Effective management of monetary resources requires a structured approach to time allocation. By organizing important dates and events related to your financial activities, you can enhance decision-making and improve overall efficiency. This strategic arrangement allows individuals and businesses alike to stay on top of their monetary obligations and opportunities throughout the year.

Utilizing a well-crafted schedule not only simplifies tracking essential deadlines but also fosters a proactive mindset. With this method, you can anticipate key moments such as tax filings, payment due dates, and budget reviews. The clarity that comes from having a comprehensive overview empowers you to make informed choices, ultimately leading to better financial outcomes.

Incorporating this organized framework into your routine can significantly reduce stress and uncertainty. By keeping your commitments and milestones visible, you enhance your ability to plan ahead, allocate resources wisely, and seize beneficial opportunities. Embracing this structured way of thinking is essential for anyone looking to navigate the complexities of their financial journey successfully.

Understanding Finance Calendars

Having a structured approach to managing monetary activities can greatly enhance decision-making and strategic planning. By organizing key dates and events, individuals and organizations can ensure they stay on track with their financial objectives. This systematic method not only promotes clarity but also aids in anticipating future requirements and obligations.

Importance of Scheduling Financial Events

Establishing a clear timeline for significant occurrences, such as tax deadlines or budget reviews, is crucial for maintaining oversight and compliance. A well-organized outline allows stakeholders to allocate resources efficiently and prepare for upcoming fiscal responsibilities. This foresight can lead to improved cash flow management and reduced stress during critical periods.

Tools for Effective Tracking

Various resources are available to help individuals and businesses outline their monetary timelines. From digital applications to traditional planners, these tools provide a way to visualize upcoming tasks and commitments. Utilizing these instruments can enhance accountability and ensure that all parties are aware of their roles in achieving financial goals.

What is a Finance Calendar?

A structured schedule for tracking and managing monetary activities plays a crucial role in personal and business planning. This tool helps individuals and organizations stay on top of important dates, ensuring that they meet obligations and seize opportunities in a timely manner.

By utilizing such a framework, one can effectively organize deadlines for payments, receipts, and reports, allowing for a clear overview of financial commitments and upcoming events. This proactive approach facilitates better decision-making and helps avoid potential pitfalls.

| Date | Event | Notes |

|---|---|---|

| 01/15 | Quarterly Tax Payment | Ensure calculations are accurate. |

| 02/01 | Annual Budget Review | Evaluate last year’s performance. |

| 03/10 | Investment Report Due | Gather all necessary documents. |

| 04/30 | End of Fiscal Year | Prepare for year-end audits. |

In summary, a well-organized schedule enhances efficiency and reduces the risk of missing critical deadlines, thereby contributing to overall financial health.

Benefits of Using a Calendar Template

Utilizing a structured planning tool can significantly enhance organization and efficiency in both personal and professional settings. By providing a clear framework, these resources help individuals stay on top of their commitments and deadlines, leading to improved time management.

- Enhanced Organization: A systematic layout allows for easy tracking of tasks and events, reducing the likelihood of missing important deadlines.

- Time Efficiency: Pre-designed formats save time by eliminating the need to create a schedule from scratch.

- Visual Clarity: Well-structured layouts promote better visibility of upcoming responsibilities, making it easier to prioritize tasks.

- Customization: Many options allow for personalization, ensuring the tool aligns with individual needs and preferences.

- Accountability: Keeping a documented plan fosters a sense of responsibility and commitment to following through with obligations.

Overall, these resources provide valuable support in navigating daily responsibilities, ultimately leading to greater productivity and less stress.

Key Features of Effective Templates

When designing a structured framework for organizing information, certain characteristics enhance usability and efficiency. An ideal format should facilitate easy navigation and provide clear visual cues to guide users through their tasks. By incorporating essential elements, these formats become indispensable tools for managing various activities.

User-Friendly Design

A crucial aspect of a well-crafted layout is its intuitive interface. Users should be able to understand how to interact with the structure without extensive instructions. This includes logical categorization of information, consistent formatting, and the use of recognizable symbols or colors to indicate different sections or priorities.

Another important feature is the ability to adapt and personalize the structure according to individual needs. Flexibility allows users to modify sections, add relevant details, and rearrange components to fit their specific requirements. This customization not only enhances user engagement but also ensures that the layout remains relevant over time.

How to Create a Finance Calendar

Establishing a structured timeline for managing your monetary activities is essential for maintaining control over your financial health. This organized approach enables you to track important events, deadlines, and tasks effectively, ensuring that you stay on top of your obligations and opportunities.

Step 1: Begin by identifying the key dates that are relevant to your financial situation. These may include due dates for bills, loan payments, tax filings, and significant events like salary deposits or investment reviews. Consider both recurring and one-time occurrences.

Step 2: Choose a format that suits your preferences. You might opt for a digital solution, such as a spreadsheet or an application, or a physical option like a planner or wall chart. The chosen format should be easily accessible and customizable.

