Managing finances can often feel overwhelming, yet with the right resources, achieving clarity and control is entirely possible. A well-structured framework allows individuals and families to track their expenditures and income over time, leading to informed decisions and reduced stress. Such an approach not only facilitates better financial health but also encourages a proactive stance towards monetary goals.

Utilizing a systematic approach to organization enables users to anticipate expenses and income fluctuations throughout the year. This foresight aids in identifying potential challenges and opportunities, making it easier to allocate resources wisely. With an organized method at your disposal, you can transform your financial landscape, setting the stage for both short-term stability and long-term growth.

Incorporating a practical layout that outlines critical dates, recurring obligations, and financial milestones ensures you remain on track. This visual representation acts as a constant reminder of your fiscal responsibilities, empowering you to stay committed to your financial objectives. By embracing this structured strategy, you can take control of your financial journey and work towards achieving your aspirations with confidence.

Understanding the Importance of Budgeting

Managing finances effectively is essential for achieving personal and professional goals. By keeping track of income and expenses, individuals can make informed decisions that promote stability and growth. This process involves setting clear objectives and understanding how to allocate resources wisely, ensuring that every dollar serves a purpose.

Clarity and Control

Establishing a financial framework allows for greater clarity in one’s monetary situation. It enables individuals to see where their money goes, helping to identify unnecessary expenditures. This transparency fosters a sense of control over finances, reducing anxiety and empowering people to take proactive steps toward their aspirations.

Planning for the Future

Another significant advantage of a structured financial approach is the ability to plan for future needs and goals. By forecasting income and expenses, individuals can set aside funds for emergencies, investments, or significant life events. This foresight not only enhances security but also paves the way for long-term success and fulfillment.

What is a Budgeting Calendar?

A structured approach to managing finances over specific periods can greatly enhance one’s ability to control spending and plan for future expenses. This organized method allows individuals to visualize their monetary flow, helping them stay on track with their financial goals.

Essentially, it serves as a tool that aids in tracking income and expenditures regularly. By breaking down financial obligations into manageable timeframes, users can anticipate costs, prioritize needs, and ensure they allocate resources wisely.

Utilizing such a system can lead to increased awareness of spending habits and facilitate better decision-making. It empowers users to identify patterns, adjust their strategies, and ultimately achieve greater financial stability.

In summary, this proactive mechanism not only supports effective financial planning but also fosters a sense of control and confidence in one’s financial journey.

Key Benefits of Using a Template

Utilizing a structured approach for managing finances can greatly enhance your planning and organization. A well-crafted framework offers numerous advantages that streamline the process, making it easier to track expenses, set goals, and ensure accountability.

Improved Organization

One of the primary benefits is the enhanced organization it provides. With a clear outline, individuals can easily categorize their financial activities. This leads to:

- Clear visibility of income and expenditures

- Simple tracking of financial goals

- Efficient allocation of resources

Time Efficiency

Another significant advantage is the time saved when using a pre-designed framework. It minimizes the need to create a system from scratch, allowing users to:

- Quickly input data and adjust figures

- Focus on analyzing trends rather than compiling information

- Spend more time on strategic planning

By adopting a structured method, individuals can effectively manage their finances, leading to better decision-making and financial health.

Essential Elements of a Budgeting Calendar

Creating an effective schedule for managing your finances involves several key components that can significantly enhance your ability to track and control your expenditures. By incorporating these vital elements, you can ensure a smoother and more organized financial planning process throughout the year.

| Element | Description |

|---|---|

| Income Tracking | Record all sources of revenue to understand your total financial inflow. |

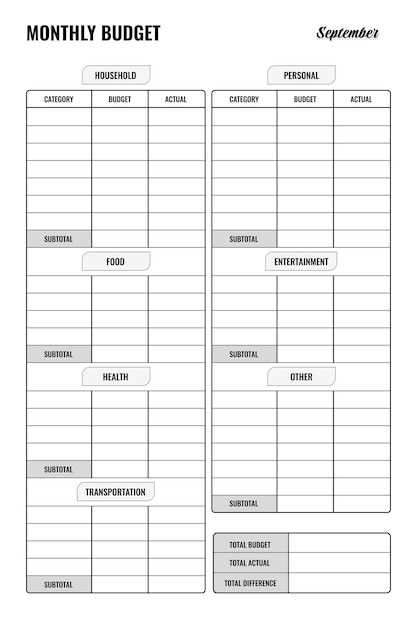

| Expense Categories | Organize your spending into categories such as housing, groceries, and entertainment for clearer insights. |

