In today’s fast-paced world, managing your expenses can feel overwhelming. A systematic approach to tracking your payments can make a significant difference in how you handle your finances. By creating a structured way to monitor your obligations, you can avoid late fees and ensure timely payments.

Having a visual representation of your recurring expenses allows you to see where your money goes each month. This can empower you to make informed decisions about your budget and spending habits. With the right tools, you can simplify your financial planning and maintain control over your resources.

Whether you’re looking to enhance your financial literacy or just want a straightforward way to keep tabs on your commitments, adopting a strategic method to lay out your dues is essential. In this article, we will explore various resources that can help you stay organized and on top of your financial game.

Understanding Monthly Bill Management

Effective financial organization is essential for maintaining control over one’s expenses. By systematically tracking obligations and due dates, individuals can avoid late payments and manage their resources more efficiently. This practice not only alleviates stress but also contributes to better budgeting and financial planning.

Key Benefits of Effective Expense Tracking

- Prevention of late fees

- Improved credit score

- Enhanced budget management

- Reduced financial stress

Strategies for Efficient Management

- List all recurring payments and their due dates.

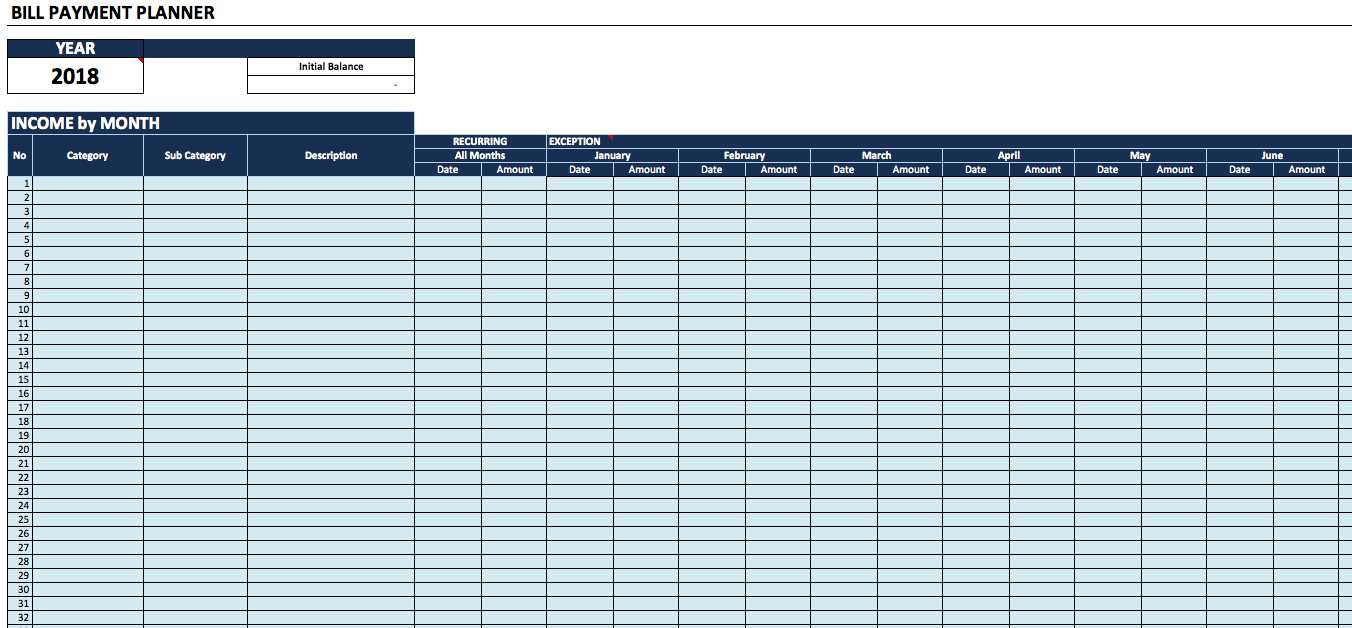

- Utilize technology, such as apps or spreadsheets, to keep track.

- Set reminders to stay on top of payment schedules.

