In the realm of organizational management, the ability to effectively plan and track time is crucial for success. Establishing a structured approach to managing periods of activity allows businesses to optimize resources and enhance productivity. This guide explores a vital tool that facilitates streamlined operations and provides a clear overview of upcoming phases.

Setting clear timelines not only aids in forecasting expenses and revenues but also fosters accountability among team members. By implementing a systematic layout, organizations can easily align their goals with actionable strategies. This structured approach empowers decision-makers to navigate through various phases with confidence.

Moreover, a well-designed framework serves as a communication tool that bridges the gap between different departments. With everyone on the same page, collaboration becomes seamless, and objectives are more easily achieved. This resource is essential for those seeking to maintain a competitive edge and ensure sustainable growth.

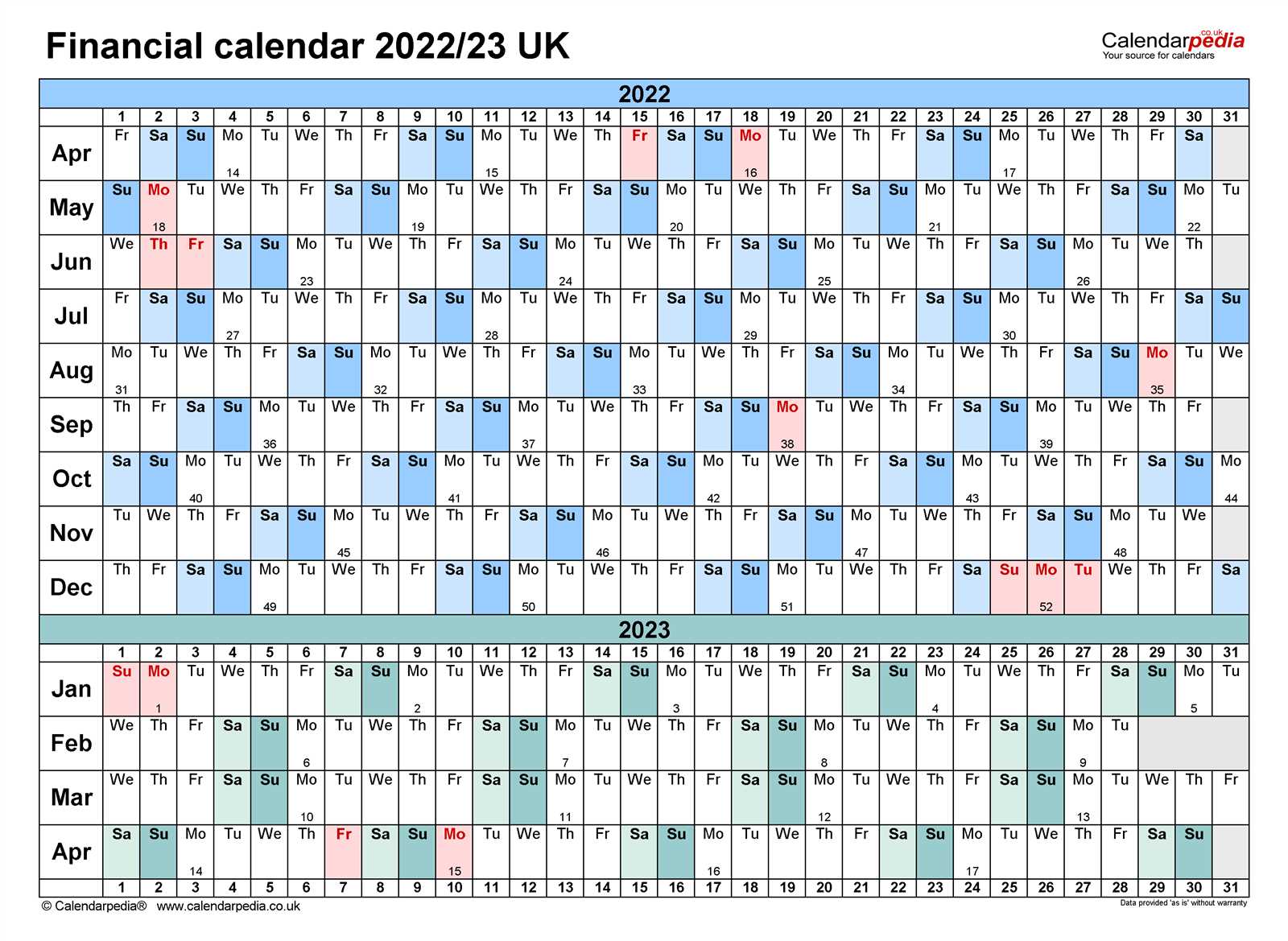

Understanding Financial Year Calendars

In the realm of business and accounting, tracking time effectively is essential for strategic planning and analysis. A structured approach to dividing periods can significantly enhance financial oversight and operational efficiency. This section delves into the nuances of such periods, emphasizing their importance in managing resources and measuring performance.

Different organizations may adopt varying structures for these divisions, influenced by industry standards, regulatory requirements, or internal policies. Recognizing these frameworks allows businesses to align their reporting and budgeting processes, ensuring clarity and consistency across all levels of operations.

| Period Type | Description |

|---|---|

| Standard Cycle | Typically spans twelve months, often aligning with the calendar months. |

| Quarterly Division | Breaks the period into four segments, facilitating more frequent assessment and adjustment. |

