Streamlining financial activities at the end of each reporting period is crucial for maintaining accurate and timely records. Organizations need a structured approach to ensure that all necessary tasks are completed efficiently, allowing for a clear overview of their financial status. By establishing a systematic routine, companies can enhance their reporting processes and minimize the risk of errors.

One effective strategy is to create a detailed plan that outlines essential steps and deadlines. This organized framework facilitates coordination among team members, ensuring that everyone is aware of their responsibilities. As a result, businesses can foster accountability and improve overall productivity.

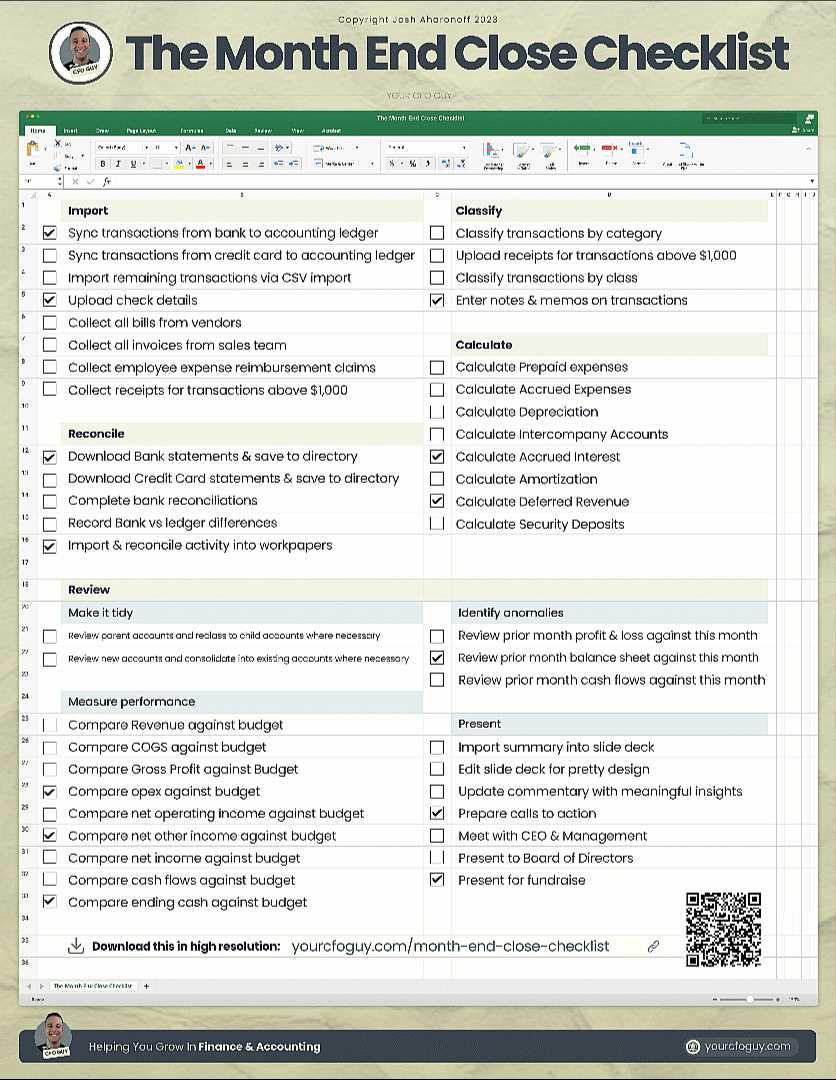

Moreover, utilizing a comprehensive guide can greatly assist in tracking key activities and deadlines. Such a resource serves as a reference point, helping to maintain consistency and streamline workflows. With proper documentation and adherence to established protocols, organizations can confidently navigate the complexities of financial management and achieve their objectives with greater ease.

Understanding the Accounting Close Process

The end-of-period procedure is a critical phase in financial management that ensures the accuracy and completeness of a company’s financial records. This essential process involves a series of steps designed to finalize and review all financial transactions within a specific timeframe, ultimately leading to the preparation of reliable financial statements.

Key Steps in the Procedure

To effectively complete this process, organizations typically follow several key steps. Initially, all transactions for the period must be gathered and reviewed for accuracy. This may involve reconciling accounts, verifying the integrity of data, and correcting any discrepancies. Once the transactions are confirmed, financial reports are generated, providing insights into the organization’s performance and position.

