In the dynamic realm of finance, having a structured approach to conclude periods efficiently is vital for maintaining clarity and accuracy. A well-defined outline can facilitate the seamless transition from one phase to another, ensuring that all necessary tasks are accounted for and completed systematically.

By adopting a strategic framework, organizations can enhance their operational effectiveness. This not only promotes transparency but also aids in aligning all team members with critical deadlines and responsibilities. Establishing a reliable guide helps in managing time and resources efficiently, ultimately supporting sound decision-making.

Implementing a practical outline enables businesses to prioritize key activities, streamline processes, and mitigate potential errors. It fosters a proactive atmosphere where each participant understands their role in achieving collective goals. The result is a more cohesive and productive environment that supports the overall financial health of the organization.

This section aims to shed light on the essential procedures involved in the finalization of financial records. The process ensures that all transactions are accurately recorded, reviewed, and reconciled, contributing to a reliable financial overview for stakeholders.

Key Steps in the Finalization Process

- Gathering necessary documentation and data from various departments.

- Reviewing and adjusting entries to ensure accuracy.

- Reconciliation of accounts to confirm balances align with records.

- Generating comprehensive reports for analysis and decision-making.

Importance of a Structured Approach

Having a systematic approach aids in reducing errors and enhancing efficiency. By following a well-defined sequence of activities, organizations can improve transparency and accountability in their financial practices.

