Understanding the intricacies of employee compensation cycles is crucial for any organization aiming to maintain financial efficiency and staff satisfaction. A well-structured approach to remuneration periods not only streamlines administrative tasks but also fosters a positive work environment. By outlining the key timelines for payments, businesses can enhance their operational flow and ensure that their workforce remains motivated and engaged.

In this article, we will explore a robust framework for managing your remuneration schedule, offering insights that cater to both small enterprises and larger corporations. With an emphasis on clarity and organization, this guide will assist you in navigating the complexities of compensatory timelines, ensuring compliance and accuracy in your financial processes.

As we delve deeper into the subject, you will discover practical tools and strategies designed to simplify your planning. The right approach to structuring payment intervals can significantly impact your overall efficiency, enabling you to allocate resources more effectively while addressing the needs of your team.

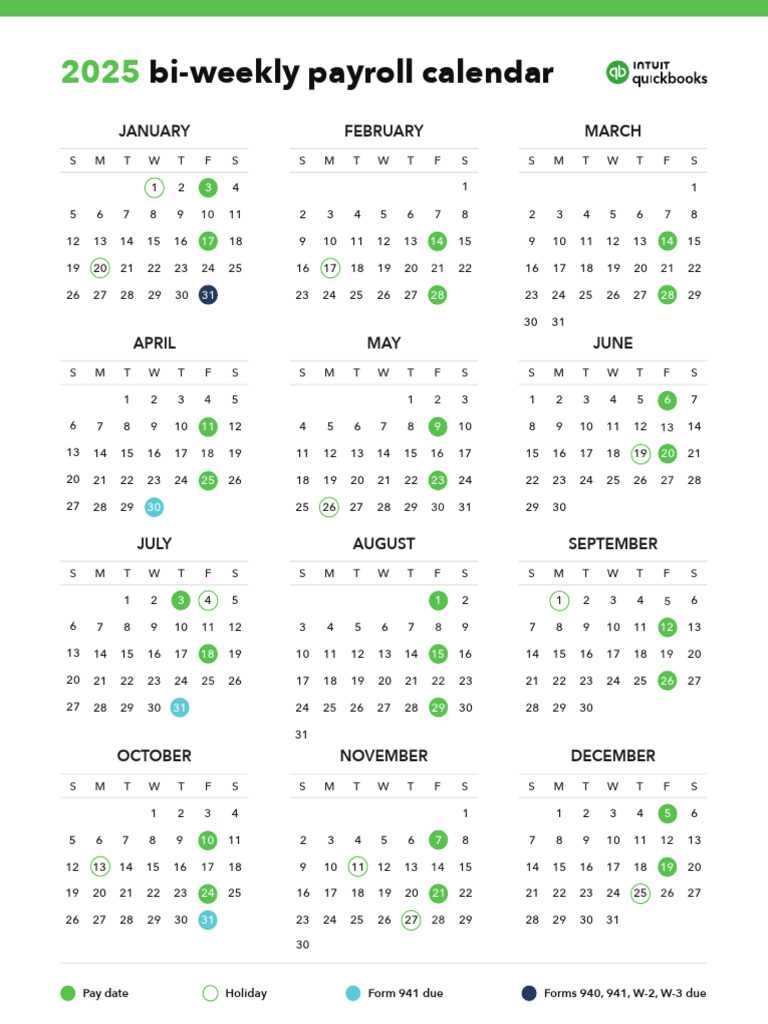

Understanding Biweekly Payroll Systems

In many organizations, the process of compensating employees follows a systematic approach that influences both workforce satisfaction and financial planning. This framework typically operates on a fixed schedule, ensuring that employees receive their earnings at regular intervals. The structure provides clarity and predictability for both workers and management alike.

One of the key advantages of this compensation method is its consistency. Employees know exactly when to expect their earnings, allowing for better personal financial management. Additionally, this system can simplify administrative tasks for human resources departments.

- Predictability in earnings helps employees manage expenses effectively.

- Regular schedules can enhance employee satisfaction and retention.

- Streamlined processes can reduce administrative workload.

To implement this system successfully, organizations should consider several factors:

- Scheduling: Clearly define the pay periods and communicate them to all staff.

- Compliance: Ensure adherence to local labor laws and regulations regarding compensation.

- Technology: Utilize software solutions to automate and streamline processes, reducing the risk of errors.

