Managing due dates for monthly expenses can be challenging without a reliable system in place. Keeping track of upcoming payments helps you avoid missed deadlines and late fees, ensuring that your finances stay in good health. By creating a structured overview of these dates, you’ll find it simpler to maintain control over recurring financial obligations.

Having a visual outline of payment schedules offers a practical way to see your financial commitments at a glance. This kind of setup is especially useful when organizing various deadlines and setting reminders for essential expenses. An organized chart allows you to anticipate upcoming payments, giving you more time to plan and allocate resources effectively.

With a structured monthly guide, you’ll benefit from a clear understanding of where your funds are allocated throughout the month. This approach not only reduces stress but also promotes healthier financial habits by ensuring that each important payment is noted and prepared for in advance. Embrace a proactive method to manage your finances, and enjoy the peace of mind that comes with thorough planning.

Free Printable Bill Calendar Template Ideas

Organizing monthly expenses can be straightforward and stress-free with structured planning tools. Creating a system that allows you to track payment dates, manage due amounts, and visualize your financial obligations all in one place can make budgeting far more manageable. With a personalized setup, you can ensure that every aspect of your spending is accounted for, helping you avoid missed deadlines and late fees.

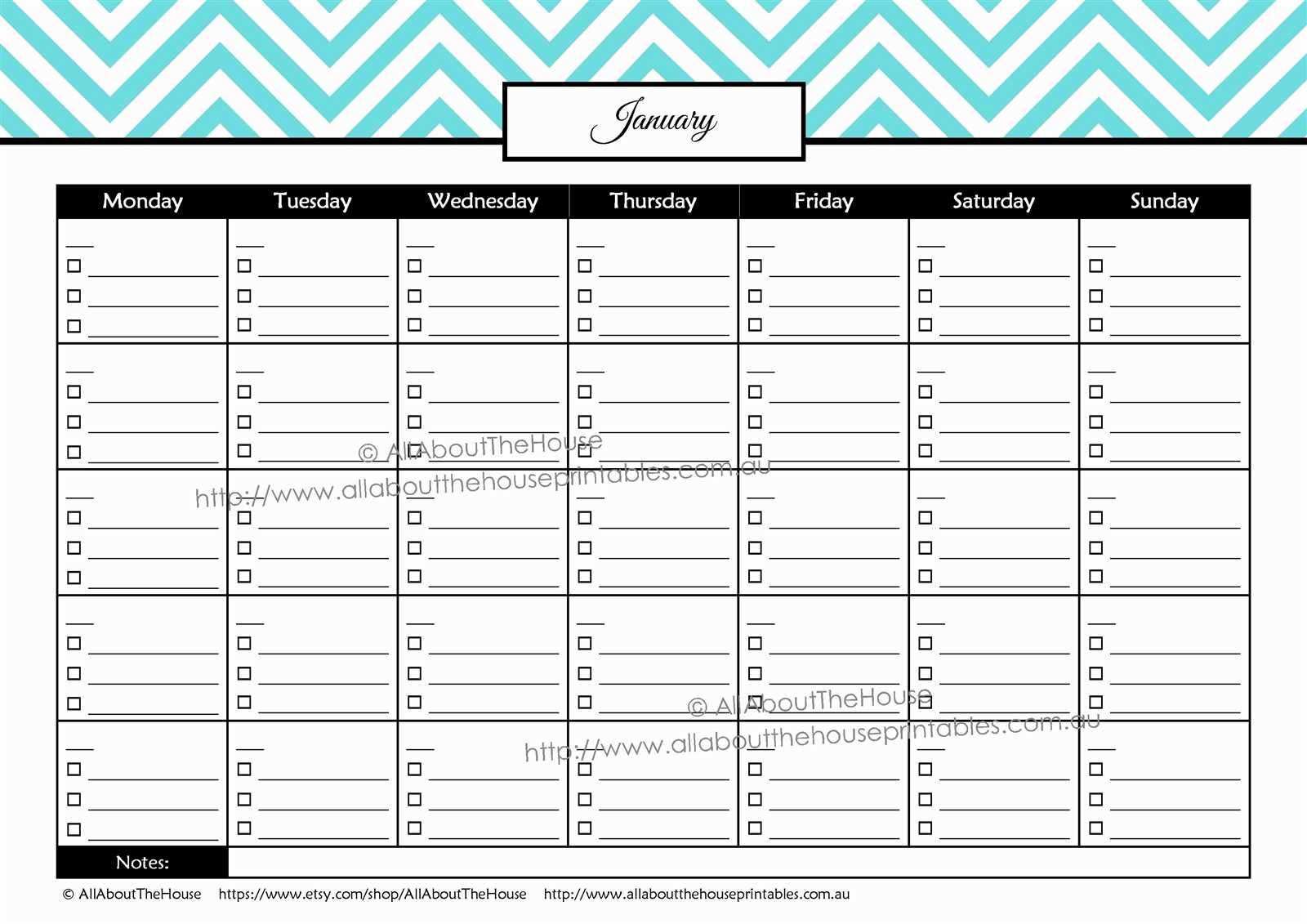

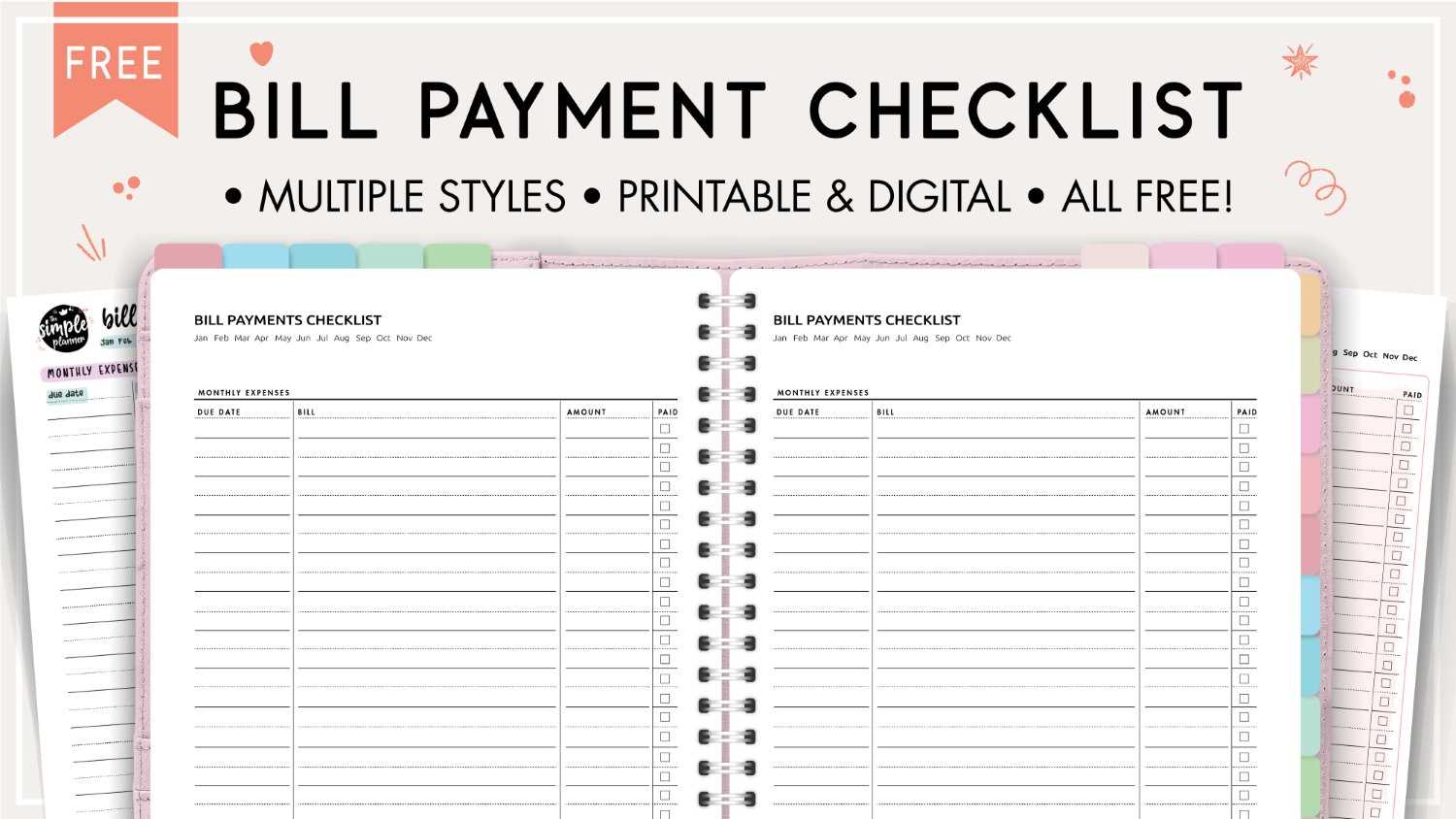

Weekly Layout for Payment Tracking

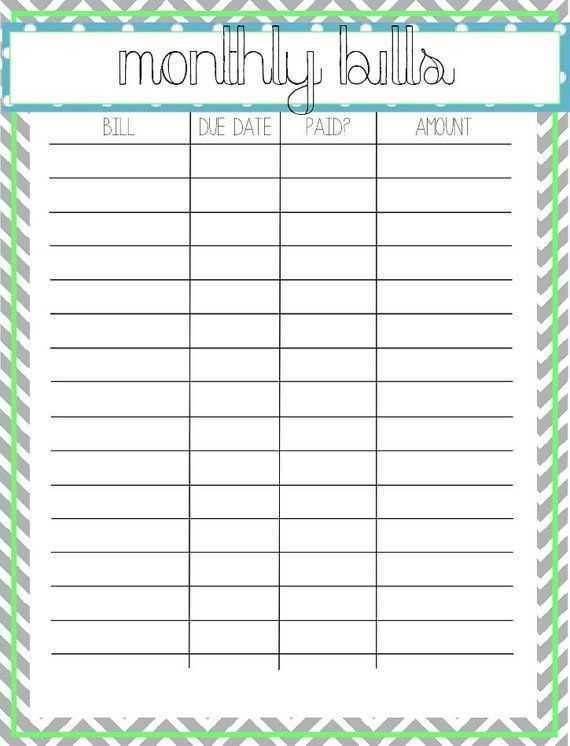

A weekly format offers a detailed breakdown for those who prefer to keep a close eye on expenses throughout the month. By organizing reminders for specific days, you can adjust and prepare for any upcoming payments. This format is especially helpful for tracking variable expenses and identifying patterns in your spending habits. Each week can feature a dedicated section to record amounts, due dates, and any notes, giving you a clear picture of weekly cash flow.

