Managing finances effectively is crucial for both individuals and organizations. A structured approach helps streamline various payment processes, ensuring that all transactions are conducted in a timely manner. With a well-organized framework, it becomes easier to track and plan expenditures over the course of the year.

Incorporating a systematic outline not only aids in maintaining accuracy but also enhances productivity. Such a resource can provide clear visibility into payment cycles, allowing for better budgeting and financial planning. It serves as a foundational tool for those aiming to optimize their monetary operations while minimizing errors and confusion.

By utilizing a practical model for financial operations, entities can better allocate their resources and avoid any disruptions. This proactive method fosters a sense of responsibility and foresight, paving the way for sustained fiscal health and growth. As we delve into the specifics of this organizational approach, the benefits of having a meticulously designed framework will become increasingly evident.

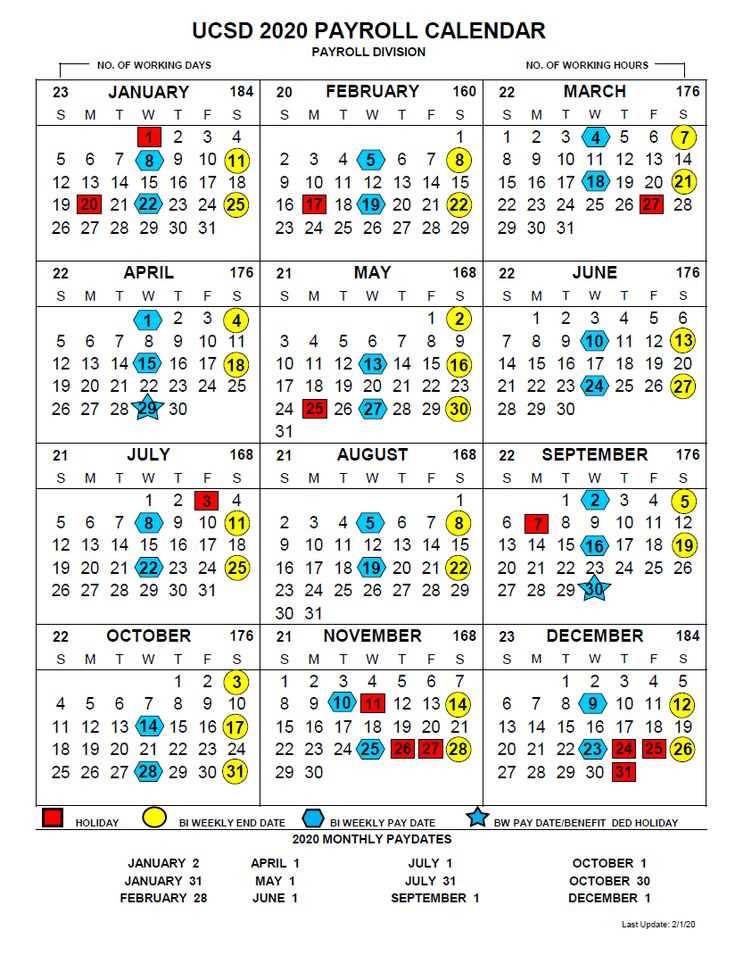

Understanding the 2025 Payroll Cycle

The framework governing employee compensation cycles plays a crucial role in organizational operations. This cycle dictates the regular intervals at which wages are calculated and distributed, ensuring that staff receive their earnings in a timely manner. A well-structured approach not only aids in financial planning but also enhances employee satisfaction and engagement.

Each cycle consists of several key stages, including the accumulation of work hours, calculation of earnings, and processing of deductions. Adhering to these stages accurately is essential for maintaining compliance with tax regulations and internal policies. The efficiency of this cycle significantly influences an organization’s cash flow management and overall productivity.

Additionally, understanding the timing and frequency of these processes allows businesses to forecast expenses more effectively. Clear communication regarding payment schedules fosters trust and transparency between employers and employees, ultimately contributing to a more positive workplace culture.

Benefits of Using a Payroll Calendar

A structured schedule for remuneration periods plays a crucial role in managing financial processes efficiently. By establishing a clear timeline, organizations can ensure timely payments, which fosters trust and satisfaction among employees. Moreover, a well-defined system minimizes the risk of errors and enhances overall productivity.

