Effective management of an organization’s monetary resources is crucial for sustained success and growth. Understanding the timing and amounts of incoming and outgoing funds enables businesses to make informed decisions, allocate resources wisely, and mitigate potential risks. A structured approach to monitoring financial activities can lead to improved strategic planning and operational efficiency.

Implementing a systematic method for tracking monetary movements helps professionals anticipate their financial needs, ensuring they remain prepared for both opportunities and challenges. By visualizing income and expenditures over specified periods, businesses can maintain a clearer picture of their financial health and establish a more reliable basis for future projections.

In this context, utilizing a practical instrument designed for organizing and visualizing these monetary transactions can greatly enhance one’s ability to oversee finances. Such a resource provides a comprehensive overview, enabling individuals and organizations to prioritize their financial commitments and optimize their economic strategies effectively.

Understanding Cash Flow Management

Effective financial oversight is crucial for any business seeking to thrive. This involves tracking the movement of funds, ensuring that income aligns with expenditures, and maintaining a healthy balance to meet obligations and seize opportunities. A comprehensive understanding of this process can significantly influence a company’s stability and growth.

The Importance of Financial Monitoring

Regularly assessing financial activities helps businesses:

- Identify trends and patterns in revenue and expenses.

- Anticipate potential shortfalls and prepare solutions.

- Make informed decisions about investments and operational adjustments.

Key Strategies for Effective Management

To enhance financial oversight, consider implementing the following strategies:

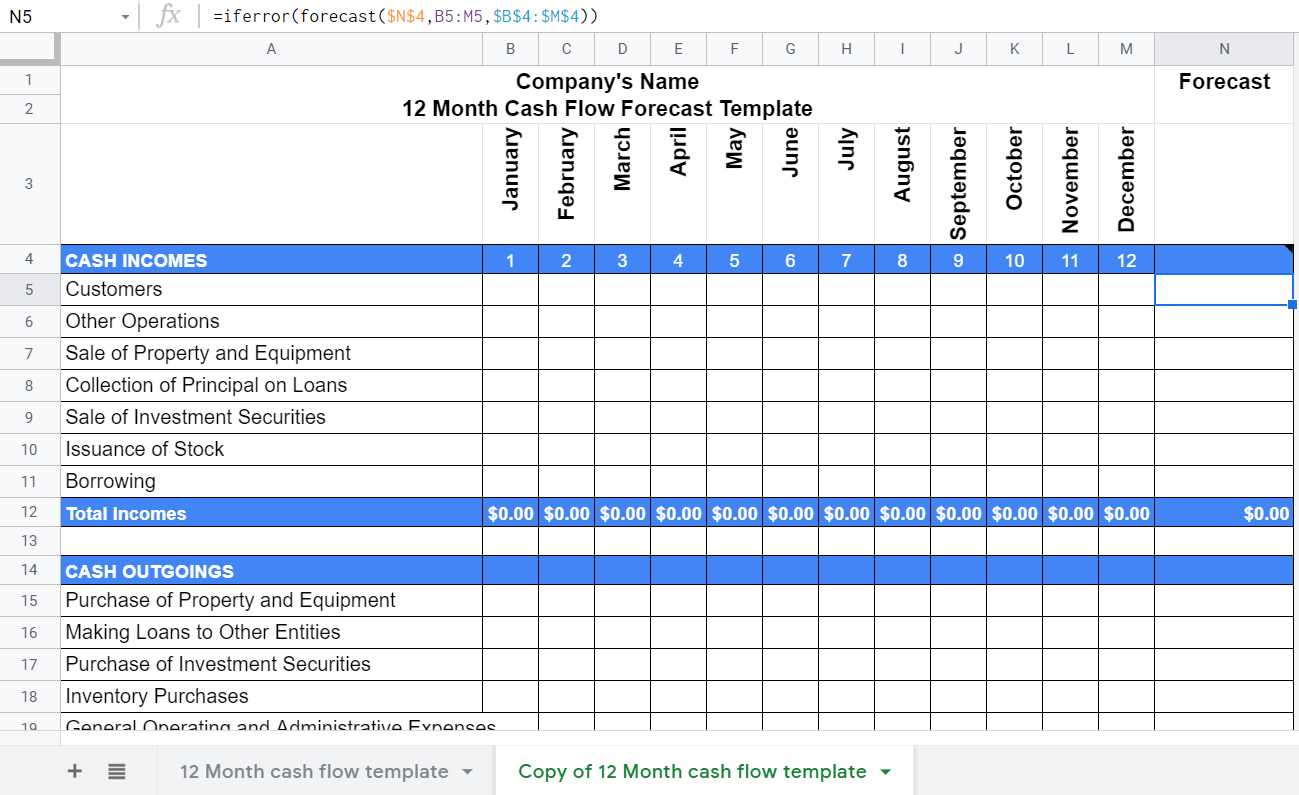

- Forecasting: Predict future income and outflows based on historical data and market analysis.

- Budgeting: Create a detailed budget that outlines expected financial activities over a specific period.

- Monitoring: Regularly review financial statements and reports to track performance against the budget.

- Adjusting: Be prepared to make changes based on actual performance and external factors impacting the business.