| Custom Periods | Tailored divisions that suit specific business needs or industry practices. |

Understanding these distinctions not only aids in compliance with legal and regulatory standards but also enhances the ability to make informed decisions based on timely data. The choice of structure can impact everything from cash flow management to strategic investments, making it crucial for organizations to select the most appropriate option for their specific context.

Importance of Financial Year Planning

Effective planning for a specific time frame is crucial for achieving long-term goals. It allows organizations to allocate resources efficiently, anticipate challenges, and seize opportunities. This structured approach is vital for maintaining stability and promoting growth within a business.

Benefits of Strategic Planning

- Enhances decision-making processes.

- Facilitates resource management.

- Improves financial forecasting.

- Strengthens accountability among teams.

Key Elements to Consider

- Setting clear objectives.

- Conducting thorough market analysis.

- Establishing a realistic budget.

- Regularly reviewing and adjusting plans.

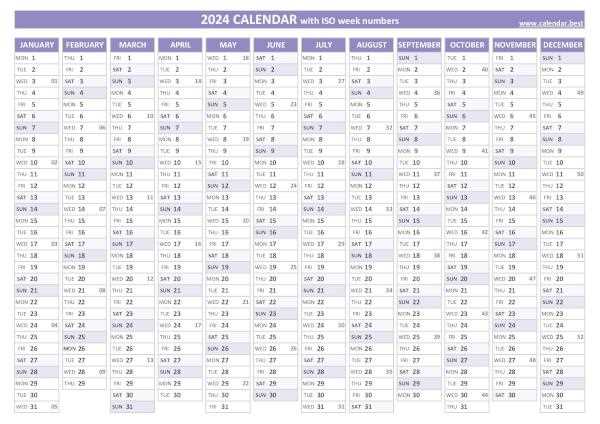

Creating Your Own Calendar Template

Designing a personalized schedule can greatly enhance your planning and organization. By tailoring it to your specific needs, you can ensure that it aligns perfectly with your unique requirements, making it an effective tool for managing your time.

Steps to Design Your Schedule

Start by identifying the key periods you want to track. Next, choose a format that suits your style, whether digital or paper. Incorporate elements like important dates and tasks, and consider color-coding for clarity. This will help you maintain focus and efficiency.

Benefits of Customization

A bespoke planning tool allows you to prioritize what matters most, providing a clear overview of your commitments. This personalized approach not only fosters better time management but also enhances productivity, ultimately leading to more fulfilling outcomes.

