Managing personal finances can often feel overwhelming, yet having a structured approach can make all the difference. By implementing an organized method to track income and expenditures, individuals can gain clarity and control over their monetary situation. This strategy not only enhances budgeting skills but also encourages mindful spending habits.

One of the most efficient ways to stay on top of financial obligations is through the use of a systematic organizer. This tool allows users to visually arrange their financial commitments, making it easier to identify patterns and areas for improvement. With a well-designed framework, anyone can navigate their financial landscape with confidence.

In this article, we will explore the benefits of utilizing a practical organizer tailored for tracking monetary movements. We will discuss essential features, tips for customization, and how to integrate this approach into your daily routine, ensuring that you remain informed and proactive about your financial health.

Understanding Free Cash Flow

Grasping the concept of surplus liquidity is essential for evaluating a company’s financial health. This measure provides insight into the funds available after all operating expenses and capital expenditures have been accounted for, offering a clear view of a firm’s ability to generate resources for various strategic initiatives.

The significance of surplus liquidity lies in its versatility. It can be utilized for debt reduction, reinvestment into the business, or distribution to shareholders. This flexibility highlights the company’s operational efficiency and its potential for growth.

Furthermore, assessing surplus liquidity helps investors gauge a firm’s sustainability. A positive figure often indicates robust performance, while a negative figure can signal potential challenges ahead. Understanding this metric equips stakeholders with the tools needed to make informed decisions regarding investments and strategic planning.

Benefits of Cash Calendar Templates

Utilizing an organized schedule for financial management can significantly enhance one’s ability to track and allocate resources effectively. Such a framework provides clarity and structure, enabling individuals and businesses to optimize their financial decisions.

Here are several advantages of implementing this structured approach:

- Improved Financial Awareness: Regularly updating your financial overview fosters a better understanding of your income and expenditures.

- Enhanced Planning: Anticipating future expenses and income allows for more strategic budgeting and resource allocation.

- Reduced Stress: Knowing when payments are due and when funds will be available alleviates anxiety and helps avoid late fees.

- Increased Accountability: Keeping a visual record encourages responsible spending and reinforces commitment to financial goals.

- Better Cash Flow Management: Tracking cash flow trends helps identify patterns and make informed decisions regarding savings and investments.

Incorporating such a system into your financial routine can lead to more informed decision-making and ultimately foster a healthier financial outlook.

How to Create Your Own Template

Designing a personalized schedule framework can greatly enhance your organizational skills and provide clarity in managing your time. By crafting a structure that suits your specific needs, you can improve productivity and ensure that important tasks are prioritized.

Follow these steps to develop a custom framework:

- Identify Your Goals: Determine what you want to achieve with your design. Consider factors like daily tasks, long-term projects, and any recurring activities.

- Choose a Format: Decide whether you prefer a digital layout or a printed version. Each format has its benefits, so select one that fits your lifestyle.

- Layout Your Sections: Think about how to organize your content. Common sections include:

- Daily tasks

- Weekly objectives

- Monthly milestones

- Notes or reflections

By following these guidelines, you can create a versatile framework tailored to your individual needs, helping you stay organized and focused on your priorities.

Essential Features of Cash Calendars

A well-structured scheduling tool is crucial for effective financial management. Such a resource aids in tracking monetary inflows and outflows, ensuring individuals and businesses maintain a clear overview of their financial status over time. Here are some key characteristics that enhance its functionality:

- Clear Visual Layout: A straightforward design allows users to easily identify important dates and amounts, promoting quick understanding.

- Customizable Entries: The ability to modify and add specific items enables users to tailor the tool to their unique financial situations.

- Time Frames: Options to view information in various intervals, such as daily, weekly, or monthly, provide flexibility and support diverse planning needs.

- Forecasting Capabilities: The inclusion of predictive features helps users anticipate future financial scenarios based on historical data.

- Automated Alerts: Notifications for upcoming obligations or income sources help ensure timely management of resources.

Incorporating these elements into a scheduling tool greatly enhances its effectiveness, allowing for improved oversight and strategic decision-making in financial matters.

