In today’s fast-paced world, managing personal finances has become an essential skill for many. Establishing a structured approach can significantly enhance one’s ability to monitor expenditures and allocate resources wisely. This methodology not only aids in achieving short-term objectives but also fosters long-term stability and growth.

By implementing a well-thought-out framework, individuals can gain clarity on their financial status and identify areas for improvement. Utilizing visual aids can streamline this process, making it easier to track progress and adjust strategies as needed. Such tools empower users to make informed decisions, enhancing their overall economic well-being.

Incorporating a systematic approach into daily routines enables individuals to build healthier financial habits. Whether aiming to reduce unnecessary costs or to prioritize essential investments, having a structured plan provides a roadmap to success. This journey towards financial awareness and discipline not only brings peace of mind but also opens doors to new opportunities.

Understanding Money Saving Calendars

Organizing financial goals can significantly enhance your ability to manage expenses and achieve monetary targets. This methodical approach allows individuals to track their progress over time, fostering accountability and motivation. By breaking down larger objectives into manageable milestones, you can cultivate healthier spending habits and make informed decisions.

Here are some key aspects to consider when exploring this strategy:

- Visual Planning: Having a clear visual representation helps in setting priorities and deadlines.

- Progress Tracking: Regularly monitoring achievements keeps you focused and encourages consistency.

- Goal Setting: Defining specific financial objectives creates a roadmap for success.

- Habit Formation: Incorporating regular review sessions fosters positive financial behaviors.

By implementing such a structured approach, you can cultivate a deeper understanding of your financial landscape, leading to improved decision-making and long-term prosperity.

Benefits of Using a Calendar Template

Utilizing a structured approach to organizing your time can lead to significant improvements in efficiency and productivity. Implementing a well-designed framework allows individuals to streamline their planning processes, ensuring that important tasks and deadlines are not overlooked.

- Enhanced Organization: A clear layout helps in visualizing upcoming commitments, making it easier to manage schedules effectively.

- Improved Time Management: By allocating specific periods for tasks, one can prioritize effectively and minimize procrastination.

- Increased Accountability: Documenting responsibilities promotes a sense of ownership and encourages follow-through on commitments.

- Stress Reduction: Knowing what to expect in the days or weeks ahead can alleviate anxiety associated with last-minute planning.

Moreover, the customizable nature of such tools allows users to tailor their planning methods to fit individual preferences, enhancing overall usability. By incorporating a systematic approach, one can foster a more balanced and fulfilling daily routine.

How to Create Your Own Template

Crafting a personalized planner can enhance your financial organization and empower you to achieve your goals. This section will guide you through the essential steps to develop a customized framework that suits your individual needs.

- Define Your Objectives:

Before you start, clarify what you want to track. Consider including:

- Expenses

- Income

- Savings goals

- Investment plans

- Choose Your Format:

Decide whether you prefer a digital or paper-based layout. Popular formats include:

- Spreadsheets (Excel, Google Sheets)

- Printable sheets

- Apps designed for tracking finances

- Design Your Structure:

Outline the sections you want to include. Common categories are:

- Monthly overview

- Weekly tracking

- Goals section

- Notes area

- Add Personal Touches:

Incorporate elements that resonate with you. This can be:

- Color coding

- Inspirational quotes

- Custom graphics

- Test and Adjust:

Use your creation for a month and note what works and what doesn’t. Be prepared to make changes to enhance its effectiveness.

lessCopy code

By following these steps, you can develop a personalized planning tool that not only helps you monitor your finances but also motivates you to stick to your goals.

