction: Timely payments contribute to a positive workplace environment.

- Better Financial Management: Helps businesses maintain cash flow and meet financial obligations efficiently.

Importance of Payroll Calendars

Effective time management in compensation processes is crucial for any organization. A structured approach to scheduling payment cycles not only enhances operational efficiency but also fosters a reliable relationship between employers and employees. Having a clear outline for remuneration periods helps in avoiding delays and misunderstandings, which can negatively impact morale and productivity.

Enhancing Financial Planning

A well-defined schedule for disbursement allows businesses to manage cash flow effectively. By knowing exactly when payments are due, organizations can plan their expenses and allocate resources accordingly. This foresight is essential for maintaining financial stability and ensuring that obligations are met without unnecessary strain.

Improving Compliance and Record-Keeping

Adopting a systematic approach to payment timelines aids in adhering to legal requirements and regulations. Consistent documentation of payment periods supports accurate reporting and reduces the risk of errors. This meticulous record-keeping is vital for audits and can safeguard against potential disputes, thereby enhancing organizational integrity.

Key Features of a Payroll Template

A well-structured scheduling framework is essential for efficient financial management in any organization. Such a framework not only simplifies tracking of employee remuneration but also ensures compliance with relevant regulations. Understanding the core attributes of this tool can greatly enhance its effectiveness and usability.

