Staying organized with your financial responsibilities is essential for effective budgeting and stress reduction. A structured approach allows individuals to track their expenditures and ensures timely fulfillment of obligations. This practice can prevent late fees and maintain a positive credit score.

Creating a personalized system to manage upcoming dues can greatly enhance your financial well-being. By organizing your commitments in a clear manner, you can visualize your spending patterns and make informed decisions about your resources. This system can also help in planning for future expenses, making it easier to allocate funds appropriately.

Utilizing a well-designed outline for your financial commitments not only simplifies tracking but also instills a sense of control over your finances. With a clear overview, you can prioritize what needs attention and adjust your budget as necessary. Embracing this strategy fosters a proactive approach to managing your financial life.

This section aims to provide a comprehensive overview of a structured approach to managing financial obligations effectively. By utilizing a systematic framework, individuals can stay organized and ensure timely fulfillment of their responsibilities.

Key elements to consider include:

- Organization: Establish a clear outline of due dates and amounts to simplify tracking.

- Reminders: Implement alerts to prompt timely actions, minimizing late fees.

- Flexibility: Adapt the structure to accommodate varying financial commitments each month.

- Visualization: Create a visual representation to enhance awareness of upcoming deadlines.

In summary, a well-structured plan for monitoring financial commitments can greatly alleviate stress and foster responsible financial management.

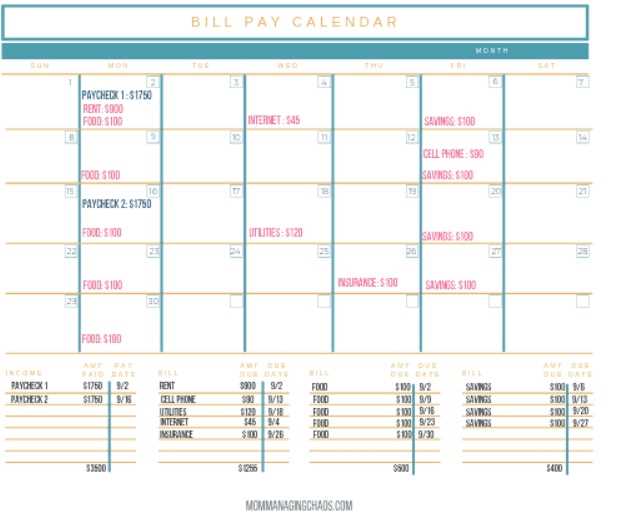

Benefits of Using a Payment Calendar

Utilizing a scheduling tool for managing financial obligations can significantly enhance organization and reduce stress. This approach allows individuals to keep track of due dates, ensuring that no essential tasks are overlooked.

Enhanced Financial Management: By clearly outlining all upcoming responsibilities, users can better allocate their resources. This foresight aids in preventing late fees and maintaining a good credit score.

Improved Planning: Regularly monitoring upcoming dues enables individuals to plan their finances effectively. This method fosters a proactive attitude, allowing for adjustments in spending when necessary.

Reduced Anxiety: Knowing exactly when commitments are due alleviates the worry of forgotten deadlines. This clarity contributes to a more relaxed approach to financial management.

Encouragement of Discipline: Establishing a routine for tracking responsibilities cultivates disciplined financial habits. Over time, this practice can lead to improved overall financial health.

