In the realm of financial management, understanding the intricacies of payment schedules is crucial for both employers and employees. This section delves into the structured approach to organizing remuneration timelines, ensuring clarity and efficiency in compensation processes.

Establishing a well-defined timeline for disbursing wages not only facilitates smoother financial operations but also enhances employee satisfaction. By adopting an organized framework, organizations can better plan their cash flow and ensure timely payments to their workforce.

In this discussion, we will explore various methodologies for crafting effective disbursement plans, providing insights into how to customize these schedules to meet specific organizational needs. This will empower businesses to maintain financial health while fostering a positive work environment.

Understanding Semi-Monthly Payroll

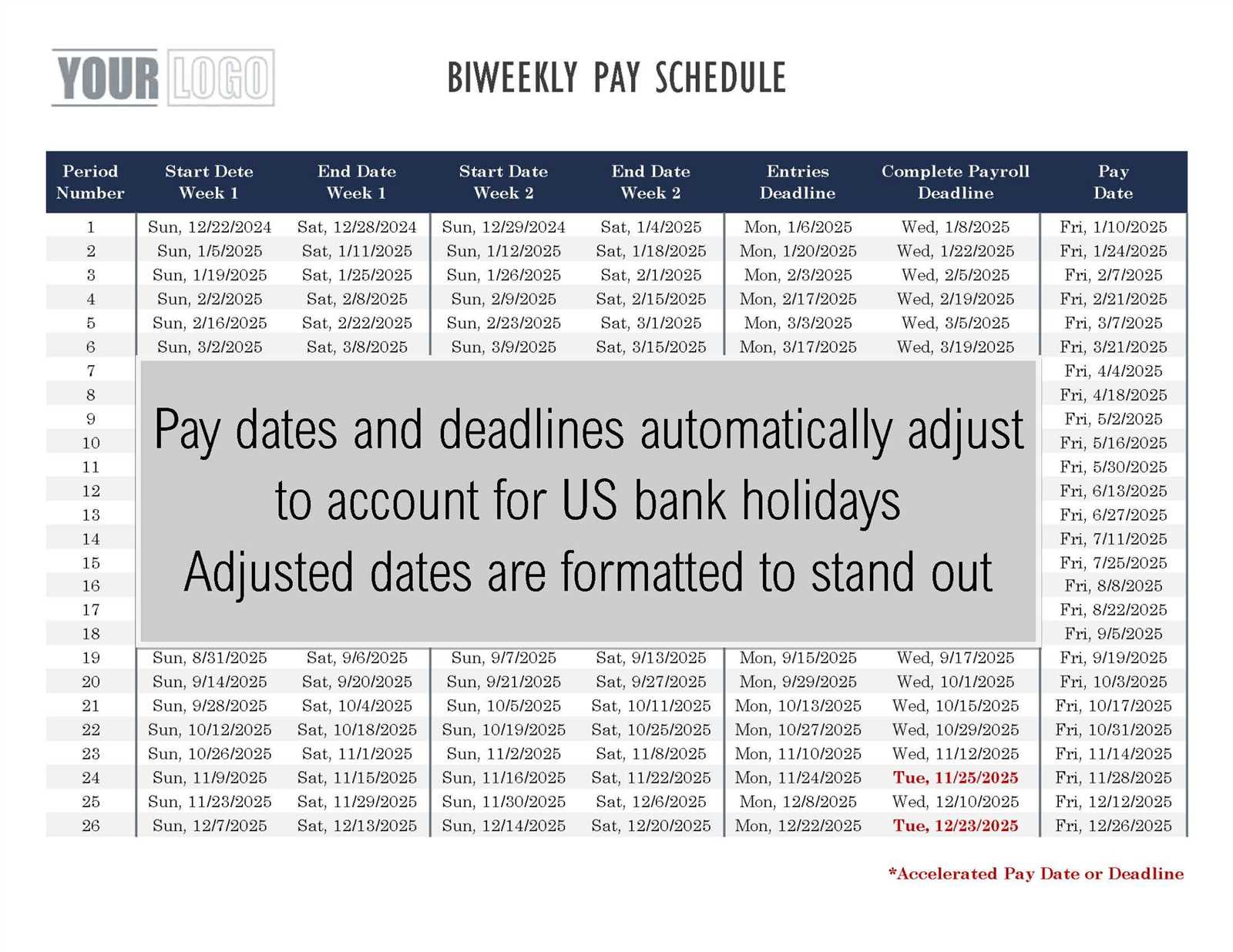

This section explores the bi-monthly compensation structure, emphasizing its significance in managing employee remuneration. The system divides the payment periods into two segments within each month, facilitating timely disbursement of wages.

