Managing your finances can often feel overwhelming, especially when it comes to tracking various due dates and obligations. Having a structured approach can significantly simplify this task, allowing you to maintain control over your expenditures and avoid late fees. An efficient system for visualizing important dates is crucial for achieving financial stability and peace of mind.

By implementing a systematic layout, individuals can easily monitor their monetary commitments throughout the month. This method not only helps in planning ahead but also in ensuring that no critical deadlines are missed. Incorporating such a framework into your routine can enhance your overall budgeting strategy.

Whether you’re a busy professional or a diligent student, creating a reliable scheme for noting essential payments and obligations can lead to improved organization. Embracing this proactive approach enables you to allocate your resources wisely, paving the way for a more secure financial future.

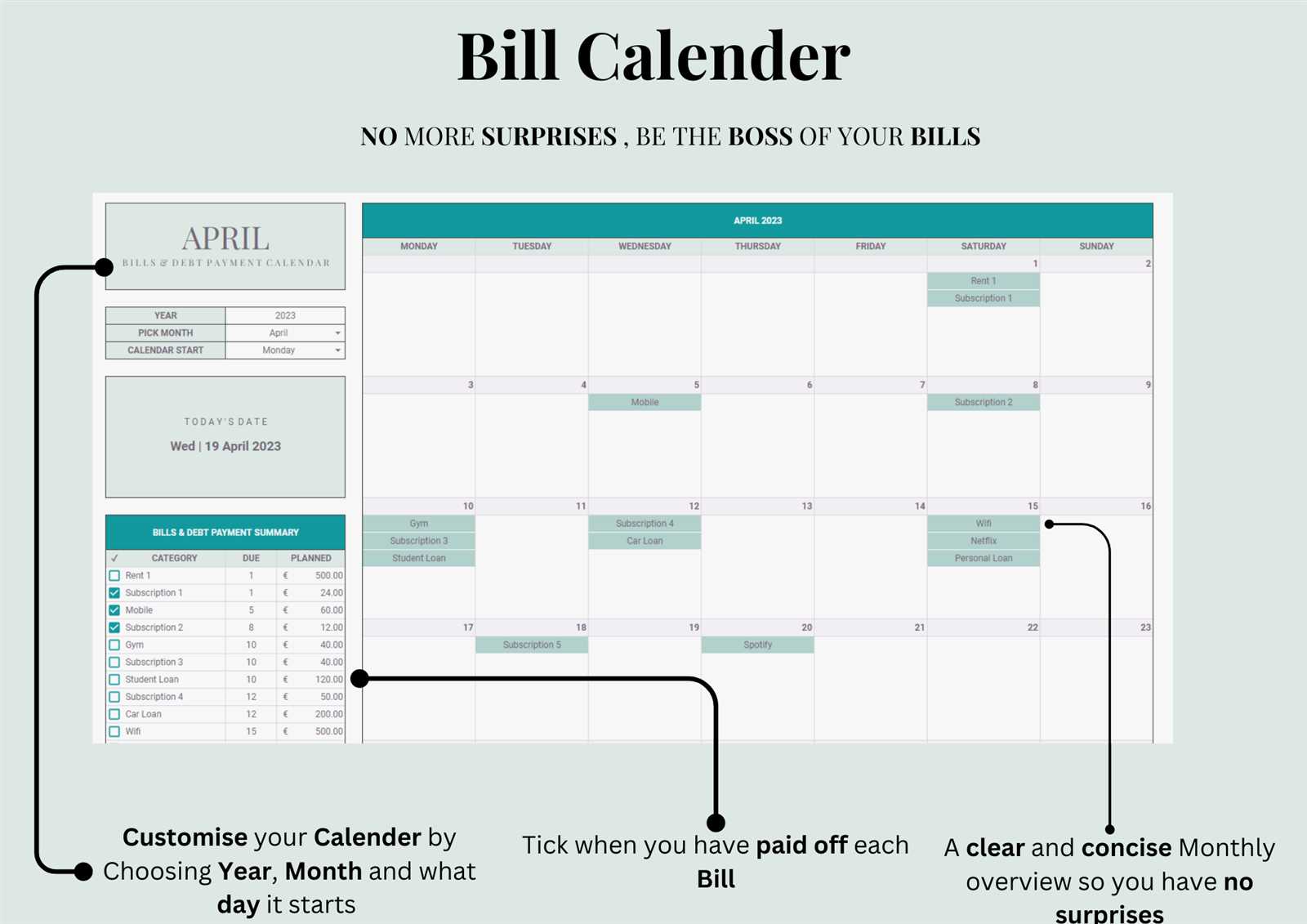

Understanding the Bills Calendar Template

Managing financial obligations effectively is essential for maintaining a stable budget. A structured approach can help individuals and businesses track due dates, categorize expenses, and ensure timely payments. This organized method aids in visualizing financial responsibilities, minimizing the risk of late fees, and promoting better financial planning.

