Managing your financial responsibilities can often feel overwhelming. With numerous deadlines and varying amounts, it is crucial to have a structured approach to ensure timely fulfillment of these duties. An organized method allows for clarity and reduces the stress associated with last-minute rushes.

One effective strategy is to utilize a structured format that helps keep track of upcoming dues. By establishing a clear system, individuals can easily visualize when each obligation is due, making it simpler to allocate resources effectively. This proactive approach not only aids in preventing late fees but also promotes better financial health.

Implementing this systematic technique can lead to enhanced financial discipline. It encourages consistent tracking and prioritization, enabling you to focus on long-term financial goals. Ultimately, this organized framework serves as a powerful tool in navigating your economic landscape.

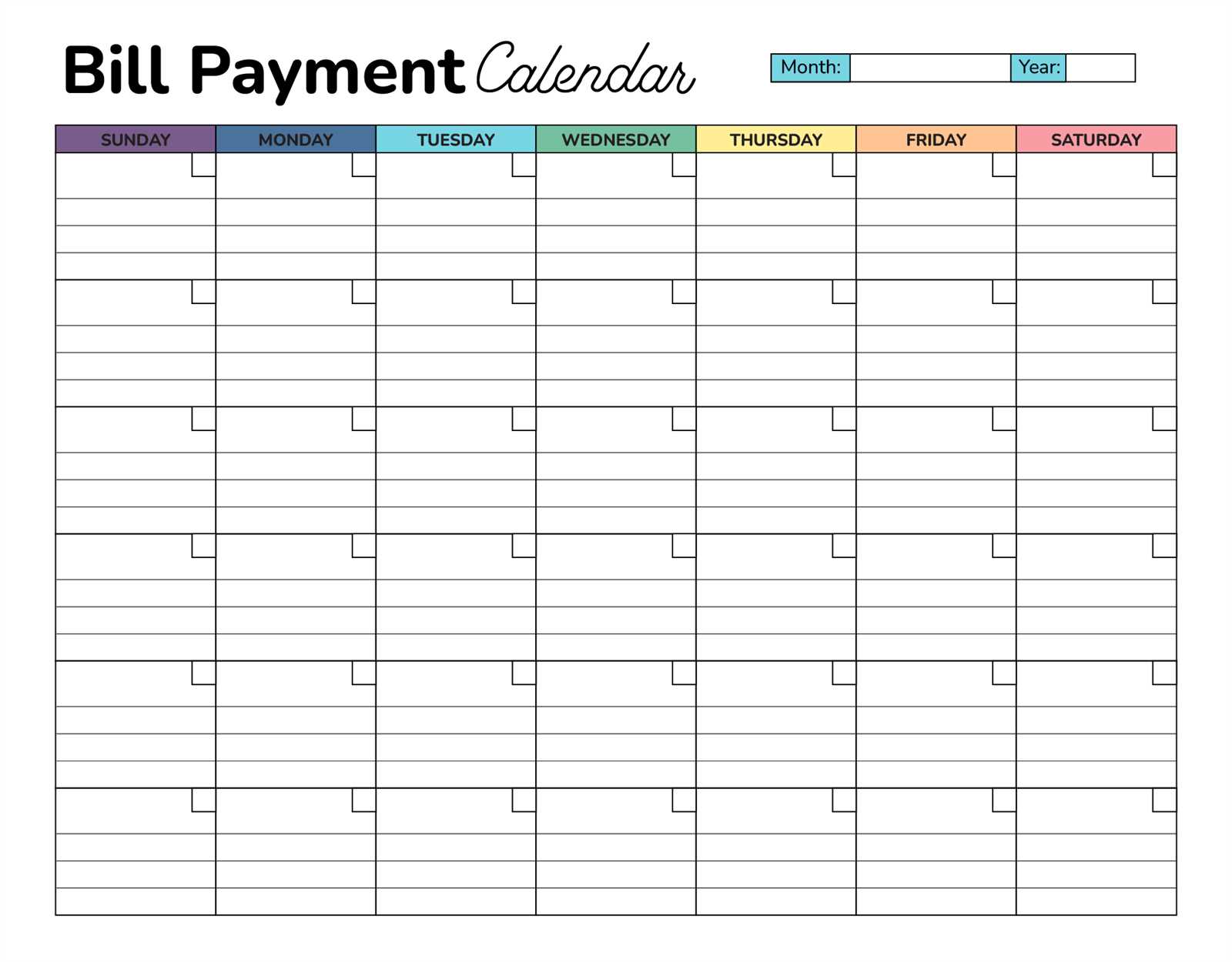

Understanding Calendar Bill Payment Templates

This section explores the concept of structured scheduling for recurring financial obligations. By utilizing an organized approach, individuals can enhance their ability to track and manage their monetary responsibilities effectively.