- Review and adjust your obligations regularly to ensure accuracy.

By implementing these strategies, individuals can take charge of their financial commitments, ensuring a smoother and more predictable cash flow each month.

Benefits of Using a Bill Calendar

Utilizing a structured system to track recurring payments can significantly enhance financial management. This approach offers a clear visual representation of obligations, helping individuals stay organized and avoid any potential lapses. By keeping everything in one place, users can gain better control over their expenditures and plan their budgets more effectively.

Enhanced Organization

A well-structured system allows for easy access to payment dates and amounts, reducing the risk of missing due dates. By having all necessary information readily available, individuals can streamline their financial processes and allocate their resources wisely.

Improved Financial Planning

Knowing upcoming obligations in advance enables better cash flow management. Individuals can anticipate their financial needs and avoid surprises that may disrupt their budget. This foresight can lead to more informed decisions regarding spending and saving.

| Feature | Benefit |

|---|---|

| Centralized Information | Easy tracking of all obligations |

| Clear Deadlines | Reduces the likelihood of late fees |

| Budgeting Aid | Facilitates informed spending decisions |

| Peace of Mind | Reduces financial stress and anxiety |

How to Create a Bill Tracker

Keeping track of expenses is essential for managing finances effectively. By developing a system that organizes due dates, amounts, and payment methods, you can maintain control over your financial obligations. This guide outlines a simple approach to set up a reliable tracking system that ensures timely payments and minimizes stress.

Step 1: Gather Your Information

Begin by collecting all relevant data regarding your financial commitments. This includes amounts owed, due dates, and any associated fees. Having a comprehensive overview allows for better planning and reduces the likelihood of missing payments.

Step 2: Choose a Tracking Method

Decide whether to use a digital application, spreadsheet, or a physical notebook for monitoring your obligations. Each option has its advantages; digital solutions often offer reminders and easy updates, while traditional methods may provide a tangible way to visualize your finances. Choose what works best for your lifestyle and preferences.