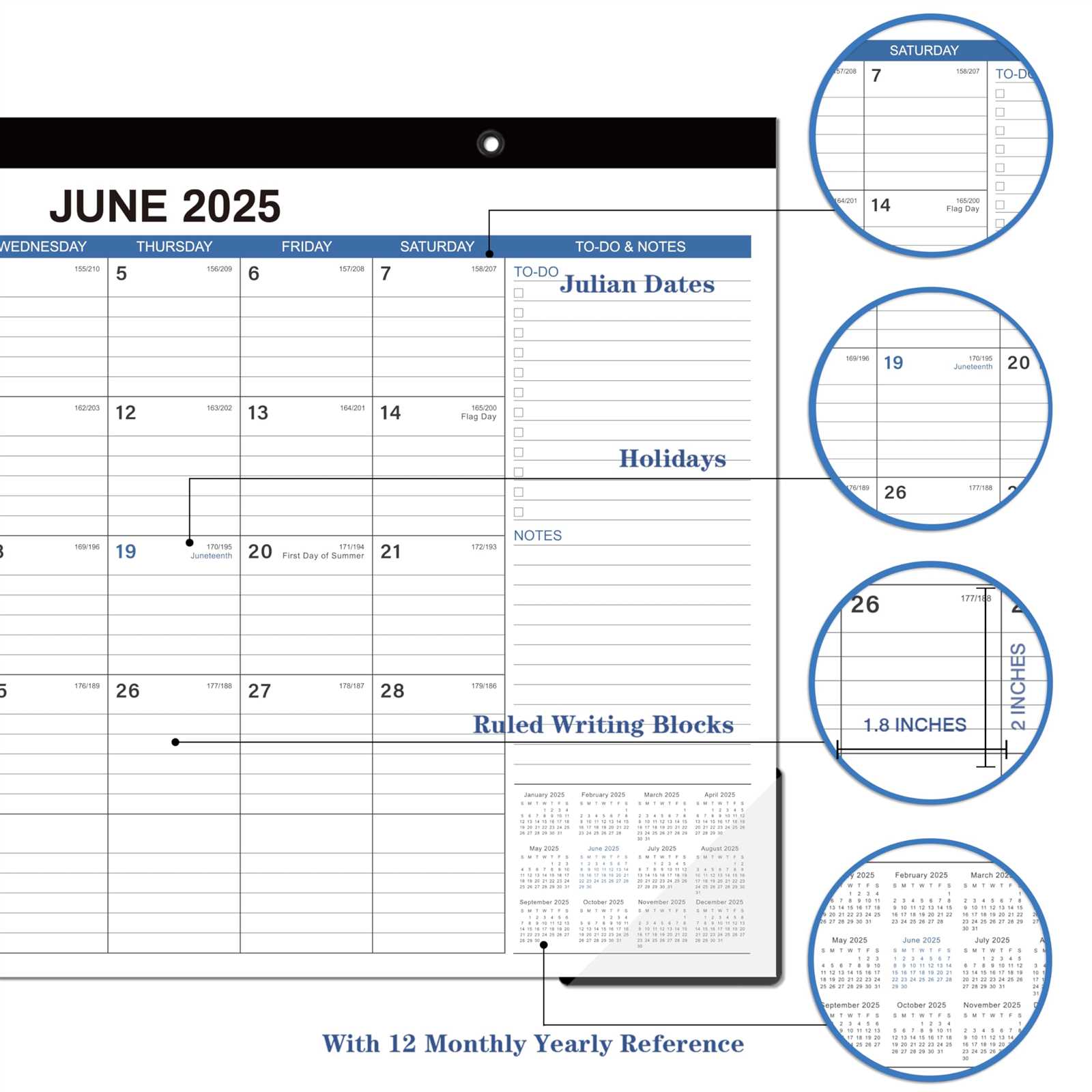

One of the primary characteristics is clarity in layout, which allows users to easily navigate through different pay periods. This ensures that both employers and employees can quickly access necessary information without confusion. Additionally, integration with accounting software is crucial; seamless data transfer minimizes errors and streamlines the overall process.

Another significant feature is the inclusion of customizable fields, which enable organizations to tailor the tool to their specific needs. This adaptability can encompass various payment types, deductions, and bonuses, providing a comprehensive view of employee compensation. Furthermore, user-friendly interfaces enhance accessibility for all staff members, facilitating smoother operations.

Lastly, having built-in compliance checks ensures that all calculations adhere to local laws and regulations, reducing the risk of penalties. Overall, these features combine to create a robust system that supports accurate financial management while promoting transparency and efficiency.