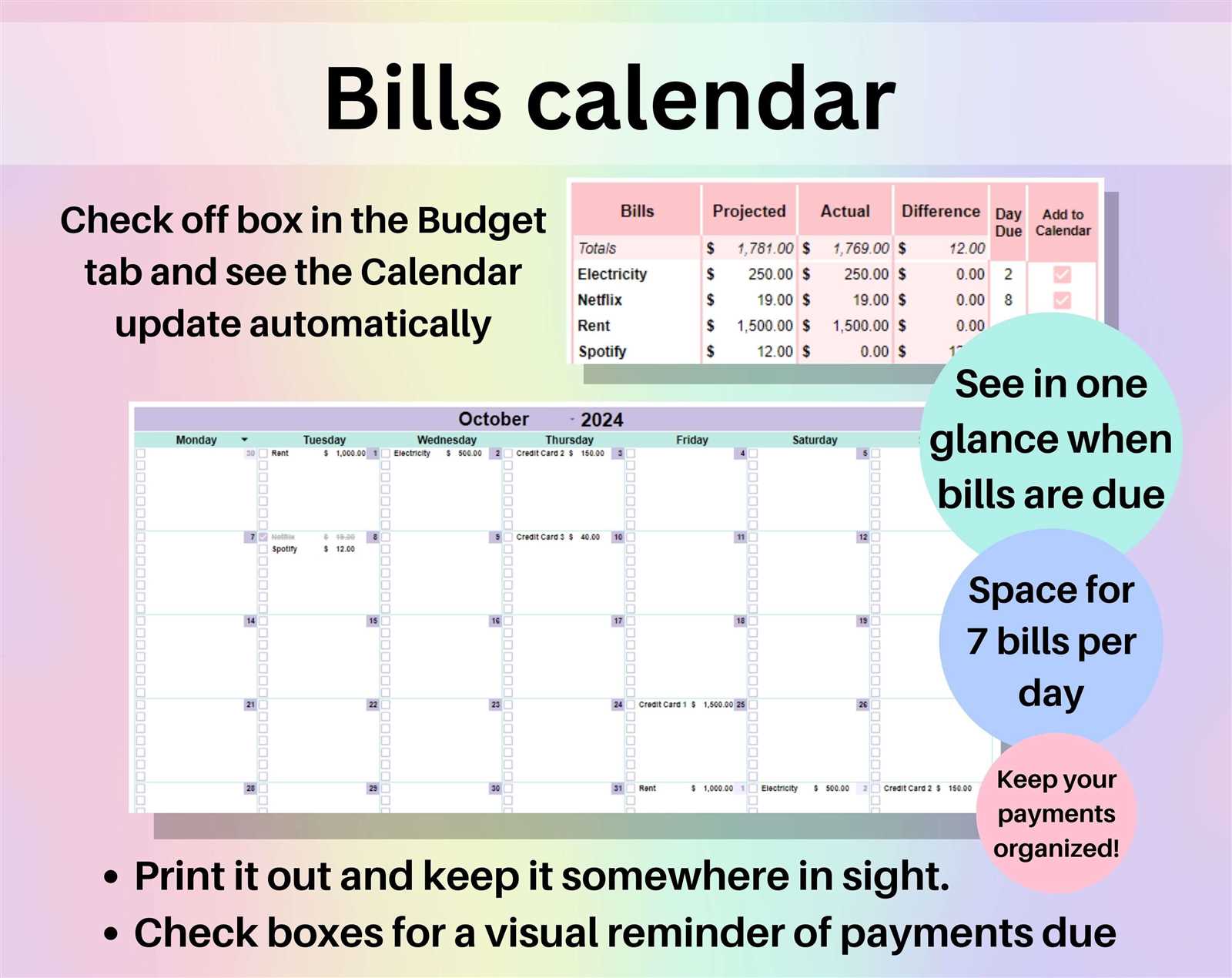

| Due Dates | Include payment deadlines for bills and subscriptions to avoid late fees. |

| Review Periods | Set regular intervals for assessing your financial standing and making necessary adjustments. |

| Goals and Targets | Define specific financial objectives to work towards, such as saving for a vacation or paying off debt. |

| Emergency Fund | Plan for unexpected expenses by allocating funds for emergencies. |

