Managing your financial obligations can often feel overwhelming, especially with multiple due dates and varying amounts to keep track of. A systematic approach to organizing these responsibilities is essential for maintaining peace of mind and avoiding unnecessary late fees. With the right resources at your disposal, staying on top of your monetary commitments becomes a much simpler task.

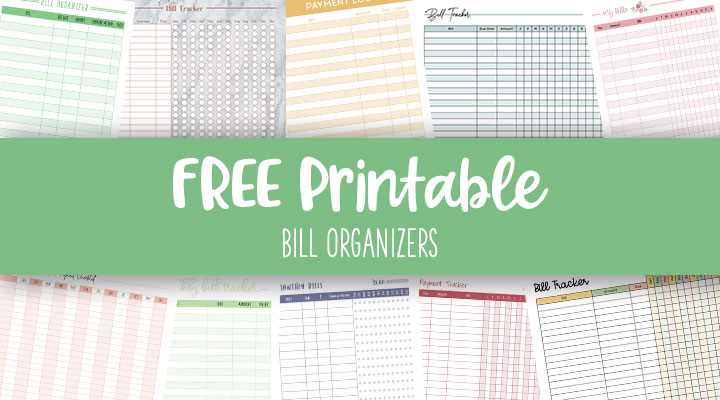

Visual aids can significantly enhance your ability to monitor your expenses and deadlines. By utilizing structured formats that provide clarity and accessibility, you can streamline your financial management process. This resource allows you to map out your monetary commitments effectively, ensuring that nothing slips through the cracks.

Whether you are an individual looking to manage personal expenditures or a professional seeking to oversee business finances, a well-designed framework can be invaluable. It empowers you to prioritize your obligations, allocate funds wisely, and ultimately achieve greater financial stability. Explore the various options available to you and discover how they can transform your approach to financial management.

Understanding Bill Payment Calendars

Managing financial obligations efficiently is crucial for maintaining a stable budget. A structured approach helps individuals keep track of due dates, preventing missed deadlines and potential late fees. By organizing monetary responsibilities, one can gain better control over their finances and plan expenditures more effectively.

Benefits of a Structured Approach

- Enhanced financial awareness

- Reduced stress associated with deadlines

- Improved cash flow management

- Opportunity for budgeting and planning

Key Components to Consider

- Due Dates: Identifying when each obligation is due.

- Amount Owed: Keeping track of how much needs to be paid.

- Payment Methods: Determining the best way to settle each account.

- Reminder Systems: Utilizing alerts or notifications for upcoming deadlines.

By implementing these elements, individuals can enhance their financial management skills and ensure timely fulfillment of their obligations.

Benefits of Using a Payment Calendar

Implementing a scheduling tool for your financial obligations can significantly enhance your ability to manage funds effectively. Such an organizational method not only helps in tracking upcoming dues but also promotes disciplined spending habits, ultimately leading to improved financial health.

Enhanced Organization

- Provides a clear overview of all upcoming expenses.

- Helps prioritize payments, reducing the chance of missing deadlines.

- Facilitates easy tracking of recurring charges.

Improved Financial Awareness

- Encourages proactive financial planning by highlighting due dates.

- Promotes mindful spending by making you aware of upcoming obligations.

- Assists in identifying patterns in your expenses for better budgeting.

How to Create a Custom Template

Crafting a personalized layout can enhance your organization and efficiency. By tailoring it to your specific needs, you can streamline the way you track important due dates and tasks, making the process more intuitive and effective.

Step 1: Determine Your Needs

- Identify key events and deadlines.

- Consider the frequency of occurrences.

- Assess what information is essential for tracking.

Step 2: Design Your Layout

- Choose a suitable format (digital or paper).

- Divide sections for easy reference.

- Incorporate visual elements to enhance usability.

Once you’ve outlined these steps, you can delve into creating your custom design, ensuring it meets your ultimate requirements efficiently.