Step 3: Populate your timeline with the identified events, ensuring that you allocate sufficient time for preparation and follow-up. Utilize color-coding or symbols to differentiate between various categories, making the information clearer at a glance.

Step 4: Regularly review and adjust your timeline to reflect any changes in your financial landscape. This ongoing process will help you stay agile and responsive to new opportunities or challenges that arise.

Step 5: Lastly, incorporate reminders and alerts into your system. This proactive step ensures that important dates do not slip through the cracks, allowing you to manage your financial responsibilities with confidence.

Popular Formats for Calendar Templates

In the realm of scheduling tools, various structures and styles cater to diverse needs and preferences. Each format provides unique advantages, allowing users to organize their time effectively and enhance productivity.

Traditional Formats

Many individuals prefer classic arrangements, such as monthly or weekly layouts, which offer a clear overview of tasks and appointments. These designs often incorporate grids that facilitate easy navigation and quick reference.

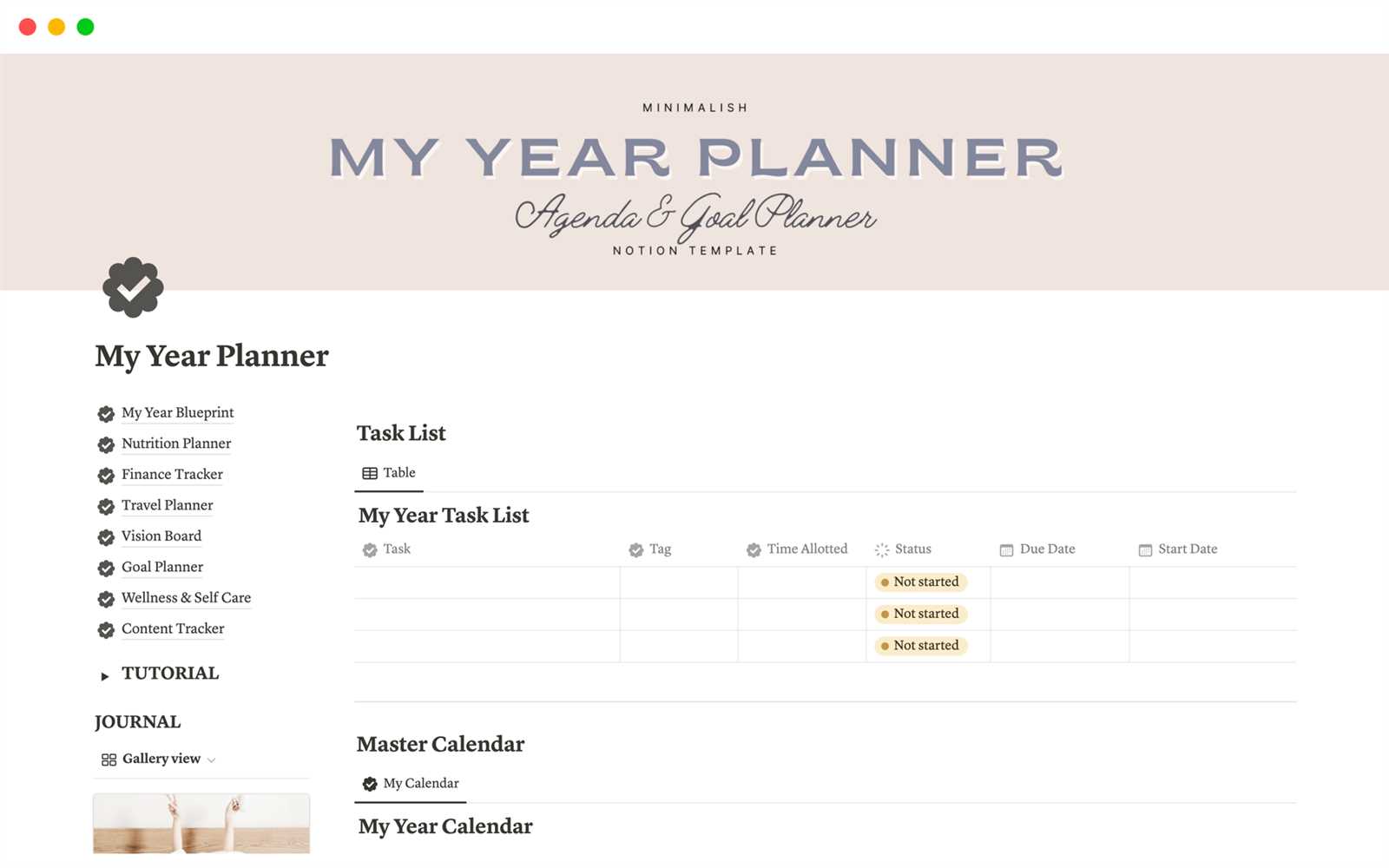

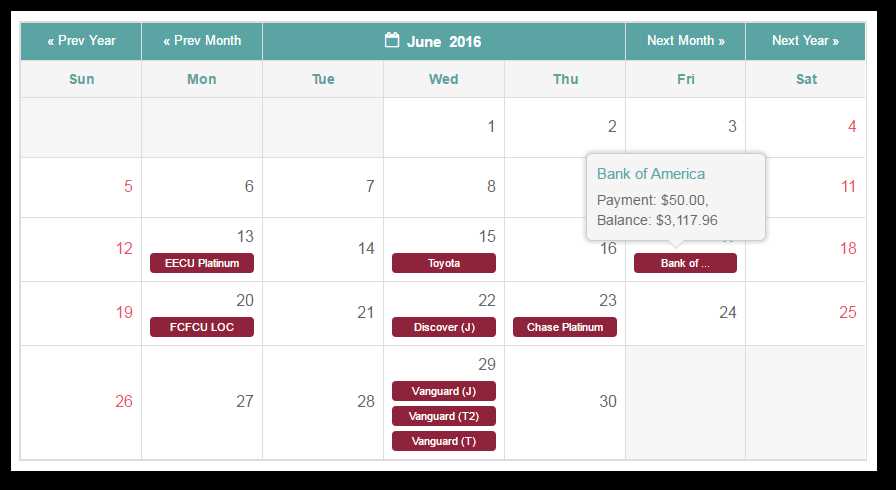

Digital Innovations

With the rise of technology, interactive versions have gained popularity. Features like color coding and reminders not only streamline planning but also engage users in a dynamic way. The ultimate goal is to provide a seamless experience that adapts to various lifestyles.

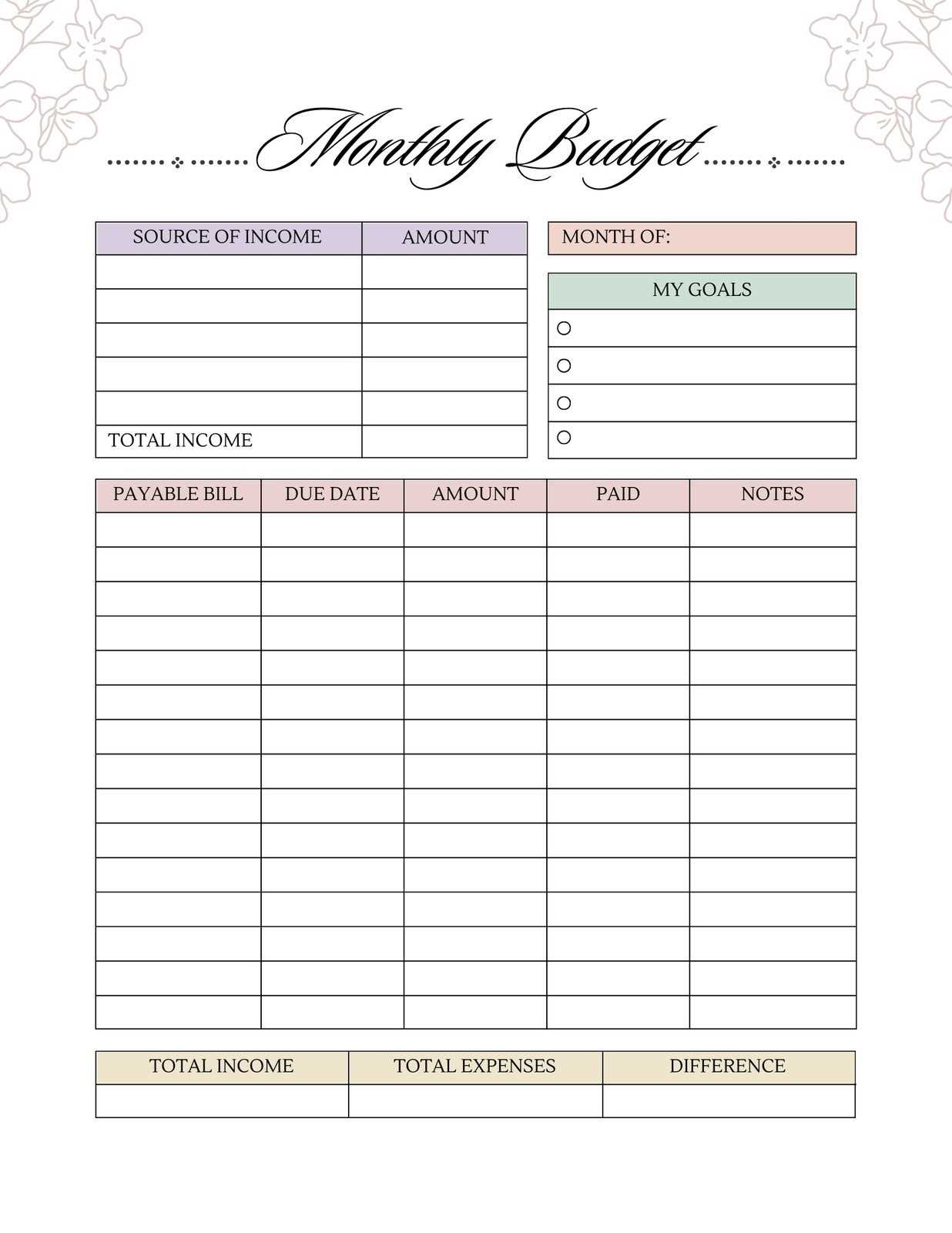

Customizing Your Finance Calendar

Tailoring your schedule to better suit your financial needs is essential for effective management and planning. By making adjustments to your organizational tools, you can enhance your ability to track important dates and milestones.