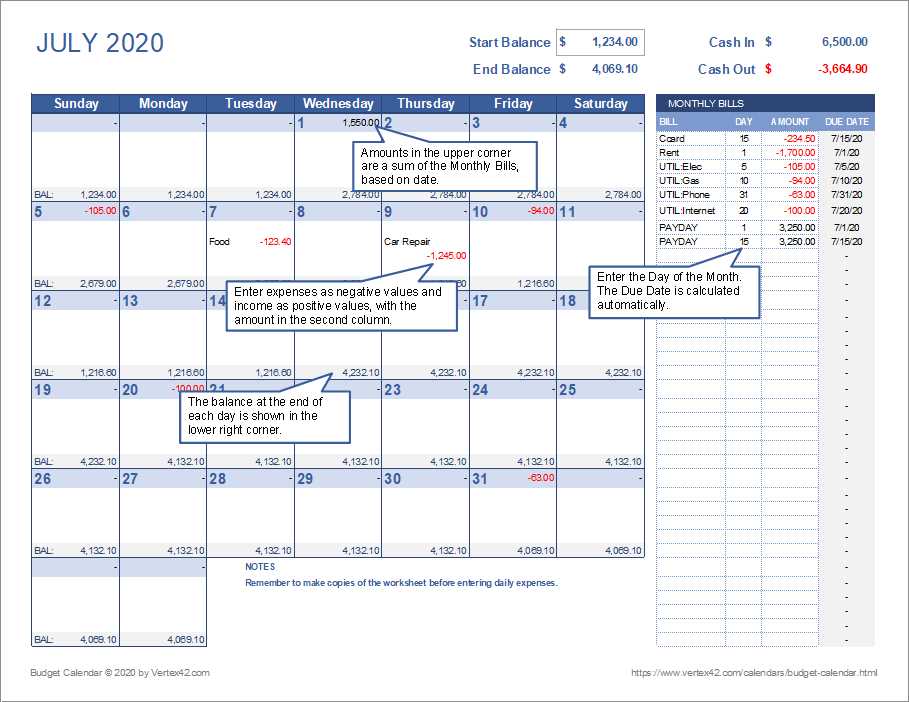

Key Components of a Financial Calendar

Establishing an effective structure for tracking and managing monetary activities involves several crucial elements. Each component plays a significant role in ensuring that all financial operations align with overarching goals and timelines. By understanding these essential parts, individuals and organizations can enhance their fiscal planning and analysis.

The first vital element is the timeline itself, which outlines the specific periods during which financial tasks are to be completed. This includes important dates for budgeting, forecasting, and reporting, allowing stakeholders to anticipate and prepare for significant financial events.

Another critical aspect is the categorization of income and expenses. Clearly defining different revenue streams and cost centers helps in monitoring performance and making informed decisions. This classification ensures that all financial data is organized and accessible for analysis.

Moreover, regular review periods are essential. Scheduling consistent intervals for evaluating financial performance allows for timely adjustments and strategic planning. This practice not only promotes accountability but also encourages proactive management of resources.

Lastly, communication channels should be established to facilitate information sharing among team members and stakeholders. Effective collaboration ensures that everyone involved is aware of financial statuses and responsibilities, fostering a unified approach to monetary management.