By prioritizing financial oversight, organizations can ensure they remain resilient and responsive to changing circumstances, ultimately leading to sustained success.

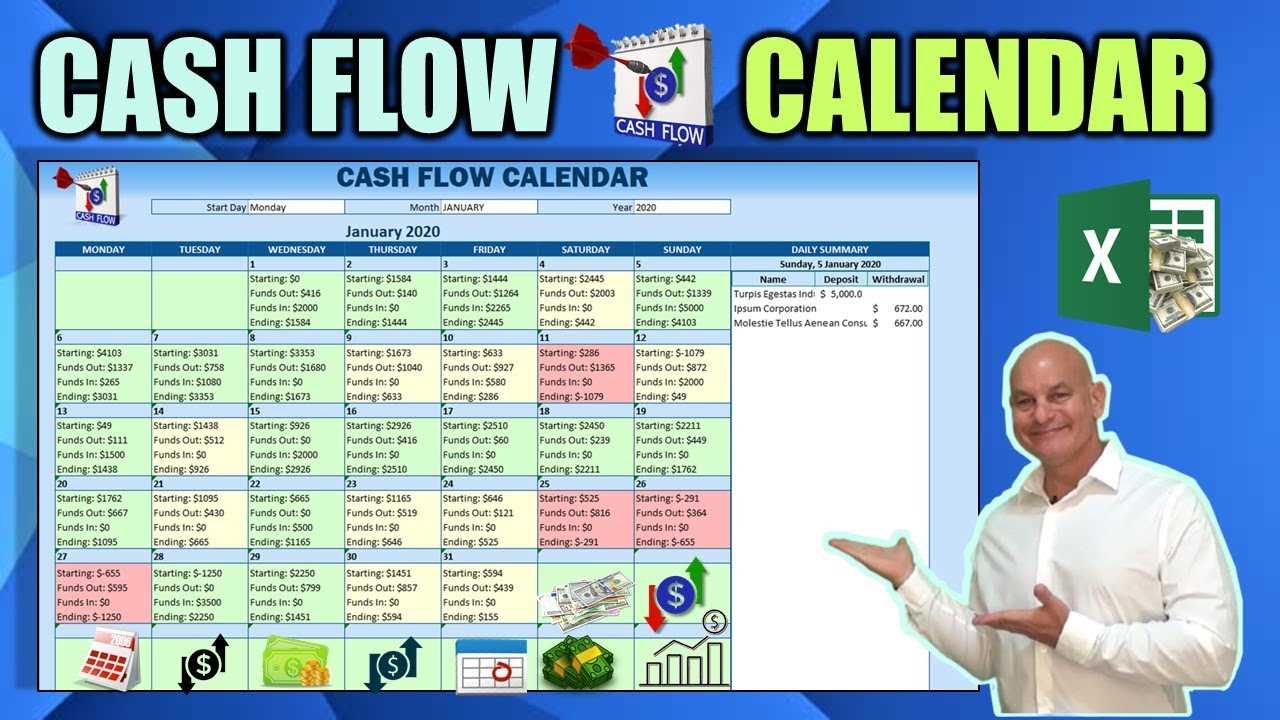

What is a Cash Flow Calendar?

A financial planning tool that helps individuals and businesses track the timing of their monetary inflows and outflows is essential for effective management. This instrument allows for better forecasting and ensures that resources are allocated efficiently, enabling users to anticipate potential shortages or surpluses in their finances.

Purpose and Benefits

The primary goal of this tool is to provide a clear overview of expected receipts and expenditures over a specified period. By visualizing these elements, users can make informed decisions regarding budgeting and investment. It promotes proactive financial behavior, allowing for timely adjustments when needed.

Structure and Components

Typically, this resource includes various categories such as income sources, fixed expenses, and variable costs. Organizing information in a systematic manner enhances clarity and usability.

| Category | Description |

|---|---|

| Income | Sources of revenue, including salaries, sales, and investments. |

| Fixed Expenses | Recurring costs that do not change, such as rent and utilities. |

| Variable Costs | Expenses that fluctuate, like groceries and entertainment. |

Benefits of Using a Calendar Template

Utilizing a structured planning tool can significantly enhance organization and time management. It provides a visual representation of upcoming obligations, enabling individuals to prioritize tasks effectively. This approach not only streamlines scheduling but also fosters productivity and reduces stress.

Enhanced Organization

Employing a systematic layout helps in categorizing responsibilities and deadlines. This clarity ensures that important dates are not overlooked, allowing for better preparation and execution of tasks.

Improved Accountability

Having a designated schedule encourages individuals to take ownership of their commitments. By tracking progress and deadlines, users can hold themselves accountable, ultimately leading to better outcomes in both personal and professional endeavors.

