In today’s fast-paced world, keeping track of monetary obligations can be a daunting task. Many individuals struggle with organizing their commitments, leading to missed deadlines and unnecessary stress. Streamlining this process is essential for maintaining financial health and peace of mind.

Utilizing structured planning aids can significantly enhance one’s ability to manage expenditures effectively. By employing organized schedules, you can ensure that all responsibilities are met in a timely manner, allowing for better control over personal finances. This practice not only fosters accountability but also contributes to smarter budgeting habits.

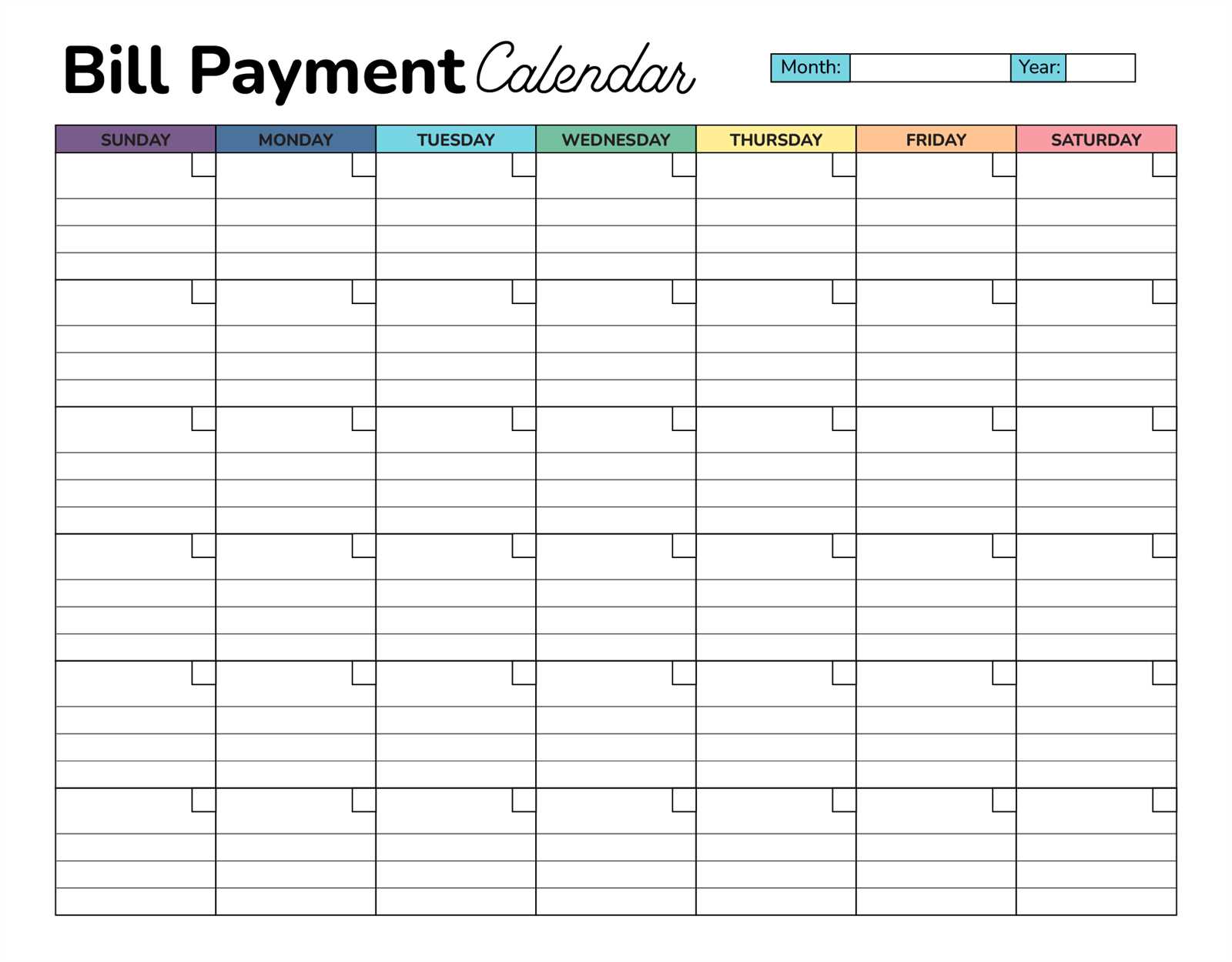

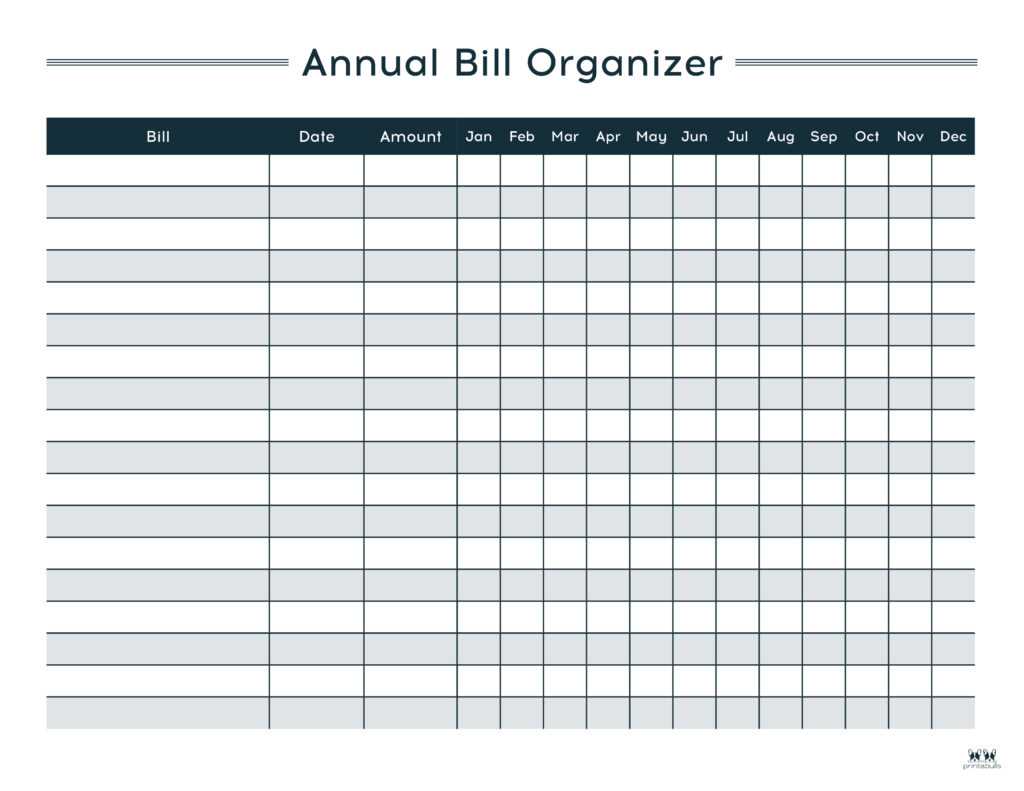

Whether you are managing household expenses or business obligations, the right planning resources can make all the difference. With a thoughtfully designed organizational tool, you can visualize your payment timelines, thus reducing anxiety and improving your overall financial strategy.

Understanding Free Bill Pay Calendars

In today’s fast-paced world, managing financial commitments can often feel overwhelming. An effective solution lies in the organization of payment schedules, which allows individuals to keep track of their obligations without the stress of missed deadlines. This method enhances financial awareness and contributes to better budgeting practices, ultimately leading to improved financial health.

The Benefits of Structured Financial Tracking

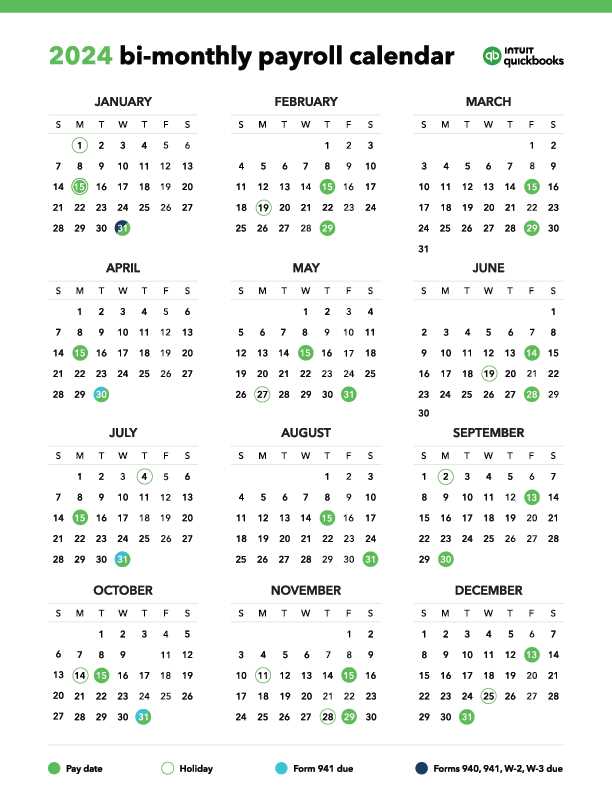

Employing a systematic approach to monitor due dates can significantly alleviate anxiety related to monetary responsibilities. By establishing a clear timeline for when payments are expected, individuals can prioritize their finances more efficiently. This structured oversight helps in avoiding late fees and maintaining a positive credit score, which is crucial for long-term financial stability.

How to Implement an Effective Tracking System

To create a reliable framework for monitoring upcoming dues, one can begin by listing all recurring obligations. Incorporating reminders into daily routines, whether through digital tools or traditional methods, can serve as an effective strategy. Utilizing visual aids can enhance retention and ensure that financial tasks are addressed timely. Consistency and organization are key elements in mastering this practice.

Benefits of Using a Calendar Template

Utilizing a structured layout for organizing tasks and important dates can significantly enhance productivity and time management. A well-designed scheduling format provides a clear overview, helping individuals and businesses maintain focus on their priorities. It serves as a valuable tool for planning and executing daily activities efficiently.