Benefits of Bi-Monthly Compensation

- Improved cash flow management for employees

- Regular payment schedule enhances financial planning

- Reduced administrative workload for HR departments

Considerations for Implementation

- Ensure accurate tracking of work hours and performance metrics.

- Communicate clearly with staff regarding payment dates.

- Utilize software tools to streamline the compensation process.

Key Benefits of Semi-Monthly Payments

Implementing a bi-monthly compensation schedule can provide various advantages for both employers and employees. This structure not only ensures regular cash flow for staff but also simplifies the management of financial obligations for businesses.

Enhanced Financial Planning

One of the main advantages of this payment frequency is the ability for employees to better manage their finances. Receiving compensation more frequently allows individuals to allocate funds for recurring expenses such as rent, utilities, and loan payments. This regular influx of cash aids in budgeting, leading to improved financial stability.

Streamlined Administrative Processes

From an organizational perspective, adopting a bi-monthly compensation strategy can simplify payroll operations. This system can reduce the workload during each payroll cycle and improve the accuracy of financial reporting. Consequently, businesses can allocate resources more efficiently and focus on strategic growth.

| Benefit | Description |

|---|---|

| Financial Stability | Regular payments help employees manage their expenses effectively. |

| Improved Cash Flow | Employers can maintain better control over cash management. |

| Operational Efficiency | Streamlined processes reduce administrative burdens. |