Here are several strategies to consider for personalization:

- Identify Key Dates: Mark significant events such as bill due dates, payment deadlines, and income arrival dates.

- Set Personal Goals: Incorporate your financial objectives, whether it’s saving for a vacation or paying off debt.

- Use Color Coding: Differentiate categories like expenses, savings, and investments with distinct colors for quick reference.

- Include Reminders: Set alerts for upcoming payments or financial check-ins to stay proactive.

By employing these techniques, you can create a more effective organizational tool that reflects your individual financial journey and helps you stay on track.

Integrating Calendar with Financial Tools

Bridging scheduling tools with monetary management applications enhances efficiency and fosters better decision-making. By synchronizing important dates and tasks related to budgets, investments, and expenses, users can gain a comprehensive overview of their financial landscape. This integration allows for timely reminders and organized tracking, which are crucial for successful fiscal planning.

Benefits of Integration

Linking your scheduling system with financial applications offers several advantages:

| Benefit | Description |

|---|---|

| Improved Organization | Centralizes all financial activities in one place, reducing the risk of oversight. |

| Enhanced Reminders | Automated notifications for upcoming payments, deadlines, and meetings streamline management. |

| Data Synchronization | Real-time updates ensure that all information remains current and accurate across platforms. |

| Strategic Planning | Helps in forecasting by visualizing cash flows and important milestones on a unified timeline. |

Implementing the Integration

To successfully merge these tools, consider the following steps:

- Select compatible applications that offer seamless connectivity.

- Utilize APIs or built-in integration features to link platforms.

- Establish clear protocols for data entry and maintenance to ensure consistency.

- Regularly review and adjust settings to align with changing needs.

Best Practices for Financial Planning

Effective resource management is crucial for achieving long-term goals and ensuring stability. By adopting strategic approaches, individuals can navigate their monetary landscape with confidence and clarity. This section outlines key strategies that enhance the planning process, leading to informed decisions and sustainable growth.

1. Set Clear Objectives

Establish specific, measurable, attainable, relevant, and time-bound (SMART) goals. Clearly defined objectives provide direction and motivation, making it easier to track progress and adjust strategies as needed.

2. Monitor Progress Regularly

Consistent evaluation of your plans allows for timely adjustments. Review your status periodically to identify successes and areas for improvement, ensuring alignment with your overarching aspirations.

3. Diversify Your Approaches

Avoid putting all resources into a single venture. By spreading your investments across various opportunities, you can minimize risks and increase the potential for returns.

4. Create a Buffer

Establish an emergency fund to safeguard against unexpected challenges. Having a financial cushion allows for peace of mind and flexibility in decision-making.

5. Seek Professional Advice

Consulting with experts can provide valuable insights and tailored strategies. Professionals can help navigate complex situations and optimize your planning efforts.

6. Stay Informed

Continuously educate yourself about trends and changes in your environment. Staying updated empowers you to make informed choices and adapt to evolving circumstances.

7. Practice Discipline

Consistent adherence to your strategies is vital for success. Cultivating discipline in your financial habits ensures that you remain focused on your objectives, even when faced with temptations or distractions.

Tracking Important Financial Dates

Monitoring key milestones and deadlines is crucial for maintaining control over your monetary affairs. By staying informed about essential events, individuals and businesses can make informed decisions, avoid penalties, and optimize their financial strategies. An organized approach to these dates can significantly enhance your overall fiscal management.

Identifying Key Milestones

It is vital to pinpoint significant dates that impact your economic health. These may include tax submission deadlines, payment schedules for loans, and renewal dates for important agreements. By marking these events, you ensure that you are prepared and can allocate resources effectively.

Using Reminders and Alerts

Incorporating reminders into your planning system can serve as a proactive measure. Utilizing digital tools or traditional methods, such as planners or sticky notes, can help you stay ahead of upcoming obligations. Setting alerts for these important occasions allows you to manage your time and responsibilities more efficiently, minimizing the risk of oversight.

Using Technology for Finance Calendars

In today’s fast-paced world, harnessing digital solutions has become essential for managing personal and business activities efficiently. Leveraging modern tools can significantly streamline the tracking of important dates, deadlines, and events, ensuring that nothing slips through the cracks. This approach not only enhances organization but also promotes proactive planning and timely decision-making.

Digital Tools and Applications

The advent of various applications has transformed the way individuals and organizations keep track of crucial information. From user-friendly interfaces to customizable features, these tools allow for effortless scheduling and reminders. Utilizing platforms that integrate with other productivity software can create a seamless experience, reducing the likelihood of missed obligations.