Understanding these principles is essential for both employers and employees, as it lays the groundwork for effective financial management and workplace harmony.

Benefits of Biweekly Pay Schedule

Adopting a regular payment structure offers numerous advantages for both employers and employees. This system provides a predictable financial rhythm, helping workers manage their expenses and savings more effectively. With payments occurring every two weeks, individuals can better align their income with recurring costs, ultimately enhancing their financial stability.

Improved Financial Management

Receiving compensation at regular intervals allows employees to budget more efficiently. It helps in planning for monthly bills, loans, and other financial commitments. This predictability can reduce stress and anxiety related to financial uncertainty, enabling individuals to focus more on their work and personal lives.

Increased Employee Satisfaction

Regular payments can lead to higher morale among staff. When employees are confident in their financial situation, they are often more engaged and productive. Additionally, timely compensation can foster a sense of trust between employers and employees, contributing to a more positive workplace atmosphere.

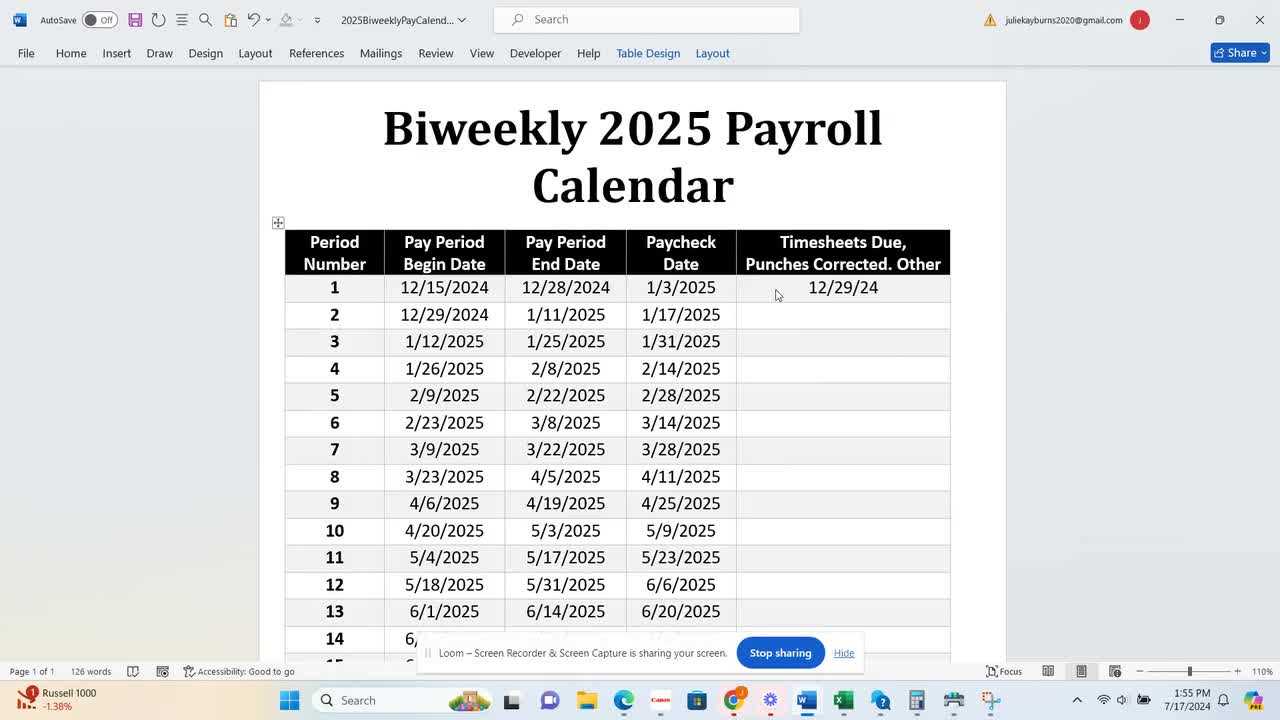

Key Dates in 2026 Payroll Calendar

Understanding the essential timelines for compensation distribution is crucial for both employers and employees. These specific dates help ensure that financial processes run smoothly, enabling all parties to plan accordingly and maintain accurate records.

