Managing your expenses and income efficiently is essential for achieving financial stability. A structured approach allows individuals to gain control over their monetary flow, making it easier to plan for future goals and unexpected expenses. With the right tools at your disposal, staying organized becomes a seamless part of your routine.

By utilizing an organized framework, you can easily track your spending habits and identify areas for improvement. This methodology not only enhances awareness of your financial situation but also empowers you to make informed decisions. As you delve into various resources available, you’ll discover how these instruments can simplify your financial management journey.

Whether you’re looking to save for a special occasion or simply want to ensure your expenses align with your income, having a strategic outline can significantly enhance your planning process. The ultimate goal is to foster a sense of security and confidence in your financial life, leading to greater peace of mind.

What is a Calendar Budget Template?

A systematic approach to managing financial resources involves organizing expenses and incomes over a specified period. This strategy helps individuals and organizations track their monetary flow, ensuring that they remain aware of their financial standing and can make informed decisions.

Purpose and Benefits

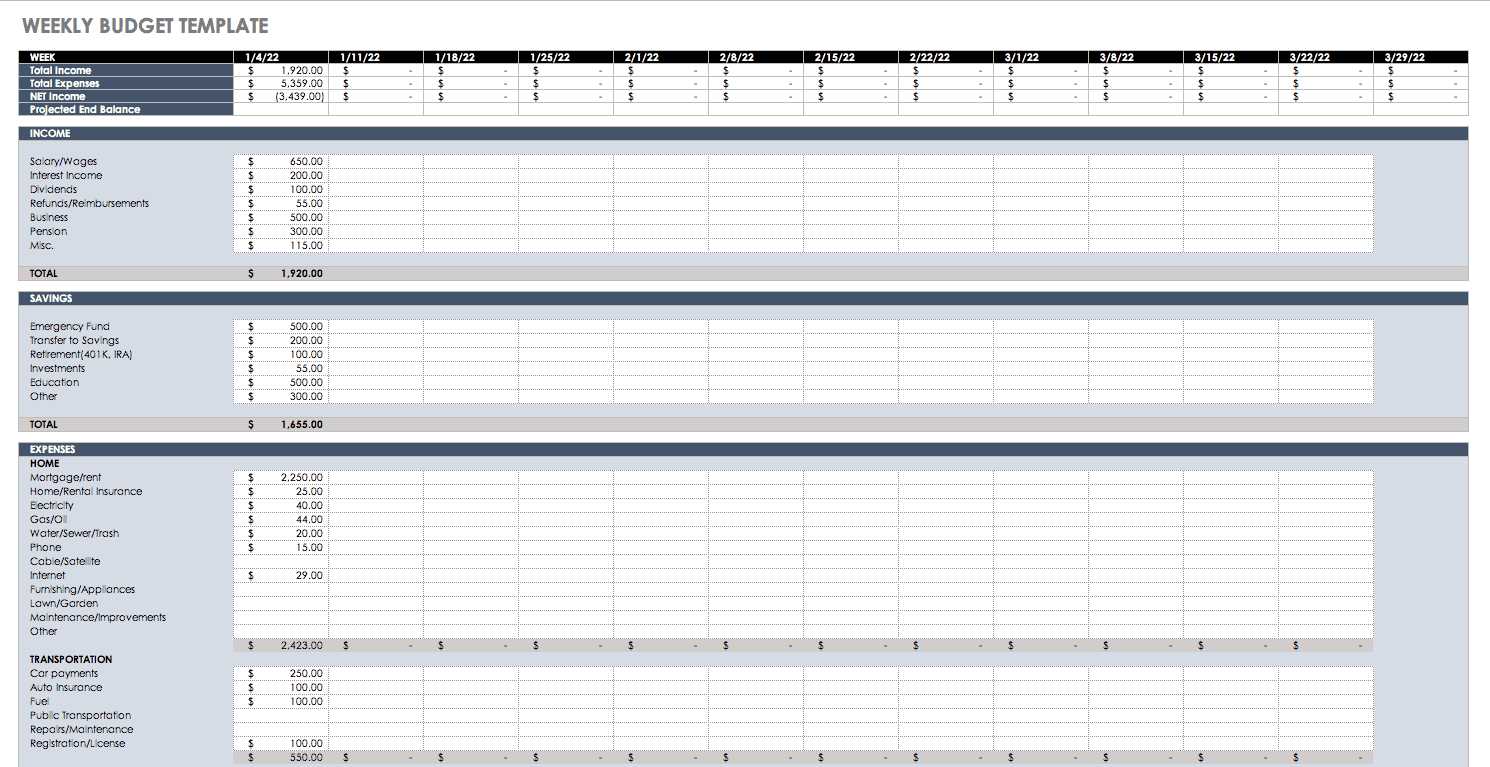

The primary aim of this organizational tool is to provide a clear visual representation of financial commitments alongside due dates. By doing so, users can easily identify trends, anticipate future expenses, and allocate funds more efficiently. Moreover, this method fosters accountability, as it encourages regular reviews of spending patterns.

How It Works

Users typically fill in their projected earnings and expenditures in a structured format, allowing for quick adjustments as circumstances change. This dynamic process can significantly enhance financial awareness, promoting better planning and ultimately leading to improved financial health. In essence, it serves as both a guide and a reminder, helping individuals stay on track with their financial goals.