The Importance of Timeliness

Timeliness is crucial in this process, as delays can lead to inaccuracies and financial misstatements. A structured approach enables organizations to meet reporting deadlines and maintain stakeholder trust. Additionally, adhering to a well-defined procedure fosters transparency and accountability, which are vital for decision-making and strategic planning.

Importance of a Close Calendar

Establishing a structured timeline for financial operations is essential for organizations striving for efficiency and accuracy. A well-defined schedule aids in streamlining processes, ensuring that all necessary tasks are completed in a timely manner. By adhering to this organized approach, businesses can mitigate errors, enhance collaboration, and maintain a clear overview of their fiscal activities.

Timely Reporting: Adopting a systematic approach allows teams to generate reports promptly. This ensures that stakeholders receive crucial information when needed, enabling informed decision-making and strategic planning. Without a clear schedule, the risk of delays increases, potentially jeopardizing the organization’s financial health.

Enhanced Accountability: A structured timeline fosters a sense of responsibility among team members. When individuals are aware of their specific roles and deadlines, they are more likely to prioritize tasks effectively and remain accountable for their contributions. This heightened sense of ownership can lead to improved performance and results.

Streamlined Workflow: Implementing an organized timeline facilitates smoother workflows. By outlining key dates and responsibilities, teams can coordinate their efforts more effectively, reducing the likelihood of bottlenecks and confusion. This streamlined process not only boosts productivity but also helps to create a more harmonious work environment.

Improved Compliance: Following a defined schedule helps ensure that all necessary regulations and standards are met. By regularly reviewing and updating processes, organizations can remain compliant with industry requirements, thus avoiding potential penalties and enhancing their credibility.

In conclusion, a structured timeline for financial operations is invaluable for any organization aiming for precision and efficiency. It enhances accountability, streamlines workflows, and ensures timely reporting, ultimately contributing to a more effective operational strategy.

Key Components of the Template

A well-structured schedule is essential for ensuring a seamless and efficient financial process. The critical elements within this framework contribute to its effectiveness and usability. Each part plays a significant role in guiding the user through various phases and activities, making it easier to manage time and resources effectively.

- Timeline Overview: A visual representation of the timeline helps users quickly understand key dates and deadlines, ensuring that everyone is aligned on important events.

- Task Assignments: Clearly defined responsibilities assigned to specific team members enhance accountability and ensure that every task is completed on time.

- Milestones: Significant checkpoints are marked within the framework, providing users with a sense of progress and urgency as they work through the various stages.

- Documentation Requirements: A list of necessary documents and reports needed at each stage helps to streamline the process and prevent last-minute scrambles.

- Review Periods: Scheduled intervals for reviewing progress and addressing any issues that may arise promote proactive management and continuous improvement.

Incorporating these components into the design enhances the overall efficiency and effectiveness of the process, allowing teams to work collaboratively and meet their goals with confidence.

Steps to Create a Calendar

Developing a structured schedule can enhance efficiency and ensure that all essential activities are accounted for. This process involves organizing time slots effectively to accommodate various tasks, deadlines, and appointments. By following a systematic approach, anyone can establish a clear and functional framework to manage their time effectively.

1. Define Key Dates

Begin by identifying significant events and deadlines that need to be incorporated into your framework. This could include important meetings, project milestones, or personal commitments. Document these dates to ensure they are prioritized and easily accessible.

2. Choose the Right Format

Select a suitable format that aligns with your needs, whether it’s a digital tool or a physical planner. Consider the level of detail required and the best way to visualize your schedule. A well-chosen format will facilitate better organization and easier updates.

By implementing these steps, you can create an effective structure that helps manage your time and increases productivity.

Common Challenges in Accounting Close

The process of finalizing financial statements and reports often presents various hurdles that can complicate the efficiency and accuracy of the overall procedure. Organizations frequently face obstacles that can hinder timely completion, affect data integrity, and create stress for the teams involved.

One major difficulty is the coordination among different departments, which can lead to miscommunication and delays. When multiple teams contribute data, ensuring consistency and alignment becomes a daunting task. This lack of synchronization can result in errors that require significant time to rectify.

Additionally, the reliance on outdated technology or manual processes can create bottlenecks. Without modern systems to automate and streamline workflows, organizations may find themselves bogged down by repetitive tasks, making it challenging to meet deadlines effectively.

