This section explores the concept of organizing important dates and financial obligations in a structured format. By utilizing an efficient framework, individuals can keep track of essential events, ensuring timely payments and deadlines are met.

Effective organization is key to managing responsibilities and avoiding last-minute stress. A well-designed structure can enhance productivity and provide clarity in daily planning.

Incorporating various elements allows for customization to suit personal preferences. This flexibility ensures that the final product is tailored to meet specific needs, ultimately leading to better time management and reduced anxiety.

This section explores the concept of organized schedules for managing financial obligations. The aim is to provide insights into how these tools can assist individuals and businesses in keeping track of due dates and payments efficiently.

Importance of Structured Planning

Having a well-structured approach to tracking expenses helps prevent late payments and associated fees. Here are some benefits:

- Enhances financial awareness

- Facilitates timely payments

- Reduces stress related to overdue bills

Components of an Effective Schedule

An effective organizational system should include several key elements:

- Clear categorization of obligations

- Specific due dates for each item

- Reminders for upcoming payments

Benefits of Using a Bill Calendar

A structured approach to managing financial obligations can significantly enhance personal organization. This tool allows individuals to track due dates, ensuring timely payments and reducing the likelihood of late fees. By visually mapping out expenses, users can create a clearer picture of their financial landscape, leading to better budgeting decisions.

Improved Financial Awareness

Utilizing a systematic method to monitor payments helps users stay informed about their financial commitments. This awareness can lead to more responsible spending habits and the ability to prioritize essential expenses over discretionary ones.

Reduced Stress

Having a reliable system in place can alleviate anxiety associated with managing multiple payments. Knowing when obligations are due empowers users to plan accordingly, fostering a sense of control over their finances.

| Advantage | Description |

|---|---|

| Timeliness | Ensures payments are made on time, preventing penalties. |

| Budgeting | Helps visualize expenses, aiding in effective financial planning. |

| Stress Reduction | Minimizes anxiety by providing a clear overview of financial obligations. |

How to Create a Bill Calendar

Establishing a schedule for financial obligations is crucial for effective personal budgeting. This process involves organizing due dates and payment amounts, ensuring that no deadline is overlooked. By following a few simple steps, anyone can develop a practical approach to managing their monetary responsibilities.

Gathering Necessary Information

Begin by collecting all relevant details regarding upcoming payments. This includes the amounts due, due dates, and any specific payment methods. Having a comprehensive overview will help in structuring an effective timeline.

Organizing the Schedule

Next, create a visual representation of the payment timeline. You can use digital tools or traditional methods, such as a planner or wall chart. Populate this schedule with the information gathered, ensuring it is easy to read and update as needed.