Benefits of Using Budget Templates

Employing structured tools for financial planning can significantly enhance your ability to manage expenses and allocate resources effectively. These tools provide a clear framework that simplifies the process, making it easier to track your financial progress and make informed decisions.

One of the primary advantages of utilizing these resources is the promotion of awareness regarding your financial situation. By systematically organizing income and expenditures, you gain insight into spending habits, enabling you to identify areas where adjustments may be necessary.

Additionally, they foster discipline and consistency in managing finances. Regularly updating these resources encourages you to stay accountable and adhere to your financial goals. This consistent practice can lead to better long-term financial health.

Moreover, these tools often come with customizable features that cater to individual needs. This adaptability allows users to create a personalized system that reflects their unique financial landscape, ensuring a more relevant and effective management experience.

Lastly, utilizing structured formats can save time and reduce stress. With everything organized in one place, you can quickly access necessary information, making financial planning less overwhelming and more efficient.

How to Create a Simple Budget

Establishing a straightforward financial plan is essential for managing your resources effectively. By outlining your income and expenditures, you can gain a clear perspective on your financial situation and make informed decisions to reach your goals.

Step 1: Identify Your Income

Begin by listing all sources of revenue, including salaries, freelance work, and any passive income. This comprehensive overview allows you to understand your financial inflow.

Step 2: Track Your Expenses

Record all outlays, categorizing them into fixed and variable costs. Fixed expenses include rent and utilities, while variable expenses cover entertainment and dining. This helps you pinpoint areas for potential savings.

By following these steps, you can delve into your financial habits and take control of your economic future.