Implementing a remuneration timeline brings several advantages:

| Advantage | Description |

|---|---|

| Improved Budgeting | Having a defined timeframe aids in forecasting expenses and managing cash flow more effectively. |

| Enhanced Compliance | A consistent schedule helps organizations adhere to legal obligations, avoiding potential penalties. |

| Increased Transparency | Employees gain clarity regarding payment dates, contributing to a positive workplace environment. |

| Streamlined Processes | Regular intervals facilitate easier planning and execution of associated administrative tasks. |

In summary, establishing a well-organized payment schedule is essential for effective financial management, contributing to both employee satisfaction and organizational efficiency.

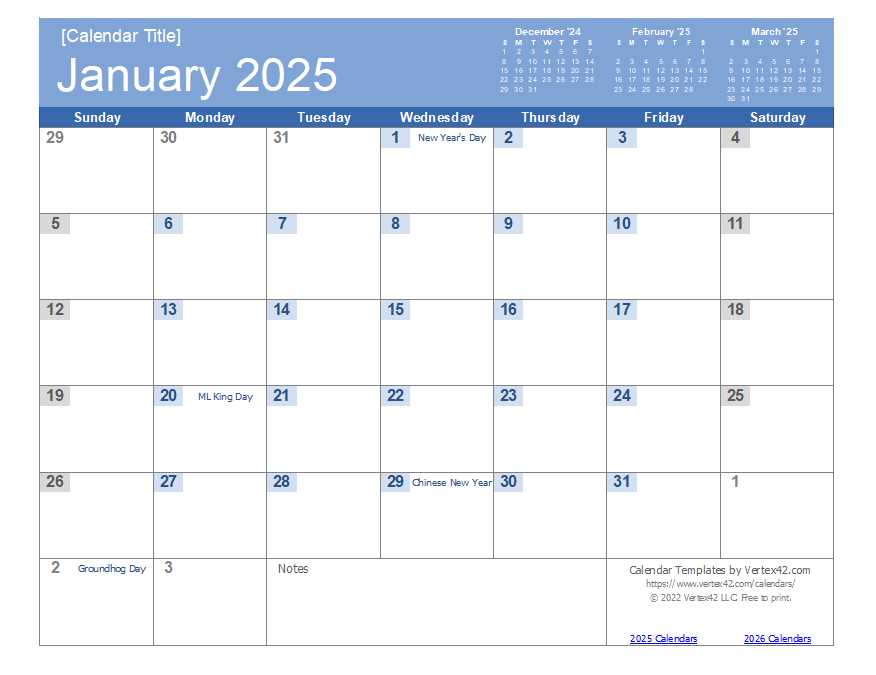

Key Dates in 2025 Payroll Schedule

Understanding important milestones in the compensation process is crucial for effective financial management. These specific moments play a significant role in ensuring that employees receive their earnings accurately and on time.

- January 1: New Year’s Day, a federal holiday, typically affecting the timing of disbursements.

- February 15: A deadline for submitting tax-related documents that may impact financial planning.

- March 31: End of the first quarter, a key point for evaluating financial performance and making necessary adjustments.

- June 30: Mid-year review, providing an opportunity to assess and modify strategies as needed.

- September 30: Third-quarter close, essential for preparing for year-end reporting and ensuring compliance.

- December 31: Conclusion of the fiscal year, marking a critical time for final adjustments and tax preparations.

Staying aware of these pivotal dates aids in maintaining an organized approach to financial obligations and helps avoid potential discrepancies in compensation distribution.

How to Create Your Template

Designing an effective schedule for tracking financial periods requires careful planning and attention to detail. By following a systematic approach, you can develop a useful structure that will serve your needs efficiently.

Here are the essential steps to consider:

- Identify Your Needs:

Determine the specific requirements for your structure, including:

- Frequency of tracking

- Key dates and deadlines

- Types of data to be included

- Choose a Format:

Select a suitable layout that works for your data organization. Consider options such as:

- Spreadsheet software

- Digital applications

- Printable formats

- Define Sections:

Organize your layout by creating distinct sections, such as:

- Time periods

- Relevant figures

- Additional notes

- Input Data:

Begin populating your structure with necessary information, ensuring accuracy and clarity.

- Review and Adjust:

After initial setup, review your layout to ensure it meets your needs. Make any necessary adjustments for improved functionality.

Following these steps will help you create a practical framework tailored to your financial tracking needs.

Tracking Employee Payment Dates

Monitoring the timing of employee compensation is essential for maintaining financial stability and ensuring employee satisfaction. A well-structured approach to recording payment intervals allows organizations to manage cash flow effectively and comply with legal obligations. This section delves into the methods for accurately tracking compensation dates.