Improved Organization

A systematic approach to scheduling allows users to categorize and prioritize their responsibilities effectively. By having a visual representation of tasks, it becomes easier to identify deadlines and allocate time appropriately. This organization minimizes the risk of overlooking crucial obligations.

Enhanced Accountability

When responsibilities are documented in a structured format, it fosters a sense of accountability. Individuals are more likely to adhere to their commitments and track their progress, leading to increased motivation and a sense of accomplishment. This transparency benefits not only the individual but also any teams involved.

| Feature | Benefit |

|---|---|

| Visual Structure | Easy to see and manage tasks |

| Prioritization | Helps focus on what matters most |

| Accountability | Encourages commitment to deadlines |

| Flexibility | Adaptable to changing needs |

How to Choose the Right Template

Selecting an appropriate design for organizing your financial commitments can greatly enhance your planning process. With various options available, it is essential to identify the one that best suits your needs and lifestyle. The right choice can help streamline your scheduling, ensure timely management, and reduce stress associated with overdue obligations.

When evaluating different designs, consider the following factors:

| Factor | Considerations |

|---|---|

| Functionality | Assess whether you need a simple layout or advanced features like reminders and tracking. |

| Customization | Look for options that allow you to personalize elements to fit your specific requirements. |

| Usability | Ensure the format is user-friendly and easy to navigate, regardless of your tech skills. |

| Design Aesthetics | Choose a visual style that resonates with you, making it enjoyable to use regularly. |

| Accessibility | Consider if you want a printable version or a digital format that you can access on multiple devices. |

By carefully reflecting on these aspects, you can make a well-informed decision that will effectively assist in managing your financial obligations and promote a more organized lifestyle.

Essential Features of Bill Pay Calendars

A well-structured scheduling tool can significantly enhance financial management by providing clarity and organization. Such resources serve as vital guides for tracking due dates, ensuring timely actions are taken. Their effectiveness lies in several key characteristics that facilitate smooth administration of expenses.

