Organizing your financial life can seem daunting, but with the right tools, it becomes an achievable goal. A well-structured approach allows individuals to track their expenditures, plan for future needs, and make informed decisions about their financial well-being. This section will explore practical resources that facilitate efficient management of your resources.

Many find that visual aids are particularly helpful in maintaining clarity and focus. By utilizing organized sheets or documents, users can gain a better perspective on their financial situation. Such resources can provide insight into spending patterns, helping to identify areas for improvement and saving opportunities.

Additionally, having a dedicated resource at your fingertips encourages consistent monitoring and adjustment of financial habits. This proactive strategy not only supports better decision-making but also fosters a sense of control over one’s economic environment. In this exploration, we’ll highlight key features and advantages of these tools that can lead to a more prosperous future.

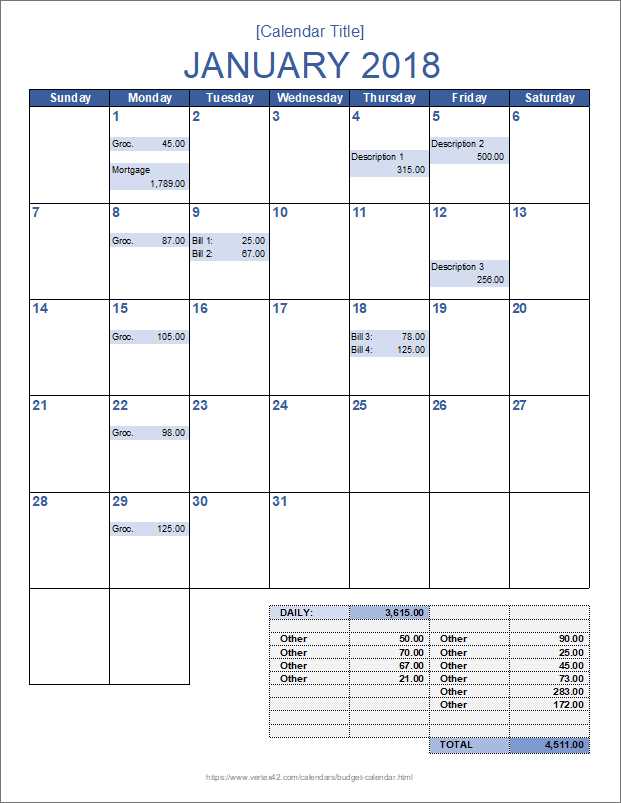

What is a Budget Calendar?

A planning tool that helps individuals manage their financial commitments and track expenses over time is essential for maintaining financial health. It serves as a structured guide, enabling users to visualize their monetary obligations and savings goals. By breaking down income and expenditures into manageable periods, it simplifies financial oversight and promotes informed decision-making.

Such a tool typically includes various sections for recording income, upcoming payments, and necessary savings. It can also assist in identifying trends and adjusting habits, fostering a proactive approach to personal finance management.

| Features | Benefits |

|---|---|

| Visual representation of income and expenses | Improved financial awareness |

| Space for monthly planning | Better preparation for upcoming costs |

| Tracking of savings goals | Encouragement to save more |

| Flexibility for adjustments | Adaptability to changing financial situations |

Benefits of Using a Printable Template

Utilizing a physical format for organizing financial plans offers numerous advantages that enhance efficiency and clarity. This approach allows individuals to manage their expenses and savings more effectively, leading to improved financial well-being.

Accessibility is one of the primary benefits. Having a tangible document at hand means you can easily reference your plans anytime, without relying on electronic devices. This is particularly useful in situations where technology may not be available or convenient.

Another advantage is the tactile experience. Writing down your goals and figures by hand can reinforce commitment and understanding. Engaging with the material physically often leads to greater retention of information and a more profound connection to your financial journey.

Moreover, these tools can be customized to fit personal preferences and specific needs. Individuals can create their own layouts, sections, and designs, making the planning process not only functional but also enjoyable and tailored to their unique situations.