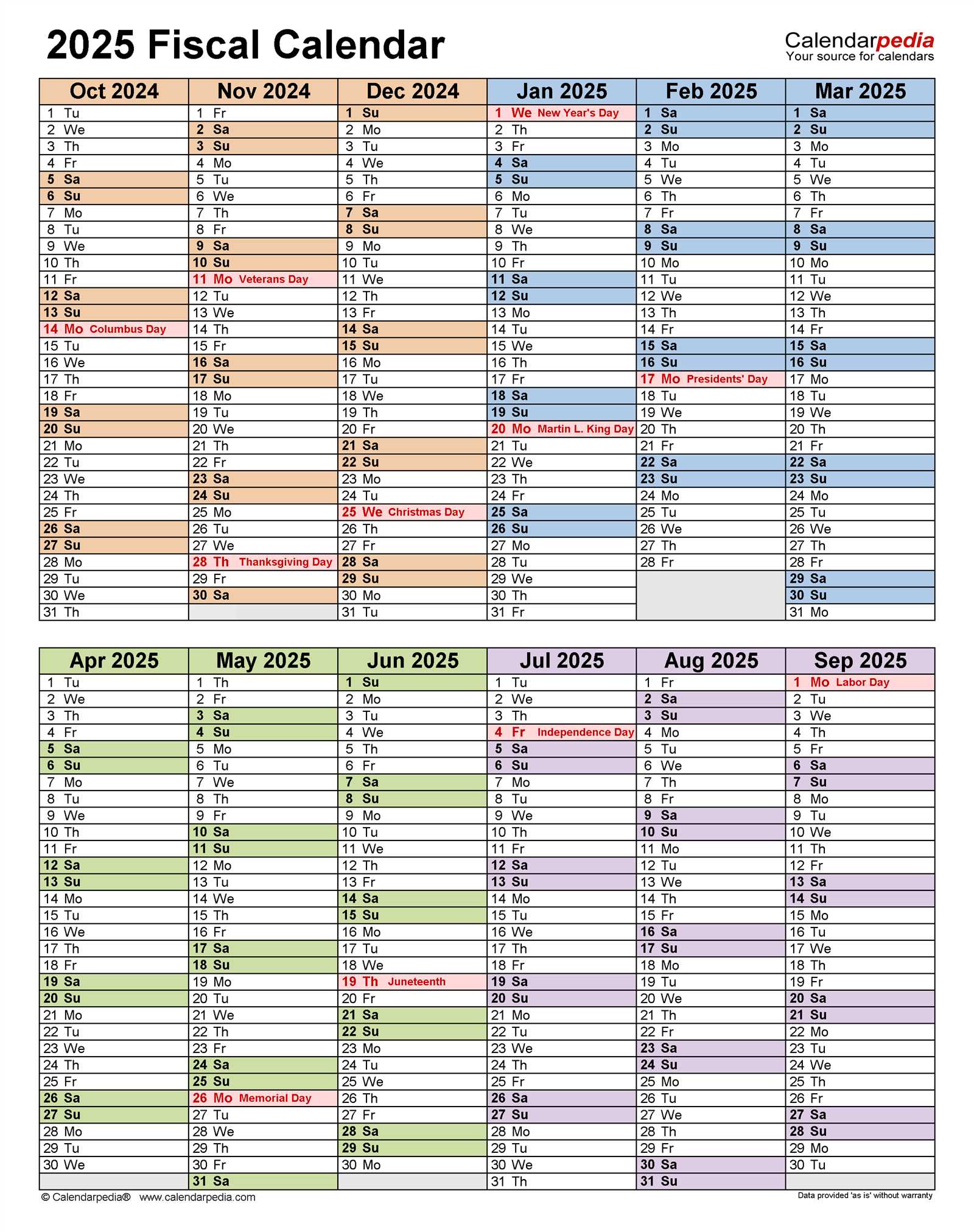

Importance of a Closing Calendar

Establishing a systematic schedule for finalizing financial records is crucial for maintaining accuracy and efficiency within an organization. A well-structured timeline not only streamlines the process but also enhances collaboration among team members, ensuring that all necessary tasks are completed on time.

Enhancing Accuracy

Implementing a detailed schedule helps in minimizing errors that can arise from rushed or overlooked tasks. By allocating specific time frames for each responsibility, teams can focus on their work without the pressure of tight deadlines. This methodical approach promotes a thorough review of all entries, resulting in more precise outcomes.

Facilitating Communication

A clear timetable fosters better communication among departments. By having a shared understanding of deadlines and expectations, teams can coordinate their efforts more effectively. This transparency not only reduces confusion but also encourages accountability, as everyone knows their roles and responsibilities in the process.

Key Steps in Month-End Closing

Successful financial reconciliation requires a systematic approach to ensure all necessary tasks are completed efficiently. This process involves several critical actions that help maintain the accuracy and integrity of financial records, paving the way for insightful analysis and reporting.

1. Prepare Documentation: Gather all relevant financial records, including invoices, receipts, and transaction logs. Ensuring that all paperwork is complete allows for a smoother review process.

2. Review Transactions: Conduct a thorough examination of all financial activities within the designated period. This involves verifying entries for accuracy and consistency, which is essential for reliable reporting.

3. Adjust Entries: Make any necessary corrections to accounts that may have discrepancies. This step is vital for reflecting the true financial position of the organization.

4. Reconcile Accounts: Match internal records with external statements, such as bank and credit card statements. This reconciliation helps identify any inconsistencies that need addressing.

5. Generate Reports: Create comprehensive financial statements that summarize the organization’s performance. These reports provide essential insights for decision-making and future planning.

6. Review and Approve: Conduct a final review of all documents and reports before obtaining necessary approvals. This ensures that all information is accurate and meets organizational standards.

7. Archive Records: Safely store all documentation and reports for future reference. Proper archiving not only aids in compliance but also supports historical analysis.