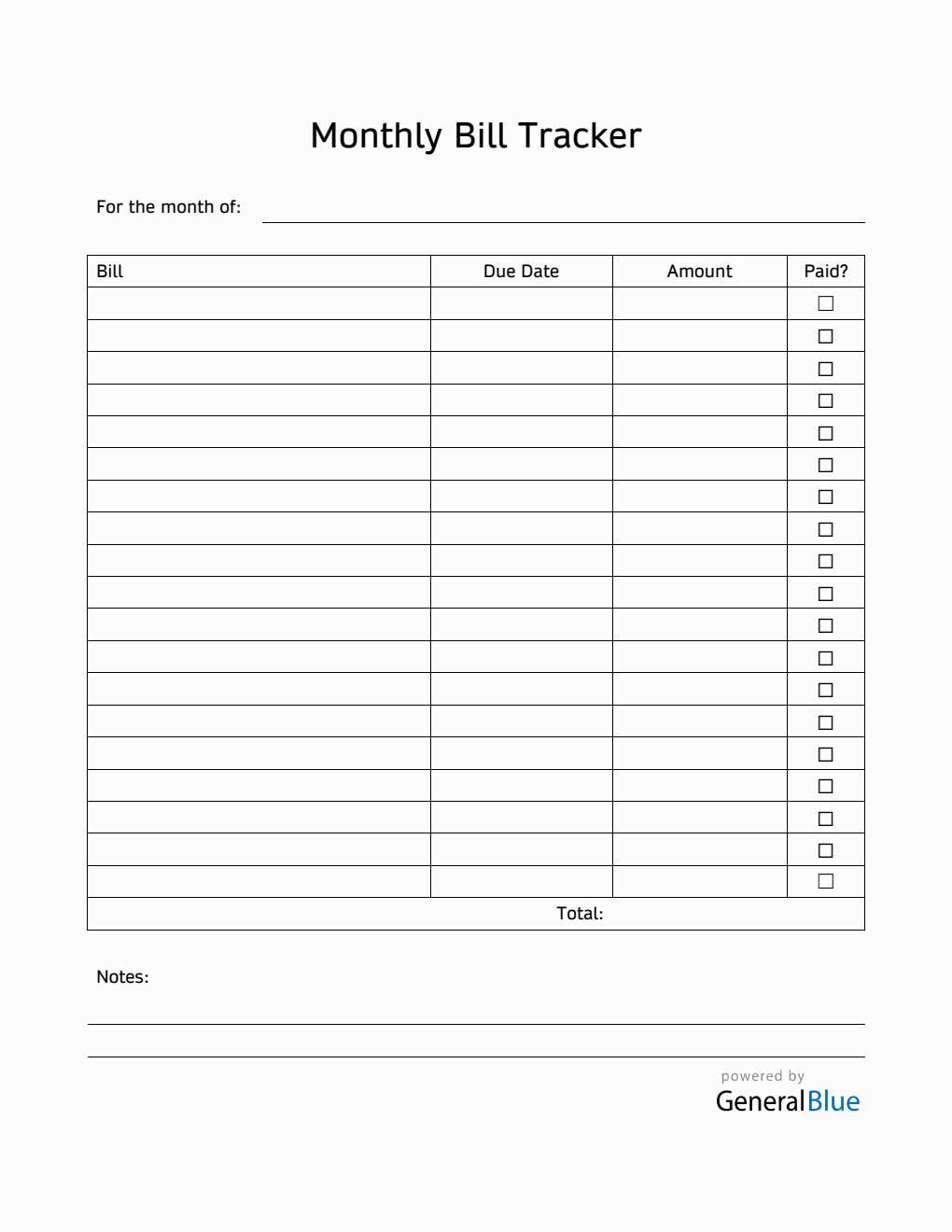

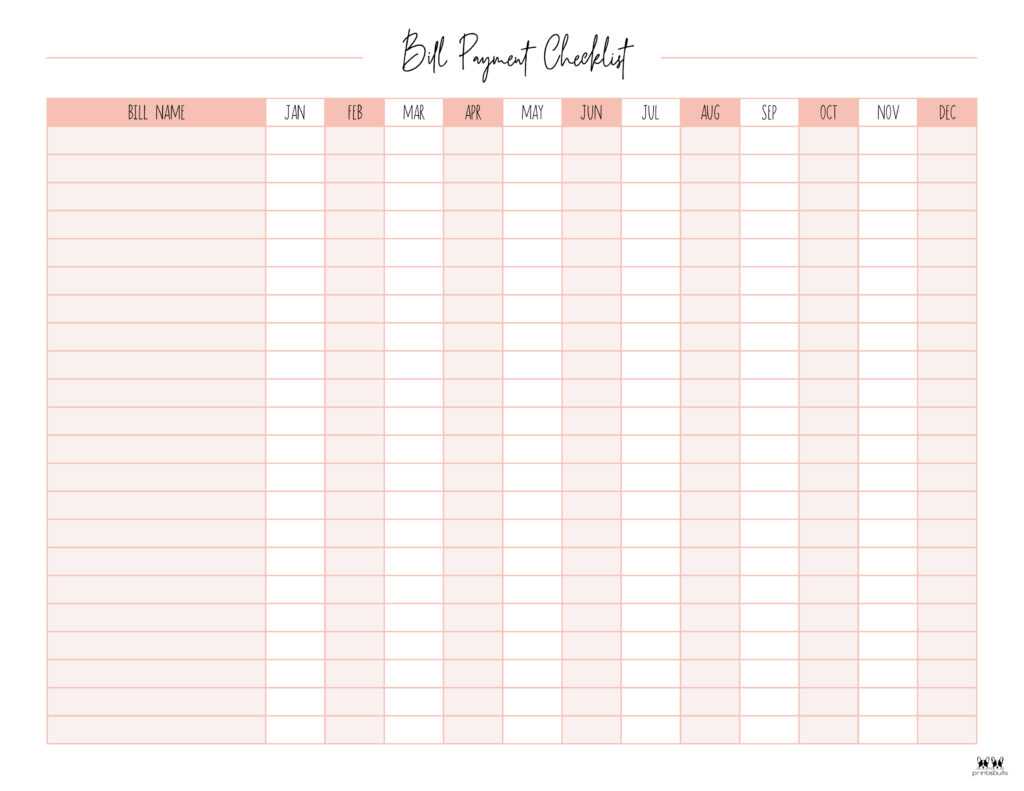

Key Features of Effective Templates

Creating an organized system for tracking expenses and due dates can greatly enhance productivity and financial management. A well-designed framework should possess certain characteristics that contribute to its overall effectiveness.