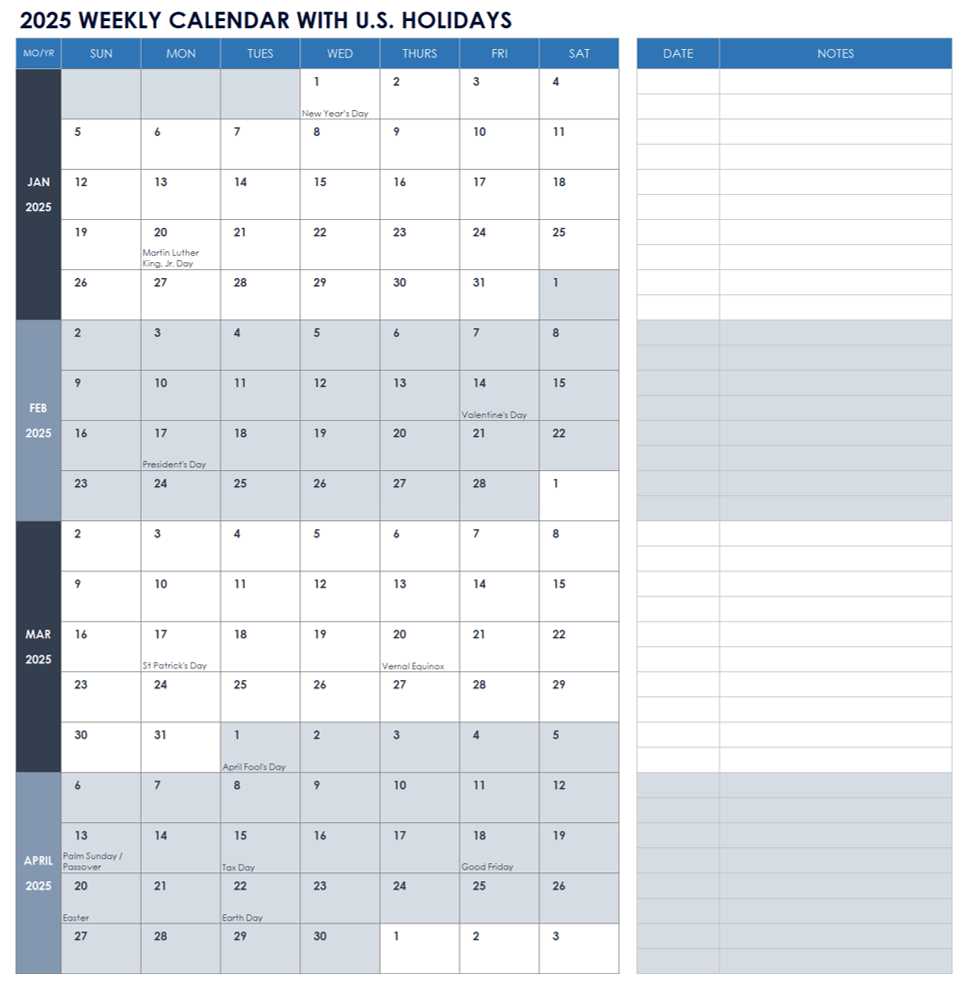

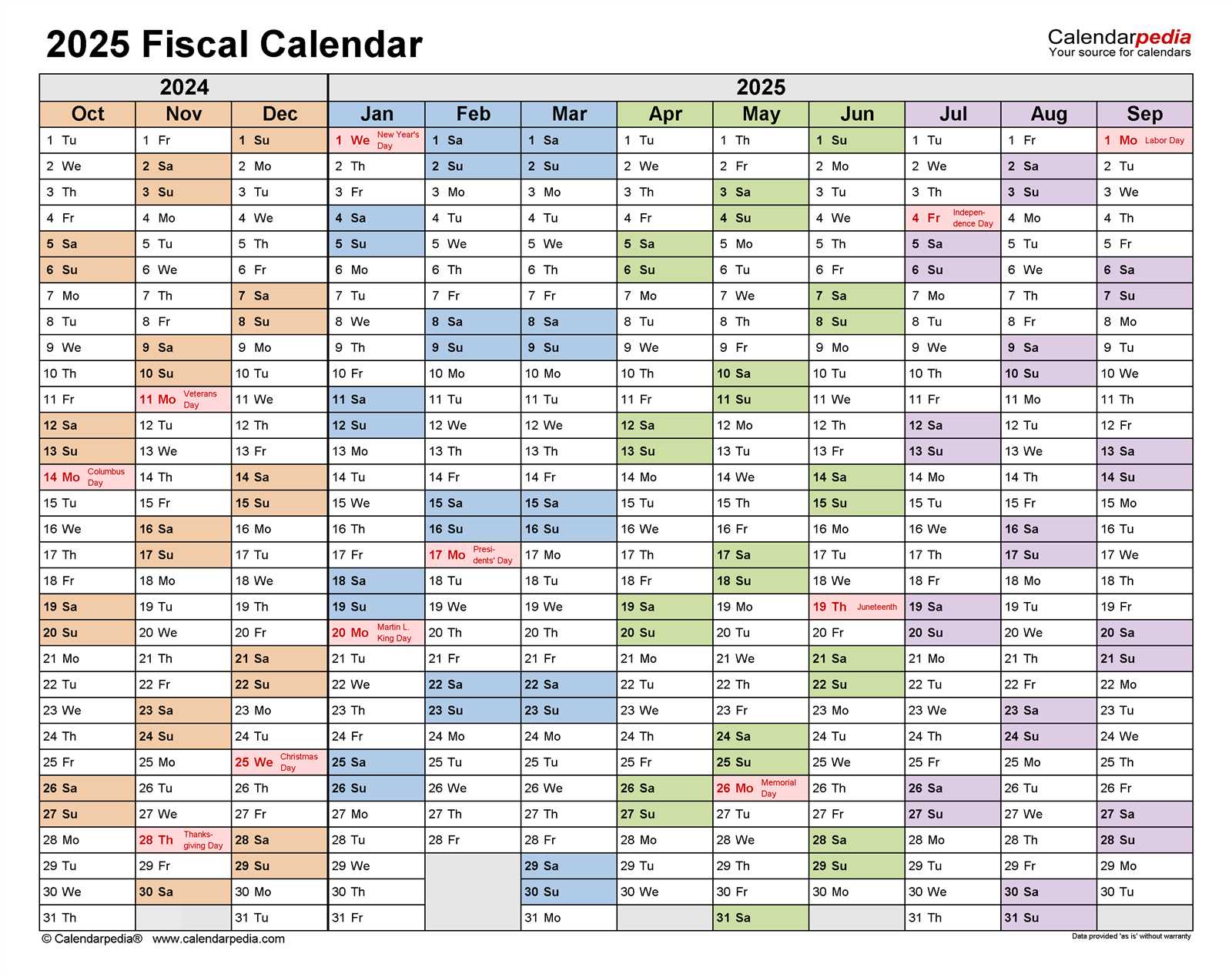

How to Create a Payroll Calendar

Designing a schedule for employee compensation is essential for any organization. This process ensures that all team members receive their earnings promptly and accurately. A well-structured timeline can help streamline financial operations and improve overall efficiency.

