Keeping track of regular financial commitments can often become overwhelming. By organizing due dates and amounts, individuals can ensure timely management of their obligations without last-minute stress. A clear system helps avoid confusion and late fees, allowing for better budgeting and control.

Having a well-structured system in place not only enhances organization but also promotes a sense of financial security. With proper planning, it becomes easier to stay on top of responsibilities, ensuring that every payment is made accurately and punctually.

Strategic planning fosters financial discipline, encouraging users to approach their obligations with clarity. By following a planned schedule, individuals can manage their finances with confidence and maintain a healthy financial standing.

Staying on top of your financial commitments can be challenging without a clear system. Having a structured approach to track due dates ensures that nothing gets overlooked, reducing the risk of late fees and maintaining your credit score. A reliable system helps you manage expenses more effectively, allowing you to plan your finances with confidence.

Stay Organized and Avoid Delays

By creating a clear system, you can keep track of when payments are due and ensure they are made on time. This proactive approach minimizes the chances of missing deadlines and helps you maintain a smooth flow in your finances.

Gain Better Control Over Finances

A well-organized system enables you to manage monthly obligations with ease. It helps in prioritizing payments, ensuring that essential bills are covered first and reducing financial stress. Over time, this approach contributes to better financial health and more effective budgeting.

| Payment Type | Due Date | Amount |

|---|---|---|

| Utility | 15th | $150 |

| Credit Card | 25th | $200 |

| Mortgage | 1st | $1,000 |

Choosing the Right Format for You

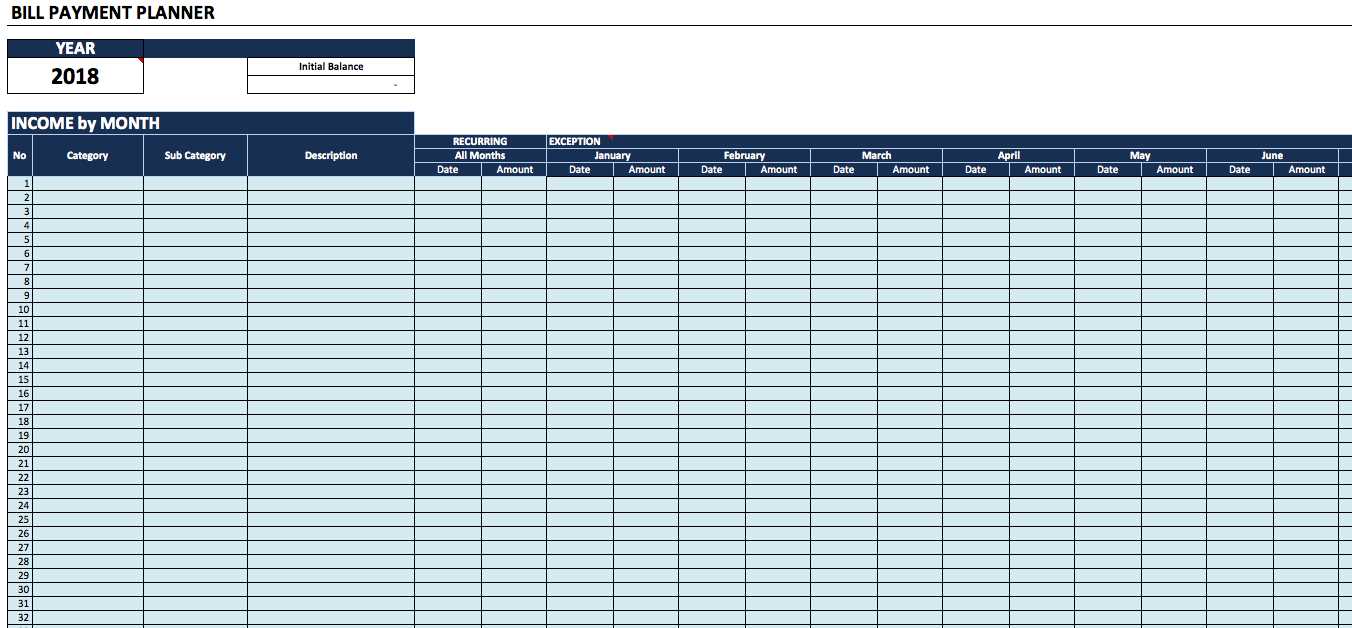

Selecting the ideal structure to manage your financial commitments depends on your personal preferences and lifestyle. Whether you need a detailed approach or prefer a more minimalist layout, understanding what works best for your routine can make managing your finances more efficient. There are various options available, each offering distinct benefits tailored to different needs.

