Maintaining a clear overview of your financial commitments can greatly enhance your budgeting skills and reduce stress related to money management. By employing a structured approach to tracking expenses and income, individuals can make informed decisions and plan for the future with confidence.

Utilizing a visual guide that helps you record and monitor your monetary activities offers an excellent solution for keeping your finances in check. This method not only simplifies tracking but also allows you to identify trends and adjust your spending habits accordingly.

In this article, we will explore various formats that facilitate efficient financial planning, ensuring that you stay on top of your obligations while maximizing your savings potential. Discover how to implement a practical system that aligns with your lifestyle and financial goals.

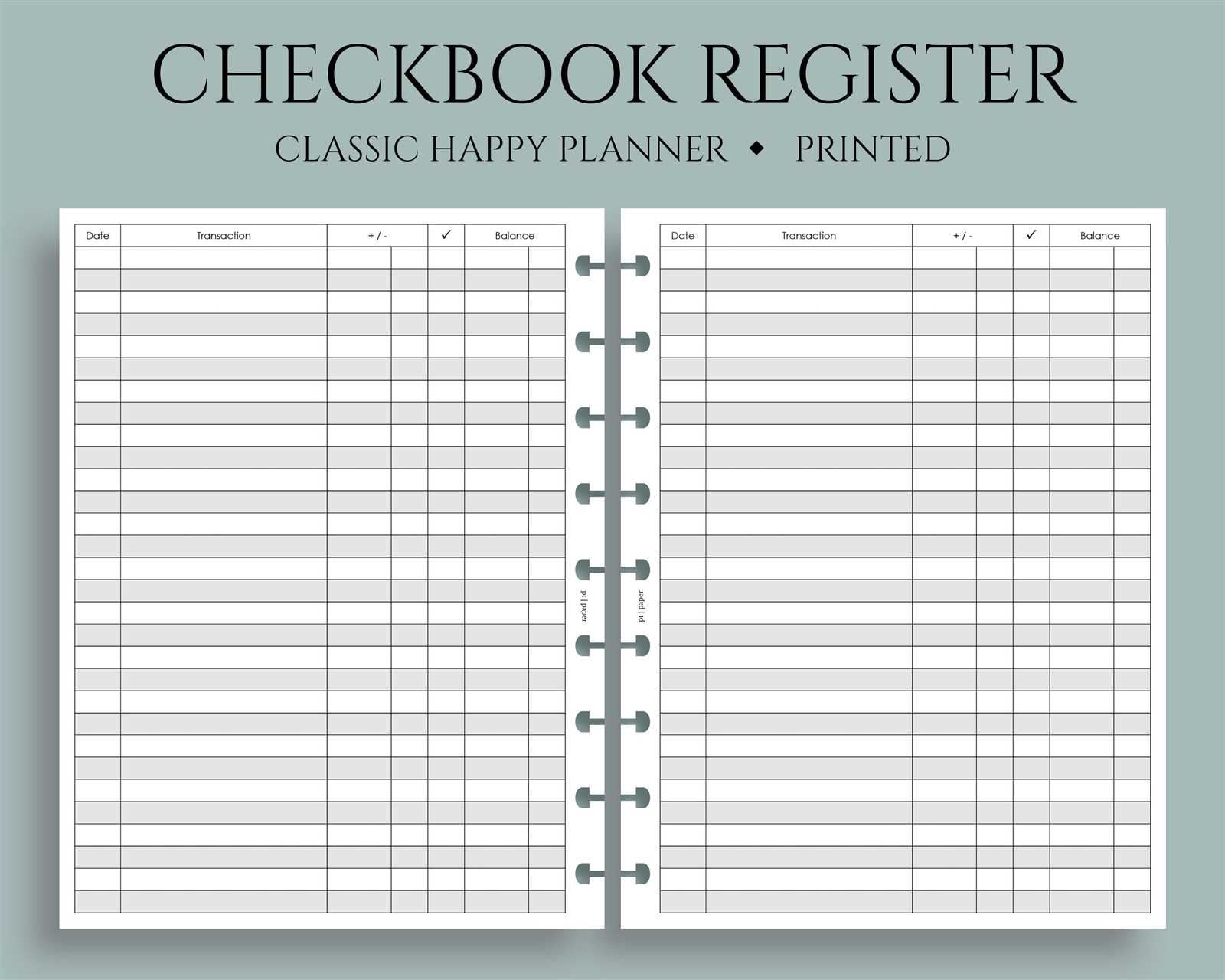

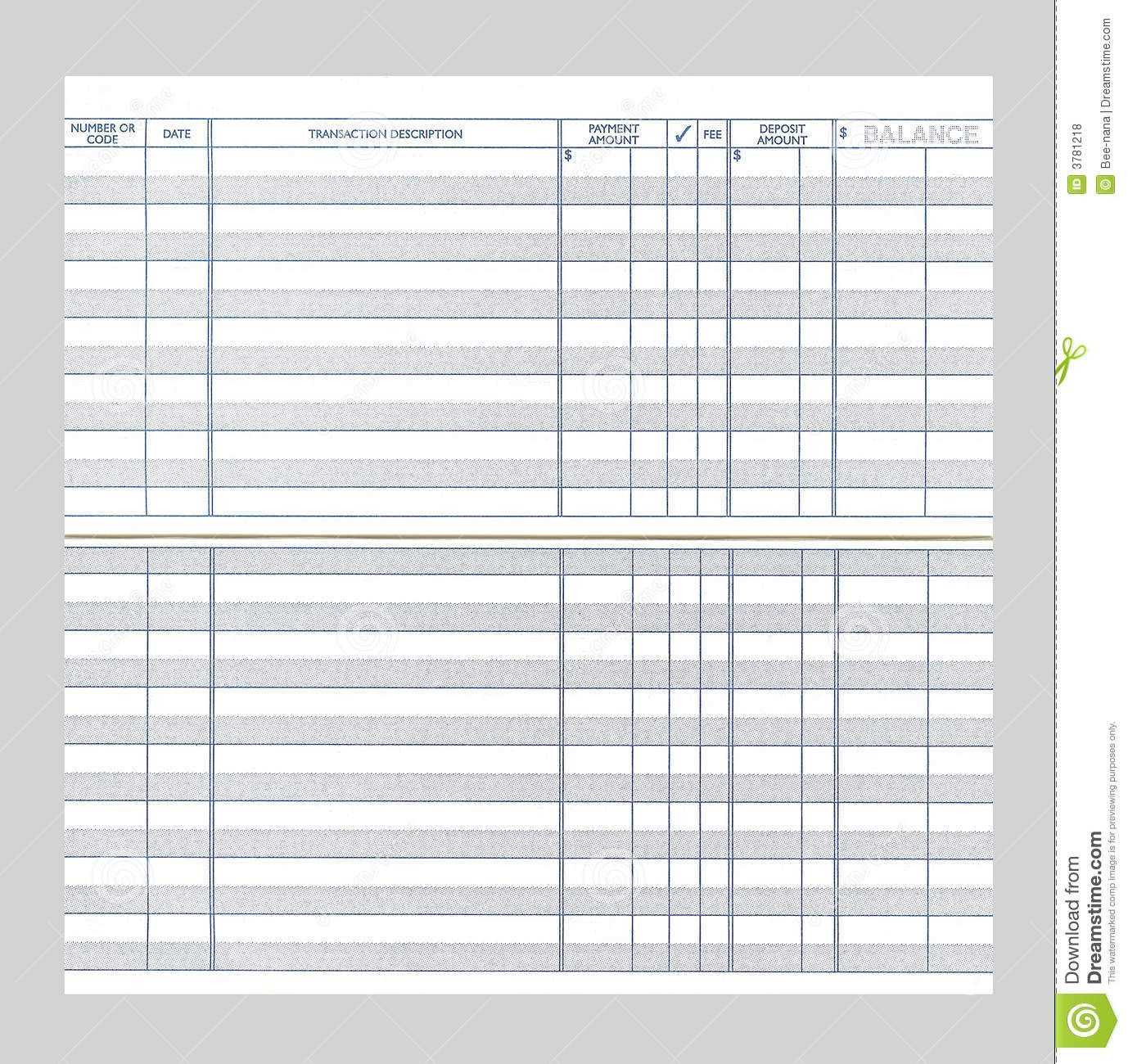

What is a Checkbook Calendar?