Essential Features to Include

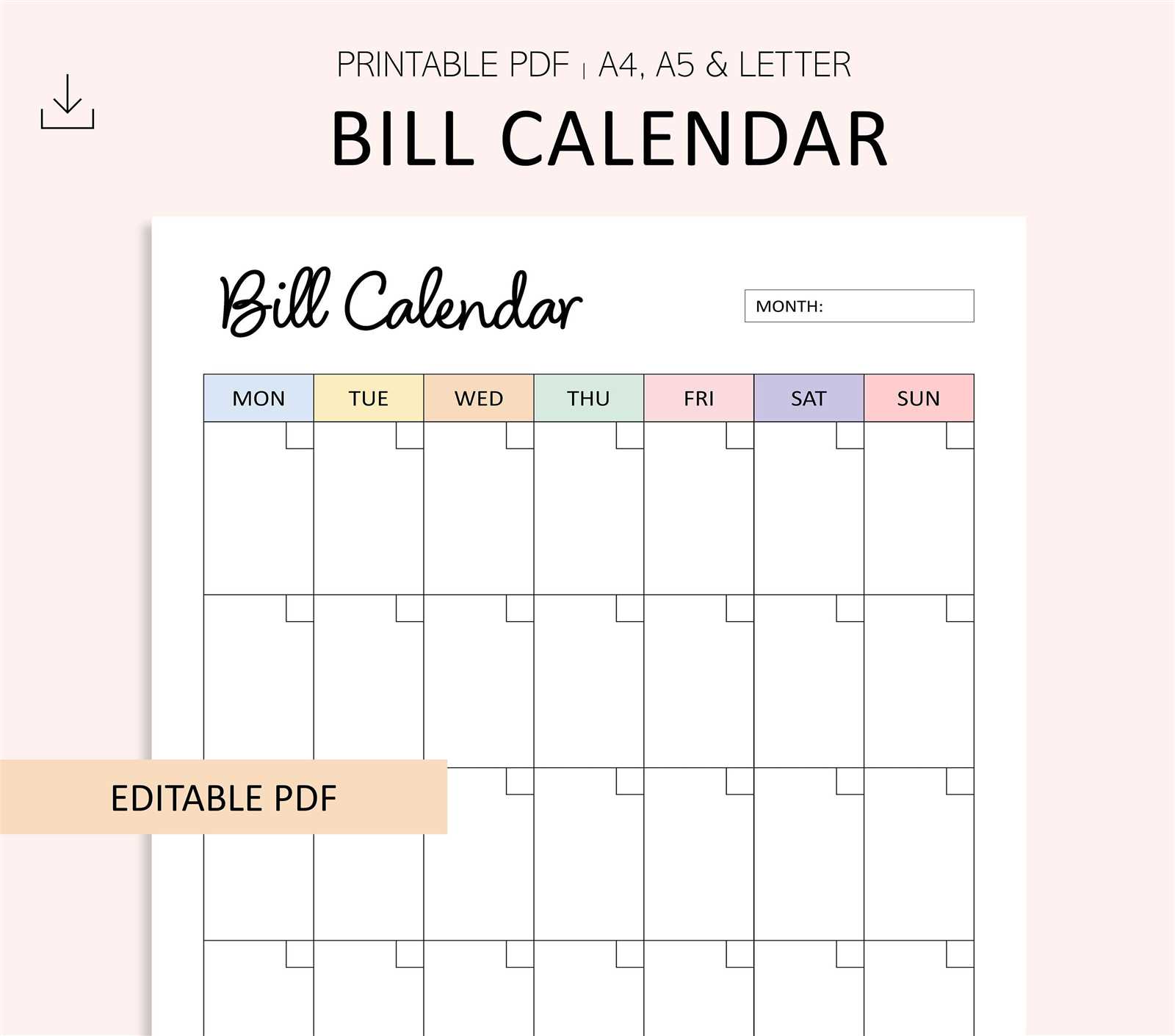

When designing an effective scheduling tool, several key elements are crucial for ensuring functionality and user satisfaction. These components not only enhance usability but also provide a comprehensive overview for better planning and organization.

| Feature | Description |

|---|---|

| User-Friendly Interface | A clear and intuitive layout that allows for easy navigation and quick access to necessary functions. |

| Customizable Layout | Options for users to modify views according to personal preferences, such as daily, weekly, or monthly formats. |

| Reminder Notifications | Automated alerts to notify users of upcoming tasks or events, ensuring nothing is overlooked. |

| Integration Capabilities | The ability to connect with other applications or tools, streamlining workflows and improving efficiency. |

| Printable Versions | Options for users to generate hard copies for offline reference or sharing with others. |

Customizing Your Bill Calendar

Personalizing your scheduling tool can greatly enhance its functionality and meet your specific needs. By tailoring various elements, you can create an efficient system that works best for you, making it easier to track important dates and responsibilities.

Start by selecting a layout that suits your preferences. Consider whether a grid or list format aligns better with your workflow. Adding colors can also improve visibility and organization, allowing you to easily distinguish between different types of entries. Incorporating reminders will help ensure that critical tasks are not overlooked.

Furthermore, you can integrate additional features, such as notes or links, to provide more context for each entry. This level of customization empowers you to manage your commitments more effectively, ultimately leading to improved productivity.

