Planning financial management requires a clear understanding of the intervals at which compensation is disbursed. Many organizations opt for a system that divides the year into manageable segments, allowing for streamlined budgeting and employee satisfaction. This structure not only enhances clarity but also promotes effective fiscal strategies within the workplace.

For those looking to simplify their financial operations, having a structured guide is essential. This resource provides a systematic approach to tracking income distribution, ensuring that both employers and employees can align their expectations and responsibilities. By maintaining an organized timeline, stakeholders can make informed decisions regarding their finances throughout the year.

Utilizing a well-designed framework can significantly ease the complexities associated with regular financial transactions. Such an arrangement allows for greater transparency, which in turn fosters trust between parties. As you navigate through the various stages of the year, this guide will serve as a valuable tool for efficient management and planning.

Understanding Biweekly Pay Periods

In many organizations, employees receive their compensation on a specific schedule that occurs every two weeks. This structure provides a systematic approach to financial planning for both workers and employers, aligning cash flow with operational needs. By grasping how this cycle functions, individuals can better manage their earnings and anticipate their financial obligations.

How It Works

The two-week cycle typically consists of 26 cycles in a year, leading to 26 distinct compensation dates. This rhythm allows employees to budget their expenses efficiently while ensuring consistent remuneration. Employers benefit by maintaining a predictable payroll process, which aids in resource allocation and financial forecasting.

Advantages of the System

One of the primary benefits of this arrangement is the frequency of receiving funds, which can enhance an employee’s liquidity and enable quicker responses to financial needs. Moreover, aligning wages with regular expenses, such as rent and utilities, creates a smoother financial experience. Additionally, for those managing various financial responsibilities, this structure can lead to improved overall financial health.

Benefits of Biweekly Payment Schedules

Choosing a payment frequency that aligns with both employee needs and organizational goals can significantly enhance financial well-being and operational efficiency. This approach offers numerous advantages that benefit both parties, ensuring a smoother financial experience.

Improved Cash Flow Management is one of the primary benefits of this system. Employees receive their earnings more frequently, allowing them to manage their personal finances better. This regular influx can help in covering monthly expenses without the stress of waiting longer intervals for compensation.

Another advantage is Enhanced Employee Satisfaction. Regular payments can lead to increased morale, as workers feel more valued and appreciated when they receive their compensation consistently. This can foster loyalty and a more positive workplace atmosphere.

Streamlined Budgeting is also a key benefit. Individuals can plan their expenses more effectively with predictable income intervals. This predictability aids in establishing savings habits and managing discretionary spending, contributing to overall financial stability.

Furthermore, companies can experience Reduced Administrative Burden. With fewer payroll processes, organizations can save time and resources, allowing them to focus on core business activities while ensuring compliance with financial regulations.

Ultimately, adopting this system can lead to a more balanced and efficient financial ecosystem, promoting well-being for employees and operational success for employers.

How to Create a Pay Calendar

Establishing a schedule for compensations is essential for effective financial management within an organization. This process involves outlining the intervals at which earnings are distributed to employees, ensuring transparency and consistency. By following a structured approach, you can create a reliable framework that meets both organizational needs and employee expectations.

Begin by determining the frequency of disbursements. Common choices include weekly, every two weeks, or monthly, depending on what best suits your workforce and cash flow requirements. Once you’ve settled on a frequency, outline the specific dates when payments will occur throughout the year.

| Month | Pay Dates |

|---|---|

| January | 1st, 15th, 29th |

| February | 12th, 26th |

| March | 12th, 26th |

| April | 9th, 23rd |

| May | 7th, 21st |

| June | 4th, 18th |

| July | 2nd, 16th, 30th |

| August | 13th, 27th |

| September | 10th, 24th |

| October | 8th, 22nd |

| November | 5th, 19th |

| December | 3rd, 17th, 31st |

After establishing the dates, it’s important to communicate this information clearly to all staff members. This transparency fosters trust and ensures everyone is aware of when to expect their remuneration. Additionally, consider integrating reminders or automated notifications to streamline the process further.