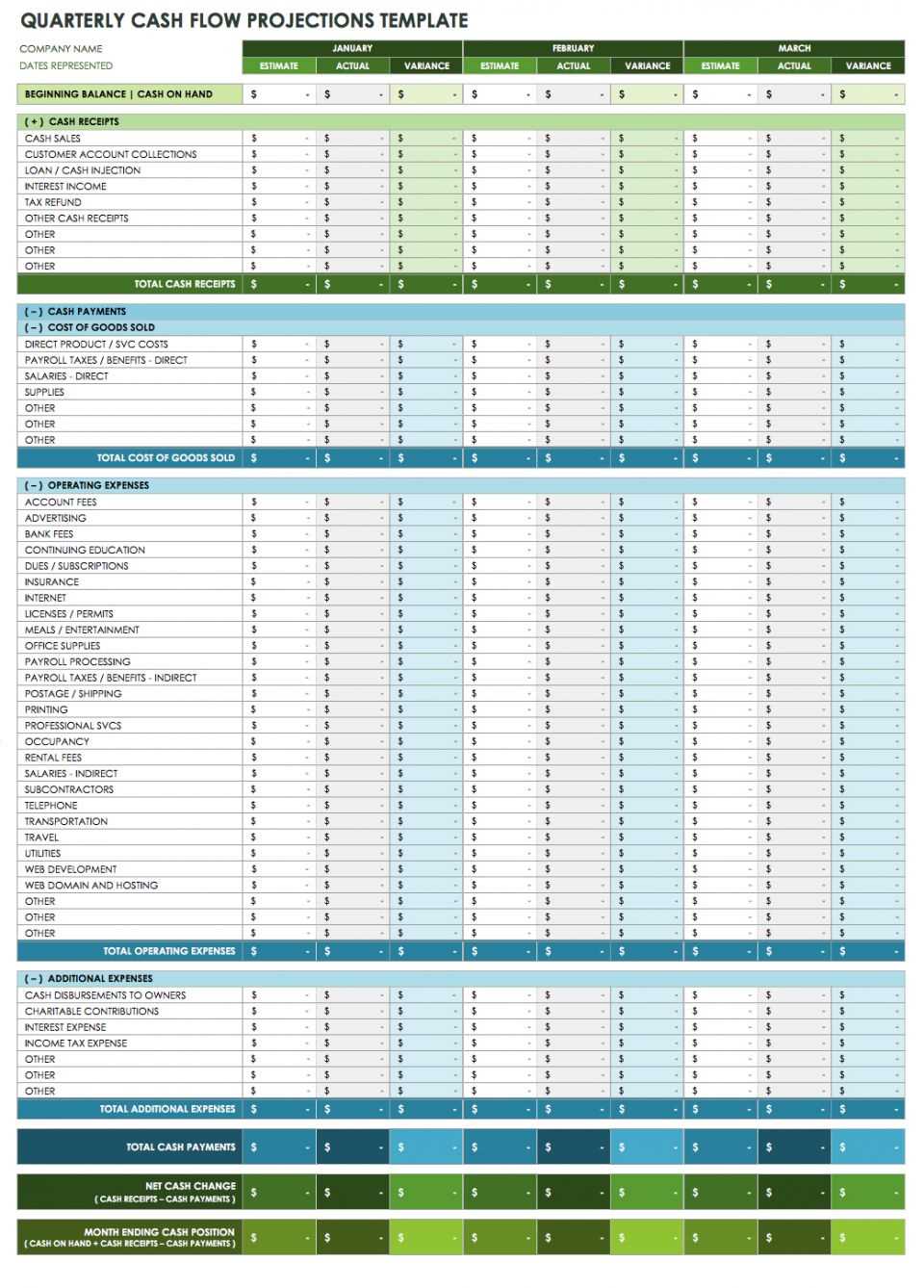

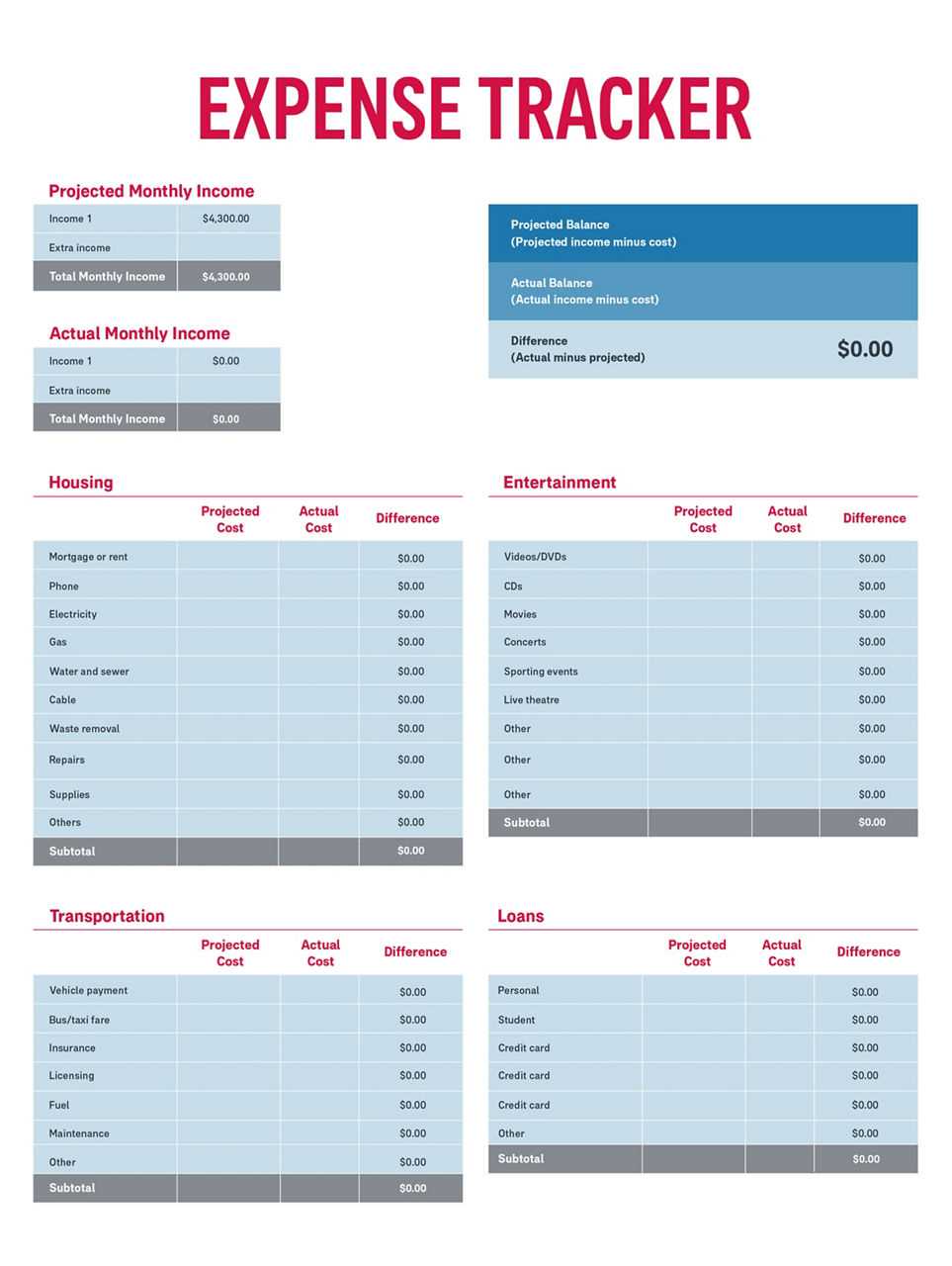

Essential Components of Cash Flow Tracking

Monitoring the movement of funds is crucial for maintaining financial health and ensuring sustainability in any business. A robust system not only helps in understanding current financial standing but also aids in forecasting future trends. Key elements play a significant role in this process.

- Income Sources: Identify all streams of revenue, including sales, investments, and any additional earnings. Accurate tracking begins with a comprehensive list of where money is coming from.

- Expenditure Categories: Classify expenses into fixed and variable costs. Understanding where funds are being spent helps in identifying potential areas for savings.

- Timing of Transactions: Document when income is received and when payments are due. This timing is essential for avoiding shortages and ensuring obligations are met.

- Forecasting: Utilize historical data to predict future income and expenses. This foresight allows businesses to prepare for fluctuations and make informed decisions.

- Reporting: Regularly generate reports to visualize the financial position. These documents are vital for analyzing trends and making strategic adjustments.

Incorporating these components into a financial monitoring system creates a clear picture of an organization’s monetary health and aids in informed decision-making.