Automation for Efficiency

Embracing automation can take organization to the next level. By setting up automated alerts and notifications, users can receive timely updates on important tasks without manual intervention. This feature not only saves time but also ensures that priorities are always front of mind. Incorporating such technology fosters a more proactive approach, allowing users to focus on strategic planning rather than getting caught up in everyday details.

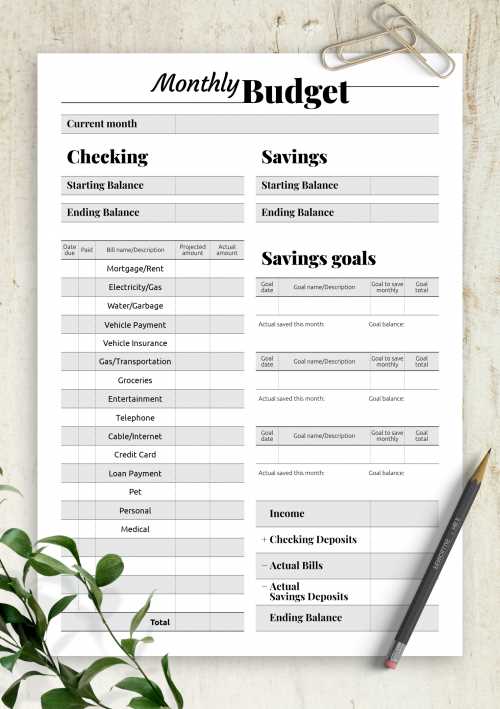

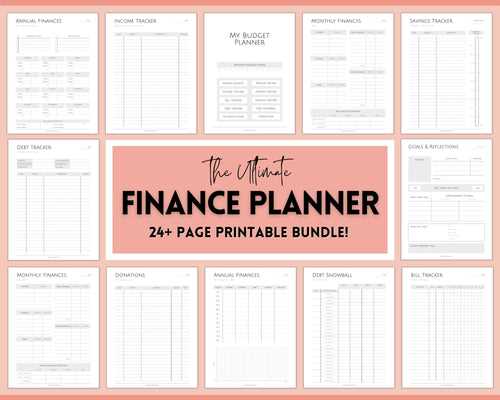

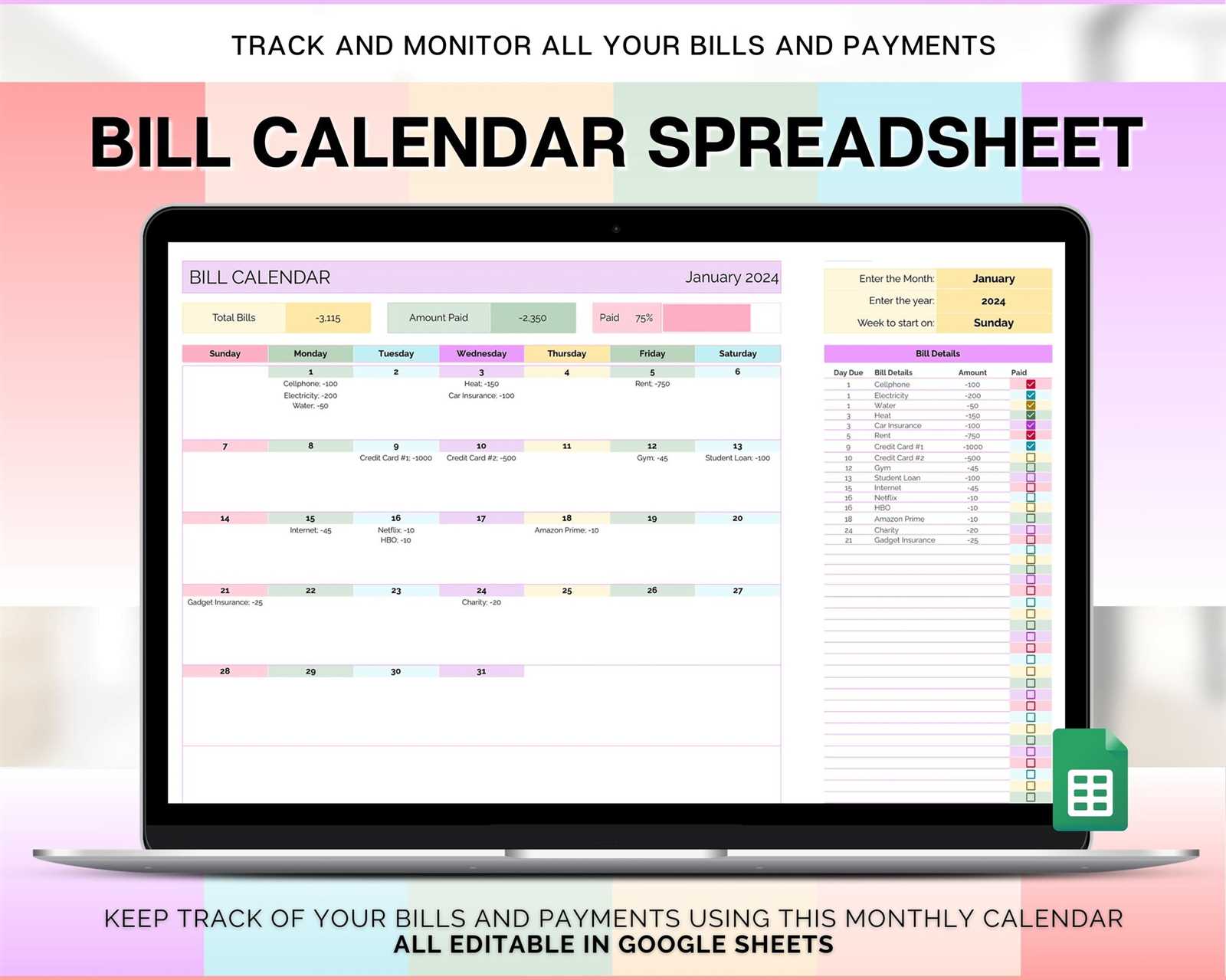

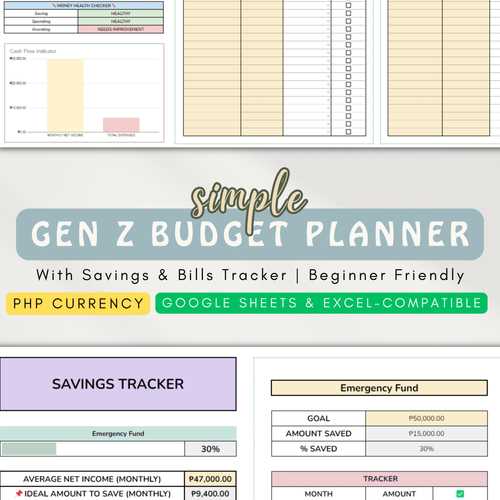

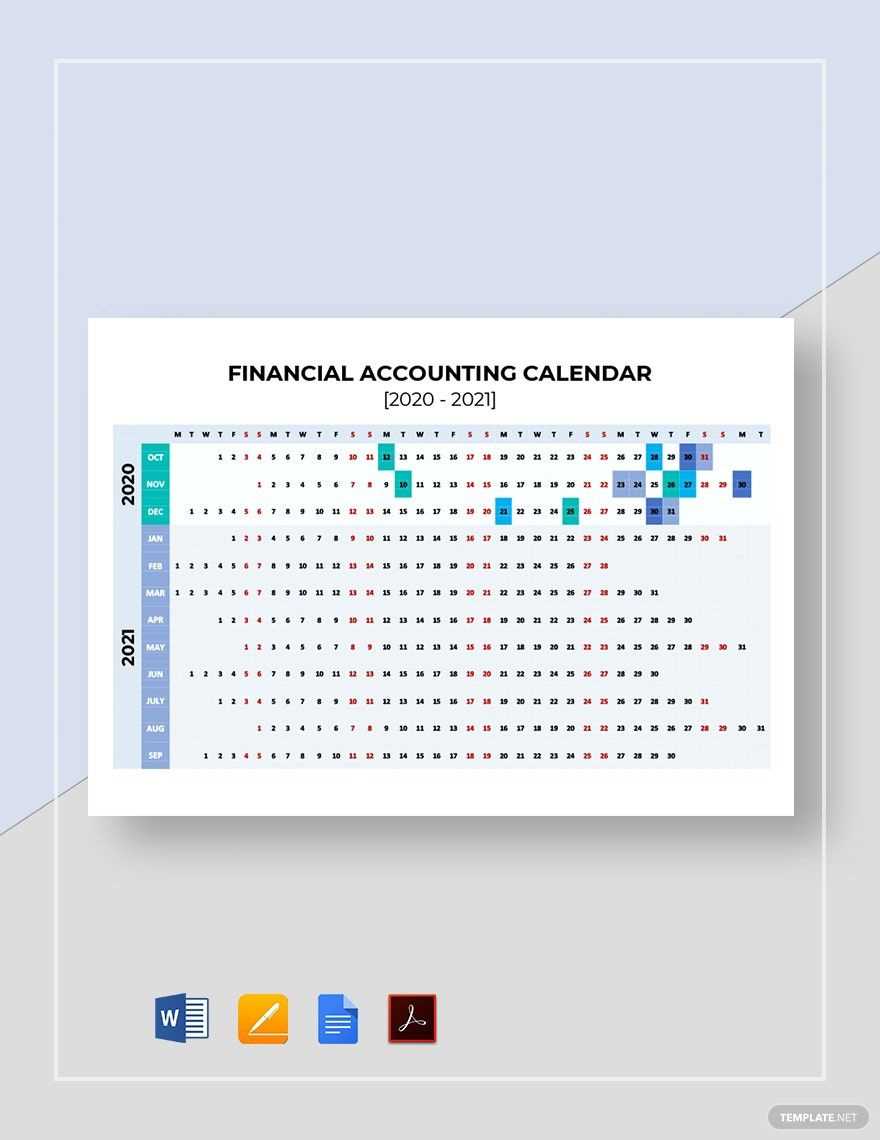

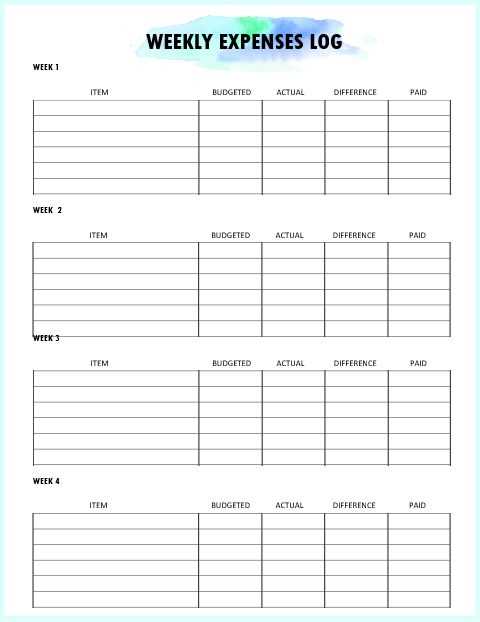

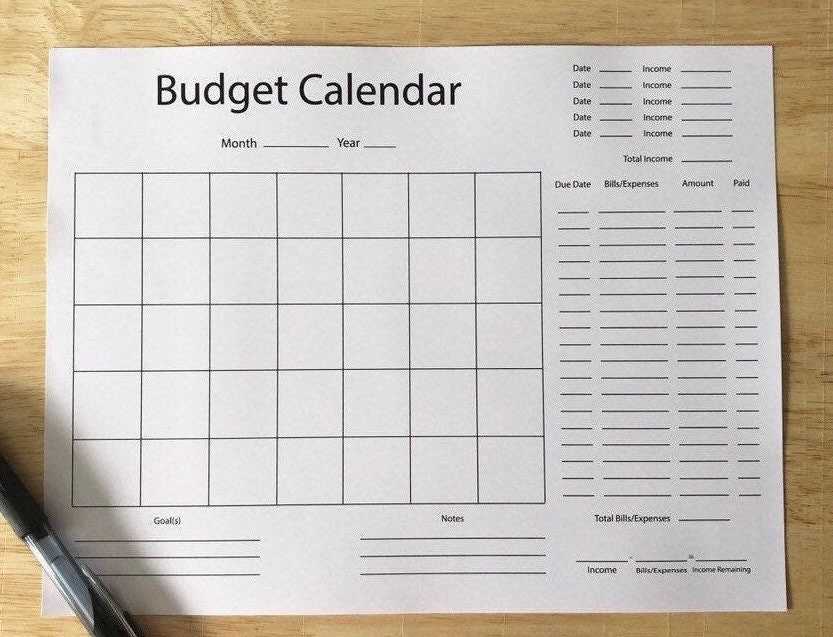

Examples of Finance Calendar Templates

This section explores various formats that assist in tracking financial activities and events. These formats can help individuals and organizations manage their monetary responsibilities effectively while providing a clear overview of important deadlines and milestones.

