Managing financial commitments can often feel overwhelming, but with a structured approach, it becomes significantly easier to keep track of due dates and avoid any last-minute scrambles. Establishing a routine that allows you to monitor upcoming dues is essential for maintaining good financial health.

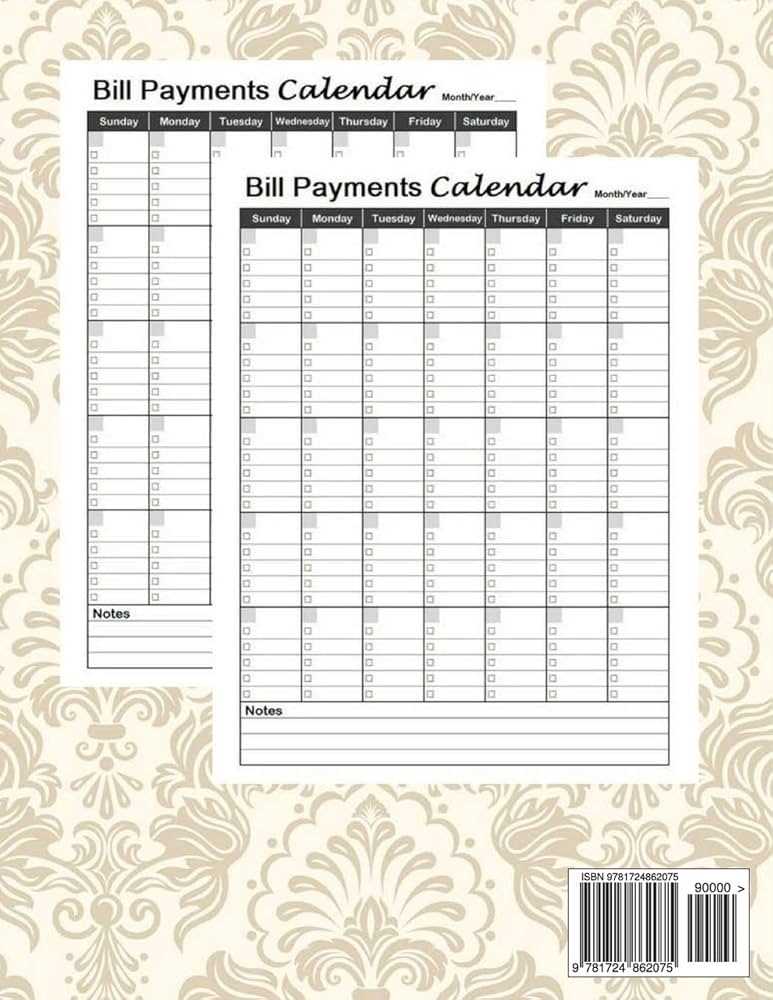

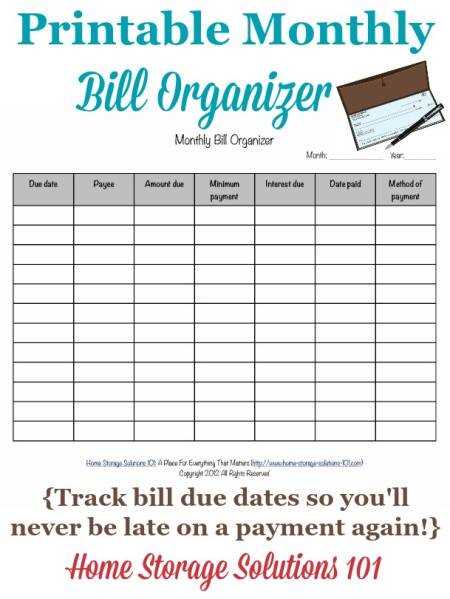

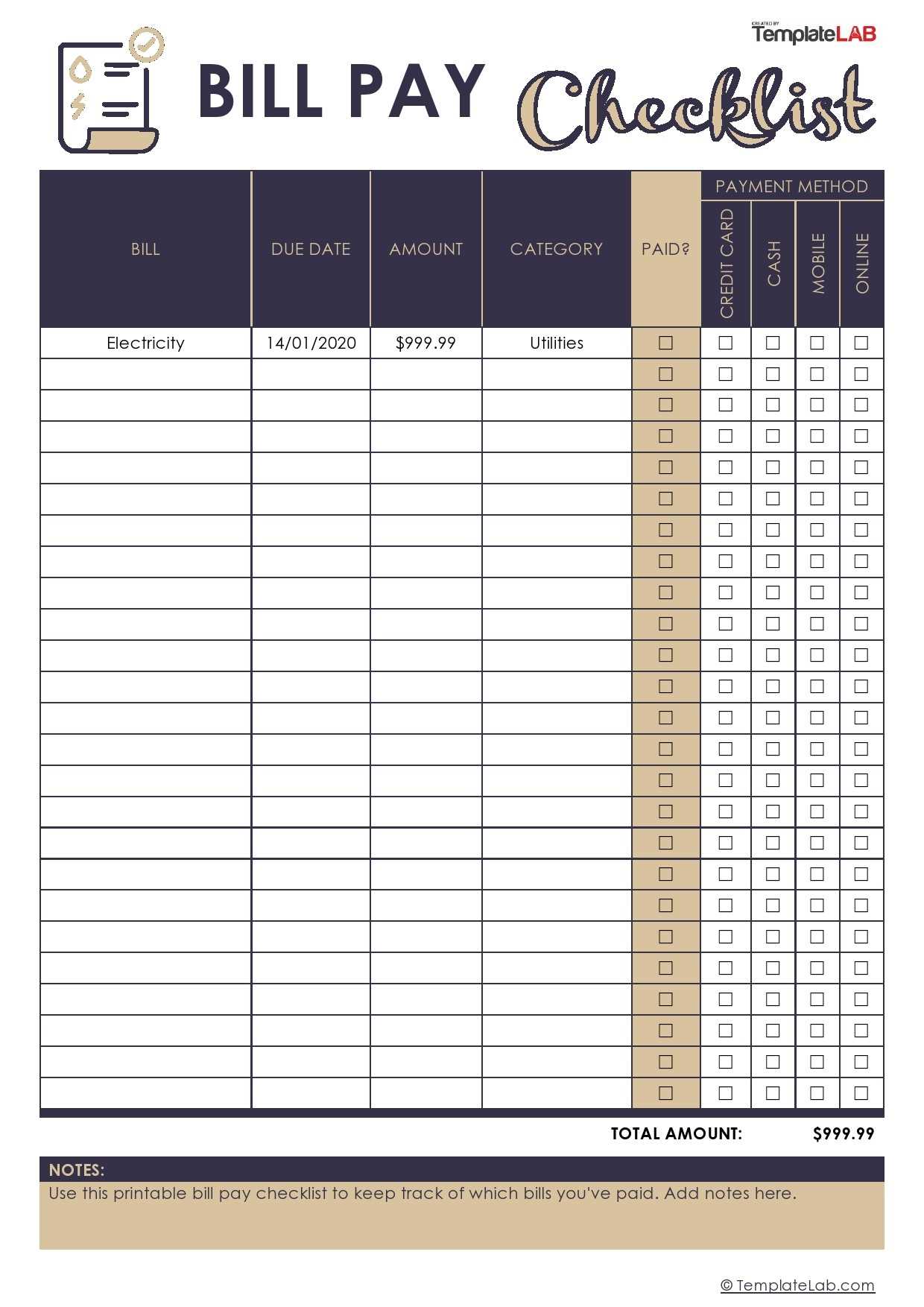

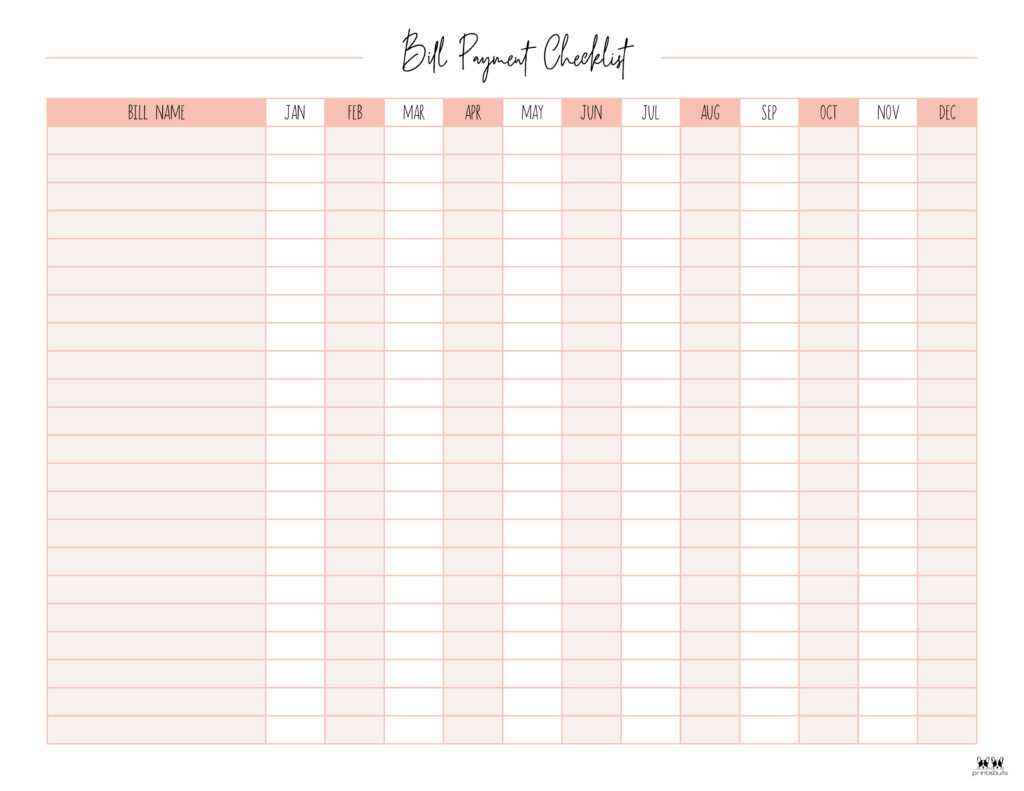

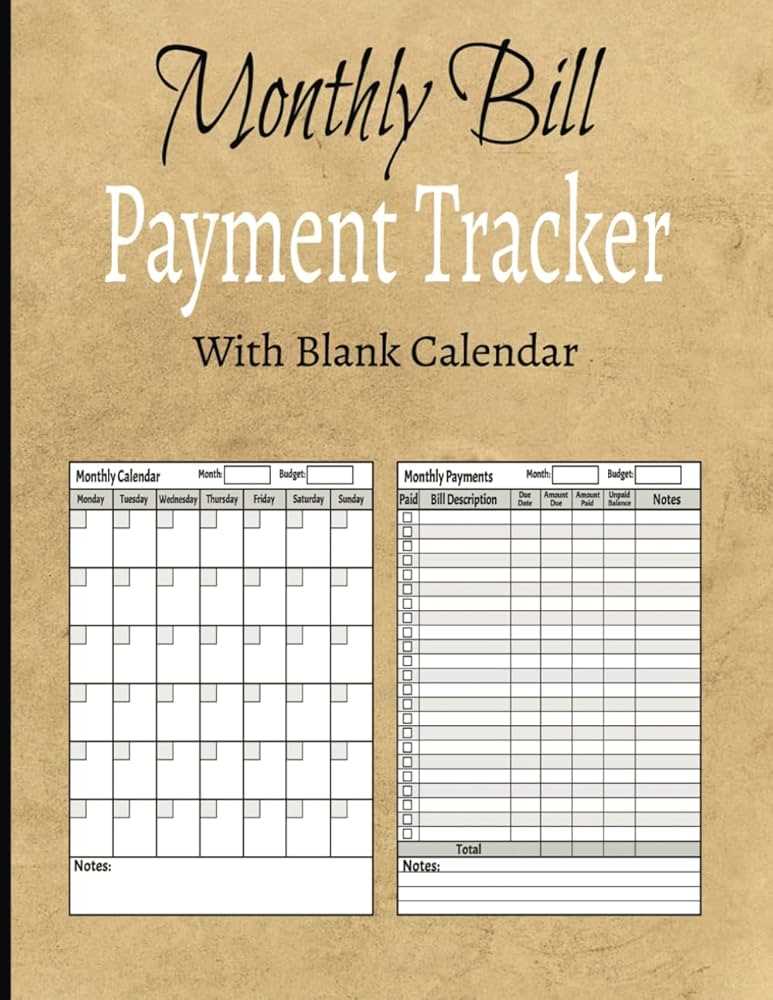

Visual aids play a crucial role in this process. By utilizing a systematic layout, you can easily visualize your responsibilities over a set period. This not only helps you stay on top of what needs to be settled but also assists in planning your budget effectively.