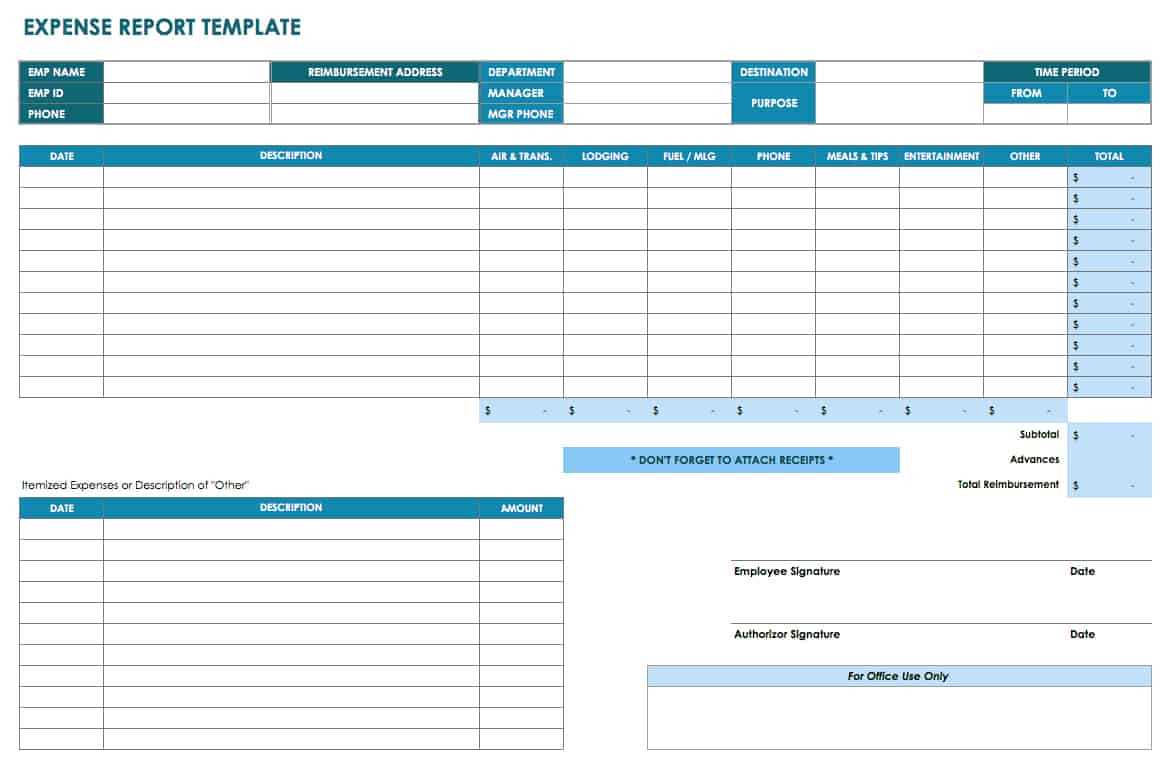

Essential Documents for Closing

When finalizing financial activities, having the right paperwork is crucial. This ensures that all processes are streamlined and accurate, allowing for a seamless transition into the next period. Proper documentation supports clarity and facilitates effective communication among team members.

Financial Statements: Comprehensive reports detailing the financial position and performance are essential. These include balance sheets, income statements, and cash flow statements, providing a clear overview of the organization’s fiscal health.

Reconciliation Reports: These documents are necessary to compare different financial records. By reconciling accounts, discrepancies can be identified and corrected, ensuring that the financial data is reliable and trustworthy.

Supporting Documentation: This encompasses various forms of evidence, such as invoices, receipts, and contracts. These items substantiate the figures presented in financial statements and offer a detailed account of all transactions.

Audit Trails: Maintaining a thorough record of all financial activities is vital. This documentation allows for tracking of transactions and provides a historical context for the figures reported, aiding in both internal and external assessments.

Management Reviews: Summaries from leadership evaluations provide insight into the operational effectiveness and financial strategies. These reviews help ensure that all aspects of the organization’s performance are considered before concluding the reporting period.