A financial planning tool helps individuals manage their expenditures and track transactions over a specific period. This resource provides a structured way to record and visualize income and expenses, making it easier to maintain a balanced budget.

Typically, this method allows users to jot down various financial activities, such as payments, receipts, and upcoming bills. By having a clear overview, individuals can avoid overspending and ensure that they meet their financial commitments in a timely manner.

Moreover, utilizing such a resource fosters a greater understanding of one’s financial habits. By regularly reviewing entries, users can identify patterns and make informed decisions about their future financial strategies. This practice ultimately promotes fiscal responsibility and enhances overall financial literacy.

Benefits of Using a Calendar Template

Utilizing a structured planning tool offers numerous advantages that enhance organization and productivity. By implementing a standardized format for tracking tasks and events, individuals can streamline their scheduling processes and improve overall time management.

Enhanced Organization: A well-designed layout provides clarity, allowing users to easily visualize their commitments. This organized approach minimizes the risk of overlooking important dates and deadlines, ensuring that nothing is missed.

Improved Efficiency: With a pre-defined structure, the time spent on planning is significantly reduced. Users can quickly input information without having to create a new layout from scratch each time.

Customization Options: Many formats allow for personalization, enabling users to adapt the design to suit their unique needs. This flexibility means that individuals can prioritize their tasks and integrate their personal style into their planning system.

Increased Accountability: By having a visual representation of obligations, users can hold themselves accountable for their time. This clear oversight encourages better adherence to schedules and deadlines.

Stress Reduction: Knowing what to expect and having a clear plan in place can alleviate anxiety. A consistent structure fosters a sense of control over one’s responsibilities, leading to a more relaxed approach to daily tasks.

How to Choose the Right Template

Selecting the perfect layout for your planning needs can significantly enhance your organizational skills. With various options available, understanding your specific requirements is essential. This section will guide you through the key factors to consider when making your choice.

Identify Your Purpose

Before diving into options, clarify what you want to achieve. Are you managing finances, tracking appointments, or organizing tasks? Each goal may require a distinct format to effectively support your activities.

Consider Usability and Design

The functionality and aesthetics of your chosen layout should align with your preferences. A user-friendly interface encourages consistent use, while a visually appealing design can make planning more enjoyable. Here’s a comparison table to help you evaluate different layouts:

| Feature | Option A | Option B | Option C |

|---|---|---|---|

| Ease of Use | High | Medium | Low |

| Visual Appeal | Modern | Classic | Simple |

| Customization | Yes | No | Yes |

By assessing these factors, you can find a suitable layout that fits your lifestyle and planning habits, ultimately helping you stay organized and productive.

Customizing Your Checkbook Calendar

Personalizing your financial tracker can enhance its functionality and make it more enjoyable to use. By tailoring it to your preferences, you can streamline your budgeting process and ensure it meets your specific needs.

Key Elements to Personalize

- Color schemes: Choose colors that appeal to you and help differentiate categories.

- Layout: Adjust the arrangement of sections to improve visibility and accessibility.

- Fonts: Select fonts that are easy to read and reflect your style.

Adding Functionality

- Include reminder sections for upcoming payments.

- Incorporate visual aids like charts to track expenses.

- Set up categories for various spending types to gain insights.

Top Features to Look For

When selecting a planning tool for managing finances and scheduling, certain functionalities can greatly enhance your experience. These essential characteristics can streamline organization, improve tracking, and ultimately make budgeting more intuitive.

User-Friendly Interface: An intuitive design ensures ease of navigation, allowing users to quickly access important features without frustration.

Customizable Layout: The ability to modify the appearance and structure can cater to individual preferences, making it easier to personalize your tracking methods.

Integrated Reminders: Built-in notifications help keep you on track with deadlines and important dates, preventing missed payments or appointments.

Data Security: Robust security measures are crucial for protecting sensitive information, ensuring peace of mind while managing your finances.

Export Options: The capability to export data in various formats can facilitate sharing and analysis, enhancing overall functionality.

Collaboration Features: Tools that allow multiple users to access and manage information can improve teamwork, especially in shared financial situations.