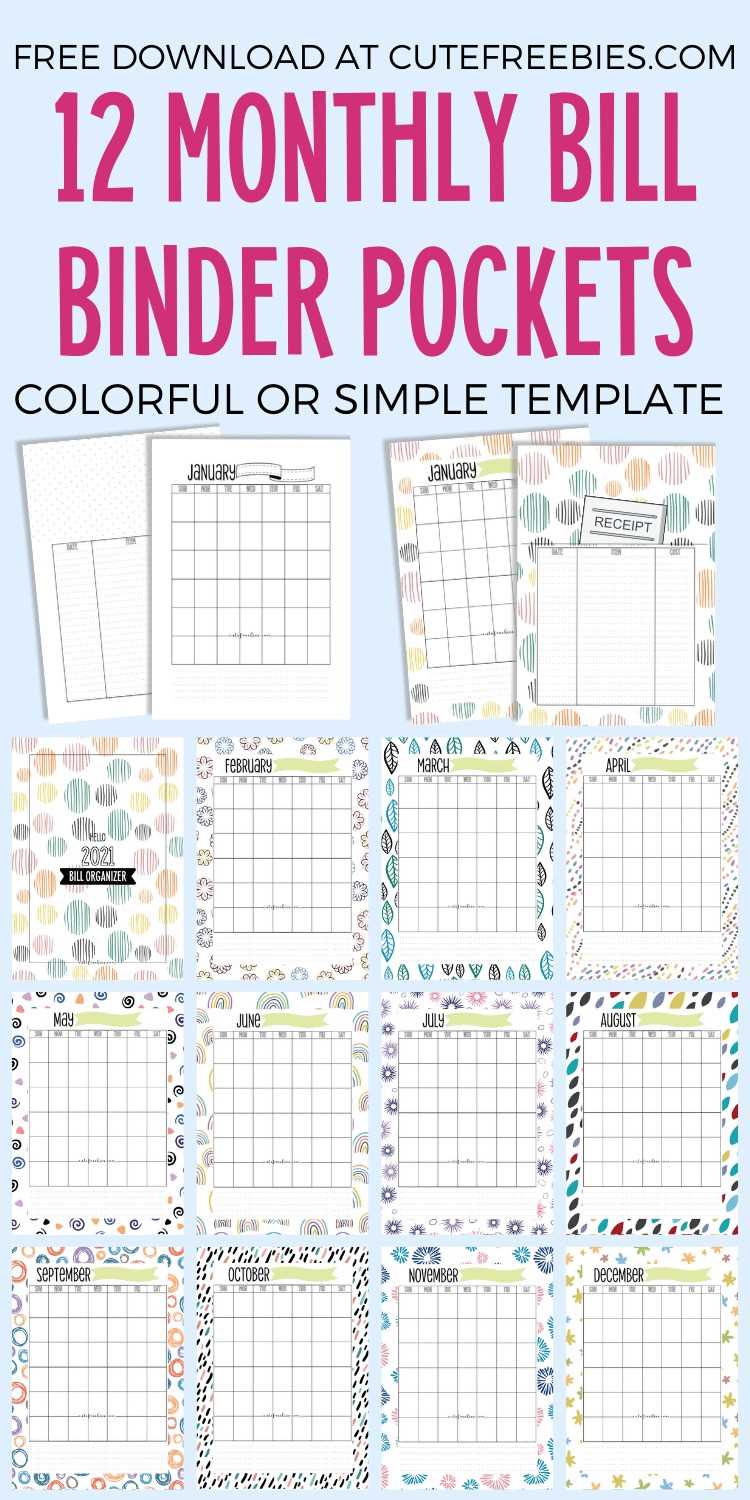

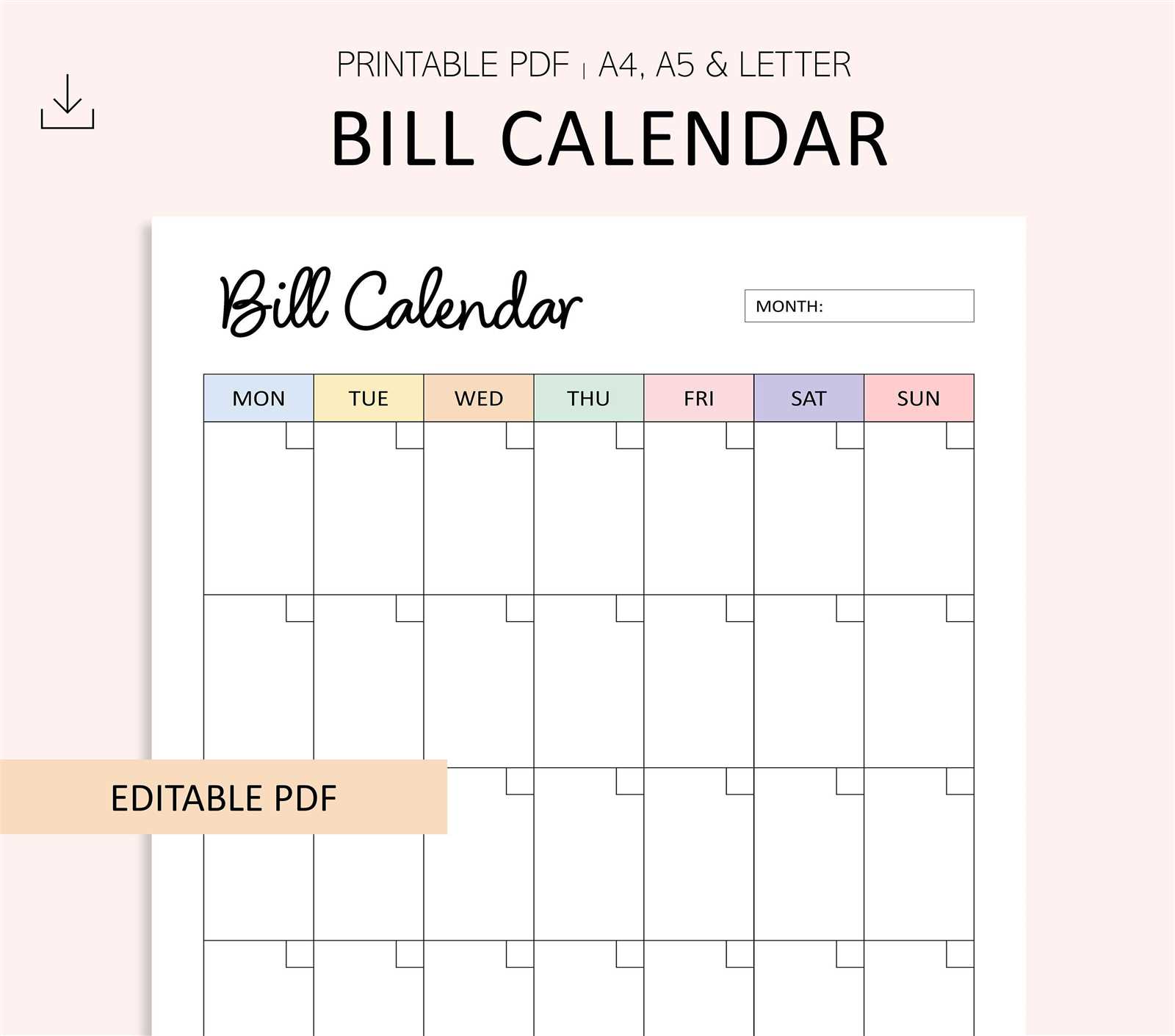

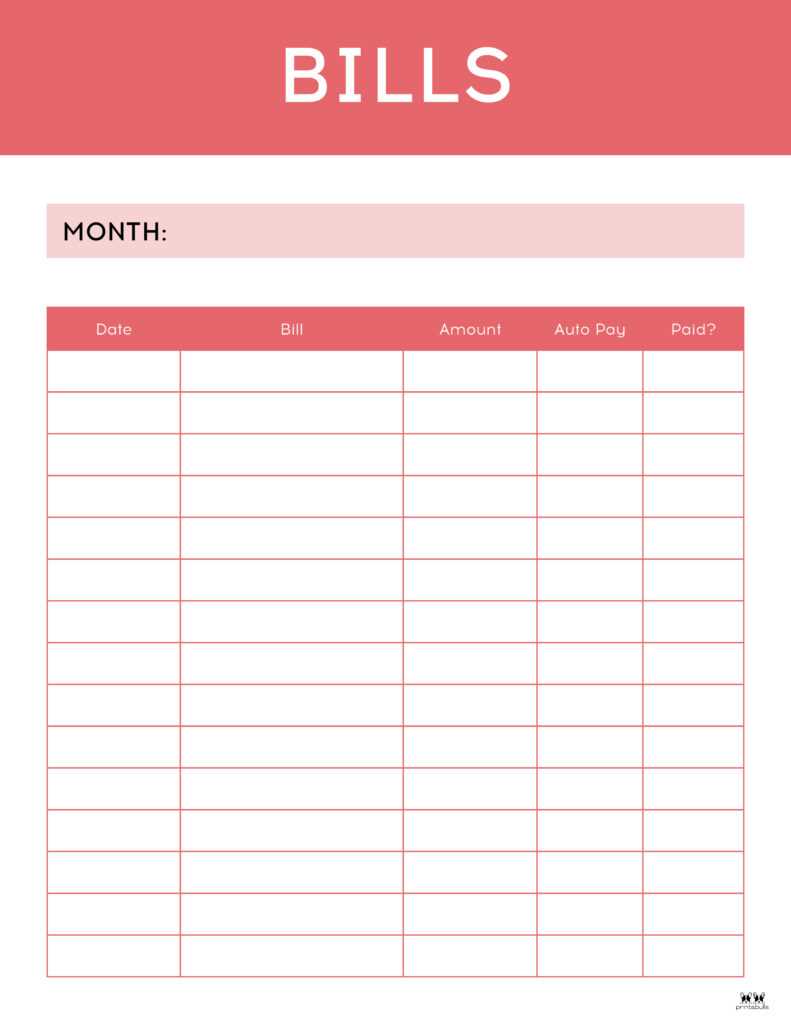

Monthly Overview for Simplified Budgeting

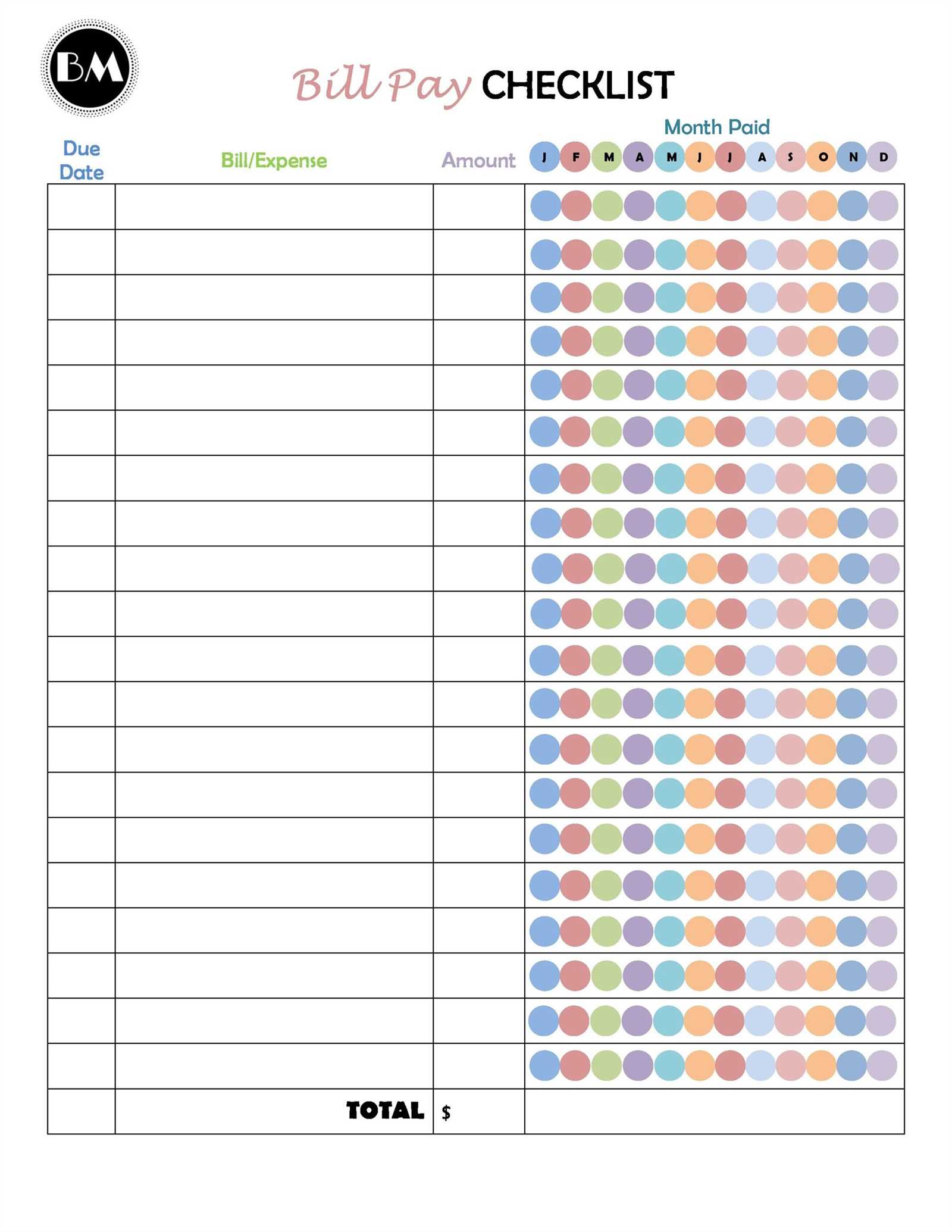

A monthly overview provides a more comprehensive look at your commitments and allows you to plan ahead. This style is ideal for those who prefer a single-page layout with an at-a-glance summary of upcoming deadlines. Highlighting key dates and grouping similar expenses together can enhance visibility and ensure nothing is overlooked. For an added layer of customization, consider color-coding different categories to differentiate between types of

Simple Ways to Track Monthly Bills

Keeping an organized approach to handling recurring payments can help avoid missed deadlines and manage finances more effectively. A systematic routine allows individuals to maintain control over their expenses, ensuring every commitment is met smoothly throughout the month.

Setting Up a Monthly Payment Routine

Start by establishing a straightforward monthly schedule that outlines each upcoming expense. Categorize these into essentials and optional expenses, which can offer a clearer perspective on where the majority of funds are allocated. This structured approach simplifies financial planning, making it easier to adjust if unexpected costs arise.