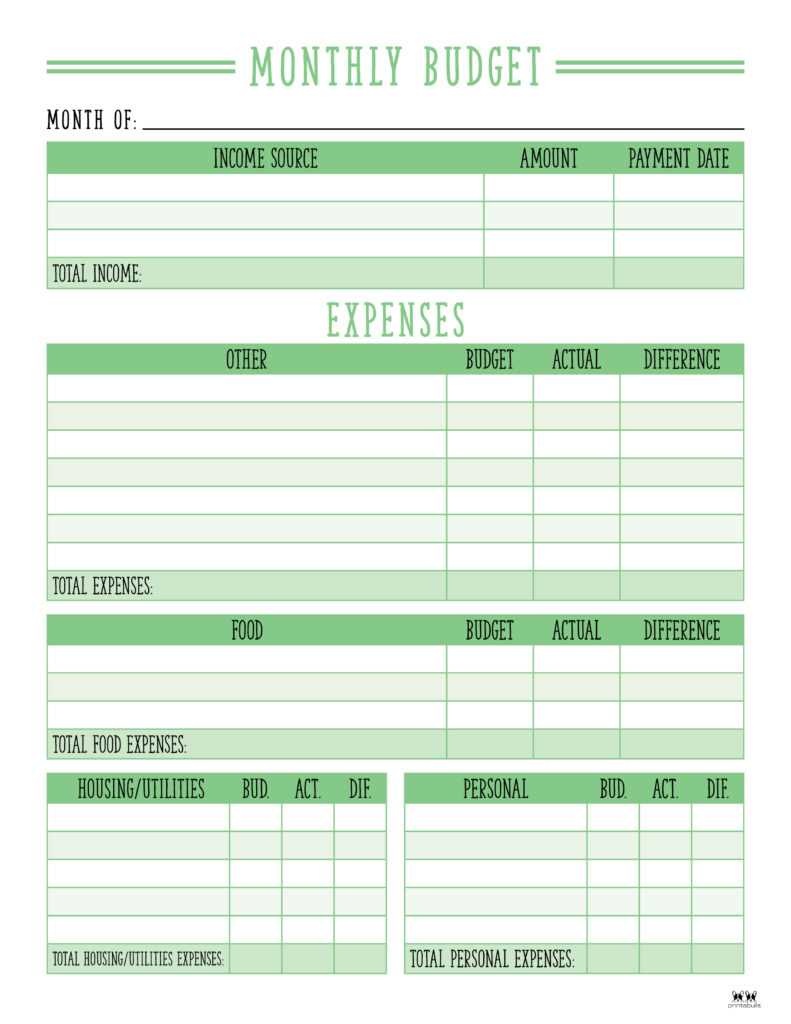

Features of a Good Template

Creating an effective planning tool involves several key characteristics that enhance usability and organization. A well-designed framework not only simplifies tracking but also encourages efficient management of tasks and finances.

- User-Friendly Layout: The design should be intuitive, allowing users to navigate with ease and locate necessary sections quickly.

- Customizability: Flexibility in adjusting elements to fit individual needs ensures that the tool remains relevant over time.

- Clear Sections: Clearly defined areas for different categories help users to separate and manage information without confusion.

- Visual Appeal: Aesthetic design that is pleasing to the eye can motivate users to engage regularly with the tool.

- Accessibility: The ability to access the tool on various devices increases convenience and usability for users on the go.

- Printable Format: Providing an option for physical copies allows users to have a tangible reference, enhancing flexibility in use.

Incorporating these features can significantly enhance the overall experience, making it easier for individuals to stay organized and achieve their goals efficiently.

Where to Find Free Templates

Exploring the digital landscape can lead you to a variety of resources offering useful designs for organizing your time and finances. These resources are often easily accessible and cater to different preferences, ensuring that everyone can find what they need.

- Online Marketplaces: Websites like Etsy and Creative Market feature independent creators who often provide samples or free versions of their products.

- Educational Websites: Institutions often share resources for students and educators, which can include organizational designs that are practical and well-structured.

- Community Forums: Online communities such as Reddit or specialized forums may have members sharing their own designs, which can be tailored to personal needs.

- Software Applications: Many applications offer built-in options for customization, allowing users to create their own arrangements with available styles.

- Blogs and Personal Websites: Numerous bloggers share their insights and provide downloadable content as part of their posts, catering to specific niches.

By exploring these avenues, you can uncover a wealth of options that fit your personal or professional requirements, enhancing your planning process effectively.

Customizing Your Budgeting Tool

Tailoring your financial management tool can significantly enhance your planning and tracking experience. By adapting the features to your specific needs, you can create a more effective approach to managing your finances, ensuring that it aligns perfectly with your lifestyle and goals.

One of the first steps in personalization is to identify which elements are most crucial for your financial journey. This may include categories for income, expenses, savings, or investment tracking. Consider the following options when designing your own tool:

| Feature | Description |

|---|---|

| Categories | Segment your finances into clear sections to provide better visibility. |

| Visual Aids | Incorporate charts or graphs to visualize your financial status over time. |

| Reminders | Set alerts for upcoming expenses or savings milestones to stay on track. |

| Custom Formulas | Utilize calculations that reflect your unique financial goals and situations. |

By considering these aspects, you can create a resource that not only serves your immediate needs but also evolves with you over time. Remember, the more it reflects your personal style and requirements, the more effective it will be in guiding you towards financial success.