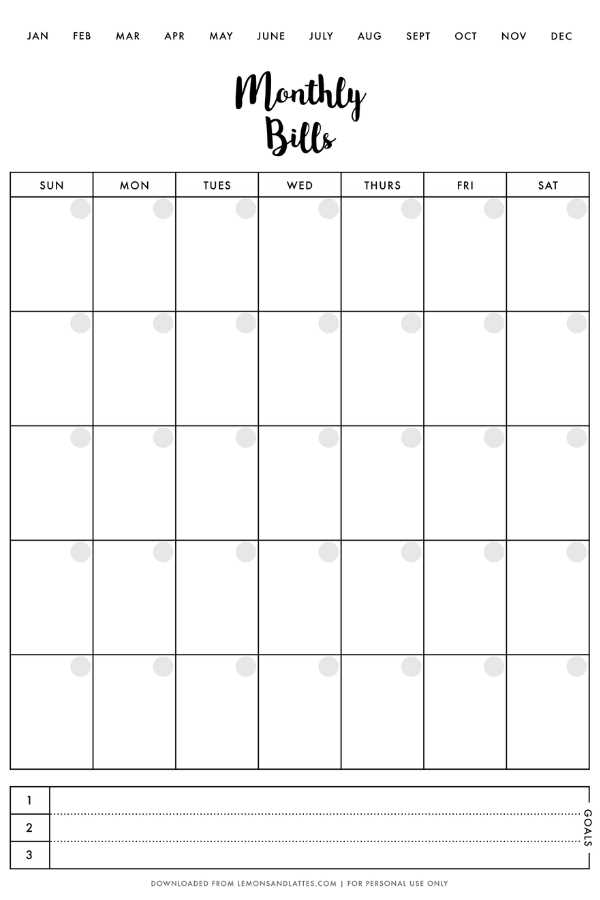

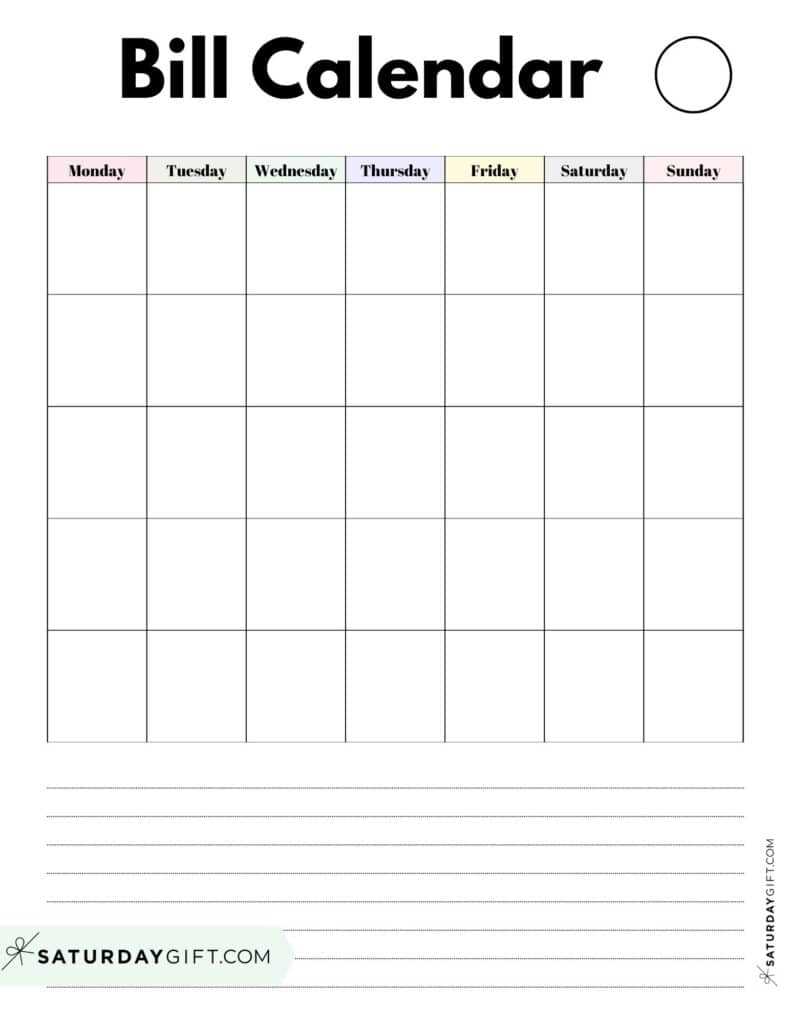

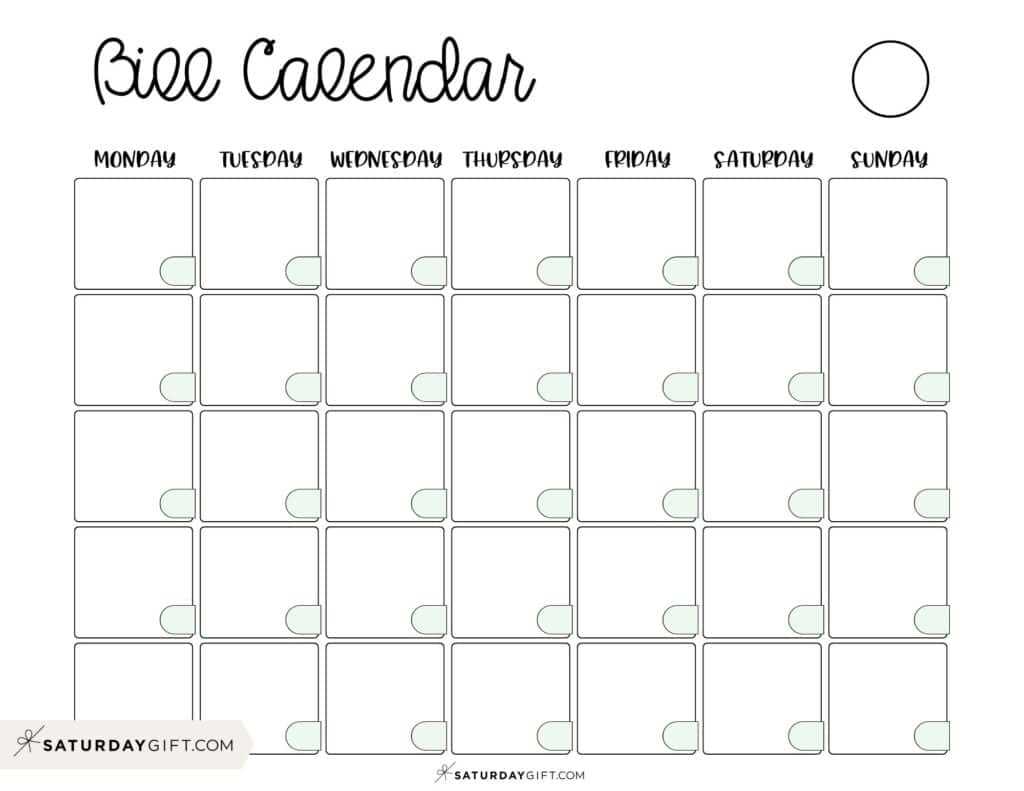

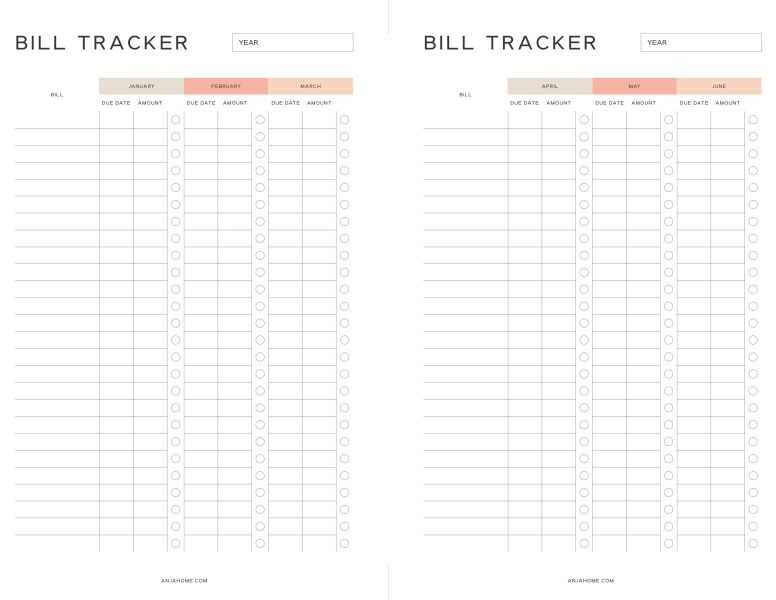

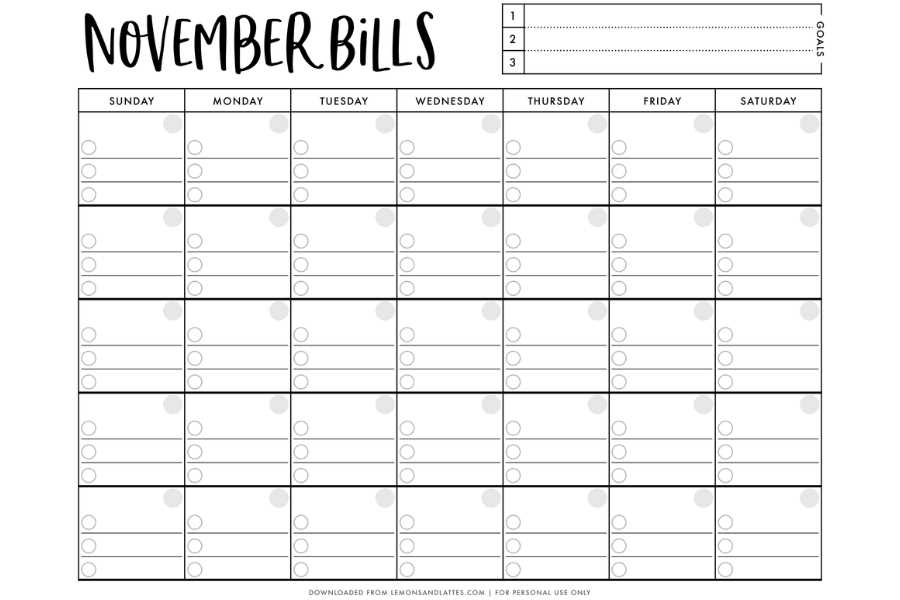

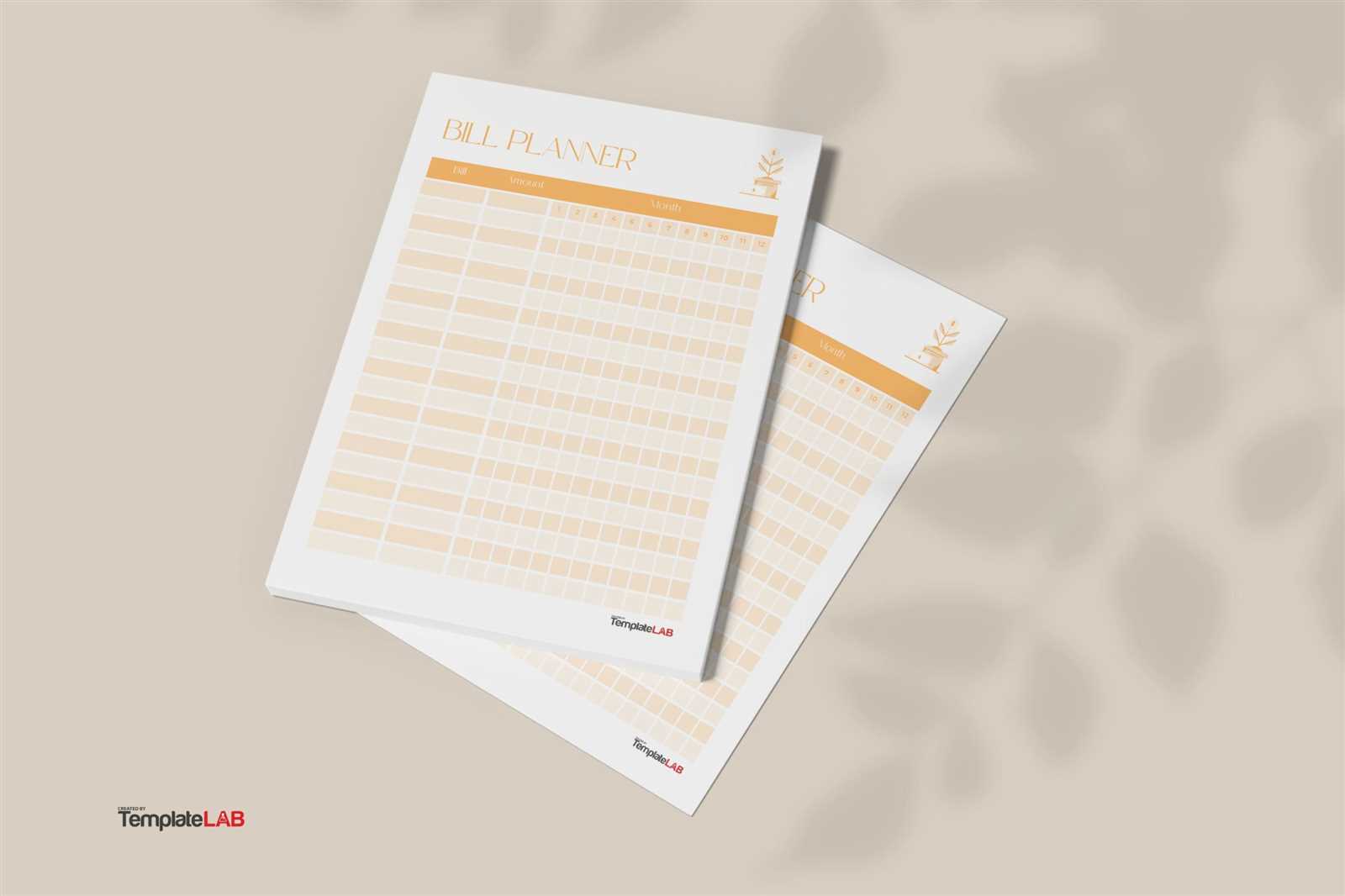

Popular Formats for Bill Calendars

When managing financial obligations, the choice of layout can significantly impact organization and tracking. Various styles cater to different needs and preferences, ensuring individuals can efficiently monitor their expenses.