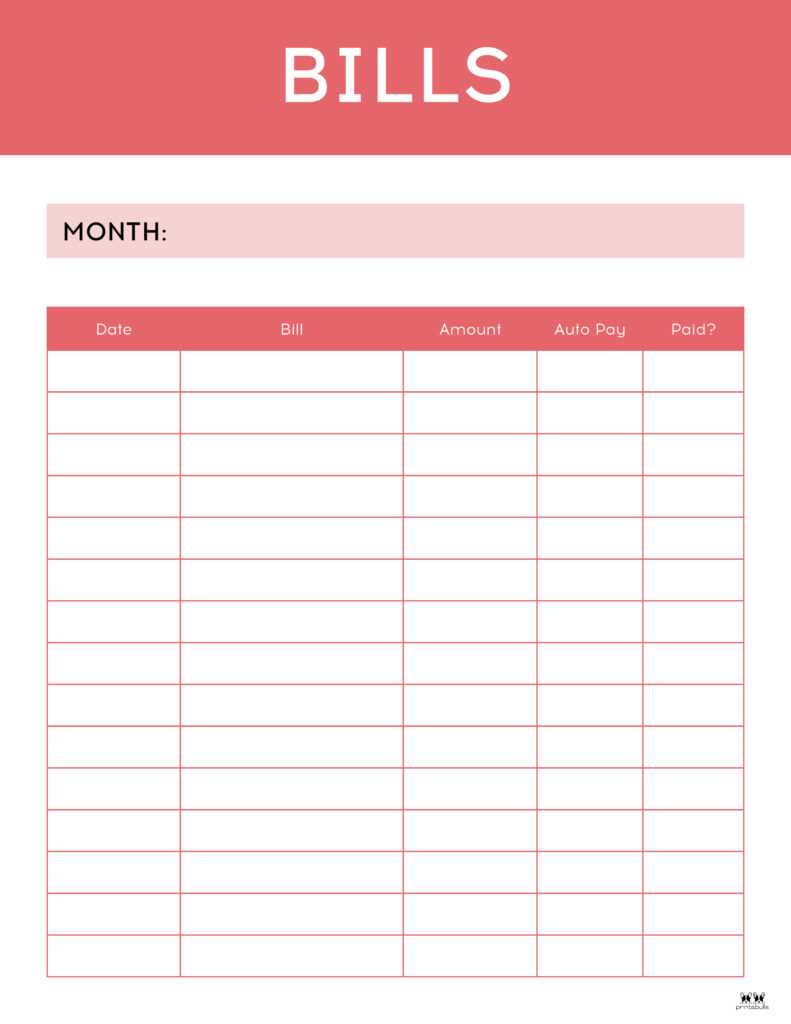

How to Create Your Own Template

Designing a personalized organizer for tracking your financial obligations can greatly enhance your budgeting efficiency. This section will guide you through the steps to develop a functional structure tailored to your specific needs.

Step 1: Define Your Requirements

Before you begin crafting your organizer, consider what features are essential for you. Here are some aspects to think about:

- Frequency of obligations (weekly, monthly, annually)

- Categories for different types of expenses

- Important due dates

- Visual elements (colors, fonts)

Step 2: Choose a Format

Decide whether you prefer a digital or physical format. Each has its advantages:

- Digital: Easily editable, shareable, and often includes reminders.

- Physical: Tangible and can be customized with stickers or drawings.

Once you have defined your needs and chosen a format, you can begin to layout your organizer, ensuring it is both functional and visually appealing.