| Month | Pay Period Start | Pay Period End | Payment Date |

|---|---|---|---|

| January | January 1 | January 14 | January 15 |

| February | January 15 | January 28 | January 29 |

| March | January 29 | February 11 | February 12 |

| April | February 12 | February 25 | February 26 |

| May | February 26 | March 11 | March 12 |

| June | March 12 | March 25 | March 26 |

| July | March 26 | April 8 | April 9 |

| August | April 9 | April 22 | April 23 |

| September | April 23 | May 6 | May 7 |

| October | May 7 | May 20 | May 21 |

| November | May 21 | June 3 | June 4 |

| December | June 4 | June 17 | June 18 |

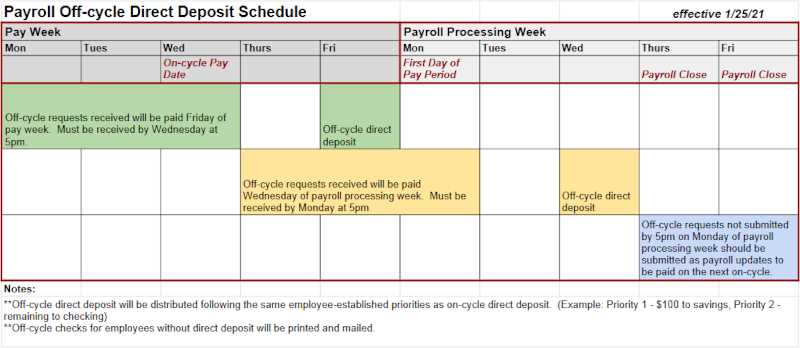

How to Create a Payroll Template

Designing a structured plan for managing employee compensation is essential for any organization. A well-organized framework not only streamlines the payment process but also ensures accuracy and compliance with regulations. Below are the steps to develop an effective document for tracking earnings and deductions.

Begin by outlining the necessary components. This should include employee information, payment dates, hourly rates, and any applicable deductions or benefits. Having a clear structure will facilitate efficient data entry and retrieval.

| Component | Description |

|---|---|

| Employee Name | The full name of the individual receiving payment. |

| ID Number | A unique identifier for each employee. |

| Payment Period | The specific timeframe for which the payment is made. |

| Hours Worked | Total hours the employee worked during the period. |

| Hourly Rate | The amount paid per hour of work. |

| Deductions | Any amounts subtracted from the gross pay, such as taxes and benefits. |

| Net Pay | The total amount the employee receives after deductions. |

Once the structure is in place, populate it with accurate data regularly. Ensure that all figures are double-checked for errors to maintain trust and transparency. Finally, keep the document updated with any changes in regulations or company policies to remain compliant and fair to all employees.

Common Mistakes in Payroll Management

Effective management of employee compensation is crucial for any organization, yet many businesses encounter pitfalls that can lead to inaccuracies and dissatisfaction. Understanding these common errors can help ensure a smoother process and enhance overall efficiency.

- Inaccurate Data Entry: One of the primary issues arises from errors in entering employee information, such as hours worked or salary rates. Simple typos can result in significant discrepancies.

- Lack of Compliance: Failing to stay updated with labor laws and tax regulations can lead to costly fines and penalties. It’s essential to regularly review and adjust practices to remain compliant.

- Ignoring Employee Changes: Not updating records for promotions, role changes, or terminations can cause confusion and payment errors. Keeping accurate and current employee files is vital.

- Overlooking Time Tracking: Inadequate monitoring of hours can lead to overpayment or underpayment. Implementing a reliable timekeeping system can mitigate this risk.

- Failure to Reconcile: Neglecting to regularly check and balance financial records can result in unnoticed mistakes. Regular reconciliation helps identify discrepancies early.

By recognizing and addressing these common mistakes, organizations can streamline their compensation processes and foster a more positive work environment.

Calculating Employee Pay Accurately

Ensuring precise compensation for employees is essential for maintaining trust and satisfaction within the workplace. Accurate calculations not only reflect fair remuneration for services rendered but also comply with legal obligations. This section outlines key considerations and methods for achieving error-free compensation determinations.

To begin with, it is important to have a clear understanding of the components that contribute to an employee’s earnings. These components typically include base salary, overtime, bonuses, and deductions such as taxes and benefits. Each element must be carefully calculated to reflect the true amount owed to the employee.

| Component | Description |

|---|---|

| Base Salary | The fixed amount paid to the employee for their regular work hours. |

| Overtime | Compensation for hours worked beyond the standard workweek, often at a higher rate. |

| Bonuses | Additional financial rewards given for exceptional performance or achievements. |

| Deductions | Amounts subtracted from the gross pay for taxes, health insurance, and retirement contributions. |

Employers should implement systematic processes to ensure all elements are accurately recorded and processed. Utilizing software solutions can streamline these calculations and reduce the likelihood of human error. Regular audits of the compensation process are also advisable to identify discrepancies and ensure compliance with regulations.