Incorporating reminders into your routine ensures that you never miss a crucial deadline. Such strategies not only foster financial discipline but also provide peace of mind, allowing you to focus on other aspects of your life without the constant worry of forgetting an obligation.

Understanding Bill Payment Calendars

Managing your financial obligations can often feel overwhelming. A structured approach can simplify this process, helping you keep track of when each amount is due and avoiding any late fees. This method allows for better planning and budgeting, ultimately leading to improved financial health.

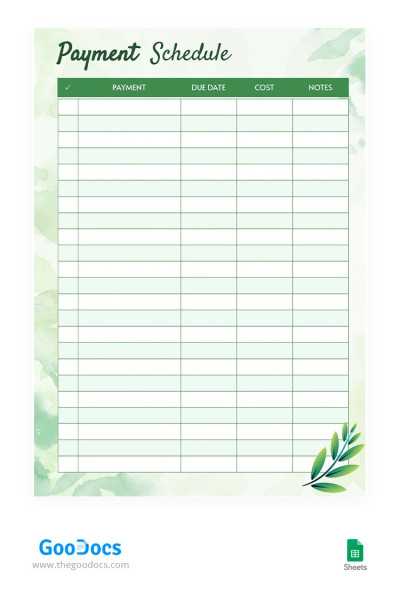

One effective strategy involves creating a clear schedule that outlines each due date. This not only serves as a reminder but also aids in prioritizing which expenses need attention first. By organizing your commitments, you can ensure that funds are allocated appropriately, reducing stress and enhancing your ability to stay on top of your financial responsibilities.

| Due Date | Payee | Amount | Status |

|---|---|---|---|

| 01/05 | Utility Company | $120 | Unpaid |

| 01/10 | Internet Provider | $60 | Paid |

| 01/15 | Credit Card | $200 | Unpaid |

| 01/20 | Rent | $1,000 | Paid |

By utilizing such a layout, individuals can visually track their responsibilities and ensure that they are fulfilling them in a timely manner. This approach not only enhances accountability but also fosters better financial habits in the long run.