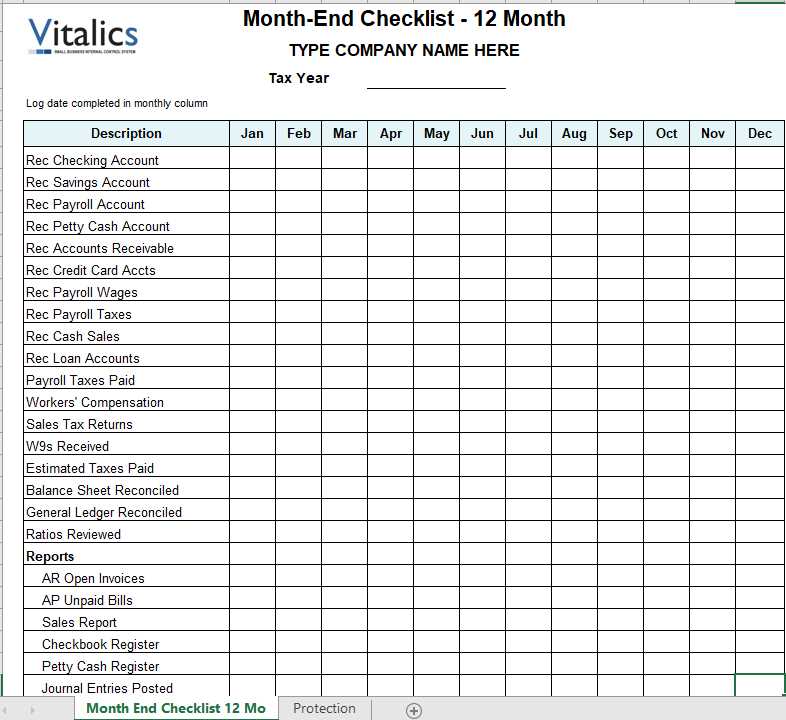

Creating a Closing Checklist

Establishing a comprehensive review guide is essential for ensuring all necessary tasks are completed efficiently and effectively. This list serves as a valuable tool to streamline processes and maintain consistency throughout the preparation phase. By following a structured approach, teams can enhance their productivity and minimize the risk of oversight.

Begin by identifying key activities that must be performed regularly. These tasks may include verifying data accuracy, reconciling accounts, and preparing reports. By breaking down each step into manageable components, individuals can stay organized and focused on the critical elements of their responsibilities.

Additionally, it is beneficial to assign specific roles to team members for each task on the list. Clear delegation fosters accountability and encourages collaboration among the group. Regularly reviewing and updating this checklist will help to adapt to any changes in processes or requirements, ensuring it remains relevant and effective.

Finally, consider integrating timeframes for each activity. Setting deadlines not only helps to maintain momentum but also provides a sense of urgency, promoting timely completion of all necessary actions. This proactive approach ultimately contributes to a smoother workflow and a more organized preparation process.

Common Challenges During Closing

Completing the financial reconciliation process can be a daunting task, often fraught with obstacles that hinder efficiency and accuracy. Various factors contribute to these difficulties, affecting the overall workflow and leading to potential delays. Understanding these challenges is essential for streamlining operations and ensuring timely outcomes.

Data Integrity Issues

One significant hurdle arises from inconsistencies in data. Errors may occur due to manual entry, system glitches, or miscommunication among teams. These discrepancies not only complicate the review process but also increase the risk of financial misstatements, necessitating additional time for corrections.

Resource Constraints

Limited personnel and time can exacerbate the situation, especially during peak periods. Teams may struggle to meet tight deadlines, leading to rushed analyses and overlooked details. Proper resource allocation and planning are crucial to mitigate these constraints and enhance the quality of the outcomes.

Best Practices for Efficiency

Enhancing productivity during financial cycles requires a strategic approach. Implementing effective methods can streamline processes, reduce errors, and ensure timely completion of tasks. This section outlines key strategies that foster improved performance and resource management.

Streamlined Processes

Developing a structured workflow is essential. Identify critical tasks and sequence them logically to minimize delays. Utilize automation tools to handle repetitive activities, allowing team members to focus on more complex issues. Regularly review procedures to eliminate redundancies and enhance speed.