Finally, using a physical format encourages mindfulness in financial planning. The act of manually tracking expenditures can promote greater awareness of spending habits and priorities, leading to more informed decisions in the long run.

How to Create Your Own Calendar

Designing a personalized planner can be an enjoyable and rewarding experience. It allows you to tailor a scheduling tool that fits your unique lifestyle and preferences. By following a few simple steps, you can craft an organizer that not only serves its purpose but also reflects your personality and creativity.

Step 1: Determine the Format

Begin by deciding the layout that suits your needs best. Consider whether you prefer a weekly, monthly, or daily overview. Each format has its advantages; for instance, a weekly view provides a broader perspective on tasks, while a daily format allows for detailed planning. Sketching your ideas on paper can help you visualize what works for you.

Step 2: Choose Your Design Elements

Next, think about the design aspects you want to incorporate. This includes selecting colors, fonts, and graphics that resonate with your style. You might want to include inspirational quotes or images that motivate you. Customization is key here; feel free to experiment until you find a look that inspires productivity.

Once you have a solid plan, it’s time to bring your vision to life, whether digitally or on paper. Enjoy the process of creating something uniquely yours!

Essential Features of a Budget Calendar

A well-structured planning tool plays a crucial role in financial management. It helps individuals and families track their income and expenditures over a specific timeframe, allowing for informed decisions and enhanced savings. Key components of this organizational instrument ensure clarity and ease of use, making financial oversight more effective.

| Feature | Description |

|---|---|

| Monthly Overview | A clear display of all financial commitments and sources of income for each month. |

| Expense Tracking | Sections dedicated to recording various spending categories to identify patterns and areas for improvement. |

| Income Sources | Space to document different revenue streams, providing a comprehensive view of financial inflow. |

| Goals Section | Incorporating a segment for setting and monitoring financial objectives, fostering motivation and accountability. |

| Notes Area | Additional space for reminders or insights, aiding in strategic planning and adjustments. |