Benefits of Using a Calendar Template

Utilizing a structured framework to manage due dates can significantly enhance personal organization and financial health. By systematically tracking obligations, individuals can avoid penalties, streamline their routines, and foster a sense of control over their commitments.

Enhanced Organization

Employing a systematic approach offers numerous advantages:

- Visual clarity: A clear overview of upcoming deadlines minimizes confusion.

- Structured reminders: Timely notifications can prevent last-minute rushes.

- Prioritization: Easily identify which obligations require immediate attention.

Financial Awareness

Regularly updating and reviewing your schedule cultivates better financial habits:

- Tracking expenditures: A clear layout aids in monitoring where money is allocated.

- Planning ahead: Forecasting future commitments can help in budgeting more effectively.

- Avoiding late fees: Staying informed about deadlines helps in sidestepping unnecessary charges.

How to Choose the Right Template

Selecting the ideal organizational framework can significantly impact your financial management strategy. It’s essential to consider various factors to ensure that the chosen layout aligns with your unique requirements and preferences. By assessing your personal habits and needs, you can find a suitable option that enhances your tracking process.

First and foremost, evaluate your overall goals. Are you looking for something simple and straightforward, or do you need a more detailed structure with multiple categories? Identifying your primary objectives will guide your decision-making process.

Next, consider the level of customization you desire. Some individuals prefer a flexible design that allows for adjustments, while others may favor a pre-defined structure that minimizes complexity. Reflect on your comfort level with modifying formats and choose accordingly.

Additionally, think about usability and accessibility. A user-friendly format will encourage consistent engagement and make it easier to maintain your financial overview. Check if the chosen option can be easily accessed across various devices, ensuring convenience in tracking your obligations.

Lastly, don’t overlook aesthetic appeal. A visually pleasing layout can motivate you to stay organized and make the process more enjoyable. Choose an option that resonates with your style, as this can enhance your overall experience.

Essential Features of a Good Template

When it comes to organizing financial obligations, a well-structured framework can make all the difference. A thoughtfully designed resource not only enhances efficiency but also promotes better management of one’s fiscal responsibilities. Certain characteristics can elevate a basic layout into a powerful tool for maintaining oversight.

User-Friendly Interface: An intuitive design is crucial. Users should be able to navigate easily, allowing for quick access to necessary information without confusion. Clear labeling and a logical flow of information contribute significantly to overall usability.

Customizability: Each individual’s financial situation is unique. The ability to tailor sections to specific needs empowers users to track various obligations effectively. Options to add, modify, or remove entries are essential for personal relevance.

Reminder Functionality: Automated alerts serve as a valuable feature. Notifications can help users stay ahead of deadlines, preventing late fees and promoting timely management of obligations. This proactive approach is fundamental for financial health.

Visual Appeal: Aesthetics play a role in user engagement. An attractive layout with appropriate color schemes and fonts can make the process of tracking obligations more enjoyable and less daunting.

Data Security: Protecting sensitive information is paramount. Features that ensure confidentiality and security build trust and encourage consistent use. Users should feel assured that their data is safeguarded.

In summary, an effective structure combines ease of use, adaptability, proactive reminders, visual charm, and robust security. These elements work together to create a comprehensive system that simplifies the management of financial commitments.

Customizing Your Bill Payment Schedule

Managing your financial commitments can often feel overwhelming, but creating a tailored approach can simplify the process significantly. By organizing due dates and setting up reminders, you can ensure timely settlements while minimizing stress. Personalization is key to developing a system that works specifically for your lifestyle and obligations.

Assessing Your Financial Obligations

Start by evaluating all your financial responsibilities. List each one along with its due date and amount. This will provide a clear overview of what needs to be prioritized. Understanding your cash flow can also help in determining the best time to address each obligation, ensuring you are never caught off guard.

Implementing Reminders and Alerts

Once you have a clear understanding of your commitments, consider utilizing technology to your advantage. Set up reminders on your phone or computer to notify you well in advance of due dates. This proactive approach not only helps in avoiding late fees but also allows for better financial planning. Use apps or digital tools that can sync with your personal schedule for added convenience.

