Staying on top of financial obligations can be a challenging task. An effective organizational approach helps individuals manage due dates efficiently, preventing last-minute scrambles and potential penalties.

Utilizing a structured approach allows for clarity in tracking necessary payments. By breaking down obligations into manageable segments, users can allocate resources effectively and avoid unexpected surprises.

This resource serves as an ultimate guide for creating an organized system. With customizable features, it encourages a proactive mindset, empowering users to take control of their finances and plan ahead with confidence.

Understanding Bill Management Calendars

Effective management of financial obligations requires organization and foresight. By structuring a systematic approach, individuals can ensure timely payments, avoid late fees, and maintain a clear overview of their financial commitments. This proactive strategy empowers users to take control of their finances while reducing stress associated with overdue payments.

Benefits of Organized Tracking

Utilizing a structured framework for monitoring financial duties offers numerous advantages. It fosters better budgeting practices, enhances cash flow management, and simplifies the overall financial planning process. Moreover, such an organized method can lead to improved credit scores, as timely payments are a key factor in maintaining good credit health.

Components of an Effective Management System

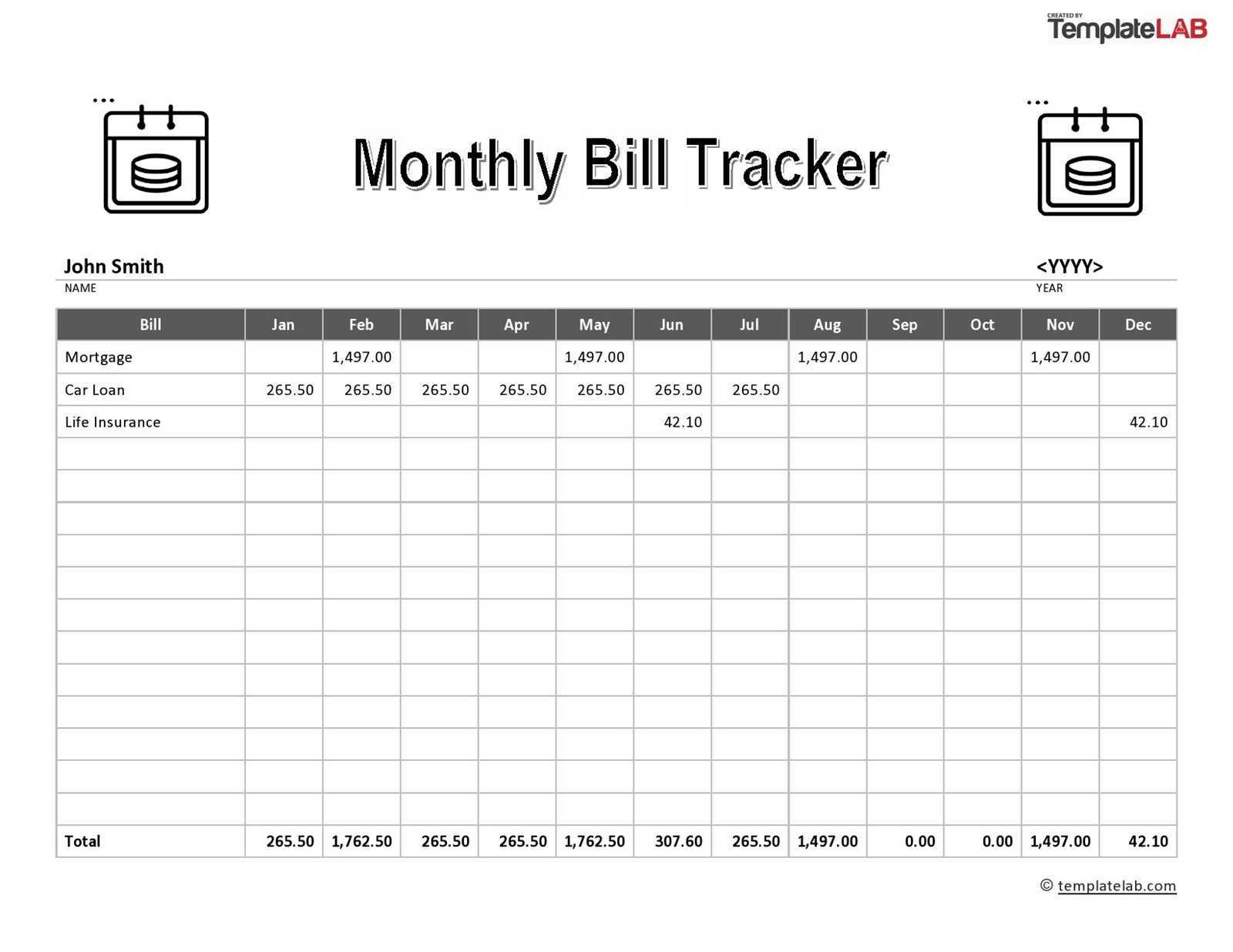

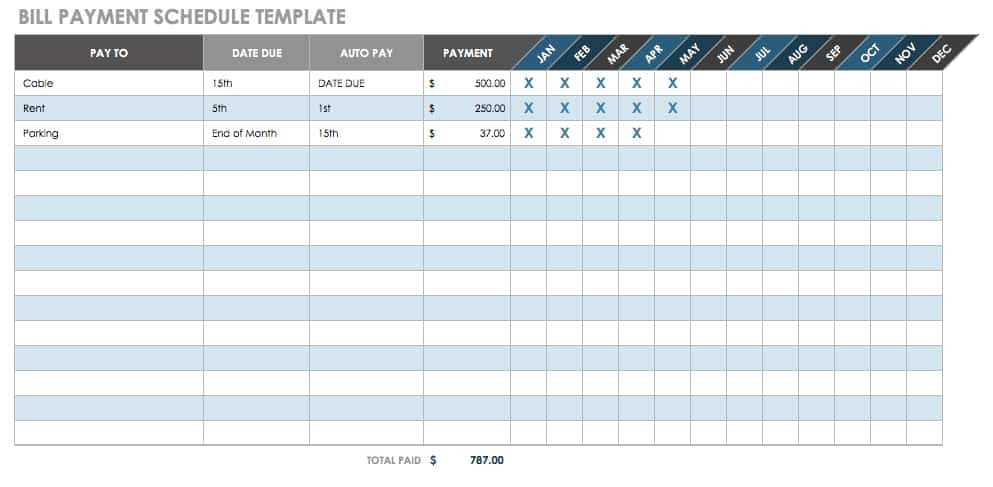

A well-designed system should encompass several critical elements to function optimally. Below is a table highlighting these essential features:

| Feature | Description |

|---|---|

| Due Dates | Identifying and marking the specific dates when payments are due to avoid delays. |

| Payment Amounts | Documenting the exact amounts required for each obligation to facilitate accurate budgeting. |

| Payment Methods | Listing various options for making payments, ensuring flexibility and convenience. |