Here are some popular formats to consider:

- Monthly Overview:

A grid layout showcasing each month with space to note key dates such as bill payments, income receipts, and budget reviews.

- Weekly Tracker:

A detailed weekly format that allows users to break down expenses and income on a daily basis, facilitating real-time management.

- Yearly Planner:

A comprehensive yearly outline that highlights significant events, such as tax deadlines, financial reviews, and investment opportunities.

In addition to these basic formats, here are some specialized variations:

- Expense Tracker:

A focused format that enables users to log daily expenses, categorize them, and review spending habits over time.

- Income Projection:

A tool for forecasting expected income, helping users plan for future financial scenarios and set savings goals.

- Debt Repayment Schedule:

A structured plan to manage and monitor debt payments, ensuring timely repayment and tracking progress toward financial freedom.

Utilizing these varied structures can enhance financial organization and promote better decision-making, leading to improved fiscal health.

Common Mistakes to Avoid

When managing your monetary activities, several pitfalls can undermine your efforts. Identifying and avoiding these errors is crucial for achieving your financial goals and maintaining a clear overview of your obligations and income. Here, we outline key missteps that can derail your planning and suggest ways to circumvent them.

Lack of Consistency

One of the most frequent errors is the inconsistency in tracking and updating your financial plans. Failing to regularly review your expenditures and income can lead to unexpected shortfalls and missed opportunities for improvement. Establish a routine that allows you to frequently assess your financial situation to stay on track.

Ignoring Long-Term Goals

Another significant mistake is focusing solely on immediate concerns while neglecting long-term aspirations. This short-sightedness can result in insufficient preparation for future needs. Ensure that your strategy incorporates both short-term actions and long-term objectives to create a balanced approach that supports sustainable growth.