Incorporating these strategies will not only enhance your ability to manage your finances but will also provide peace of mind as you stay on top of your obligations.

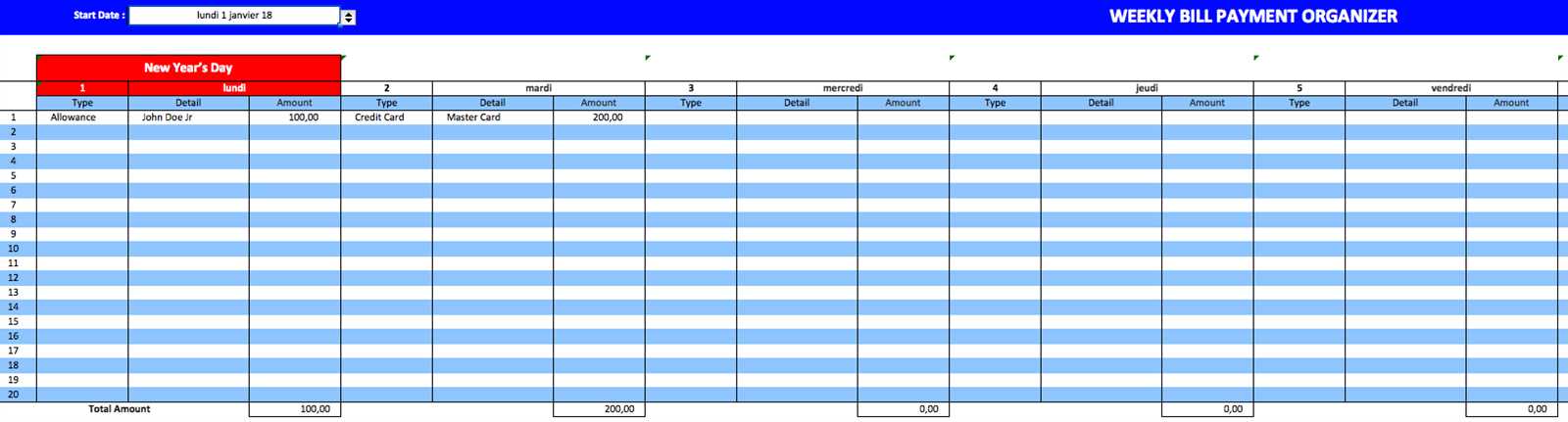

Tracking Payments Effectively

Maintaining a clear overview of financial obligations is crucial for managing personal and professional finances. A systematic approach to monitoring due dates and amounts can significantly reduce the risk of missing important deadlines, thus ensuring a smoother financial experience. This practice involves creating a reliable system that allows for easy tracking and timely actions, ultimately leading to better budgeting and financial planning.

To enhance your ability to monitor expenses, consider implementing a structured method. Below is a simple format that can help you organize and oversee your obligations:

| Due Date | Description | Amount | Status |

|---|---|---|---|

| 2024-11-05 | Utility Services | $100 | Pending |

| 2024-11-10 | Internet Subscription | $60 | Pending |

| 2024-11-15 | Credit Card Payment | $150 | Pending |

By regularly updating this record and checking it against your financial activities, you can ensure that all commitments are met on time. This not only helps in avoiding late fees but also promotes a disciplined approach to personal finance management.

Setting Reminders for Due Dates

Keeping track of important deadlines is essential to avoid last-minute scrambles. Establishing effective alerts ensures that you remain informed about upcoming responsibilities, allowing for timely actions and reducing stress. By utilizing various methods, you can enhance your organizational skills and maintain a smooth flow of obligations.

Utilizing Digital Tools

Modern technology offers numerous applications designed to assist with reminders. Utilizing smartphone apps or desktop software can provide notifications directly to your device, ensuring you are alerted well in advance. Many of these tools allow customization, so you can set specific times and frequencies for alerts that suit your routine best.

Traditional Methods

If you prefer a more tactile approach, consider using physical planners or sticky notes. Writing down important dates in a planner or placing reminders in visible locations can serve as effective prompts. This method caters to those who find that visual cues help reinforce their memory and keep them on track.