| Reminders | Setting alerts or notifications to keep track of upcoming deadlines. |

Importance of Tracking Monthly Expenses

Monitoring financial outflows on a regular basis is essential for maintaining control over one’s economic situation. By keeping a close eye on where money is spent, individuals can make informed decisions that ultimately lead to better financial health.

Understanding spending habits plays a crucial role in personal finance management. When you track expenditures, you become aware of patterns and tendencies that may not be obvious at first glance. This awareness allows you to identify areas where you might be overspending and make necessary adjustments.

Additionally, establishing a clear picture of your finances aids in effective budgeting. By analyzing past spending, you can allocate resources more wisely for upcoming months. This proactive approach reduces the risk of unexpected expenses disrupting your financial plans.

Moreover, tracking outgoings fosters accountability. When you actively monitor your financial activities, you are less likely to engage in impulsive purchases. This discipline not only saves money but also cultivates a more mindful approach to spending.

In summary, consistently observing your monthly expenditures is vital for achieving financial stability and success. It empowers you to make smarter choices and prepares you for future challenges.

How to Create Your Own Template

Designing a personalized layout for managing expenses can greatly enhance your organization skills. By following a structured approach, you can craft a system that meets your specific needs, allowing for better tracking and planning. This guide will provide you with essential steps to create a practical and effective design tailored to your financial commitments.

Step 1: Determine Your Needs

Begin by assessing your requirements. Consider the frequency of your payments, types of expenses, and any deadlines that are crucial for your financial planning. This will help you decide what elements should be included in your design, ensuring that it aligns perfectly with your lifestyle and financial habits.