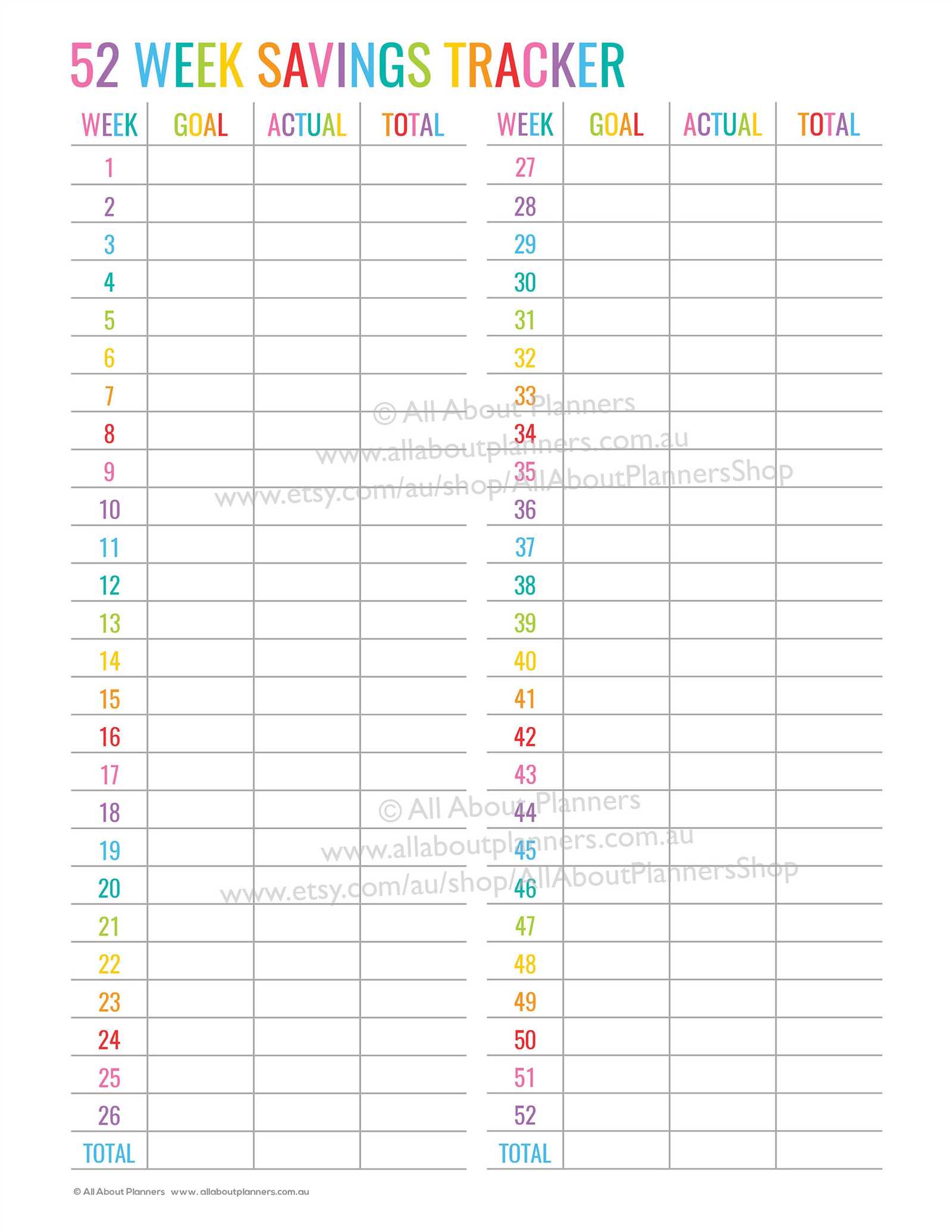

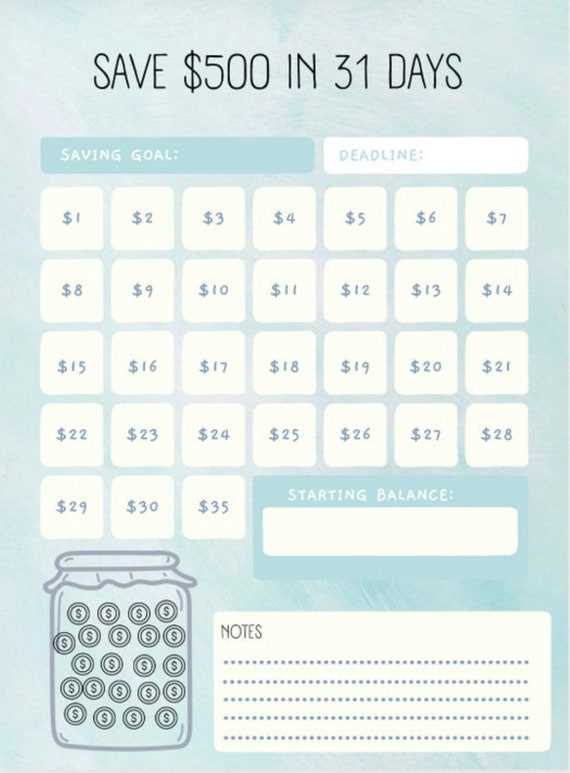

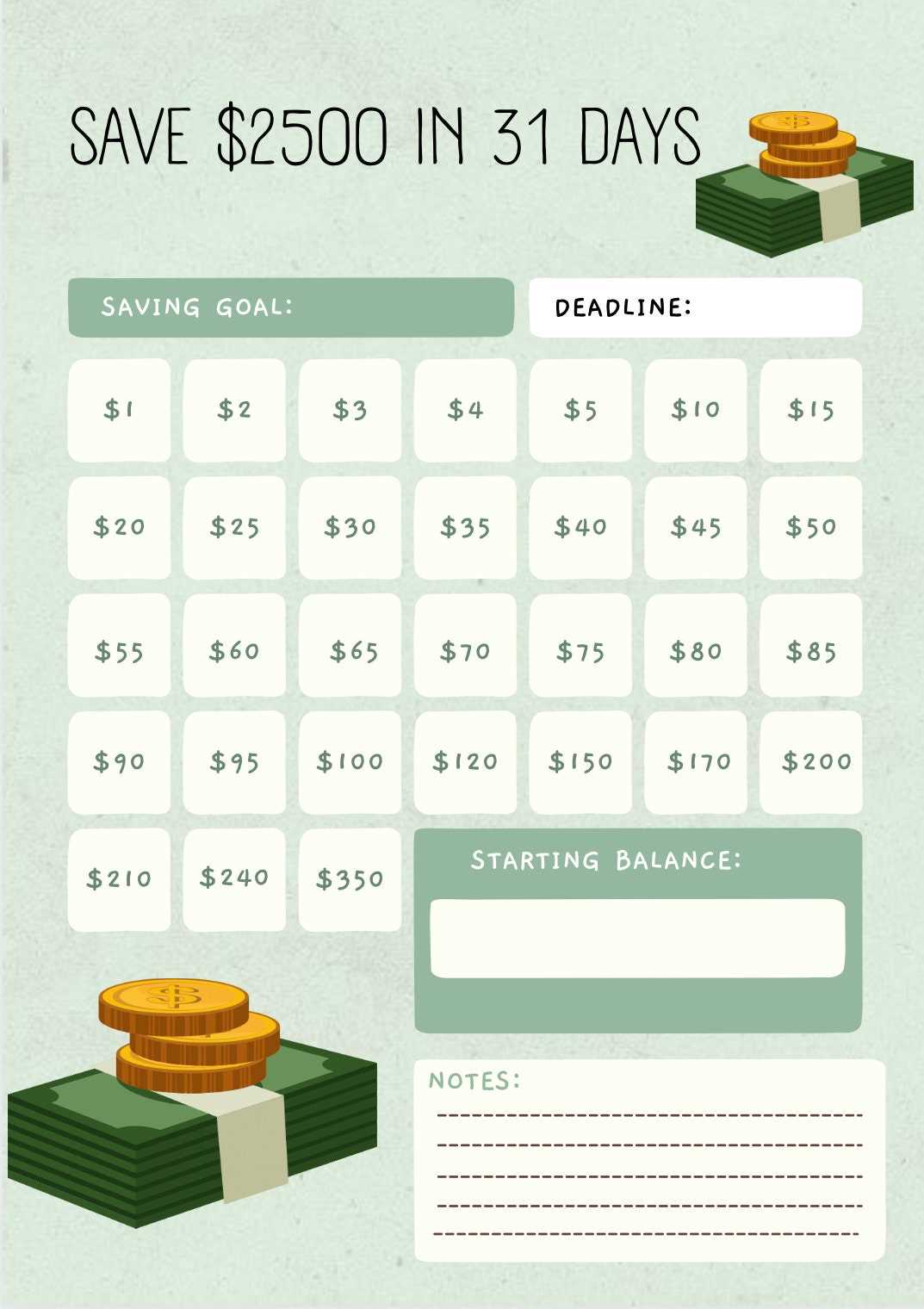

Monthly Savings Goals and Tracking

Establishing clear objectives for your finances can significantly enhance your ability to manage resources effectively. This approach allows individuals to focus on specific targets, making the process of accumulating wealth more structured and intentional.