Effective Communication

Clear communication among team members is vital for success. Establish channels for timely updates and feedback. Regular check-ins can help address potential challenges early and maintain alignment on objectives. Encouraging collaboration fosters a proactive environment, which is essential for meeting deadlines.

How to Use Templates Effectively

Utilizing structured formats can significantly streamline your workflow and enhance efficiency. By incorporating well-designed frameworks into your routine, you can minimize errors and save time, allowing for a more organized approach to tasks.

Understanding the Basics

Before diving into application, it is essential to grasp the fundamental aspects of these structures:

- Identify key components that are essential for your specific needs.

- Familiarize yourself with common features that can aid in navigation and usability.

- Adjust elements to suit your unique requirements and preferences.

Implementing Best Practices

To maximize the benefits of these frameworks, consider the following strategies:

- Regularly update and review your formats to ensure they remain relevant.

- Involve your team in the customization process to encourage collaboration.

- Utilize feedback to make necessary adjustments, enhancing overall effectiveness.

Automation in Month-End Processes

In today’s fast-paced business environment, streamlining repetitive tasks is crucial for enhancing efficiency and accuracy. Automating routine procedures not only saves time but also minimizes human errors, allowing teams to focus on more strategic activities. By implementing advanced technologies, organizations can significantly improve their operational workflows.

Integrating automation tools into financial workflows transforms how organizations handle essential tasks. These systems can perform data entries, generate reports, and track performance metrics without constant manual intervention. As a result, the overall productivity of the team increases, leading to quicker turnaround times for critical operations.

Moreover, automation facilitates better data management. With automated systems, data is collected and stored consistently, ensuring that information is readily available for analysis. This capability empowers decision-makers to access real-time insights, enabling them to make informed choices swiftly and effectively.

Role of Accounting Software

In today’s dynamic business environment, the utilization of digital tools has become essential for efficient financial management. These applications streamline various processes, ensuring that organizations maintain clarity and accuracy in their fiscal operations. By automating routine tasks, they free up valuable time for professionals to focus on strategic decision-making and analysis.

Efficiency and Accuracy

One of the primary benefits of these applications is their ability to enhance both speed and precision. Automated calculations minimize the risk of human error, which is crucial in maintaining reliable records. With features such as real-time data entry and instant reporting, businesses can make informed choices quickly, adapting to changes as they arise.

Integration and Accessibility

Furthermore, modern solutions often integrate seamlessly with other business systems, creating a cohesive environment for data management. This interconnectedness allows for easier access to financial information across various departments, facilitating collaboration and improving overall workflow. Remote accessibility also ensures that stakeholders can review and analyze performance from anywhere, fostering transparency and accountability.

Review and Reconciliation Techniques

Ensuring accuracy in financial data is crucial for effective decision-making and operational efficiency. This section focuses on the methods and practices that can be employed to verify information and rectify discrepancies. By systematically reviewing records, organizations can enhance their financial integrity and maintain compliance with regulatory standards.

Systematic Verification

Implementing a structured approach to reviewing financial records helps identify errors and omissions. This technique involves cross-checking data against source documents and external statements. Regular audits and checks foster a culture of accuracy and transparency within the organization.

Collaborative Reconciliation

Involving multiple stakeholders in the reconciliation process encourages thoroughness and diverse perspectives. Engaging teams from different departments can uncover inconsistencies that might otherwise go unnoticed. This collaborative effort not only strengthens the validation process but also promotes a unified understanding of financial practices across the organization.

Communication with Stakeholders

Effective dialogue with relevant parties is essential for ensuring clarity and alignment throughout the financial process. Establishing robust channels of communication fosters transparency and builds trust, which is crucial for informed decision-making.

Key Strategies for Effective Communication

- Regular Updates: Providing consistent information regarding progress and potential issues keeps everyone informed and engaged.

- Feedback Mechanisms: Encouraging input from stakeholders allows for diverse perspectives and can lead to improvements in processes.