Step 2: Choose Your Format

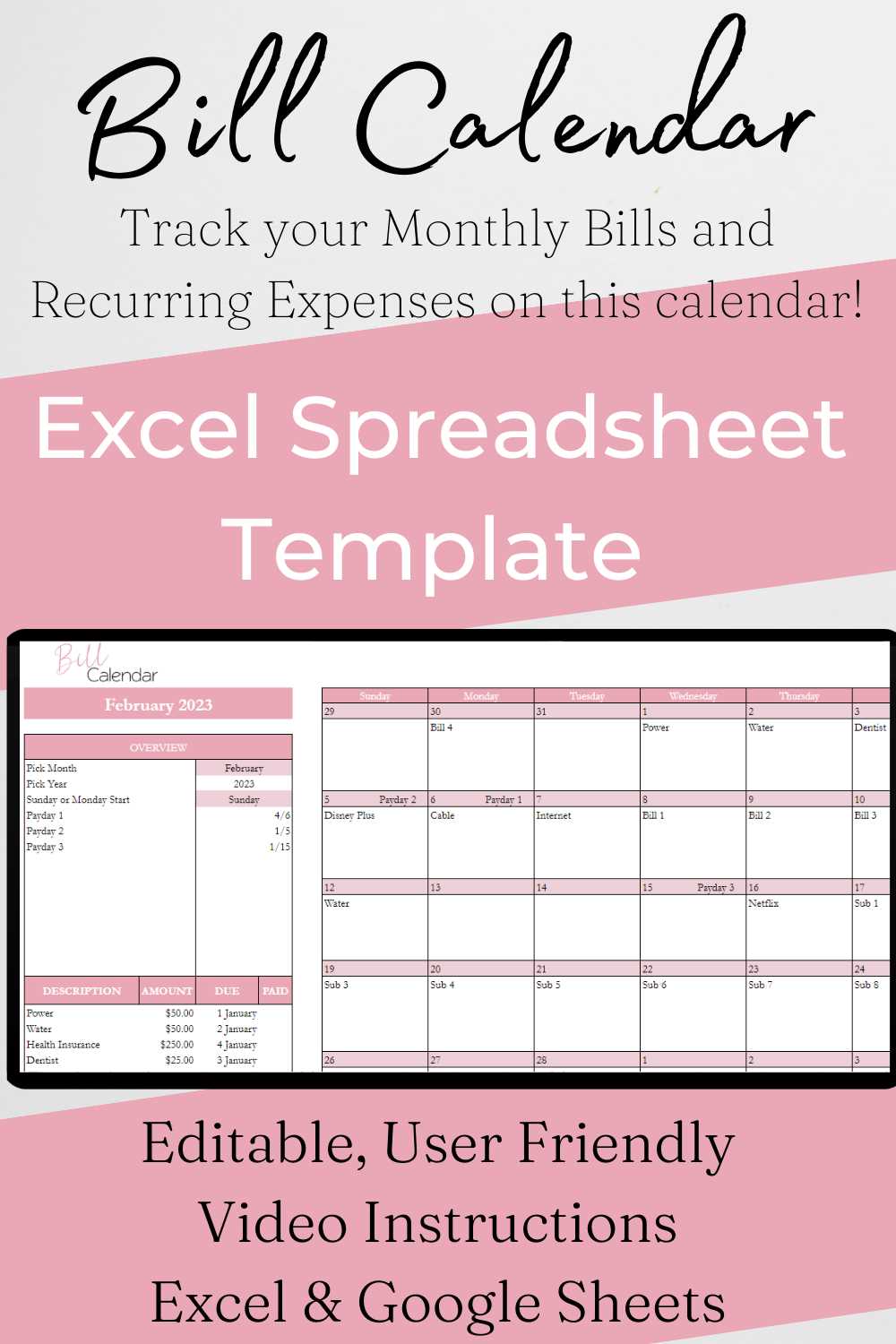

Decide whether you prefer a digital or paper format. Each has its benefits: digital versions allow for easy updates and accessibility, while paper layouts can provide a tangible reference. Choose what feels most comfortable for you and suits your organizational style best.

Digital vs. Paper Calendar Options

The choice between electronic and traditional methods for organizing schedules can significantly influence productivity and ease of management. Each format offers distinct advantages and challenges, catering to different preferences and lifestyles.