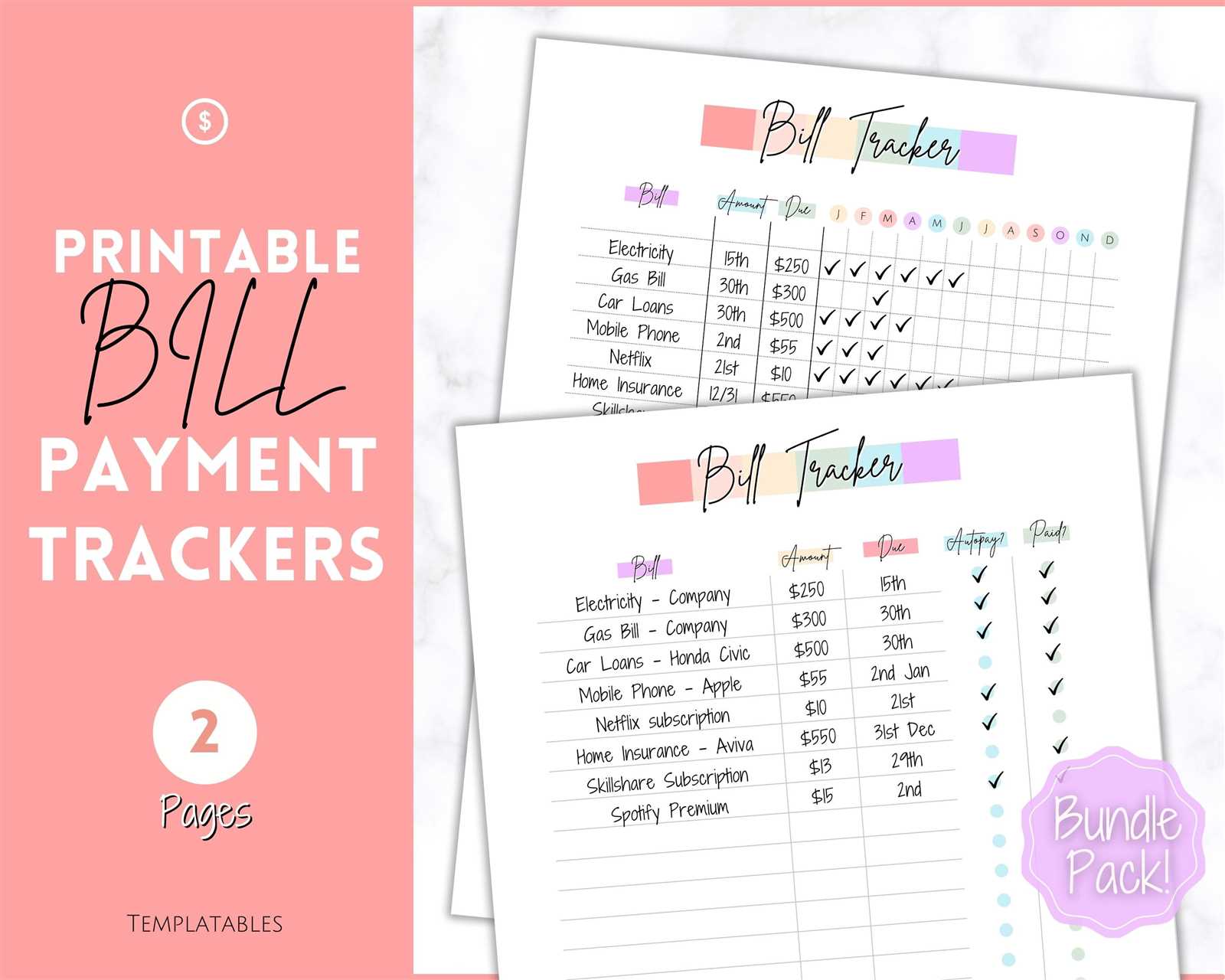

Essential Features for Effective Tracking

To ensure smooth management of recurring obligations, it is vital to incorporate key functionalities that enhance oversight and organization. A robust approach not only aids in monitoring due dates but also streamlines overall administration.

Clear Visualization

One of the fundamental aspects of efficient oversight is the ability to see upcoming deadlines at a glance. Incorporating a visually appealing layout that highlights critical dates can significantly reduce the risk of oversight.

Customizable Reminders

Setting up adaptable notifications helps individuals stay informed about impending deadlines. Personalizing these alerts according to preferences ensures that reminders are timely and relevant.

| Feature | Description |

|---|---|

| Visual Layout | Intuitive design for easy date tracking. |

| Notification System | Custom alerts for important deadlines. |

| Category Organization | Grouping by type for better management. |

Digital vs. Paper Calendar Options

In today’s fast-paced world, organizing schedules can be achieved through various methods. Each approach offers unique benefits, catering to different preferences and lifestyles. Understanding the advantages and drawbacks of both digital and traditional formats can help individuals choose the most suitable option for their needs.

Advantages of Digital Formats

- Accessibility: Digital tools can be accessed from multiple devices, allowing users to manage their schedules on the go.

- Customization: Many applications provide options to personalize reminders, notifications, and layouts.

- Integration: Digital solutions often integrate with other applications, enhancing overall productivity.

Benefits of Traditional Formats

- Tangible Experience: Writing by hand can enhance memory retention and engagement.

- Visual Overview: A physical planner provides a comprehensive view of tasks at a glance without screen distractions.

- No Technical Issues: Traditional methods do not rely on technology, making them reliable in all situations.

Best Software for Bill Management

Managing finances effectively requires reliable tools that simplify tracking obligations and deadlines. Various software solutions are designed to assist users in organizing their expenditures and ensuring timely actions. Choosing the right application can greatly enhance productivity and reduce stress associated with financial management.

Key Features to Consider

When selecting a solution for financial oversight, it’s important to look for features that enhance usability and efficiency. Here are some critical aspects to keep in mind:

| Feature | Description |

|---|---|

| User-Friendly Interface | An intuitive layout that simplifies navigation and minimizes confusion. |

| Reminders and Alerts | Automated notifications to prompt timely actions and avoid overdue situations. |

| Expense Tracking | Tools to categorize and monitor spending habits over time for better insights. |

| Reporting Features | Visual data representations to help users understand their financial status at a glance. |

Top Recommendations

Several applications stand out in the market for their effectiveness and user satisfaction. Below are some highly-rated options that cater to diverse needs:

| Software Name | Key Benefit |

|---|---|

| Mint | Comprehensive tracking with budgeting tools and real-time updates. |

| YNAB (You Need A Budget) | Focuses on proactive budgeting to help users allocate funds effectively. |

| Personal Capital | Investment tracking alongside budgeting features for holistic financial management. |

Customizing Your Calendar for Needs

Tailoring your schedule to fit personal preferences and requirements is essential for effective organization. By modifying the layout and features, you can create a more user-friendly system that enhances productivity and keeps you on track.