Types of Bills to Track

Keeping a close watch on various expenses is essential for effective financial management. By categorizing and monitoring different types of obligations, individuals can ensure timely settlements and avoid unnecessary penalties. Below are some common categories that one should consider tracking regularly.

| Category | Description |

|---|---|

| Utilities | Regular charges for services such as electricity, water, and gas. |

| Internet and Cable | Monthly fees for internet access and television subscriptions. |

| Insurance | Payments for health, auto, home, and other forms of coverage. |

| Rent or Mortgage | Recurring payments for housing, whether rented or financed. |

| Loans | Monthly installments for personal, student, or auto loans. |

| Subscriptions | Regular charges for services like streaming platforms, magazines, or gym memberships. |

Best Formats for Your Calendar

When organizing your schedule, selecting the right layout can significantly enhance your experience. Various structures cater to different needs, ensuring clarity and efficiency. The ideal choice depends on your personal preferences and how you wish to visualize your tasks.

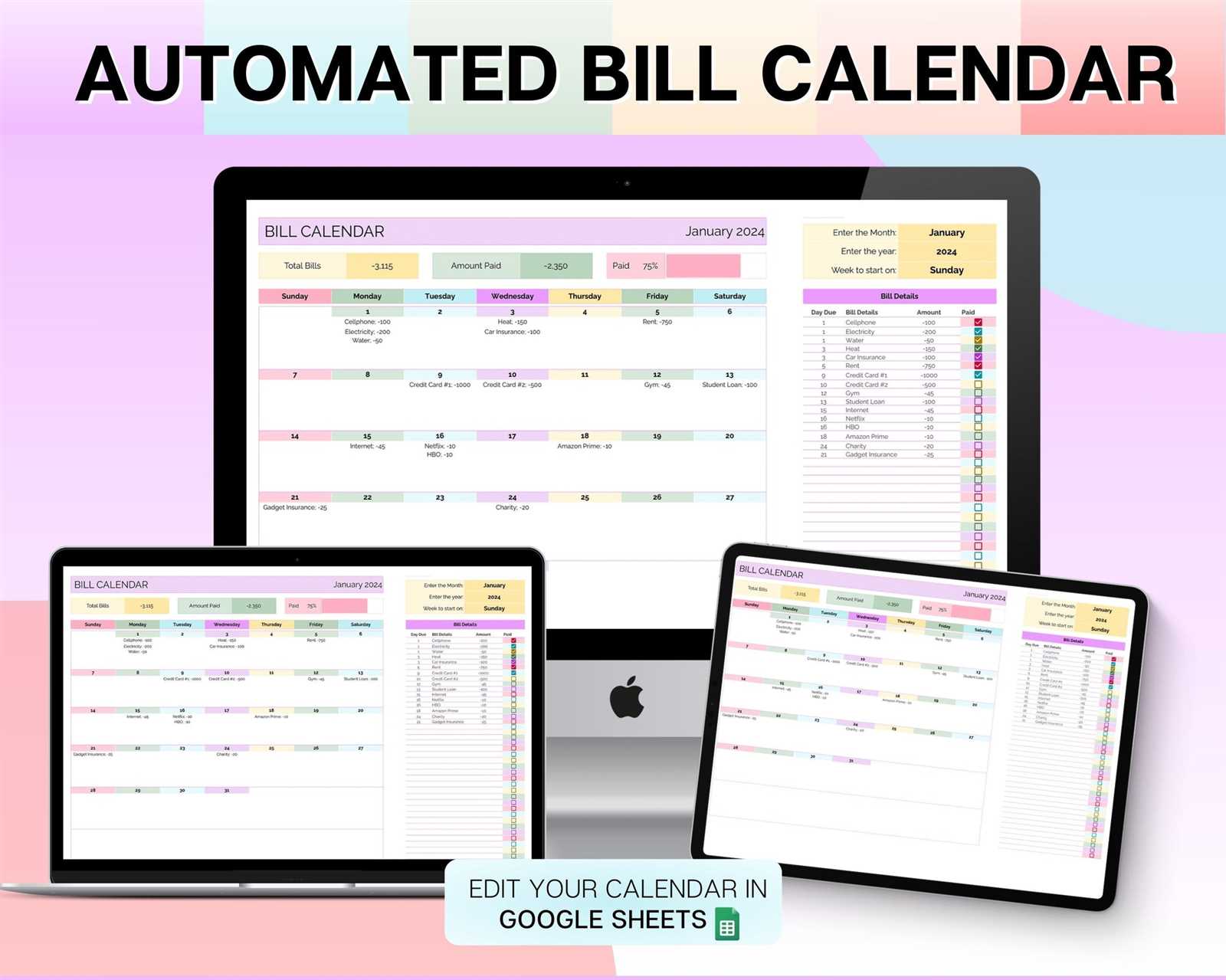

Digital Formats: Electronic options provide flexibility and ease of use. Apps and software allow for quick edits, reminders, and easy sharing. This format is perfect for those who are often on the go and need instant access to their schedules.