Importance of Payment Tracking

Establishing a clear system for tracking compensation dates helps in planning for expenses and managing employee expectations. Timely payments foster trust and motivate staff to perform at their best. Furthermore, accurate records are crucial during audits and financial reviews.

Methods for Effective Tracking

Employing a variety of methods can enhance the tracking process. Utilizing digital tools, spreadsheets, or specialized software can streamline the recording of payment schedules. Below is an example of a simple tracking table that outlines compensation intervals:

| Employee Name | Payment Date | Amount |

|---|---|---|

| John Doe | January 15 | $2,500 |

| Jane Smith | January 15 | $3,000 |

| Emily Johnson | January 15 | $2,800 |

Implementing such a tracking mechanism ensures that all stakeholders are aware of payment schedules, ultimately contributing to a more efficient and transparent work environment.

Adjusting for Holidays in Payroll

Incorporating public observances into compensation schedules is essential for maintaining fairness and accuracy in employee remuneration. These adjustments ensure that workers are properly compensated, even when their regular workdays are disrupted by holidays. Understanding the nuances of these modifications is vital for any organization aiming to uphold employee satisfaction and compliance with labor laws.

When a recognized day off occurs during a designated work period, employers must determine how to adjust hours and payments accordingly. This often involves calculating the regular earnings for employees who would normally work on that day and deciding if any additional compensation is warranted for those who must work during holidays. Proper communication about these adjustments can help in fostering a positive workplace environment.

Furthermore, organizations may need to establish clear policies that outline how such situations are handled. This includes defining which holidays are observed and how they impact the overall remuneration strategy. By being proactive and transparent, businesses can minimize confusion and ensure that their workforce feels valued and respected.

Importance of Timely Payments

Ensuring that individuals receive their due compensation on schedule is crucial for maintaining financial stability and fostering a sense of trust. When payments are made promptly, it not only aids employees in managing their personal finances but also enhances their overall job satisfaction and loyalty to the organization.

Boosting Employee Morale

Receiving payments without delays plays a significant role in boosting employee morale. When individuals feel secure in their financial situation, they are more likely to be productive and engaged in their work. A reliable compensation process reflects a company’s commitment to its workforce, cultivating a positive work environment.

Enhancing Financial Planning

On-time compensation allows employees to plan their budgets effectively. When individuals can anticipate their earnings, they can make informed decisions regarding expenses, savings, and investments. This level of predictability contributes to better financial health and reduces stress, ultimately benefiting both employees and employers.

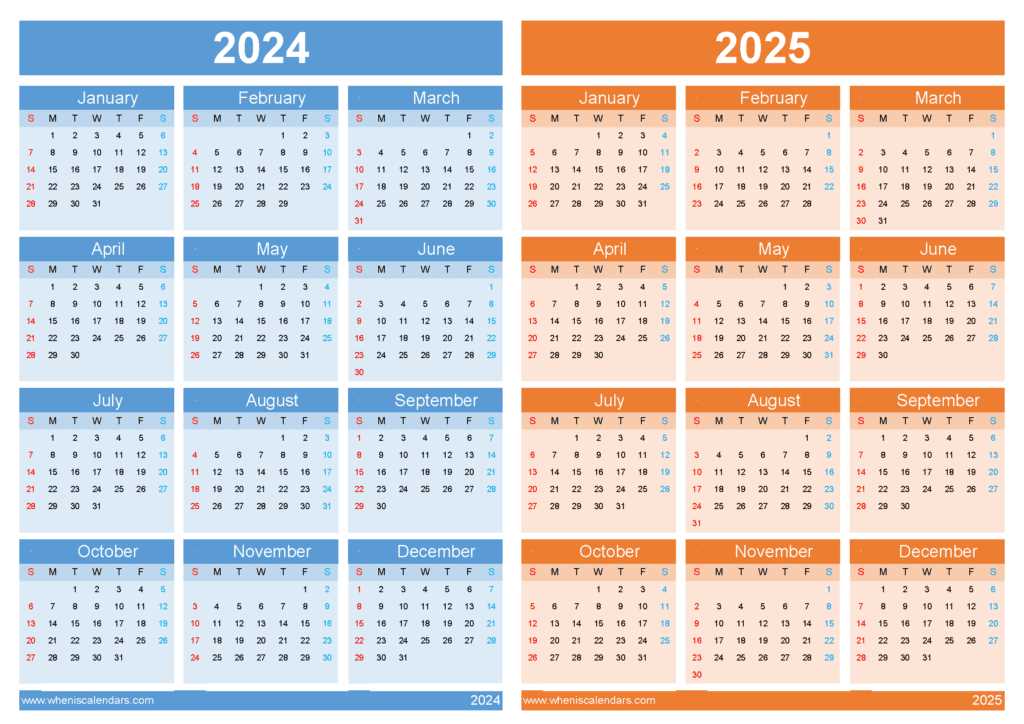

Types of Payroll Calendars Available

Understanding the various schedules for employee compensation can greatly enhance financial management and ensure timely payments. Different structures are designed to meet the diverse needs of organizations, balancing efficiency and clarity.