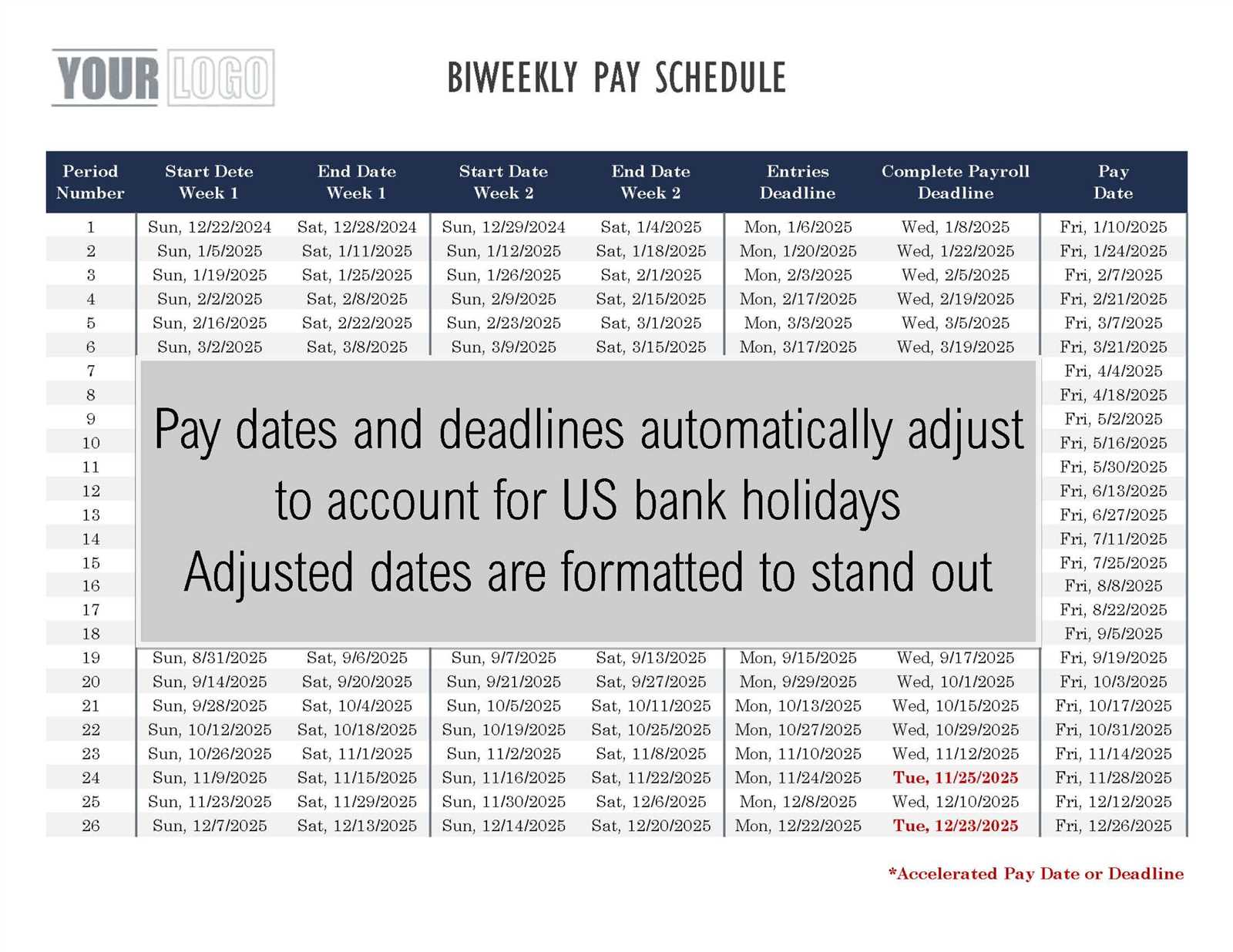

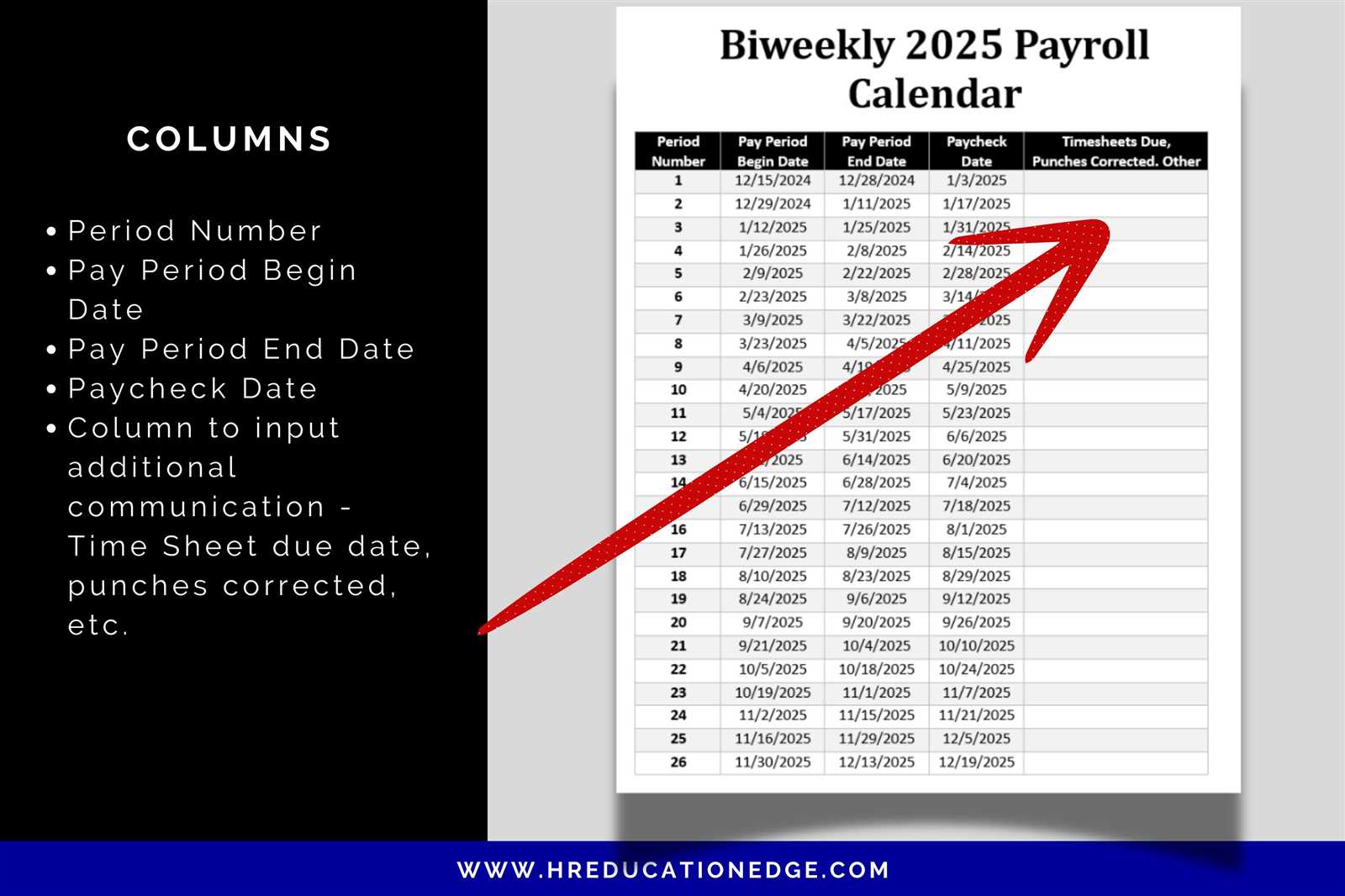

Key Dates in 2025 Biweekly Pay

Understanding important dates for remuneration schedules is essential for both employees and employers. This knowledge ensures timely compensation and helps in effective financial planning. Below, we outline crucial dates for the year that will assist individuals in managing their financial expectations efficiently.

Remuneration Schedule Overview

Each compensation cycle typically involves specific start and end dates that determine when earnings are calculated and disbursed. Keeping track of these dates can streamline budgeting and financial commitments.

Important Dates for 2025

| Start Date | End Date | Payment Date |

|---|---|---|

| January 1 | January 14 | January 16 |

| January 15 | January 28 | January 30 |

| January 29 | February 11 | February 13 |

| February 12 | February 25 | February 27 |

| February 26 | March 11 | March 13 |

| March 12 | March 25 | March 27 |

| March 26 | April 8 | April 10 |

| April 9 | April 22 | April 24 |

| April 23 | May 6 | May 8 |

| May 7 | May 20 | May 22 |

| May 21 | June 3 | June 5 |

| June 4 | June 17 | June 19 |

| June 18 | July 1 | July 3 |

| July 2 | July 15 | July 17 |

| July 16 | July 29 | July 31 |

| July 30 | August 12 | August 14 |

| August 13 | August 26 | August 28 |

| August 27 | September 9 | September 11 |

| September 10 | September 23 | September 25 |

| September 24 | October 7 | October 9 |

| October 8 | October 21 | October 23 |

| October 22 | November 4 | November 6 |

| November 5 | November 18 | November 20 |

| November 19 | December 2 | December 4 |

| December 3 | December 16 | December 18 |

| December 17 | December 30 | January 1, 2026 |

Staying informed about these key dates allows for better financial management and ensures that all parties involved can effectively plan their financial activities throughout the year.