Setting achievable targets is crucial. Consider what you wish to accomplish each month, whether it’s for a vacation, an emergency fund, or future investments. Breaking these aspirations down into manageable portions can lead to more consistent progress.

Once your goals are defined, tracking your progress becomes essential. Regularly reviewing your achievements not only motivates you but also highlights areas needing improvement. Utilize tools like spreadsheets or dedicated apps to monitor your journey, ensuring you stay aligned with your ultimate objectives.

Integrating Budgeting with Your Calendar

Combining financial planning with your schedule can enhance your ability to track expenses and manage resources effectively. By intertwining these two elements, you create a cohesive system that allows for proactive oversight of your financial commitments and future allocations. This approach not only keeps you informed but also helps you establish clearer priorities in both your spending and time management.

Benefits of Synchronizing Financial Plans and Schedules

When you align your financial activities with your daily tasks, you can visualize your obligations and opportunities more clearly. This integration facilitates timely payments and assists in identifying periods where discretionary spending can be limited. Additionally, it encourages a more mindful approach to expenditures, as you can assess your financial situation in conjunction with your ongoing responsibilities.

How to Implement This Integration

To effectively combine these two aspects, consider setting up reminders and alerts for important dates related to your financial responsibilities. Utilizing a structured format can aid in tracking and planning. Below is an example structure to illustrate how to align your financial commitments with your routine:

| Date | Activity | Financial Commitment |

|---|---|---|

| 1st of Month | Rent Payment | $1200 |

| 15th of Month | Utility Bills | $150 |

| Weekly | Grocery Shopping | $100 |

| End of Month | Review Financial Goals | N/A |

By following this structured approach, you can ensure that your financial landscape remains organized, promoting not only fiscal responsibility but also peace of mind as you navigate your daily life.

Setting Realistic Financial Milestones

Establishing attainable targets is essential for achieving long-term success in managing your resources. By breaking down larger objectives into smaller, achievable steps, you can create a clear path toward your desired outcomes. This approach not only fosters motivation but also allows for regular assessment of your progress.

To begin, evaluate your current situation and define what you hope to achieve. Consider factors such as your income, expenses, and overall financial health. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals will enhance your ability to track progress and make necessary adjustments along the way.

As you outline your objectives, prioritize them based on urgency and importance. This will help you focus on what truly matters and allocate your efforts effectively. Regularly reviewing and updating your milestones ensures that they remain aligned with your evolving aspirations and circumstances.

Finally, celebrate your achievements, no matter how small. Acknowledging progress boosts morale and reinforces positive habits, making the journey toward financial well-being more rewarding and engaging.