Such systems offer various benefits, including:

- Improved organization of due dates and amounts

- Reduction in late fees through timely notifications

- Enhanced visibility into overall financial health

- Facilitation of budget planning by forecasting expenses

Implementing a systematic framework involves several key components:

- Identification of recurring financial commitments

- Establishment of a clear timeline for each obligation

- Regular updates to reflect any changes in amounts or due dates

- Utilization of digital tools for reminders and alerts

By adopting this structured method, individuals can streamline their financial management, leading to more informed decisions and less stress regarding monetary commitments.

Importance of Organizing Payment Dates

Keeping track of due dates is essential for maintaining financial health and ensuring that obligations are met on time. By systematically arranging these dates, individuals can avoid late fees and penalties, which can accumulate over time and lead to unnecessary expenses. This proactive approach not only enhances financial stability but also reduces stress associated with missed deadlines.

Moreover, having a structured timeline allows for better budgeting and planning. When individuals are aware of upcoming responsibilities, they can allocate resources accordingly, ensuring that funds are available when needed. This practice encourages a disciplined financial routine, fostering habits that contribute to long-term success.

In addition, being organized with due dates improves overall productivity. When responsibilities are clearly outlined, it minimizes the risk of oversight and distractions. This clarity enables individuals to focus on other important tasks without the constant worry of looming deadlines, ultimately leading to a more balanced and effective lifestyle.

Key Features of Effective Templates

Creating a structured approach to managing financial obligations can significantly enhance organization and reduce stress. A well-crafted design not only facilitates better tracking of due dates but also ensures clarity in the overall process, enabling users to stay on top of their commitments.

Clarity and Simplicity: An effective arrangement should be straightforward, allowing users to quickly grasp the information presented. Avoiding clutter helps in focusing on essential details, making it easier to navigate through various tasks.

Customization Options: Personalization is crucial. Users should have the ability to modify elements according to their preferences, such as adjusting categories or adding notes, which enhances usability and relevance to individual needs.

Visual Appeal: Aesthetically pleasing layouts can motivate users to engage with the system regularly. Thoughtful use of colors and fonts can help highlight important dates while maintaining a professional appearance.

Integration Capabilities: Compatibility with other tools and systems can greatly improve functionality. Seamless synchronization with digital calendars or reminder applications can provide timely notifications and enhance overall efficiency.

Accessibility: Ensuring that designs are available across multiple platforms, such as mobile and desktop, allows users to manage their responsibilities wherever they are. This flexibility is essential in today’s fast-paced environment.

Incorporating these characteristics into a well-organized system can empower users to maintain better control over their financial responsibilities, leading to a more structured and stress-free approach to managing time-sensitive tasks.

How to Create a Custom Template

Designing a personalized framework can enhance your organization and efficiency. This process allows you to tailor a structure that meets your specific needs, ensuring that you stay on top of essential activities and obligations. By following a few simple steps, you can craft a unique layout that reflects your preferences.

Begin by identifying the key elements you want to incorporate into your design. Consider what information is vital for your routine and how you can arrange it logically. Once you have a clear vision, select a suitable platform or software that enables customization. Many applications provide user-friendly interfaces that make it easy to manipulate layouts and styles.

Next, start building your framework. Arrange the sections in a way that promotes easy access to information. Use headings, bullet points, or color coding to differentiate categories and prioritize tasks. This visual clarity will help you quickly identify what needs your attention.

Finally, test your creation to ensure it meets your expectations. Make adjustments as needed, and don’t hesitate to seek feedback from others who may benefit from your design. With a little experimentation, you can develop a functional and visually appealing layout that supports your daily endeavors.

Best Practices for Bill Management

Effectively handling financial obligations requires organization and strategic planning. By implementing certain approaches, individuals can ensure that their expenses are tracked and settled in a timely manner, reducing the risk of late fees and improving overall financial health.