Popular Tools for Template Design

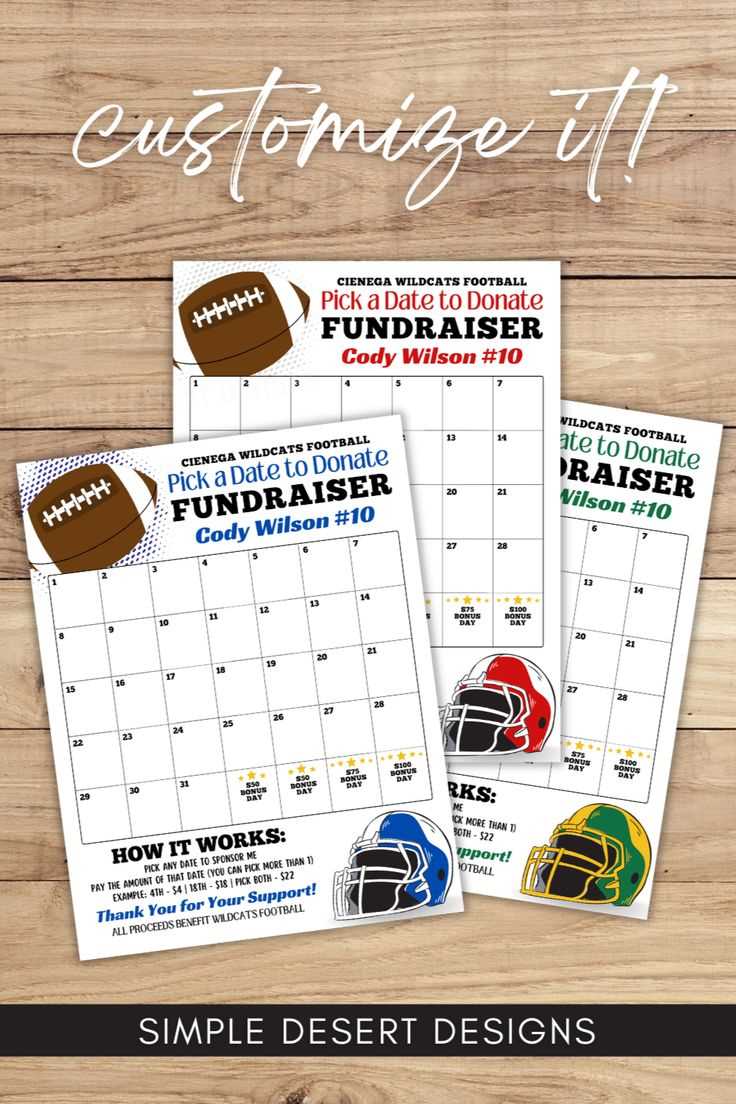

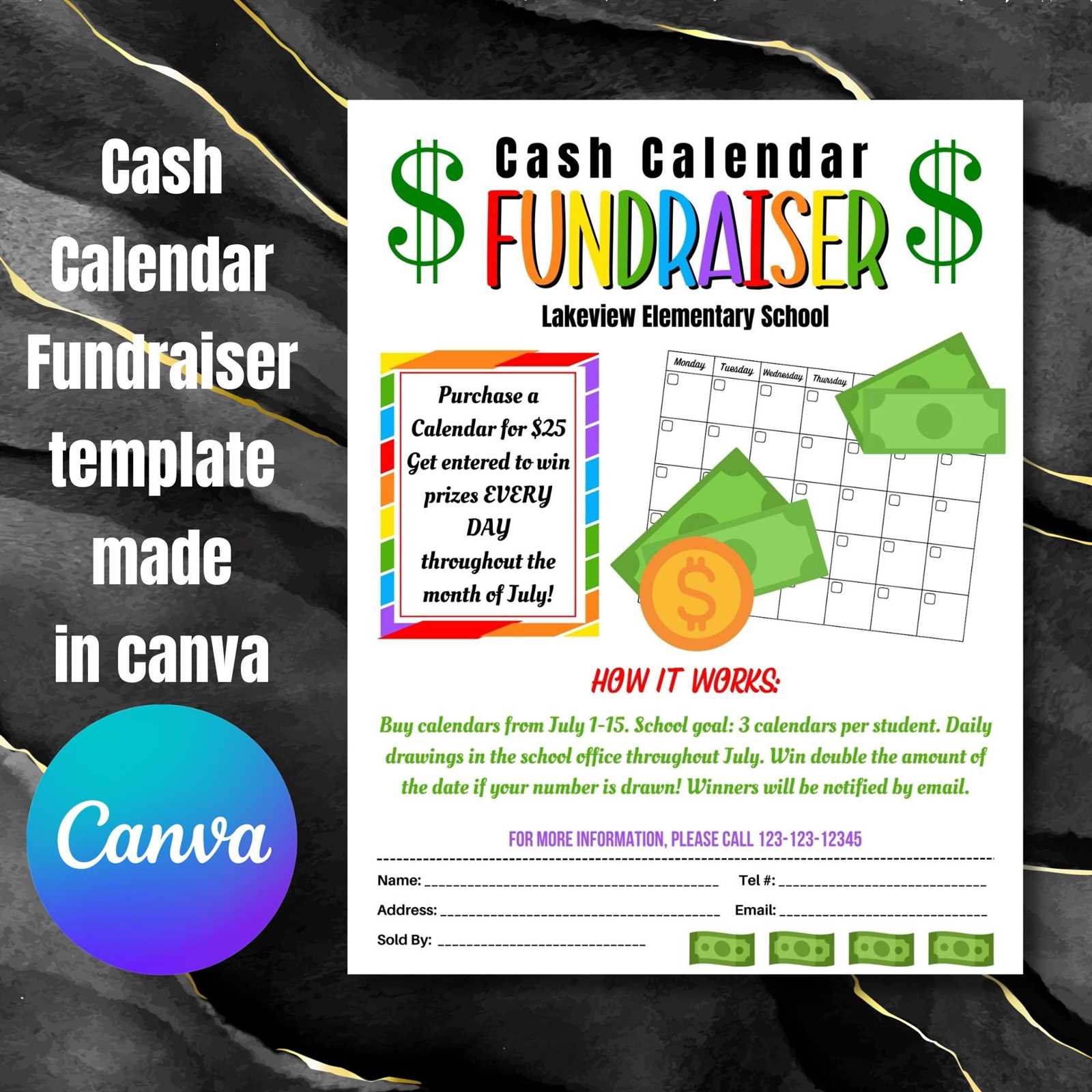

In the realm of design, having the right resources can significantly enhance creativity and productivity. Various platforms and software solutions offer a wealth of options for creating visually appealing layouts that cater to diverse needs. Below are some of the most renowned tools available for crafting sophisticated designs.

| Tool Name | Description | Key Features |

|---|---|---|

| Canva | A user-friendly platform ideal for both beginners and professionals. | Drag-and-drop interface, extensive library of elements, collaboration options. |

| Adobe InDesign | A powerful desktop application for high-quality layout design. | Advanced typography control, rich print production features, integration with Adobe Creative Cloud. |