- Clarity: The layout should be intuitive, making it easy for users to navigate and locate necessary information quickly.

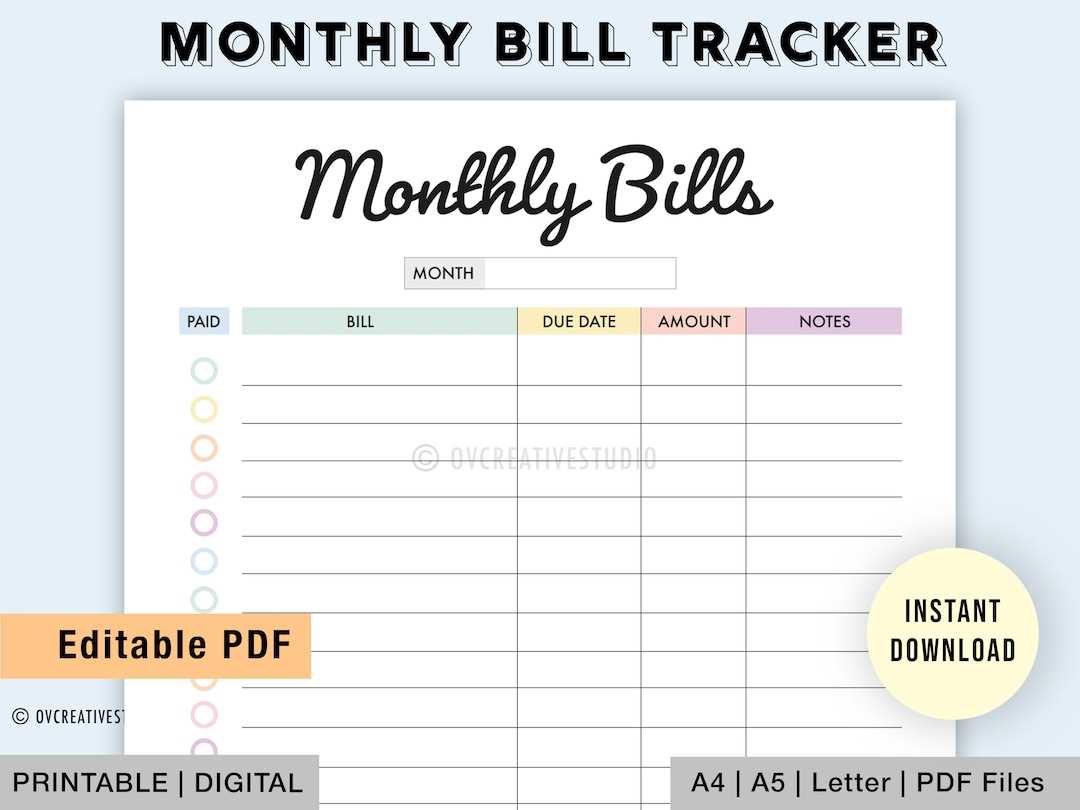

- Customization: Flexibility allows individuals to tailor the structure to meet specific needs, ensuring relevance and personal significance.

- Visual Appeal: Aesthetically pleasing designs engage users and encourage consistent use, promoting better adherence to tracking habits.

- Accessibility: Options for both digital and printable formats ensure that users can access their information in the way that suits them best.

- Reminders: Built-in alerts can help users remember important dates, reducing the risk of late payments or missed obligations.

By incorporating these key elements, individuals can develop a system that not only organizes financial responsibilities but also promotes proactive management of personal and household finances.

Free Resources for Bill Organization

Managing finances can often feel overwhelming, but there are various tools available to streamline the process. These resources assist individuals in tracking their expenses, ensuring timely payments, and ultimately fostering better financial habits.