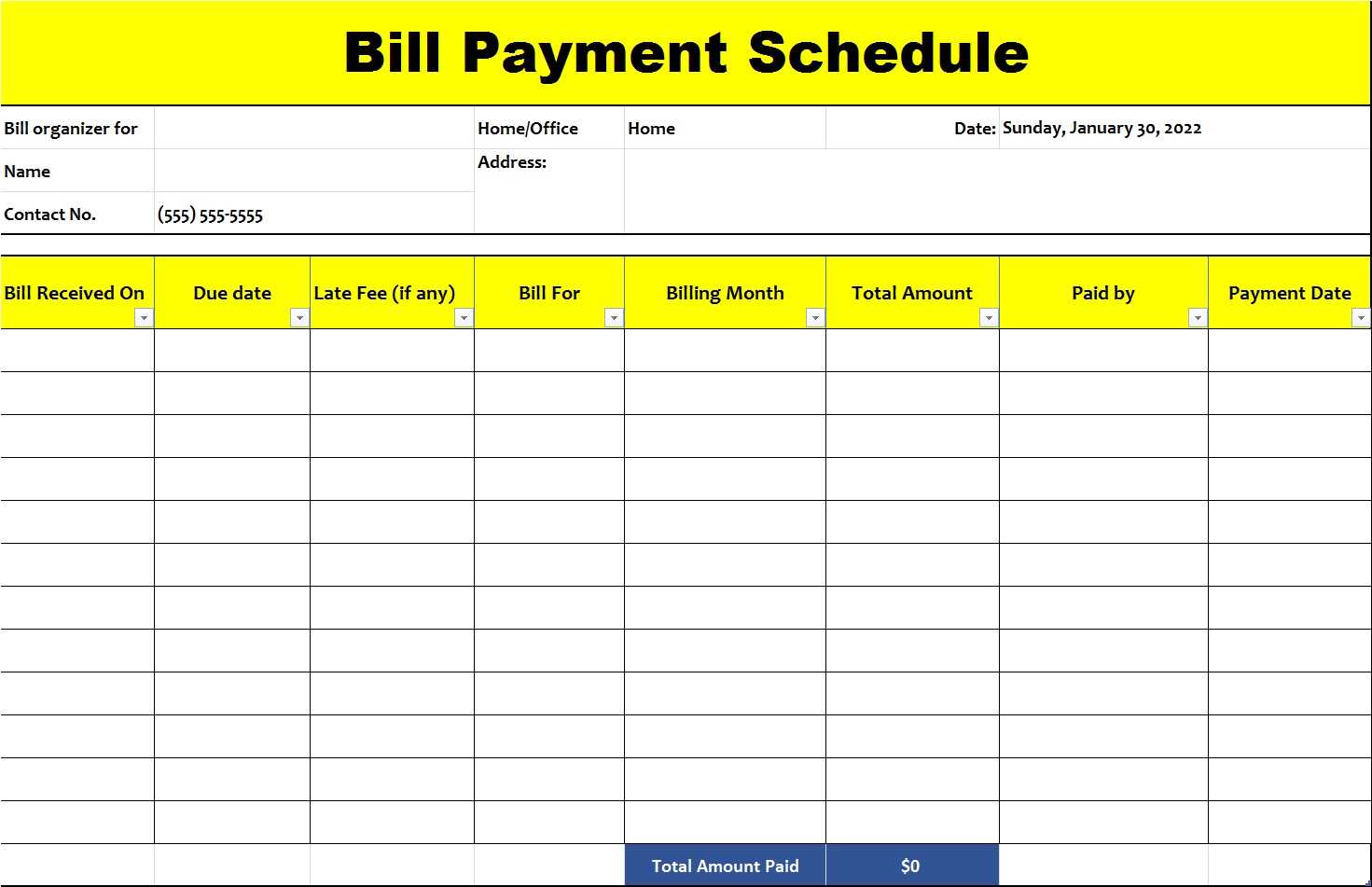

1. Create a Comprehensive Overview: Start by compiling a detailed list of all obligations. This overview should include due dates, amounts, and the entities involved. Having a centralized view allows for better planning and helps avoid oversight.

2. Set Reminders: Utilize technology to set alerts for upcoming due dates. Notifications can be scheduled days in advance to provide ample time for preparation, ensuring no payment is overlooked.

3. Automate Where Possible: Consider setting up automated transfers for recurring expenses. Automation simplifies the process and minimizes the likelihood of forgetting an important date.

4. Review Regularly: Periodically reassess your financial obligations. This review can help identify unnecessary expenses and allow for adjustments in your budget, fostering a more efficient financial strategy.

5. Stay Organized: Maintain a dedicated space for all related documents and correspondence. Keeping everything in one location makes it easier to access important information when needed and supports effective tracking.

By adopting these practices, individuals can enhance their approach to managing financial responsibilities, leading to greater peace of mind and improved financial stability.

Digital vs. Paper Templates: Pros and Cons

The choice between electronic and physical planning tools is a common dilemma faced by many individuals and businesses. Each option comes with its own set of advantages and disadvantages, influencing usability, accessibility, and organization.

Advantages of Digital Solutions

- Convenience: Easily accessible from multiple devices, allowing for on-the-go management.

- Customization: Offers a variety of formats and layouts that can be tailored to specific needs.

- Automation: Can integrate reminders and alerts to ensure deadlines are met.

- Environmental Impact: Reduces paper waste, making it a more eco-friendly choice.

Benefits of Physical Formats

- Tactile Experience: Many people prefer the physical act of writing, which can aid memory retention.

- Visual Clarity: Provides a clear overview without distractions from digital notifications.

- No Technology Dependence: Usable anywhere, regardless of power sources or internet access.