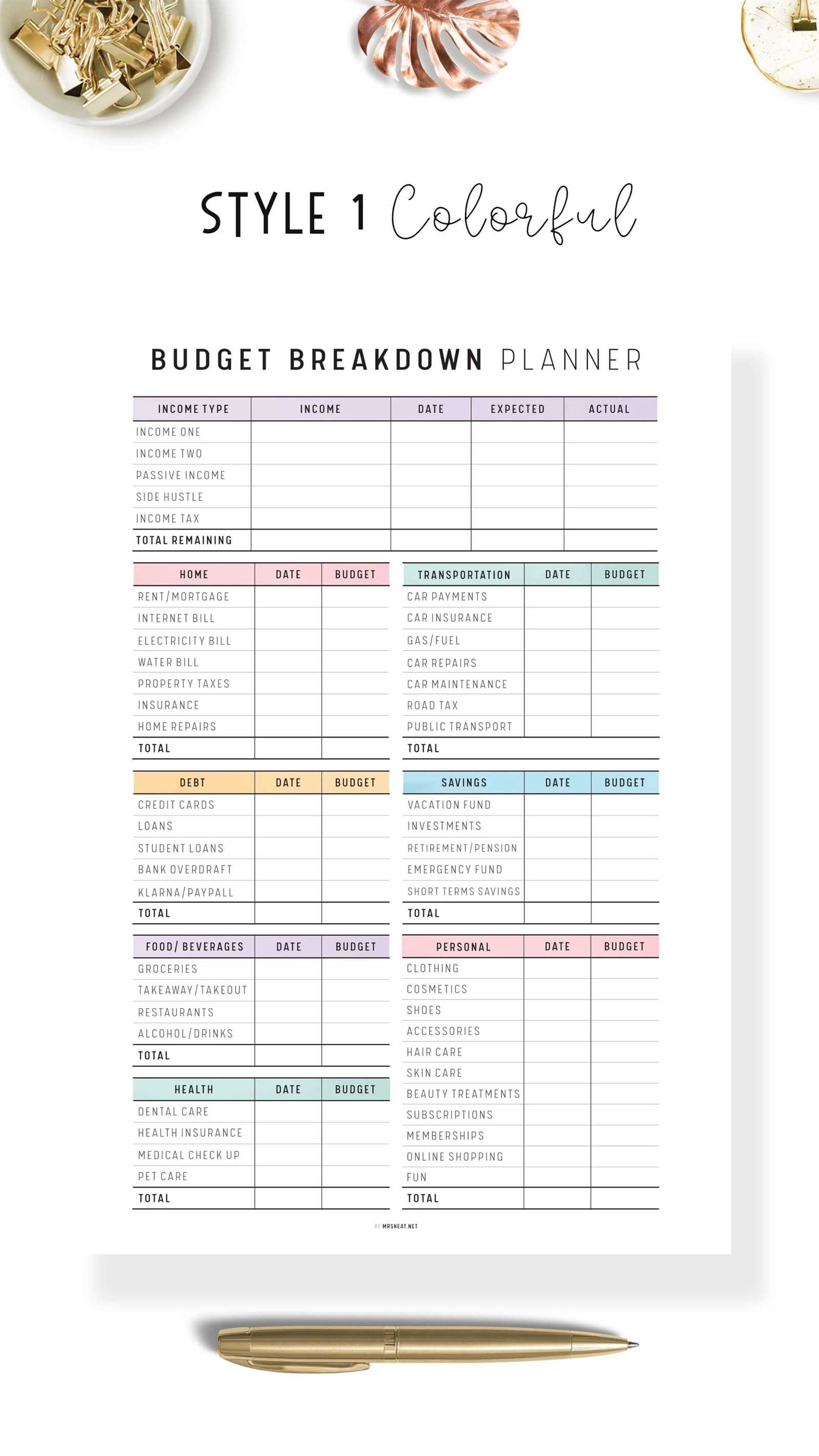

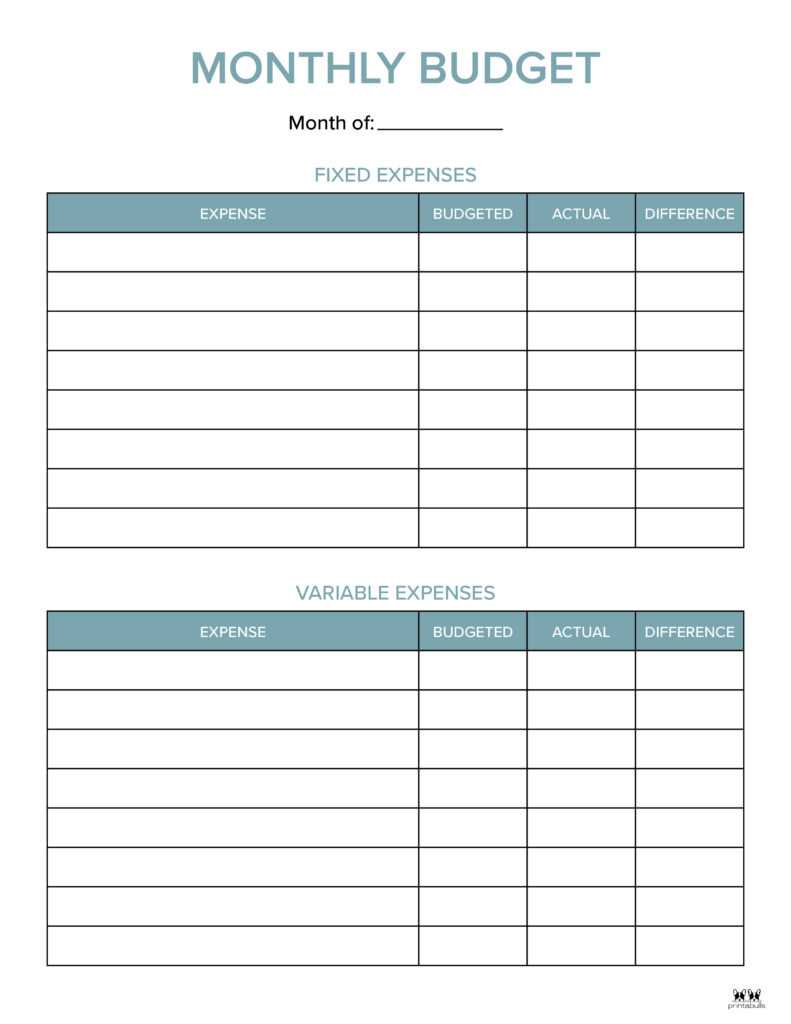

Top Free Printable Templates Online

Finding useful resources for organizing personal finances can significantly enhance your planning skills. Numerous websites offer a variety of formats that can help streamline your financial management tasks. These resources can be easily downloaded and utilized to keep track of expenses, goals, and schedules effectively.

Benefits of Using Free Resources

- Cost-effective solutions for managing finances.

- Customizable formats to suit individual needs.

- Easy access to a wide range of designs and layouts.

Popular Sources for Downloading

- Canva – Offers a range of creative options with user-friendly customization.

- Vertex42 – Known for its practical and straightforward designs that cater to various financial aspects.

- Template.net – Provides an extensive collection of professionally designed layouts for different purposes.

- Microsoft Office Templates – Features reliable formats compatible with popular software.

By exploring these platforms, you can easily find resources that match your style and requirements, empowering you to take control of your financial journey.

Customizing Your Budget Calendar Design

Creating a personalized planning tool allows individuals to tailor their financial tracking experience to fit their unique needs and preferences. By modifying various elements, you can enhance functionality while ensuring the design resonates with your aesthetic taste.

Colors and Themes: Choosing a color scheme that reflects your personality can make your organizing tool more enjoyable to use. Whether you prefer bright, energetic hues or calm, neutral tones, the right palette can motivate you to engage with your financial goals.

Layout and Structure: Experimenting with different layouts can improve readability and usability. Consider adjusting the size of sections for income, expenses, or savings, ensuring that the most critical areas are easily accessible and visible.