How to Create Your Own Template

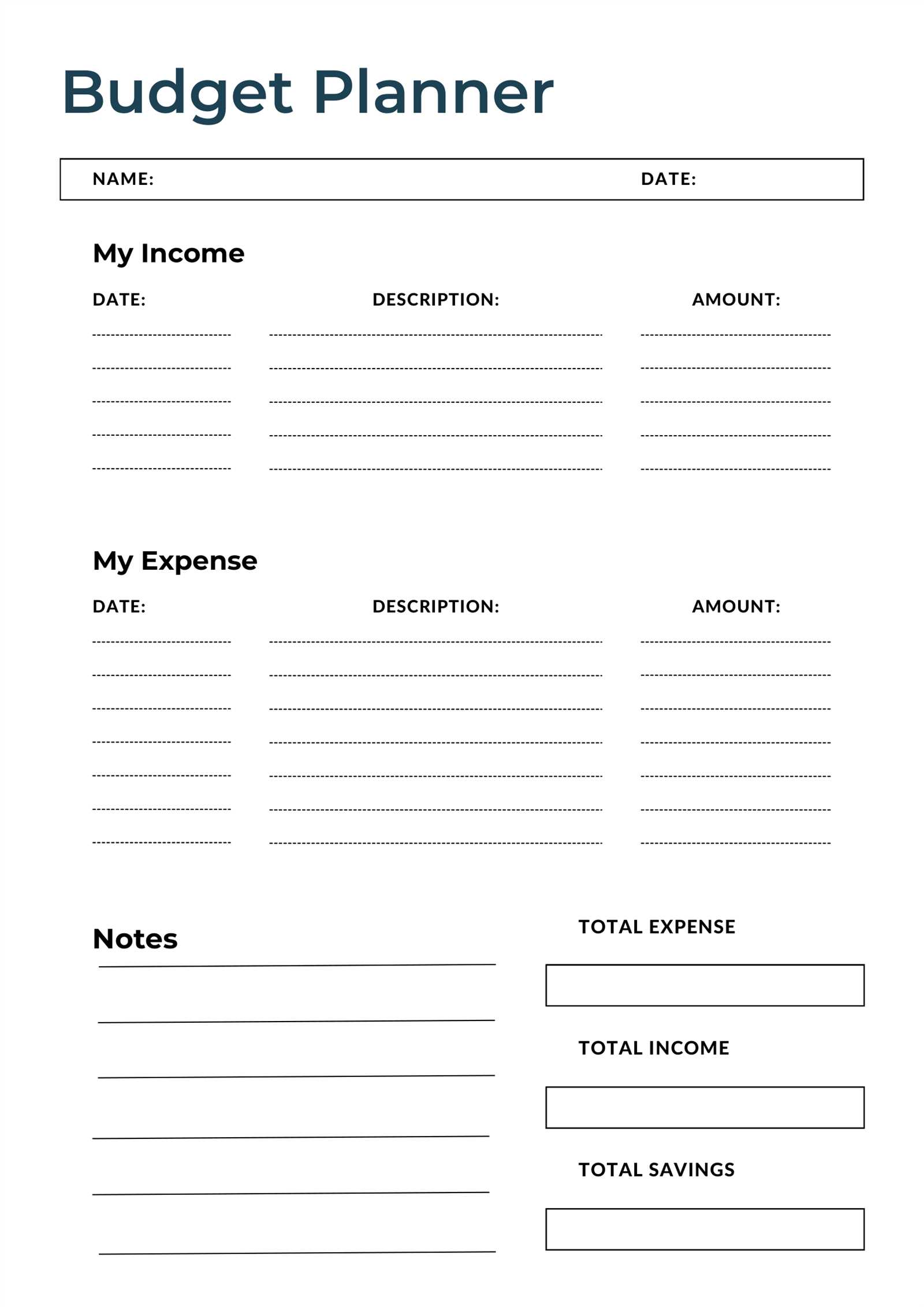

Designing a personalized planning tool can significantly enhance your financial management. By customizing your own framework, you can effectively track expenses, income, and savings in a way that resonates with your unique lifestyle and goals. This guide will provide you with essential steps to craft an effective structure tailored to your needs.

1. Identify Your Needs: Start by assessing what you want to achieve with your planning tool. Consider factors such as monthly expenses, income sources, and any savings goals. This initial step will inform the design and elements you include.

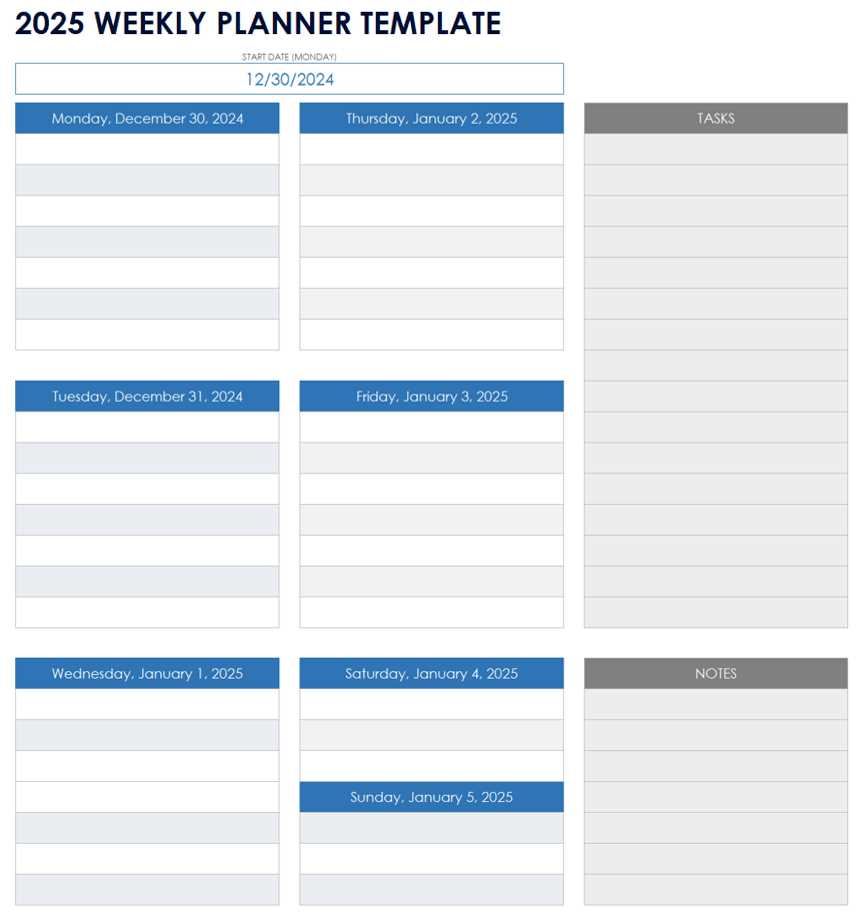

2. Choose the Format: Decide whether you prefer a digital approach or a physical version. Digital options offer flexibility and ease of use, while physical formats can provide a tangible experience that some find motivating.