- Personalization: Allows for creative expression through hand-drawn designs and annotations.

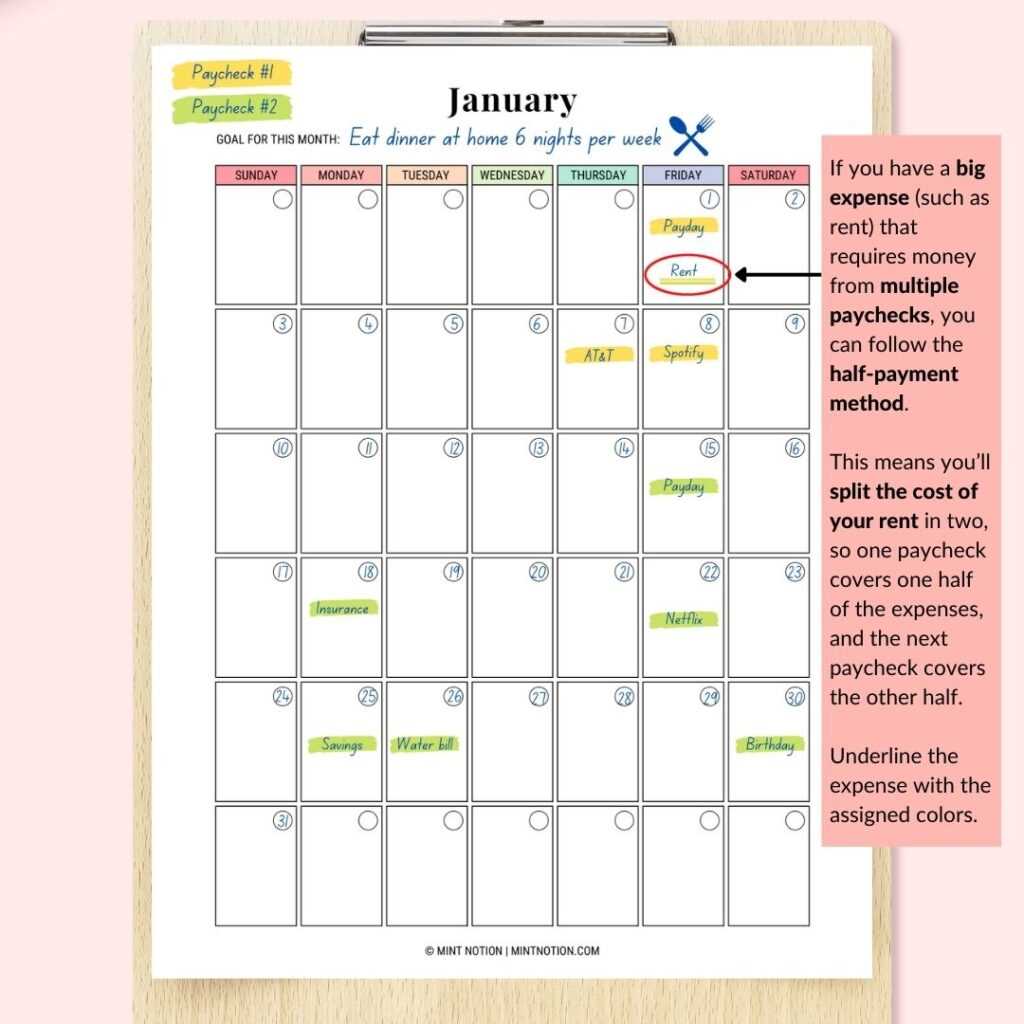

Integrating Reminders with Your Calendar

Incorporating alerts into your scheduling system enhances your ability to stay organized and on track with essential tasks. These notifications serve as timely prompts that ensure you never miss crucial deadlines, helping you manage responsibilities more effectively.

To effectively integrate reminders, consider the following strategies:

- Choose the Right Tools: Utilize applications that allow seamless synchronization of notifications with your scheduling platform.

- Set Custom Alerts: Personalize the timing and frequency of notifications based on your unique needs and preferences.

- Utilize Recurring Reminders: For tasks that occur regularly, set up automatic prompts to save time and reduce the risk of oversight.

- Link Alerts to Specific Dates: Ensure your notifications are directly tied to relevant events to maintain clarity and purpose.

By implementing these approaches, you can create a robust system that not only keeps you informed but also empowers you to manage your time with confidence.

Common Mistakes to Avoid

When managing financial obligations, it’s essential to be aware of frequent errors that can lead to unnecessary complications. By understanding these pitfalls, individuals can ensure a smoother experience and maintain better control over their expenses.