Additional Features: Incorporating elements such as motivational quotes, icons, or stickers can add a personal touch. These features can make tracking progress more engaging and visually appealing, transforming routine entries into a more enjoyable task.

Font Styles: The typography you select plays a crucial role in the overall look. Opt for fonts that are not only stylish but also easy to read, ensuring that your entries are clear and straightforward.

By implementing these modifications, you can create a customized tool that not only serves its practical purpose but also reflects your individuality, making financial management a more enjoyable and motivating process.

Using Digital vs. Printable Formats

In today’s fast-paced world, the choice between electronic and physical formats for organizing personal finances has become increasingly relevant. Each option offers unique benefits and challenges, catering to different preferences and lifestyles. Understanding these differences can help individuals make informed decisions about which approach best suits their needs.

Advantages of Digital Formats

- Accessibility: Digital solutions can be accessed from multiple devices, allowing for on-the-go updates and reviews.

- Flexibility: Users can easily modify entries, add new categories, or change layouts without the constraints of paper.

- Automation: Many digital tools offer features such as reminders and automatic calculations, simplifying the tracking process.

Benefits of Physical Formats

- Tactile Experience: Writing by hand can enhance memory retention and provide a sense of accomplishment.

- Reduced Distractions: Paper formats eliminate the temptation of digital interruptions, allowing for focused planning.

- Visual Appeal: Customizing a physical layout can be a creative outlet, making the organization process enjoyable.

Ultimately, the choice between digital and physical formats depends on individual preferences and habits. Evaluating the advantages of each can help individuals create a system that works best for their personal finance management.