Advantages of Digital Solutions

One of the primary benefits of electronic tools is their accessibility. With cloud-based applications, individuals can access their schedules from multiple devices, ensuring they are always up to date. Additionally, features like reminders, notifications, and integration with other apps streamline the process of tracking commitments. The ability to quickly edit and share plans enhances collaboration, making it easier to coordinate with others.

Benefits of Traditional Methods

On the other hand, physical planners provide a tactile experience that many users find satisfying. Writing things down can aid memory retention and encourage a deeper connection to tasks. Furthermore, traditional options are free from digital distractions, allowing for focused time management. For those who prefer simplicity, a paper format can be less overwhelming and easier to navigate.

Ultimately, the decision hinges on personal preference and lifestyle. Evaluating the unique benefits of each approach can help individuals choose the method that best aligns with their organizational needs.

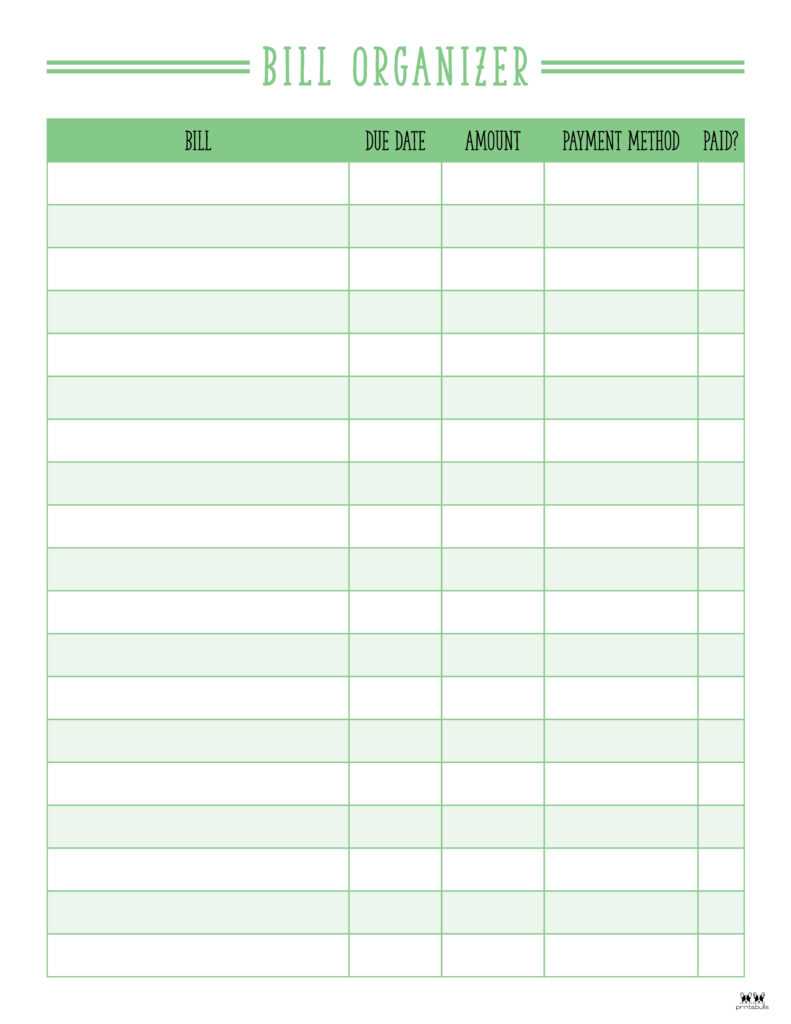

Essential Features of a Bill Calendar

Managing financial obligations effectively requires a structured approach to track deadlines, amounts due, and payment methods. An efficient organizational tool serves as a comprehensive guide to ensure timely payments and avoid penalties. Here are some key attributes that enhance this essential tool.

Key Attributes

- Reminders: Automated notifications to alert users about upcoming due dates.

- Payment Tracking: A feature to monitor paid and outstanding amounts, offering a clear financial overview.

- Customizable Categories: Ability to categorize different expenses for easier management and analysis.

- User-Friendly Interface: An intuitive layout that simplifies navigation and accessibility of information.

Integration Options

- Bank Syncing: Direct connection with bank accounts for seamless updates on payments and balances.

- Mobile Access: Compatibility with mobile devices for on-the-go management and reminders.

- Data Export: Options to export data to spreadsheets or accounting software for further analysis.