3. Select Key Sections: Outline the main areas you wish to track. Common categories may include fixed expenses, variable expenses, income streams, and savings goals. Customize these sections to reflect your priorities.

4. Create a Layout: Design a layout that is visually appealing and easy to navigate. If you’re using software, take advantage of tools that allow for grids, color coding, and clear headings. For a handwritten version, consider using a ruler for neatness.

5. Test and Revise: After creating your initial version, test it out for a month. Make adjustments as necessary to ensure it works effectively for you. Flexibility is key; your structure should evolve as your financial situation changes.

6. Stay Committed: Consistency is vital for success. Dedicate time each week or month to update your planning tool, review your progress, and make any necessary changes. Staying engaged will help you stay on track with your financial goals.

Common Mistakes in Budgeting

Managing finances can be challenging, and many individuals encounter pitfalls that hinder their ability to effectively track and allocate their resources. Recognizing these errors is crucial for achieving financial stability and growth.

- Lack of Planning: Failing to outline a clear strategy can lead to confusion and missed goals.

- Overestimating Income: Assuming higher earnings than actual can result in overspending and debt.

- Ignoring Irregular Expenses: Not accounting for occasional costs, such as car repairs or medical bills, can disrupt financial balance.

- Neglecting Emergency Funds: Without a safety net, unexpected events can quickly lead to financial strain.

- Inflexibility: Sticking rigidly to a plan without adapting to changing circumstances can be detrimental.

By being aware of these common missteps, individuals can take proactive steps to improve their financial management practices and foster a healthier economic future.

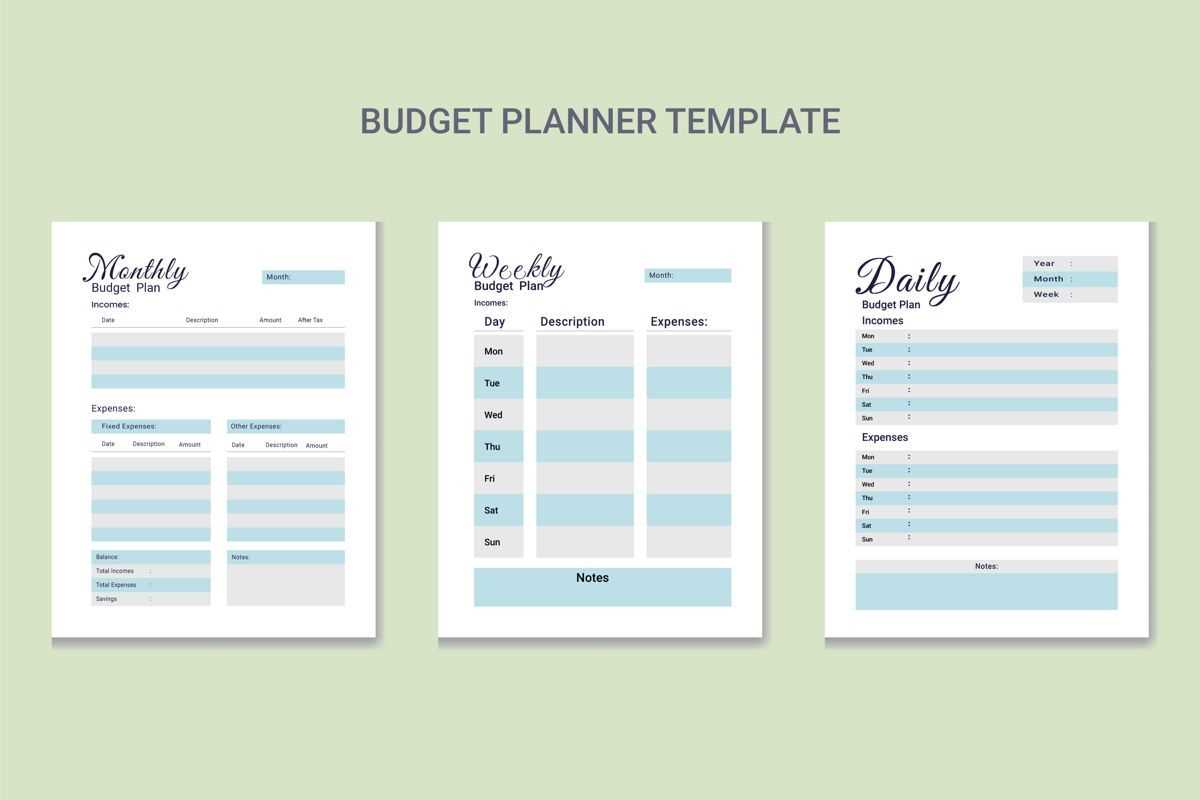

Monthly vs. Annual Budgeting Approaches

When it comes to managing finances, individuals often find themselves weighing the merits of different planning strategies. Each approach offers distinct advantages and can cater to varying needs, ultimately impacting how one tracks expenses and allocates resources. Understanding the nuances between short-term and long-term frameworks can enhance overall financial awareness.