Consider the following aspects when adjusting your planner:

- Layout: Choose between daily, weekly, or monthly views based on what best suits your lifestyle.

- Color Coding: Implement a color scheme that distinguishes different types of tasks or events for quick identification.

- Reminders: Set notifications to ensure you never miss an important deadline or obligation.

By implementing these adjustments, you can create a customized system that aligns perfectly with your daily routine and responsibilities.

Integrating Reminders for Payments

Setting up notifications for financial obligations is crucial for maintaining a well-organized budget. By incorporating reminders into your routine, you can ensure that you never miss a due date. This practice not only helps avoid late fees but also fosters better financial management.

There are various methods to implement reminders effectively. Digital tools such as mobile applications and calendar systems offer customizable alerts that can be tailored to your preferences. Additionally, physical planners can serve as a tangible way to keep track of upcoming responsibilities, allowing for visual cues that enhance awareness.

Moreover, consider setting reminders for various intervals, such as weekly or monthly, depending on your schedule. This approach enables you to spread out your tasks and manage your time efficiently, ultimately leading to a more stress-free financial experience.

Setting Up Recurring Payment Alerts

Establishing notifications for regular transactions can help manage finances effectively. This practice ensures that important deadlines are not overlooked, promoting better budgeting and financial planning.

Choosing Your Notification Method

There are various ways to receive alerts for upcoming charges. Consider the following options:

- Email notifications

- Text message alerts

- In-app reminders

Creating Alerts in Your Financial App

Most financial applications offer features to set up reminders. Follow these steps:

- Open your preferred financial application.

- Navigate to the notifications or alerts section.

- Select the option to create a new reminder.

- Enter the necessary details such as frequency and due date.

- Choose your preferred notification method.

By implementing these reminders, you can ensure timely awareness of regular expenses, contributing to a more organized financial approach.

Managing Multiple Bills Efficiently

Keeping track of various financial obligations can be a daunting task. Organizing and prioritizing these responsibilities is crucial for maintaining a healthy financial status. Here are some strategies to handle them effectively.

- Consolidate Information: Gather all due dates and amounts in one location. This can be a digital document or a physical notebook.

- Set Reminders: Utilize technology to your advantage by setting alerts on your smartphone or computer. This ensures you never miss a due date.

- Prioritize Payments: Identify which obligations are most critical and tackle them first to avoid late fees and penalties.

- Automate Where Possible: Consider setting up automatic transfers for recurring expenses to streamline the process.

- Review Regularly: Periodically assess your financial commitments to adjust as necessary, ensuring you stay on top of any changes.

By implementing these strategies, managing various financial duties can become more organized and less stressful, allowing for better financial health.

Tips for Staying Organized Monthly

Maintaining a structured approach to your financial obligations can greatly enhance your overall productivity. By implementing a few simple strategies, you can ensure that you never miss a crucial deadline and keep everything in order.

1. Create a Visual Schedule: Use a wall planner or a digital application to visualize your commitments. This will allow you to see upcoming responsibilities at a glance, helping you prioritize tasks effectively.

2. Set Reminders: Utilize reminders on your phone or computer to alert you ahead of time. Setting notifications a few days prior can give you ample time to prepare.

3. Allocate a Dedicated Time: Designate a specific day each month to review your commitments. This routine will help you stay on top of what’s due and plan accordingly.

4. Organize Important Documents: Keep all relevant documents in a designated folder, whether physical or digital. This ensures that you have quick access to what you need without unnecessary searching.

5. Regularly Review Your Plan: Periodically reassess your organization methods to ensure they are still effective. Adapt as necessary to maintain efficiency and clarity in managing your obligations.

Common Mistakes to Avoid

Managing financial obligations effectively requires careful planning and awareness of potential pitfalls. Here are some common errors that individuals often encounter in this process.