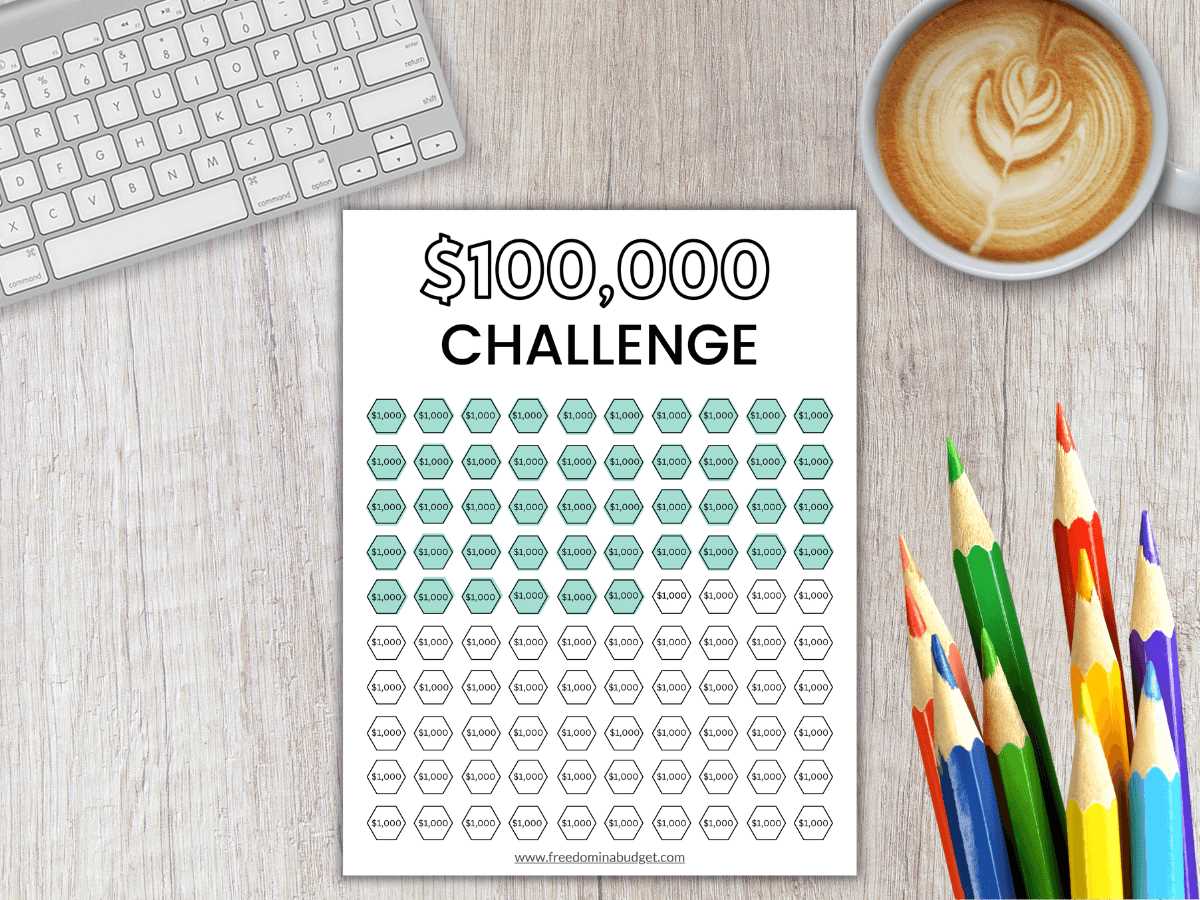

Visualizing Savings Through Design

Effective visualization plays a crucial role in understanding and managing personal finances. By incorporating design elements that illustrate progress and goals, individuals can cultivate a more engaging and motivating experience. This approach transforms abstract figures into relatable representations, helping to instill a sense of accomplishment and direction.

Engaging Graphics for Tracking Progress

Utilizing vibrant charts and intuitive layouts can significantly enhance the tracking of financial objectives. Infographics that depict trends over time allow users to see how their efforts contribute to their aspirations. By employing colors and symbols that resonate with personal values, the experience becomes not just practical, but also enjoyable.

Incorporating Milestones and Celebrations

Designing visual markers for key achievements fosters a sense of celebration and encourages continued effort. Whether through creative icons or distinct sections in a visual plan, acknowledging milestones can reinforce positive behaviors. This approach not only highlights what has been accomplished but also creates anticipation for future successes.

Using Technology for Money Management

In today’s fast-paced world, leveraging digital tools can significantly enhance how individuals track and allocate their resources. The integration of applications and software into everyday life has opened up new avenues for achieving financial clarity and control. By harnessing the power of technology, users can monitor their expenditures, set goals, and make informed decisions with ease.

Mobile applications designed for financial oversight allow users to categorize their spending effortlessly, offering visual representations of their habits. This real-time feedback can empower individuals to adjust their behaviors proactively, leading to more mindful decisions. Moreover, automated features, such as reminders for due dates and notifications for upcoming obligations, can reduce the risk of oversights that often lead to unnecessary costs.

Online platforms also provide access to valuable resources, including budgeting tools and financial education materials. These resources can equip users with the knowledge necessary to build healthier practices and long-term strategies. Collaborative features in certain applications allow family members or partners to share insights and work together towards common financial objectives, fostering a sense of accountability and teamwork.

Ultimately, embracing these technological advancements not only simplifies the management of resources but also cultivates a more strategic approach to financial wellness. As individuals become more adept at utilizing these tools, they can pave the way for a more secure and informed future.

Printable vs. Digital Calendar Options

When it comes to organizing your schedule, choosing between physical and electronic formats can significantly impact your planning experience. Each option offers unique advantages and limitations, catering to different preferences and lifestyles.

Benefits of Physical Formats

- Tactile Experience: Many people find writing by hand more engaging and memorable.