User-Friendly Layout: An intuitive design is crucial. Users should easily navigate through the interface, allowing them to quickly find relevant information without confusion. Clear labeling and logical arrangements contribute to a seamless experience.

Customizable Reminders: Personalized notifications play a pivotal role in preventing overdue payments. The ability to set alerts according to individual preferences helps maintain financial discipline and ensures nothing is overlooked.

Comprehensive Overview: A summary feature that consolidates upcoming obligations provides users with a snapshot of their financial commitments. This aids in effective planning and decision-making regarding budget allocations.

Integration Capabilities: Seamless connection with banking and financial applications enhances functionality. Such integrations allow for automatic updates and facilitate a holistic view of one’s financial landscape.

Print and Export Options: The ability to print or export data is essential for those who prefer physical records or wish to share their financial schedule with others. This flexibility supports various user needs and preferences.

Customizing Your Calendar for Personal Needs

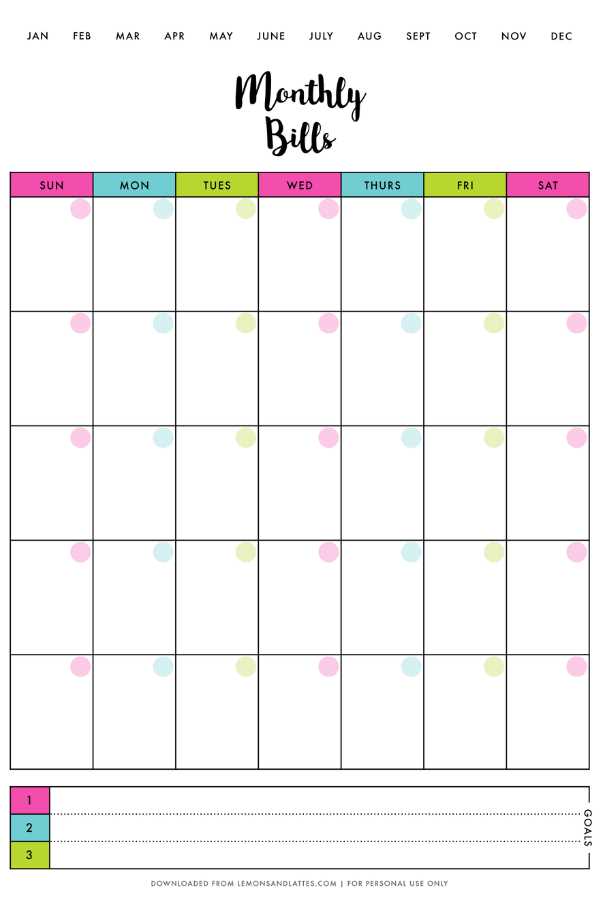

Tailoring your scheduling tool to fit your unique lifestyle can greatly enhance your productivity and organization. Personalizing this resource allows you to incorporate specific tasks, reminders, and important dates that resonate with your daily routine.

Identifying Key Features

Start by determining which elements are essential for your usage. Consider including sections for appointments, deadlines, and goals. A well-structured layout can help prioritize your responsibilities efficiently.

Utilizing Visual Elements

Adding color coding and symbols can provide visual cues, making it easier to distinguish between various activities. This approach helps in quickly recognizing what needs immediate attention or planning.

| Feature | Description |

|---|---|

| Appointments | Designate time slots for meetings and events. |

| Deadlines | Highlight important dates for tasks and projects. |

| Goals | Set long-term objectives to track progress. |

Top Sources for Free Templates

Finding high-quality resources for creating organized schedules can significantly enhance productivity. Various platforms offer a wealth of designs that cater to different needs, making it easier to stay on track with tasks and appointments. This section highlights some of the best places to discover these invaluable resources.

Online Design Platforms

Websites like Canva and Adobe Express provide a plethora of visually appealing layouts that can be easily customized. These platforms allow users to modify colors, fonts, and layouts to suit individual preferences. Their intuitive interfaces make it simple for anyone, regardless of design experience, to create stunning documents that fulfill their organizational requirements.

Document Sharing Sites

Sites such as Google Docs and Microsoft Office Online offer an extensive array of shared resources. Users can access a wide variety of files uploaded by others, often including creative and practical arrangements. Many of these shared documents are editable, allowing for personal adjustments while maintaining the original structure.

By exploring these sources, individuals can find diverse options that not only meet their organizational needs but also add a touch of creativity to their planning processes.

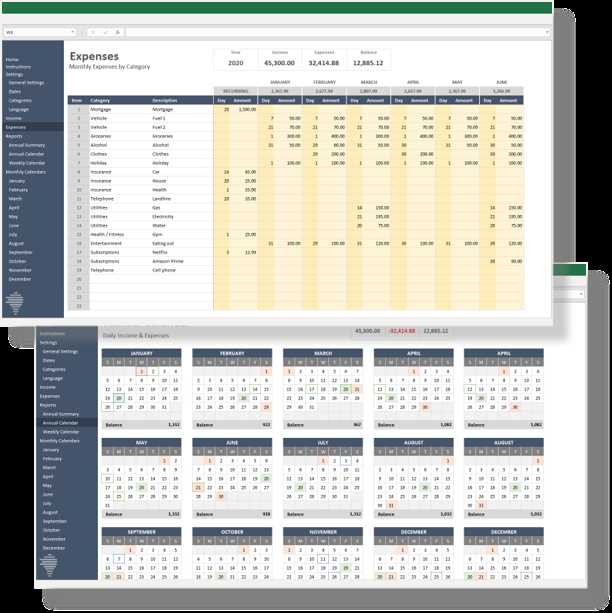

Integrating Calendar with Budgeting Tools

Connecting time management systems with financial tracking applications can significantly enhance your ability to oversee expenditures and plan future investments. This integration allows for a streamlined approach to managing both your schedule and your finances, ensuring that deadlines and monetary commitments are met seamlessly.