Short-term planning typically involves a granular focus on individual months. This method allows for real-time adjustments, making it easier to respond to immediate financial shifts. Tracking income and expenditures on a monthly basis can help identify spending patterns, pinpoint areas for improvement, and ensure essential bills are covered without strain.

On the other hand, long-term planning emphasizes a broader perspective. This approach encourages individuals to set yearly goals, aligning resources with aspirations such as saving for a home or planning a vacation. By evaluating finances over an extended period, one can anticipate larger trends and make informed decisions that promote sustained financial health.

Both methodologies possess their own unique strengths. While short-term strategies offer flexibility and responsiveness, long-term approaches foster strategic foresight and goal alignment. Ultimately, the choice between these strategies depends on personal circumstances and financial objectives.

Tracking Expenses Effectively

Monitoring your financial outflows is crucial for maintaining control over your finances. By consistently observing where your money goes, you can identify patterns, make informed decisions, and ultimately enhance your financial health. A systematic approach can simplify this process and lead to better management of your resources.

Methods for Effective Monitoring

There are several approaches you can adopt to keep an eye on your spending. Here are a few popular methods:

| Method | Description |

|---|---|

| Manual Tracking | Writing down each expense in a notebook or spreadsheet for detailed oversight. |

| Mobile Apps | Utilizing smartphone applications designed for expense tracking, which often include visual aids. |

| Bank Statements | Regularly reviewing your bank and credit card statements to track expenditures. |

| Envelope System | Dividing cash into envelopes for different spending categories to visually manage limits. |

Benefits of Keeping Track

Implementing a consistent monitoring strategy provides numerous advantages. It helps in pinpointing unnecessary costs, encourages responsible spending, and empowers you to allocate funds towards your priorities. Over time, this practice fosters a stronger awareness of your financial situation, paving the way for better decision-making and future planning.

Integrating Savings Goals into Your Calendar

Aligning your financial aspirations with your daily routine can significantly enhance your ability to achieve them. By weaving these objectives into your schedule, you create a visual reminder that keeps your goals at the forefront of your mind. This approach fosters a proactive mindset, helping you to stay focused and motivated throughout the year.

Establish Clear Objectives: Start by defining specific targets you wish to reach, such as saving for a vacation, a new gadget, or an emergency fund. Having a clear vision helps in planning effectively.

Set Milestones: Break down your larger objectives into smaller, manageable steps. Mark these milestones on your timeline, providing a sense of accomplishment as you progress towards your ultimate goal.

Regular Check-Ins: Schedule periodic reviews to assess your progress. These moments of reflection allow you to adjust your strategies if necessary, ensuring you remain on track.

Visual Reminders: Incorporate visual cues that resonate with your ambitions. Whether it’s a motivational quote or an image representing your goal, these reminders can enhance your commitment and enthusiasm.

Involve Others: Share your objectives with friends or family. Having an accountability partner can increase your motivation and provide support during challenging times.

Integrating your savings aspirations into your daily plans not only structures your approach but also transforms your mindset towards achieving financial freedom. Embrace this strategy to see tangible results in your journey.

Adjusting Your Budget for Irregular Income

Managing finances when income fluctuates can be challenging. It requires a strategic approach to ensure expenses are covered without overspending during leaner months. This section will explore effective methods to navigate the complexities of variable earnings.

To successfully adapt your financial plan to unpredictable income, consider the following steps:

- Track Your Income: Monitor your earnings over time to identify patterns. This will help you predict potential income ranges.

- Establish a Safety Net: Aim to save a portion of your income during high-earning periods. This reserve can provide security during lower-income months.

- Prioritize Essential Expenses: List your necessary expenditures and ensure they are funded first. This includes housing, utilities, and food.

- Create a Flexible Spending Plan: Develop a plan that allows for adjustments based on your income fluctuations. Be prepared to scale back non-essential spending during lean months.

- Review Regularly: Regularly assess your financial situation and make necessary adjustments to your plan. This can help you stay on track despite changes in income.

By implementing these strategies, you can navigate the challenges of varying income, ensuring financial stability and peace of mind.

Tips for Staying on Track

Maintaining control over your financial plans requires discipline and a few strategic approaches. By implementing these practical tips, you can ensure that your efforts remain focused and effective throughout the period.

1. Set Clear Goals: Begin by defining specific and measurable objectives. Whether you aim to save for a vacation or pay off debt, having clear targets helps maintain motivation and direction.

2. Review Regularly: Schedule consistent reviews of your progress. Assessing your financial situation at regular intervals allows you to identify areas needing adjustment and celebrate milestones.

3. Stay Organized: Keep all relevant documents and records in one place. An organized approach simplifies tracking and reduces the likelihood of overlooking important details.

4. Use Tools: Leverage apps or spreadsheets to streamline your tracking process. These tools can provide insights and reminders, making it easier to stay focused on your objectives.