Digital Tools: Numerous applications provide intuitive interfaces for tracking outgoings. Users can set reminders, categorize expenses, and visualize their spending patterns. Many of these solutions offer cloud synchronization, allowing access from multiple devices.

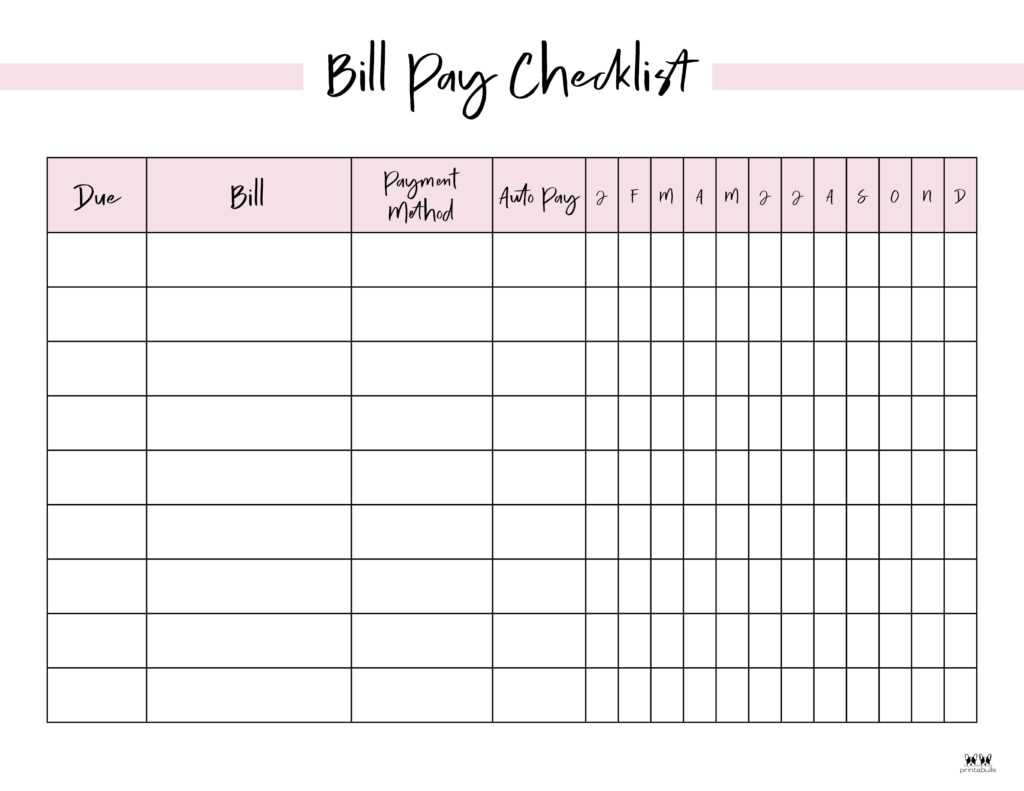

Printable Guides: For those who prefer a tactile approach, printable worksheets are invaluable. These guides help individuals organize their expenditures and visualize their budget on paper. They can be customized to fit personal needs and preferences, making them versatile options.

Community Forums: Engaging with others facing similar financial challenges can provide insights and motivation. Online communities often share tips, strategies, and even resources that have worked for them, fostering a supportive environment.

Educational Resources: Websites and blogs dedicated to financial literacy offer articles, videos, and tutorials aimed at enhancing understanding of money management. Learning about effective budgeting techniques can empower individuals to take control of their financial situation.

Utilizing these varied resources can lead to a more organized approach to personal finances, reducing stress and enhancing overall financial wellness.

Choosing the Right Template Format

Selecting an appropriate layout for tracking your regular expenses and payments can significantly enhance your organization and planning. The right structure not only helps in maintaining clarity but also ensures that you have easy access to crucial information when you need it. With various options available, understanding the strengths of each format can assist you in making an informed decision that aligns with your specific needs.