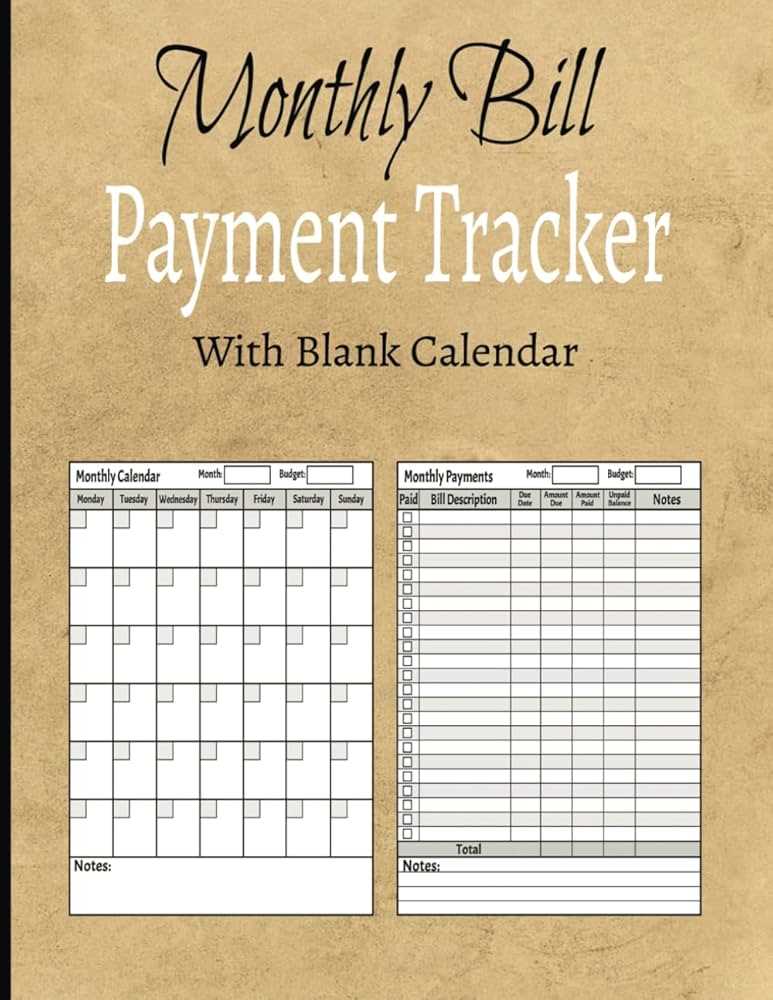

Printable Designs: For individuals who prefer a tangible approach, physical layouts can be incredibly beneficial. These can be customized with colors and designs, allowing for a personalized touch. Writing things down often aids in memory retention, making this format appealing for many.

Hybrid Models: Combining both digital and printable elements offers the ultimate convenience. For instance, a printable format that can also be synced with an app can maximize organization and adaptability. This approach suits diverse lifestyles, bridging the gap between traditional and modern methods.

Ultimately, the best format aligns with your lifestyle and helps you effectively manage your obligations, whether you lean towards technology or enjoy the simplicity of pen and paper.

Digital vs. Paper Templates

In today’s fast-paced world, individuals often find themselves choosing between electronic and traditional formats for managing their schedules. Each option offers distinct advantages and caters to different preferences, influencing how one organizes and tracks important dates.

Digital solutions provide convenience and accessibility, allowing users to integrate reminders and share schedules effortlessly. With just a few clicks, they can be updated or modified, ensuring that the latest information is always at hand.

On the other hand, paper formats can evoke a sense of nostalgia and tangibility that many appreciate. Writing things down can enhance memory retention and offers a physical representation of one’s planning efforts, which some find rewarding.

Ultimately, the choice between digital and traditional formats hinges on personal preference, lifestyle, and how one wishes to engage with their planning tools.

Tips for Staying Organized

Maintaining a structured approach to managing your obligations can significantly enhance productivity and reduce stress. By adopting a few practical strategies, you can ensure that important tasks are completed on time and with minimal effort.