Integrating Calendars with Budgets

Combining time management with financial planning can significantly enhance personal organization and resource allocation. By effectively coordinating schedules with monetary resources, individuals can better track their expenses and align their spending with their goals. This approach not only fosters discipline but also promotes a more informed decision-making process regarding both time and finances.

One effective way to achieve this integration is through the use of visual aids that link specific dates with corresponding financial activities. This allows for a clearer overview of when expenditures are due and helps prioritize spending based on immediate needs and long-term objectives.

| Activity | Date | Estimated Cost |

|---|---|---|

| Grocery Shopping | Nov 10 | $150 |

| Utilities Payment | Nov 15 | $120 |

| Gym Membership | Nov 20 | $50 |

| Monthly Savings | Nov 30 | $200 |

Utilizing such a structured approach not only aids in tracking obligations but also empowers individuals to make timely adjustments to their plans. By recognizing patterns in spending and aligning them with their schedules, users can achieve a balanced lifestyle while maintaining control over their financial health.

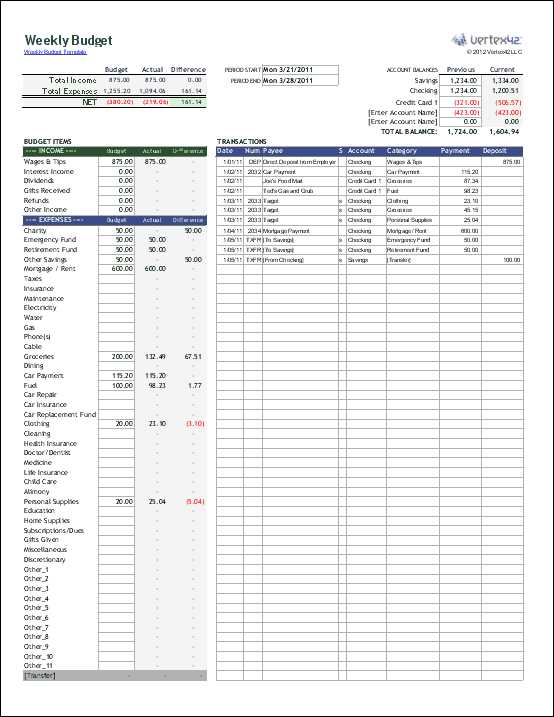

Tracking Expenses Effectively

Managing your finances requires a systematic approach to monitor outflows. By understanding where your money goes, you can make informed decisions and prioritize your spending. Establishing a clear method to record and evaluate your expenditures is essential for achieving financial stability.

To begin, consider categorizing your spending into distinct groups. This allows you to identify patterns and areas where you might be overspending. For example, separating essentials from discretionary purchases provides clarity and aids in recognizing where adjustments can be made.

Utilizing tools to log expenses can enhance your tracking process. Whether through digital applications or traditional methods like spreadsheets, find what works best for you. The key is consistency; regular updates will ensure your records remain accurate and helpful.

Additionally, setting specific goals can serve as motivation. Whether aiming to save for a particular item or to reduce overall spending, having a target in mind helps maintain focus and discipline in managing your finances.

Regularly reviewing your records is equally important. This practice not only helps you stay accountable but also provides opportunities to adjust your strategies. By reflecting on your financial habits, you can cultivate a more mindful approach to spending and ultimately achieve your financial objectives.

Setting Financial Goals with Calendars

Establishing clear financial objectives is crucial for effective money management. Utilizing a structured time framework can significantly enhance your ability to visualize progress and stay committed to achieving your aspirations. By strategically planning milestones, you create a roadmap that guides your financial journey and helps you maintain focus.

Defining Your Objectives

Begin by identifying specific aims that resonate with your overall financial vision. This could include saving for a significant purchase, reducing debt, or increasing your investment portfolio. Be sure to set both short-term and long-term targets, ensuring that they are measurable and attainable. Documenting these aspirations within a timeline allows for periodic reviews, which can motivate and inspire continued effort.