Key Components of an Effective System

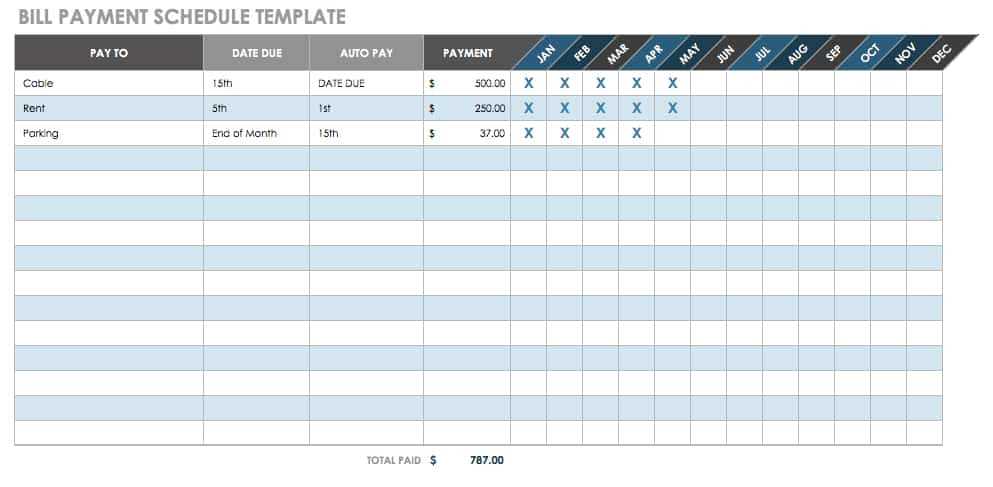

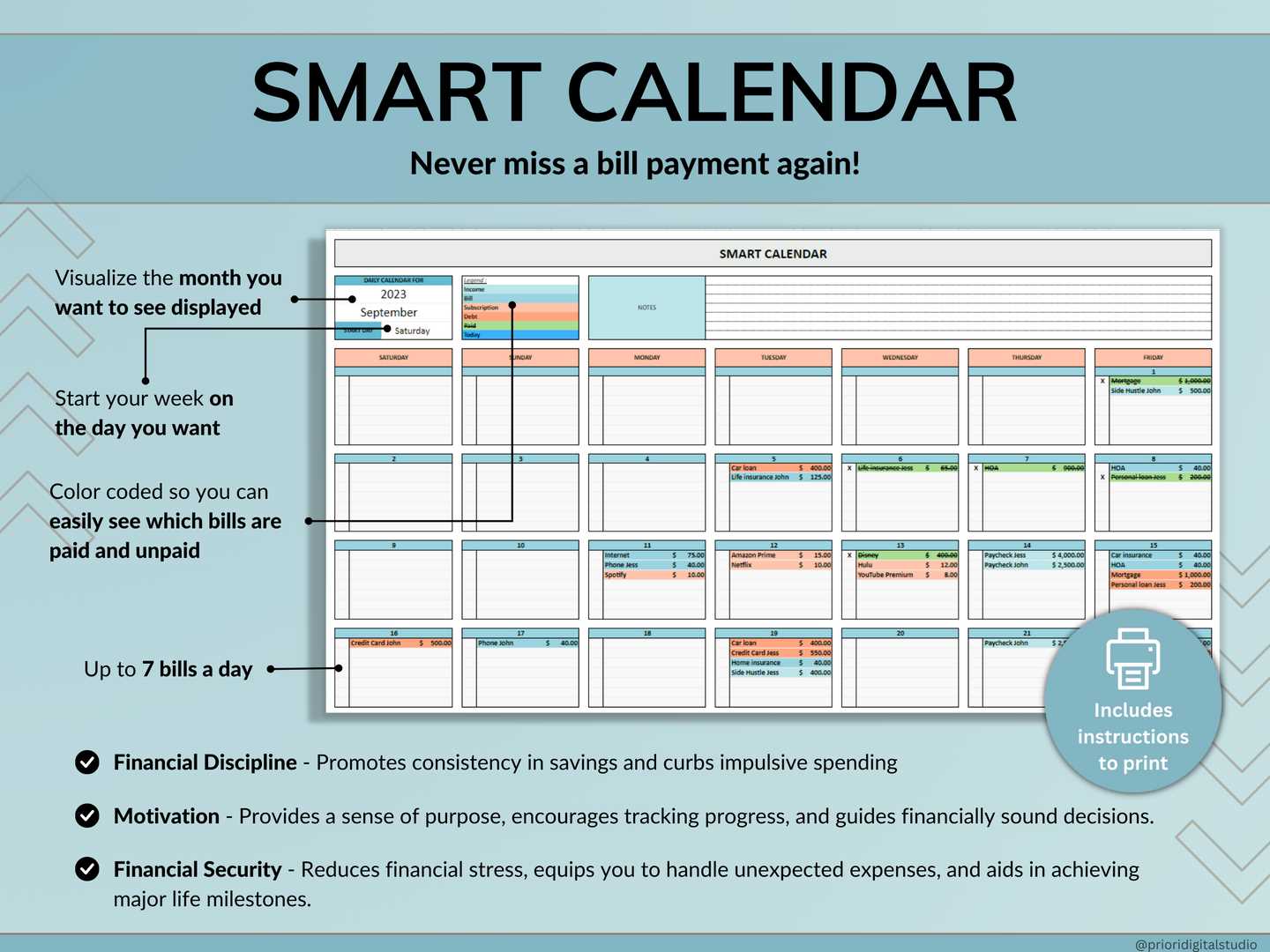

An effective framework typically includes clear sections for different types of expenses, allowing users to categorize their obligations based on priority or frequency. By incorporating features such as reminders and color coding, one can enhance visibility and improve overall management. Regular updates and reviews of this structure can also lead to better insights into spending habits.

Benefits of Using a Structured Approach

Employing a systematic method provides numerous advantages, including reduced stress and improved cash flow management. It fosters discipline and encourages proactive financial behaviors, leading to informed decision-making. Ultimately, this practice not only supports meeting obligations on time but also contributes to long-term financial health.

Benefits of Using a Calendar Template

Employing a structured framework for organizing time can significantly enhance personal and professional efficiency. By utilizing a pre-designed format, individuals can streamline their planning processes, ensuring that important deadlines and tasks are not overlooked. This approach fosters better time management and allows for clearer prioritization of responsibilities.

One key advantage is the reduction of mental clutter. With a visually organized layout, users can quickly assess their upcoming commitments at a glance, which helps in making informed decisions about how to allocate time effectively. This clarity can lead to decreased stress levels, as individuals feel more in control of their schedules.

Additionally, the use of an established layout encourages consistency and routine. Regularly utilizing a familiar structure can make it easier to develop habits around planning and productivity. This consistency not only improves accountability but also enhances the likelihood of achieving long-term goals.

Another benefit lies in the ease of customization. Many formats allow for personal modifications, enabling users to tailor their planning tools to fit unique needs. This adaptability can increase engagement, making the process of managing time more enjoyable and effective.

Finally, integrating such a framework promotes collaboration, particularly in team settings. When everyone follows a shared format, communication regarding schedules and deadlines becomes clearer, fostering teamwork and accountability among colleagues. Overall, this strategic approach can lead to improved outcomes across various aspects of life.