Understanding Your Needs

Consider your regular financial obligations and how frequently you need to track them. A simple setup might suit those with fewer tasks, while a more elaborate format could be useful for individuals managing multiple payments. The key is to choose something that minimizes stress and maximizes clarity, making it easy to stay on top of due dates and amounts.

Digital vs. Paper Formats

While digital options offer convenience and easy access from multiple devices, some may prefer the tactile experience of writing things down. Both formats have their advantages; digital formats often come with automatic reminders, whereas paper formats allow for more personal engagement. Choose the one that best fits your habits and helps you stay organized.

How to Organize Payment Dates

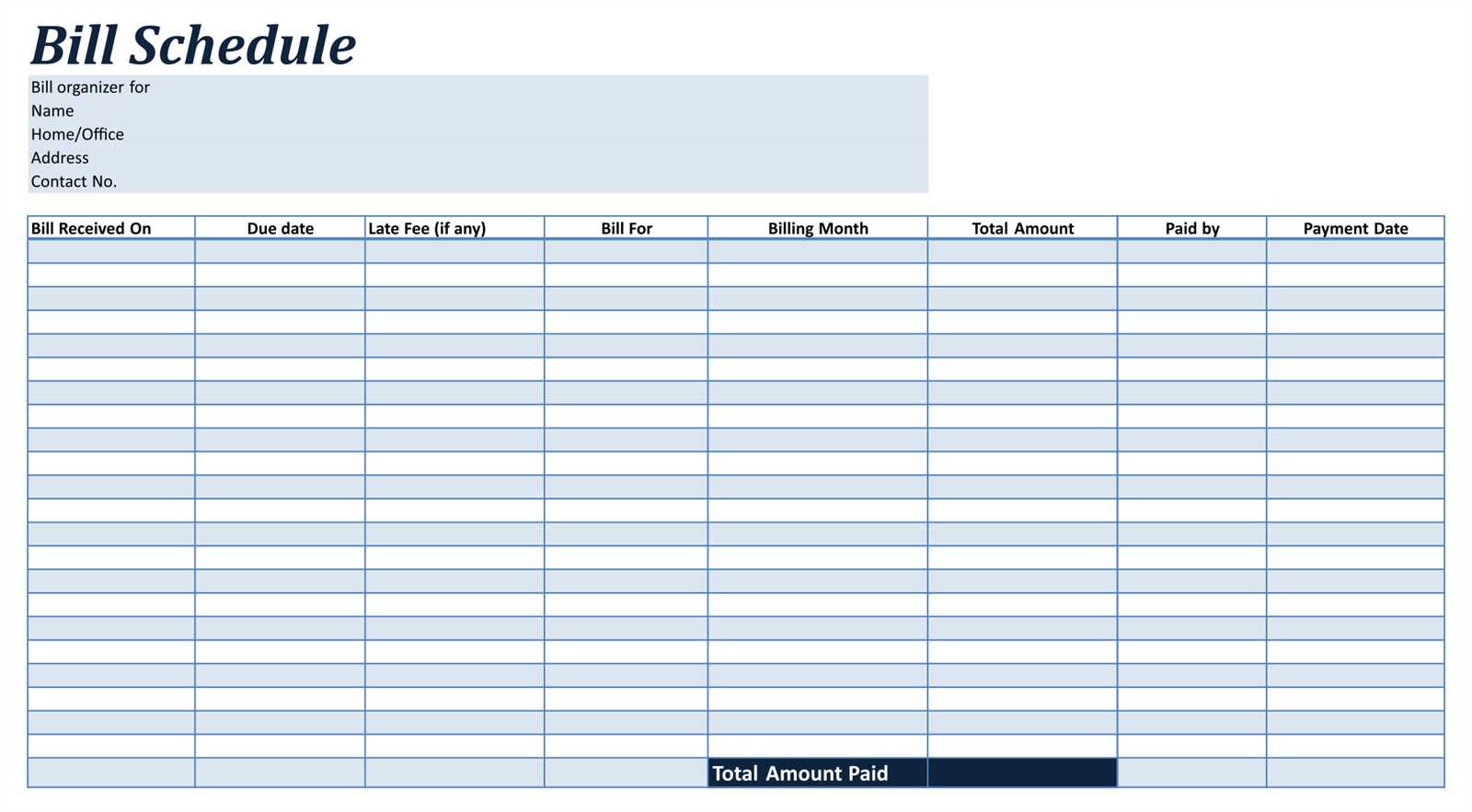

Efficiently managing financial obligations requires a well-structured approach to track due dates. By categorizing payments and setting reminders, you can avoid late fees and ensure timely transactions. The key is creating a system that works with your routine and enables easy monitoring.