To start, determine the frequency of payment distribution. Common intervals include bi-weekly or monthly arrangements. Next, establish the specific dates when funds will be disbursed. It is crucial to consider holidays and weekends, as these may impact the timing of payments.

After defining the payment intervals and dates, create a visual representation that clearly outlines this information. Using a spreadsheet or specialized software can enhance clarity and ease of access for all stakeholders. Make sure to update this document regularly to reflect any changes in policies or regulations.

Finally, share the finalized schedule with employees well in advance. This transparency helps build trust and ensures that everyone is aware of when they can expect their earnings. Regular communication about any updates or changes is also vital for maintaining a smooth process.

Essential Elements of a Payroll Template

A well-structured framework for managing employee compensation is crucial for any organization. It serves as a fundamental tool for ensuring that payments are processed accurately and efficiently. Incorporating key components into this framework can streamline operations and enhance overall effectiveness.

Key Components for Accuracy

To ensure precision in processing payments, it’s vital to include detailed sections for employee information, such as identification numbers, payment rates, and hours worked. This data should be clearly organized to facilitate quick reference and verification. Accuracy in these details helps to avoid discrepancies and ensures that employees receive the correct amounts on time.

Flexibility for Various Scenarios

Incorporating adaptability into the structure allows for adjustments based on different pay cycles or unique situations, such as bonuses or deductions. This flexibility is essential for meeting the diverse needs of the workforce. By providing options for customization, organizations can address individual employee circumstances effectively. Flexibility enhances user experience and supports diverse payroll strategies.

Common Challenges with Payroll Scheduling

Managing the timing of employee compensation can present various obstacles for organizations. These difficulties often arise from the need to balance regulatory requirements, employee expectations, and internal processes. Understanding these challenges is essential for optimizing payment systems and ensuring a smooth operation.

Regulatory Compliance

Adhering to legal guidelines is a critical aspect of managing employee remuneration. Organizations must navigate various laws and regulations that dictate payment frequency and reporting requirements. Failure to comply can result in penalties and damage to the company’s reputation.

Employee Satisfaction

Timely compensation is vital for maintaining employee morale and trust. Delays in payment can lead to dissatisfaction and lower productivity. Companies must ensure their scheduling processes align with employees’ needs and expectations to foster a positive work environment.

- Inconsistent payment schedules can confuse staff.

- Unexpected changes may disrupt personal financial planning.

- Lack of communication about payment dates can lead to frustration.

Addressing these issues requires careful planning and proactive communication to create a system that meets both regulatory standards and employee needs.

Best Practices for Payroll Management

Effective handling of employee compensation involves a variety of strategies that ensure accuracy and compliance. Establishing a streamlined process can significantly enhance efficiency and reduce errors.

One key approach is to automate as many steps as possible. This not only saves time but also minimizes the risk of human mistakes. Implementing reliable software can provide essential tools for tracking hours, calculating wages, and managing deductions.

| Practice | Description |

|---|---|

| Regular Audits | Conduct frequent reviews to ensure accuracy and compliance with regulations. |

| Clear Communication | Maintain open channels with employees regarding their earnings and any changes. |

| Training and Development | Invest in ongoing training for staff involved in compensation processes. |

Legal Requirements for Payroll Frequency

Understanding the regulatory framework surrounding the timing of employee compensation is crucial for businesses. Various jurisdictions impose specific mandates that dictate how often wages must be disbursed. Compliance with these regulations ensures not only the smooth operation of a business but also protects the rights of workers.

Variations by Jurisdiction

Different regions may have distinct stipulations regarding the frequency of compensation. Some areas might require weekly disbursements, while others may allow for longer intervals. It is essential for employers to familiarize themselves with local laws to avoid penalties and ensure adherence to statutory obligations.

Employee Rights and Employer Responsibilities

Employees have the right to receive their earnings in a timely manner. This right underlines the necessity for employers to establish consistent and lawful practices for compensation distribution. Failure to meet these legal requirements can result in grievances and potential legal action, highlighting the importance of compliance in fostering a positive workplace environment.