Another challenge is the ever-evolving regulatory landscape. Changes in compliance requirements necessitate continuous updates to processes and procedures, which can overwhelm teams already under pressure to deliver timely reports. Staying informed and adaptable to these changes is crucial to maintaining accuracy.

Lastly, the pressure to produce flawless outcomes can lead to heightened stress among team members. This stress may result in burnout or decreased morale, further complicating the finalization process. Addressing these challenges requires strategic planning, effective communication, and the right tools to enhance productivity.

Best Practices for Efficient Closures

Streamlining financial processes is essential for organizations aiming to enhance productivity and accuracy. Implementing effective strategies during the concluding phases of financial reporting can significantly reduce errors and ensure timely completion. Here are some best practices to consider.

- Establish Clear Deadlines: Set specific timelines for each phase of the process. This helps in maintaining focus and ensures that all team members are aligned.

- Utilize Automation Tools: Leverage technology to automate repetitive tasks. This not only saves time but also minimizes the risk of human error.

- Standardize Procedures: Develop uniform protocols for tasks. Standardization enhances consistency and enables team members to work more efficiently.

- Conduct Regular Training: Provide ongoing education for staff on the latest tools and techniques. Keeping the team informed fosters competence and confidence.

- Encourage Open Communication: Promote a culture of transparency. Regular check-ins and updates among team members facilitate problem-solving and foster collaboration.

- Review and Analyze: After each reporting cycle, take time to review the process. Identifying bottlenecks and areas for improvement will lead to more effective practices in the future.

By integrating these strategies, organizations can create a more efficient workflow that not only meets deadlines but also enhances overall financial integrity.

Tools to Simplify the Process

Efficiently managing financial activities is essential for any organization, and leveraging the right instruments can greatly streamline this undertaking. Utilizing innovative solutions not only enhances productivity but also minimizes errors and saves valuable time. Below are some effective tools designed to facilitate these tasks.

1. Software Solutions

- Integrated Financial Platforms: These systems provide a comprehensive approach to managing monetary operations, offering features such as automated reporting and real-time data tracking.

- Task Management Tools: Utilizing applications that enable teams to assign, track, and complete tasks ensures that every step of the process is managed effectively.

- Document Management Systems: Organizing and storing essential paperwork in a digital format can simplify retrieval and sharing, reducing the chances of misplacement.

2. Best Practices

- Standardized Procedures: Establishing uniform processes can help eliminate confusion and ensure that all team members are aligned in their approach.

- Regular Training: Providing ongoing education and resources to employees keeps everyone updated on the latest tools and practices, fostering a culture of continuous improvement.

- Feedback Mechanisms: Implementing ways to gather insights from team members about the processes allows for adjustments and enhancements based on practical experiences.

Customizing Templates for Your Needs

Adapting tools to suit your specific requirements is essential for achieving efficiency and effectiveness in any task. By personalizing the available resources, you can streamline processes and ensure that the structure aligns with your unique objectives. This approach not only enhances productivity but also fosters a sense of ownership over your workflow.

Understanding Your Requirements

Before diving into adjustments, take time to analyze your needs thoroughly. Identify the aspects that are most crucial to your operations. Whether it’s tracking deadlines, managing tasks, or facilitating collaboration, having a clear vision of what you want will guide your customization efforts.

Implementing Changes

Once you have a comprehensive understanding of your goals, start making modifications. This can involve altering layouts, adding specific fields, or integrating new functionalities that support your workflow. Consider employing visual aids and color coding to make the structure more intuitive and visually appealing. Remember, the key to successful adaptation lies in ensuring that your modifications are both practical and user-friendly.

Impact on Financial Reporting Timeliness

The efficiency of the reporting process plays a crucial role in the overall health of an organization. Timely dissemination of financial data not only enhances transparency but also fosters trust among stakeholders. Delays in reporting can lead to a loss of credibility, affecting decision-making and strategic planning.

Consequences of Delayed Reporting

When financial information is not presented promptly, it can hinder the ability of investors and management to assess performance accurately. Delayed reports may cause misalignment in expectations, leading to poor investment decisions and potentially damaging the organization’s reputation. Additionally, regulatory compliance can be compromised, resulting in penalties and further complications.