Calculating Paydays for Employees

Determining the dates when workers receive their remuneration is crucial for both management and staff. Understanding how to accurately establish these dates ensures financial planning and enhances employee satisfaction. This section delves into the essential aspects of calculating these crucial moments in the work cycle.

Factors Influencing Payday Calculation

Several elements must be taken into account when deciding when employees will receive their earnings:

- Frequency of Compensation: The intervals at which wages are distributed, whether weekly, biweekly, or monthly.

- Company Policy: Internal regulations that dictate how and when remuneration is processed.

- Legal Requirements: Local laws that govern payment practices, including minimum frequency and timely delivery.

- Employee Preferences: Worker feedback on preferred payment intervals can influence company practices.

Steps to Calculate Remuneration Dates

To effectively establish when workers will receive their funds, follow these steps:

- Identify the start date of the compensation cycle.

- Determine the length of the cycle based on company policy.

- Calculate the ending date by adding the cycle duration to the start date.

- Set the payment date, ensuring it complies with both internal and legal standards.

- Communicate the established dates to all employees to ensure transparency.

By carefully considering these factors and steps, organizations can streamline their compensation processes and foster a positive work environment.

Differences Between Biweekly and Weekly Pay

When it comes to compensating employees, various schedules can significantly impact both the organization and the workforce. Understanding how different frequencies of remuneration affect cash flow, budgeting, and overall employee satisfaction is essential for effective financial management.

Frequency and Financial Planning

The most apparent distinction lies in the frequency of receiving funds. Employees receiving their earnings every week benefit from a more consistent cash flow, which can aid in managing expenses and budgeting effectively. Conversely, those who are compensated every other week may experience larger sums less frequently, which could require more careful financial planning to cover ongoing expenses.

Impact on Employee Morale

The timing of compensation can also influence employee morale and satisfaction. Regular, weekly compensation might create a sense of stability and prompt employees to feel more secure. In contrast, receiving a larger amount biweekly can provide a sense of a financial boost, especially for those managing significant bills or expenses that align with the end of the month.

Impact on Employee Budgeting

The frequency of compensation distribution significantly influences how employees manage their finances. Understanding the timing and structure of earnings can help workers plan their expenses more effectively, allowing for better financial decision-making and stability.

Financial Planning and Management

When employees receive their earnings consistently, they can create more accurate budgets. Regular income streams enable individuals to allocate funds for essential expenses, savings, and discretionary spending. This predictability fosters a sense of financial security and empowers employees to make informed choices about their resources.

Potential Challenges

Despite the benefits, some may encounter difficulties with the timing of their income. For instance, individuals with variable or high monthly expenses may find it challenging to synchronize their cash flow with their financial obligations. This misalignment can lead to stress and may necessitate careful planning to avoid cash shortages.

| Income Frequency | Advantages | Disadvantages |

|---|---|---|

| Regular Intervals | Improved budgeting and financial security | Potential misalignment with high monthly expenses |

| Variable Intervals | Flexibility in spending | Uncertainty in financial planning |

Common Challenges with Biweekly Payments

Managing a system that distributes earnings every two weeks can present various hurdles for both employees and employers. These difficulties may stem from the frequency of disbursements, the impact on budgeting, and the alignment with other financial obligations. Understanding these issues is essential for fostering a smoother experience for all parties involved.

Budgeting Difficulties

One significant challenge is the impact on personal finances. For many individuals, adjusting to a new rhythm of income can complicate monthly budgeting. Since essential expenses, like rent or utilities, are often due at the beginning of the month, individuals may find themselves juggling funds to meet these obligations. This can lead to cash flow issues and unexpected shortfalls.