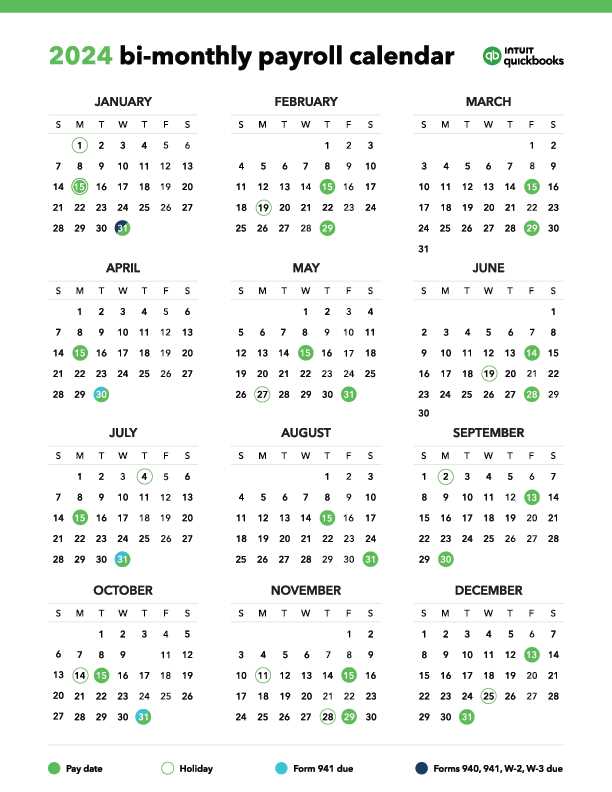

Monthly Budgeting Strategies Explained

Effective planning is crucial for managing resources wisely and achieving your goals. By breaking down your finances into manageable segments, you can gain better control over your spending and savings. This section delves into various approaches to help you optimize your monthly allocations and ensure that your financial objectives are met.

One popular strategy involves tracking income and expenditures meticulously. This practice allows you to identify patterns and areas where adjustments can be made. By categorizing your spending, you can pinpoint necessities versus discretionary expenses, enabling more informed decisions.

Another effective method is the envelope system, where you allocate cash for specific categories of spending. This tactile approach reinforces discipline and makes it easier to stick to your limits, preventing overspending in any one area.

Setting clear goals is also vital. Whether saving for a vacation or building an emergency fund, having a target can motivate you to allocate resources accordingly. Regularly reviewing these goals ensures they remain relevant and achievable.

Lastly, consider using tools or apps that facilitate tracking and planning. Technology can simplify the process, providing insights into your habits and progress over time. By employing these strategies, you can cultivate a healthier financial lifestyle and work towards your aspirations with confidence.

Aligning Calendar with Business Goals

Establishing a clear connection between organizational timelines and strategic objectives is crucial for success. By synchronizing planning processes with the overarching aspirations of the enterprise, teams can enhance productivity and ensure that resources are effectively allocated to achieve desired outcomes.

One effective way to achieve this alignment is through a structured approach that incorporates key performance indicators (KPIs) and milestones into the planning framework. This ensures that every phase of the process supports the primary aims of the organization.

| Strategic Objective | Key Actions | Timeline | Responsible Team |

|---|---|---|---|

| Increase Market Share | Launch new marketing campaign | Q1 2024 | Marketing |

| Enhance Customer Satisfaction | Implement feedback system | Q2 2024 | Customer Service |

| Improve Operational Efficiency | Conduct process audit | Q3 2024 | Operations |

| Expand Product Line | Research and develop new products | Q4 2024 | R&D |

By outlining specific initiatives alongside timelines and accountability, organizations can foster a culture of alignment and ensure that all team members are working toward common objectives. This strategic coherence not only enhances focus but also drives engagement and motivation across the board.