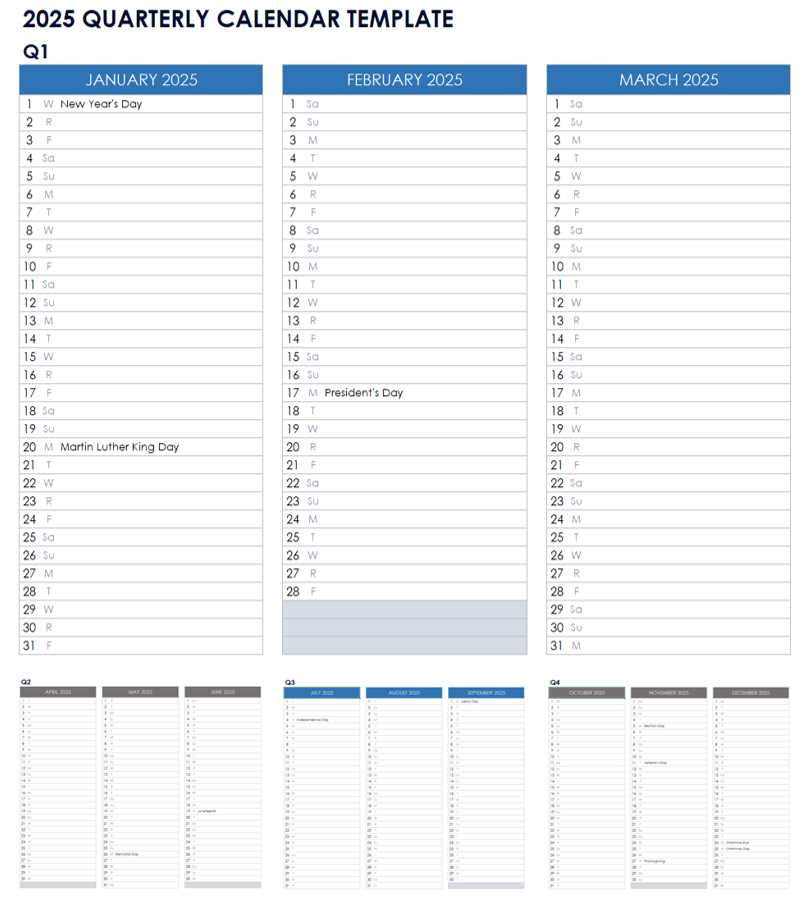

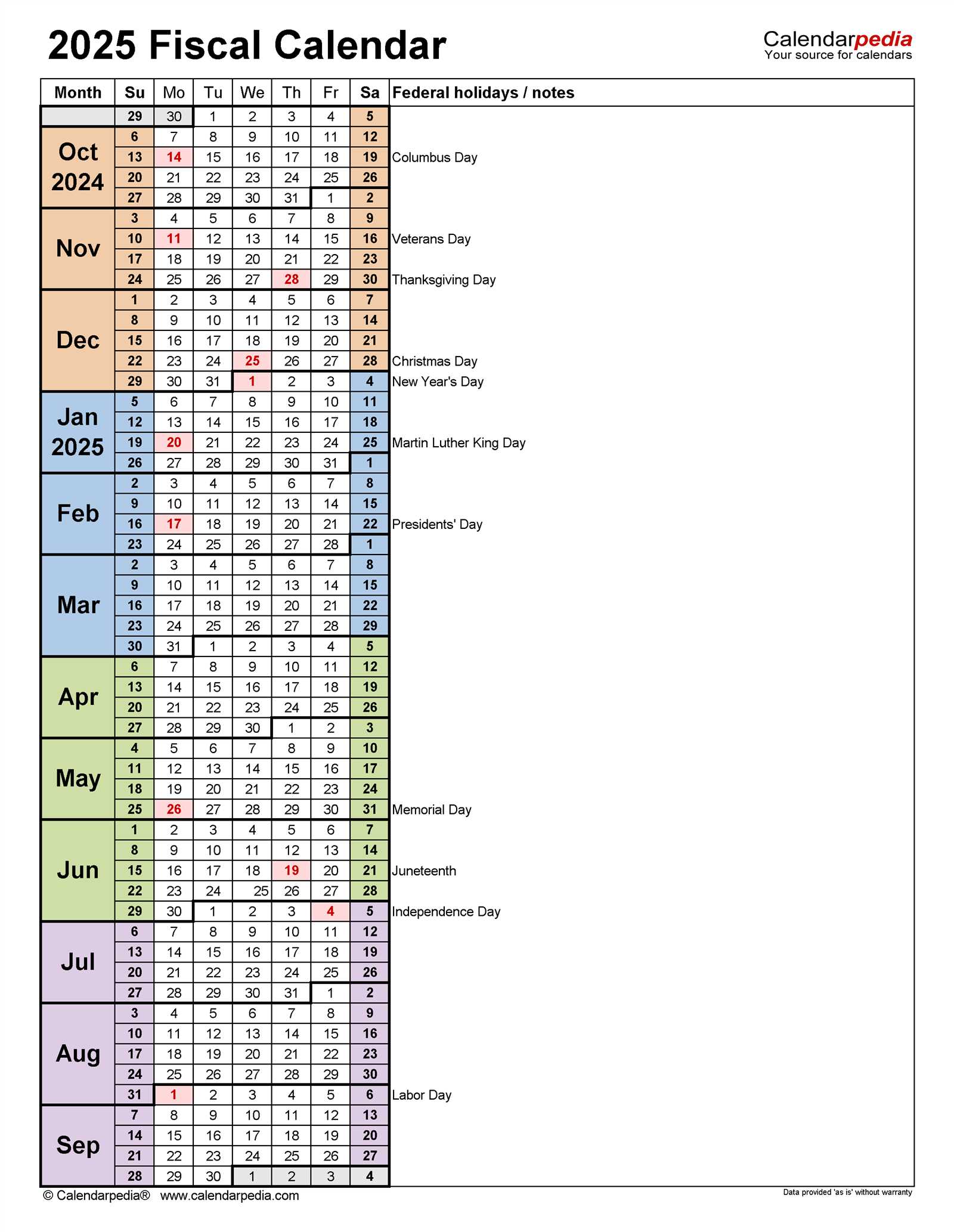

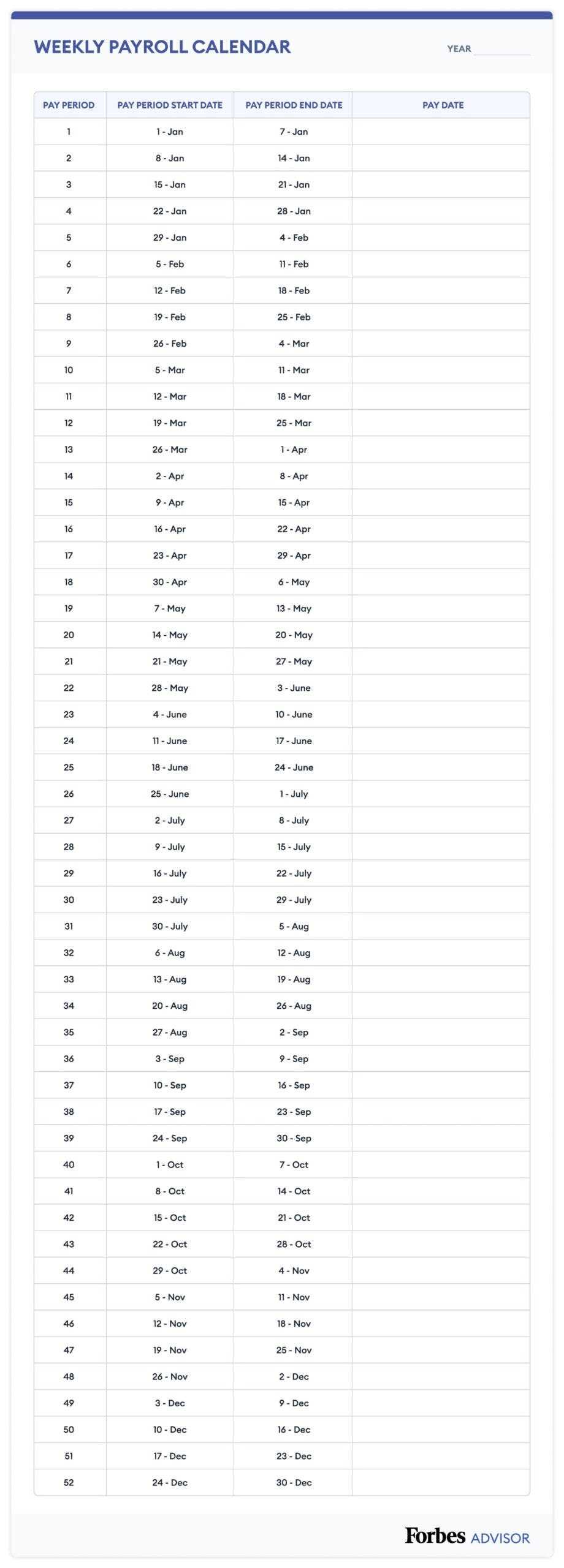

Monthly Breakdown of Pay Periods

Understanding the distribution of compensation intervals throughout the year is essential for both employers and employees. This section explores how pay cycles are structured on a monthly basis, ensuring clarity and alignment with financial planning.

January: Typically starts with a fresh slate, often featuring two pay periods for most organizations.

February: This month usually consists of the same two cycles, although some companies might adjust for leap years.

March: Employees can expect the regular two pay periods, aligning with standard practices.

April: Similar to March, this month generally maintains the two-cycle system, ensuring consistency.

May: This month often includes two pay intervals, providing a predictable schedule.

June: As summer approaches, the typical pattern continues with two pay periods.

July: Expect the usual two cycles, with many enjoying summer activities during this time.

August: Like July, this month typically features two compensation periods.

September: The return to routine often includes two standard pay cycles.

October: This month maintains the established two intervals, aligning with fiscal planning.

November: As the year winds down, employees continue to receive their compensation in the usual two cycles.

December: Wrapping up the year, this month also adheres to the familiar pattern of two pay periods, often accompanied by holiday bonuses.

How to Customize Your Template

Personalizing your scheduling document can enhance its functionality and make it better suited to your specific needs. By modifying various elements, you can ensure that the layout reflects your organization’s requirements while remaining user-friendly and efficient.

Identify Key Elements for Customization

Before diving into modifications, consider which components are most critical for your situation:

- Time Frames: Adjust the periods to align with your operational cycles.

- Categories: Add or remove sections that pertain to different groups or departments.

- Visual Layout: Change the design for better clarity and ease of use.

Steps to Personalize Your Document

- Review the current format and determine areas that need adjustment.

- Use spreadsheet software or dedicated tools to modify rows and columns as necessary.

- Incorporate color coding or highlights to distinguish between various activities.

- Test the revised version to ensure that all adjustments function as intended.