Consider Your Needs

Before settling on a format, evaluate your personal requirements. Do you prefer a simple overview, or do you need detailed breakdowns? Some individuals benefit from a straightforward approach that highlights key dates and amounts, while others may require a more intricate setup that includes categories or notes. Understanding your preferences will guide you in selecting the most effective format.

Accessibility and Usability

Think about how you plan to access and use your chosen layout. If you frequently use digital devices, an electronic format may be more convenient. On the other hand, a printable option might suit those who prefer a tactile approach. Ensure that the layout you choose is easy to navigate and fits seamlessly into your daily routine, allowing for quick updates and reference.

Customizing Your Bill Calendar

Tailoring your schedule for tracking expenses can significantly enhance your financial management. By adjusting the layout, colors, and elements, you can create a personalized approach that aligns with your preferences and needs. This section will guide you through the steps to make your planner not only functional but also visually appealing.

Choosing the Right Format

Selecting a suitable format is essential. Whether you prefer a grid layout for clarity or a more artistic design with flowing lines, the choice impacts usability. Consider your daily activities and how you visualize your financial obligations. The right arrangement will make it easier to spot upcoming due dates.

Incorporating Visual Elements

Adding visual cues can enhance your tracking system. Use colors to categorize different types of payments, such as utilities, subscriptions, or personal expenses. Icons can also provide quick references, making it simpler to identify specific entries at a glance. Personalizing with your favorite colors or themes can motivate you to stay on top of your responsibilities.

Tips for Staying On Schedule

Maintaining a structured routine can significantly enhance your productivity and ensure that important tasks are completed on time. Here are some effective strategies to help you stay organized and adhere to your commitments consistently.

| Tip | Description |

|---|---|

| Set Clear Deadlines | Establish specific due dates for your tasks to create a sense of urgency and prioritize effectively. |

| Use Reminders | Utilize digital tools or physical notes to remind you of upcoming deadlines and appointments. |

| Break Tasks Down | Divide larger projects into smaller, manageable steps to prevent feeling overwhelmed and to track progress easily. |

| Review Weekly | Set aside time each week to assess what you’ve accomplished and adjust your plans for the following week accordingly. |

| Avoid Multitasking | Focus on one task at a time to improve concentration and efficiency, making it easier to meet your goals. |

Integrating Digital Tools for Management

In today’s fast-paced environment, the incorporation of digital solutions into management practices is essential for enhancing efficiency and organization. These tools streamline processes, making it easier to track obligations, deadlines, and financial commitments.

Utilizing these advanced resources can significantly improve workflow and overall productivity. Consider the following advantages:

- Improved Organization: Digital tools help keep tasks and responsibilities in order, reducing the risk of oversight.

- Real-Time Updates: Instant notifications and updates ensure that all team members are informed about changes and deadlines.

- Accessibility: Information can be accessed from various devices, promoting flexibility and remote work.

- Data Analysis: Many digital solutions offer analytical features that provide insights into spending habits and performance metrics.

To effectively implement these resources, follow these steps:

- Identify Needs: Assess what specific areas require improvement and what functionalities are necessary.

- Choose Appropriate Tools: Select platforms that align with your management style and organizational goals.

- Train Team Members: Ensure that everyone is proficient in using the new tools to maximize their potential.

- Evaluate and Adjust: Regularly review the effectiveness of the tools and make adjustments as needed.

By embracing these innovative solutions, organizations can achieve greater control over their operations and foster a more collaborative environment. The right digital tools not only facilitate task management but also enhance communication among team members, leading to more successful outcomes.

Visualizing Payment Due Dates

Understanding when payments are due is crucial for effective financial management. By clearly illustrating these deadlines, individuals can better navigate their obligations and avoid any unnecessary penalties. A visual representation allows for quicker comprehension and easier planning, helping to maintain a healthy financial state.

Benefits of Visualization

Utilizing graphics or organized layouts enhances awareness of upcoming due dates. This approach not only streamlines the tracking process but also encourages timely actions. Seeing all obligations at a glance can significantly reduce stress and foster proactive planning.