- Monthly View: This format offers a comprehensive overview of all due payments within a month, allowing for easy planning and prioritization.

- Weekly Layout: Ideal for those who prefer a closer look at their obligations, this structure breaks down payments into manageable weekly segments.

- Customizable Options: Many users benefit from formats that allow them to personalize their tracking system according to their unique requirements.

- Digital Formats: With the rise of technology, online tools and applications provide interactive ways to manage due dates, offering reminders and alerts.

Choosing the right format can lead to improved financial awareness and better budgeting practices.

Using Technology for Bill Management

In today’s digital age, managing financial obligations has become more efficient and accessible through various technological solutions. These tools help individuals and businesses streamline their payment processes, ensuring that deadlines are met without the stress of manual tracking.

Benefits of Digital Solutions

- Automated Reminders: Notifications can be set up to alert users about upcoming due dates, minimizing the risk of late payments.

- Centralized Tracking: All financial commitments can be monitored in one place, making it easier to manage cash flow.

- Secure Transactions: Online platforms often provide enhanced security features to protect sensitive information.

Popular Tools and Applications

- Expense Management Software: Applications designed to categorize and track spending effectively.

- Online Banking: Many institutions offer apps that allow for easy monitoring and payment of obligations.

- Personal Finance Apps: Tools that integrate various accounts and provide a holistic view of financial health.