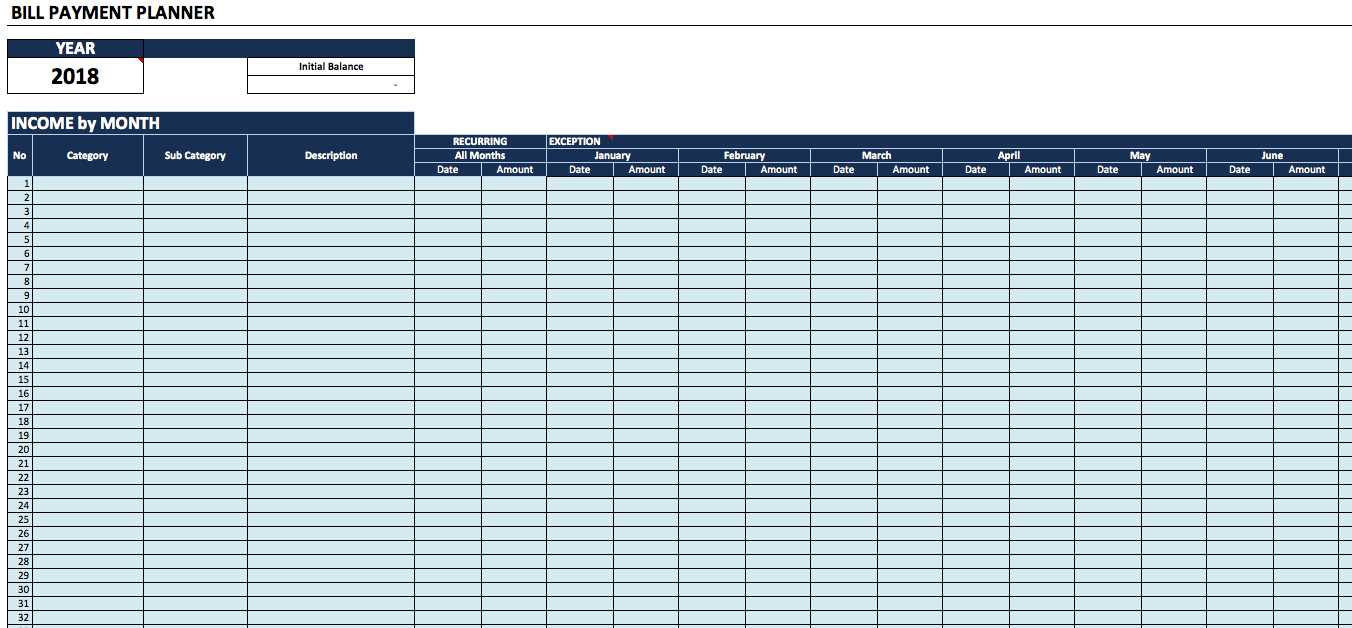

How to Create Your Own Template

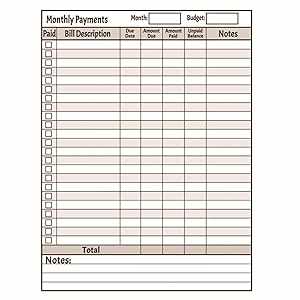

Designing a personal layout for tracking your financial commitments can greatly enhance your organizational skills. This section will guide you through the essential steps to craft a unique format tailored to your needs, ensuring that all your essential information is easily accessible and visually appealing.

Step 1: Define Your Needs

Before you begin, consider what specific features you require. Think about the types of expenditures you wish to monitor, the frequency of these transactions, and any additional information that would be beneficial. This preliminary stage is crucial for ensuring that your layout serves its intended purpose effectively.

Step 2: Choose a Structure

Once you have a clear idea of your requirements, select a suitable structure. You can choose from various layouts depending on how detailed you want your overview to be. Below is an example structure you might consider:

| Date | Description | Amount | Status |

|---|---|---|---|

| 01/01/2024 | Monthly Subscription | $15.00 | Paid |

| 15/01/2024 | Utility Bill | $75.00 | Pending |

| 28/01/2024 | Internet Service | $50.00 | Paid |

With this basic outline, you can modify and expand based on your specific requirements, ensuring your layout remains functional and user-friendly.