Tracking Progress Effectively

Regularly monitoring your advancements is essential to staying on track. Allocate time to assess your achievements and adjust your plans as necessary. This reflection not only highlights successes but also reveals areas needing improvement. By creating a visual representation of your progress, you reinforce positive habits and remain accountable to your financial commitments. Embrace this organized approach to cultivate a sense of control over your financial future.

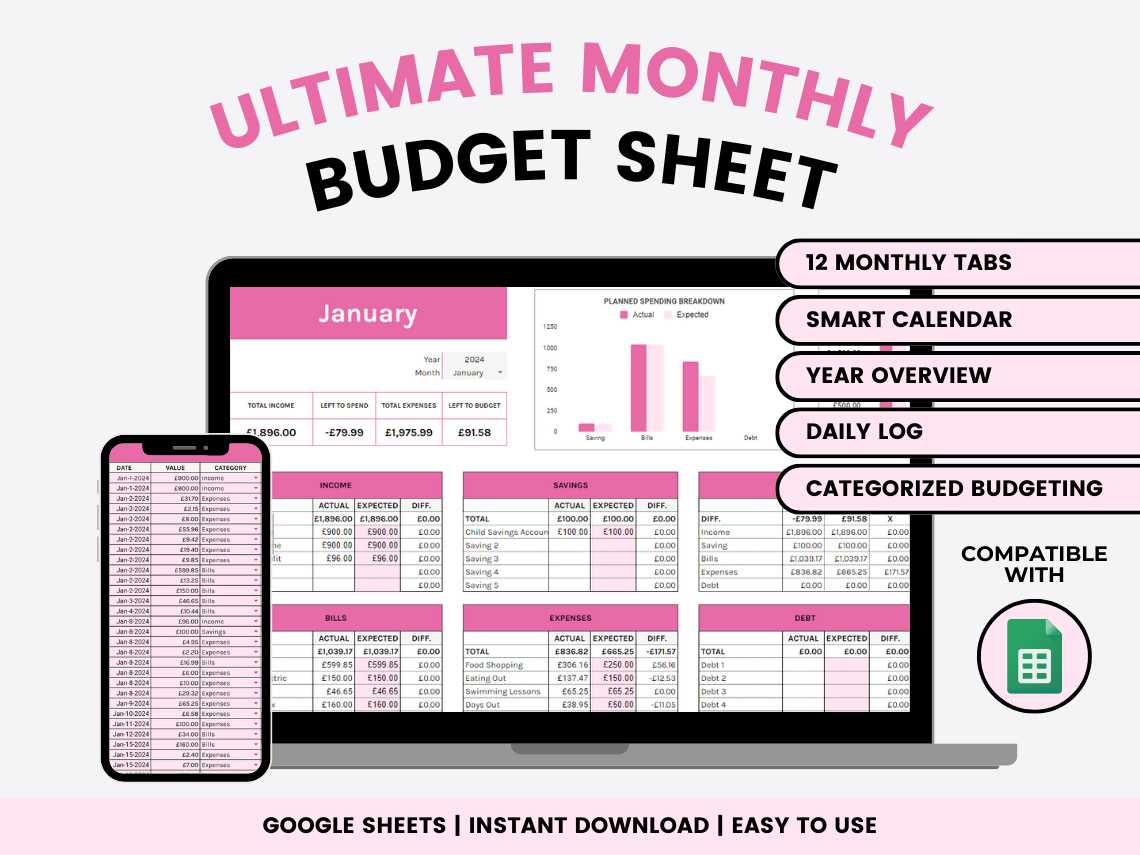

Monthly vs. Annual Budgeting

When managing personal finances, individuals often face a choice between planning on a monthly or yearly basis. Each approach has its own merits and drawbacks, influencing how effectively one can track expenses and achieve financial goals.

Monthly planning allows for a more granular view of finances. By assessing income and expenditures each month, individuals can quickly identify trends and adjust their spending habits accordingly. This method promotes awareness of cash flow, enabling timely responses to unexpected costs. However, it can also lead to a reactive mindset, focusing on short-term fluctuations rather than long-term strategies.