Create a Routine

Establishing a consistent schedule is essential for effective management. Set aside specific times each week to review your responsibilities and prioritize them. This regularity helps create a habit that makes it easier to stay on top of your commitments.

Utilize Tools for Tracking

Incorporating various organizational tools can streamline your process. Consider using digital apps or physical planners to jot down deadlines and reminders. Visual aids like lists or charts can also enhance clarity and keep you motivated. Additionally, using color-coding systems can help you quickly identify different categories of tasks, making organization more intuitive.

By implementing these strategies, you can foster an environment where staying on track becomes second nature, allowing you to focus on achieving your goals.

Integrating Reminders with Your Calendar

Enhancing your organizational system with timely notifications can significantly improve your productivity and reduce stress. By seamlessly incorporating alerts into your scheduling framework, you ensure that important tasks and deadlines never slip through the cracks. This approach allows for better time management and helps you stay focused on your priorities.

Setting Up Effective Notifications

To make the most of your reminder system, consider the following strategies:

| Strategy | Description |

|---|---|

| Prioritize Tasks | Identify the most critical activities and set notifications accordingly to ensure they receive your attention. |

| Use Multiple Channels | Leverage different platforms, such as mobile apps, email, or desktop alerts, to ensure you receive prompts at convenient times. |

| Customize Timing | Adjust alert timings to suit your routine, providing reminders well in advance of deadlines for better preparedness. |

Maintaining Consistency

Regularly reviewing and updating your notification settings is crucial. As your commitments evolve, adapt your reminders to align with changing priorities. This flexibility will help maintain an efficient workflow and keep you on track throughout your tasks.

Common Mistakes to Avoid

When managing your financial obligations, certain pitfalls can undermine your efforts and lead to unnecessary complications. Awareness of these common errors is crucial for maintaining a smooth process and ensuring that you stay on track with your responsibilities.

One major mistake is neglecting to review due dates regularly. Failing to keep an updated schedule can result in missed deadlines, which often incur late fees. Setting reminders can significantly mitigate this risk.

Another frequent error is underestimating expenses. Many individuals overlook smaller charges that accumulate over time. Creating a comprehensive list of all financial obligations, including variable costs, helps in achieving a more accurate overview.

Additionally, not tracking payments made can lead to confusion. It’s important to maintain a record of transactions to ensure accuracy and prevent double payments. Utilizing a systematic approach to document all actions will enhance clarity.

Lastly, relying solely on digital tools without having a backup plan can be detrimental. Technical issues may arise unexpectedly. Always have a manual method of tracking your obligations to safeguard against potential disruptions.

By steering clear of these common pitfalls, you can enhance your financial management and achieve greater peace of mind.

Adjusting Your Calendar for Flexibility

Creating a versatile planning tool is essential for effectively managing your financial obligations. Flexibility allows you to adapt to unforeseen circumstances while ensuring that important dates remain organized. By implementing a few strategic adjustments, you can enhance your planning approach and maintain control over your schedules.

Strategies for Flexibility

One effective method to achieve adaptability is by incorporating buffer periods between due dates. This ensures that even if an unexpected event arises, you have ample time to address it without falling behind. Additionally, regularly reviewing and updating your entries can help you stay aligned with any changes in your financial landscape.

Sample Adjustment Table

| Original Date | Adjusted Date | Reason for Change |

|---|---|---|

| 2024-01-15 | 2024-01-22 | Schedule conflict |

| 2024-02-10 | 2024-02-17 | Unexpected expense |

| 2024-03-05 | 2024-03-12 | Travel plans |

By employing these techniques, you can create a dynamic organization system that not only keeps you on track but also accommodates the ebb and flow of everyday life.

How to Download Free Templates

Accessing helpful resources can greatly enhance your organizational skills and streamline your tasks. Many online platforms offer various formats that can assist you in planning and managing your responsibilities efficiently. In this section, we will explore the process of acquiring these valuable resources without any cost.

Finding the Right Resource

Begin by searching for websites dedicated to providing helpful formats. Look for platforms that specialize in document sharing or productivity tools. Ensure to read reviews or ratings to find reliable sources that offer quality options tailored to your needs.

Downloading the Format

Once you have identified a suitable site, navigate to the desired resource. Typically, you will find a download button or link. Click on it, and your browser should prompt you to save the file to your device. After downloading, check the format compatibility with your software to ensure a smooth experience.