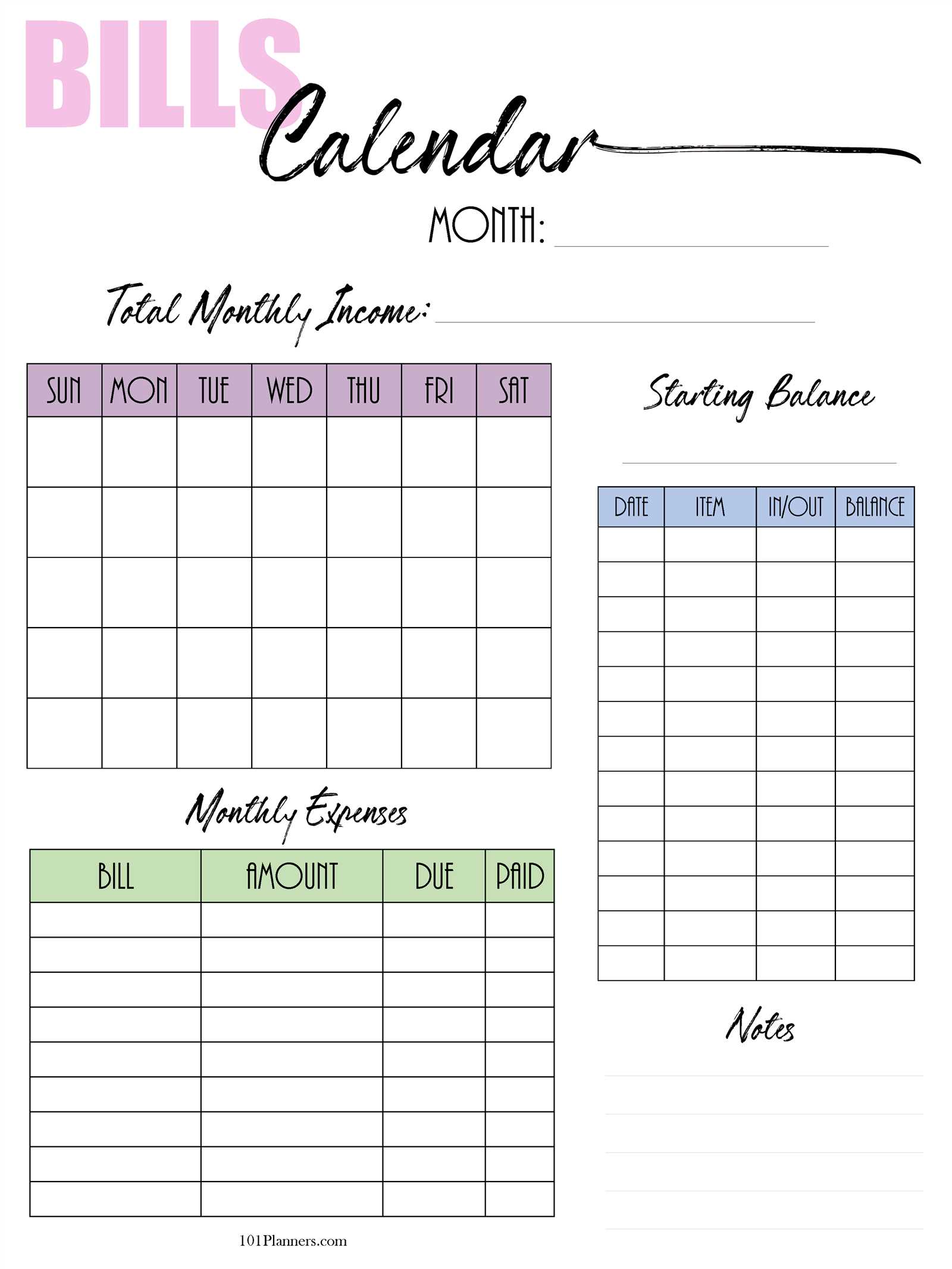

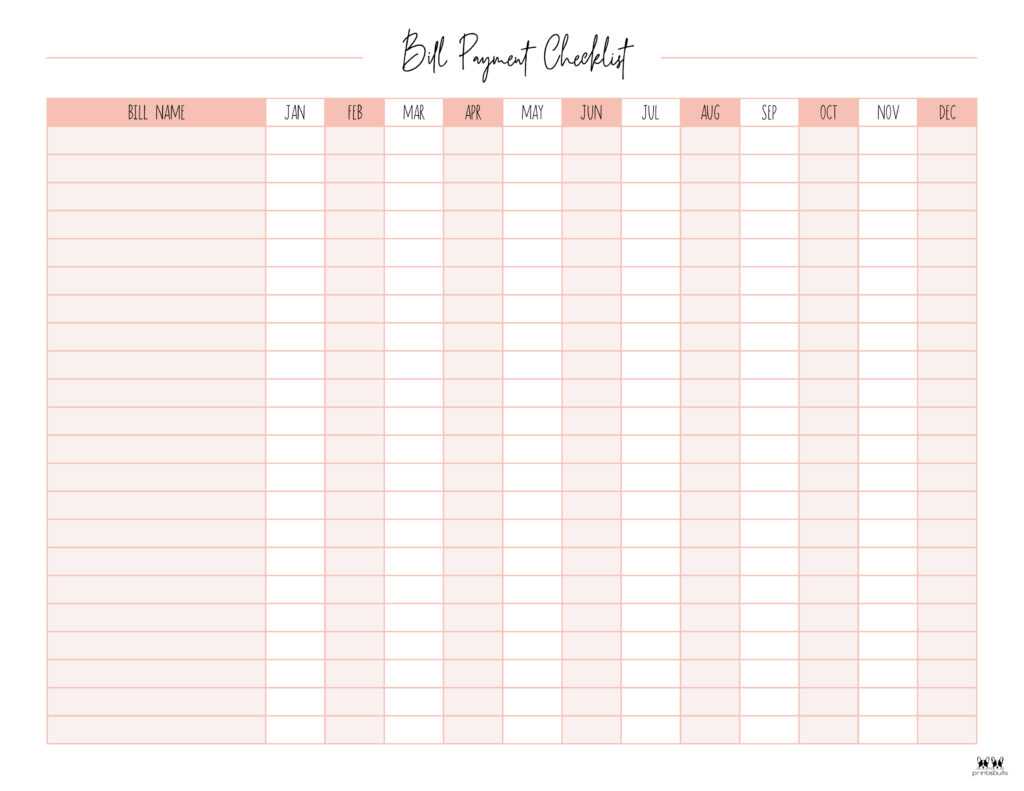

Essential Features of a Bills Calendar

Organizing payment schedules is crucial for effective financial management. A well-structured system helps individuals and businesses keep track of due dates, avoid penalties, and maintain a good credit score. Here are some fundamental aspects to consider when creating a robust management tool for monitoring payment deadlines.

Key Components

- Due Date Tracking: Ensure that all payment deadlines are clearly marked to avoid late fees.

- Category Organization: Differentiate between various types of payments, such as utilities, loans, and subscriptions, for easier management.

- Automated Reminders: Incorporate notifications that alert users ahead of due dates, allowing them ample time to prepare funds.

- Payment History: Keep a record of past payments to track spending patterns and ensure accountability.

User-Friendly Interface

- Simple Navigation: A clear and intuitive layout helps users find information quickly and efficiently.

- Customizable Views: Allow users to tailor their experience, such as viewing payments by month or category.

- Accessibility: Ensure that the tool is available on multiple devices, making it easy to check and manage payment schedules on the go.

By incorporating these essential features, individuals can better manage their financial commitments, leading to improved budgeting and reduced stress associated with overdue payments.