By prioritizing accuracy in pay calculations, organizations can foster a positive work environment and enhance employee morale, ultimately leading to greater productivity and retention.

Tools for Payroll Automation

In the modern workplace, efficiency and accuracy in managing employee compensation are essential. Automation tools streamline the process, reduce the likelihood of errors, and save time for human resources teams. By leveraging technology, organizations can enhance their financial operations, ensuring timely and precise remuneration.

Key Features of Automation Tools

When selecting an automation solution, consider the following essential features:

| Feature | Description |

|---|---|

| Integration | Ability to connect with existing HR systems and financial software for seamless data flow. |

| Reporting | Comprehensive reporting capabilities to analyze compensation data and trends over time. |

| User-Friendly Interface | Intuitive design that simplifies navigation for users of all technical levels. |

| Compliance Management | Tools to ensure adherence to regulations and standards in compensation practices. |

| Mobile Access | Options for remote access to manage tasks on-the-go, enhancing flexibility. |

Benefits of Using Automation

Implementing automation solutions can lead to significant advantages, such as improved accuracy, reduced administrative workload, and enhanced employee satisfaction. By automating repetitive tasks, organizations can focus on strategic initiatives that contribute to overall growth and development.

Employee Time Tracking Best Practices

Effective monitoring of employee hours is crucial for optimizing productivity and ensuring accurate compensation. Establishing reliable methods for tracking time can lead to improved efficiency, enhanced accountability, and streamlined operations within any organization.

Utilize Technology

Embracing modern tools and software can significantly simplify the process of time tracking. Automated systems reduce the likelihood of human error and provide real-time data that is accessible to both employees and management. Consider solutions that offer mobile access, integration with existing systems, and user-friendly interfaces to encourage consistent usage.

Encourage Transparency

Fostering an environment of openness regarding time management helps build trust among team members. Regularly communicate the importance of accurate time recording and how it benefits the entire organization. Encourage employees to track their hours consistently and discuss any discrepancies as they arise, creating a culture of accountability and collaboration.

Legal Compliance in Payroll Processing

Ensuring adherence to relevant laws and regulations during the compensation disbursement process is critical for organizations. This involves a comprehensive understanding of various legal requirements that govern employee remuneration, tax obligations, and benefits. Organizations must establish robust practices to mitigate risks associated with non-compliance, which can lead to significant financial penalties and reputational damage.

Understanding Regulatory Frameworks

Each jurisdiction has its own set of rules regarding worker compensation. Familiarity with local, state, and federal regulations is essential. Employers should stay informed about updates to labor laws, minimum wage standards, overtime provisions, and other related stipulations. Regular training and updates for human resources personnel can enhance awareness and ensure compliance throughout the organization.

Record-Keeping and Reporting Obligations

Meticulous record-keeping is vital in demonstrating compliance. Organizations must maintain accurate records of employee hours, wages, and deductions. Additionally, timely submission of required reports to governmental agencies is crucial. Utilizing reliable software solutions can help streamline this process and reduce the likelihood of errors that could lead to compliance issues.

In summary, a proactive approach to understanding and implementing legal requirements in employee compensation processes is indispensable for organizations aiming to foster a compliant and ethical workplace environment.

Integrating Payroll with Accounting Software

Seamless connection between employee compensation systems and financial management tools is crucial for businesses aiming to enhance efficiency and accuracy. This integration minimizes manual data entry, reduces errors, and ensures that financial records reflect real-time labor costs.

Here are the key benefits of integrating these systems:

- Improved Accuracy: Automating data transfer eliminates discrepancies that often arise from manual entry.

- Time Savings: Streamlined processes allow teams to focus on strategic tasks rather than repetitive data handling.

- Real-time Reporting: Access to up-to-date financial information aids in timely decision-making.

- Compliance Management: Integration helps maintain accurate records, making it easier to adhere to regulatory requirements.

To achieve effective integration, consider the following steps:

- Choose compatible systems that can communicate effectively with each other.