Here are some common mistakes that people often make:

| Mistake | Description |

|---|---|

| Neglecting Due Dates | Forgetting to track deadlines can result in late fees and damaged credit scores. |

| Inaccurate Information | Providing incorrect details can lead to payment errors and confusion. |

| Overlooking Automatic Transactions | Failing to account for recurring charges may disrupt budgeting efforts. |

| Not Reviewing Statements | Ignoring monthly statements can cause missed discrepancies and unnecessary expenses. |

| Procrastinating | Pushing tasks to the last minute can create stress and lead to mistakes. |

Avoiding these errors will not only streamline the process but also enhance financial stability and peace of mind.

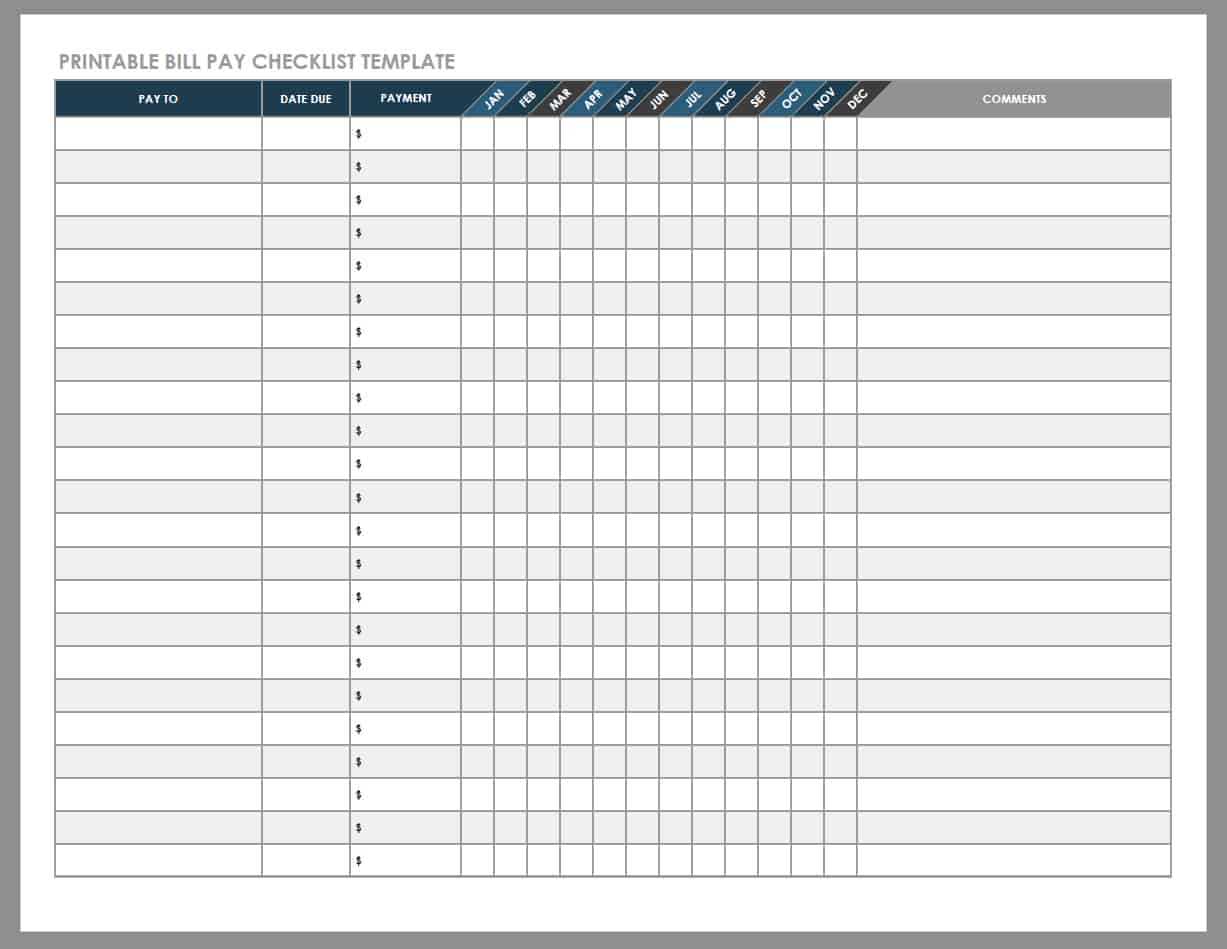

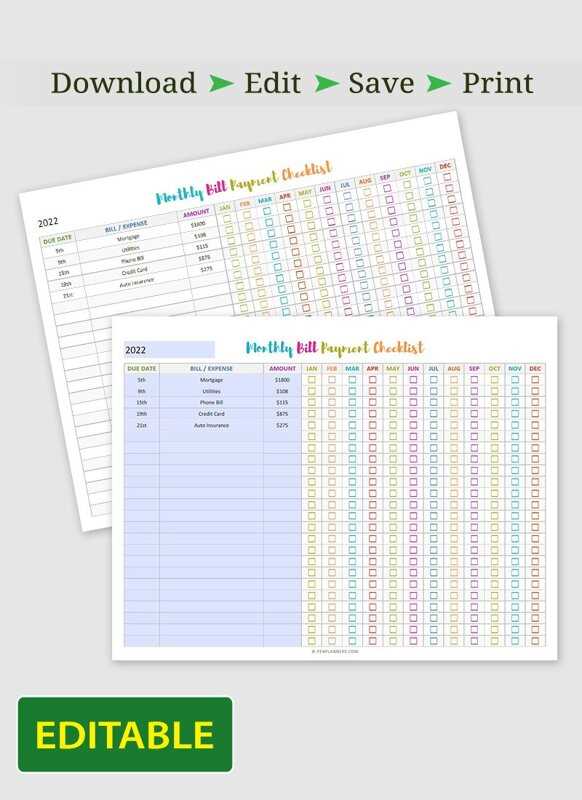

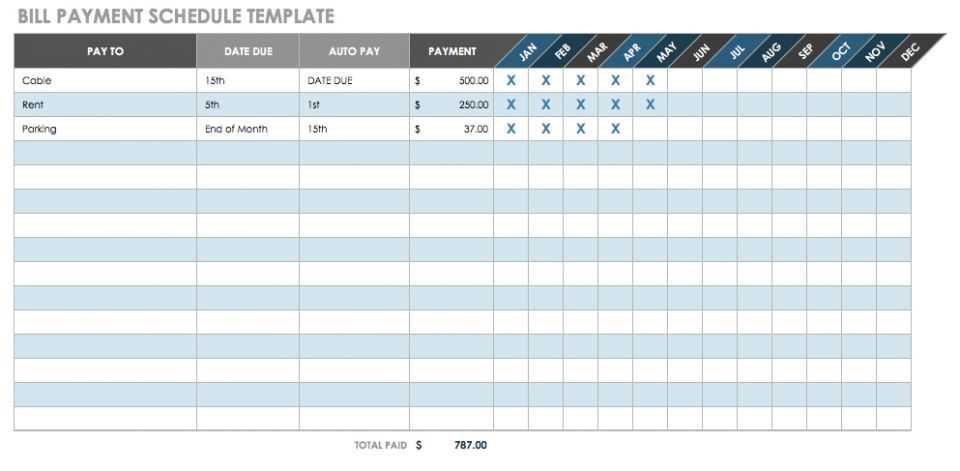

Template Options for Different Needs

When managing recurring obligations, having a structured approach can greatly enhance efficiency. Various designs exist to cater to diverse preferences and situations, allowing individuals and organizations to choose the most suitable format for their requirements.

Personalized Formats

For individuals, customizable layouts provide flexibility in tracking personal responsibilities. These formats can include features such as reminders and checklists, enabling users to stay organized and informed about upcoming commitments.

Business Solutions

Organizations often require more sophisticated systems to monitor financial obligations. Professional layouts can incorporate detailed information such as due dates, amounts, and status updates, streamlining the process and ensuring timely actions are taken.