Strategies for Improved Timeliness

To enhance the speed of reporting, organizations can implement various strategies. Streamlining processes through technology can significantly reduce the time required to gather and analyze data. Regular training for staff involved in data collection and reporting ensures that everyone is equipped with the skills necessary to meet deadlines effectively. Furthermore, establishing a clear timeline and accountability within teams can facilitate a more efficient workflow.

Integrating Technology in the Process

In today’s rapidly evolving landscape, leveraging technological advancements has become essential for enhancing efficiency and accuracy in financial operations. The adoption of innovative tools streamlines workflows, minimizes errors, and facilitates real-time data access, ultimately leading to informed decision-making. This section explores the various ways technology can be integrated into financial management practices to optimize processes.

Benefits of Automation

Automation plays a pivotal role in transforming traditional practices. By implementing automated solutions, organizations can significantly reduce the time spent on repetitive tasks. This not only frees up valuable human resources but also ensures a higher level of precision in data handling.

Cloud-Based Solutions

Cloud technology offers unparalleled flexibility and accessibility. With the ability to access financial data from anywhere at any time, teams can collaborate seamlessly. Cloud-based platforms also enhance data security and provide automatic updates, ensuring that organizations remain compliant with the latest regulations.

| Technology | Impact on Processes | Examples |

|---|---|---|

| Automation Tools | Reduces manual workload | RPA software, AI-driven analytics |

| Cloud Computing | Enhances accessibility and security | Google Cloud, Microsoft Azure |

| Data Analytics | Improves decision-making through insights | Power BI, Tableau |

Team Collaboration During Closures

Effective teamwork is crucial during periods of finalization in any organization. When the time comes to review and finalize financial results, the seamless cooperation among team members can significantly impact the overall efficiency and accuracy of the process. Clear communication and a unified approach enable teams to navigate complex tasks and meet deadlines, ensuring that all aspects are thoroughly addressed.

Enhancing Communication

Establishing open lines of communication is essential for fostering a collaborative environment. Team members should regularly share updates, address concerns, and provide feedback throughout the process. Utilizing collaborative tools and platforms can facilitate real-time discussions and document sharing, allowing for quicker resolutions to potential issues. This proactive engagement not only enhances transparency but also builds trust within the team.

Leveraging Diverse Skills

Each team member brings unique skills and perspectives that can enrich the finalization process. Encouraging individuals to contribute their expertise fosters a sense of ownership and accountability. By assigning specific roles based on strengths, teams can optimize their efforts and ensure a more comprehensive approach to tackling challenges. Recognizing and valuing these diverse contributions promotes a collaborative culture that benefits the entire organization.

Tracking Changes and Updates Effectively

In the dynamic landscape of modern business, maintaining a clear record of modifications and enhancements is crucial for ensuring operational efficiency. Implementing systematic methods for monitoring alterations can significantly enhance decision-making processes and facilitate seamless communication among team members. By fostering a culture of transparency and accountability, organizations can better navigate challenges and capitalize on opportunities.

Establishing Clear Protocols

Creating structured guidelines for documenting changes is essential. These protocols should outline the specific steps to follow when implementing modifications, ensuring that all team members understand their roles in the process. Additionally, utilizing collaborative tools can streamline communication and provide real-time updates, allowing for a more cohesive workflow. Regularly revisiting these protocols will help adapt to evolving needs and technologies.

Utilizing Technology for Enhanced Tracking

Leveraging software solutions designed for monitoring alterations can significantly improve tracking efficiency. These tools can automate notifications and provide comprehensive reports, enabling teams to stay informed about recent updates. Furthermore, integrating version control systems can assist in managing changes systematically, ensuring that every adjustment is logged and easily retrievable. Emphasizing the importance of utilizing technology will empower teams to enhance their operational agility.

Training Staff on the Calendar Use

Effectively preparing employees to utilize scheduling tools is essential for maintaining operational efficiency. Training sessions should be designed to familiarize team members with the various features and functions of these tools, ensuring they can navigate and apply them in their daily tasks. A well-structured approach can enhance productivity and improve communication within the organization.

Key Objectives of Training

- Understand the functionalities and benefits of the scheduling system.

- Encourage consistent usage among all team members.

- Foster collaboration through shared scheduling practices.

- Minimize errors and misunderstandings related to time management.

Training Methods

- Workshops: Interactive sessions where staff can practice using the scheduling system with real-life scenarios.