- Ignoring Due Dates: Failing to keep track of deadlines can lead to unnecessary fees and penalties.

- Neglecting to Update Information: Not revising contact details or account information can result in missed notifications.

- Overlooking Automatic Withdrawals: Forgetting about recurring transactions may disrupt budgeting efforts.

- Not Reviewing Statements: Skipping the examination of financial summaries can lead to unnoticed discrepancies.

- Relying Solely on Technology: Sole dependence on apps or digital reminders without personal checks can be risky.

By being mindful of these common missteps, individuals can enhance their financial management skills and avoid unnecessary complications.

Adjusting for Seasonal Expenses

Managing finances effectively requires adapting to various costs that arise throughout the year. As seasons change, certain expenses may increase, necessitating a proactive approach to budgeting.

Understanding seasonal fluctuations in expenditures is crucial for maintaining financial stability. For instance, utility bills may spike during summer or winter months due to increased heating or cooling needs. Additionally, holiday-related costs can significantly impact overall spending in the final quarter of the year.

To mitigate these seasonal variations, it’s advisable to create a strategy that includes setting aside funds during less expensive months. This can help ensure that when higher costs arise, there are sufficient resources available to cover them without stress.

By planning ahead and anticipating these fluctuations, individuals can avoid financial strain and maintain a balanced approach to their economic responsibilities.