- Visual Clarity: A physical layout can provide an easy overview of your tasks at a glance.

- No Distractions: Using a paper format reduces the temptation of digital notifications.

- Customization: You can personalize designs and layouts to suit your style.

Advantages of Digital Formats

- Accessibility: Electronic options can be accessed from various devices, ensuring you’re always connected.

- Integration: They often sync with other apps, streamlining your planning process.

- Search Functionality: Quickly find events or notes using keywords, saving time and effort.

- Eco-Friendly: Reduces paper waste and is more sustainable for the environment.

Incorporating Seasonal Expenses into Planning

Effective financial planning requires awareness of various recurring obligations throughout the year. Recognizing how different seasons influence expenditures can significantly enhance budget management. By anticipating these periodic costs, individuals can allocate resources more effectively and reduce unexpected financial strain.

Identifying Seasonal Trends

Understanding typical spending patterns can help in forecasting future outlays. Consider the following common seasonal expenses:

- Holidays and celebrations (e.g., Christmas, Thanksgiving)

- Seasonal travel and vacations

- Home maintenance and repairs (e.g., winterizing, spring cleaning)

- Back-to-school shopping

- Seasonal clothing purchases

Strategic Planning Approaches

Once seasonal costs are identified, incorporating them into overall financial strategies becomes essential. Here are some approaches to consider:

- Establish a dedicated fund for anticipated expenses.

- Divide yearly costs into monthly contributions to ease the financial load.

- Review previous years’ expenditures to adjust estimates for the upcoming seasons.

- Prioritize essential expenses while being mindful of discretionary spending.

By incorporating these practices, individuals can navigate seasonal fluctuations with confidence and maintain a balanced financial outlook throughout the year.

Strategies for Consistent Savings Habits

Establishing a routine that encourages regular contributions to your financial goals can lead to long-term stability and security. By implementing practical approaches, individuals can foster a mindset that prioritizes future prosperity over immediate gratification.

1. Set Clear Goals: Defining specific objectives can provide motivation and direction. Whether it’s for a trip, a new gadget, or an emergency fund, having a target in mind can drive consistent action.

2. Automate Contributions: Utilizing technology to automate your contributions can help eliminate the temptation to spend. By scheduling transfers to your accounts, you ensure that a portion of your resources is allocated before it can be used elsewhere.

3. Track Progress: Keeping an eye on your achievements can reinforce positive behavior. Regularly reviewing your status not only highlights your successes but also helps identify areas for improvement.

4. Create a Budget: A well-structured budget provides a roadmap for managing your resources effectively. By outlining your income and expenses, you can identify potential areas for reallocating funds towards your goals.

5. Reward Yourself: Celebrating milestones can enhance motivation. Acknowledge your achievements, no matter how small, and consider treating yourself in a way that aligns with your long-term aspirations.

6. Educate Yourself: Knowledge is empowering. Understanding financial concepts can help you make informed decisions, allowing you to navigate challenges with confidence and clarity.

By incorporating these strategies into your daily life, you can develop enduring habits that will support your aspirations and contribute to a more secure future.

Adjusting Your Template Over Time

As you navigate your financial journey, the need to evolve your planning tools becomes evident. It’s essential to periodically review and refine your strategies to align with your changing circumstances and goals.

Start by assessing your current approach. Identify what is working well and what may require adjustment. This reflective process allows for a more tailored experience that can better serve your objectives.

Consider setting regular intervals for evaluation, whether monthly or quarterly. This practice ensures that you remain responsive to new challenges and opportunities, keeping your framework relevant and effective.

Additionally, don’t hesitate to incorporate feedback from experiences. If certain methods are less effective than anticipated, be willing to pivot and try alternative solutions that may yield better results.

Involving Family in Saving Goals

Creating a shared vision for achieving financial aspirations can strengthen bonds within a household. When family members work together towards common objectives, it fosters a sense of teamwork and accountability. Engaging everyone in the journey not only makes the process more enjoyable but also instills valuable lessons about prioritizing resources and making informed choices.

Setting Collective Objectives

Establishing group aspirations allows each member to contribute their ideas and aspirations. Whether it’s planning a family vacation or investing in a future project, discussing these goals openly encourages participation. By assigning specific roles and responsibilities, everyone feels a sense of ownership, enhancing motivation to reach the targets.