- Online Tutorials: Video guides or e-learning modules that employees can access at their convenience.

- Mentorship: Pairing experienced users with those less familiar to provide guidance and support.

- Feedback Mechanism: Regularly collecting input from staff on the training process to improve future sessions.

By implementing a comprehensive training program, organizations can ensure that their employees are well-equipped to utilize scheduling tools effectively, leading to enhanced coordination and overall success.

Reviewing Past Closures for Improvement

Analyzing previous wrap-up processes is essential for enhancing efficiency and accuracy in future operations. By reflecting on past experiences, organizations can identify bottlenecks, recognize effective practices, and implement strategic changes. This continuous improvement cycle is vital for adapting to evolving challenges and ensuring optimal performance.

To effectively evaluate prior procedures, it is crucial to collect and review key data points. The following table outlines significant factors to consider during the assessment:

| Factor | Description | Actionable Insights |

|---|---|---|

| Time Taken | Duration of each phase in the previous processes. | Identify phases that require more time and explore ways to streamline them. |

| Accuracy | Frequency of discrepancies or errors encountered. | Implement additional checks or training to reduce mistakes. |

| Team Collaboration | Effectiveness of communication and teamwork among departments. | Encourage regular meetings and feedback sessions to improve collaboration. |

| Technological Utilization | Assessment of tools and software used during the wrap-up. | Consider upgrades or new tools to enhance efficiency. |

| Stakeholder Feedback | Input received from team members and external parties involved. | Gather insights to address concerns and improve overall satisfaction. |

Utilizing the insights gained from this review will enable organizations to refine their practices, minimize errors, and enhance overall performance in subsequent endeavors. Establishing a culture of continuous improvement through regular evaluations is vital for long-term success.

Benchmarking Against Industry Standards

Evaluating performance against established benchmarks is a crucial practice for organizations striving for excellence. By comparing internal processes and outcomes to those recognized in the industry, companies can identify gaps, recognize best practices, and implement improvements that drive efficiency and effectiveness.

Utilizing industry standards as a reference point enables businesses to gain insights into their operational strengths and weaknesses. This analysis not only highlights areas for enhancement but also provides a framework for setting achievable goals. Through continuous monitoring and adjustment based on these comparisons, organizations can maintain a competitive edge in their respective markets.

Moreover, aligning operations with recognized standards fosters accountability and transparency within the organization. It encourages a culture of performance measurement and data-driven decision-making, which is vital in today’s fast-paced business environment. Ultimately, the pursuit of excellence through benchmarking enhances overall organizational performance and customer satisfaction.

Future Trends in Accounting Closures

The evolution of financial reporting and the processes that accompany it are witnessing significant transformations. Organizations are increasingly focusing on efficiency and accuracy, leveraging technology to streamline their operations. As these practices advance, we can anticipate several key developments that will reshape the way financial periods are concluded.

Automation and AI Integration: The rise of automation and artificial intelligence is set to revolutionize traditional practices. By implementing advanced software solutions, companies can enhance data processing, reduce manual errors, and accelerate the completion of financial cycles. This technological shift allows for real-time data analysis and quicker decision-making.

Increased Emphasis on Transparency: As stakeholders demand greater visibility into financial processes, organizations are adopting practices that prioritize transparency. Enhanced reporting standards and accessible documentation are becoming essential, fostering trust and confidence among investors and regulators alike.

Collaboration and Cloud Solutions: The trend towards cloud-based solutions facilitates collaboration among teams, regardless of their geographical location. This connectivity enables seamless communication and sharing of information, thereby expediting the closing process. As remote work becomes more prevalent, these tools will become integral to financial practices.

Focus on Sustainability: The growing emphasis on sustainability will influence financial operations. Companies will increasingly incorporate environmental, social, and governance (ESG) factors into their reporting processes. This shift not only aligns with global trends but also attracts socially conscious investors.

Continuous Improvement Methodologies: Organizations are adopting continuous improvement methodologies to refine their financial processes continually. By analyzing performance metrics and identifying areas for enhancement, businesses can optimize their practices and adapt to changing regulatory environments.

In summary, the future landscape of financial period completion is poised for innovative changes. The integration of technology, emphasis on transparency, collaborative tools, sustainability efforts, and a focus on continuous improvement will collectively redefine how organizations manage their financial reporting.