Popular Tools for Bill Management

Managing expenses efficiently can significantly enhance financial well-being. Utilizing various applications and software can streamline the process, ensuring that individuals stay organized and on top of their obligations. These tools offer features that help track due dates, manage budgets, and facilitate timely transactions.

Top Applications

Numerous applications are available, each offering unique functionalities. For instance, some provide reminders and alerts for upcoming obligations, while others focus on comprehensive budgeting features. Exploring different options can help find the ultimate fit for specific needs.

Online Platforms

Web-based platforms have gained popularity due to their accessibility and user-friendly interfaces. These services often include detailed analytics that allow users to delve into spending habits and make informed decisions. Choosing the right online tool can transform the approach to financial management.

Personal Finance and Bill Tracking

Managing personal finances effectively is essential for maintaining a stable and stress-free life. Keeping an organized approach to tracking expenses ensures that individuals remain aware of their financial commitments and can plan accordingly. This proactive method not only aids in avoiding overdue obligations but also helps in cultivating a healthier relationship with money.

Establishing a system for monitoring regular expenditures can significantly reduce anxiety associated with financial responsibilities. Utilizing various tools and techniques, one can create a structured environment that simplifies the process of overseeing monetary obligations. Regular updates and reviews of this system can lead to better budgeting practices and informed decision-making.

Moreover, identifying trends in spending habits empowers individuals to allocate resources more wisely. By analyzing past patterns, it becomes possible to anticipate future needs and make adjustments to enhance savings. This strategic oversight not only fosters financial security but also lays the groundwork for achieving long-term goals.

Sharing Your Calendar with Family

Coordinating schedules among family members can enhance communication and reduce misunderstandings. By providing a shared resource for tracking important dates and activities, everyone stays informed and engaged. This collaborative approach fosters a sense of unity and ensures that no one feels left out of family plans.

Establishing a shared resource allows each member to contribute their commitments, from appointments to special occasions. This transparency helps in planning family gatherings, outings, and even everyday tasks. Moreover, when everyone has access to the same information, it minimizes the chances of scheduling conflicts.

To facilitate this process, consider using digital solutions that allow for easy updates and notifications. An intuitive platform can enable real-time sharing, ensuring that any changes are communicated promptly. Encourage family members to regularly check and update their entries, fostering accountability and shared responsibility.

Lastly, make it a fun and engaging experience. Regularly review the shared resource together, celebrate milestones, and plan future activities as a unit. This not only strengthens relationships but also transforms routine planning into a family bonding opportunity.