| Microsoft PowerPoint | A versatile tool often used for presentations but also effective for design. | Template customization, smart guides, multimedia integration. |

| Visme | A platform that allows users to create engaging visual content easily. | Interactive elements, data visualization tools, customizable graphics. |

| Lucidpress | An online design tool that simplifies brand management. | Brand asset management, drag-and-drop functionality, template sharing. |

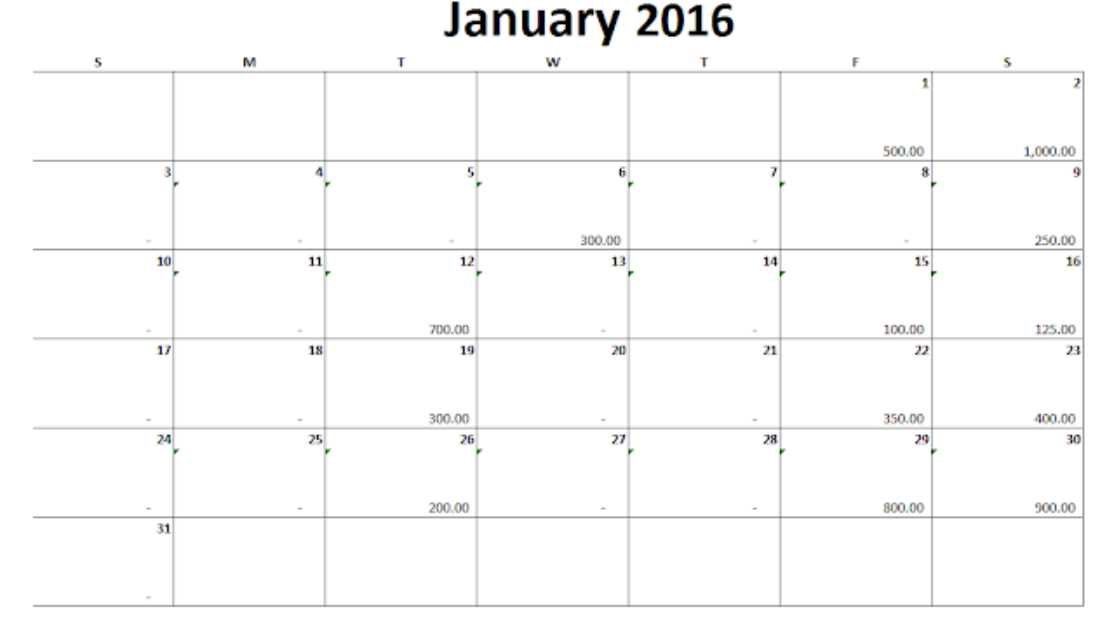

Using Excel for Cash Flow Tracking

Excel serves as a powerful tool for monitoring financial movements within a business or personal finances. By utilizing its robust features, users can effectively manage their income and expenditures, ensuring a clear view of financial health over time. This section will explore the advantages of leveraging Excel for tracking monetary flows and offer practical guidance for creating a structured approach.