By following these steps, you can create a more effective organizational tool that meets the demands of your workplace.

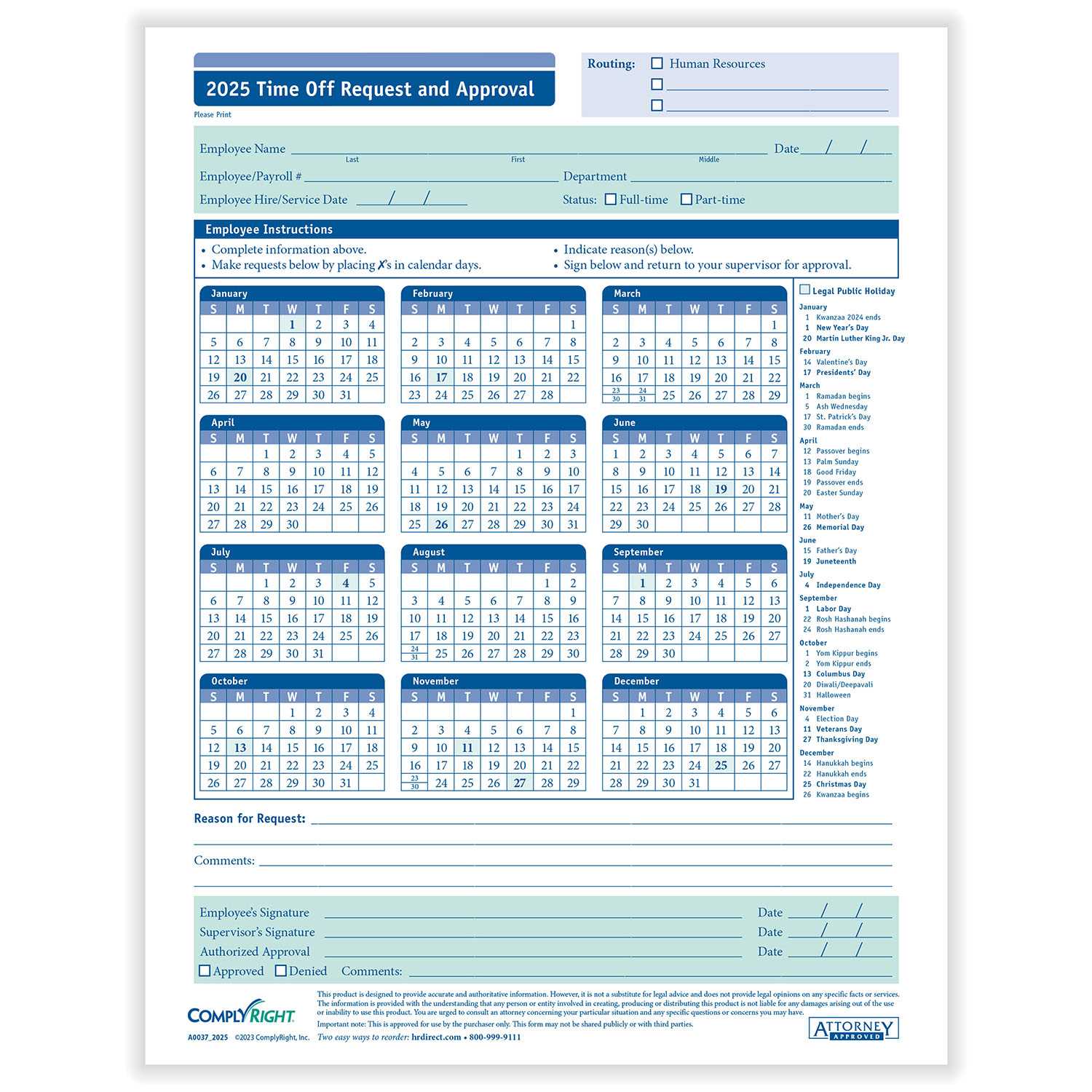

Setting Up Holiday Pay Dates

Establishing appropriate compensation dates for holidays is crucial for ensuring that employees are fairly rewarded for their time off. This process requires careful planning and clear communication to avoid confusion and maintain morale. By strategically determining these dates, organizations can streamline their operations and enhance employee satisfaction.