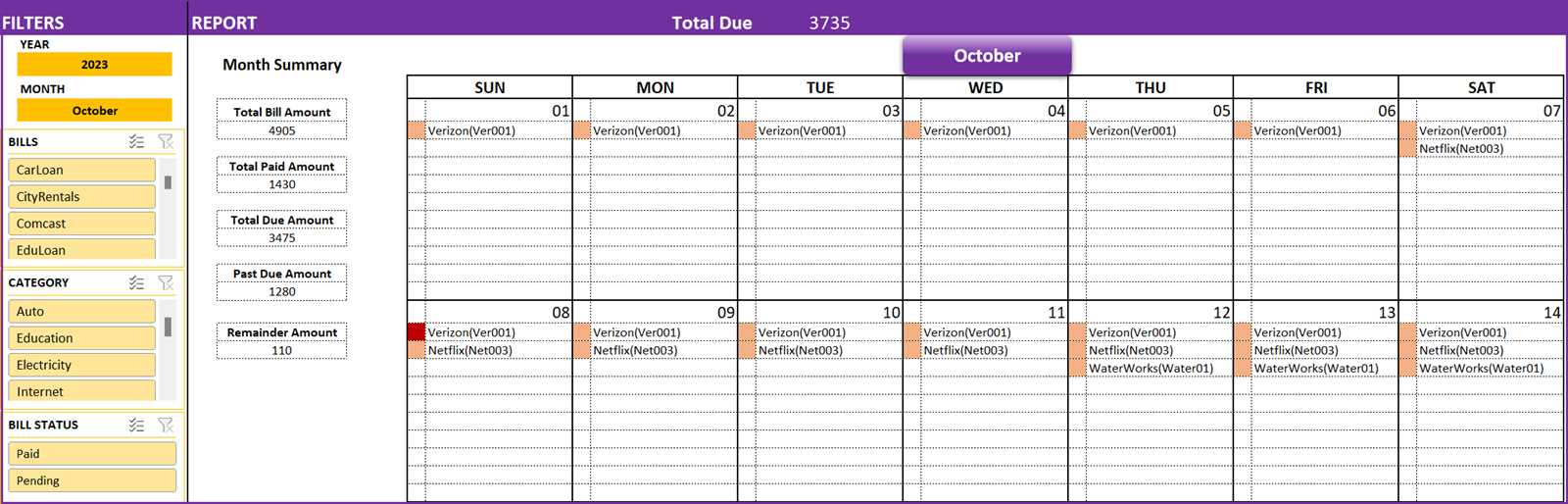

Visual Aids for Tracking Payments

Utilizing visual tools can significantly enhance the management of financial obligations. By incorporating graphical representations and organized layouts, individuals can better monitor their fiscal responsibilities and avoid missed deadlines. These aids not only streamline the tracking process but also provide a clearer overview of upcoming due dates and outstanding amounts.

Charts, graphs, and color-coded systems serve as effective mechanisms for visualizing expenses. For instance, a simple bar graph can illustrate the proportion of different financial commitments, while a color-coded grid can quickly indicate which items are nearing their due dates. Such visualizations allow for rapid assessments and informed decision-making regarding budgeting and cash flow.

Moreover, employing digital applications with built-in visual features can further simplify the tracking experience. Many tools offer customizable dashboards that present vital information at a glance, enabling users to stay on top of their finances effortlessly. By integrating these visual aids into routine financial management, individuals can foster a more proactive approach to their monetary affairs.

Monthly vs. Weekly Payment Views

When managing finances, choosing between different timeframes for tracking obligations can significantly impact organization and planning. Each approach offers distinct advantages and can cater to varying personal preferences and lifestyles. Understanding these differences allows individuals to tailor their tracking methods to better suit their needs.

Monthly perspectives provide a broader overview, allowing users to see all upcoming dues at a glance. This method is particularly useful for individuals who prefer a holistic view of their commitments, enabling them to plan their finances over a longer horizon. It helps in identifying patterns and trends in expenditure, making it easier to allocate funds effectively.

In contrast, a weekly framework offers a more granular approach, breaking down responsibilities into smaller, manageable segments. This view can reduce overwhelm, as it focuses only on immediate obligations, making it simpler to prioritize and act swiftly. Weekly tracking is ideal for those who thrive on short-term planning and want to stay closely engaged with their financial activities.

Ultimately, the choice between these two perspectives hinges on individual habits and preferences. Some may find that a combination of both views suits their lifestyle, allowing for flexibility and a comprehensive understanding of their financial landscape.

Automating Payments with Your Calendar

Integrating your scheduling system with financial obligations can streamline your life significantly. By utilizing various tools, you can ensure that all due dates are handled effortlessly, allowing you to focus on more important tasks.

Here are some advantages of synchronizing your scheduling tool with payment management:

- Time Management: Organizing your financial commitments reduces the time spent on manual tracking.

- Reduced Stress: Automatic reminders help you stay on top of deadlines, minimizing the risk of late fees.

- Increased Accuracy: Automation helps eliminate human error in tracking due dates.

To implement this effectively, consider the following steps:

- Choose a reliable scheduling application that supports notifications and reminders.

- Input all relevant financial dates, including due dates and amounts.

- Set up alerts for several days prior to deadlines to prepare adequately.

- Review and adjust your schedule regularly to account for any changes in obligations.

By taking these steps, you can create a seamless flow between your scheduling and financial responsibilities, ultimately leading to better organization and peace of mind.

Real-Life Examples of Usage

Understanding how various individuals and organizations incorporate scheduling tools into their daily routines can provide valuable insights. These practical applications highlight the versatility and effectiveness of such resources in managing financial commitments and time efficiently.

Personal Finance Management

Many families utilize organization aids to keep track of their monthly obligations. By marking due dates for utilities, subscriptions, and loans, they can avoid late fees and maintain a clear overview of their financial landscape. This approach fosters discipline and enables proactive budgeting, ensuring that funds are allocated appropriately.

Business Operations

Small enterprises often rely on similar resources to streamline their operational expenses. By maintaining a systematic approach to tracking invoices and payment deadlines, business owners can enhance cash flow management. This not only helps in planning future expenditures but also strengthens relationships with vendors through timely settlements.