Tracking Expenses with Your Calendar

Managing your finances effectively requires a systematic approach to monitoring your expenditures. Utilizing a visual tool can help you stay organized and aware of where your money goes each month. By noting your transactions in a designated format, you can easily identify spending patterns and make informed decisions about your financial future.

To effectively monitor your spending, consider creating a dedicated section in your planning document where you can log your expenses. This will enable you to see at a glance how your financial activities align with your goals. Here’s a simple structure to get you started:

| Date | Description | Amount | Category |

|---|---|---|---|

| 01/01/2024 | Groceries | $50 | Food |

| 01/05/2024 | Utilities | $120 | Household |

| 01/10/2024 | Dining Out | $75 | Entertainment |

| 01/15/2024 | Transportation | $30 | Travel |

By regularly updating this log, you’ll gain insights into your financial habits and can adjust your strategies accordingly. This practice not only promotes accountability but also helps you to foresee potential shortfalls, enabling proactive management of your resources.

Integrating Budgeting Tools and Apps

In today’s digital age, effective financial management relies heavily on the use of various applications and tools. These resources not only streamline the process of tracking expenses but also enhance one’s ability to analyze spending patterns and set financial goals. By combining traditional methods with modern technology, individuals can create a holistic approach to their financial well-being.

Benefits of Using Financial Applications

- Convenience: Access your finances anytime and anywhere, ensuring that you stay informed on your spending habits.

- Real-Time Tracking: Monitor transactions as they occur, providing immediate insights into your financial situation.

- Automated Reporting: Generate detailed reports effortlessly, allowing for a clearer understanding of financial trends over time.

- Goal Setting: Set and track progress toward financial objectives, making it easier to stay motivated and accountable.

Popular Tools to Consider

- Mobile Apps: Applications like Mint or YNAB offer user-friendly interfaces for tracking expenses on the go.

- Spreadsheets: Customizable spreadsheets can be used for more tailored financial planning and detailed analysis.

- Online Services: Platforms such as Personal Capital provide insights into investments alongside day-to-day finances.

- Expense Trackers: Simple tools that help categorize spending and highlight areas for improvement.

By thoughtfully integrating these digital resources into everyday financial practices, individuals can achieve greater clarity and control over their economic lives.

Monthly vs. Yearly Budget Calendars

When managing finances, the choice between short-term and long-term planning tools can significantly impact one’s ability to achieve financial goals. Each approach offers distinct advantages and challenges, catering to different preferences and lifestyles. Understanding these differences can help individuals select the method that best suits their needs.

Advantages of Monthly Planning

Short-term planning focuses on tracking expenses and income within a single month. This method allows for a detailed analysis of spending habits, making it easier to adjust behaviors quickly. It provides a clear view of immediate financial commitments and facilitates better cash flow management. Additionally, it encourages regular reflection, helping individuals to stay accountable and make timely adjustments.

Benefits of Yearly Planning

In contrast, long-term planning offers a broader perspective, allowing for the identification of overarching trends and financial objectives over the course of a year. This approach enables individuals to allocate resources more effectively for future needs, such as saving for major purchases or investments. By visualizing the entire year, individuals can anticipate and prepare for fluctuations in income or expenses, creating a more comprehensive financial strategy.

Setting Financial Goals with Calendars

Establishing clear financial objectives is essential for achieving long-term stability and success. Utilizing visual planning tools can significantly enhance this process, making it easier to track progress and stay motivated. By integrating time management into financial planning, individuals can create a structured approach to reach their aspirations.

Benefits of Time Management in Financial Planning

- Enhanced Focus: Breaking down goals into smaller, manageable tasks allows for greater concentration on specific targets.

- Increased Accountability: Setting deadlines fosters responsibility and encourages commitment to achieving milestones.

- Visual Progress Tracking: Seeing accomplishments over time can boost motivation and provide a sense of achievement.

Steps to Set Effective Financial Objectives

- Define clear, specific goals such as saving for a vacation or paying off debt.

- Break these goals down into actionable steps with designated time frames.