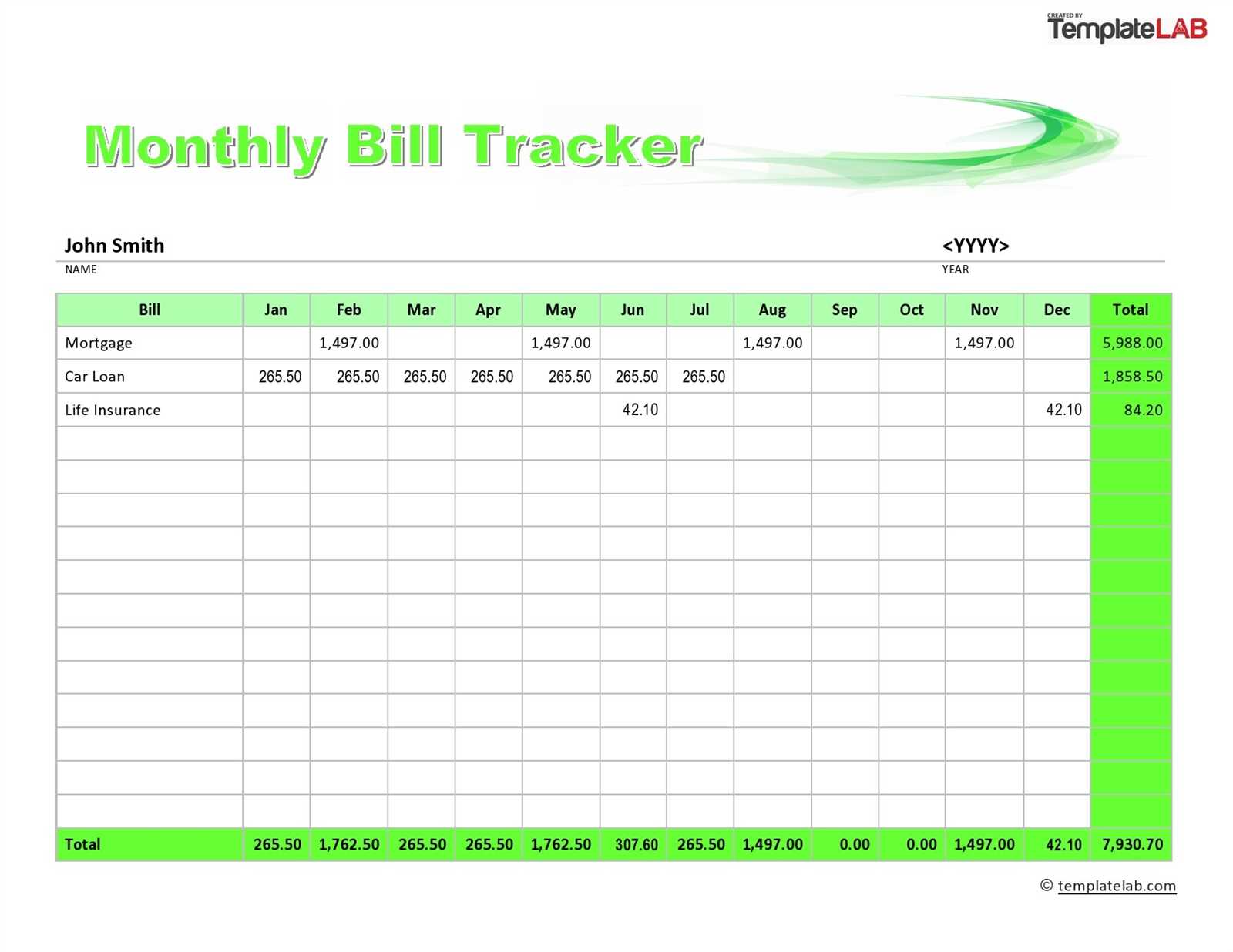

Using Spreadsheets for Bill Tracking

Leveraging spreadsheets can significantly enhance your financial organization by providing a structured way to monitor your expenses. This approach allows for a customizable layout, enabling you to adapt the tool to your specific needs and preferences.

Here are some key benefits of utilizing spreadsheets for tracking your expenditures:

- Flexibility: You can easily add or modify categories, dates, and amounts as your financial situation evolves.

- Automation: Functions and formulas can automate calculations, reducing the risk of errors.

- Visualization: Graphs and charts can be created to help visualize spending patterns over time.

To effectively manage your finances, consider the following steps:

- Create Categories: Define different types of expenses to categorize your outflows.

- Input Data: Regularly enter your transactions to keep your records up to date.

- Review Periodically: Schedule regular reviews to assess your spending habits and adjust accordingly.

By employing a spreadsheet for financial oversight, you can gain a clearer understanding of your economic commitments and make informed decisions regarding your resources.

How to Share Templates with Others

Sharing your organized formats with others can significantly enhance collaboration and productivity. Whether for personal use or professional settings, distributing these tools ensures everyone is on the same page and can benefit from the streamlined processes you’ve created.

Methods for Distribution

- Email: Sending the formats as attachments allows for quick and direct sharing. Ensure the recipient knows how to open and utilize the files.

- Cloud Storage: Upload your files to a cloud service and share the link. This method enables easy access for multiple users and facilitates updates.

- Collaboration Tools: Use platforms designed for teamwork, where users can access, edit, and leave comments on the shared formats in real time.

Tips for Effective Sharing

- Provide clear instructions on how to utilize the formats to avoid confusion.

- Consider setting permissions to control who can edit or view the documents.

- Follow up to gather feedback on usability and make necessary adjustments.

Automating Payments for Convenience

Streamlining financial obligations can greatly enhance personal efficiency and reduce stress. By employing automation, individuals can ensure that their monetary responsibilities are met without the need for constant oversight, allowing for more time to focus on other priorities.

Benefits of Automation

- Time-Saving: Eliminates the need to remember due dates, freeing up mental space for other tasks.

- Consistency: Ensures timely fulfillment of obligations, avoiding late fees and penalties.

- Peace of Mind: Reduces anxiety associated with missed deadlines and potential financial repercussions.

How to Implement Automation

- Choose reliable services that offer automated features.

- Set up your accounts with necessary information for seamless processing.

- Regularly review your automated transactions to ensure accuracy and adjust as needed.

Adapting Templates for Monthly Expenses

Managing recurring financial commitments can be streamlined by customizing organized layouts to track outflows effectively. By tailoring these structures to fit individual needs, one can enhance clarity and maintain control over financial obligations, ensuring nothing is overlooked each month.