Start by organizing your obligations based on frequency–whether they occur weekly, bi-weekly, or monthly. This classification will help prioritize which payments need attention first. Consider using a visual tool to display these dates clearly, making it easier to follow.

| Payment Type | Due Date | Frequency |

|---|---|---|

| Electricity | 15th of every month | Monthly |

| Internet Subscription | 1st of every month | Monthly |

| Rent | 5th of every month | Monthly |

Setting Up Recurring Payment Reminders

Managing regular financial commitments can become overwhelming without a system to keep track of due dates. A useful way to stay organized is by establishing reminders for payments that occur on a consistent schedule. This approach ensures that no payment slips through the cracks and helps maintain a smooth financial routine.

Choosing the Right Method for Notifications

There are several options available for setting up reminders, depending on your preferences and the tools you use regularly. Some of the most effective methods include:

- Using a digital assistant to set voice alerts.

- Scheduling reminders via your smartphone or computer calendar.

- Setting up email notifications through your bank or service provider.

- Using specialized apps designed for recurring financial tasks.

Organizing Payment Reminders Efficiently

To optimize your reminder system, consider these best practices:

- Group similar payments by due date or frequency to reduce clutter.

- Ensure that reminders are set for a few days in advance to allow time for processing payments.

- Review reminders periodically to confirm that all recurring obligations are accounted for.

- Make adjustments as necessary if payment dates change or new recurring commitments arise.

Budgeting Tips for Monthly Bills

Managing regular expenses efficiently is key to maintaining financial stability. By organizing and allocating resources wisely, you can ensure that you meet your obligations without unnecessary stress. This section offers strategies to help you stay on top of your recurring obligations while avoiding overspending.

1. Set Priorities – Identify your most critical expenses, such as housing and utilities, and make sure these are covered first. This approach ensures that the essentials are always accounted for, reducing the risk of late fees or disruptions.

2. Track Your Spending – Regularly monitoring your outflows can help you understand where your money is going. Use apps or simple spreadsheets to track your transactions, allowing you to spot patterns and adjust when needed.

3. Automate Payments – Whenever possible, set up automatic transfers for your obligations. This eliminates the possibility of forgetting due dates and can save time, ensuring that payments are made on schedule.

4. Build an Emergency Fund – Having a small cushion for unexpected costs can prevent you from dipping into your savings or relying on credit. Aim to set aside a certain amount each month, even if it’s just a small sum.

5. Evaluate Regular Expenses – Periodically review your subscriptions and services. Cutting out any unnecessary expenses, or negotiating better rates, can free up money for other important areas of your budget.

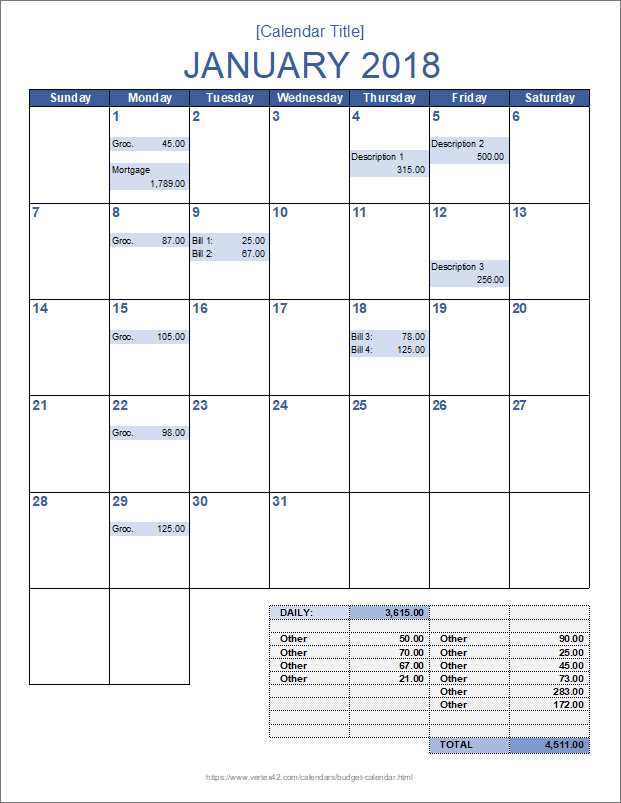

Tracking Payments with Calendar Templates

Managing regular financial obligations can become overwhelming without a clear method of tracking due dates and amounts. Utilizing a structured system to monitor recurring expenses ensures timely payments and prevents unnecessary delays. With the right tools, keeping tabs on upcoming payments becomes simpler and more organized.