Payroll Processing Complications

From an organizational perspective, the implementation of a system that dispenses earnings on a biweekly basis can complicate administrative processes. Employers must ensure accurate tracking of hours worked, overtime, and any deductions. Mistakes in these calculations can result in employee dissatisfaction and can damage trust. Additionally, payroll systems must be robust enough to handle the increased frequency of transactions, which may require additional resources or adjustments to existing software.

Tools for Payroll Management

Effective financial administration is crucial for any organization, ensuring that employees are compensated accurately and on time. A variety of resources are available to streamline this process, making it easier for businesses to handle employee remuneration while maintaining compliance with regulations.

One essential tool is specialized software designed to automate calculations and track hours worked, reducing the risk of errors. These programs often come with features that facilitate the generation of reports and manage deductions, enhancing overall efficiency. Additionally, cloud-based solutions allow for real-time updates and access from multiple devices, ensuring that information is always current.

Another valuable resource includes mobile applications that enable employees to monitor their earnings and submit requests for time off conveniently. This promotes transparency and empowers staff to engage actively with their compensation details. Furthermore, integrating these applications with existing systems can create a seamless workflow that simplifies management tasks.

Lastly, educational resources and training sessions can provide insights into best practices and regulatory requirements. By equipping teams with knowledge, organizations can foster a culture of accuracy and compliance, ultimately leading to better financial health and employee satisfaction.

Setting Up Payroll Software

Establishing an effective system for managing employee compensation is crucial for any organization. The right tools streamline processes, enhance accuracy, and ensure compliance with regulations. By implementing robust software, businesses can minimize errors and save time in their administrative tasks.

Before diving into the setup, it’s essential to gather all necessary information, including employee details, tax information, and payment methods. This data will serve as the foundation for the software, enabling seamless integration and functionality.

Next, choose a program that aligns with your company’s needs. Look for features such as automated calculations, reporting capabilities, and user-friendly interfaces. Once selected, follow the installation guidelines provided by the software vendor to ensure a smooth implementation.

Customization is key. Tailor the settings to fit your organization’s unique structure and compensation plans. This may involve configuring salary structures, benefit deductions, and overtime calculations to reflect your policies accurately.

Finally, conduct thorough testing to identify any potential issues before going live. Engaging your team in this process can help gather valuable feedback and ensure everyone is comfortable with the new system. By investing time upfront, you’ll set a solid foundation for efficient management of employee remuneration.

Legal Considerations for Employers

Employers must navigate a complex landscape of regulations when determining compensation schedules for their workforce. Ensuring compliance with federal and state laws is crucial to avoid legal repercussions and maintain employee satisfaction.

Fair Labor Standards Act (FLSA) outlines minimum wage and overtime pay requirements, necessitating that employers understand how to calculate hours worked accurately. It is essential to establish clear guidelines for employees regarding their earnings to prevent misunderstandings and disputes.

Additionally, state-specific regulations may impose further requirements, such as mandated pay frequency and payment methods. Employers should regularly delve into these laws to remain compliant and adapt their practices accordingly.

Lastly, keeping comprehensive records of compensation and hours worked is vital for addressing any potential claims or audits. The ultimate goal should be to create a transparent and equitable system that aligns with legal standards while fostering a positive workplace culture.

Adjusting for Holidays and Leave

When planning remuneration schedules, it is essential to account for official holidays and employee absences. These adjustments ensure that everyone receives their rightful compensation while maintaining a fair structure. Recognizing these variations helps in accurately forecasting budgets and resources.

Holidays can significantly impact the timing of financial distributions. Organizations often need to modify their schedules to align with these dates, ensuring that employees are not inconvenienced. For instance, if a designated payment date falls on a holiday, it is prudent to move it to the nearest working day to avoid disruption.

Additionally, leave taken by employees, whether for personal reasons or medical necessities, should also be factored into the overall remuneration strategy. Tracking these absences and understanding their implications allows for precise calculations and prevents potential discrepancies in compensation. Adjustments may be necessary to reflect these changes, ensuring transparency and trust between employers and their teams.

Best Practices for Payroll Accuracy

Ensuring the precision of compensation processes is essential for maintaining employee trust and organizational efficiency. Implementing effective strategies can minimize errors and enhance the overall reliability of financial distributions.

- Regular Audits: Conduct periodic reviews of financial records to identify discrepancies and rectify them promptly.