Here are some key benefits of this integration:

- Improved Organization: Synchronizing your planning tools with financial management software creates a centralized view of both your appointments and your financial obligations.

- Enhanced Awareness: With reminders for due dates and budget limits, you can avoid overspending and ensure timely actions.

- Automated Tracking: Linking these systems allows for automatic updates and notifications regarding your financial situation, reducing the manual effort involved.

To effectively integrate these systems, consider the following steps:

- Select compatible tools that support integration.

- Set up synchronization options to ensure real-time updates.

- Customize alerts for key financial dates and spending thresholds.

- Regularly review both your schedule and budget to maintain alignment.

By effectively merging your time management and financial oversight tools, you can foster better control over your resources and enhance your financial health.

Organizing Payments for Monthly Expenses

Managing financial obligations each month can often feel overwhelming. However, with a structured approach, you can streamline this process, ensuring that no obligation is overlooked. By establishing a systematic way to track and schedule your expenditures, you can maintain better control over your finances and reduce the stress associated with managing various due dates.

Creating a Strategy is the first step towards effective management. Consider categorizing your obligations into fixed and variable expenses. Fixed costs, such as rent or insurance, remain constant, while variable expenses, like groceries or entertainment, may fluctuate. Understanding these categories will help you allocate funds more efficiently.