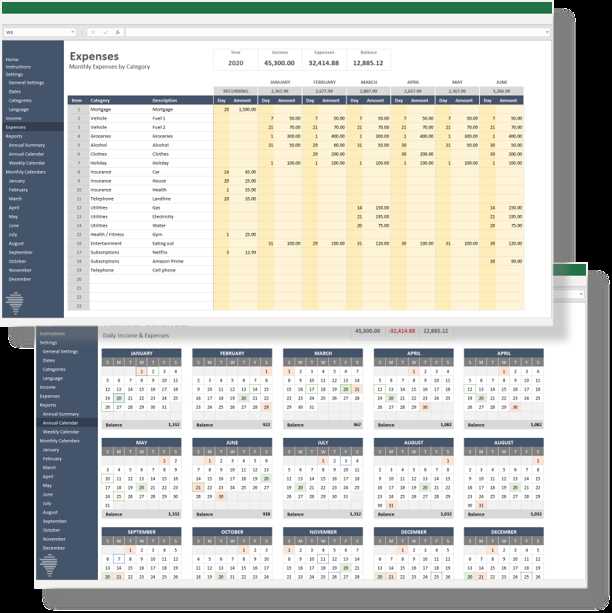

Integrating with Digital Tools

In today’s fast-paced environment, leveraging technology can significantly enhance how we manage our financial commitments. By seamlessly connecting various digital solutions, individuals and businesses can create a cohesive approach to staying organized and on track with their responsibilities. This integration not only improves efficiency but also reduces the likelihood of oversight.

Utilizing Applications

Numerous applications are available that specialize in tracking obligations and reminders. These platforms often provide features such as notifications, automated scheduling, and even synchronization with financial accounts. By selecting the right tools, users can ensure they are informed in real-time, allowing for timely actions and decisions.

Cloud Services and Collaboration

Cloud-based services enable users to share and access their schedules from multiple devices. This collaborative approach can be particularly beneficial for families or teams, as it fosters transparency and accountability. Integrating these services with other financial tools can create a holistic view of one’s commitments, simplifying management and promoting proactive engagement.

Managing Recurring Payments with Ease

Handling regular financial obligations can often feel overwhelming, yet it doesn’t have to be. By establishing a systematic approach, you can simplify the process, ensuring that everything is taken care of on time. This allows you to focus on other important aspects of your life without the constant worry of missing due dates.

Creating a structured plan is essential for effective management. Start by identifying all the regular expenses you need to address each month. This might include subscriptions, utilities, and loan installments. Once you have a comprehensive list, you can prioritize them according to their due dates and amounts.

Utilizing automated solutions can significantly ease the burden of remembering each obligation. Many financial institutions and service providers offer options to set up automatic withdrawals. This feature not only saves time but also helps avoid late fees and negative impacts on your credit score.

In addition to automation, maintaining a track record of your expenses is crucial. Consider using a budgeting app or a simple spreadsheet to monitor your financial commitments. Regularly reviewing this information can provide insights into your spending habits and help you adjust as needed, ensuring you stay on top of your finances.

Lastly, be proactive about communicating with service providers. If you anticipate a change in your financial situation, reach out to discuss options for adjusting payment schedules or amounts. Many companies are willing to work with you to find a solution that meets both parties’ needs.

Creating a Family Bill Payment Calendar

Establishing a unified schedule for managing household expenses can significantly ease financial stress. This approach not only ensures timely settlements but also fosters teamwork among family members. By outlining obligations in a clear manner, everyone can contribute to maintaining the household budget effectively.

Benefits of a Unified Financial Schedule

Adopting a collective approach to financial responsibilities promotes transparency and accountability. When each member is aware of their roles and the timing of upcoming dues, it reduces the likelihood of missed deadlines. This practice can also encourage discussions about budgeting, helping the family to plan future expenditures more efficiently.

Steps to Create an Effective System

Start by gathering all necessary information regarding recurring expenses. List out due dates, amounts, and payment methods for each obligation. Next, assign specific tasks to family members to ensure that responsibilities are shared. Utilizing a shared digital platform or a physical board can help visualize the timeline, making it easier for everyone to stay informed. Regularly reviewing and updating this system will keep the family on track and adaptable to any changes in financial circumstances.

Comparing Online vs. Offline Templates

When it comes to organizing financial obligations, individuals often face the choice between digital and traditional methods. Each approach offers distinct advantages and drawbacks, influencing how users manage their schedules and keep track of their commitments.

Digital solutions provide convenience and accessibility, allowing users to set reminders and access their information from various devices. This modern approach often includes features like automated alerts and synchronization with other applications, enhancing efficiency. On the other hand, traditional methods offer a tangible experience, enabling individuals to physically write down their tasks, which can aid memory retention and create a sense of satisfaction when checking off completed items.

Ultimately, the decision between these two options depends on personal preferences and lifestyle. Some may prefer the immediacy and integration of online tools, while others might value the simplicity and mindfulness of a paper-based system. Understanding these differences can help users select the most effective strategy for managing their obligations.