Here are some common formats utilized in the industry:

| Schedule Type | Description |

|---|---|

| Bi-weekly | Employees receive their earnings every two weeks, providing consistency for budgeting and financial planning. |

| Monthly | Compensation is distributed once a month, simplifying administrative processes but requiring careful cash flow management. |

| Semi-monthly | This method divides the month into two pay periods, often aligning with the first and fifteenth of the month, allowing for more regular payments compared to monthly schedules. |

| Weekly | Payments are made once a week, which can be advantageous for employees needing immediate access to funds but may require more administrative effort. |

Common Mistakes to Avoid

When managing timeframes for employee compensation, it’s crucial to steer clear of common pitfalls that can lead to confusion and inaccuracies. These errors often stem from oversight, lack of clarity, or insufficient planning. Recognizing and addressing these issues beforehand can streamline processes and ensure compliance.

- Neglecting Regular Updates: Failing to revise schedules regularly can result in outdated information, affecting timely payments.

- Inaccurate Data Entry: Mistakes in recording hours worked or rates of pay can lead to significant discrepancies, causing dissatisfaction among staff.

- Ignoring Compliance Requirements: Not adhering to local regulations regarding payment cycles can result in legal repercussions.

- Overlooking Employee Communication: A lack of clear communication with employees about their compensation timelines may lead to confusion and frustration.

Avoiding these common missteps is essential for maintaining an efficient and reliable approach to employee remuneration.

How to Share the Calendar

Sharing a schedule effectively ensures that all relevant parties stay informed and aligned. By distributing this document, you facilitate transparency and coordination among team members, making it easier to track important dates and deadlines.

Methods of Distribution

- Email: Sending the file as an attachment or a link via email is a straightforward way to share it with colleagues.

- Cloud Storage: Uploading the document to a cloud service allows for real-time access and updates. Services like Google Drive or Dropbox are popular choices.

- Collaboration Tools: Utilize platforms like Slack or Microsoft Teams to share the document within channels or direct messages, ensuring quick access for all team members.

Best Practices for Sharing

- Ensure the document is up-to-date before sharing.

- Provide clear instructions on how to access and use the document.

- Consider setting permissions to control who can view or edit the file.

- Follow up to confirm that everyone has received the information and understands it.

Tools for Payroll Management

Efficient compensation administration relies heavily on a variety of instruments designed to streamline processes and enhance accuracy. These solutions help organizations manage employee remuneration, ensuring compliance with legal standards and fostering satisfaction among staff members.

Accounting Software: One of the foundational tools in this realm is robust accounting software. These applications allow for the systematic recording of financial transactions, including salaries and deductions, making it easier to generate comprehensive reports and maintain accurate financial records.

Time Tracking Systems: Accurate time tracking is crucial for determining the amount owed to each employee. Advanced time tracking systems capture hours worked, manage leave requests, and integrate seamlessly with compensation systems to minimize discrepancies.

Compliance Management Tools: Navigating the complex landscape of labor laws can be challenging. Compliance management tools provide essential resources to ensure that organizations adhere to local, state, and federal regulations, thus avoiding potential penalties.

Employee Self-Service Portals: These platforms empower employees by allowing them to access their compensation details, tax information, and benefits options. Such transparency fosters trust and reduces the administrative burden on HR departments.

In summary, leveraging the right assortment of instruments can significantly enhance the efficiency of compensation management, enabling organizations to focus on growth while ensuring their workforce is fairly compensated.

Integrating Calendar with Software

In the modern workplace, seamlessly combining scheduling tools with various software applications can enhance efficiency and streamline processes. The ability to synchronize dates and tasks with existing platforms ensures that users can manage their time effectively and keep track of essential deadlines without hassle.

Benefits of Integration

- Improved Efficiency: Automating the synchronization between scheduling systems and other applications reduces manual data entry and minimizes errors.