Tips for Staying Organized Financially

Maintaining clarity in your financial commitments is essential for a stress-free life. Implementing effective strategies can help you keep track of your expenses, due dates, and overall budgeting. By following a few practical suggestions, you can enhance your financial management and avoid unnecessary complications.

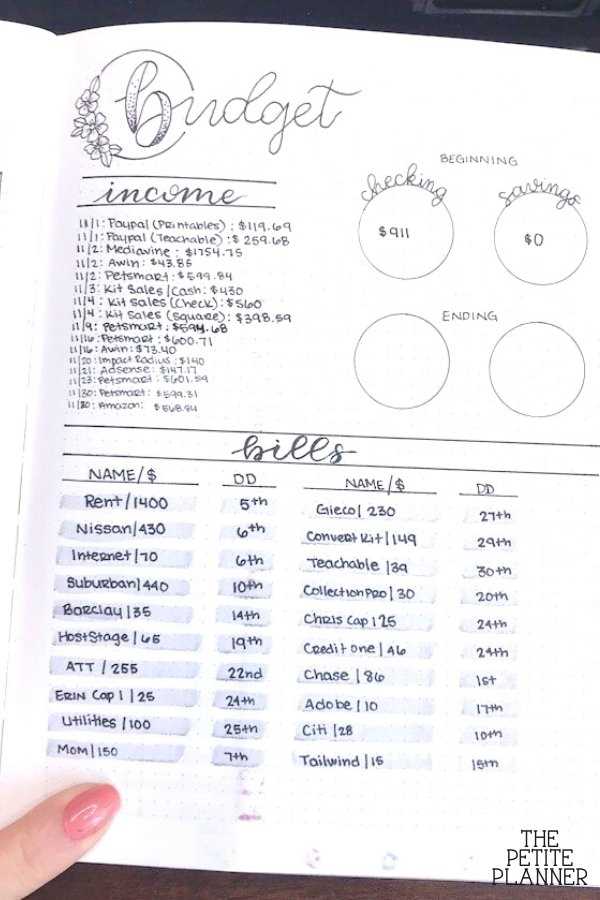

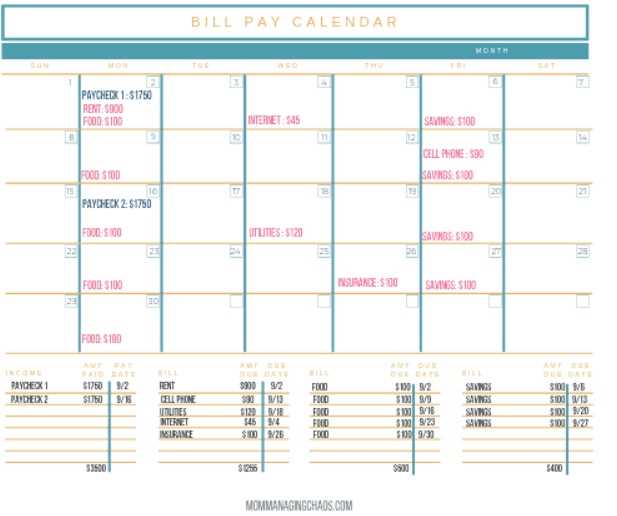

Create a Comprehensive List

Begin by compiling a detailed list of all your financial obligations. This should include recurring payments, such as utilities, subscriptions, and loans. Having a complete overview allows you to anticipate due dates and plan your spending accordingly, reducing the likelihood of missed payments.

Utilize Digital Tools

Take advantage of technology to streamline your financial organization. Various applications and software can help you track expenses, set reminders, and visualize your budget. Utilizing these tools ensures that you remain aware of your financial situation and can adjust your plans as needed.

Integrating Reminders into Your System

Establishing a system for timely notifications is essential for managing recurring obligations efficiently. By embedding alerts into your workflow, you enhance your ability to stay organized and ensure that important tasks are completed without delay.

Choosing the Right Tools

Selecting appropriate software or applications can significantly impact the effectiveness of your reminders. Look for features such as customizable alerts, integration with existing applications, and user-friendly interfaces to facilitate seamless management.

Setting Up Effective Notifications

Once you’ve chosen your tools, the next step is to configure your notifications. Schedule reminders to suit your routine, making them as specific as possible to reduce the risk of overlooking any important dates. Consider using visual cues and auditory signals to reinforce the importance of these alerts.