Benefits of Excel for Financial Management

- Flexibility: Customizable spreadsheets allow users to tailor their tracking methods to specific needs.

- Data Analysis: Built-in formulas and functions enable easy calculations and comparisons of financial data.

- Visualization: Graphs and charts provide a visual representation of financial trends, aiding in decision-making.

- Accessibility: Excel files can be easily shared and accessed across various devices, promoting collaboration.

Steps to Create an Effective Tracking System

- Set Up Your Spreadsheet: Start by creating a new file with distinct sections for income and expenses.

- Define Categories: Organize your entries into clear categories to enhance clarity and ease of tracking.

- Input Data Regularly: Consistency is key; update your entries frequently to maintain an accurate overview.

- Utilize Formulas: Incorporate formulas for automatic calculations of totals and balances, saving time and reducing errors.

- Review and Adjust: Periodically assess your financial data to identify trends and make necessary adjustments to your budgeting strategies.

By adopting Excel for financial oversight, individuals and businesses can gain significant insights into their monetary activities, ultimately leading to more informed financial decisions.

Customizing Your Cash Calendar

Personalizing your financial planner can significantly enhance its effectiveness. Tailoring it to your unique needs allows for better tracking of your funds and helps you stay organized.

Here are some key aspects to consider when modifying your planner:

- Categories: Create specific sections for different types of income and expenses to simplify your tracking process.

- Color Coding: Use colors to represent various categories or priorities, making it visually easier to interpret your data.

- Frequency: Adjust the time intervals (daily, weekly, monthly) according to your financial activities for better clarity.

By applying these modifications, you can ultimately create a more intuitive and efficient tool that meets your financial management goals.

Integrating Templates with Financial Software

In today’s digital landscape, the seamless incorporation of design frameworks into financial applications is essential for enhancing user experience and operational efficiency. By utilizing structured formats, businesses can streamline their processes, ensuring data consistency and accuracy. This synergy not only simplifies financial management but also fosters better decision-making through organized insights.

Benefits of Integration

Linking organized formats with financial tools offers numerous advantages. Firstly, it minimizes manual entry errors, allowing for automated data flow between platforms. Secondly, it enhances collaboration among team members, as everyone can access and update shared resources in real time. This integrated approach ultimately leads to more informed financial planning and reporting.

Best Practices for Implementation

To effectively merge structured formats with financial systems, it’s crucial to follow certain guidelines. Identify compatible software that allows for easy importing and exporting of data. Additionally, ensure that all users are trained on how to utilize these resources effectively. Regular updates and maintenance of both the frameworks and the software will further ensure that the integration remains smooth and beneficial over time.

Tracking Income and Expenses Effectively

Managing finances requires a systematic approach to monitor both earnings and expenditures. By implementing a structured method, individuals can gain valuable insights into their financial health, ensuring that resources are allocated wisely and goals are met efficiently.

Establishing a Consistent Method

To achieve effective oversight, it is essential to adopt a consistent method for recording financial transactions. This could involve utilizing digital tools or traditional pen-and-paper methods. Whatever the choice, the key lies in regularly updating the records to reflect real-time financial situations. This practice not only aids in identifying spending habits but also highlights areas where savings can be made.

Analyzing Trends Over Time

Once a reliable recording system is in place, analyzing trends becomes crucial. Regularly reviewing data allows individuals to discern patterns in their financial behavior. Recognizing fluctuations in income and expenses helps in making informed decisions regarding budgeting and investment. Moreover, this analysis can reveal opportunities for improvement, leading to a more secure financial future.

Monthly vs. Weekly Cash Calendars

When managing personal finances, the choice between a broader overview and a more detailed approach can significantly impact budgeting strategies. Each format offers unique advantages and caters to different needs, allowing individuals to tailor their financial tracking to their lifestyle and objectives.

Monthly frameworks provide a comprehensive view of overall financial health. They enable users to see income and expenses in a larger context, facilitating long-term planning. This method is particularly useful for identifying trends, making it easier to adjust spending habits over time. However, it may lack the granularity needed for day-to-day management, potentially leading to oversights in smaller, recurring expenditures.

On the other hand, weekly structures allow for meticulous tracking of financial activities. This approach is ideal for those who prefer close monitoring and immediate adjustments. By focusing on short-term goals, individuals can more effectively manage their expenditures and income, reducing the risk of unexpected financial strain. Nonetheless, this method may feel overwhelming for some, as it requires consistent engagement with one’s finances.