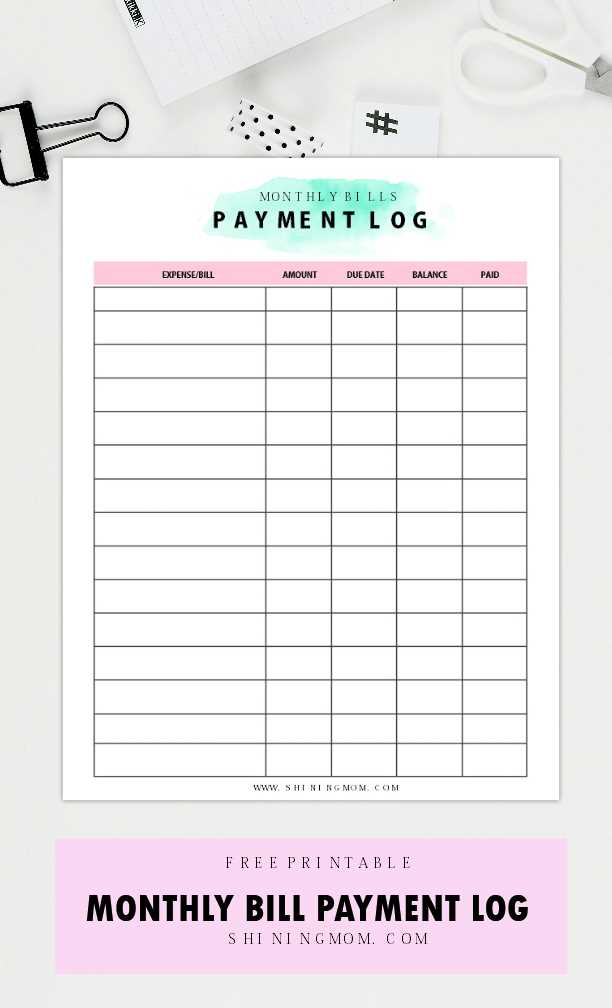

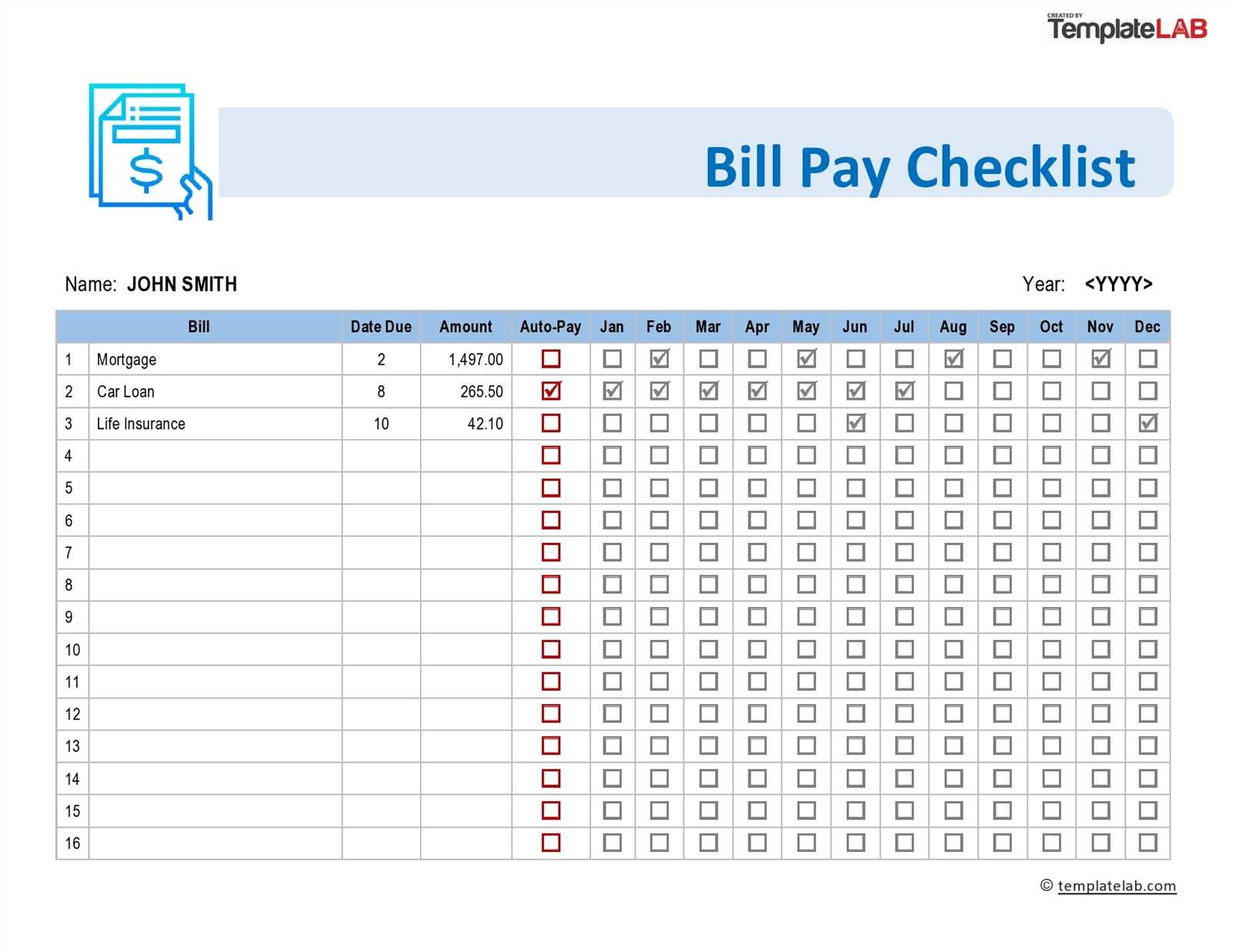

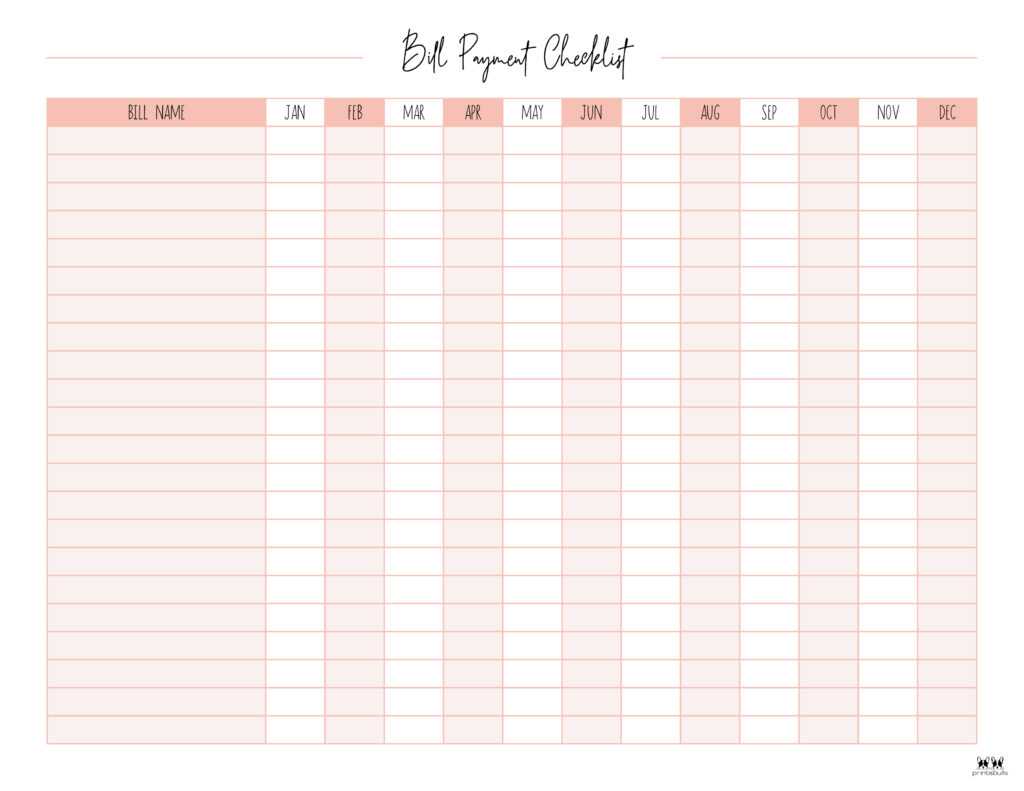

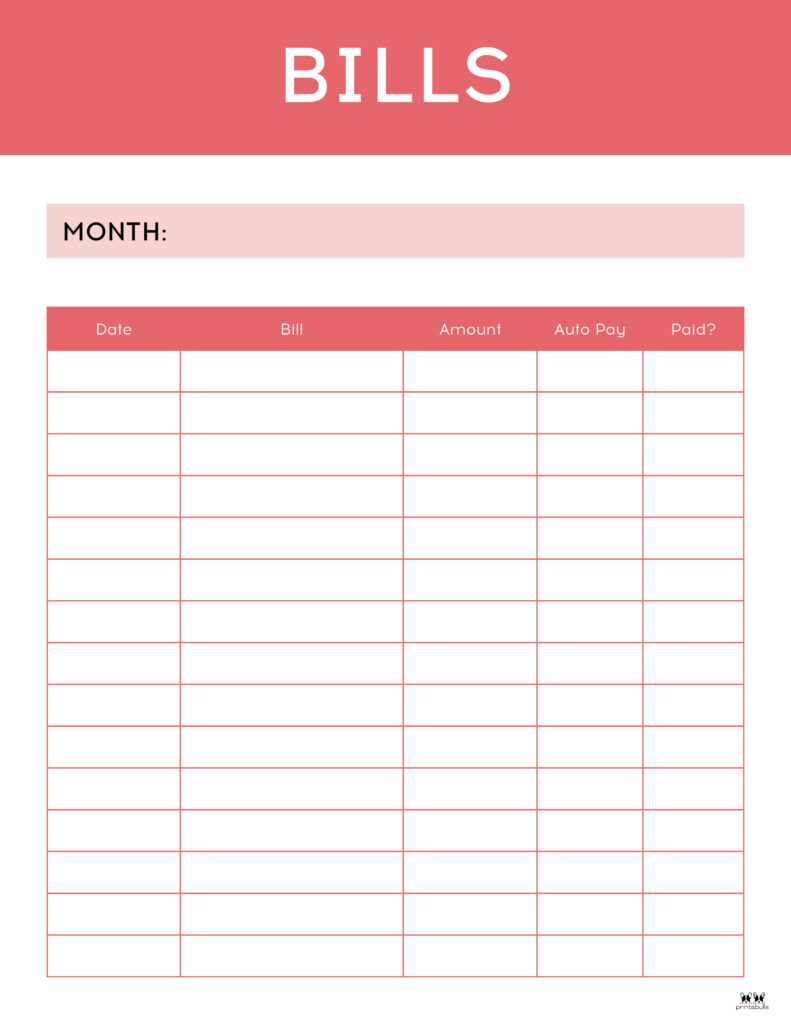

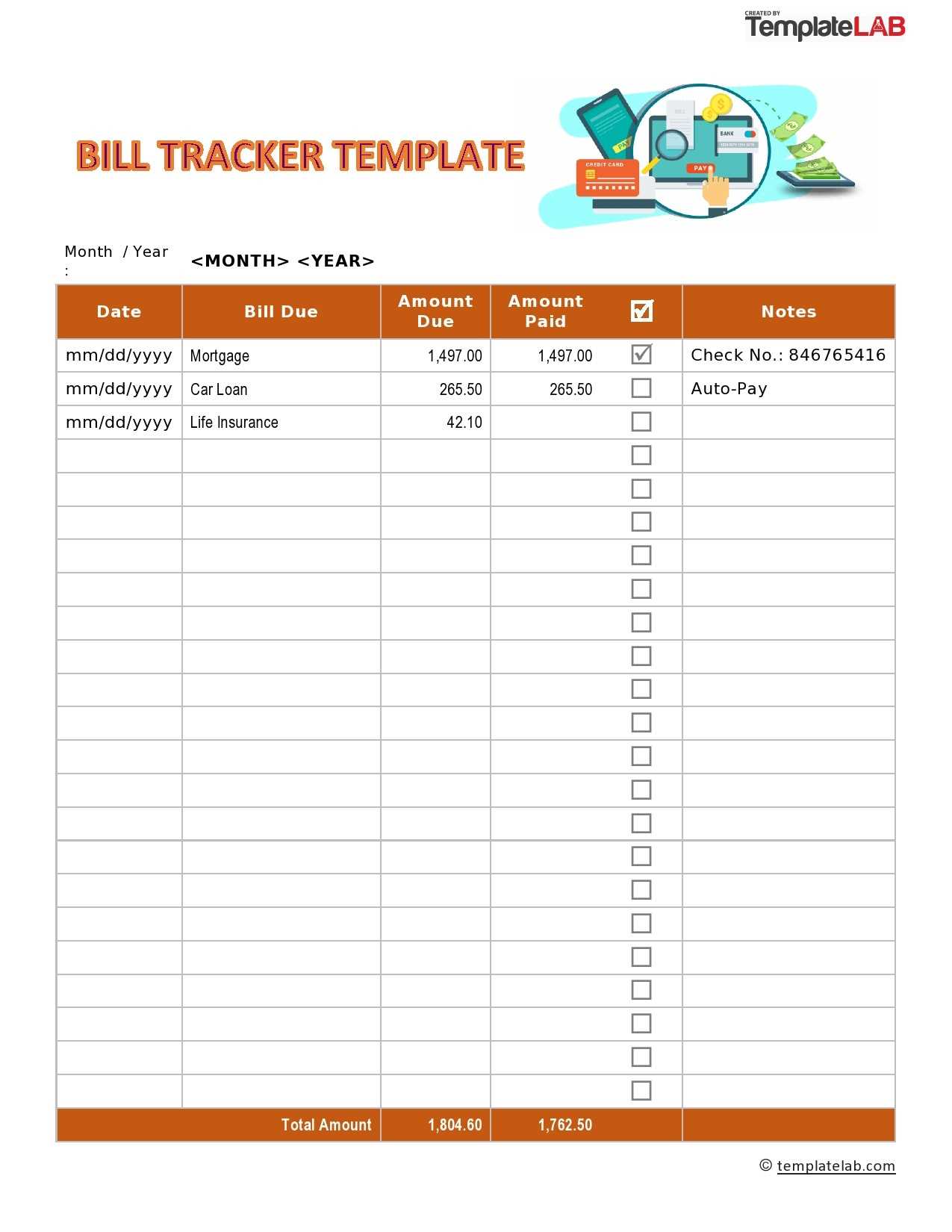

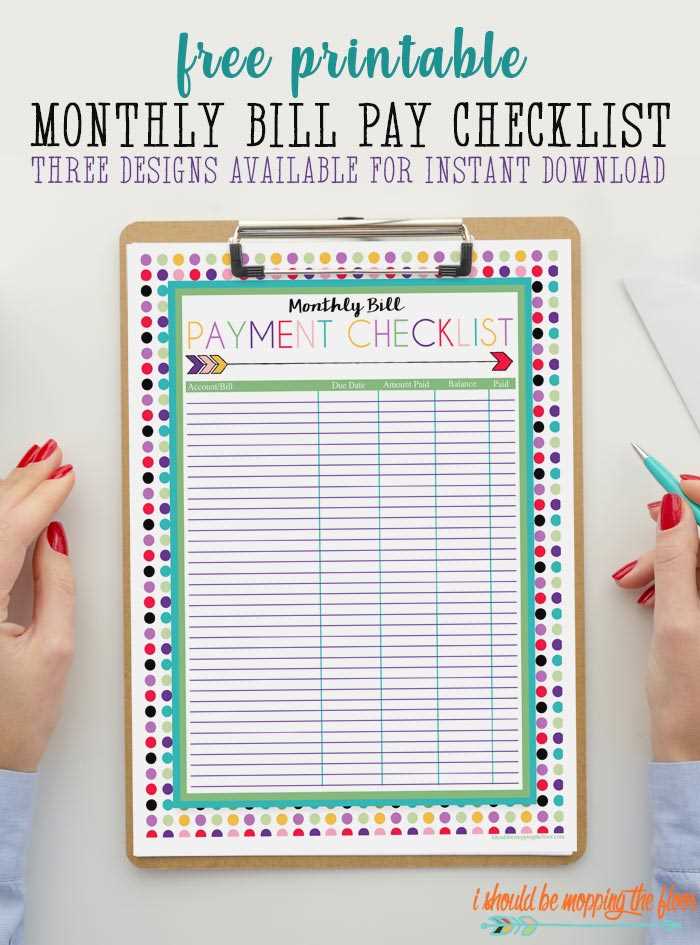

Utilizing Tools to organize your financial commitments is essential. Whether you prefer digital applications or traditional paper methods, choose a format that suits your lifestyle. A visual representation can enhance your awareness of upcoming payments and allow for timely actions.