- Automated Systems: Utilize technology to streamline calculations and reduce human error.

- Clear Policies: Establish transparent guidelines regarding compensation practices, including overtime, bonuses, and deductions.

- Employee Training: Invest in ongoing education for staff involved in compensation management to ensure they are updated on best practices and compliance requirements.

- Verification Processes: Implement double-check systems where another team member reviews calculations before finalizing transactions.

By adopting these methods, organizations can foster a more accurate and reliable system that supports both employees and management effectively.

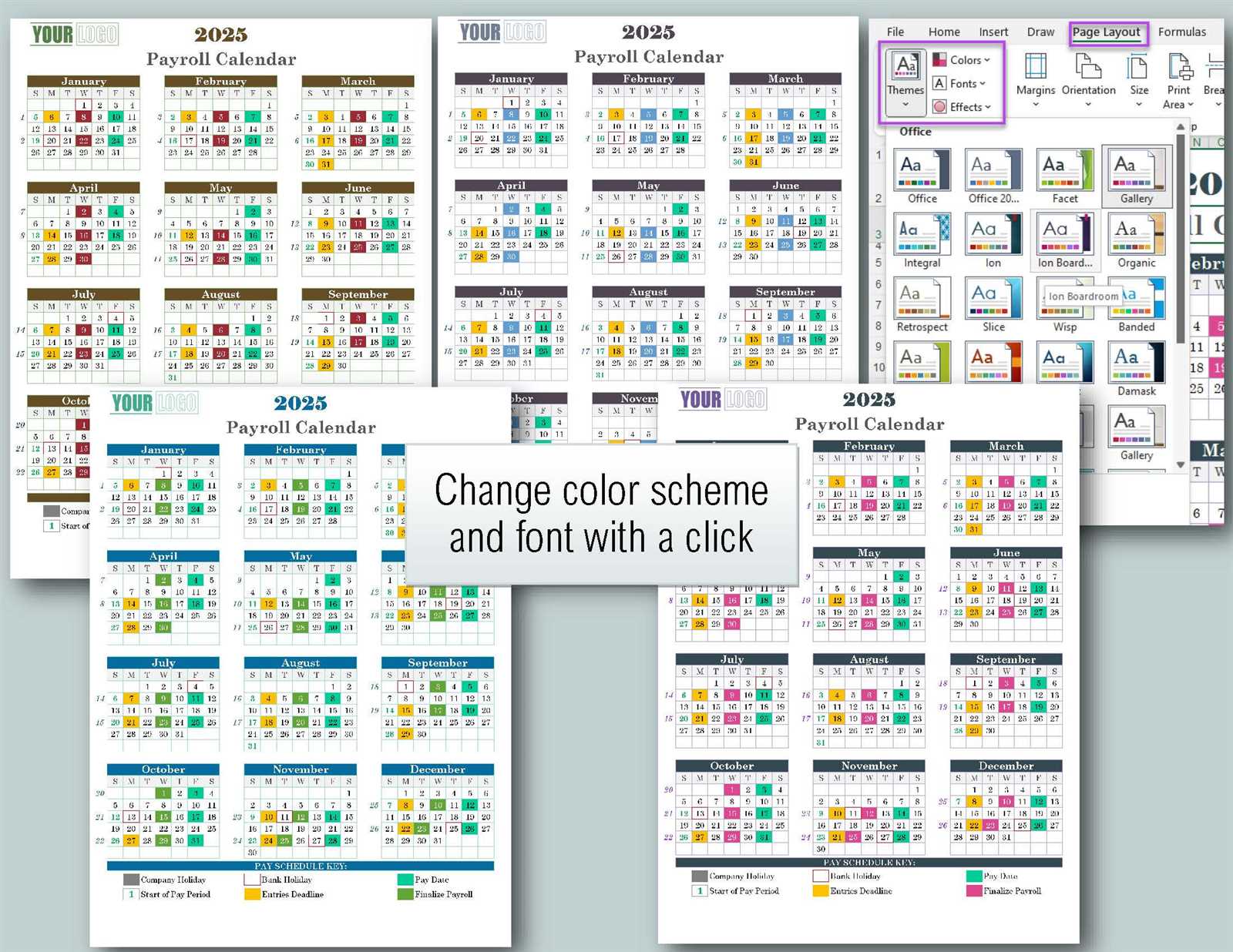

Using Templates for Efficiency

In today’s fast-paced environment, leveraging structured formats can significantly streamline various processes. By adopting ready-made frameworks, individuals and organizations can minimize time spent on repetitive tasks, allowing them to focus on more critical aspects of their work. These organized blueprints not only enhance productivity but also promote consistency and accuracy across different activities.