Customizing Templates for Your Needs

Personalizing your organizational tools can significantly enhance your efficiency and productivity. By tailoring pre-designed layouts to fit your specific requirements, you create a system that resonates with your unique style and preferences. This adaptability ensures that you are more engaged with your planning process, ultimately leading to better management of your responsibilities.

Identifying Your Requirements

Before diving into modifications, it is essential to assess your individual needs. Consider what information is most important for you to track and how frequently you need to access it. This analysis will guide you in selecting the right features to incorporate, ensuring that your setup remains functional and relevant.

Practical Adjustments

Once you have a clear understanding of your needs, you can start implementing practical changes. This might include altering layouts, adjusting color schemes, or integrating additional sections for tracking various aspects of your commitments. The goal is to create an arrangement that not only looks appealing but also serves its purpose effectively.

Digital vs. Paper Calendar Options

In today’s fast-paced world, individuals have a choice between traditional methods and modern technology for organizing their schedules. Each approach offers unique advantages and disadvantages, influencing how people manage their time and tasks. Understanding these differences can help in selecting the most suitable option for personal or professional use.

Advantages of Digital Solutions

- Accessibility: Digital tools can be accessed from multiple devices, ensuring information is always at hand.

- Automation: Many platforms offer reminders and notifications, reducing the risk of overlooking important dates.

- Customization: Users can tailor features to suit their preferences, such as color coding and recurring entries.

- Collaboration: Sharing schedules with others is seamless, enhancing teamwork and coordination.

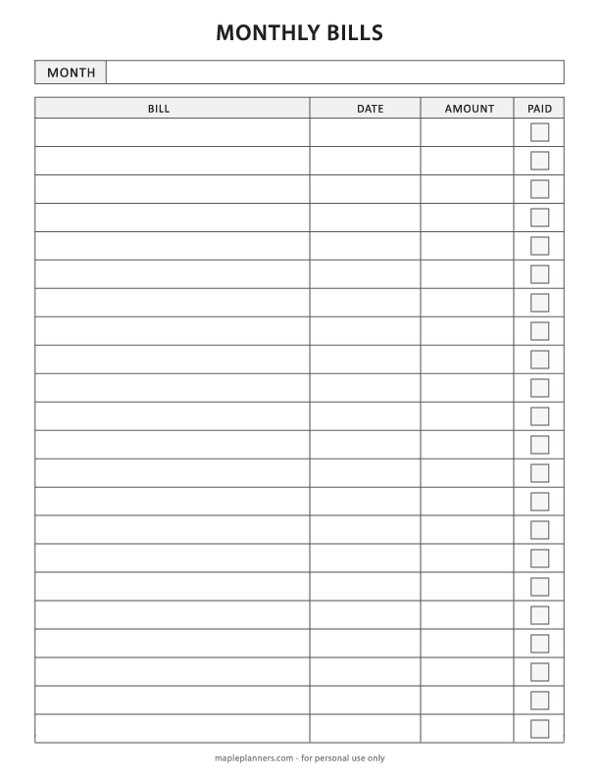

Benefits of Traditional Approaches

- Tactile Experience: Writing things down can improve memory retention and understanding.

- No Distractions: A paper format eliminates the potential for interruptions from notifications or apps.

- Personalization: Many enjoy the ability to customize their layouts with stickers, drawings, or personal notes.

- Reduced Screen Time: Using a physical format encourages less reliance on digital devices, promoting a break from technology.

Ultimately, the choice between these two formats depends on individual preferences, lifestyle, and specific needs. Whether opting for the convenience of a digital format or the personal touch of a traditional one, understanding their respective strengths can lead to better organization and time management.

Tips for Staying Organized

Maintaining order in daily tasks is essential for reducing stress and enhancing productivity. Implementing effective strategies can help streamline your routine and ensure nothing important slips through the cracks. Here are some practical suggestions to improve your organizational skills.

- Prioritize Tasks: Start each day by identifying your most important activities. Focus on high-impact tasks first to maximize your efficiency.

- Create Lists: Write down all your responsibilities. Using checklists can provide a clear overview and a sense of accomplishment as you complete items.

- Set Reminders: Utilize alarms or notifications to keep track of deadlines and appointments. This will help you stay on schedule and avoid last-minute rushes.

- Designate a Workspace: Choose a specific area for work-related activities. A tidy, dedicated space can enhance concentration and reduce distractions.

- Review Regularly: Take time each week to assess your progress. Adjust your plans as needed to stay aligned with your goals.

By incorporating these strategies into your daily routine, you can cultivate a more organized and productive lifestyle, leading to greater peace of mind and efficiency.

Integrating Reminders with Your Calendar

Effective time management involves not only tracking important dates but also ensuring that you never overlook critical tasks. Incorporating notification systems into your planning method enhances your ability to stay organized and proactive. This approach allows you to seamlessly blend your scheduling with timely alerts, creating a holistic view of your responsibilities.

Enhancing Productivity

By linking alerts with your scheduling tools, you can boost your efficiency. Set reminders for upcoming deadlines or events, enabling you to allocate your time wisely. For instance, receiving a prompt a day in advance helps you prepare adequately, reducing last-minute stress. Embracing technology in this way transforms how you approach daily obligations.

Customizing Your Alerts

Personalization is key to effective reminders. Tailor your notifications to fit your preferences, whether through specific sounds, recurring prompts, or visual cues. This customization ensures that important alerts resonate with you, making them more likely to be heeded. Adjusting settings to suit your lifestyle can significantly improve your overall management strategy.

Common Mistakes to Avoid

Managing financial obligations effectively is crucial for maintaining stability and avoiding unnecessary stress. However, many individuals fall into common pitfalls that can lead to confusion and missed deadlines. By identifying these frequent errors, you can streamline your processes and ensure timely management of your responsibilities.

One prevalent mistake is neglecting to update your records regularly. Failing to adjust your entries can result in inaccurate information, leading to missed due dates or overpayments. It’s essential to keep your documentation current to reflect any changes in amounts or due dates.

Another common oversight is underestimating the importance of organization. Without a clear system, tracking your obligations can become overwhelming. Consider implementing a structured approach to categorize your commitments, making it easier to manage them efficiently.