Setting Reminders is crucial in avoiding late fees and maintaining a good credit score. You can leverage technology to set alerts on your phone or computer, ensuring you receive notifications before any due dates. This proactive approach fosters accountability and aids in building a positive financial habit.

Finally, reviewing your financial landscape regularly can help you adjust your strategies as necessary. Monthly evaluations allow you to identify trends in your spending, highlight areas for improvement, and adapt your budgeting strategies accordingly. By consistently monitoring your obligations, you can enhance your financial literacy and make informed decisions for the future.

Setting Reminders for Due Dates

Keeping track of important deadlines is essential for managing financial obligations effectively. Establishing timely alerts can significantly reduce the risk of late fees and ensure that all responsibilities are met promptly. By leveraging various reminder methods, individuals can maintain a clear overview of their upcoming commitments.

Methods for Setting Reminders

There are several effective strategies to ensure you never miss a deadline. These methods can be tailored to fit your personal preferences and daily routines:

| Method | Description |

|---|---|

| Digital Calendars | Utilize apps or online platforms that allow you to set notifications for upcoming due dates. Syncing with mobile devices ensures reminders are received anywhere. |

| Physical Planners | Write down due dates in a dedicated planner. This tactile method can help reinforce memory through visual cues. |

| Mobile Alerts | Use your smartphone’s built-in reminder feature to create alerts. Customizable settings allow you to choose how far in advance you want to be notified. |

| Email Notifications | Sign up for email reminders from service providers. This ensures you receive timely notifications directly to your inbox. |

Tips for Effective Reminder Management

To enhance the effectiveness of your reminder system, consider these helpful tips:

- Set multiple reminders at different intervals, such as one week and one day prior to the due date.

- Review your reminders regularly to ensure they are up-to-date and relevant.

- Incorporate visual reminders, such as sticky notes, in frequently visited areas.

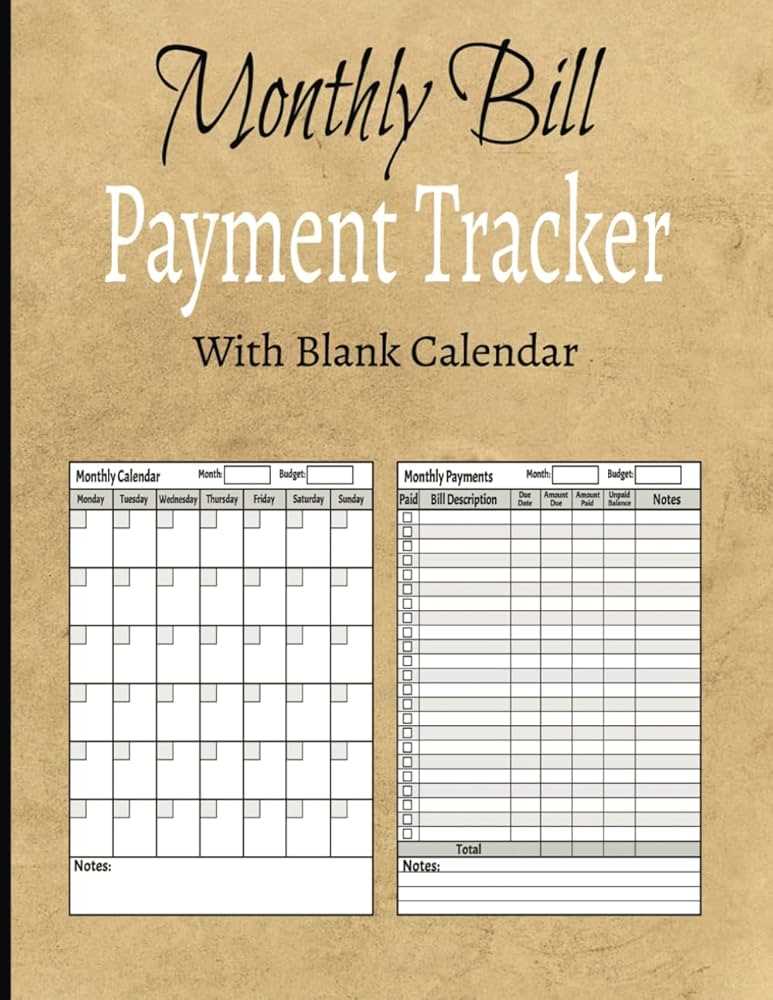

Tracking Paid and Unpaid Bills

Managing financial obligations effectively is crucial for maintaining good standing and avoiding late fees. Keeping a record of settled and outstanding amounts helps in organizing expenses and planning future payments. This section outlines strategies for tracking these transactions efficiently.

Benefits of Tracking

- Prevents late payments and associated penalties.

- Enhances budgeting by providing a clear overview of expenditures.

- Facilitates identification of recurring obligations.

- Promotes better financial planning and decision-making.

Effective Tracking Methods

- Utilize spreadsheets to log amounts, due dates, and statuses.

- Adopt digital applications designed for financial management.

- Establish a physical filing system for paper statements and invoices.

- Set reminders for upcoming obligations to ensure timely action.

By implementing these practices, individuals can gain greater control over their finances and minimize the risk of overlooked payments.

Using Digital vs. Printable Templates

In today’s fast-paced world, the choice between digital tools and physical documents has become increasingly relevant. Each format offers distinct advantages that cater to different preferences and lifestyles. Understanding these differences can help individuals select the option that best fits their needs.