5. Be Flexible: Life can be unpredictable, so be prepared to adapt your plans when necessary. Adjusting your strategy in response to changes ensures you remain on course even when faced with challenges.

6. Reward Yourself: Celebrate achievements, no matter how small. Recognizing your progress can provide motivation and reinforce positive behaviors.

By incorporating these strategies into your routine, you can enhance your ability to stay committed and effectively manage your financial journey.

Using Digital Tools for Budgeting

In today’s fast-paced world, leveraging technology can significantly enhance financial management. By utilizing various digital resources, individuals can streamline their tracking and planning processes, making it easier to oversee their financial health. These tools offer user-friendly interfaces and powerful features that cater to different needs, providing a comprehensive approach to managing expenses and savings.

Advantages of Digital Solutions

One of the primary benefits of adopting digital resources is the ability to access information anytime, anywhere. Many applications sync with bank accounts, enabling real-time updates and notifications regarding spending patterns. This immediate feedback helps users stay informed and make timely decisions. Furthermore, automated reports can provide insights into financial habits, identifying areas where adjustments might be beneficial.

Popular Applications and Tools

There are numerous platforms available that cater to various preferences and requirements. Some tools focus on expense tracking, while others emphasize goal setting or investment management. Applications like Mint and YNAB (You Need A Budget) are popular choices, each offering unique features to enhance financial awareness. Additionally, many users appreciate the capability to create custom plans tailored to their specific situations, ensuring that they can navigate their financial journeys effectively.

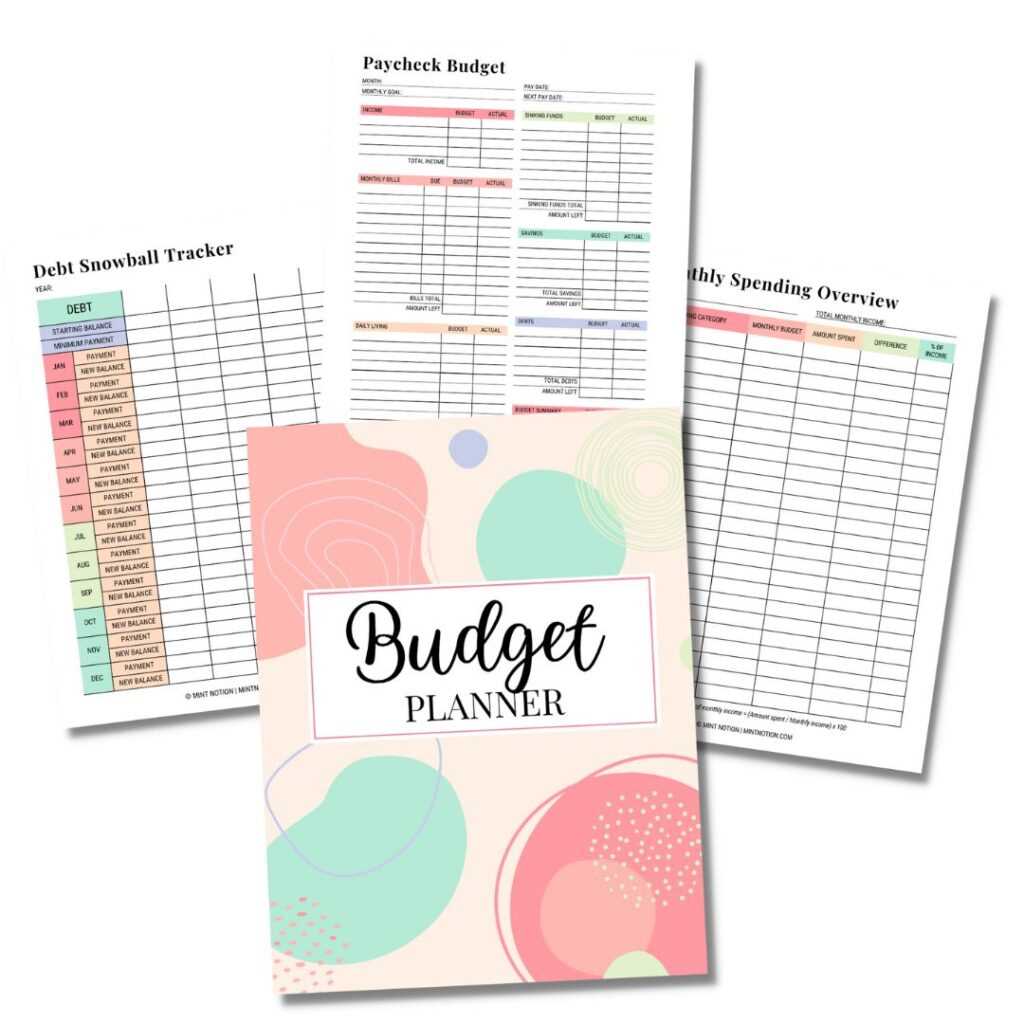

Printable vs. Digital Templates: Pros and Cons

When it comes to organizing financial plans, individuals often face a choice between physical and electronic solutions. Each option presents its unique advantages and drawbacks, influencing how effectively one can manage their resources and track expenditures.