Additionally, many overlook the value of setting reminders. Relying solely on memory can lead to lapses, especially during busy periods. Using alerts or notifications can serve as a helpful prompt, ensuring you stay on top of your commitments.

Finally, be cautious of procrastination. Delaying tasks can create a snowball effect, resulting in a backlog of responsibilities that may become unmanageable. Establishing a routine can help mitigate this tendency, allowing you to address your duties promptly.

By being aware of these common errors and taking proactive steps, you can enhance your management strategy and avoid unnecessary complications.

Tracking Expenses Effectively

Monitoring financial outflows is crucial for maintaining a healthy budget. By keeping a close eye on expenditures, individuals can make informed decisions that lead to better financial stability. Understanding where money is spent helps identify areas for improvement and fosters responsible spending habits.

Establishing a Clear System

A well-structured approach is essential for tracking outlays efficiently. Start by categorizing expenses into essential groups, such as housing, food, transportation, and entertainment. This organization allows for easier analysis and can highlight spending patterns that may require adjustment.

| Category | Monthly Budget | Actual Spending | Difference |

|---|---|---|---|

| Housing | $1200 | $1150 | $50 |

| Food | $400 | $450 | -$50 |

| Transportation | $200 | $180 | $20 |

| Entertainment | $150 | $200 | -$50 |

Utilizing Tools for Better Insights

Incorporating technology can significantly enhance the tracking process. Numerous applications and software solutions provide features that help categorize and analyze spending effortlessly. Utilizing these tools not only simplifies data entry but also generates reports that can offer valuable insights into financial behavior.

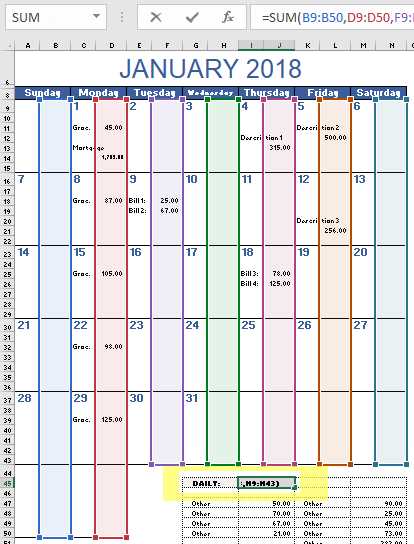

Using Color Codes for Clarity

Incorporating a system of hues can significantly enhance the organization of information, making it easier to distinguish between various categories. This visual approach not only captures attention but also facilitates quicker comprehension, allowing individuals to navigate through details effortlessly.

Assigning specific colors to different types of entries can streamline the process of tracking important dates or events. For instance, utilizing one shade for due dates and another for reminders can help users identify priorities at a glance, thus minimizing the risk of overlooking crucial tasks.

Moreover, consistency in color application reinforces the overall structure and coherence of the information presented. By establishing a recognizable pattern, users can develop a mental map that improves retention and reduces confusion, ultimately leading to a more efficient management experience.

Sharing Your Calendar with Others

Collaborating with others is essential for effective time management. By enabling access to your schedule, you can enhance communication, streamline planning, and ensure that everyone is on the same page. Sharing your organized time slots can lead to more productive teamwork and fewer scheduling conflicts.

Benefits of Sharing Your Schedule

- Improved collaboration and teamwork

- Minimized misunderstandings regarding availability

- Increased efficiency in planning group activities

- Real-time updates and notifications

Methods for Sharing Your Schedule

- Email: Send a copy of your organized time slots to colleagues or friends.

- Shared Online Platforms: Use cloud-based services that allow others to view or edit your planning.

- Mobile Apps: Utilize applications that facilitate easy sharing through links or invites.

- Social Media: Post relevant events or meetings on platforms where your contacts can see.

Choosing the right method depends on your audience and the level of interaction you desire. By effectively sharing your organized time, you foster a culture of transparency and cooperation.

How to Set Up Payment Alerts

Managing due dates effectively is crucial for maintaining financial health. Setting up reminders can help ensure that you never miss a payment. By using various tools and methods, you can create a system that keeps you informed and organized.

Choosing the Right Method

There are several ways to receive notifications regarding upcoming payments. Below are some popular options to consider:

| Method | Description |

|---|---|

| Mobile Apps | Many financial apps offer reminder features that send push notifications for due dates. |

| Email Notifications | Set up alerts through your email provider or financial service to receive reminders in your inbox. |

| Calendar Alerts | Utilize digital calendars to set recurring events with notifications prior to payment deadlines. |

| Text Messages | Some services provide SMS reminders, ensuring you receive alerts directly on your phone. |

Implementing Your Alerts

Once you’ve selected your preferred method, it’s time to configure your reminders. Follow these steps for effective setup:

1. Determine the frequency of alerts: daily, weekly, or monthly reminders based on your payment schedule.

2. Input all necessary due dates into your chosen system.

3. Test the alert system to ensure notifications are received as intended.

4. Adjust settings as needed for optimal performance.

Reviewing and Updating Your Template

Regular assessment and enhancement of your organization tool is essential to ensure it meets your evolving needs. By periodically revisiting your structure, you can identify areas for improvement and adapt to changing circumstances, thereby maximizing efficiency and effectiveness.

Steps for Assessment

- Evaluate current usage: Analyze how you utilize the system and identify any bottlenecks.

- Gather feedback: Consult with users to understand their experiences and suggestions.

- Identify trends: Look for patterns in your data that may highlight areas needing attention.

Updating Your System

- Make necessary adjustments: Based on your assessment, implement changes that enhance functionality.

- Incorporate new features: Stay informed about tools and options that could benefit your workflow.

- Schedule regular reviews: Establish a routine for future evaluations to ensure ongoing relevance.

By committing to a cycle of review and enhancement, you ensure your organizational strategies remain effective and responsive to your needs.