Ultimately, the choice between these two formats hinges on personal preferences and financial goals. Whether opting for the broader perspective of a monthly layout or the detail-oriented nature of a weekly system, each has the potential to enhance financial management practices.

Common Mistakes to Avoid

When managing financial resources, certain pitfalls can undermine your efforts and lead to unintended consequences. Recognizing these missteps is crucial for effective planning and execution.

One frequent error is failing to set realistic goals. Without achievable objectives, it becomes difficult to measure progress and make necessary adjustments.

Another mistake is neglecting regular reviews. Not assessing your strategy can result in missed opportunities and overlooked issues that need attention.

Additionally, many overlook the importance of maintaining a clear distinction between personal and business finances. Blending these can complicate tracking and accountability.

Finally, procrastination can severely hinder success. Delaying important decisions can lead to missed deadlines and financial shortfalls.

By avoiding these common mistakes, you can enhance your planning process and work towards achieving your ultimate financial goals.

Best Practices for Budgeting

Effective financial planning is essential for achieving long-term goals and ensuring stability. By implementing strategic approaches to managing expenses and income, individuals can gain better control over their finances and make informed decisions.

Establish Clear Goals

Setting specific, measurable objectives helps provide direction and motivation. Consider the following:

- Identify short-term and long-term financial aspirations.

- Determine necessary steps to reach these goals.

- Regularly review and adjust goals as needed.

Track Your Spending

Monitoring expenditures is crucial for understanding financial habits. Utilize these methods:

- Keep a detailed record of daily expenses.

- Use apps or spreadsheets to categorize spending.

- Analyze spending patterns to identify areas for improvement.

By adhering to these principles, anyone can enhance their financial management skills and create a more secure future.

How to Analyze Cash Flow Trends

Understanding financial movement over time is crucial for effective business management. By examining these patterns, one can gain insights into income stability, spending habits, and potential areas for improvement. This analysis helps in making informed decisions that ultimately enhance financial health.

Identify Key Indicators

Focus on metrics such as inflows, outflows, and net positions. Tracking these indicators allows for a comprehensive view of financial performance and highlights seasonal variations that may affect liquidity.

Utilize Visual Tools

Graphs and charts can simplify complex data. Visual representations make it easier to spot trends, enabling more straightforward comparisons and facilitating strategic planning.

Sharing Your Template with Teams

Collaborating with colleagues often requires sharing tools that enhance productivity and organization. Effectively distributing your organizational framework can significantly streamline workflows and improve team coordination. Here, we explore the best practices for sharing your organized framework with your team members.

Best Practices for Sharing

- Choose the Right Platform: Utilize cloud-based solutions that allow easy access and real-time collaboration.

- Set Permissions: Ensure that team members have the appropriate access levels, whether for viewing or editing.

- Provide Clear Instructions: Include a brief guide on how to navigate and utilize the shared resource effectively.

Enhancing Collaboration

To foster better teamwork, consider the following approaches:

- Schedule regular check-ins to discuss updates and gather feedback.

- Encourage team members to share their insights or modifications to improve the overall framework.

- Utilize visual aids and annotations to clarify complex sections.

By implementing these strategies, you can ensure that your organizational resource not only supports individual productivity but also enhances the collective effort of your team.