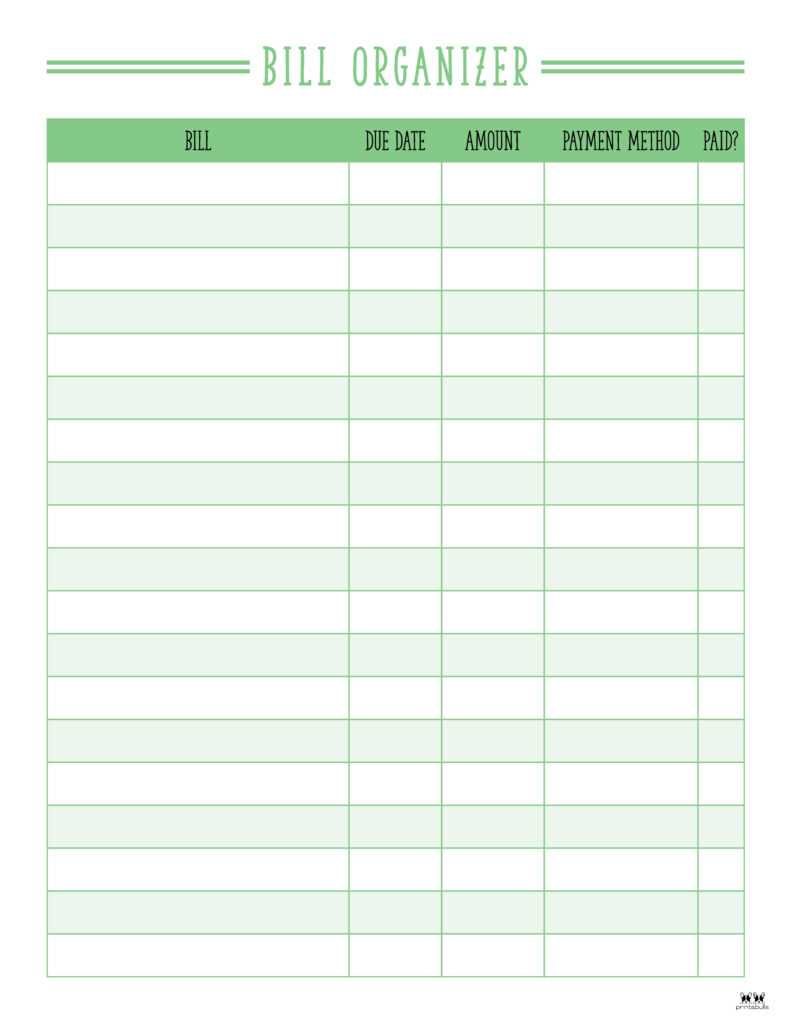

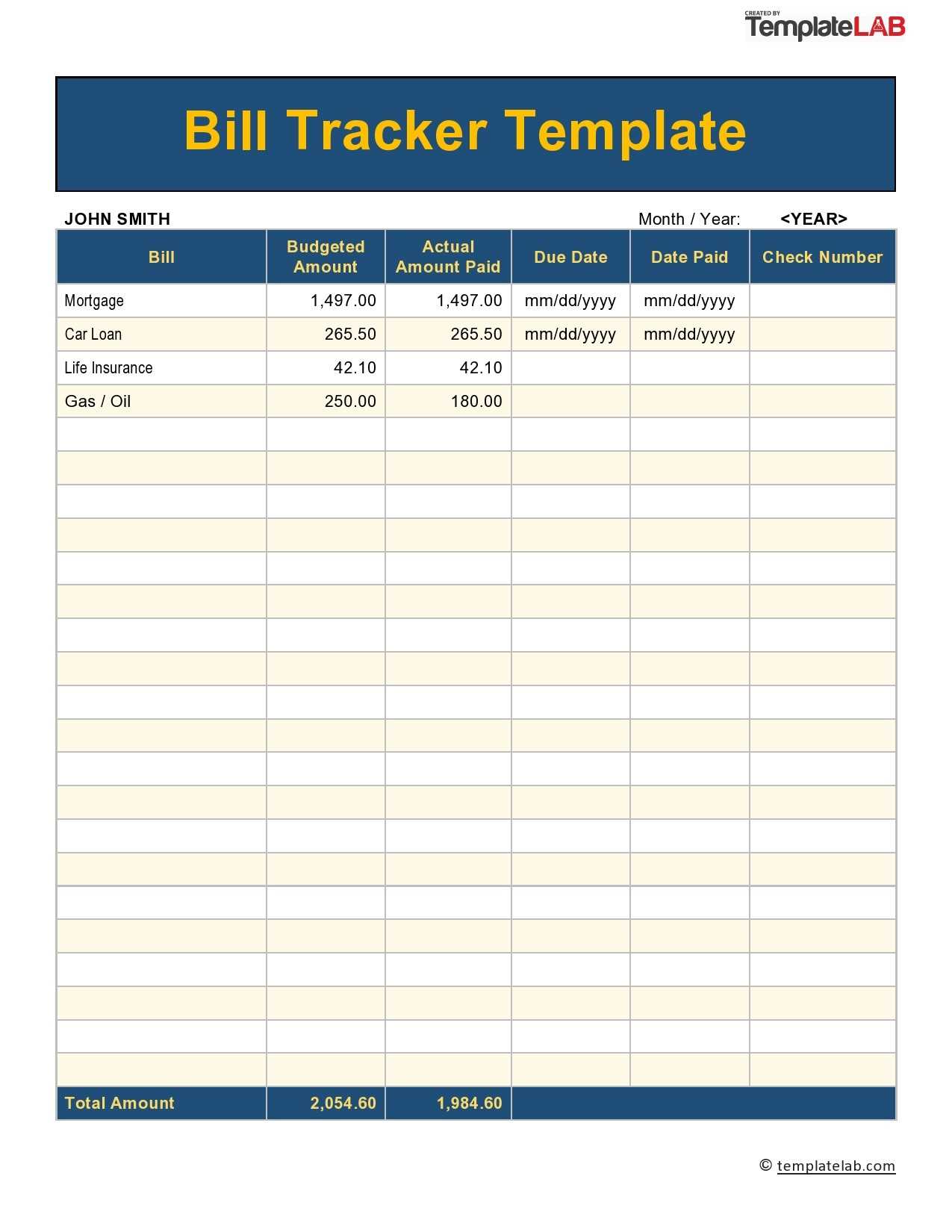

Using a Payment Tracking Table

A simple table can be a helpful tool for monitoring each payment’s due date and status. This layout offers an at-a-glance view of all recurring charges, allowing for quick updates and adjustments as needed.

| Expense Category | Due Date | Amount | Status | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Housing | 1st of Month | $1,000 | Paid | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Utilities | 5th of Month | $150 | Pending | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expense | Due Date | Amount | Payment Status | ||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rent | 1st of the month | $1,200 | Pending | ||||||||||||||||||||||||||||||||||||||||||||||||

| Utilities | 15th of the month | $150 | Pending | ||||||||||||||||||||||||||||||||||||||||||||||||

| Internet | 10th of the

Benefits of Using Printable Calendars

Using a physical schedule can enhance organization and improve time management by offering a clear, tangible overview of important dates and plans. This format allows for easy access and helps users structure their tasks and commitments effectively.