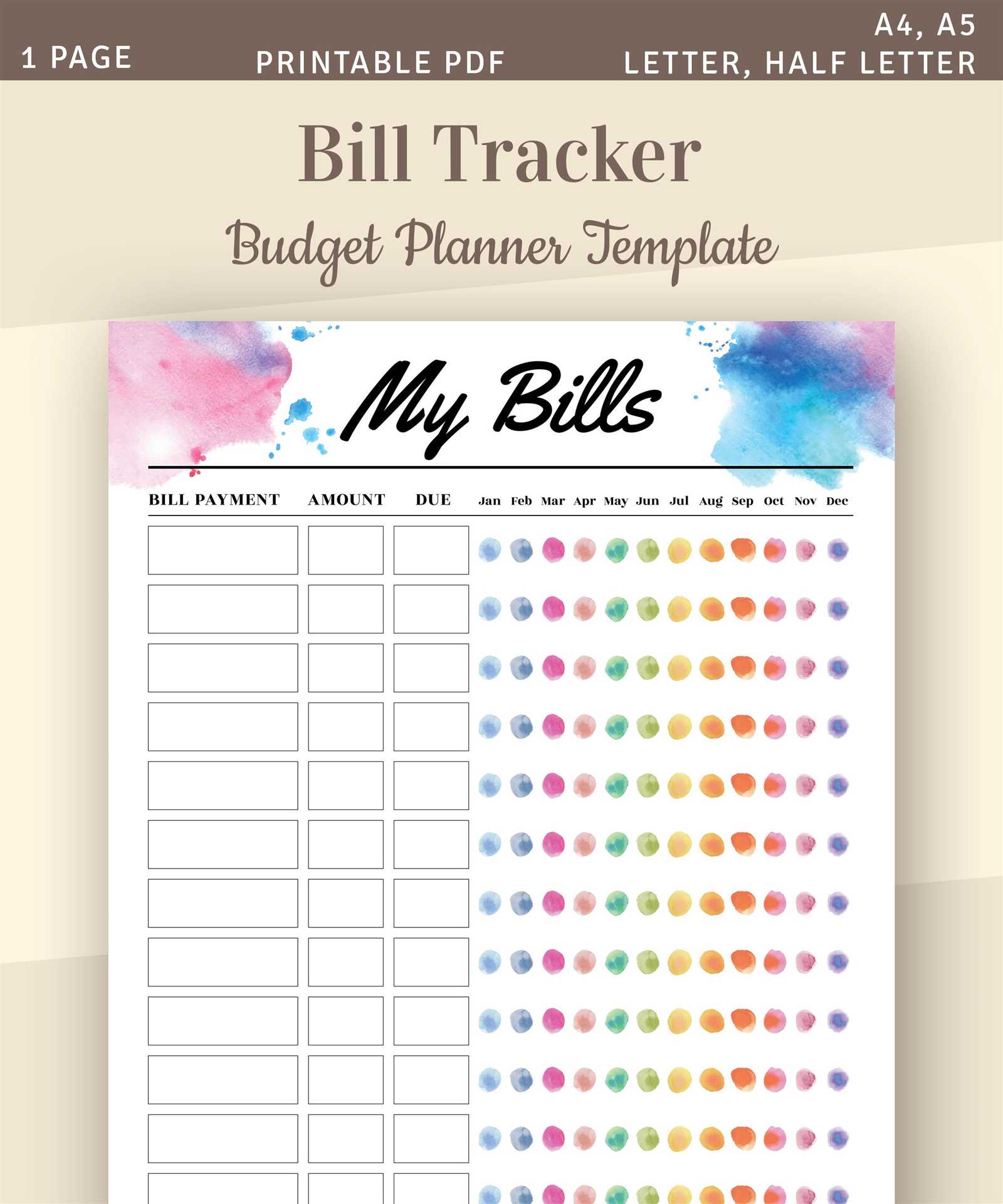

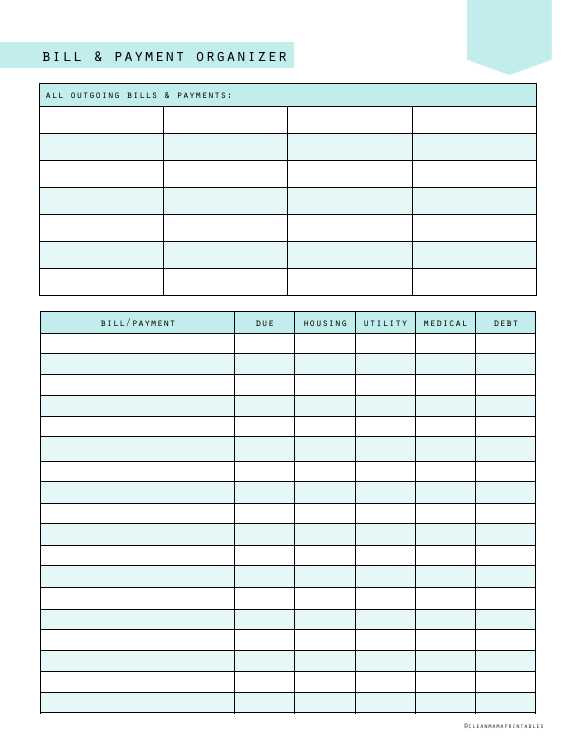

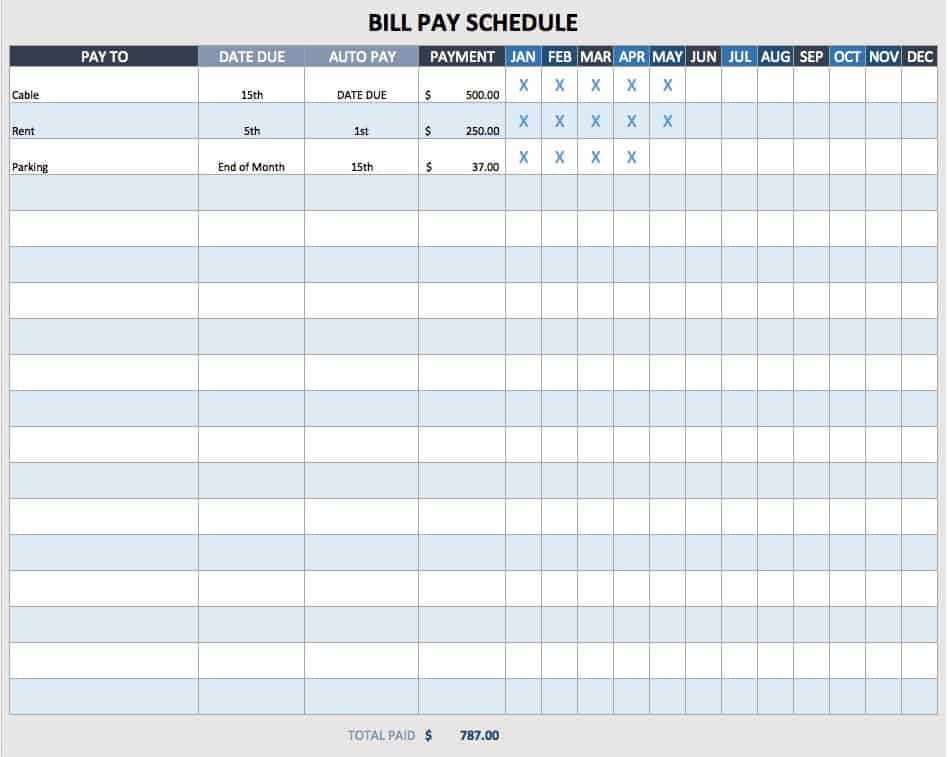

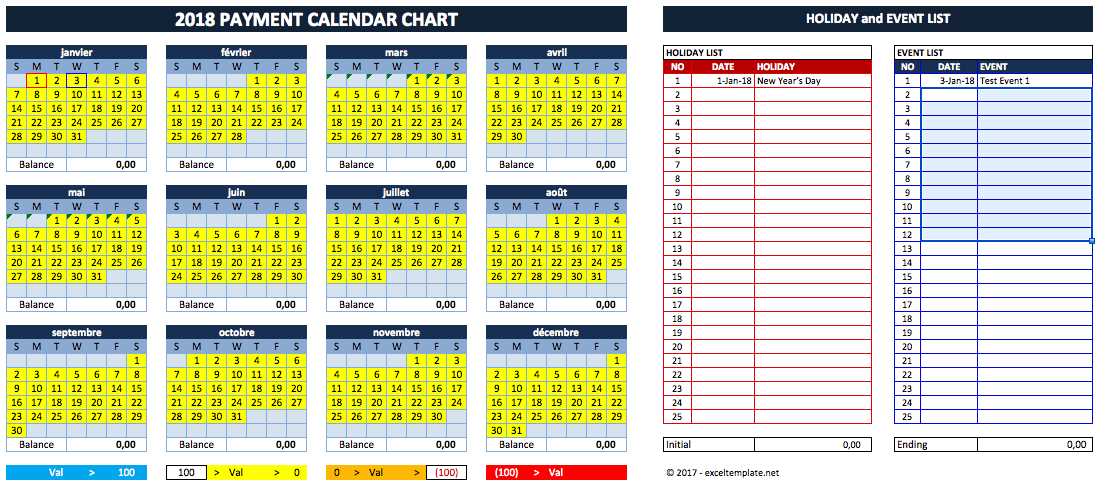

Exploring Pre-made Template Options

When it comes to managing expenses and staying organized, having ready-made solutions can be incredibly beneficial. These pre-designed formats provide a convenient way to keep track of financial obligations without the hassle of starting from scratch. With various options available, users can select formats that best suit their individual needs and preferences.

One of the key advantages of utilizing such formats is the time saved in planning and structuring. Users can easily find layouts that are both aesthetically pleasing and functional, allowing for a smooth user experience. Furthermore, many of these designs come with customizable features, enabling adjustments that cater specifically to personal or household requirements.

In addition to practicality, these formats often incorporate essential elements that enhance usability. Features such as sections for due dates, payment amounts, and reminders can streamline the management process, making it easier to stay on top of finances. Exploring various options ensures that individuals can find a suitable match that not only meets their organizational needs but also reflects their style.

Case Studies of Effective Calendar Use

Utilizing time management tools can significantly enhance productivity and organization in both personal and professional settings. By examining various approaches, we can identify strategies that have proven successful in helping individuals and teams streamline their tasks and improve efficiency. This section explores specific instances where innovative time management practices have led to remarkable outcomes.

Case Study 1: Corporate Project Management