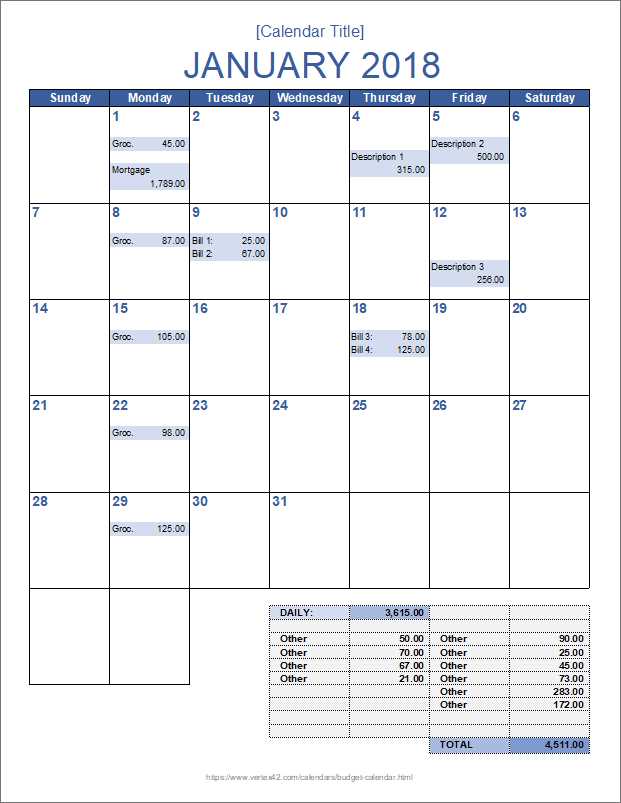

Using Color Codes for Easy Reference

Incorporating color schemes into your organization system can significantly enhance your ability to track important dates and obligations. By assigning specific hues to various categories, you create a visual guide that allows for quick identification and prioritization of tasks.

Utilizing color codes not only improves efficiency but also minimizes the risk of overlooking critical deadlines. For example, you might designate red for urgent payments, green for completed tasks, and blue for upcoming reminders. This simple strategy transforms a potentially overwhelming schedule into a clear, manageable overview.

Moreover, consistency in your color usage reinforces familiarity, enabling you to navigate your commitments with ease. As you develop your unique coding system, consider personalizing it to fit your preferences, ensuring that it resonates with your organizational style. Ultimately, a well-implemented color scheme can make the process of managing responsibilities not only easier but also more engaging.

Best Apps for Bill Tracking

Managing recurring expenses can often feel overwhelming, but with the right tools, it becomes much easier to stay organized and on top of your financial obligations. Numerous applications are designed to help individuals monitor their due dates, track payments, and even send reminders, ensuring that nothing slips through the cracks. Here, we explore some of the most effective options available, highlighting their unique features and benefits.

One standout choice is a platform that offers a user-friendly interface and seamless integration with banking services. This app allows users to link their accounts, providing real-time insights into upcoming payments and available funds. Another popular application focuses on customization, allowing users to set specific reminders tailored to their unique schedules, thus ensuring they never miss a due date.

For those who prefer a more visual approach, there are apps that incorporate charts and graphs to display spending habits and upcoming financial commitments. These tools not only enhance awareness but also encourage better budgeting practices. Additionally, some platforms even offer community features, where users can share tips and strategies for managing finances effectively.

Whether you’re looking for simplicity or advanced features, there is an ideal application to fit your needs. By leveraging these innovative tools, individuals can take control of their financial responsibilities and reduce the stress associated with managing regular payments.

Customizing Your Calendar for Personal Needs

Creating a personalized schedule can greatly enhance your organization and efficiency. Tailoring this tool to fit your unique lifestyle and responsibilities ensures that you stay on top of important dates and tasks without feeling overwhelmed. By making adjustments that reflect your habits and priorities, you can streamline your planning process.

Start by identifying your key commitments. This includes regular payments, appointments, and deadlines. Once you have a clear understanding of what needs to be included, you can categorize these elements based on frequency and urgency. For example, distinguishing between monthly payments and weekly obligations allows for better visibility and management.

Next, consider incorporating color coding. Assigning different colors to various types of entries can provide instant recognition at a glance. Whether you choose to use shades for recurring expenses, one-time payments, or personal events, this visual aid simplifies navigation and prioritization.