- Regularly review and adjust your plan based on progress and changing circumstances.

- Celebrate milestones to maintain motivation and reinforce positive habits.

Tips for Sticking to Your Budget

Maintaining financial discipline can be challenging, but with the right strategies, it becomes much more manageable. Implementing a structured approach helps you keep track of your expenses and ensures that you meet your financial goals effectively.

1. Set Clear Goals: Define what you want to achieve financially. Whether it’s saving for a vacation or paying off debt, having specific objectives gives you motivation and direction.

2. Track Your Spending: Regularly monitor where your money goes. Keeping a detailed record of expenditures helps you identify patterns and areas where you can cut back.

3. Create Realistic Limits: Establish practical spending limits for different categories. Ensure these limits reflect your lifestyle and necessities, making it easier to adhere to them.

4. Use Envelopes or Apps: Consider using the envelope system for cash or finance management applications to track your spending. Both methods can visually reinforce how much you have left in each category.

5. Review and Adjust: Regularly revisit your financial plan to make adjustments as needed. Life changes, and being flexible allows you to stay on track without feeling constrained.

6. Stay Motivated: Celebrate small victories along the way. Recognizing progress can boost your morale and encourage you to stick with your financial discipline.

7. Limit Impulse Purchases: Before making any unplanned purchases, take a moment to evaluate if it aligns with your goals. Waiting a day can often help you make more informed decisions.

Common Mistakes to Avoid

When organizing your finances, there are several pitfalls that can derail your planning efforts. Identifying these errors can help you maintain clarity and control over your expenditures and savings. Here are some frequent missteps to be aware of.

| Mistake | Consequences | Solution |

|---|---|---|

| Neglecting to track expenses | Overspending and financial surprises | Keep a detailed log of all transactions |

| Setting unrealistic goals | Frustration and loss of motivation | Establish achievable targets based on past behavior |

| Ignoring irregular costs | Unexpected financial strain | Plan for occasional expenses in advance |

| Not reviewing progress | Stagnation and lack of awareness | Regularly assess your financial position and adjust as needed |

| Failing to involve household members | Disagreement and lack of cooperation | Communicate openly about financial plans with everyone involved |

Updating Your Budget Regularly

Maintaining financial awareness is essential for achieving your monetary goals. Regularly revisiting your financial plan allows you to adapt to changing circumstances, ensuring that your strategies align with your current situation and aspirations. This practice not only fosters accountability but also enhances your understanding of income and expenditures.

By scheduling periodic reviews, you can identify trends, assess the effectiveness of your financial strategies, and make informed adjustments. Whether it’s a monthly or quarterly evaluation, this proactive approach helps in recognizing areas where you may need to cut back or where you can invest more effectively. Additionally, keeping your plan up to date reduces the risk of unforeseen financial challenges.

Incorporating recent financial data and adjusting your goals accordingly can provide clarity and direction. This adaptability is crucial, as life events–such as a new job, changes in family dynamics, or unexpected expenses–can significantly impact your financial landscape. Regular assessments empower you to navigate these changes confidently, reinforcing your financial stability.

Involving Family in Budget Planning

Engaging family members in financial discussions fosters a sense of responsibility and teamwork. When everyone contributes to the planning process, it encourages transparency and helps to create shared goals. This collaborative approach not only strengthens relationships but also ensures that each person’s priorities and concerns are taken into account.

Encouraging Open Communication

Establishing a space for honest dialogue is crucial. Family members should feel comfortable expressing their thoughts on spending and saving. Regular meetings can help everyone stay informed and aligned, allowing for adjustments based on changing circumstances. This openness also cultivates trust and accountability among all participants.

Setting Common Goals

Working together to identify mutual aspirations can motivate the entire family. Whether it’s saving for a vacation, a new home, or an emergency fund, having a collective vision creates a sense of purpose. Involving everyone in the decision-making process ensures that each person is invested in achieving these goals, making the journey more enjoyable and collaborative.