Effective Methods for Displaying Dates

There are various ways to represent payment deadlines effectively. For instance, color-coded systems can indicate urgency, while grids or charts provide a structured view of when payments are expected. Incorporating reminders or alerts can further assist in ensuring that no due date goes unnoticed. By implementing these strategies, managing financial commitments becomes more straightforward and efficient.

Common Mistakes to Avoid

When organizing your financial commitments, it’s easy to overlook certain details that can lead to unnecessary complications. Understanding the pitfalls can help streamline your planning process and ensure you stay on track.

Neglecting to Review Regularly: One common oversight is failing to revisit your financial obligations consistently. Without regular reviews, it’s easy to miss due dates or changes in amounts due, which can result in late fees.

Ignoring Variable Expenses: Many individuals focus solely on fixed costs, forgetting that expenses can fluctuate. It’s essential to account for these variations to avoid surprises in your financial planning.

Not Prioritizing Payments: A significant mistake is treating all obligations as equally urgent. Identifying priorities can help manage cash flow and prevent penalties on more critical payments.

Forgetting About Emergency Funds: Some people concentrate solely on immediate expenses, neglecting to allocate funds for unexpected situations. Having a cushion can alleviate stress and prevent financial strain.

Underestimating the Time Required: Lastly, many underestimate the time needed to organize their finances. Allowing adequate time for this task ensures thoroughness and reduces the risk of overlooking important details.

Strategies for Reducing Monthly Expenses

Managing finances effectively often involves identifying areas where costs can be minimized. By adopting a few key strategies, individuals can optimize their spending and enhance their overall financial health. Here are some practical approaches to consider for cutting down on regular outlays.

| Strategy | Description |

|---|---|

| Budgeting | Creating a detailed budget helps track income and expenditures, making it easier to spot unnecessary expenses. |

| Shopping Smart | Utilizing sales, coupons, and comparison shopping can significantly lower the cost of everyday items. |

| Reducing Subscriptions | Evaluating and eliminating unused or unnecessary subscription services can lead to substantial savings. |

| Energy Efficiency | Implementing energy-saving measures at home can reduce utility costs over time. |

| Meal Planning | Planning meals ahead can minimize impulse purchases and food waste, leading to more efficient grocery spending. |

By incorporating these techniques into daily routines, individuals can achieve a more sustainable financial approach while still enjoying a comfortable lifestyle.

How to Share Templates with Others

Sharing organized documents can enhance collaboration and streamline planning processes. Whether you’re working with colleagues, friends, or family, effectively distributing these resources ensures everyone is on the same page. Here are some methods to share your carefully crafted designs.

Email Distribution

One of the simplest ways to share your creations is through email. Attach the file directly, providing a brief description in the message to clarify its purpose. This method allows for immediate access and easy follow-up conversations.

Cloud Storage Solutions

Utilizing cloud storage platforms enables seamless sharing without the limitations of email attachments. Upload your document to services like Google Drive or Dropbox, and share the link with others. This approach not only facilitates access but also ensures that everyone is viewing the most up-to-date version.

Regardless of the method you choose, ensure that the recipients understand how to utilize the resource effectively. A quick guide or instructions can make a significant difference in how well the information is received and used.

Tracking Irregular Payments Effectively

Managing expenses that do not follow a regular schedule can be challenging, yet it is crucial for maintaining financial stability. These unpredictable transactions can often catch individuals off guard, leading to potential overspending or missed payments. To navigate this complexity, a systematic approach is essential.

Establishing a Clear Overview: Begin by creating a comprehensive list of all irregular transactions. This includes those that occur quarterly, annually, or on varying dates. By compiling this information, you gain a clearer picture of your financial landscape, enabling better planning and allocation of funds.

Utilizing Technology: Leverage financial management tools and applications that allow you to set reminders for these non-regular payments. Many tools offer features such as notifications and trend tracking, which can help you anticipate when expenses are due, ensuring you remain prepared.

Setting Aside Reserves: Consider establishing a dedicated fund for these irregular costs. By contributing a small amount regularly, you can create a financial cushion that absorbs unexpected expenses without disrupting your overall budget.