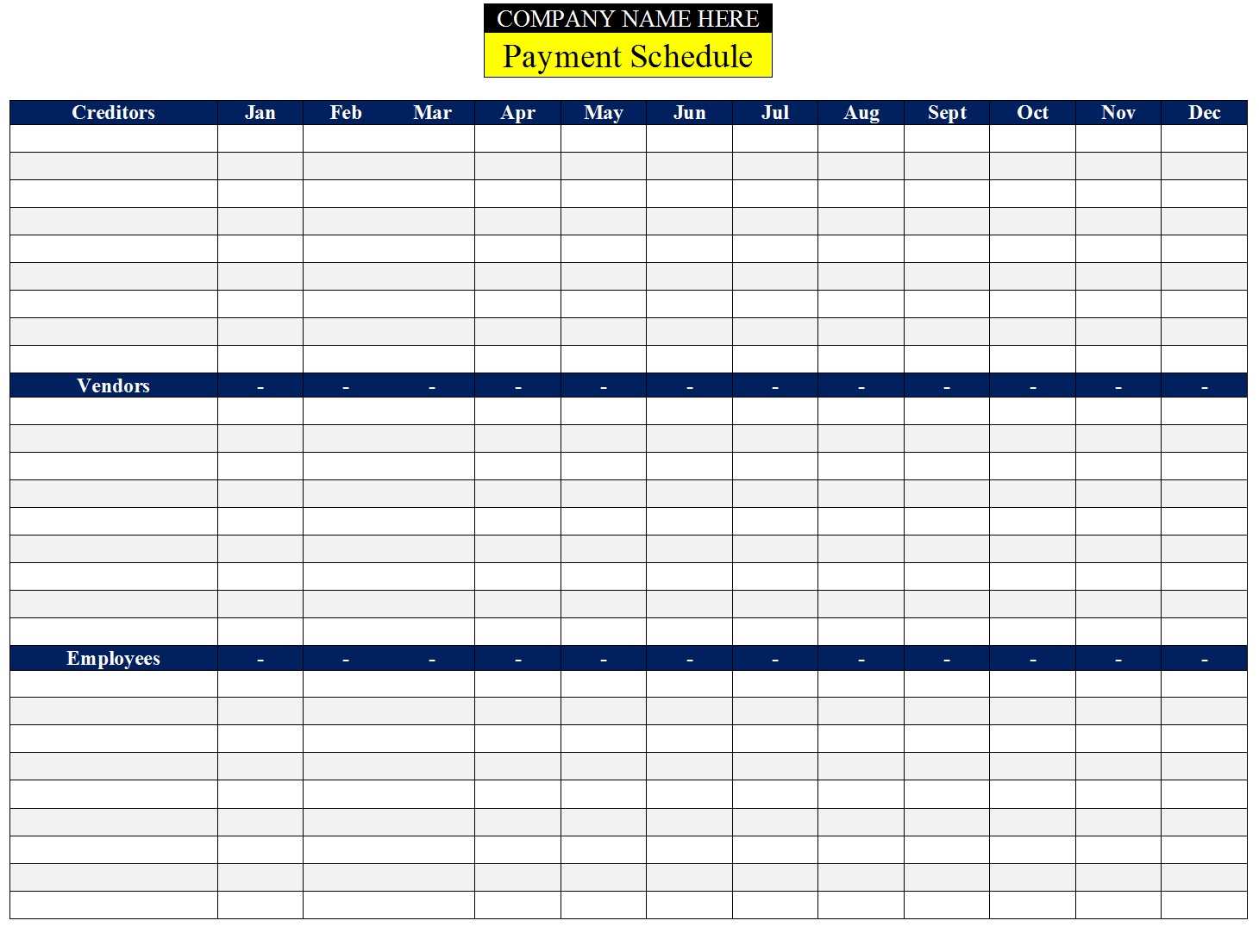

Utilizing Spreadsheets for Tracking

Spreadsheets serve as an excellent tool for monitoring financial obligations and due dates. By leveraging their versatile features, individuals can create an organized system that enhances clarity and efficiency in managing expenses.

One of the key advantages of using spreadsheets is the ability to customize layouts according to personal preferences. Users can incorporate various columns to categorize expenses, set reminders for upcoming deadlines, and even track payment statuses. This flexibility allows for a comprehensive view of financial commitments at a glance.

Furthermore, spreadsheets enable the use of formulas to automate calculations, making it easier to sum total amounts due or to assess monthly expenditures. By employing conditional formatting, users can highlight overdue entries, ensuring that important deadlines are never overlooked.

Overall, utilizing spreadsheets provides a practical approach to keeping financial obligations in check, facilitating better planning and management of resources.

Sharing Your Calendar with Family

Creating a shared schedule can significantly enhance communication and organization within a household. By collaborating on a shared timeline, family members can stay informed about important events, deadlines, and activities. This approach fosters a sense of teamwork and helps everyone manage their time more effectively.

Encouraging Participation is key when it comes to a collective timetable. Involving everyone in the process of adding events and reminders ensures that all voices are heard. This can be particularly beneficial for keeping track of various commitments, from appointments to social gatherings.

Utilizing technology can streamline this experience. Many digital tools offer options for shared access, allowing family members to view and update the schedule in real time. This flexibility means that changes can be communicated instantly, reducing the chances of misunderstandings and missed commitments.

Reviewing Your Finances Regularly

Regularly assessing your financial situation is essential for maintaining control over your economic well-being. By taking the time to analyze your resources, expenses, and savings, you can make informed decisions that align with your goals.

Here are some key steps to consider during your financial reviews:

- Track Your Income: Keep a detailed record of all sources of revenue to understand your cash flow.

- Examine Expenses: Categorize your outgoings to identify areas where you can reduce costs.

- Set Financial Goals: Define short-term and long-term objectives to guide your spending and saving habits.

- Adjust Budgeting Strategies: Modify your financial plans based on changing circumstances or priorities.

- Monitor Savings Progress: Regularly check your savings to ensure you are on track to meet your goals.

By consistently reviewing your finances, you empower yourself to make strategic adjustments that enhance your financial health.

Transitioning to Automated Payments

In today’s fast-paced world, embracing automated financial transactions can greatly enhance efficiency and reduce stress. By shifting to systems that manage these obligations automatically, individuals can save valuable time and ensure timely fulfillment of their responsibilities.

Benefits of this approach include less risk of missed deadlines, which can lead to late fees and penalties. Furthermore, automation fosters better financial management, allowing individuals to monitor their expenses more effectively.

To successfully implement automated systems, it is crucial to choose reliable services and regularly review account details. This proactive strategy not only simplifies finances but also promotes a more organized and stress-free lifestyle.

Evaluating Your Budget with a Calendar

Tracking your financial commitments can greatly enhance your ability to manage expenses effectively. By utilizing a structured approach, individuals can gain insights into their spending habits and ensure they stay on top of their financial responsibilities. This method encourages awareness and discipline, ultimately leading to better financial health.

Establishing a routine for reviewing your finances allows you to identify patterns and make informed adjustments. By dedicating specific times to assess your obligations, you can prioritize your expenditures and allocate resources more efficiently. This proactive strategy not only helps in meeting deadlines but also in avoiding unnecessary stress associated with last-minute decisions.

Implementing this practice can also highlight areas where you might cut back or save, giving you a clearer picture of your overall financial situation. Regular evaluations pave the way for smarter financial choices, fostering a sense of control over your economic landscape.