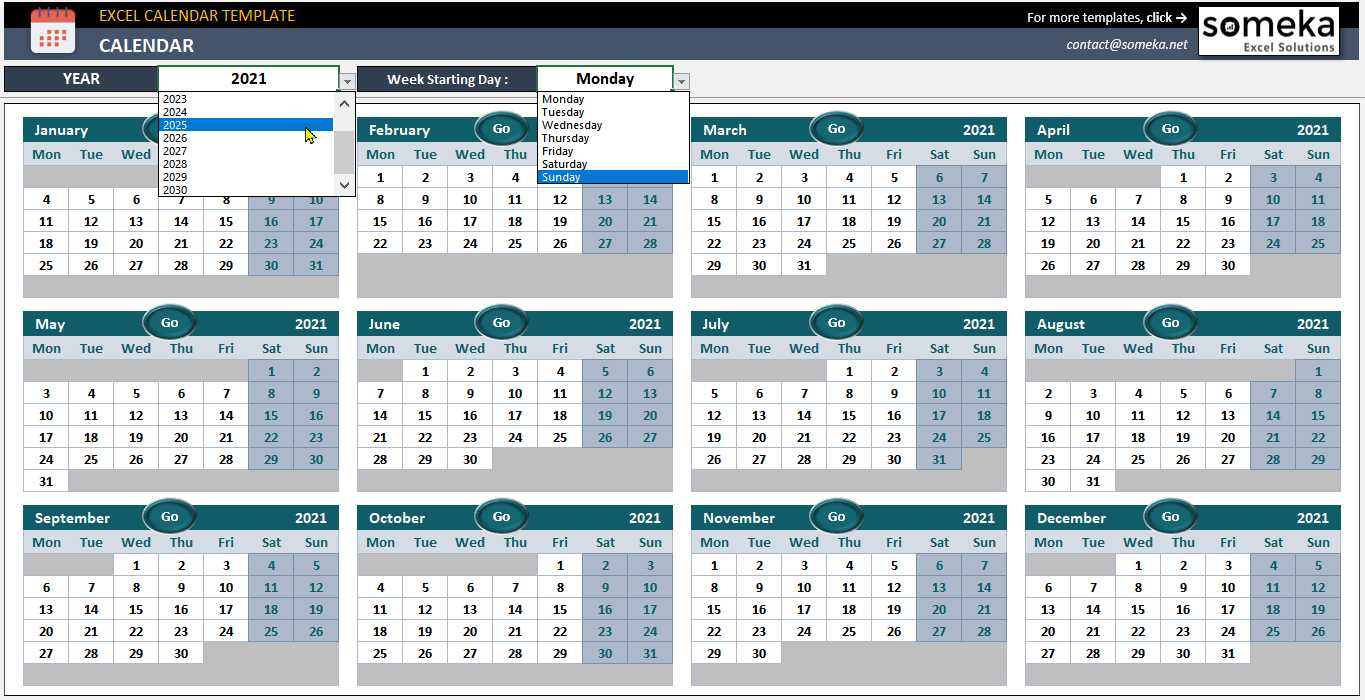

Tools for Calendar Management

Effective organization and time tracking are essential for both personal and professional success. Various tools are available to assist individuals and teams in managing their schedules efficiently. These solutions can help streamline processes, enhance productivity, and ensure that important deadlines and appointments are not overlooked.

Digital Solutions

In today’s digital age, numerous applications offer features that allow users to customize their planning experience. These platforms often include reminders, event sharing, and integration with other software, making it easier to coordinate tasks and meetings. Users can choose from a range of options based on their specific needs, whether they require simple task lists or complex project management capabilities.

Traditional Methods

For those who prefer a tangible approach, physical planners and organizers remain popular. Writing down tasks and appointments can enhance retention and provide a satisfying sense of accomplishment as items are checked off. Moreover, some individuals find that the act of physically organizing their tasks helps to reduce stress and maintain focus on their goals.

Ultimately, the choice of tools depends on personal preference and the specific requirements of the user. By exploring both modern technology and traditional methods, individuals can find the best strategies to optimize their time management efforts.

Adjusting for Fiscal Year Changes

Organizations often encounter the need to realign their operational timelines to better reflect their strategic objectives and external economic conditions. This process involves modifying periods for reporting and planning, ensuring that all stakeholders remain informed and capable of making data-driven decisions.

One of the primary considerations in this adjustment is the impact on budgeting and resource allocation. It’s crucial to provide a clear view of how these changes will influence financial forecasting and performance metrics.

| Aspect | Consideration |

|---|---|

| Transition Period | Identify the duration necessary for effective changeover. |

| Stakeholder Communication | Ensure all parties are informed about adjustments and their implications. |

| Impact Analysis | Evaluate how the shift affects current financial models and projections. |

| Regulatory Compliance | Check for any legal requirements related to reporting periods. |

Successful navigation of these adjustments relies on meticulous planning and clear communication, allowing entities to adapt seamlessly while maintaining operational integrity.

Visualizing Your Financial Timeline

Creating a clear representation of your monetary journey is essential for effective planning and management. By illustrating key events and milestones, you can easily track progress, anticipate future needs, and make informed decisions. This approach allows you to gain insights into your economic patterns and prepare for upcoming challenges.