Tips for Organizing Bill Due Dates

Managing financial obligations can often be overwhelming. Having a systematic approach to track deadlines can significantly reduce stress and help maintain a good standing. Here are some effective strategies to ensure timely payments and avoid late fees.

Utilize Digital Tools: Leverage technology by using applications or software designed to track deadlines. These tools can send reminders and alerts, ensuring you never miss a payment.

Create a Visual Tracker: Establish a physical or digital chart that clearly displays due dates. Visual representations can enhance your awareness and make it easier to plan your finances.

Prioritize Payments: List your obligations in order of importance or due date. This prioritization helps you allocate funds accordingly and prevents any last-minute rush.

Set Up Automatic Payments: Whenever possible, opt for automatic withdrawals. This method guarantees that payments are made on time without requiring constant attention.

Review Regularly: Schedule a monthly review of your obligations. This practice allows you to adjust for any changes in your financial situation and stay informed about upcoming deadlines.

Common Mistakes to Avoid

When creating a scheduling layout, there are several pitfalls that can hinder effectiveness and organization. Recognizing these common errors can help ensure that your planning efforts are fruitful and that you stay on top of your commitments.

One frequent mistake is neglecting to clearly define timeframes and deadlines. Without precise intervals, it becomes challenging to track tasks and manage responsibilities efficiently. Be sure to set specific periods for each entry to maintain clarity.

Another issue is overcrowding the design with too much information. A cluttered layout can be overwhelming and may lead to important tasks being overlooked. Keep entries concise and prioritize the most critical details to enhance usability.

Lastly, failing to regularly update your layout can result in outdated information. Make it a habit to review and modify your entries frequently to reflect current tasks and appointments. This practice ensures that you remain organized and informed.

Tracking Expenses with a Calendar

Utilizing a structured approach to monitor financial outflows can significantly enhance one’s budgeting capabilities. By organizing expenditures in a systematic manner, individuals can gain a clearer perspective on their spending habits and identify areas for potential savings.

| Date | Category | Amount | Notes |

|---|---|---|---|

| 2024-11-01 | Groceries | $150 | Weekly shopping |

| 2024-11-02 | Utilities | $75 | Electricity bill |

| 2024-11-03 | Entertainment | $50 | Cinema tickets |

Printable vs. Digital Bill Calendars

When managing financial obligations, individuals often face a choice between traditional paper formats and modern electronic solutions. Each option presents unique advantages and considerations, influencing how users track and organize their commitments.

Physical formats offer a tangible method for keeping track of due dates and payments. Many find comfort in visually marking off completed tasks, which can enhance the sense of accomplishment. Additionally, printed materials can be easily customized to fit personal preferences, allowing for a more personalized approach to organization.

On the other hand, electronic formats provide unmatched convenience and accessibility. With digital solutions, reminders can be set to ensure timely payments, and users can access their information from various devices. This adaptability helps streamline financial management, especially for those with busy lifestyles. Moreover, electronic options often come with features that allow for easy updates and modifications.

Ultimately, the decision between physical and digital formats hinges on individual preferences and lifestyles. Understanding the strengths of each can aid in making an informed choice that best suits one’s needs.

Integrating Calendar with Financial Apps

Combining scheduling tools with financial management applications can greatly enhance personal budgeting and expense tracking. This integration allows users to visualize their financial commitments alongside their daily tasks, fostering better planning and awareness of upcoming payments.

By linking these systems, individuals can receive timely reminders for due dates, helping to avoid late fees and ensuring that financial responsibilities are met on time. Additionally, users can set goals and track their progress in real-time, making informed decisions about their spending habits.

Seamless Synchronization between these platforms ensures that all important dates are accounted for, creating a comprehensive overview of both personal and financial obligations. This holistic approach promotes a more organized lifestyle, allowing for improved financial health.

Ultimately, the synergy between scheduling tools and financial applications not only saves time but also empowers users to take control of their finances with confidence.

Setting Reminders for Payments

Establishing reminders for financial obligations is crucial for effective budgeting and avoiding late fees. By implementing timely notifications, individuals can stay organized and ensure that they meet their payment deadlines.