Tips for Accurate Payroll Calculations

Ensuring precise financial distributions is essential for any organization. Implementing effective strategies can minimize errors and enhance overall efficiency. Here are some best practices to consider when handling compensations.

| Practice | Description |

|---|---|

| Regular Reviews | Conduct frequent assessments of the compensation process to identify and rectify discrepancies. |

| Clear Documentation | Maintain comprehensive records of hours worked, deductions, and benefits to support calculations. |

| Automation Tools | Utilize software solutions designed to streamline calculations and reduce human error. |

| Employee Training | Ensure staff responsible for calculations are well-trained in applicable laws and practices. |

Integrating Payroll Software Solutions

In today’s fast-paced business environment, the implementation of software systems designed for financial management has become essential. These solutions not only streamline processes but also enhance accuracy and efficiency in managing employee compensation. By automating various tasks, organizations can reduce manual errors and save valuable time.

Choosing the right software involves evaluating features that cater to specific organizational needs. Considerations may include compatibility with existing systems, user-friendliness, and the ability to generate detailed reports. Additionally, cloud-based options provide flexibility and remote access, allowing for seamless updates and integration with other business tools.

Furthermore, training staff on the new system is crucial for successful adoption. Engaging employees in the transition process fosters a sense of ownership and facilitates a smoother adjustment. With proper support and resources, organizations can fully leverage the benefits of these innovative solutions, leading to improved overall performance.

How to Customize Your Payroll Calendar

Tailoring your schedule for compensation management can significantly enhance your organizational efficiency. By modifying the structure to suit your specific requirements, you ensure that all relevant parties are informed and aligned with the payment cycles, thus streamlining the overall process.

Assess Your Needs

Begin by evaluating the particular demands of your organization. Consider factors such as employee count, pay frequency preferences, and reporting requirements. Understanding these elements will help you create a framework that accommodates both administrative efficiency and employee satisfaction.

Implement User-Friendly Features

Incorporate elements that promote clarity and accessibility. This could include color coding for different pay periods, clear annotations for holidays or breaks, and easy-to-navigate layouts. Such enhancements will not only simplify usage but also reduce errors in the payment process.

Setting Up Employee Payment Dates

Establishing a schedule for compensating personnel is a crucial element of workforce management. A well-organized payment timeline ensures that employees receive their earnings consistently and on time, fostering trust and satisfaction within the workplace.

To effectively configure payment dates, it is essential to consider various factors such as local regulations, company policies, and employee preferences. Below is a structured approach to aid in the decision-making process:

| Factor | Description |

|---|---|

| Legal Requirements | Review state and federal laws regarding payment frequencies to ensure compliance. |

| Company Practices | Consider historical practices within the organization and adjust based on employee feedback. |

| Employee Preferences | Survey employees to gather insights on their preferred payment intervals for better alignment. |

| Cash Flow Management | Analyze the company’s financial situation to determine the most sustainable payment frequency. |

By thoughtfully addressing these factors, organizations can create a reliable framework for employee compensation that benefits both the workforce and the business as a whole.

Using Templates for Payroll Efficiency

Implementing structured frameworks can significantly enhance the effectiveness of financial management processes. By utilizing predefined formats, organizations can streamline operations, reduce errors, and ensure consistency in handling financial data. This approach not only saves time but also contributes to better resource allocation and planning.

One of the key advantages of adopting such formats is the ability to easily customize them to fit the unique needs of an organization. Different businesses may have varying requirements for their financial cycles, making it crucial to have adaptable solutions that can cater to specific needs.

| Benefits | Description |

|---|---|

| Time Savings | Predefined formats allow quicker preparation and processing. |

| Reduced Errors | Standardization minimizes mistakes in calculations and data entry. |

| Consistency | Uniform formats ensure that all records adhere to the same standards. |

| Customizability | Frameworks can be tailored to meet the specific demands of any organization. |

In summary, leveraging structured formats not only simplifies the management of financial operations but also enhances overall organizational efficiency. The right approach can lead to improved accuracy and greater satisfaction among stakeholders involved in financial processes.

Understanding Overtime and Bonuses

In the realm of employee compensation, it is essential to comprehend the various components that enhance an individual’s earnings. Additional financial rewards, such as extra pay for extended hours worked and performance incentives, play a significant role in motivating personnel and recognizing their contributions to the organization.

Overtime Pay Explained

Overtime compensation is awarded when an employee exceeds the standard working hours established by the employer or regulatory guidelines. This additional pay is typically calculated at a higher rate, encouraging employees to fulfill extra responsibilities. It is crucial for both employers and workers to understand the legal stipulations surrounding this type of remuneration to ensure compliance and fairness.