Identifying Key Holidays

Start by identifying the holidays that will be recognized within your organization. Consider both federal and local observances, as well as any industry-specific days that might be relevant. Ensure that all holidays are communicated clearly to your workforce, as this fosters transparency and helps employees anticipate their earnings.

Calculating Compensation Rates

Once holidays are established, it is essential to calculate the appropriate compensation rates for those days. This may include regular pay, overtime, or premium rates, depending on your company’s policies. Be sure to document these calculations and communicate them effectively to avoid misunderstandings. Adopting a systematic approach will not only simplify the process but also reinforce trust within your team.

Common Payroll Scheduling Mistakes

Effective time management is crucial for any organization, yet many companies fall into the trap of common errors when planning their remuneration processes. These pitfalls can lead to confusion, delays, and dissatisfaction among employees. Understanding these typical missteps can help businesses streamline their operations and maintain a positive work environment.

Inconsistent Timelines: One of the most frequent issues is having varying pay periods without a clear structure. This inconsistency can create uncertainty for staff, making it difficult for them to manage their finances effectively.

Lack of Communication: Failing to inform employees about changes in payment schedules or procedures can result in frustration. Transparency is key; keeping everyone in the loop fosters trust and reduces anxiety regarding compensation.

Overlooking Legal Compliance: Neglecting to stay updated with regulations and laws can lead to significant consequences. Organizations must ensure they adhere to all relevant guidelines to avoid legal troubles and potential fines.

Inaccurate Data Entry: Errors in recording hours worked or other critical information can disrupt the entire process. Double-checking data entry and implementing reliable systems can prevent these mistakes and enhance overall accuracy.

Neglecting Employee Feedback: Ignoring input from staff about their experiences with the payment process can hinder improvement. Regularly soliciting feedback can help identify issues and create a more efficient system.

By recognizing and addressing these common scheduling errors, organizations can improve their operational efficiency and enhance employee satisfaction, leading to a more productive workplace.

Integrating State Tax Deadlines

Incorporating the necessary deadlines for state tax obligations is crucial for ensuring compliance and avoiding penalties. Each jurisdiction has its own schedule, which can vary significantly, making it essential for organizations to stay informed about local requirements. This section will explore how to effectively integrate these deadlines into operational practices, facilitating smooth financial management.

Understanding the specific dates for state tax submissions can prevent last-minute scrambles and help maintain a consistent workflow. Below is a table outlining common types of state tax obligations and their corresponding deadlines:

| Type of Tax | Frequency | Typical Deadline |

|---|---|---|

| Income Tax | Quarterly | 15th of April, July, October, January |

| Sales Tax | Monthly | Last day of the month following the sales period |

| Unemployment Tax | Quarterly | Last day of the month following the end of the quarter |

| Franchise Tax | Annually | May 15 |

By clearly outlining these requirements, organizations can allocate resources efficiently, ensuring that all necessary submissions are completed on time. Regular updates and training regarding these deadlines can further enhance compliance and operational efficiency.

Tracking Employee Benefits Periods

Monitoring the timelines associated with employee benefits is crucial for maintaining an efficient workplace and ensuring that all personnel receive their entitled advantages. Clear oversight of these intervals allows for timely communication, informed decision-making, and enhanced employee satisfaction.

Understanding the Importance of tracking benefits periods can significantly impact both the organization and its workforce. Proper management helps avoid gaps in coverage and ensures compliance with relevant regulations. Furthermore, it allows employees to maximize their options, such as health insurance, retirement plans, and other perks.

To effectively monitor these durations, organizations should establish a systematic approach. Utilizing digital tools can streamline the process, providing reminders and updates that facilitate smooth transitions between different benefits phases. Regular audits of these periods also play a vital role in identifying discrepancies and improving overall efficiency.

Incorporating regular check-ins with employees about their benefits not only fosters transparency but also encourages engagement. This proactive communication can lead to a more informed workforce, where employees are aware of their choices and can plan accordingly.

Adjusting for Leap Years

Incorporating an extra day into the annual cycle can significantly impact various planning and financial processes. Understanding how to accommodate this additional day is crucial for maintaining accuracy and consistency in calculations.

When an extra day is added, it’s essential to re-evaluate timelines and distribute hours accordingly. This adjustment ensures that all stakeholders are aligned and that no discrepancies arise due to the unique nature of such years.