On the other hand, annual planning offers a broader perspective. It encourages a holistic view of financial health over a longer period, allowing individuals to set ambitious goals and make strategic decisions. This approach can be beneficial for identifying seasonal trends and planning for larger expenses. Nonetheless, it may overlook short-term variances, leading to potential mismanagement of resources during certain months.

Ultimately, the choice between these two methodologies depends on personal preferences and financial circumstances. Combining elements of both can create a balanced strategy that addresses immediate needs while also fostering long-term financial stability.

Tips for Staying on Budget

Managing your finances effectively requires a strategic approach. Implementing certain practices can help you maintain control over your spending while ensuring you meet your financial goals. Here are some key strategies to keep your expenditures in check.

Create a Spending Plan

Establishing a clear outline of your anticipated expenses can significantly enhance your financial discipline. By categorizing your outlays, you can identify areas where you might cut back. Consider the following breakdown:

| Category | Amount Allocated | Actual Spending |

|---|---|---|

| Groceries | $300 | $320 |

| Utilities | $150 | $140 |

| Transportation | $100 | $90 |

| Entertainment | $200 | $250 |

Track Your Progress

Regularly monitoring your financial activities is crucial for staying on course. Utilize apps or journals to log your transactions and reflect on your habits. This practice not only helps you spot trends but also keeps your goals in focus.

Common Mistakes to Avoid

When managing personal finances, there are several pitfalls that individuals often encounter. Recognizing and steering clear of these errors can lead to a more effective approach to tracking income and expenses, ultimately fostering better financial health.

Neglecting to Track Expenses

A frequent oversight is failing to monitor expenditures regularly. Without a clear picture of spending habits, it’s easy to exceed limits and make uninformed financial decisions. Keeping detailed records can help identify areas for improvement and encourage more mindful spending.

Setting Unrealistic Goals

Another common mistake is establishing overly ambitious financial targets. While aiming high can be motivating, setting unattainable objectives may lead to frustration and demotivation. It’s essential to create achievable milestones that promote consistent progress and a sense of accomplishment.

Using Digital vs. Paper Templates

In today’s world, the choice between digital and traditional methods for organizing your finances has become a crucial decision. Each approach offers unique advantages and caters to different preferences and lifestyles. Understanding these differences can help individuals determine which method aligns best with their needs and habits.

Digital options provide convenience and accessibility, allowing users to update and track their information in real-time from various devices. They often come with features such as reminders and automatic calculations, streamlining the process and minimizing errors. Additionally, many online platforms facilitate sharing and collaboration, making it easier for families or partners to stay on the same page.

On the other hand, traditional methods appeal to those who prefer a tangible experience. Writing things down can enhance memory retention and provide a satisfying sense of accomplishment. Paper formats allow for creative expression through doodling or color-coding, which can make the planning process more enjoyable. Moreover, they can be used without the need for technology, making them accessible anywhere.

Ultimately, the decision hinges on personal preference and lifestyle. Some may thrive with the efficiency of digital solutions, while others find comfort and clarity in the simplicity of paper. Experimenting with both can also lead to a personalized hybrid approach that leverages the strengths of each method.

Incorporating Savings Plans

Establishing a structured approach to setting aside funds is essential for achieving financial goals. By integrating a savings strategy into your routine, you can ensure that you are consistently working towards your aspirations while maintaining control over your finances. This section explores effective methods to weave savings into your financial habits.

One effective way to manage your savings is by creating a detailed plan that outlines your financial targets and the steps required to reach them. Below is a simple framework to help you visualize your savings strategy:

| Goal | Target Amount | Timeframe | Monthly Contribution |

|---|---|---|---|

| Emergency Fund | $5,000 | 12 months | $417 |

| Vacation | $2,000 | 8 months | $250 |

| New Car | $10,000 | 24 months | $417 |

By breaking down your financial objectives into manageable components, you can more easily track your progress and stay motivated. Regularly reviewing your plan ensures you remain focused and can adjust your contributions as needed, ultimately leading to greater financial stability and satisfaction.