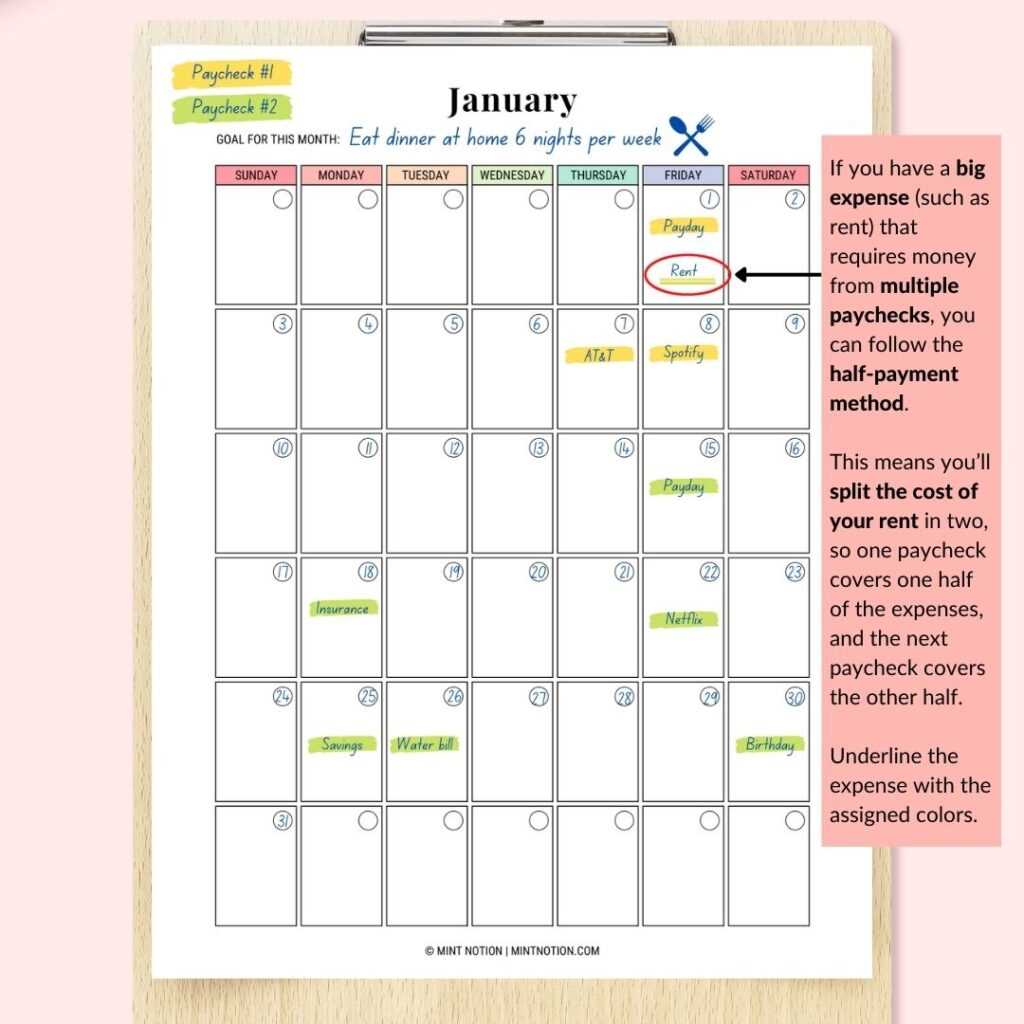

Using Color Codes for Clarity

Implementing a color-coding system can significantly enhance organization and understanding of various obligations. By assigning specific hues to different categories, you create an immediate visual distinction that aids in quick recognition and prioritization. This method not only streamlines tracking but also minimizes the risk of overlooking critical responsibilities.

Below is an example of how to effectively utilize color codes in your planning system:

| Color | Category | Description |

|---|---|---|

| Green | Recurring Charges | Monthly subscriptions and utilities |

| Red | Urgent Obligations | Due dates approaching within the week |

| Blue | Non-Essential Expenses | Optional purchases or services |

| Yellow | Upcoming Due Dates | Items due in the next month |

This approach not only organizes tasks visually but also enhances productivity, allowing individuals to manage their obligations with greater ease and efficiency.

Strategies for Staying Organized

Maintaining an efficient system for managing your financial obligations can significantly enhance your productivity and peace of mind. By implementing a few effective methods, you can streamline your approach and ensure that nothing slips through the cracks. The following strategies are designed to help you remain on top of your responsibilities without unnecessary stress.

Utilize Digital Tools

Leveraging technology can simplify the tracking of your financial commitments. Various applications and software options allow you to set reminders, categorize expenses, and even automate transactions. Choosing the right tools can transform your management process into a seamless experience.

Create a Structured Schedule

Establishing a well-organized timetable can aid in visualizing due dates and necessary actions. Consider the following structure to maintain clarity:

| Week | Task | Due Date |

|---|---|---|

| 1 | Review Expenses | Monday |

| 2 | Set Reminders | Wednesday |

| 3 | Check Account Balances | Friday |

| 4 | Plan for Upcoming Obligations | Saturday |

By following these structured approaches, you can enhance your overall organization and ensure timely management of your financial duties.