Benefits of Structured Formats

Utilizing organized designs leads to better time management, as individuals can quickly adapt and fill in necessary information without starting from scratch. This approach reduces the likelihood of errors and ensures that essential details are not overlooked. Additionally, having a standardized method fosters collaboration, as team members can easily share and understand each other’s work, regardless of their specific roles.

Implementing Organized Frameworks

To make the most of structured designs, it is important to customize them according to specific needs while maintaining their core efficiency features. Regularly updating these formats to reflect any changes in workflow or requirements can further enhance their utility. By integrating such practices, teams can ensure they remain agile and responsive in an ever-evolving landscape.

Employee Communication about Pay Schedules

Effective communication regarding compensation timelines is crucial for fostering trust and transparency within the workplace. Ensuring that all team members are informed about when they can expect their earnings allows for better personal financial planning and enhances overall job satisfaction.

Organizations should provide clear information about the frequency and specific dates associated with salary disbursements. This can be achieved through various channels such as internal newsletters, digital platforms, and informational meetings. Consistent messaging helps prevent misunderstandings and ensures that employees feel valued and informed.

Additionally, it’s beneficial to establish a feedback mechanism that encourages employees to voice their concerns or ask questions about their remuneration schedules. This two-way communication not only addresses individual queries but also highlights areas for improvement in the organization’s approach to financial communications.

Incorporating visual aids, such as charts or timelines, can further enhance understanding. Visual representations can clarify the sequence of compensation events, making it easier for employees to grasp when they will receive their earnings.

Overall, a proactive approach to discussing remuneration timelines promotes a positive workplace culture, reinforcing the organization’s commitment to its employees’ well-being.

Tracking Hours in Biweekly Periods

Effectively monitoring work hours is essential for both employees and employers. It ensures accurate compensation and fosters accountability within the workplace. By implementing systematic approaches, organizations can streamline this process, making it efficient and transparent.

Consistency in tracking hours is vital. Utilizing tools such as spreadsheets or specialized software allows for easy updates and adjustments. Employees should record their hours regularly, which helps avoid discrepancies and promotes a clear overview of time worked.

Establishing clear guidelines for hour tracking can significantly enhance productivity. Providing training on best practices ensures everyone understands how to log their time correctly. Regular reviews of recorded hours can also help identify patterns or issues, leading to better management strategies.

Frequency of Payroll Reports

The regularity of financial summaries is essential for effective business management. Companies often determine the intervals at which these summaries are generated to ensure compliance and maintain accurate records. A consistent schedule helps organizations monitor their financial health and manage their workforce efficiently.

Different businesses may adopt varying frequencies based on their operational needs and workforce size. For some, generating reports on a weekly basis allows for quick adjustments and responsiveness to labor costs, while others may opt for a less frequent schedule to streamline administrative efforts. Each approach has its advantages, impacting cash flow management and resource allocation.

Moreover, the choice of reporting frequency can influence employee satisfaction. Regular updates provide transparency and can help in addressing any payroll discrepancies promptly. Thus, striking the right balance is crucial for maintaining a harmonious relationship with staff and ensuring organizational efficiency.

Future Trends in Payroll Systems

The landscape of compensation management is evolving rapidly, driven by technological advancements and shifting workforce expectations. As organizations seek greater efficiency and accuracy in their remuneration processes, several emerging trends are reshaping how businesses approach this crucial aspect of operations.

Automation and Artificial Intelligence

Automation is becoming a cornerstone in the evolution of remuneration systems. By integrating artificial intelligence, organizations can streamline processes, reduce human error, and enhance data analysis capabilities. Machine learning algorithms are particularly valuable, enabling predictive analytics that can inform better decision-making and improve financial forecasting.

Enhanced Employee Experience

As the workforce becomes increasingly diverse and mobile, enhancing the employee experience is paramount. Flexible options for accessing compensation information, along with real-time updates, empower individuals to manage their finances more effectively. Personalized insights into earnings and benefits can lead to increased satisfaction and engagement, ultimately benefiting both employees and employers.