Celebrating Achievements Together

Recognizing milestones along the way can significantly boost morale. When the family reaches a target, celebrating that success creates positive reinforcement and encourages continued efforts. Simple rewards, like a special meal or an outing, can reinforce the importance of working together and highlight the progress made, further inspiring commitment to future objectives.

Learning from Savings Success Stories

Inspiring narratives often illuminate paths to financial achievements. By exploring the journeys of individuals who have successfully navigated their fiscal goals, we can uncover valuable insights and strategies that may aid others in their own quests for economic well-being. These stories provide practical examples of how determination and smart choices can lead to remarkable transformations.

Real-Life Inspirations

Consider the tale of a young professional who, through disciplined planning and consistent efforts, was able to accumulate substantial resources over a few years. By setting specific targets and adhering to a structured approach, this individual turned aspirations into tangible results. Such examples serve as powerful reminders of the effectiveness of setting clear intentions.

Key Strategies and Lessons

One recurring theme in these success stories is the importance of adaptability. People who have thrived often adjusted their strategies in response to changing circumstances. Prioritization plays a crucial role as well; focusing on essential expenditures while minimizing unnecessary outlays can significantly enhance progress. Additionally, the practice of regularly reviewing and reassessing goals ensures continued alignment with personal values and objectives. Emulating these practices can empower others to embark on their own journeys toward financial wellness.

Resources for Template Inspiration

Finding innovative ideas for organizing your financial goals can significantly enhance your planning experience. The following sources provide creative concepts that can help you visualize and track your progress effectively.

- Online Design Platforms:

- Canva – Offers a variety of customizable layouts.

- Adobe Spark – Features user-friendly tools for creating unique designs.

- Piktochart – Great for infographics that can aid in visual tracking.

- Social Media Inspirations:

- Pinterest – Explore boards dedicated to organizational ideas.

- Instagram – Search for hashtags related to planning and budgeting.

- Facebook Groups – Join communities that share creative strategies.

- Blogs and Websites:

- The Balance – Offers tips on effective financial planning.

- Smart Passive Income – Focuses on entrepreneurship and management tools.

- Lifehacker – Provides hacks for efficient organization.

- Books and E-books:

- “The Total Money Makeover” by Dave Ramsey – Provides structured approaches to financial goals.

- “You Are a Badass at Making Money” by Jen Sincero – Motivational insights on wealth building.

- “The Budgeting Habit” by S.J. Scott – Guides on developing effective tracking habits.

Utilizing these resources can spark creativity and help you develop an effective system tailored to your personal aspirations. Experiment with different ideas to discover what works best for you.

Common Mistakes to Avoid in Planning

Effective organization requires careful consideration and foresight. However, many individuals fall into pitfalls that can derail their efforts and lead to frustration. Understanding these common errors can help streamline the process and enhance overall success.

Lack of Clear Goals

One frequent misstep is failing to establish precise objectives. Without well-defined targets, it’s easy to lose direction and motivation. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals can provide clarity and focus throughout your journey.

Neglecting Flexibility

Another mistake is becoming too rigid in your approach. Life is unpredictable, and unforeseen circumstances can arise. Being adaptable allows for adjustments when necessary, ensuring that you remain on track despite challenges. Embrace change as a part of the planning process rather than a setback.

Tracking Progress and Celebrating Achievements

Monitoring advancements and recognizing milestones are essential components of any successful journey. By systematically recording accomplishments, individuals can maintain motivation and foster a sense of fulfillment. A structured approach allows for reflection on efforts, ensuring that every step forward is acknowledged and appreciated.

Establishing a system for tracking progress not only highlights achievements but also identifies areas for improvement. This reflective practice can inspire continuous development and reinforce positive habits. Celebrating these successes, no matter how small, serves as a powerful reminder of one’s dedication and hard work.

| Date | Milestone Achieved | Celebration Method |

|---|---|---|

| January 15 | Reached initial target | Special dinner with friends |

| March 10 | Completed a major goal | Weekend getaway |

| June 5 | Surpassed quarterly objectives | Gift to self |

Utilizing such a method fosters a sense of accountability and enthusiasm. Documenting both the journey and the celebrations encourages a positive mindset, ultimately contributing to sustained commitment and achievement. Embracing progress and acknowledging successes pave the way for future aspirations and endeavors.