A leading tech firm implemented a structured scheduling system to manage project timelines and deliverables. By centralizing task allocation and setting clear deadlines, the team was able to improve collaboration and accountability. The following table summarizes the key outcomes:

| Outcome | Before Implementation | After Implementation |

|---|---|---|

| Project Completion Rate | 70% | 90% |

| Team Satisfaction | 60% | 85% |

| Average Task Overdue | 5 days | 1 day |

Case Study 2: Academic Success

An educational institution adopted a visual planning method to help students manage their study schedules effectively. By promoting the use of visual aids and time allocation techniques, students reported improved grades and reduced stress levels. The following table highlights the results:

| Outcome | Before Adoption | After Adoption |

|---|---|---|

| Average GPA | 2.8 | 3.5 |

| Student Stress Levels | High | Moderate |

| Retention Rate | 75% | 90% |

Frequently Asked Questions about Templates

This section addresses common inquiries regarding pre-designed formats that assist users in organizing their information efficiently. Understanding the functionalities and features of these arrangements can enhance productivity and simplify various tasks.

| Question | Answer |

|---|---|

| What are the benefits of using pre-made formats? | They save time, provide structure, and can enhance the visual appeal of your documents. |

| Can I customize these formats to fit my needs? | Yes, most designs allow for personalization, letting you modify elements to suit your preferences. |

| Where can I find quality designs? | Many websites offer free and paid options, including marketplaces and template repositories. |

| Are there formats available for specific tasks? | Absolutely! You can find formats tailored for various functions such as project management, budgeting, and scheduling. |

| Do I need special software to use these formats? | Most can be accessed with standard software applications, but some may require specific programs for full functionality. |