- Enhanced Collaboration: Teams can easily share important dates and milestones, fostering better communication and coordination.

- Real-Time Updates: Instant notifications of changes ensure that everyone stays informed about schedule adjustments.

Key Considerations

- Compatibility: Ensure that the scheduling tool can connect with the software platforms already in use.

- User-Friendly Interface: The integration process should be intuitive, allowing users to adopt the new features quickly.

- Security: Protect sensitive information by choosing secure integration methods that comply with data protection regulations.

Updating Payroll Information Regularly

Maintaining accurate and timely updates to employee compensation details is essential for any organization. Regular revisions ensure that all relevant data reflects current circumstances and legal requirements. This process helps in minimizing discrepancies and enhancing overall efficiency.

To effectively manage these updates, consider the following practices:

- Schedule Regular Reviews: Establish a routine for examining compensation records to capture changes in roles, responsibilities, or rates.

- Communicate with Employees: Encourage staff to report any personal information changes that could affect their remuneration.

- Utilize Technology: Implement software solutions that facilitate automatic updates and reminders for necessary adjustments.

- Ensure Compliance: Stay informed about relevant laws and regulations that might impact compensation structures.

By prioritizing these strategies, organizations can maintain accurate financial records and foster a transparent environment for all employees.

Tips for Efficient Payroll Processing

Streamlining compensation management is essential for any organization to ensure timely and accurate payments. Implementing effective practices can enhance productivity and reduce errors in the financial cycle.

Organize Employee Information

Maintaining up-to-date records of all personnel is crucial. This includes personal details, salary structures, and tax information. An organized database minimizes discrepancies and facilitates quicker processing.

Utilize Automation Tools

Leveraging technology can significantly simplify financial tasks. Automation tools can handle calculations, generate reports, and maintain compliance with regulations, reducing the administrative burden on staff.

| Practice | Benefit |

|---|---|

| Regular Training | Ensures staff is familiar with the latest procedures and tools. |

| Clear Communication | Minimizes misunderstandings regarding payment schedules and procedures. |

| Data Backup | Protects against data loss and ensures quick recovery in case of issues. |

Customizing Templates for Your Needs

Adapting documents to suit your specific requirements can significantly enhance efficiency and clarity. By personalizing layouts and formats, you can ensure that the information is presented in a way that resonates with your objectives and audience. This practice not only streamlines processes but also improves user experience.

When tailoring documents, consider the elements that matter most to you. Adjusting colors, fonts, and spacing can create a more visually appealing product that captures attention. Additionally, incorporating relevant fields and sections allows for a more functional tool that meets your unique demands.

Furthermore, maintaining flexibility in your approach is essential. As your needs evolve, so too should your documents. Regular updates ensure that the materials remain relevant and useful, allowing you to stay ahead in a dynamic environment. Embrace the opportunity to innovate and refine, ensuring your resources are always aligned with your goals.

Future Trends in Payroll Scheduling

As organizations evolve, so do their approaches to compensating employees. The landscape of remuneration planning is shifting towards more innovative methods that enhance efficiency and employee satisfaction. Emerging trends highlight the need for flexibility, technology integration, and adaptability to changing workforce dynamics.

One significant development is the increasing adoption of automation in financial management processes. Businesses are leveraging advanced software solutions that streamline payment systems, ensuring accuracy and timely transactions. This not only reduces administrative burdens but also minimizes human errors, fostering a more reliable environment for staff remuneration.

Additionally, companies are exploring personalized compensation frequencies to meet diverse employee needs. The traditional set schedules are giving way to more dynamic approaches, allowing workers to select their preferred payment intervals. This customization reflects a deeper understanding of employee preferences and financial wellbeing.

Moreover, the integration of real-time data analytics is becoming a crucial aspect of remuneration strategies. Organizations can now analyze workforce trends, performance metrics, and economic indicators to make informed decisions about their financial planning. This data-driven approach facilitates a more responsive and proactive strategy, aligning compensation practices with overall business objectives.

| Trend | Description |

|---|---|

| Automation | Implementing software solutions to enhance accuracy and reduce administrative tasks. |

| Flexible Payment Options | Offering employees the choice of payment intervals to suit individual preferences. |

| Data Analytics | Utilizing real-time data to drive informed decisions and adapt financial strategies. |

In summary, the future of compensation scheduling is marked by technological advancements and a shift towards employee-centric practices. Organizations that embrace these changes will likely experience improved engagement and retention rates, fostering a more motivated workforce.