Bonuses as Incentives

Bonuses serve as a form of reward for exceptional performance or meeting specific targets. These financial incentives can vary significantly in amount and frequency, often depending on company policies and individual achievements. By offering bonuses, organizations aim to foster a culture of excellence and dedication, ultimately enhancing overall productivity.

Tracking Payroll Changes Effectively

Monitoring financial adjustments within an organization is crucial for maintaining accuracy and compliance. An effective approach ensures that all modifications are documented, analyzed, and processed in a timely manner, reducing the risk of discrepancies and enhancing overall operational efficiency.

Importance of Regular Updates

Frequent revisions to compensation structures, benefits, and other related factors necessitate a systematic tracking method. Keeping abreast of these changes helps to align organizational goals with employee expectations and legal requirements.

Tools for Efficient Monitoring

Utilizing the right tools can significantly improve the tracking process. Software solutions can automate notifications and updates, ensuring that all relevant personnel are informed of changes as they occur.

| Change Type | Description | Frequency of Review |

|---|---|---|

| Salary Adjustments | Modifications to employee compensation due to performance or market conditions. | Quarterly |

| Benefits Changes | Alterations to health, retirement, or other employee benefits packages. | Annually |

| Regulatory Updates | New laws or regulations affecting employee compensation and benefits. | As needed |

Managing Payroll Records and Compliance

Effective administration of financial documentation is crucial for organizations to ensure adherence to regulations and maintain accurate records. Proper management not only facilitates timely disbursements but also minimizes risks associated with discrepancies. A well-organized approach can enhance efficiency and ensure that all relevant laws are followed.

Importance of Accurate Record-Keeping

Maintaining precise records is essential for tracking employee compensation, tax obligations, and compliance with labor laws. Inaccuracies can lead to legal issues, financial penalties, and damage to an organization’s reputation. Therefore, establishing a systematic method for documentation is vital.

Strategies for Compliance

Organizations should implement robust procedures to ensure compliance with all applicable regulations. This involves regular audits, employee training, and the use of technology to streamline processes. Additionally, staying updated on legislative changes is critical to avoid potential pitfalls.

| Action Item | Description | Frequency |

|---|---|---|

| Record Review | Conduct regular checks to ensure accuracy | Quarterly |

| Compliance Training | Train staff on relevant laws and regulations | Annually |

| Audit Process | Implement an audit to identify discrepancies | Bi-annually |

Impact of Payroll on Employee Satisfaction

The method and frequency of compensation distribution play a crucial role in shaping the overall contentment of the workforce. Regular and reliable disbursement not only meets the basic financial needs of employees but also fosters a sense of security and trust within the organization. When team members feel confident about their earnings, their engagement and loyalty to the company tend to increase significantly.

Moreover, timely payments can enhance morale and productivity. Employees who receive their earnings consistently are more likely to feel valued and respected, which translates into a positive workplace atmosphere. Conversely, any disruptions or inconsistencies in the compensation process can lead to dissatisfaction and unrest.

| Factors Influencing Satisfaction | Effects on Employees |

|---|---|

| Consistency | Increased trust and reliability |

| Timeliness | Enhanced morale and productivity |

| Transparency | Stronger engagement and loyalty |

Future Trends in Payroll Processing

The landscape of employee compensation management is evolving rapidly, influenced by technological advancements and shifting workplace dynamics. Organizations are increasingly seeking efficient methods to streamline their remuneration systems, ensuring accuracy and compliance while enhancing employee satisfaction.

Several key trends are shaping the future of this field:

- Automation and AI: The integration of artificial intelligence and automated systems is transforming traditional practices. By minimizing manual input, these technologies reduce errors and expedite processes.

- Real-time Analytics: Companies are adopting tools that provide instant insights into financial data. This allows for timely decision-making and a better understanding of workforce costs.

- Employee Self-service: Empowering staff to access their financial information and manage preferences fosters transparency and satisfaction. Self-service portals enhance the user experience while reducing administrative burdens.

- Cloud-based Solutions: Shifting to cloud platforms offers flexibility and scalability. These solutions enable businesses to adapt quickly to changes and access data from anywhere.

- Focus on Compliance: As regulations become more complex, organizations are prioritizing compliance management. Advanced systems can help track changes in legislation and ensure adherence to relevant laws.

By embracing these innovations, organizations can create more effective and responsive frameworks for managing employee remuneration, paving the way for a more engaged and productive workforce.