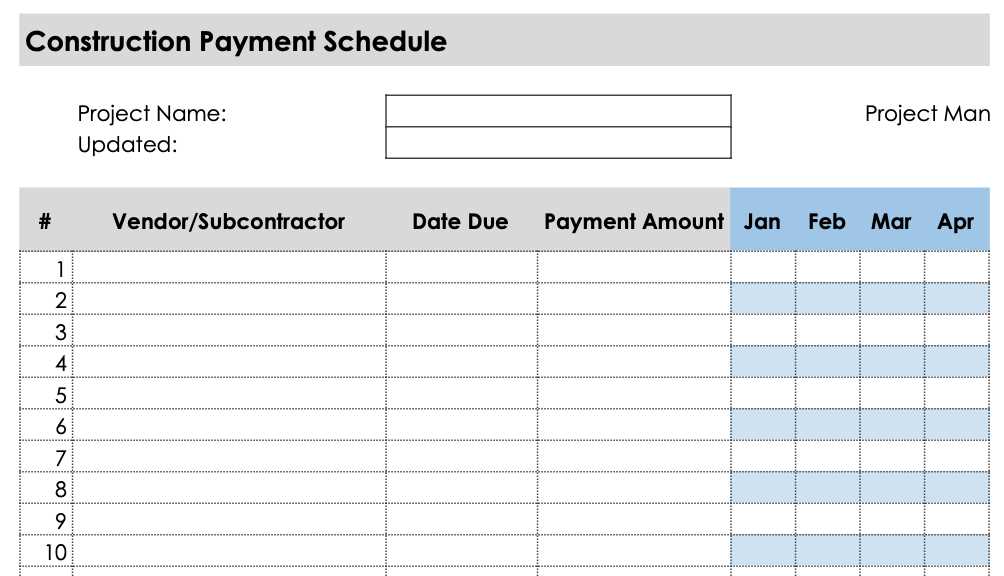

How to Create a Cash Flow Calendar

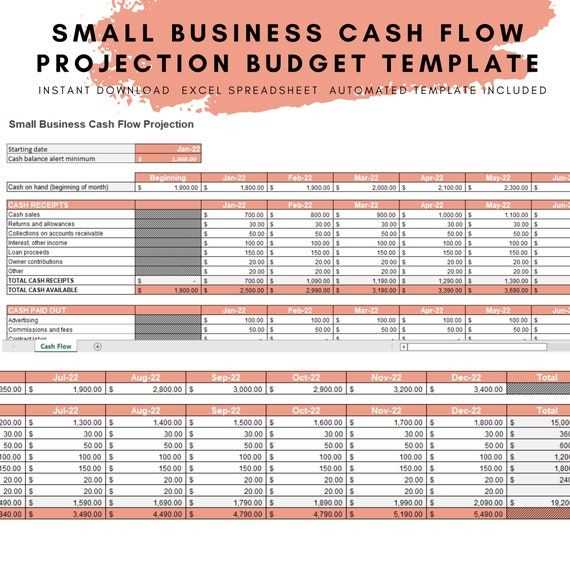

Establishing a structured approach to monitoring and predicting your financial movements is essential for effective management. By organizing your income and expenditures over specific periods, you can gain valuable insights into your fiscal health, allowing for better decision-making and planning. This section outlines the steps to develop an efficient schedule that captures all financial activities systematically.

Step 1: Gather Financial Information

Begin by collecting all relevant financial data, including income sources, recurring payments, and any expected one-time transactions. This information will serve as the foundation for your organized structure. Ensure you account for all potential income streams and obligations to create a comprehensive overview.

Step 2: Choose the Right Timeframe

Select the timeframe that best suits your needs, whether it be weekly, monthly, or quarterly. A shorter timeframe may provide more detailed insight, while a longer duration can help identify trends over time. Consistency in your chosen intervals will enhance the reliability of your financial insights.

Types of Cash Flow Calendar Templates

Understanding various formats for tracking financial movements can significantly enhance an organization’s budgeting and forecasting capabilities. Each type serves unique needs, enabling users to monitor their monetary transitions efficiently and make informed decisions based on their financial landscapes.

1. Monthly Overview Format

This design provides a comprehensive view of incoming and outgoing finances for each month. It allows businesses to easily visualize trends and identify periods of surplus or deficit. With dedicated sections for anticipated revenue and expenditures, users can plan strategically for upcoming obligations and investment opportunities.

2. Weekly Tracker Structure

A more granular approach is the weekly tracker, which breaks down financial activities into manageable segments. This format is particularly useful for small businesses or freelancers who need to keep a close eye on short-term liquidity. By recording transactions on a weekly basis, users can quickly adapt to fluctuations in their economic environment and ensure they remain solvent.

Monthly vs. Weekly Cash Flow Calendars

Understanding the different timeframes for financial tracking is crucial for effective budgeting and resource management. Each approach offers unique advantages and suits varying business needs. Choosing between a longer-term view or a more granular perspective can significantly impact decision-making and financial health.

Benefits of Monthly Tracking

Utilizing a monthly overview allows for a broader perspective on income and expenditures. This longer timeframe helps in identifying trends and patterns that might not be evident in shorter intervals. Businesses can better plan for large expenses, assess monthly profitability, and make informed projections for the upcoming months. Additionally, this method simplifies reporting and analysis, making it easier to communicate financial status to stakeholders.

Advantages of Weekly Monitoring

A weekly approach offers a more detailed examination of financial activities, enabling prompt adjustments to spending and revenue strategies. This frequency allows businesses to respond quickly to changes in cash availability, helping to avoid shortfalls. Regular reviews also facilitate tighter control over resources, ensuring that any discrepancies are caught early. For organizations with fluctuating income or expenses, this method provides a dynamic tool for maintaining financial stability.

Common Mistakes in Cash Flow Management

Effective management of financial resources is crucial for the sustainability of any business. However, there are several pitfalls that can hinder this process, leading to unforeseen challenges. Understanding these common missteps can help organizations optimize their financial practices and ensure long-term success.

1. Inaccurate Projections

One of the most frequent errors is the reliance on faulty forecasts. Businesses often overestimate income or underestimate expenses, resulting in a distorted financial picture. This can lead to:

- Insufficient funds during critical periods

- Inability to meet financial obligations

- Loss of credibility with stakeholders

2. Ignoring Timing Differences

Another significant mistake is failing to consider the timing of revenue and expenditures. Organizations may overlook the fact that income does not always coincide with expenses, leading to cash shortages. Key factors to keep in mind include:

- Payment terms with clients and suppliers

- Seasonal variations in sales

- Delayed invoices or collections

By recognizing these common miscalculations, businesses can take proactive steps to enhance their financial strategies and maintain a healthier economic position.

Integrating Software with Cash Flow Tracking

In today’s business environment, the effective management of financial resources is essential for sustainability and growth. Leveraging technology for monitoring and predicting financial movement can provide valuable insights, streamline processes, and enhance decision-making capabilities.

Benefits of Software Integration

Integrating specialized applications into financial management practices offers several advantages:

- Real-time Monitoring: Automated tools allow for immediate visibility into financial activities, helping to identify trends and potential issues promptly.