Adapting Budgets for Families

Managing finances as a family can be a complex task, requiring flexibility and creativity. Each household has unique needs and priorities, making it essential to develop a financial plan that accommodates varying circumstances. A well-structured approach can lead to greater stability and peace of mind.

Understanding Family Needs

Recognizing the specific requirements of your household is the first step in tailoring your financial plan. Consider the following factors:

- Number of family members

- Age and stage of life (children, teenagers, adults)

- Income sources and stability

- Recurring expenses and savings goals

Creating a Flexible Plan

Once you have a clear understanding of your family’s needs, you can create a dynamic financial strategy that can adapt to changes. Here are some strategies:

- Set realistic goals that reflect both short-term and long-term priorities.

- Monitor expenses regularly to identify patterns and adjust as necessary.

- Involve all family members in discussions to ensure everyone is on board.

- Allocate funds for emergencies to handle unexpected situations smoothly.

- Review and revise the plan periodically to keep it relevant.

By focusing on adaptability and communication, families can effectively navigate their financial landscape, ensuring that their approach remains aligned with their evolving needs and aspirations.

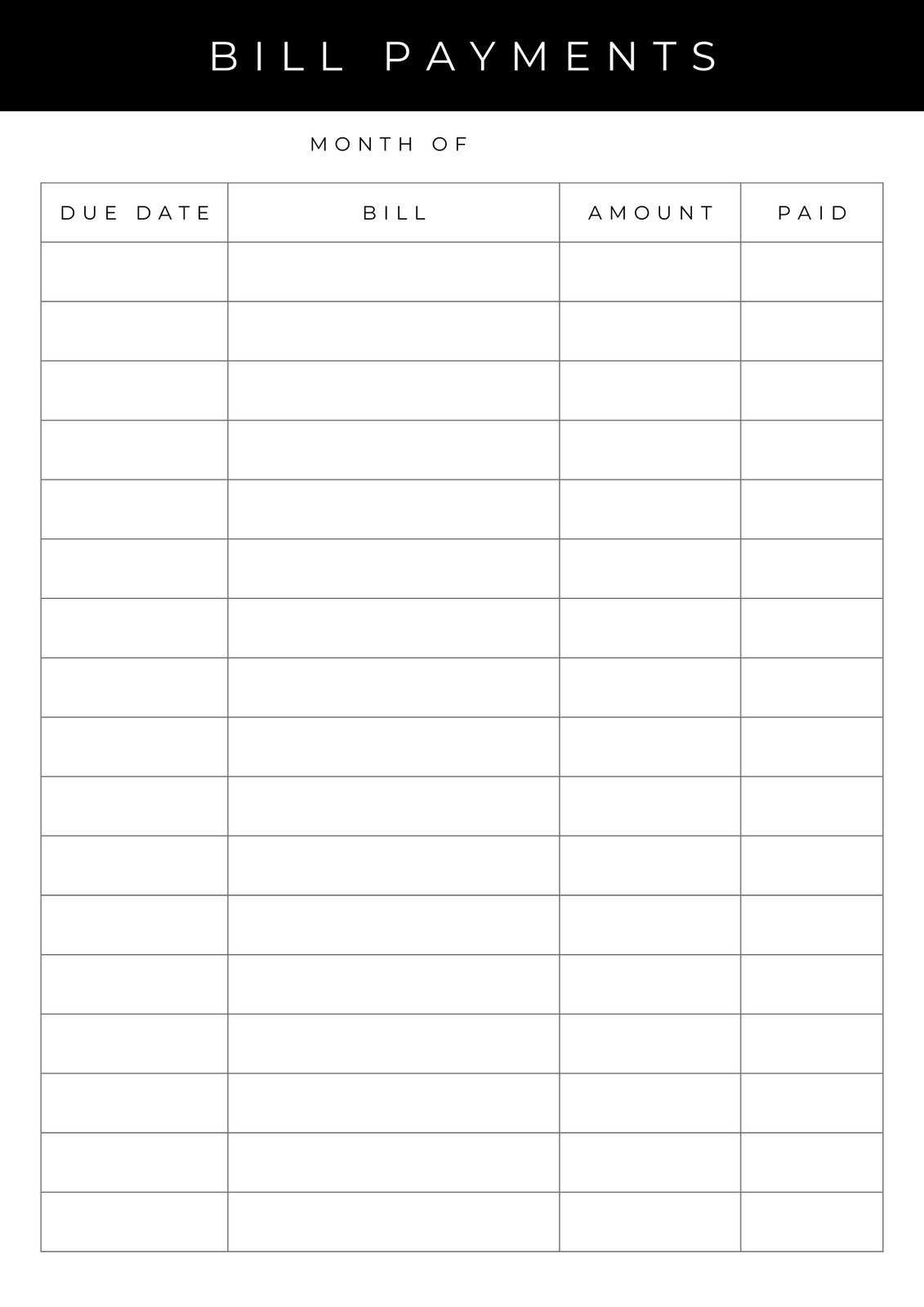

Using Templates for Debt Management

Managing financial obligations can often feel overwhelming, but utilizing structured resources can streamline the process. These tools provide a framework to help individuals track their expenses, monitor repayments, and set achievable financial goals. By employing organized formats, you can gain clarity and control over your financial situation.

Here are some key advantages of using organized resources for handling financial responsibilities:

- Clear Visualization: Structured formats allow you to see your financial landscape at a glance, making it easier to identify trends and areas needing attention.

- Improved Organization: Having a designated space for tracking payments and due dates helps prevent missed obligations and late fees.

- Goal Setting: These resources encourage you to establish specific targets, fostering a proactive approach to managing your finances.

- Enhanced Accountability: Regularly updating your progress in an organized way can motivate you to stick to your repayment plan.

When selecting a resource, consider the following aspects:

- User-Friendliness: Choose a format that is easy to navigate and update regularly.

- Customization: Look for options that allow you to tailor the structure to fit your unique financial situation.

- Tracking Features: Ensure the format includes sections for monitoring both income and expenditures.