Reviewing and Adjusting: Regularly revisit your list of irregular expenses to ensure it remains current. Life circumstances and spending habits can change, so adjusting your strategies accordingly will help you stay on top of your financial commitments.

By implementing these strategies, you can effectively manage unpredictable payments, reduce stress, and maintain better control over your finances.

Reviewing and Updating Your Calendar

Maintaining an organized schedule is essential for managing your finances effectively. Regularly assessing your planning system ensures that you stay on top of important dates and obligations. By refining your approach, you can enhance your ability to track expenses and commitments, ultimately leading to better financial health.

To keep your scheduling efficient, consider the following steps:

- Set a Regular Review Schedule: Dedicate time each month to evaluate your organization methods.

- Check for Accuracy: Ensure that all entries are correct and reflect your current obligations.

- Update as Needed: Adjust any outdated information, and add new obligations or changes in your financial responsibilities.

- Prioritize Tasks: Rank your commitments to focus on what requires immediate attention.

- Reflect on Your System: Assess what is working well and what could be improved in your approach.

By actively engaging in these practices, you will foster a more proactive mindset towards your financial obligations and time management, paving the way for a more organized future.

Impact of Late Payments on Credit

Timely financial commitments are crucial for maintaining a strong credit reputation. When obligations are not met within the specified timeframe, it can lead to significant repercussions that affect overall financial health. This section explores the various ways in which delayed payments can influence one’s creditworthiness.

Consequences of Delayed Payments

Failing to pay bills on schedule can result in negative marks on credit reports. These late entries are often reported to credit bureaus, which can lower credit scores considerably. A diminished score not only affects future borrowing opportunities but may also lead to higher interest rates on loans and credit products.

Long-term Effects on Financial Opportunities

Repeated late payments can create a pattern that lenders scrutinize closely. Over time, this may limit access to credit and result in the need for higher deposits or co-signers for loans. Individuals may find it challenging to secure favorable terms, impacting major life decisions such as purchasing a home or financing a vehicle.

In summary, understanding the impact of late payments is essential for anyone looking to maintain a robust credit profile. Prioritizing timely financial management can help avoid the pitfalls associated with credit deterioration.

Using Alerts to Stay Informed

In our fast-paced world, staying updated on important dates and obligations is crucial. Implementing notifications can serve as an effective tool to ensure you never miss a deadline or payment. By harnessing the power of alerts, you can streamline your scheduling and enhance your financial management.

Types of Alerts

There are various types of notifications you can utilize. For instance, email reminders are popular for their convenience, allowing you to receive updates directly in your inbox. Alternatively, mobile notifications provide immediate alerts, ensuring you are informed no matter where you are. Some applications even offer customizable settings, allowing you to choose how far in advance you want to be alerted.

Benefits of Using Alerts

Utilizing notifications can greatly reduce stress. By setting up reminders, you create a structured approach to managing your responsibilities. This proactive strategy not only helps in avoiding late fees but also promotes better budgeting practices. Moreover, the timely nature of alerts can give you peace of mind, knowing that you are always in control of your financial commitments.

Finding Support for Financial Planning

Effective management of finances often requires external guidance and resources. Many individuals seek assistance to navigate their monetary responsibilities and achieve their economic goals. Whether through professional help or community resources, having support can make a significant difference in financial decision-making and stability.

There are various avenues to explore when looking for support in managing your finances. Professionals, such as financial advisors and planners, can provide tailored advice based on your specific situation. Additionally, community programs and workshops often offer valuable insights and education on budgeting and saving techniques.

| Support Type | Description | Benefits |

|---|---|---|

| Financial Advisors | Professionals who provide personalized advice on managing finances. | Expert insights, customized strategies, and accountability. |

| Workshops | Community-led sessions focused on financial literacy and management skills. | Networking opportunities and practical tools for everyday finances. |

| Online Resources | Websites and platforms offering advice, tools, and templates for financial management. | Accessibility, variety of information, and self-paced learning. |

By exploring these options, individuals can gain the knowledge and support necessary to make informed financial decisions and work towards their long-term objectives. Finding the right assistance is crucial to navigating the complexities of personal finance successfully.