Furthermore, this alteration may influence budgeting and forecasting efforts. Organizations must consider how this additional time affects payroll calculations, benefit distributions, and overall financial reporting.

Ultimately, proper adjustments for leap years enhance operational efficiency and promote a smoother transition throughout the year, allowing teams to focus on their core objectives without unnecessary interruptions.

Using Software for Payroll Management

In today’s fast-paced business environment, utilizing technology for employee compensation processes has become essential. Automated systems not only streamline operations but also enhance accuracy and compliance, reducing the burden on human resources teams. This shift allows organizations to focus on strategic initiatives rather than getting bogged down by repetitive tasks.

Employing software solutions for compensation management provides numerous advantages. These platforms can efficiently calculate wages, track hours worked, and manage deductions, all while ensuring adherence to regulations. By minimizing manual input, businesses can significantly reduce errors and improve the reliability of financial data.

Moreover, many modern applications offer user-friendly interfaces that facilitate easy access to information. This accessibility enables employees to view their payment details, tax information, and benefits, fostering transparency and trust within the organization. Real-time reporting features also allow management to analyze financial trends and make informed decisions swiftly.

Integrating technology into the compensation process can lead to considerable time savings. Automation of routine tasks means that human resources professionals can dedicate more time to strategic planning and employee engagement initiatives. Additionally, the ability to access historical data enhances the capacity for accurate forecasting and budgeting.

In conclusion, leveraging specialized software for compensation management not only simplifies administrative tasks but also contributes to a more efficient and informed workplace. By embracing these technological advancements, businesses can ensure that their compensation processes are both effective and compliant.

Visual Representation of Pay Dates

A clear illustration of remuneration dates is essential for both employers and employees to ensure timely financial planning. By providing a visual guide, organizations can enhance understanding and streamline communication regarding when funds will be disbursed. This section highlights various methods to effectively showcase these crucial dates.

Benefits of Using Visual Aids

Employing graphical representations can significantly improve comprehension of payment schedules. Visual aids help in quickly identifying key dates, reducing confusion and fostering better financial management among staff. Furthermore, these tools can accommodate different payment frequencies, allowing for a tailored approach to suit diverse needs.

Example Schedule

| Month | Payment Date |

|---|---|

| January | January 15 |

| February | February 15 |

| March | March 15 |

| April | April 15 |

| May | May 15 |

| June | June 15 |

| July | July 15 |

| August | August 15 |

| September | September 15 |

| October | October 15 |

| November | November 15 |

| December | December 15 |

Compliance with Labor Laws

Adhering to regulations governing employment is essential for any organization. These laws are designed to protect the rights of workers and ensure fair treatment in the workplace. Organizations must remain vigilant to avoid potential legal pitfalls that could arise from non-compliance.

To maintain conformity, it is crucial to stay informed about changes in legislation that affect employee rights, wages, and working conditions. Regular training and updates for HR personnel can foster a culture of awareness and responsibility. Documentation plays a key role in demonstrating compliance, so accurate records should be meticulously kept and easily accessible.

Moreover, understanding regional and national mandates can help businesses implement policies that are not only lawful but also foster a positive workplace environment. By prioritizing compliance, organizations not only mitigate risks but also enhance their reputation as fair employers.

Tips for Accurate Payroll Processing

Ensuring precision in employee compensation management is crucial for any organization. It involves careful planning, attention to detail, and consistent practices to avoid errors that can affect both the workforce and the company’s financial standing.

1. Maintain Up-to-Date Employee Records

Regularly update employee information, including personal details, tax withholding statuses, and benefits selections. Accurate records help in calculating the right amounts and ensuring compliance with legal obligations.

2. Utilize Reliable Software

Invest in robust software designed for compensation management. Such tools automate calculations and reduce the likelihood of human error, streamlining the entire process.

3. Implement a Consistent Schedule

Establish a regular schedule for processing payments. Consistency helps employees plan their finances and fosters trust in the organization’s reliability.

4. Double-Check Calculations

Before finalizing any payment, conduct thorough reviews of all calculations. Verifying deductions, overtime, and bonuses ensures that every aspect is accounted for accurately.

5. Communicate with Employees

Encourage open communication regarding compensation. Allow employees to report discrepancies or concerns promptly, creating a transparent environment that promotes trust.