Digital vs. Printable Templates

The choice between electronic solutions and traditional printed formats offers distinct advantages and appeals to different preferences. Each approach serves unique needs, catering to various lifestyles and organizational methods. Understanding these differences can help individuals select the most suitable option for their planning requirements.

Benefits of Digital Solutions

Digital formats provide a range of features that enhance convenience and accessibility. They often come equipped with customizable options and integration capabilities with other software. Users can access their digital planners on multiple devices, allowing for seamless updates and reminders. This flexibility ensures that individuals can stay organized on the go.

Advantages of Printed Formats

On the other hand, printed formats offer a tangible experience that many find appealing. The act of writing by hand can improve memory retention and provide a satisfying sense of accomplishment. Additionally, physical planners can be personalized through drawings and stickers, making the planning process more enjoyable. Many users appreciate the simplicity of having a dedicated space free from digital distractions.

| Feature | Digital | Printed |

|---|---|---|

| Accessibility | Available on multiple devices | Limited to physical copy |

| Customization | Highly customizable | Personalized by hand |

| Notifications | Automated reminders | No digital alerts |

| Memory Retention | Varies by user | Often improved by writing |

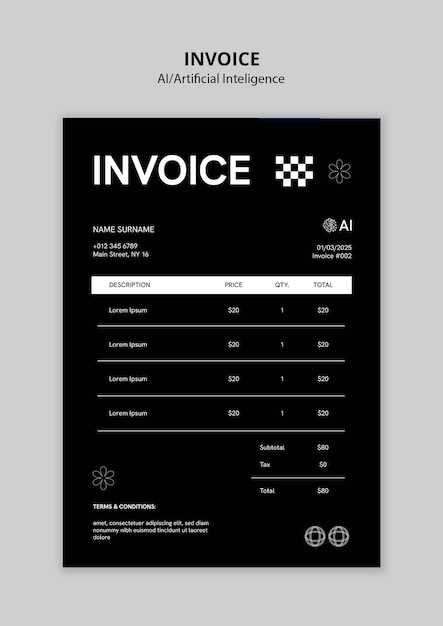

Integrating with Financial Software

Seamless connection with financial management systems is crucial for optimizing personal and business budgeting. This integration facilitates efficient tracking of income and expenditures, ensuring accurate reporting and analysis. By linking tools and applications, users can enhance their financial oversight and streamline their workflows.

There are various ways to connect these systems, including direct API links, import/export functionalities, and third-party services. Each method offers unique advantages depending on user needs and the software in use.

| Integration Method | Advantages | Considerations |

|---|---|---|

| API Integration | Real-time data synchronization | Requires technical knowledge |

| Import/Export Files | Simplicity and ease of use | Manual updates needed |

| Third-Party Services | Wide compatibility | Additional costs may apply |

Ultimately, selecting the right integration approach depends on the specific goals and requirements of the user, ensuring that financial tracking remains efficient and effective.

Steps to Create Your Own Template

Designing a personalized scheduling layout can be a rewarding endeavor, allowing you to tailor it to your specific needs and preferences. This guide outlines a series of straightforward actions to help you develop a functional and visually appealing layout that fits your lifestyle.

1. Define Your Requirements

Start by determining what features are essential for your layout. Consider factors such as:

- How you plan to organize your entries (daily, weekly, or monthly)

- The type of information you need to track (appointments, expenses, notes)

- Preferred layout style (grid, list, or freeform)

Having a clear understanding of your requirements will guide your design choices.

2. Choose a Design Tool

Select a software application or online platform that suits your design skills and preferences. Options range from simple word processors to advanced graphic design tools. Consider the following:

- User-friendliness

- Customization options

- Accessibility and compatibility with your devices

Familiarizing yourself with the chosen tool will enhance your ability to create a polished final product.

Once you’ve defined your needs and selected your design platform, you’re ready to start crafting your unique scheduling layout!

Common Mistakes to Avoid

Managing personal finances effectively requires careful planning and attention to detail. However, many individuals encounter pitfalls that can undermine their budgeting efforts. By recognizing and avoiding these common errors, one can ensure a more accurate and effective tracking of expenditures and income.