- Enhanced Accuracy: Reducing manual data entry minimizes errors, ensuring that financial information is reliable and up-to-date.

- Data Analysis: Advanced analytics can uncover patterns and forecasts, enabling informed strategic planning.

Key Features to Consider

When choosing software for tracking financial resources, consider the following features:

- Integration Capability: Ensure that the software can connect seamlessly with existing financial systems and other tools.

- User-Friendly Interface: A simple and intuitive design promotes user adoption and reduces training time.

- Reporting Tools: Look for robust reporting functions that provide insights into financial status and performance metrics.

- Mobile Access: Mobile-friendly options facilitate on-the-go management and oversight.

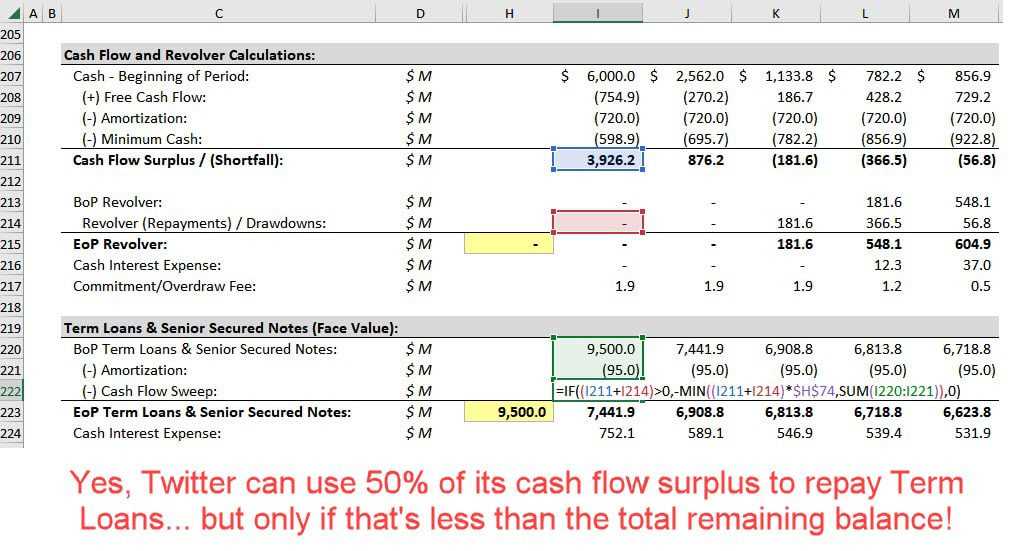

Visualizing Cash Flow with Charts

Creating clear representations of financial movements can significantly enhance understanding and decision-making. By utilizing graphical tools, individuals and organizations can transform complex numerical data into easily digestible visuals. These representations not only facilitate better insights but also help in identifying trends, patterns, and potential issues over time.

Different types of charts serve unique purposes in depicting financial information. Bar charts, for instance, allow for straightforward comparisons between various categories of income and expenditures, making it simple to spot discrepancies. Line graphs, on the other hand, effectively illustrate changes over time, showcasing the trajectory of financial health at a glance. Pie charts can also be useful for representing proportions, helping to visualize how different elements contribute to the overall financial picture.

Incorporating these visual elements into financial analysis encourages more informed decisions. Stakeholders can quickly assess the impact of their financial activities, facilitating proactive management strategies. Additionally, these visuals can be easily shared with others, promoting transparency and collaborative planning.

To maximize the effectiveness of these visual tools, it is essential to choose the right type of chart for the specific data being analyzed. Ensuring clarity and accuracy in representation is crucial, as misleading visuals can lead to poor conclusions. By thoughtfully integrating charts into financial evaluations, one can achieve a more nuanced understanding of economic dynamics.

Strategies for Improving Cash Flow

Effective management of financial resources is crucial for maintaining a healthy business. Implementing the right strategies can significantly enhance the liquidity position, allowing organizations to meet their obligations and invest in growth opportunities. Below are several approaches to consider.

Optimize Receivables

Accelerating the collection process can lead to a more robust financial standing. Consider offering discounts for early payments, which can incentivize clients to settle invoices sooner. Additionally, establishing clear terms and maintaining consistent communication can help reduce delays in payments. Automating invoicing processes can also streamline operations, ensuring timely billing.

Manage Payables Wisely

Strategic management of outgoing payments can free up valuable resources. Negotiate better terms with suppliers to extend payment deadlines without incurring penalties. This approach allows businesses to retain funds longer while maintaining good relationships. Furthermore, prioritizing payments based on their impact on operations can optimize resource allocation.

Overall, a proactive approach to financial management can pave the way for enhanced stability and growth. Implementing these strategies will contribute to a more favorable financial landscape, enabling organizations to thrive in a competitive environment.

Using Historical Data for Projections

Leveraging past financial performance is essential for making informed future predictions. By analyzing historical patterns, businesses can gain insights into trends and seasonal variations that significantly influence their fiscal outcomes. This approach not only aids in understanding revenue and expense cycles but also enhances strategic planning and resource allocation.