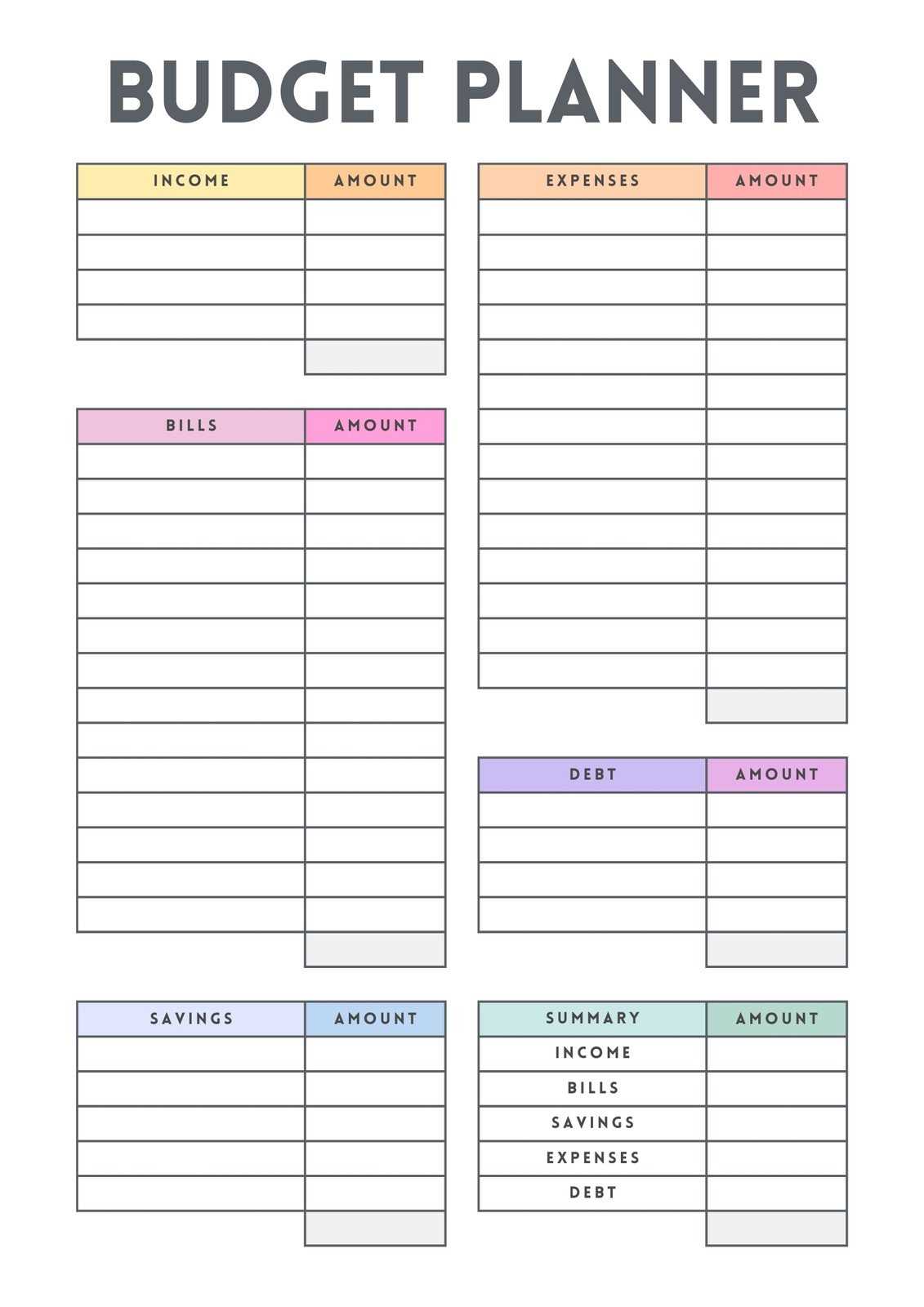

Best Templates for Budget PlanningEffective financial management relies on having the right tools to track income and expenses. Utilizing various resources designed for organizing your finances can greatly enhance your budgeting efforts. Here are some of the most suitable options that cater to different planning needs.

Customizing Your Bill Calendar LayoutTailoring the design of your financial tracking tool allows you to create a more efficient and visually appealing way to manage your expenses. By adjusting various elements, you can enhance its functionality and make it more suited to your personal style and needs. Start by selecting a layout that best fits your lifestyle. Consider whether you prefer a weekly, monthly, or yearly overview, as this choice will significantly impact how you interact with your entries. Additionally, think about incorporating different sections for various types of payments, such as utilities, subscriptions, and loans. This organization will help you quickly identify due dates and amounts. Another important aspect is the choice of colors and fonts. Using distinct colors for different categories can make it easier to differentiate between types of expenditures at a glance. Opt for fonts that are easy to read, ensuring clarity and reducing the chances of overlooking important information. You might also want to include visual elements, such as icons or symbols, to represent specific types of transactions. Finally, don’t forget to leave space for notes or reminders. This addition can help you jot down relevant information regarding payments, such as confirmation numbers or changes in amounts. By personalizing these details, you can create a more functional and enjoyable experience while keeping track of your finances. Using Calendars for Debt ManagementEffective financial planning is essential for maintaining control over personal finances. One useful strategy is utilizing a structured system to track obligations and payment dates. This approach helps individuals remain organized, ensuring timely payments and avoiding late fees that can accumulate over time. Establishing a ScheduleCreating a systematic schedule allows for better visibility of financial commitments. By marking important due dates, individuals can allocate their resources more effectively. This practice not only aids in managing cash flow but also contributes to a sense of security, as knowing when payments are due reduces the stress associated with financial management. Enhancing Financial Awareness

Using a structured approach fosters greater awareness of overall financial health. By regularly reviewing upcoming obligations, individuals can identify patterns in spending and prioritize their finances. This heightened awareness encourages proactive decision-making, leading to improved financial habits and ultimately supporting long-term financial stability. Free Tools to Simplify Payment Tracking

Managing financial obligations can be a daunting task, but with the right resources, it can become much more manageable. Utilizing digital solutions allows individuals to keep track of their expenditures and due dates effectively, minimizing the stress often associated with financial management. Essential Digital Resources

Mobile Applications for On-the-Go Tracking

Managing Finances with Printable Planners

Effective financial management is crucial for maintaining stability and achieving long-term goals. Utilizing physical planning tools can significantly enhance one’s ability to organize expenses and track income. These tools allow individuals to visualize their financial commitments, helping them make informed decisions about their spending habits. Organizing Financial Tasks is essential for success. By adopting a structured approach, users can allocate their resources more efficiently. Having a designated space to jot down due dates and amounts due encourages accountability and ensures that no obligation is overlooked. Moreover, customizing these organizational aids to fit personal needs can lead to improved clarity. Different layouts and designs can cater to various financial situations, whether one is managing household expenses or planning for larger investments. This tailored approach not only streamlines processes but also fosters a greater sense of control over financial matters. In conclusion, employing traditional planning methods empowers individuals to stay on top of their finances. With consistent use, these resources can transform chaotic financial situations into manageable tasks, paving the way for a more secure and organized future. Top Printable Options for Bill Reminders

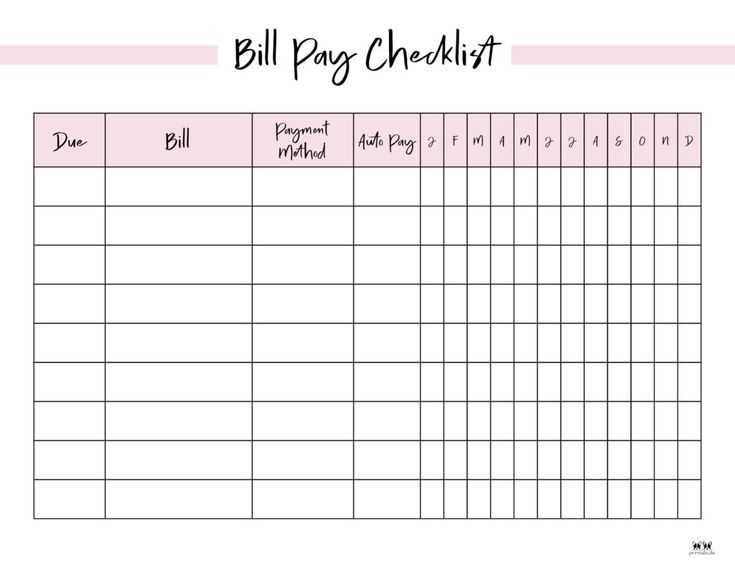

Staying on top of financial obligations is essential for maintaining a healthy budget and avoiding late fees. Utilizing various visual tools can significantly enhance your organization skills and help you manage payment deadlines effectively. Below are some of the most efficient choices for tracking due dates and ensuring timely payments.