Overlooking Regular Expenses

A frequent mistake is neglecting to account for recurring costs such as subscriptions, insurance premiums, or utility bills. These items can accumulate and lead to unexpected deficits if not properly integrated into financial plans.

Failing to Update Records

Another common error is the failure to regularly refresh and review financial records. Outdated information can result in poor decision-making, leading to overspending or missed opportunities for savings.

| Mistake | Consequences |

|---|---|

| Ignoring Fixed Expenses | Unexpected shortfalls |

| Not Regularly Reviewing | Poor financial decisions |

| Neglecting to Plan for Irregular Expenses | Inability to cover unplanned costs |

| Using Inconsistent Methods | Confusion and inaccuracies |

Best Practices for Tracking Expenses

Effective management of financial outflows is crucial for maintaining a healthy budget. By implementing structured methods to monitor expenditures, individuals and businesses can gain clearer insights into their financial habits, allowing for better decision-making and improved savings strategies. This section outlines essential approaches to enhance your expense tracking process.

1. Categorize Your Spending

Organizing your expenditures into specific categories can simplify the tracking process and help identify areas for potential savings. Common categories include necessities such as housing and groceries, as well as discretionary spending like entertainment and dining out. By grouping expenses, you can quickly assess where your money is going and make informed adjustments.

2. Utilize Digital Tools

Embracing technology can significantly streamline your financial tracking. Numerous applications and software solutions offer features that allow for easy input of transactions, automatic categorization, and real-time updates. These tools can enhance accuracy and reduce the time spent on manual entry, freeing you to focus on analysis and strategy.

| Expense Category | Percentage of Total Spending |

|---|---|

| Housing | 30% |

| Food | 15% |

| Transportation | 10% |

| Entertainment | 10% |

| Utilities | 10% |

| Other | 25% |

By adopting these best practices, you can develop a robust system for monitoring financial outflows, ultimately leading to more effective budgeting and enhanced financial well-being.

Using Colors and Codes Effectively

Incorporating a well-thought-out color scheme and coding system can significantly enhance your planning process. By utilizing distinct hues and symbols, you can create a visual hierarchy that simplifies tracking tasks and deadlines. This approach not only aids in organization but also improves overall efficiency.

Here are some effective strategies to implement colors and codes:

- Define a Color Palette: Choose a set of colors that represent different categories or priorities. For instance:

- Red for urgent tasks

- Green for completed items

- Blue for scheduled events

- Establish Consistent Codes: Develop a coding system using symbols or abbreviations. This can include:

- “MT” for meetings

- “DL” for deadlines

- “EV” for events

- Maintain Clarity: Ensure that your chosen colors and codes are easy to distinguish. Avoid overly similar shades that may cause confusion.

- Regularly Update: As your tasks evolve, revisit your color and code system to ensure it still meets your needs. Adaptability is key.

lessCopy code

By effectively utilizing colors and codes, you can create a visually engaging and functional organizational tool that enhances your planning experience.