- Clear Documentation: Maintaining well-organized records aids in providing clarity and serves as a reference for all involved.

Tools for Enhancing Communication

- Email Newsletters: Regularly scheduled updates sent via email can keep stakeholders informed on important developments.

- Collaborative Platforms: Utilizing software solutions that facilitate real-time collaboration can streamline discussions and document sharing.

- Meetings and Workshops: Organizing face-to-face or virtual gatherings promotes dialogue and strengthens relationships.

Monitoring Closing Timelines

Effective tracking of financial reporting periods is essential for ensuring timely completion of all necessary procedures. Establishing a structured approach allows teams to streamline their activities and meet critical deadlines efficiently. By implementing a well-defined process, organizations can enhance their overall productivity and maintain a clear overview of their progress.

Utilizing tools for oversight and coordination can significantly aid in visualizing each stage of the financial reporting journey. Regular assessments and updates help identify any potential delays, enabling proactive adjustments to be made. This practice fosters a culture of accountability, where team members are encouraged to adhere to their responsibilities while contributing to collective goals.

Moreover, maintaining open lines of communication throughout the organization is crucial. Encouraging discussions about timelines and progress not only helps to keep everyone aligned but also promotes collaborative problem-solving when challenges arise. By prioritizing these elements, companies can ensure a smooth transition through each reporting cycle.

Adjusting for Unforeseen Delays

In any project or operational cycle, unexpected setbacks can arise, necessitating a flexible approach to management and planning. These interruptions can stem from various sources, including unforeseen circumstances or resource constraints, and may impact overall timelines and deliverables.

To effectively navigate these challenges, it’s essential to reassess priorities and allocate resources accordingly. This may involve shifting tasks, extending timelines, or reallocating team members to ensure that critical objectives are met without compromising quality.

Communication is key during these times. Keeping all stakeholders informed about potential impacts and revised schedules fosters collaboration and helps maintain morale. Implementing regular check-ins can also facilitate prompt identification of issues and enable swift adjustments to the strategy.

By adopting a proactive mindset and embracing adaptability, organizations can better manage unexpected delays and ensure continued progress toward their goals.

Post-Close Analysis and Reporting

After the completion of the financial period, it is crucial to conduct a thorough evaluation of the outcomes and performance metrics. This phase involves scrutinizing the gathered data to identify trends, discrepancies, and areas for improvement. Analyzing results helps organizations make informed decisions moving forward.

Key Components

The analysis phase encompasses various components, including variance analysis, trend identification, and performance benchmarking. By comparing actual results against forecasts or historical data, businesses can understand the reasons behind any deviations. This insight is vital for refining future strategies and enhancing operational efficiency.

Reporting Practices

Effective communication of findings is equally important. Generating comprehensive reports that summarize the analysis allows stakeholders to grasp the financial health of the organization. Utilizing visual aids, such as graphs and charts, can further clarify complex information, making it accessible and actionable for all parties involved.

In summary, this stage is essential for fostering a culture of continuous improvement and accountability. By dedicating time to analysis and reporting, organizations can ensure they are well-equipped for future challenges and opportunities.

Continuous Improvement Strategies

Enhancing operational efficiency requires a proactive approach focused on ongoing advancements. By adopting systematic methods for refining processes, organizations can achieve higher productivity, greater accuracy, and overall effectiveness. This section delves into various strategies that foster a culture of perpetual enhancement.

Feedback Mechanisms

Establishing robust channels for feedback is crucial. Engaging employees in discussions about their experiences and challenges allows for valuable insights that can drive positive changes. Implementing regular surveys and suggestion boxes creates an environment where continuous improvement is prioritized.

Data-Driven Decision Making

Leveraging data analytics can significantly influence improvement strategies. By analyzing performance metrics, organizations can identify trends and pinpoint areas requiring attention. This evidence-based approach ensures that decisions are informed and targeted, leading to effective enhancements in operations.