By incorporating these visual aids into your routine, you can create a more structured approach to managing your financial commitments, ultimately leading to better control over your spending habits. How to Stay on Top of BillsManaging expenses effectively is essential for maintaining financial stability. Implementing a structured approach can help ensure that obligations are met on time, reducing the risk of late fees and promoting better budgeting practices. By staying organized and proactive, you can streamline your payment process and avoid unnecessary stress. Organize Your FinancesCreating a systematic method to track your commitments can make a significant difference. Start by compiling a list of all recurring payments, noting their due dates and amounts. This overview allows you to prioritize and plan your expenditures efficiently. Utilize a Tracking SystemIncorporating a tracking mechanism, whether digital or on paper, helps you visualize upcoming payments. This can be done using a simple table that outlines essential details, facilitating easy access to your financial responsibilities.

Monthly Planning for Bills and ExpensesManaging your finances effectively requires a systematic approach to track your obligations and spending. Creating a structured method for overseeing your monetary responsibilities can help you stay organized and avoid potential pitfalls. By setting aside time each month to assess and plan for your financial commitments, you can gain clarity and maintain control over your budget. Establishing a RoutineImplementing a consistent schedule for reviewing your financial duties can significantly enhance your money management. Consider the following steps to develop an efficient routine:

Tracking Your ExpensesMonitoring your financial outflows is essential for making informed decisions. Use these strategies to effectively track your spending:

By adhering to a monthly planning approach for your obligations and expenditures, you can develop a clearer understanding of your financial landscape and enhance your overall economic well-being. Creative Bill Tracking with Free TemplatesManaging your financial obligations can be a challenging task, but with the right resources, it becomes much easier. Utilizing innovative resources can enhance your ability to monitor expenses effectively. These helpful tools can assist in organizing payments, setting reminders, and ensuring you never miss a due date. By implementing visually appealing designs, tracking your monetary commitments can also become a more enjoyable process. Organizational Strategies

Incorporating various approaches to keep track of your obligations can significantly improve your financial management. Consider using themed layouts that resonate with your personal style. Color-coded systems can also add a layer of clarity, allowing you to quickly identify upcoming payments and their respective deadlines. This level of organization not only keeps you informed but also reduces stress related to financial planning. Engaging with VisualsEmploying visual elements in your tracking process can make managing finances less daunting. Opt for engaging designs that motivate you to stay on top of your expenditures. Incorporating graphics, charts, or even motivational quotes can transform a mundane task into an inspiring experience. This creative approach fosters a proactive mindset, encouraging you to take charge of your financial health. Saving Money with Organized Payment Schedules

Managing finances effectively is crucial for maintaining a healthy budget and ensuring timely obligations are met. By structuring payment timelines and systematically tracking due dates, individuals can minimize late fees and avoid unnecessary expenses. A well-structured approach to financial commitments not only enhances awareness of upcoming payments but also promotes better financial planning. Implementing organized schedules can significantly reduce financial stress. When payment dates are clearly laid out, it’s easier to allocate funds appropriately, ensuring that there are sufficient resources available when obligations arise. This proactive strategy empowers individuals to anticipate their expenses and make informed decisions regarding their finances.

By regularly updating and reviewing payment schedules, individuals can gain insights into their spending habits and identify areas for potential savings. This method not only fosters financial discipline but also cultivates a deeper understanding of one’s financial landscape. Efficient Calendar Templates for BudgetingManaging finances effectively requires a structured approach to tracking expenses and income. Utilizing well-designed scheduling tools can greatly enhance the budgeting process. These resources help individuals visualize their financial obligations and manage their cash flow efficiently. By incorporating a systematic layout, users can easily monitor due dates and plan their expenditures accordingly. Organizational Tools for Financial TrackingImplementing an organizational tool can simplify the process of keeping track of monetary commitments. A clear layout allows users to allocate their resources wisely and avoid unnecessary overspending. By marking important dates and amounts, individuals can maintain a comprehensive overview of their financial situation, leading to better decision-making and reduced stress. Customizable Formats for Personalized Management

Flexibility in design is crucial for accommodating diverse financial needs. Customizable formats allow users to adapt their tracking methods to fit their unique circumstances. Whether it’s adjusting columns for different categories or incorporating color codes for visual clarity, personalized management tools foster a more engaging approach to budgeting. Digital vs. Printable Bill CalendarsWhen managing financial obligations, individuals often find themselves choosing between electronic solutions and traditional paper formats. Each option presents unique advantages and potential drawbacks that cater to different preferences and lifestyles. Understanding these distinctions can help users select the most suitable approach for their needs. Advantages of Digital Solutions

Benefits of Traditional Formats

Setting Financial Goals with CalendarsEstablishing financial objectives is essential for achieving long-term stability and success. Utilizing a structured approach can help individuals track their progress and maintain focus on their aspirations. By leveraging organizational tools, you can visualize your goals, set deadlines, and monitor your achievements more effectively. Creating a Clear Vision

To begin your journey towards financial success, it’s crucial to outline specific aspirations. This may involve saving for a major purchase, reducing debt, or planning for retirement. Clearly defining these aims allows you to break them down into manageable steps. Using a visual aid can enhance motivation and serve as a constant reminder of what you are working towards. Tracking ProgressMonitoring your advancement is vital for maintaining accountability. Regularly reviewing your objectives enables you to assess your achievements and make necessary adjustments. Incorporating specific milestones and deadlines into your organizational structure can facilitate this process, ensuring you stay on track and remain motivated throughout your journey. |