How to Share Your Calendar

Collaborating effectively often requires that you share your schedules with others. Whether it’s for personal planning or professional projects, making your agenda accessible can enhance communication and ensure everyone stays aligned. This section will explore various methods to distribute your timeline and coordinate with your peers seamlessly.

Utilizing Digital Platforms

Many modern applications offer features that facilitate the sharing of your schedule. By utilizing cloud-based services, you can easily grant access to specific individuals or groups. This allows for real-time updates and visibility, ensuring that all participants are informed of any changes. Take advantage of settings that permit different levels of access, so you can control how much information is visible to others.

Manual Sharing Options

If you prefer a more traditional approach, consider exporting your schedule as a file and sending it directly via email. You can choose formats that are widely accepted, such as PDF or CSV, which allow for easy viewing and integration into other tools. Make sure to include any relevant notes or important dates to provide context for your recipients.

Updating Your Finance Calendar Regularly

Maintaining an organized schedule for managing your monetary activities is crucial for achieving your financial goals. Regularly revisiting and refreshing this schedule ensures that you stay aligned with your objectives and can adapt to any changes in your circumstances.

Here are several reasons why consistent updates are essential:

- Reflecting Changes: Life events, such as a job change or new expenses, can significantly impact your financial landscape.

- Enhancing Accuracy: Regular reviews help correct any discrepancies and ensure that your planning reflects your current situation.

- Staying Motivated: By tracking your progress and adjusting your goals, you maintain enthusiasm and focus on your aspirations.

- Anticipating Future Needs: Updating your plan allows you to foresee upcoming obligations and prepare accordingly.

To effectively update your schedule, consider the following steps:

- Set a regular review period, such as monthly or quarterly.

- Gather all relevant financial documents and data.

- Assess your current situation against your previous goals.

- Adjust your objectives as necessary based on your findings.

- Document any changes and communicate them if working with a partner or advisor.

By committing to regular updates, you enhance your ability to manage your resources wisely and navigate your financial journey with confidence.

Resource Recommendations for Templates

Creating effective planning documents requires access to high-quality resources. The right materials can greatly enhance productivity and organization, making it easier to manage important tasks and deadlines. Below are some valuable sources to consider when seeking out well-crafted planning formats that cater to various needs.

Online Platforms

Numerous websites specialize in offering a wide range of customizable formats. Sites such as Template.net and Canva provide a user-friendly interface that allows individuals to tailor layouts according to their specific requirements. These platforms often feature a variety of styles, ensuring that users can find something that resonates with their personal or professional aesthetic.

Document Sharing Services

Another excellent resource includes document sharing services like Google Drive and Microsoft OneDrive. These platforms not only allow users to access a plethora of shared materials but also facilitate collaboration among team members. By utilizing shared resources, individuals can leverage diverse ideas and approaches, leading to more effective planning strategies.

Measuring the Effectiveness of Your Calendar

Evaluating the impact of your scheduling tool is crucial for ensuring optimal organization and productivity. By assessing its efficiency, you can identify areas for improvement and make informed adjustments to enhance your planning process. This analysis not only aids in streamlining tasks but also in achieving your goals more effectively.

Key Metrics to Consider

- Time Allocation: Analyze how much time is dedicated to various activities. Are there tasks that consume more hours than necessary?

- Completion Rates: Track the percentage of tasks completed on time. This can highlight bottlenecks in your workflow.

- Task Prioritization: Assess whether high-priority items are consistently addressed first. Are urgent matters overshadowing important ones?

- Overall Productivity: Review your output in relation to your schedule. Is the amount of work done satisfactory compared to your planned commitments?

Strategies for Improvement

- Conduct regular reviews of your scheduling practices to identify patterns and inefficiencies.

- Implement adjustments based on feedback from your evaluations, such as reallocating time or reprioritizing tasks.

- Utilize tools and resources that provide insights into your productivity metrics.

- Seek input from peers or mentors to gain different perspectives on your organizational strategies.

By systematically measuring and refining your scheduling strategies, you can significantly enhance your efficiency and effectiveness in achieving both short-term and long-term objectives.

Future Trends in Finance Planning Tools

The landscape of financial management is evolving rapidly, influenced by technological advancements and changing consumer needs. As individuals and businesses seek more efficient methods for tracking and forecasting their economic activities, innovative solutions are emerging to enhance planning processes. The focus is shifting toward automation, integration, and user-centric design, promising to streamline operations and improve decision-making.

Integration of Artificial Intelligence

One of the most significant developments is the incorporation of artificial intelligence into financial planning solutions. AI algorithms can analyze vast amounts of data, offering insights that were previously unattainable. These systems can anticipate trends, optimize budgeting, and even provide personalized recommendations based on user behavior and preferences. This shift towards smart technology is set to revolutionize how individuals manage their finances.

Emphasis on User Experience

Another key trend is the growing importance of user experience in financial management tools. As users become more tech-savvy, they expect intuitive interfaces that simplify complex tasks. Design thinking is being prioritized, ensuring that tools are not only functional but also engaging and accessible. This focus on usability will lead to higher adoption rates and better overall satisfaction, empowering users to take control of their financial futures.