- Map out the data flow between the two platforms to ensure consistency.

- Implement robust security measures to protect sensitive employee information.

- Test the integration thoroughly before going live to identify and resolve any issues.

Ultimately, integrating compensation systems with accounting software fosters a more cohesive financial strategy, driving better business outcomes.

Managing Deductions and Taxes

Effectively handling withholdings and obligations is crucial for any organization aiming to maintain compliance and support employee satisfaction. A clear understanding of how to calculate and implement these deductions can lead to smoother operations and a more transparent work environment.

To ensure accuracy and compliance, consider the following key elements:

- Understand Local Regulations: Stay informed about federal, state, and local laws that govern withholding rates and tax responsibilities.

- Review Employee Documentation: Collect and verify essential information from employees, such as W-4 forms, to determine the correct withholding amounts.

- Implement Consistent Processes: Develop standardized procedures for calculating and processing deductions to minimize errors and maintain efficiency.

When managing these components, it’s essential to keep track of various factors:

- Health insurance premiums

- Retirement contributions

- Tax levies and garnishments

Regular audits of deductions will help identify discrepancies and ensure that all amounts are accurately reflected in financial records. By prioritizing these aspects, organizations can foster trust and reliability among their workforce.

Preparing for Payroll Audits

Ensuring compliance and accuracy in financial reporting is essential for any organization. An audit of financial records can uncover discrepancies and promote accountability. Proper preparation not only simplifies the audit process but also helps maintain the integrity of the organization.

To effectively prepare for audits, consider the following steps:

- Review Documentation: Ensure that all relevant documents, such as employee records, compensation details, and tax filings, are accurate and up-to-date.

- Establish Clear Processes: Develop and maintain clear procedures for tracking and reporting financial information to prevent errors.

- Conduct Internal Reviews: Perform regular internal audits to identify and correct issues before external auditors arrive.

- Train Staff: Educate team members on compliance requirements and the importance of accurate record-keeping.

- Implement Technology Solutions: Utilize software tools that streamline data collection and reporting, reducing the likelihood of mistakes.

By taking these proactive measures, organizations can facilitate a smoother audit experience, demonstrating a commitment to transparency and accountability.

Adjusting Payroll for Overtime Hours

Managing compensation for additional hours worked is crucial for maintaining employee satisfaction and compliance with labor regulations. When team members exceed their standard working hours, it is essential to accurately calculate their earnings to reflect this extra effort. This section outlines the process and considerations for adjusting compensation when overtime is involved.

To ensure proper remuneration, employers typically use a formula that multiplies the regular hourly wage by a set overtime rate, often 1.5 times the standard rate. It is vital to keep clear records of hours worked to avoid discrepancies and ensure transparency.

| Standard Hours | Overtime Hours | Hourly Rate | Overtime Rate | Total Compensation |

|---|---|---|---|---|

| 40 | 10 | $20 | $30 | $800 |

| 38 | 12 | $25 | $37.50 | $1,125 |

Furthermore, it is crucial to communicate overtime policies clearly to all team members. Regular updates and training can help ensure everyone understands how additional hours affect their earnings. Keeping accurate records not only benefits employees but also aids in financial planning and reporting for the organization.

Employee Access to Pay Information

Access to compensation details is crucial for employees to maintain transparency and trust within an organization. Understanding one’s earnings, deductions, and overall financial information fosters a sense of empowerment and helps individuals manage their finances effectively. Organizations should prioritize making this information readily available to their staff, ensuring they can review and comprehend their financial statements at any time.

Importance of Transparency

Transparency in financial matters encourages a positive workplace environment. When employees can easily obtain their payment details, it minimizes misunderstandings and builds confidence in the management. A clear view of earnings and deductions enables staff to make informed decisions about their personal finances, such as budgeting and planning for future expenses.

Methods of Access

There are various ways to facilitate access to financial information. Organizations can implement secure online platforms where employees can log in to view their details. Additionally, providing physical pay statements or access through mobile applications ensures that all employees, regardless of their technological comfort level, can stay informed. Regular updates and clear communication regarding how to access these resources are essential to maintaining employee engagement and satisfaction.

Updates to Payroll Regulations in 2026

The landscape of employee compensation continues to evolve as new guidelines are introduced. As organizations adapt to these changes, understanding the latest rules is crucial for maintaining compliance and ensuring fair treatment of workers. This section outlines the significant adjustments that have been implemented and their implications for businesses and employees alike.