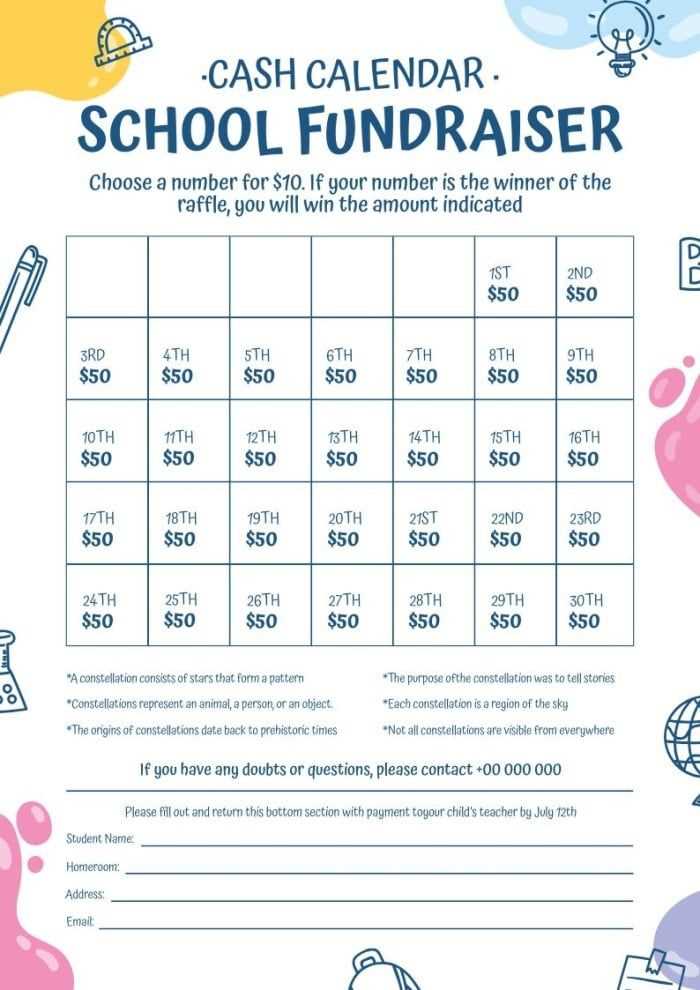

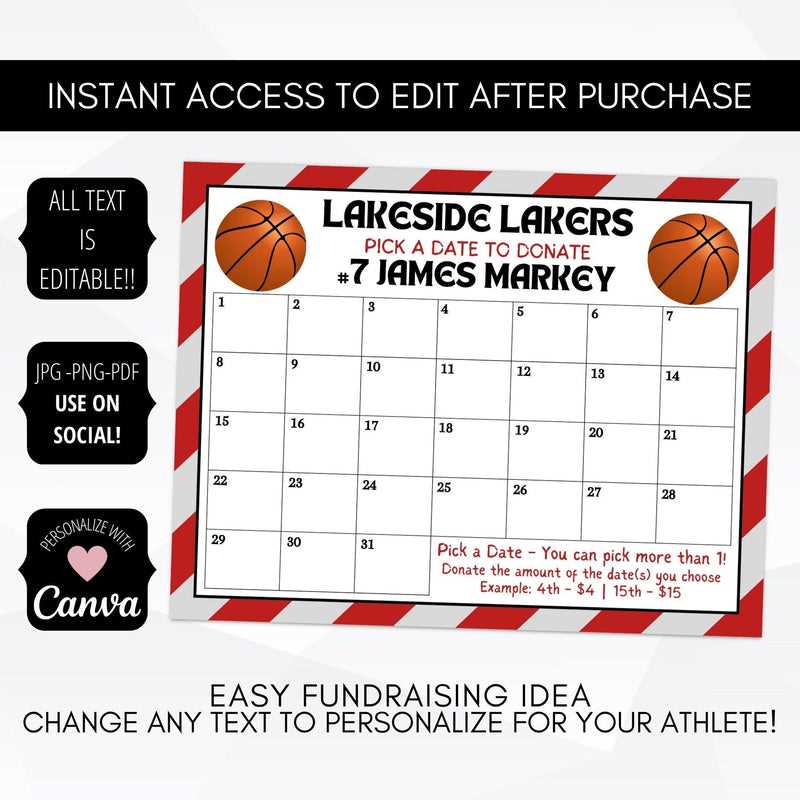

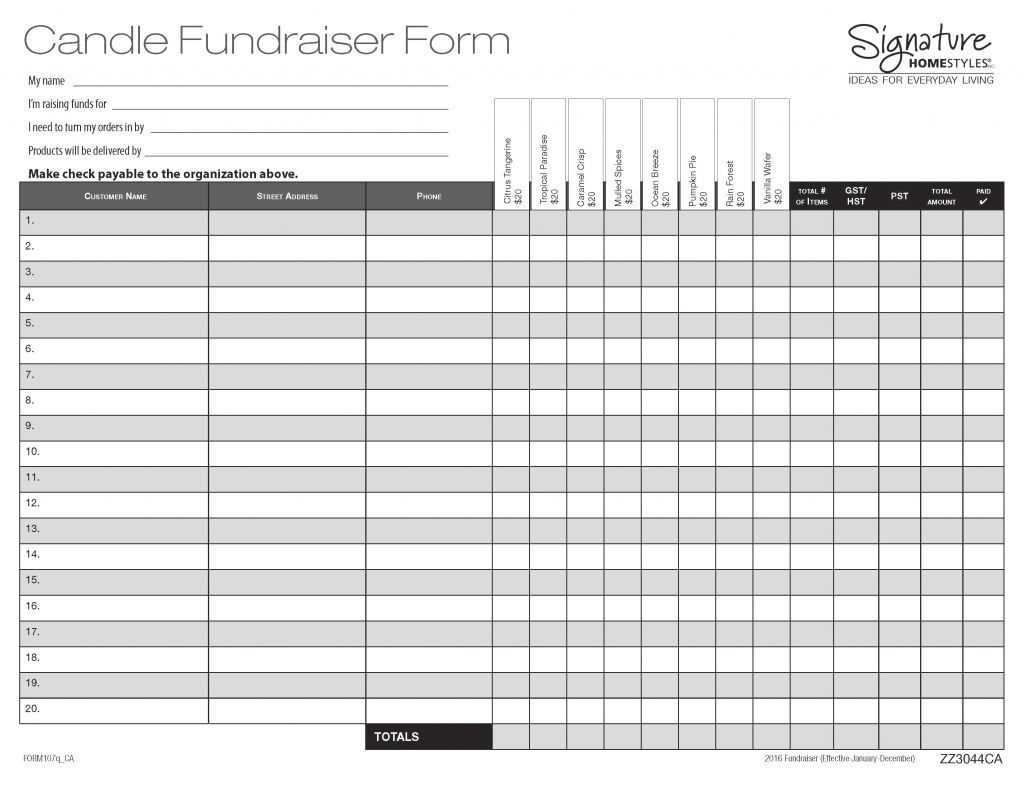

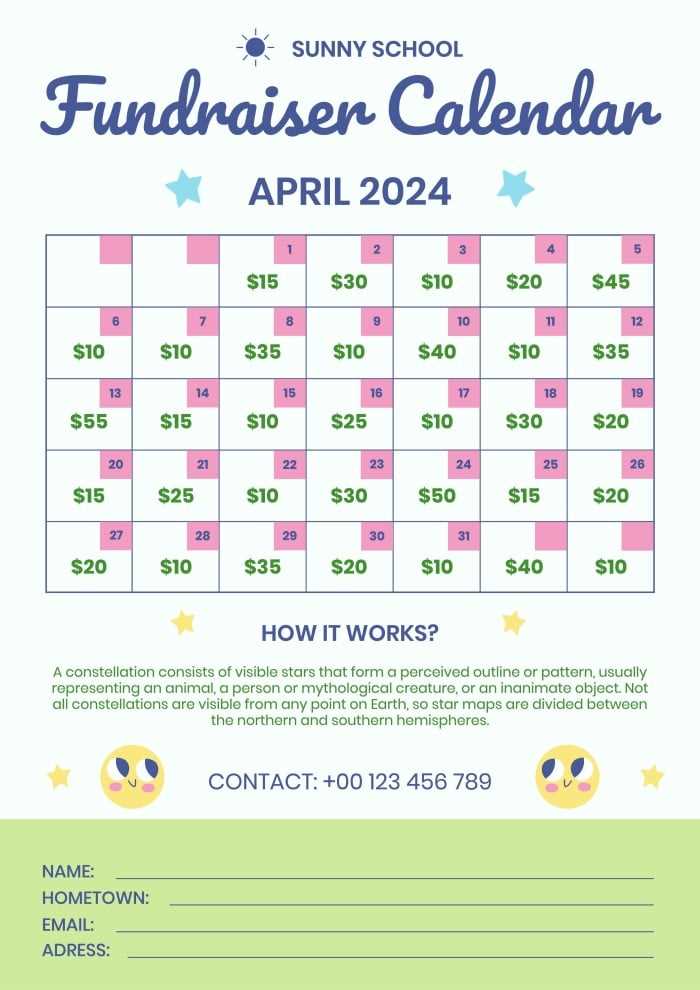

Examples of Cash Calendar Use Cases

Understanding the practical applications of financial planning tools can significantly enhance both personal and organizational management. These resources serve as essential instruments for tracking monetary flow, enabling users to make informed decisions and forecast future needs effectively.

1. Personal Budgeting: Individuals often utilize these resources to monitor their monthly income and expenditures. By organizing finances in a structured manner, users can identify spending habits, set savings goals, and ensure that necessary bills are paid on time.

2. Small Business Management: Entrepreneurs benefit from these instruments by managing operational expenses and income streams. This aids in predicting cash requirements for inventory, payroll, and other critical business activities, thus supporting sustainable growth.

3. Project Planning: In project management, these tools facilitate tracking the financial aspects of various initiatives. By aligning costs with timelines, teams can better allocate resources, avoid budget overruns, and achieve project milestones efficiently.

4. Event Planning: Organizers of events can employ these resources to manage budgets related to venues, catering, and entertainment. This ensures that all expenses are accounted for, enabling a smooth execution of the event without financial hiccups.