Key Elements to Include

- Income Streams: Outline different sources of revenue and their expected timing.

- Expenses: Identify fixed and variable costs, highlighting when they occur.

- Investments: Mark significant investment dates and expected returns.

- Goals: Include both short-term and long-term objectives that align with your overall strategy.

Effective Visualization Techniques

- Graphs: Utilize bar or line graphs to depict income and expenses over time.

- Timelines: Create a linear timeline that showcases important dates and events.

- Color Coding: Use different colors to differentiate between types of transactions or priorities.

- Charts: Incorporate pie charts for visualizing budget allocations and proportions.

By employing these strategies, you can transform abstract numbers into a visual story, making it easier to understand your financial landscape and strategize for the future.

Best Practices for Record Keeping

Maintaining accurate and organized documentation is essential for any entity seeking to ensure transparency and efficiency. Proper management of records not only supports compliance but also facilitates informed decision-making. Here are some best practices to consider for effective record keeping.

- Establish a Clear System: Create a consistent method for organizing documents, whether digital or physical. This can include categorizing files by date, type, or project.

- Utilize Technology: Leverage software solutions to streamline the process. Document management systems can automate organization and retrieval, reducing manual effort.

- Regular Updates: Schedule routine reviews of your records. This ensures that all information is current and any outdated or irrelevant documents are disposed of properly.

- Backup Data: Implement regular backups of all electronic records. This protects against data loss due to technical failures or unforeseen events.

- Maintain Compliance: Stay informed about relevant laws and regulations regarding record retention. Adhering to legal requirements helps avoid potential penalties.

- Train Employees: Ensure that all staff members understand the importance of record keeping and are trained in the established procedures.

By following these guidelines, individuals and organizations can enhance their record management practices, leading to improved operational effectiveness and accountability.

Integrating with Accounting Software

Seamless integration with accounting platforms is crucial for optimizing financial management processes. By connecting your scheduling framework with robust software solutions, you can enhance accuracy, streamline operations, and gain deeper insights into your organization’s fiscal health.

Consider the following benefits of integrating your planning tools with accounting applications:

- Automated data transfer reduces manual entry errors.

- Real-time updates provide current insights into budgetary performance.

- Enhanced reporting capabilities allow for more informed decision-making.

- Simplified compliance tracking helps adhere to regulatory requirements.

To effectively integrate these systems, follow these essential steps:

- Assess compatibility between your scheduling solution and accounting software.

- Identify key data points that need synchronization.

- Utilize APIs or integration tools provided by the software vendors.

- Test the integration thoroughly to ensure data accuracy and reliability.

- Provide training for users to maximize the benefits of the new system.

By prioritizing these strategies, organizations can achieve a cohesive operational framework that supports better financial oversight and management.

Tracking Financial Milestones Effectively

Monitoring key achievements within a specific timeframe is essential for ensuring growth and stability. By keeping a close eye on significant targets and objectives, organizations can make informed decisions, adjust strategies, and ultimately enhance performance. This section explores methods for effectively tracking these important benchmarks, ensuring that progress remains on course.

Establishing Clear Objectives

The first step in effective monitoring is the establishment of precise goals. These should be measurable, attainable, relevant, and time-bound. Clarity in objectives allows for focused efforts and a clear understanding of what success looks like.

Utilizing a Structured Approach

A systematic framework can significantly enhance the tracking process. By organizing data and progress in a coherent manner, stakeholders can easily assess performance and identify areas needing attention. Below is an example of a structured overview for tracking important milestones:

| Milestone | Target Date | Status | Comments |

|---|---|---|---|

| Quarterly Revenue Target | March 31 | On Track | Anticipating a strong quarter due to increased sales. |

| New Client Acquisition | June 30 | Behind Schedule | Need to ramp up marketing efforts. |

| Cost Reduction Initiative | September 30 | On Track | Initial savings are above expectations. |

| Product Launch | December 15 | Pending | Final testing phase underway. |

By regularly reviewing and updating this structure, organizations can stay aligned with their ambitions and make proactive adjustments as needed, paving the way for sustained success.