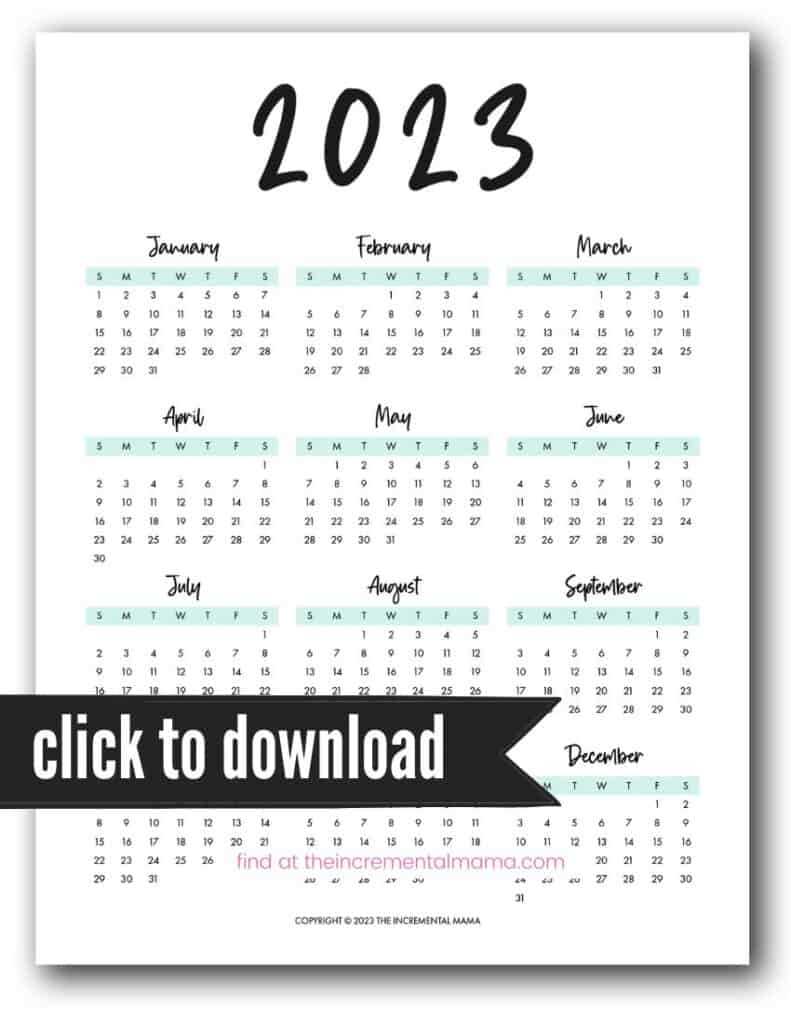

Examples of Popular Templates

When it comes to managing finances effectively, various designs can help individuals track their expenses and income seamlessly. These layouts can vary in style and function, catering to different needs and preferences.

- Monthly Tracker: A straightforward design that allows users to log income and expenditures on a monthly basis. This option is ideal for those who prefer a clear overview of their financial activity throughout the month.

- Expense Log: A detailed format focused on recording daily spending. It often includes sections for categorizing expenses, making it easier to identify spending patterns.

- Income Overview: A specialized layout designed to help users document various income sources. This can be particularly useful for freelancers or those with multiple revenue streams.

- Budget Planner: A comprehensive design that combines both income and expenses, allowing for detailed budgeting. Users can set limits and track their adherence to planned financial goals.

- Yearly Summary: This format provides a broad view of finances over an entire year, making it easier to spot trends and prepare for future financial planning.

Choosing the right structure can significantly enhance financial management, leading to better decision-making and improved savings strategies.

Where to Find Free Resources

For those seeking effective planning tools without the financial burden, numerous online platforms offer valuable materials at no cost. These resources can help streamline organization and enhance productivity, making it easier to manage tasks and deadlines.

Online Libraries: Websites dedicated to sharing educational and professional content often have a section for downloadable documents. Explore these libraries to find useful formats tailored to various needs.

Community Forums: Many online communities provide a space for users to exchange resources. By participating in discussions, you can discover hidden gems shared by fellow users who have similar interests.

Educational Websites: Numerous institutions and organizations publish free guides and resources aimed at improving personal and professional skills. Check their resource sections for quality offerings.

Social Media Groups: Platforms like Facebook and Reddit host groups focused on productivity and organization. Joining these communities can lead to discovering free downloads that others have shared.

Creative Marketplaces: Some websites allow creators to offer their work for free, often as promotional material. Regularly browsing these marketplaces can uncover new and unique planning solutions.

By utilizing these diverse platforms, anyone can access a wealth of free resources designed to enhance their organizational efforts and improve time management skills.

How to Stay Organized Year-Round

Maintaining a sense of order throughout the year is essential for achieving personal and professional goals. By implementing effective strategies, individuals can streamline their tasks and enhance productivity. Consistency in organization allows for better time management and reduced stress, ultimately leading to a more fulfilling life.

One effective method is to establish a routine that incorporates regular planning sessions. Setting aside time each week to review upcoming commitments helps keep priorities clear and manageable. Additionally, utilizing tools that track tasks and deadlines can provide a visual overview of responsibilities, making it easier to allocate time effectively.

Another key aspect is the practice of decluttering. Regularly assessing your environment and removing unnecessary items can create a more focused workspace. A tidy area fosters concentration and encourages a proactive mindset, which is vital for staying organized.