Additionally, think about the format that works best for you. Whether it’s a digital application or a physical planner, select a medium that aligns with your lifestyle. Some may prefer the tactile experience of writing things down, while others might benefit from the convenience of reminders and notifications on their devices.

Finally, make it a habit to review and adjust your setup regularly. Life is dynamic, and so are your responsibilities. By periodically revisiting your layout and making necessary changes, you can ensure that it remains an effective tool in managing your time and obligations.

Common Mistakes to Avoid in Planning

Effective organization is crucial for managing financial obligations successfully. However, many individuals overlook key elements that can lead to confusion and missed deadlines. Understanding these pitfalls can significantly enhance the effectiveness of your strategy.

- Neglecting to Review Regularly: Failing to revisit your schedule can result in missed payments and unexpected expenses.

- Inaccurate Estimates: Underestimating amounts due or dates can create financial strain and lead to penalties.

- Overcomplicating the Process: Introducing unnecessary complexity can hinder clarity and make tracking more difficult.

By steering clear of these common errors, you can streamline your approach and ensure a more manageable financial routine.

- Ignoring Notifications: Not setting reminders can lead to oversights, impacting your credit and financial health.

- Underestimating Time Needed: Allowing insufficient time for payments can cause last-minute stress and mistakes.

- Not Prioritizing Essentials: Focusing too much on non-essentials can detract from managing crucial obligations effectively.

By being mindful of these issues, you can create a more efficient and reliable approach to managing your finances.

Reviewing and Updating Your Schedule

Maintaining an effective plan requires regular assessment and adjustments. This practice ensures that you stay on top of your financial commitments and adapt to any changes in your circumstances. By revisiting your timetable periodically, you can enhance your organization and minimize the risk of overlooking important deadlines.

Here are some key steps to consider when evaluating and refreshing your timetable:

- Assess Your Current Situation: Take a moment to review your existing obligations and deadlines. Identify any areas where you may be falling behind.

- Prioritize Tasks: Determine which tasks are most urgent and need immediate attention. This helps in allocating your resources effectively.

- Incorporate Changes: If there are new responsibilities or modifications to your existing ones, update your schedule accordingly. Ensure that it reflects your current priorities.

- Set Reminders: Utilize notifications or alerts to help you remember crucial dates and responsibilities. This will aid in staying organized.

- Review Regularly: Establish a routine for checking your plan, whether it’s weekly or monthly. Consistency is key in maintaining an effective approach.

By committing to a routine of evaluation and adaptation, you can create a more fluid and responsive framework for managing your financial duties. This proactive stance will ultimately lead to better control over your obligations and peace of mind.

Benefits of Early Payment Strategies

Implementing timely payment practices can lead to significant advantages for individuals and businesses alike. By prioritizing prompt settlements, one can enhance financial stability and foster better relationships with service providers.

- Improved Cash Flow: Paying obligations early can streamline cash management, allowing for better forecasting and planning.

- Discount Opportunities: Many vendors offer discounts for early settlements, leading to cost savings that can accumulate over time.

- Enhanced Credit Score: Consistent early payments contribute positively to credit ratings, which can facilitate future financing options.

- Stronger Relationships: Vendors appreciate timely payments, which can result in better service, priority support, and favorable terms.

- Reduced Stress: Settling obligations ahead of time can alleviate the pressure associated with last-minute payments and deadlines.

Adopting early payment strategies not only ensures financial discipline but also promotes a proactive approach to managing obligations.

Setting Up Automatic Payments Safely

Automating financial transactions can enhance convenience and ensure timely payments. However, it is crucial to implement these systems securely to avoid potential pitfalls. This section explores best practices for establishing reliable automatic payment methods while safeguarding personal information and finances.

To begin, it is essential to choose reputable service providers. Opt for companies that offer strong security measures, such as encryption and two-factor authentication. Regularly updating passwords and monitoring account activity can further protect against unauthorized access.

When setting up these automatic transactions, consider the following key strategies:

| Strategy | Description |

|---|---|

| Use Strong Passwords | Choose complex passwords and change them regularly to enhance security. |

| Enable Alerts | Set up notifications for transactions to monitor your account activity in real-time. |

| Review Statements | Regularly check financial statements for any discrepancies or unauthorized charges. |

| Limit Information Shared | Provide only necessary information to service providers to minimize risk. |

By implementing these measures, individuals can enjoy the benefits of automatic payments while minimizing the risks associated with them. Always remain vigilant and proactive in managing financial security.