Setting Deadlines for Financial Reports

Establishing timelines for report submissions is crucial for maintaining efficiency and clarity in any organization. These deadlines ensure that stakeholders receive timely information, enabling informed decision-making.

To effectively set these timelines, consider the following steps:

- Identify key reporting requirements.

- Evaluate the time needed for data collection and analysis.

- Involve team members in the planning process.

- Set realistic deadlines that account for potential delays.

- Communicate deadlines clearly to all involved parties.

By adhering to these practices, organizations can enhance the accuracy and timeliness of their reporting processes.

Common Mistakes in Calendar Planning

Effective planning can significantly influence the success of any organization, yet many individuals and teams fall into predictable pitfalls that hinder their efficiency. Understanding these missteps is crucial for establishing a well-structured timeline that enhances productivity and minimizes confusion.

Overlooking Key Dates

A frequent error involves failing to account for significant events or deadlines. When important occasions are ignored, it can lead to last-minute scrambles and increased stress. It’s essential to have a comprehensive overview of all critical dates to ensure seamless operations.

Lack of Flexibility

Another common issue is rigid planning. While having a structured approach is important, an inflexible system can stifle adaptability. Being open to adjustments allows teams to respond to unforeseen changes effectively.

| Mistake | Consequence | Solution |

|---|---|---|

| Overlooking Key Dates | Increased stress and disorganization | Regularly update and review important dates |

| Lack of Flexibility | Inability to adapt to changes | Incorporate buffers and review regularly |

| Inadequate Communication | Misalignment among team members | Establish clear communication channels |

| Neglecting Stakeholder Input | Overlooked needs and perspectives | Engage stakeholders early in the process |

Tips for Collaborative Calendar Use

Effective teamwork relies heavily on synchronized scheduling and clear communication. Utilizing a shared planning tool can greatly enhance collaboration, allowing team members to stay informed and engaged. Here are some practical tips to maximize the benefits of joint scheduling platforms.

Establish Clear Guidelines

- Define roles and responsibilities regarding event creation and updates.

- Set expectations for how and when team members should add information.

- Agree on the format for event titles and descriptions to ensure consistency.

Utilize Notifications and Reminders

- Enable alerts for important deadlines and meetings to keep everyone on track.

- Encourage team members to customize their notification settings based on their preferences.

- Regularly review and adjust reminder settings to maintain relevance and effectiveness.

By following these tips, teams can foster a more organized and efficient collaborative environment, ultimately leading to better project outcomes.

Evaluating Performance Throughout the Year

Assessing effectiveness over a designated timeframe is crucial for understanding progress and making informed decisions. Regular evaluations help organizations to identify strengths and weaknesses, enabling timely adjustments and strategic planning for future endeavors.

Setting Key Indicators

To effectively measure success, it is essential to establish clear and relevant metrics. These indicators should align with overall objectives, providing a benchmark for analysis. By focusing on specific outcomes, teams can gauge their performance accurately and remain motivated toward achieving their goals.

Reviewing Outcomes and Strategies

Periodic reviews of results facilitate a deeper understanding of what strategies are working and what needs improvement. Regular assessments encourage a culture of transparency and accountability. Engaging stakeholders in these evaluations can provide diverse perspectives, fostering a collaborative approach to problem-solving and innovation.

Resources for Financial Calendar Templates

Having access to well-structured planning tools is essential for effective management and strategic decision-making. A variety of resources can provide users with the necessary frameworks to organize their fiscal periods efficiently. Whether for personal use or for larger organizations, these aids can streamline operations and enhance productivity.

| Resource Type | Description | Access Link |

|---|---|---|

| Online Tools | Web-based applications that offer customizable structures for planning and tracking. | Visit |

| Printable Formats | Downloadable documents that can be printed for offline use and easy reference. | Download |

| Software Solutions | Comprehensive programs designed for extensive financial management and reporting. | Explore |

| Mobile Apps | Applications that allow users to manage their schedules on-the-go with user-friendly interfaces. | Get App |