Advantages of Printable Options

- Tangible Experience: Holding a physical document can enhance engagement and commitment to tracking expenses.

- Customization: Easily personalize with drawings, stickers, or handwritten notes.

- No Screen Fatigue: A paper format reduces time spent on digital devices, offering a break from screens.

- Accessibility: Can be used anywhere without needing a device or internet connection.

Benefits of Digital Solutions

- Ease of Use: Quickly edit, adjust, and update without wasting paper or ink.

- Storage and Organization: Keep all information in one place, easily searchable and retrievable.

- Integration: Sync with other apps or tools for seamless management of finances.

- Environmentally Friendly: Reduces paper waste, supporting sustainability efforts.

Ultimately, the choice between physical and electronic formats depends on individual preferences and lifestyle. Weighing the pros and cons can help in making an informed decision that best fits one’s organizational habits.

Real-Life Examples of Successful Budgeting

Managing finances effectively can lead to significant improvements in one’s financial health. Many individuals and families have achieved remarkable results through strategic planning and disciplined practices. This section highlights a few inspiring stories that demonstrate how proactive management of resources can transform lives.

Case Study: The Johnson Family

The Johnsons, a family of four, struggled with living paycheck to paycheck. After realizing their spending habits were unsustainable, they decided to implement a structured approach to their finances. By tracking their expenses meticulously and setting clear financial goals, they were able to save for a family vacation and pay off debt within two years. Their journey showcased the power of awareness and accountability in achieving financial stability.

Individual Success: Sarah’s Journey

Sarah, a recent college graduate, found herself overwhelmed with student loans and credit card debt. Determined to regain control, she created a detailed spending plan and committed to living below her means. By focusing on reducing unnecessary expenses and increasing her income through side jobs, she managed to pay off her debt within three years. Sarah’s story illustrates how commitment and strategic planning can lead to financial freedom.

These examples reflect the transformative potential of thoughtful financial management. With dedication and the right strategies, anyone can navigate their financial challenges and build a more secure future.

How to Review Your Budget Regularly

Regularly assessing your financial plan is crucial for maintaining control over your finances and achieving your goals. By consistently revisiting your expenditures and income, you can identify areas for improvement, adjust your strategies, and ensure that you are on track to meet your financial objectives.

Establish a routine for evaluating your finances. This could be monthly, quarterly, or annually, depending on your personal preference and financial situation. Create a checklist to guide your review process, focusing on key aspects such as income sources, spending patterns, and savings progress.

| Review Frequency | Key Actions | Notes |

|---|---|---|

| Monthly | Track expenses, compare against goals | Adjust categories as needed |

| Quarterly | Analyze trends, set new targets | Consider seasonal changes |

| Annually | Review overall progress, revise long-term goals | Evaluate major life changes |

During each assessment, take the time to reflect on what is working and what isn’t. Look for patterns that could indicate areas where you can save more or invest wisely. Additionally, setting specific goals for the next review period can help maintain motivation and direction.