Choosing the Right Reminder Method

There are several methods to set up reminders, including:

- Mobile applications

- Email notifications

- Physical notes or planners

Tips for Effective Reminders

To enhance the effectiveness of your reminders, consider the following:

- Schedule reminders a few days in advance.

- Use clear and specific wording.

- Incorporate visual cues, like colors or symbols.

How to Share Your Bill Calendar

Sharing your scheduling tool can significantly enhance collaboration and ensure everyone stays informed about upcoming payments. By distributing access to this essential resource, you facilitate better communication and financial planning among all involved parties.

There are several effective methods to share this tool with others:

| Method | Description |

|---|---|

| Send the file as an attachment or provide a link to access it online, ensuring recipients can view or edit it as needed. | |

| Cloud Storage | Upload the resource to a cloud service and share the link, allowing real-time updates and access from any device. |

| Collaborative Tools | Utilize apps designed for teamwork, where users can work together, leave comments, and make updates in one centralized location. |

Assessing Your Monthly Expenses

Understanding your monthly financial obligations is essential for maintaining a healthy budget. By carefully evaluating your expenditures, you can identify areas for improvement and make informed decisions about your finances.

To effectively analyze your monthly outgoings, consider the following steps:

- Gather all financial statements and receipts for the month.

- Organize your expenses into categories such as housing, utilities, groceries, and entertainment.

- Review each category to determine your total spending and identify patterns.

It can also be helpful to track variable costs, as these often fluctuate. To manage these effectively:

- List regular discretionary purchases, like dining out or shopping.

- Set limits on each category to avoid overspending.

Regular assessment of your financial commitments will empower you to adjust your spending habits and enhance your savings potential.

Examples of Effective Bill Calendars

Creating a structured system for managing payments can greatly enhance financial organization. Visual aids that outline due dates and amounts can help individuals stay on track, ensuring timely payments and reducing the likelihood of late fees.

One popular approach is to utilize color coding to signify different categories of expenses. For instance, essential payments can be marked in red, while discretionary expenses might be highlighted in green. This method allows for quick visual assessments of upcoming obligations.

Another effective strategy involves incorporating reminders or alerts. Digital tools can send notifications prior to due dates, providing an additional layer of accountability and minimizing the risk of overlooking payments.

Lastly, monthly overviews that display all upcoming expenses in one glance can foster better planning. By summarizing obligations, individuals can allocate resources more effectively and avoid financial strain.

Maintaining Your Bill Calendar

Keeping track of your financial commitments is essential for managing your expenses effectively. A well-organized schedule helps ensure that you never miss a payment, thus avoiding late fees and maintaining a positive credit standing. Regular updates and careful attention to detail are key components in maintaining this system.

Start by reviewing your entries regularly, ideally at the beginning of each month. This allows you to account for any changes in your financial obligations and adjust your plans accordingly. Additionally, incorporating reminders for upcoming payments can significantly enhance your ability to stay on top of your finances.

Consider using color-coding or symbols to categorize different types of obligations, making it easier to visualize your overall financial picture. This method not only aids in quick reference but also adds a layer of organization that can be particularly beneficial during busy periods.

Future Trends in Bill Management

The evolution of financial organization is steering towards innovative methods that enhance efficiency and accuracy in tracking expenditures. As technology advances, new strategies emerge to streamline the oversight of payments, ensuring individuals and businesses can manage their financial responsibilities more effectively.

Several key developments are expected to shape the future of financial oversight:

- Automation: The integration of automated systems will simplify the tracking process, reducing manual input and minimizing errors.

- Mobile Applications: Increasing reliance on mobile technology will lead to the creation of user-friendly apps that enable on-the-go monitoring of financial commitments.

- Artificial Intelligence: AI-driven solutions will provide personalized insights and recommendations, helping users make informed financial decisions.

- Cloud-Based Solutions: Storing data in the cloud will enhance accessibility and security, allowing users to manage their finances from anywhere.

These advancements will not only improve how financial obligations are monitored but also empower users to take control of their economic landscape with confidence and precision.