To effectively utilize historical information, it is important to collect and organize relevant data. Below is an example of how this data can be structured to facilitate analysis:

| Year | Quarter | Revenue | Expenses | Net Profit |

|---|---|---|---|---|

| 2021 | Q1 | $50,000 | $30,000 | $20,000 |

| 2021 | Q2 | $60,000 | $35,000 | $25,000 |

| 2022 | Q1 | $55,000 | $32,000 | $23,000 |

| 2022 | Q2 | $70,000 | $40,000 | $30,000 |

By reviewing this structured data, organizations can identify trends, such as growth patterns or fluctuations, that may inform future financial strategies. Additionally, this analysis allows for more accurate forecasting, enabling businesses to prepare for potential challenges and capitalize on opportunities.

Setting Up Alerts for Cash Flow Changes

Monitoring financial transitions is crucial for maintaining a healthy economic status. Implementing notifications can greatly enhance your ability to respond promptly to variations, ensuring that you stay informed and prepared for any financial shifts.

Here are some effective strategies for establishing alerts:

- Utilize Financial Software: Many applications offer built-in notification features that can track your monetary movements and send alerts based on predetermined criteria.

- Email Notifications: Set up alerts through your email provider to receive updates about significant changes in your accounts or balances.

- Mobile Alerts: Enable push notifications on your smartphone for real-time updates regarding your financial status, making it easy to stay informed on the go.

- Threshold Settings: Define specific thresholds for your financial indicators. Alerts will notify you when these limits are reached, allowing for timely decision-making.

By incorporating these techniques, you can ensure that you are always aware of important changes, allowing for better management and strategic planning.

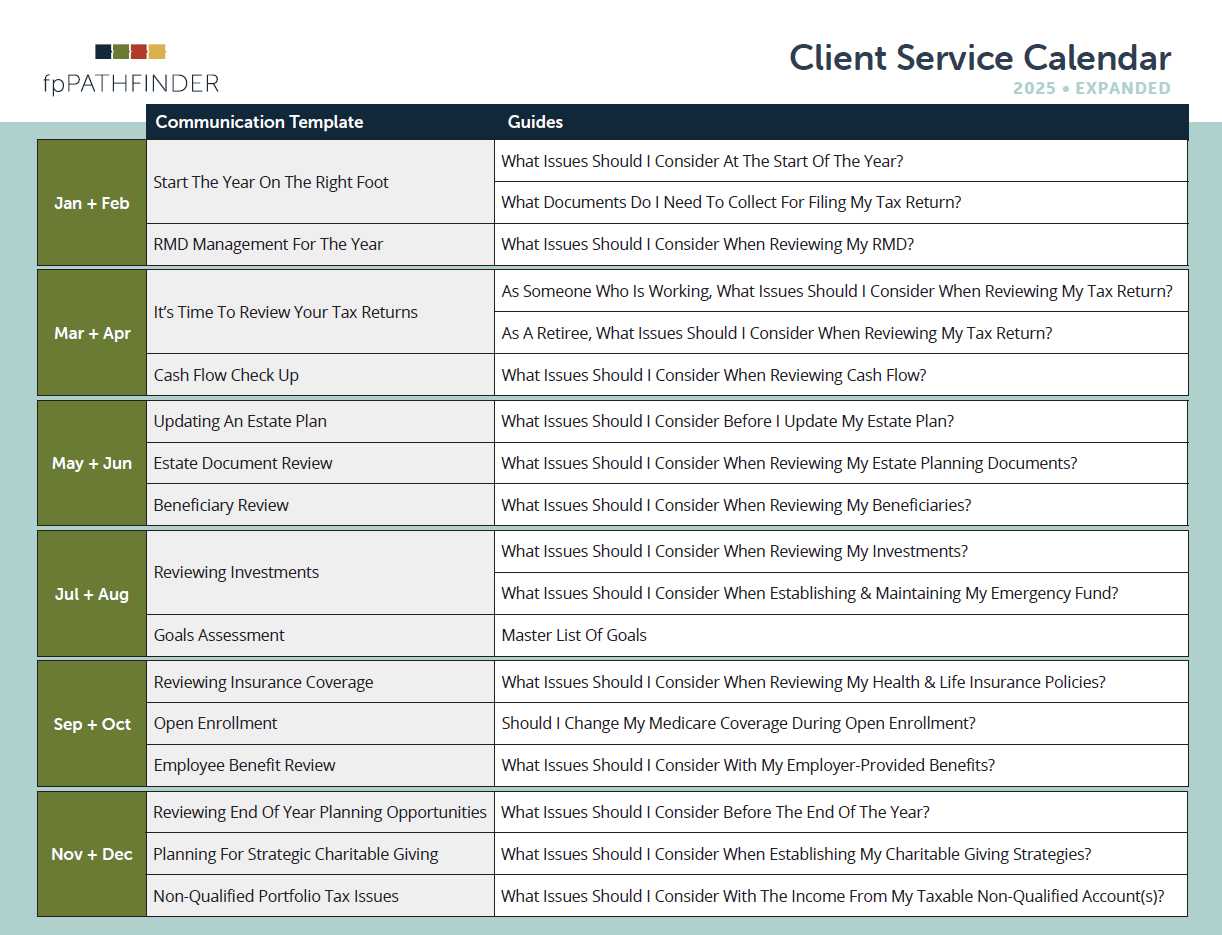

Analyzing Trends in Cash Flow

Understanding the patterns in your financial movement is crucial for effective decision-making. By examining the variations in income and expenses over time, businesses can gain valuable insights into their economic health. Recognizing these trends helps in forecasting future performance and strategizing accordingly.