Incorporating these structured tools into your financial routine can significantly enhance your ability to manage obligations effectively. By fostering discipline and organization, you can work towards a more secure financial future.

Feedback and Improvement Strategies

In any planning process, the collection of insights and suggestions plays a crucial role in enhancing efficiency and effectiveness. By actively engaging with participants and stakeholders, you can gather valuable input that informs future modifications and optimizations. This dynamic approach fosters a culture of continuous improvement, ensuring that your planning efforts evolve to meet changing needs.

Gathering Constructive Input

To create a meaningful feedback loop, it’s essential to implement various channels for collecting opinions. Surveys, interviews, and informal discussions can yield rich data about what works well and what requires adjustment. Encouraging open communication and making it easy for individuals to share their thoughts will result in a more comprehensive understanding of the current approach.

Implementing Changes Based on Feedback

Once you have collected feedback, the next step involves analyzing the information to identify patterns and areas for enhancement. Prioritize the most critical suggestions and develop an action plan to address them. By systematically integrating these improvements, you demonstrate responsiveness and commitment to refining processes, which can lead to increased satisfaction and better outcomes in future initiatives.

Real-Life Success Stories

This section highlights inspiring accounts of individuals who transformed their financial situations through effective planning and organization. These narratives showcase how strategic approaches can lead to significant improvements in managing resources, achieving goals, and ultimately attaining a sense of financial stability.

Story of Sarah: From Chaos to Clarity

Sarah was overwhelmed by her expenses and often found herself living paycheck to paycheck. After discovering a systematic approach to tracking her finances, she began to categorize her spending and set achievable targets. Within months, she eliminated unnecessary costs and even managed to save for a vacation. Her journey exemplifies how determination and structure can lead to remarkable changes.

John’s Journey: Building Wealth Through Discipline

John, a recent college graduate, struggled to navigate his new financial responsibilities. By adopting a meticulous method for monitoring his income and expenditures, he gained control over his finances. His commitment to setting aside a portion of his earnings for long-term savings paid off, allowing him to invest in opportunities that accelerated his wealth. John’s story serves as a testament to the power of discipline and proactive financial management.