Digital solutions provide unmatched convenience, allowing users to access their resources from various devices anytime, anywhere. This flexibility enables quick updates and easy sharing, making collaboration seamless. Moreover, many digital platforms offer features such as reminders and automated tracking, which can enhance organization and efficiency.

On the other hand, physical documents can evoke a sense of tangibility that some users find comforting. The act of writing by hand can aid memory retention and provide a satisfying tactile experience. For those who prefer a more traditional approach, printed resources can be easily displayed and customized, making them a visually appealing choice for planning and tracking purposes.

Ultimately, the decision between digital and physical formats boils down to personal preference and lifestyle. Evaluating the specific needs and habits of individuals can lead to a more effective and enjoyable experience in managing tasks and schedules.

Enhancing Financial Management Skills

Improving one’s ability to manage finances effectively is crucial for achieving long-term economic stability and making informed decisions. Developing robust strategies for tracking expenditures, setting budgets, and planning for future expenses can significantly enhance overall financial health. This section explores practical approaches that individuals can adopt to refine their financial management capabilities.

| Skill | Description |

|---|---|

| Budgeting | Creating a detailed plan that outlines income and expenditures, allowing for better allocation of resources. |

| Tracking Expenses | Monitoring daily spending habits to identify patterns and areas for improvement. |

| Setting Financial Goals | Establishing short-term and long-term objectives to guide financial decisions and motivate savings. |

| Investing Wisely | Understanding different investment options and making informed choices to grow wealth over time. |

| Emergency Planning | Preparing for unexpected financial challenges by setting aside funds for emergencies. |

By focusing on these essential skills, individuals can cultivate a greater sense of control over their financial situations, ultimately leading to enhanced security and prosperity.

Common Mistakes to Avoid

When managing your financial obligations, it’s essential to steer clear of common pitfalls that can lead to oversights and stress. Understanding these missteps can significantly improve your organizational skills and ensure timely handling of expenses.

- Neglecting to Track Due Dates: Missing deadlines can result in late fees and interest charges. Always note important dates in a visible manner.

- Ignoring Automatic Reminders: Relying solely on memory can be risky. Utilize technology to set up alerts and notifications.

- Overlooking Variable Expenses: Fixed amounts are easy to remember, but fluctuating costs can catch you off guard. Keep a separate record for these items.

- Failing to Review Regularly: Periodically assess your financial obligations to identify any changes or trends that require adjustment in your approach.

- Not Having a Backup Plan: Unexpected circumstances may arise, so it’s wise to have a contingency strategy in place to handle unforeseen events.

By being mindful of these common errors, you can enhance your financial management and maintain a smoother process for handling your responsibilities.

Tips for Staying Consistent with Payments

Maintaining regularity in managing your financial obligations can significantly enhance your peace of mind and financial health. Implementing effective strategies can help you stay on track and avoid unnecessary stress associated with missed deadlines.

Create a Routine

Establishing a consistent schedule for handling your financial duties is crucial. Consider setting aside a specific time each week or month dedicated solely to reviewing and settling your responsibilities. This habit will make it easier to remember and prioritize your commitments.

Utilize Reminders

Leveraging technology can be a game changer. Set up alerts on your smartphone or use a digital organizer to remind you of upcoming deadlines. This proactive approach ensures that you remain aware of your obligations, reducing the likelihood of forgetting important dates.

Consistency is key. By creating a routine and utilizing reminders, you can effectively manage your financial tasks and enjoy greater peace of mind.

Sharing Your Calendar with Others

Collaborating with others by sharing your scheduling tool can significantly enhance communication and organization. Whether for personal or professional reasons, enabling access to your time management system allows for better coordination and planning among team members or family.

There are various methods to distribute your scheduling information effectively. Below is a summary of popular options to consider when sharing your planning tool:

| Method | Description |

|---|---|

| Email Invitations | Send direct invitations via email to specific individuals, allowing them to view or edit your schedule. |

| Link Sharing | Create a shareable link that provides access to your planning tool, which can be sent to multiple people at once. |

| Integration with Collaboration Platforms | Utilize tools that integrate with platforms like Slack or Microsoft Teams for seamless sharing among colleagues. |

| Public Access | Set your scheduling tool to public mode, enabling anyone with the link to view your availability. |

Choosing the right method depends on your specific needs and the audience you wish to reach. Ensuring that everyone involved is informed can lead to more effective planning and fewer scheduling conflicts.

Adapting to Seasonal Payment Changes

As the year progresses, individuals often face variations in their financial obligations influenced by seasonal factors. Understanding these shifts can lead to better financial management and planning.

- Recognizing trends: Different times of the year bring specific expenses, such as holidays or seasonal activities.

- Budget adjustments: It is essential to revise budgets periodically to accommodate these fluctuations.

- Timing payments: Strategically scheduling payments can help avoid late fees and improve cash flow management.

To effectively navigate these changes, consider the following strategies:

- Track historical patterns: Analyze past spending habits to predict future obligations.

- Set aside funds: Create a reserve for anticipated expenses to minimize financial strain.

- Utilize reminders: Employ digital tools to alert you of upcoming due dates and payment schedules.

By staying proactive and adaptable, one can achieve greater financial stability throughout the year.

Feedback and Improvements on Your Template

Gathering insights from users is crucial for enhancing the functionality and usability of your design. By understanding their experiences and suggestions, you can make informed adjustments that better meet their needs and preferences.

Collecting User Feedback

Effective methods for obtaining user insights include:

- Surveys: Distributing questionnaires to gather opinions on various aspects.

- Focus Groups: Engaging small groups to discuss their experiences in detail.

- Online Reviews: Monitoring comments and ratings on relevant platforms.

Implementing Changes

Once feedback is collected, consider the following steps for improvement:

- Prioritize Suggestions: Identify common themes and urgent requests.

- Test Modifications: Implement changes incrementally and gather further feedback.

- Keep Users Informed: Communicate updates and enhancements to your audience.