Addressing Late Payments and Fees

Timely settlement of financial obligations is crucial for maintaining good standing with service providers and avoiding unnecessary penalties. When deadlines are missed, not only can this lead to increased charges, but it can also affect credit ratings and overall financial health. Understanding how to manage these situations effectively can alleviate stress and minimize consequences.

Understanding Late Fees

Late fees can vary significantly based on the type of obligation and the policies of the provider. Familiarizing yourself with these charges can help you make informed decisions about your finances. Below is a breakdown of common fees associated with overdue amounts:

| Type of Obligation | Typical Late Fee | Impact on Credit |

|---|---|---|

| Utilities | $10 – $30 | No immediate impact |

| Credit Cards | Up to $40 | Possible negative effect |

| Loans | $15 – $50 | May affect score |

Strategies to Avoid Late Fees

Implementing proactive measures can significantly reduce the risk of incurring extra charges. Consider the following strategies:

- Set reminders for due dates through digital notifications or alerts.

- Establish automatic deductions from your bank account for recurring obligations.

- Review your obligations regularly to keep track of upcoming deadlines.

Sharing Your Template with Others

Collaborating with others can enhance efficiency and organization in managing financial commitments. By distributing your structured schedule, you can help friends or family members keep track of their responsibilities more effectively.

Here are some ways to share your organized schedule:

- Email: Send your document as an attachment or include a link to an online version.

- Cloud Storage: Upload to services like Google Drive or Dropbox, and share access with others.

- Social Media: Post a link or screenshot to inform your network about important dates.

- Printed Copies: Distribute physical copies during meetings or family gatherings.

Consider the following tips for effective sharing:

- Clarity: Ensure that your document is easy to read and understand.

- Updates: Regularly revise the information and notify others of changes.

- Access: Choose sharing methods that suit your audience’s preferences.

By effectively sharing your organized plan, you contribute to a collective effort in staying on top of financial responsibilities, fostering better habits among those you share it with.

Updating Your Calendar Regularly

Maintaining an organized schedule is essential for managing financial obligations effectively. Regularly refreshing your planning system ensures that all important dates are current, preventing any unexpected lapses. By committing to this practice, you enhance your ability to stay on top of upcoming responsibilities and minimize the risk of late fees or service interruptions.

Set aside time each month to review and adjust your entries. This proactive approach allows you to add new commitments and remove outdated ones, ensuring that your records accurately reflect your current situation. Incorporating reminders can also be beneficial, as they prompt you to revisit your schedule periodically, keeping everything aligned with your financial goals.

Additionally, integrating digital tools can streamline this process. Many applications offer synchronization features, allowing you to update your information effortlessly across multiple devices. This convenience supports your efforts to maintain accuracy and accessibility, making it easier to manage your obligations on the go.

Case Studies: Success Stories

This section showcases real-world examples demonstrating how effective organization strategies can lead to enhanced financial management. By exploring various scenarios, we can uncover valuable insights into the practices that have helped individuals and businesses streamline their financial obligations.

One notable case involved a small business owner who struggled to keep track of various financial commitments. By implementing a systematic approach to scheduling due dates and reminders, the owner significantly reduced late fees and improved cash flow. The shift not only alleviated stress but also fostered stronger relationships with vendors through timely settlements.

Another inspiring story comes from a family that faced challenges in managing household expenses. By establishing a clear routine for monitoring obligations, they gained better control over their finances. This proactive method allowed them to allocate funds more efficiently, ultimately enabling them to save for a family vacation, something they had long dreamed of achieving.

These examples illustrate the power of structured planning in achieving financial goals. Whether for personal or professional contexts, implementing thoughtful strategies can transform how commitments are managed, leading to greater peace of mind and financial stability.

Future Trends in Bill Management

The landscape of managing financial obligations is rapidly evolving, driven by technological advancements and changing consumer preferences. Innovations in this arena promise to enhance convenience, efficiency, and transparency, reshaping how individuals and businesses track their commitments.

Automation will play a pivotal role in the future, with intelligent systems capable of analyzing spending patterns and predicting upcoming dues. This shift toward automation will minimize human error and streamline the entire process, allowing users to focus on more critical financial decisions.

Mobile accessibility is another trend that will dominate, as smartphones become the primary tool for managing financial responsibilities. With mobile applications offering real-time notifications and easy access to financial summaries, users will enjoy unprecedented control over their finances, making timely decisions at their fingertips.

Moreover, the integration of artificial intelligence and machine learning will provide personalized insights, helping users understand their habits and offering tailored advice on optimizing their spending and saving strategies. This level of customization will foster more responsible financial management.

Finally, as digital payment solutions gain traction, the emphasis on security and privacy will intensify. Enhanced encryption methods and blockchain technology will ensure that sensitive financial information is protected, fostering trust and encouraging broader adoption of these modern management tools.