Furthermore, setting specific, achievable goals can aid in maintaining organization. Break larger objectives into smaller, manageable tasks, and celebrate progress along the way. This approach not only keeps you on track but also boosts motivation.

Lastly, remember to be flexible. Life is unpredictable, and adapting to changes while keeping your overarching plans in mind is crucial. Embracing a mindset of resilience will help you stay organized, no matter what challenges arise.

Sharing Your Calendar with Others

Collaboration and communication are key when it comes to effective time management. By allowing others access to your scheduling tool, you can enhance teamwork, reduce misunderstandings, and ensure that everyone is on the same page regarding important events and deadlines.

When sharing your scheduling tool, consider the following aspects:

- Permissions: Determine what level of access each person should have. Options may include view-only access or the ability to edit.

- Privacy: Be mindful of sensitive information. Ensure that you share only what is necessary and that confidential details remain protected.

- Platforms: Use tools that facilitate easy sharing, whether through email, cloud services, or specialized applications.

To effectively share your scheduling tool, follow these steps:

- Select the individuals or groups you want to share with.

- Choose the appropriate access level for each person.

- Send out invitations or share the link to your scheduling tool.

- Communicate any important details about how to use the shared access.

By thoughtfully sharing your scheduling tool, you can foster a more organized and collaborative environment, making it easier for everyone involved to stay coordinated and informed.

Updating Your Template Regularly

Maintaining an organized system is crucial for effective planning and tracking of personal finances. Regularly refreshing your documents ensures they remain relevant and functional, accommodating any changes in your needs or circumstances.

Consistency is key; by revisiting and adjusting your records periodically, you can better align them with your goals. Consider setting a specific time each month or quarter to review and modify your documents.

Additionally, incorporating new features or tools can enhance usability and efficiency. Staying up-to-date with the latest options can ultimately lead to a more streamlined experience, enabling you to manage your resources effectively.

Feedback from Users and Experts

This section aims to highlight insights and evaluations from both users and professionals regarding the utility and effectiveness of organizing tools designed for personal management. Such feedback is crucial for understanding the overall impact and areas for improvement in these planning solutions.

Users often share their experiences and suggestions, which can reveal practical benefits and challenges:

- Usability: Many users appreciate the intuitive layout that simplifies daily tracking.

- Flexibility: The ability to customize entries has been noted as a significant advantage, allowing individuals to tailor the system to their needs.

- Accessibility: Feedback indicates that digital formats are favored for their convenience and ease of access.

Experts in organization and productivity also provide valuable perspectives:

- Enhanced Productivity: Professionals emphasize that structured planning leads to better time management and goal achievement.

- Behavioral Insights: Experts highlight the psychological benefits, such as reduced stress from having a clear overview of tasks.

- Recommendations for Improvement: Suggestions often include integrating additional features to cater to diverse user needs.

In conclusion, the amalgamation of user experiences and expert analysis creates a comprehensive understanding of how these organizational tools function in real-life scenarios, guiding future enhancements and developments.

Future Trends in Calendar Design

The evolution of time management tools is rapidly advancing, reflecting changing societal needs and technological innovations. As we move forward, the emphasis on personalization, functionality, and sustainability is becoming increasingly prominent. This transformation is not just about aesthetics; it’s about creating a harmonious balance between form and function that resonates with users on multiple levels.

One significant trend is the rise of interactive formats. With the integration of smart technology, planners are transitioning from static representations to dynamic interfaces. Users will be able to customize layouts and features in real time, enhancing the overall experience. This shift towards interactivity encourages engagement and makes tracking tasks more enjoyable.

Moreover, eco-friendly materials and production methods are gaining traction. As awareness of environmental issues grows, creators are prioritizing sustainable resources and recyclable components. This movement not only appeals to eco-conscious consumers but also fosters a sense of responsibility among designers to contribute positively to the planet.

Additionally, the incorporation of wellness features is expected to become a focal point. Integrating elements that promote mindfulness, such as inspirational quotes or wellness tracking sections, can transform these tools into holistic companions that support mental and emotional well-being.

Lastly, the future will likely see a blend of digital and analog approaches. Many users appreciate the tactile experience of physical products while also valuing the convenience of digital solutions. The fusion of these modalities could lead to innovative designs that cater to diverse preferences and lifestyles.