To conduct a thorough analysis, it’s important to collect data over specific periods, allowing for comparisons and identification of cyclical behaviors. This process can illuminate areas of strength and pinpoint potential risks that may require attention.

| Month | Income | Expenses | Net Position |

|---|---|---|---|

| January | $10,000 | $7,500 | $2,500 |

| February | $12,000 | $8,000 | $4,000 |

| March | $9,000 | $7,000 | $2,000 |

| April | $15,000 | $10,000 | $5,000 |

Reviewing the table above reveals shifts that can indicate seasonal fluctuations or unexpected changes in financial behavior. Identifying these dynamics allows businesses to adapt their strategies, ensuring sustainability and growth in the long run.

Cash Flow vs. Profit: Key Differences

Understanding the distinction between available funds and overall earnings is crucial for any business. While both concepts are fundamental to financial health, they serve different purposes and provide unique insights into the company’s performance. Recognizing how these elements interact can help in making informed decisions and strategic planning.

Available funds refer to the actual money that a business has on hand at any given time. This metric focuses on the movement of cash in and out of the organization, reflecting the liquidity position and ability to meet immediate obligations. On the other hand, earnings represent the total revenue generated from sales minus all expenses incurred, giving a broader view of profitability over a specific period.

One key difference lies in the timing of recognition. Available funds are recorded when cash is received or paid, providing a real-time perspective. In contrast, earnings can include revenues that are accounted for even if payment has not yet been received, leading to potential discrepancies between reported profits and actual cash on hand.

Furthermore, while available funds highlight operational efficiency and short-term financial stability, earnings are often used to evaluate long-term performance and business viability. A company can show healthy profits while struggling with liquidity if its revenue is tied up in accounts receivable or inventory.

In summary, while both metrics are essential for assessing a business’s financial health, understanding their key differences can lead to better management practices and financial strategies. Balancing both aspects is vital for sustained growth and success.

How to Adjust Your Calendar Regularly

Maintaining an organized schedule is essential for effective time management. Regularly updating your planning tool ensures that you stay aligned with your financial objectives and personal commitments. This practice not only enhances your productivity but also helps you anticipate and respond to changes in your circumstances.

To begin with, set aside dedicated time each week to review your schedule. Assess your upcoming tasks and priorities, adjusting them as needed based on new information or shifting deadlines. This will keep your agenda relevant and focused on your goals.

In addition, track your progress regularly. By evaluating what has been accomplished versus what remains, you can identify areas that require more attention or adjustments. This reflection will guide you in making informed decisions about future tasks and timelines.

Moreover, remain flexible. Life is unpredictable, and being open to changes will help you adapt your plans without stress. Embrace unexpected opportunities and challenges by recalibrating your agenda to fit new realities.

Lastly, consider leveraging digital tools for reminders and notifications. These can help you stay on top of your commitments and prompt you to revisit your agenda periodically. Utilizing technology can make the adjustment process smoother and more efficient.

Importance of Regular Reviews

Conducting consistent evaluations of financial practices is essential for maintaining a healthy economic position. Regular assessments not only help in identifying discrepancies but also foster strategic decision-making. By keeping a close eye on financial trends and patterns, organizations can ensure they are on the right path toward their goals.

Benefits of Frequent Evaluations

- Identifying Trends: Regular checks allow businesses to spot emerging patterns that could indicate potential challenges or opportunities.

- Enhancing Budgeting Accuracy: Consistent reviews improve the precision of budgeting, helping to allocate resources more effectively.

- Strengthening Financial Health: Routine monitoring can prevent financial pitfalls by addressing issues before they escalate.

Strategies for Effective Reviews

- Schedule periodic assessments, such as monthly or quarterly, to ensure timely evaluations.

- Involve key stakeholders in the review process to gain diverse insights.

- Utilize analytical tools to facilitate data analysis and reporting.

By prioritizing regular evaluations, organizations can adapt to changes swiftly and maintain a robust economic strategy that supports long-term success.

Resources for Cash Flow Management

Effective management of financial movements is crucial for any business. Utilizing the right resources can enhance visibility into income and expenditures, enabling informed decision-making. From software tools to educational materials, there are various options available to help streamline the process and optimize financial health.

Software Solutions

Investing in dedicated software can significantly simplify tracking financial activities. Many programs offer features like forecasting, reporting, and integration with accounting systems. Popular choices include financial planning tools that help visualize trends and create budgets, allowing businesses to anticipate future needs more accurately.

Educational Resources

Knowledge is key in managing monetary dynamics effectively. Online courses, webinars, and workshops provide valuable insights into best practices and strategies. Additionally, blogs and podcasts focused on financial literacy can offer tips and real-world examples, empowering individuals to enhance their understanding of fiscal management.