Identifying Key Categories

The first step in personalizing an organized structure is to identify essential spending categories. Common classifications may include housing, utilities, transportation, and entertainment. Each category should reflect the unique financial landscape of the individual.

Sample Structure for Monthly Tracking

| Category | Amount | Due Date | Status |

|---|---|---|---|

| Housing | $1,200 | 1st | Pending |

| Utilities | $300 | 15th | Paid |

| Transportation | $150 | 20th | Pending |

| Entertainment | $100 | 25th | Pending |

By utilizing a structured approach, individuals can effectively monitor their monthly expenditures, ensuring they remain within budget while avoiding any last-minute surprises. Tailoring these arrangements to reflect personal priorities enhances financial awareness and management.

Reviewing and Adjusting Payment Schedules

Regularly assessing and modifying your financial timelines is crucial for maintaining a healthy budget. By evaluating your existing commitments, you can identify opportunities to optimize your cash flow and ensure that you meet your obligations efficiently. This proactive approach allows for better management of resources and helps to avoid potential pitfalls associated with late or missed obligations.

Start by examining your current timeline and the frequency of your obligations. Consider whether the existing intervals align with your income cycles. If discrepancies arise, adjust the dates to match your cash inflow, allowing for smoother transactions. This alignment can help reduce stress and financial strain.

Furthermore, be mindful of any changes in your financial situation, such as income fluctuations or unexpected expenses. These factors may necessitate a reassessment of your timelines. By remaining flexible and open to adjustments, you can enhance your overall financial stability.

Lastly, documenting these changes is essential for maintaining clarity. Keeping a record of revised schedules will not only aid in tracking progress but also provide a reference for future evaluations. By regularly reviewing and fine-tuning your financial plans, you create a more resilient and adaptable strategy for managing your commitments.

Utilizing Apps for Bill Management

Managing financial obligations can be a daunting task, but technology offers powerful solutions to simplify the process. Various applications provide users with tools to track due dates, organize expenses, and ensure timely settlements. By leveraging these digital resources, individuals can enhance their financial oversight and reduce the risk of late fees.

These applications typically feature intuitive interfaces, allowing for easy input of amounts and deadlines. Many also offer reminders and alerts, ensuring that users stay informed about upcoming commitments. Here’s a comparison of some popular options:

| App Name | Key Features | Platforms |

|---|---|---|

| App A | Custom reminders, expense tracking | iOS, Android |

| App B | Recurring obligations, analytics | Web, iOS |

| App C | Collaboration features, budgeting tools | Android, Web |

Incorporating these applications into your routine can lead to improved financial discipline and awareness. By utilizing these tools, users can take charge of their monetary responsibilities, leading to a more organized and stress-free experience.

Building a Habit of Timely Payments

Establishing a routine for managing financial obligations is essential for maintaining a healthy budget. By incorporating consistent practices into your schedule, you can ensure that commitments are met on time, leading to improved financial stability and reduced stress. This section will explore effective strategies for creating a habit of punctuality in managing expenses.

One effective approach is to utilize reminders and notifications. Setting up alerts on your devices can help prompt you to review upcoming responsibilities. Here is a simple table outlining potential methods to enhance your time management skills:

| Method | Description |

|---|---|

| Digital Reminders | Use smartphone apps to set alerts for approaching due dates. |

| Automated Transactions | Consider setting up automatic transfers to streamline the process. |

| Monthly Reviews | Schedule a monthly review to assess your financial commitments. |

| Visual Aids | Utilize charts or checklists to track obligations visually. |

By integrating these strategies into your routine, you will gradually build a reliable habit of managing financial responsibilities, fostering a sense of accomplishment and financial wellness.

Resources for Template Downloads

Finding high-quality resources for downloadable formats can significantly enhance your organizational efforts. Whether you’re looking for ready-made options or customizable solutions, numerous platforms offer a variety of choices tailored to your needs.

Online Platforms

Several websites specialize in providing users with diverse formats that can be easily modified to suit individual requirements. Here are some popular platforms:

| Website | Description |

|---|---|

| Template.net | A vast collection of customizable formats across various categories. |

| OfficeTemplatesOnline.com | Offers free and premium options for multiple purposes, including planners and organizers. |

| Vertex42.com | Known for its user-friendly designs, this site provides a variety of formats for personal and professional use. |

Community Resources

In addition to commercial sites, community-driven platforms often feature user-generated formats that can be beneficial. Consider exploring forums and groups where users share their creations and tips:

| Platform | Details |

|---|---|

| Subreddits dedicated to productivity often have threads sharing downloadable resources. | |

| Facebook Groups | Many groups focus on organizational tools, providing members with exclusive downloads and discussions. |

| Creative Market | A marketplace where designers share unique formats for purchase or free download. |