Key Changes in Compensation Regulations

Recent updates have focused on enhancing employee rights and addressing wage disparities. Organizations must now comply with stricter reporting requirements and implement measures to guarantee equitable pay across various demographics. The following table summarizes the primary modifications:

| Regulation | Description |

|---|---|

| Minimum Wage Adjustments | Increases in base salary standards to reflect living costs. |

| Reporting Obligations | Enhanced transparency in wage distribution and disparities. |

| Employee Benefits | Expansion of mandatory benefits, including parental leave and healthcare. |

| Remote Work Considerations | Guidelines for compensating remote employees fairly based on location. |

Implications for Employers and Employees

These updates not only promote fairness but also require organizations to invest in their payroll systems and employee training. Companies will need to reassess their internal policies and ensure that they are aligned with the new standards to avoid penalties. Employees, on the other hand, will benefit from a more equitable work environment, leading to improved morale and productivity.

Comparing Biweekly and Monthly Payrolls

When organizations evaluate their compensation schedules, two prevalent methods emerge: one involves disbursing earnings every two weeks, while the other follows a monthly rhythm. Each approach has its own advantages and considerations, impacting both employees and financial management. Understanding these differences can assist businesses in making informed decisions that align with their operational needs and workforce preferences.

Advantages of Each Approach

The method of issuing payments twice a month often appeals to employees who prefer more frequent access to their earnings. This can enhance cash flow and budget management for individuals. Conversely, the once-a-month strategy simplifies administrative tasks, reducing the frequency of calculations and transactions required for each pay period.

Key Differences in Financial Management

From a business perspective, the choice between these two schedules influences cash flow, budgeting, and financial planning. The two-week cycle necessitates more regular allocation of funds, while the monthly option allows for a more consolidated financial overview.

| Criteria | Every Two Weeks | Once a Month |

|---|---|---|

| Frequency of Payment | 26 times a year | 12 times a year |

| Employee Cash Flow | More frequent access | Less frequent access |

| Administrative Complexity | Higher | Lower |

| Budgeting for Employers | Requires regular fund allocation | More predictable cash flow |

Tips for a Smooth Payroll Process

Ensuring a seamless compensation distribution system is crucial for any organization. A well-organized approach not only enhances employee satisfaction but also streamlines administrative tasks. Here are some effective strategies to help you navigate this essential function with ease.

Maintain Accurate Records

Keeping precise documentation is fundamental. Regularly update employee information, including hours worked, deductions, and bonuses. Implementing an efficient tracking system can minimize errors and discrepancies, leading to timely and accurate disbursements.

Establish Clear Communication

Effective communication with your team is vital. Clearly outline procedures, deadlines, and any changes in regulations. Providing resources, such as FAQs or informational sessions, can empower employees to understand their entitlements and foster transparency within the organization.

Emphasize Training and Technology

Investing in training for staff responsible for handling financial distributions is essential. Utilize technology to automate repetitive tasks and reduce manual errors. This not only saves time but also enhances accuracy, allowing your team to focus on strategic initiatives.

Review and Adapt Regularly

Periodically assess your systems and processes. Gathering feedback from employees and administrators can reveal areas for improvement, ensuring that your approach remains efficient and compliant with evolving regulations.

Future Trends in Payroll Management

As organizations evolve, so too do their approaches to employee compensation and management of financial processes. The landscape is shifting towards more innovative and technology-driven solutions that enhance efficiency and employee satisfaction. This section explores the anticipated developments in the realm of compensation management.

- Automation and AI Integration: Increasing reliance on automated systems and artificial intelligence will streamline processes, reduce errors, and free up valuable time for HR professionals.

- Real-Time Data Access: Companies will prioritize instant access to compensation information, allowing for immediate adjustments and increased transparency for employees.

- Personalized Compensation Packages: Tailoring benefits and pay structures to individual employee needs will become more common, fostering higher engagement and retention rates.

- Mobile Solutions: The rise of mobile applications will enable employees to manage their finances on-the-go, increasing accessibility and convenience.

- Blockchain Technology: This secure method of record-keeping will provide a transparent and tamper-proof way to manage financial transactions and employee records.

These trends indicate a significant transformation in how organizations handle their financial obligations to employees, ultimately leading to a more engaged and satisfied workforce.