6. Stay Informed on Regulations

Regularly educate yourself and your team about changes in labor laws and tax regulations. Being informed helps in adapting practices to remain compliant and avoid potential penalties.

7. Conduct Regular Audits

Periodically review processes and records to identify any discrepancies or areas for improvement. Audits can uncover potential issues before they escalate, ensuring ongoing accuracy.

Sharing the Calendar with Staff

Effective communication of important dates is crucial for any organization. Ensuring that all team members are informed about the timing of key events enhances productivity and helps in managing expectations. A well-organized schedule can significantly reduce confusion and promote a smoother workflow.

Methods for Distribution

- Email: Sending the schedule directly to each employee’s inbox ensures immediate access and serves as a reference.

- Intranet: Uploading the document to a shared platform allows staff to view and download it at their convenience.

- Printed Copies: Distributing hard copies can be beneficial for those who prefer physical documents or work in environments with limited digital access.

Engaging Staff with the Schedule

Encouraging staff involvement can further enhance the effectiveness of the shared information. Consider the following approaches:

- Feedback Sessions: Organize meetings to discuss the schedule, allowing team members to voice concerns or suggestions.

- Reminders: Set up automated alerts to remind employees of upcoming deadlines and important dates.

- Visual Aids: Create infographics or posters summarizing key points, which can be displayed in common areas.

By using these strategies, organizations can foster a more informed and engaged workforce, ensuring that everyone is on the same page regarding crucial timelines.

Budgeting for Payroll Expenses

Effective financial planning for employee compensation is crucial for any organization. A well-structured approach helps ensure that resources are allocated efficiently, allowing for both operational stability and employee satisfaction.

To successfully manage these expenditures, consider the following key elements:

- Understanding Costs: Analyze all elements of employee remuneration, including salaries, bonuses, and benefits.

- Forecasting Future Expenses: Use historical data to predict upcoming financial obligations related to staff compensation.

- Regulatory Compliance: Stay informed about labor laws and taxation that could impact overall financial commitments.

- Employee Turnover: Account for potential costs associated with hiring and training new staff, as turnover can significantly affect the budget.

Incorporating these factors into your financial strategy will help create a comprehensive plan that aligns with your organization’s goals. By keeping a close eye on expenditures and making adjustments as necessary, you can maintain a healthy financial outlook while supporting your workforce effectively.

Regular reviews of your financial allocations can lead to better resource management and allow for timely adjustments based on changing business needs. Emphasizing transparency and communication within your team can further enhance the budgeting process.

Accessing Resources for Payroll Templates

Finding the right tools for managing employee compensation can significantly streamline financial operations. Various sources offer valuable documents and formats that can enhance efficiency and ensure compliance with regulations.

When seeking these essential resources, consider exploring the following avenues:

| Resource Type | Description | Where to Find |

|---|---|---|

| Online Libraries | Comprehensive collections of formats and guidelines. | Website directories and professional associations. |

| Software Solutions | Integrated applications providing automated tools. | Vendor websites and technology marketplaces. |

| Government Websites | Official documentation on legal requirements and standards. | National and regional labor department sites. |

| Community Forums | Peer-shared formats and personal experiences. | Online business communities and discussion groups. |

Future Trends in Payroll Management

The landscape of employee compensation is rapidly evolving, influenced by technological advancements and changing workforce expectations. As organizations strive for efficiency and transparency, several key trends are emerging that will shape the way salaries and benefits are processed.

- Automation and AI Integration: The adoption of automated systems and artificial intelligence will streamline processes, reduce human error, and enhance decision-making.

- Real-Time Data Access: Employees will increasingly expect instant access to their earnings and deductions, leading companies to implement real-time reporting systems.

- Personalized Employee Experiences: Customizable options for compensation packages will cater to diverse employee needs, enhancing satisfaction and retention.

- Compliance and Security Enhancements: With stricter regulations, businesses will invest more in technologies that ensure compliance and protect sensitive information.

- Globalization of Workforce Management: As companies expand internationally, the need for solutions that accommodate various legal requirements and currencies will grow.

In conclusion, the future of employee remuneration processes will be characterized by increased automation, personalized services, and a strong emphasis on security and compliance. Staying ahead of these trends will be essential for organizations looking to thrive in a competitive landscape.