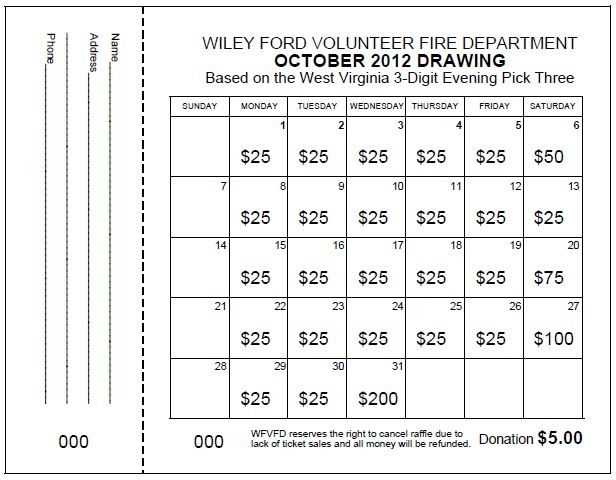

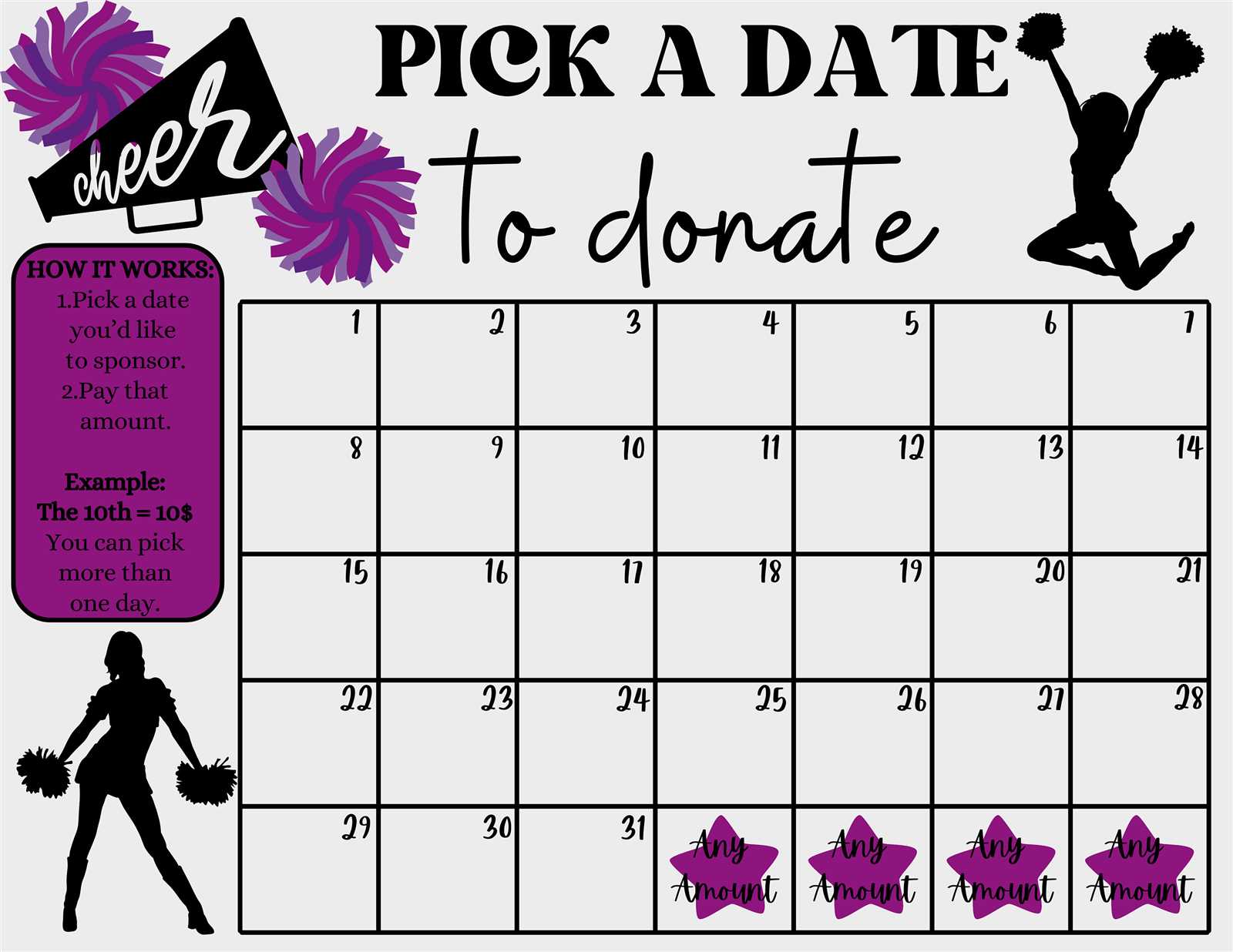

5. Non-Profit Fundraising: Charitable organizations often utilize these systems to oversee donations and expenditures. This transparency helps in maintaining trust with donors while effectively allocating funds to various programs and initiatives.