How to Handle Unexpected Expenses

Life is full of surprises, and sometimes these surprises come with a financial burden. Being prepared for unforeseen costs is essential for maintaining stability in your financial situation. By adopting proactive strategies, you can effectively manage these challenges without derailing your budget.

Establish an Emergency Fund – One of the most effective ways to handle sudden financial demands is to create a dedicated savings account. This fund acts as a safety net, allowing you to cover unexpected expenses without resorting to credit or loans. Aim to save at least three to six months’ worth of living expenses to provide adequate protection.

Assess Your Current Budget – When faced with an unplanned expense, revisit your existing financial plan. Look for areas where you can cut back temporarily. Adjusting discretionary spending can free up necessary funds to address urgent costs.

Prioritize Your Expenses – Not all costs are created equal. Identify which expenses are essential and which can be postponed. Focus on immediate needs, such as repairs or medical bills, and allocate resources accordingly.

Consider Alternative Solutions – Sometimes, unexpected situations can be mitigated by exploring different options. For instance, negotiate with service providers or look for community resources that may offer assistance. Finding creative solutions can help alleviate some of the financial strain.

Seek Professional Advice – If you find it challenging to navigate unexpected financial challenges on your own, consider consulting with a financial advisor. They can offer personalized guidance and strategies tailored to your unique situation, helping you regain control.

By implementing these strategies, you can better manage unforeseen costs and maintain your financial health. The key is to stay prepared and adaptable, allowing you to handle whatever life throws your way.

Sharing Your Calendar with Family

Coordinating schedules and keeping everyone informed is essential in any household. By enabling family members to view important dates and deadlines, you create an environment of transparency and teamwork. This practice not only fosters responsibility but also strengthens communication among loved ones.

One effective approach is to utilize digital platforms that allow multiple users to access and update events seamlessly. This way, everyone can contribute to planning and stay in the loop regarding upcoming obligations. Encouraging family members to add their own important dates enhances participation and ensures that nothing is overlooked.

Moreover, setting reminders for key events can help avoid last-minute surprises. Discussing these notifications as a family can establish a sense of accountability. By sharing this organizational tool, you empower each member to manage their own responsibilities while supporting one another in achieving collective goals.

Evaluating Your Financial Progress Regularly

Regular assessment of your monetary journey is essential for achieving long-term goals and ensuring stability. By taking the time to review your finances systematically, you can identify areas for improvement, celebrate successes, and adjust your strategies as needed.

Establishing a routine for evaluation allows you to stay informed about your economic health. This process helps you remain accountable to your objectives, ensuring that you’re on track to meet your aspirations. Here are some key elements to consider during your evaluations:

| Evaluation Aspect | Purpose | Frequency |

|---|---|---|

| Income Tracking | Understand earnings trends | Monthly |

| Expense Review | Identify unnecessary spending | Monthly |

| Debt Assessment | Monitor repayment progress | Quarterly |

| Saving Goals | Evaluate progress towards targets | Quarterly |

| Investment Performance | Review growth and risks | Bi-Annually |

By incorporating these aspects into your financial assessments, you can develop a clearer picture of your economic standing and make informed decisions moving forward.

Resources for Further Financial Education

Expanding your knowledge about personal finance is essential for achieving long-term financial stability. Various tools and materials are available to enhance your understanding of managing finances, budgeting, and investing wisely. Engaging with these resources can empower you to make informed decisions and improve your financial literacy.

Online Courses

- Coursera: Offers courses from top universities on topics like budgeting, investing, and financial planning.

- edX: Provides access to professional finance courses, often free of charge, from reputable institutions.

- Khan Academy: Features a range of video lessons covering essential financial concepts and skills.

Books and Guides

- “The Total Money Makeover” by Dave Ramsey: A practical guide to getting out of debt and building wealth.

- “Rich Dad Poor Dad” by Robert Kiyosaki: Explores the mindset and financial education necessary for wealth creation.

- “Your Money or Your Life” by Vicki Robin and Joe Dominguez: Focuses on transforming your relationship with money and achieving financial independence.

By exploring these educational tools, individuals can significantly enhance their financial capabilities and navigate their financial journeys with confidence.