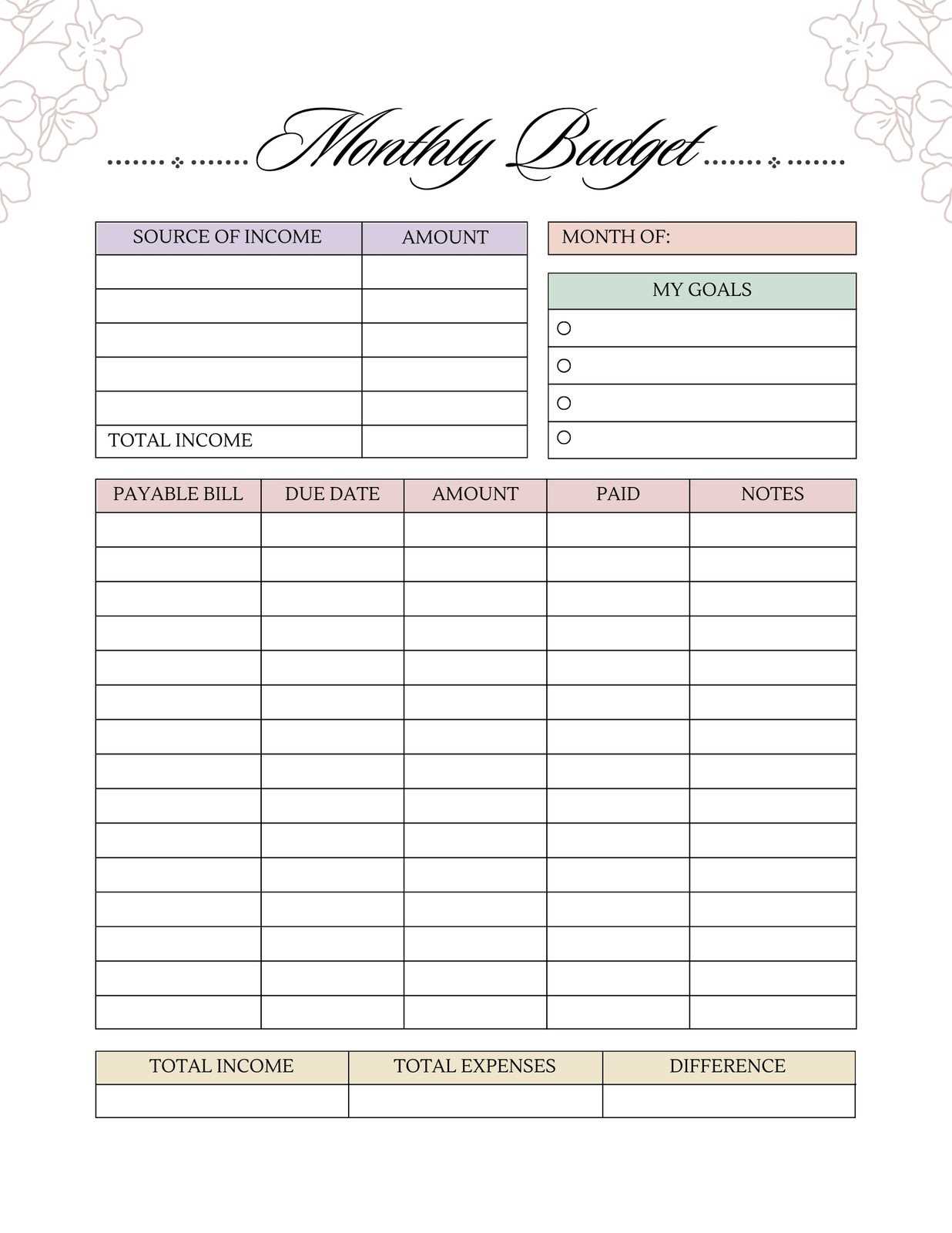

Creating a Family Budgeting Calendar

Establishing a structured approach to managing household finances can significantly enhance financial stability and goal achievement. By implementing a systematic way to track income and expenses, families can foster better spending habits and ensure that savings are prioritized. This process helps in visualizing financial commitments, ultimately leading to informed decision-making.

Setting Financial Goals

Before diving into the planning process, it is essential to define clear financial objectives. Discussing short-term and long-term aspirations as a family can align everyone’s priorities. Consider factors such as saving for vacations, home improvements, or emergency funds. By setting specific, measurable goals, family members can stay motivated and focused on their collective financial journey.

Tracking Income and Expenses

Once goals are established, the next step involves meticulously documenting all sources of income and outflows. Create a detailed list that captures fixed costs, variable expenses, and discretionary spending. Utilizing a shared document or digital tool can facilitate easy updates and accessibility for all family members. This transparency not only promotes accountability but also encourages discussions about spending choices and adjustments that may be necessary to stay on track.

Seasonal Budgeting Considerations

Managing finances effectively throughout the year involves recognizing seasonal fluctuations and adjusting plans accordingly. Different times of the year can bring unique expenses and opportunities that require thoughtful planning. By understanding these variations, individuals can optimize their financial strategies and prepare for upcoming changes.

- Winter Expenses: Consider heating bills, holiday shopping, and travel costs.

- Spring Adjustments: Plan for taxes, spring cleaning costs, and garden-related purchases.

- Summer Activities: Account for vacations, outdoor recreation, and increased utility bills.

- Autumn Preparations: Set aside funds for back-to-school expenses and preparing for winter.

Being aware of these seasonal trends allows for a proactive approach. Here are some key points to consider:

- Evaluate past spending patterns to identify peak expense months.

- Establish an emergency fund to manage unexpected seasonal costs.

- Look for sales and discounts during off-peak times to save money.

- Adjust saving goals based on anticipated changes in income or expenses.

Ultimately, staying mindful of these seasonal factors can lead to more effective financial management and peace of mind throughout the year.

Resources for Budgeting Inspiration

Finding the right motivation and guidance can significantly enhance your financial planning journey. Whether you are looking to save, invest, or manage expenses, there are numerous tools and platforms that can offer valuable insights and creative ideas. Here are some resources that can spark your imagination and help you stay on track with your financial goals.

- Blogs and Websites:

- Mint Blog – Offers tips and personal finance stories.

- The Penny Hoarder – Focuses on money-saving strategies and financial advice.

- Frugalwoods – Shares insights on frugal living and achieving financial independence.

- Podcasts:

- Smart Passive Income – Discusses generating income and managing finances.

- BiggerPockets Podcast – Focuses on real estate investing and wealth-building strategies.

- The Financial Confidence Coach – Provides insights on building confidence in financial decisions.

- Books:

- The Total Money Makeover by Dave Ramsey – A classic guide to personal finance management.

- Your Money or Your Life by Vicki Robin and Joe Dominguez – Focuses on transforming your relationship with money.

- Rich Dad Poor Dad by Robert Kiyosaki – Offers lessons on financial literacy and investing.

- Online Courses:

- Udemy Personal Finance Courses – Wide range of courses on financial literacy.

- Coursera Finance Courses – Offers university-level classes on various financial topics.

- Khan Academy – Free resources on personal finance basics.

These resources can provide fresh perspectives and effective strategies to help you achieve your financial aspirations. Explore them to find the inspiration you need to manage your finances effectively.