Why Use a Structured System?

Implementing a system for tracking regular payments offers various benefits:

- Reduces the risk of forgetting deadlines.

- Helps allocate funds efficiently for upcoming expenses.

- Ensures no penalties or late fees are incurred.

Key Features of an Effective Tracking Method

When designing a system to track payments, consider the following:

- Clear marking of due dates for each payment.

- Space for tracking amounts and payment status.

- Color-coding or prioritization for high-priority payments.

- Room for notes on payment methods or adjustments.

Digital vs. Paper Calendar: Which One?

When organizing tasks and keeping track of important events, people often face the decision of choosing between electronic tools and traditional paper-based methods. Both options come with distinct advantages, making it essential to weigh the benefits of each before making a choice.

Digital solutions offer a high level of convenience and flexibility. Accessible from virtually any device, they allow for instant updates, reminders, and synchronization across multiple platforms. This makes it easy to manage appointments and deadlines from anywhere, without the need for physical space.

On the other hand, paper systems provide a tactile experience that some find irreplaceable. Writing things down by hand can help with retention and focus. Additionally, there’s a certain satisfaction in physically crossing off tasks as they are completed, which can enhance a sense of accomplishment.

Ultimately, the choice between digital and paper methods depends on individual preferences and lifestyle. While electronic tools may suit those on the go, traditional paper options can offer a more personal touch for those who appreciate a hands-on approach to organization.

How to Customize Your Bill Pay Calendar

Creating a personalized schedule to manage your financial commitments can greatly simplify your routine. By adjusting the timeframes and organizing due dates according to your preferences, you gain full control over your responsibilities. This approach helps you stay on top of all payments, ensuring nothing is overlooked.

Start by defining your payment periods. Adjust the intervals based on your unique needs–whether you prefer weekly, bi-weekly, or monthly check-ins. This flexibility allows you to spread out expenses or consolidate payments based on your financial goals.

Color coding or prioritizing tasks is another useful tool to enhance clarity. Highlight different categories or the most urgent items, making it easier to identify which obligations require immediate attention.

Benefits of Automating Bill Payments

Automating regular payments offers several advantages that simplify financial management and reduce the likelihood of errors. By setting up automatic transactions, individuals can save time, avoid late fees, and ensure timely processing of important obligations. This method helps to streamline the management of finances, freeing up mental space and offering peace of mind.

Time-Saving Efficiency

One of the key benefits of automation is the time saved on manual processes. With automatic payment systems, there is no need to spend time logging into accounts or remembering due dates. Once set up, payments are processed without additional effort, allowing individuals to focus on other financial priorities or personal matters.

Improved Financial Security

Automating payments reduces the risk of missed deadlines or human error. By ensuring that payments are made consistently and on time, individuals can maintain a better credit score and avoid penalties. Additionally, this system adds a layer of financial security by preventing accidental overdrafts or bounced checks due to forgotten payments.

| Benefits | Impact |

|---|---|

| Time-Saving | Reduces the need for manual transactions, freeing up time for other tasks. |

| Security | Ensures timely payments and reduces the risk of missed deadlines or penalties. |

| Convenience | Offers peace of mind by handling payments automatically, without requiring constant attention. |

Managing Late Payments on Your Calendar

Keeping track of overdue financial obligations is crucial for maintaining a healthy budget. Using a structured system allows you to stay on top of missed deadlines, ensuring that late fees or penalties are avoided. By organizing your payment schedule, you can effectively manage delays and take prompt action when necessary.

Identifying Delayed Payments

When an obligation is missed, it’s important to immediately mark it in your tracking system. This helps you prioritize which payments need attention and avoid any confusion as to whether the payment has been addressed. The key is consistency in reviewing and updating your system regularly.

Setting Up Alerts and Reminders

Utilizing reminders for outstanding dues can significantly reduce the chances of further delay. Set up notifications that prompt you ahead of time, ensuring you have ample opportunity to resolve any outstanding issues before they escalate. Taking proactive steps will help keep your financial obligations in check and avoid any unnecessary stress.

Color Coding Your Monthly Bill Calendar

Organizing your financial commitments can be significantly more manageable with the use of color. By assigning distinct hues to various tasks, you can easily spot deadlines and track payments without overwhelming yourself. This simple yet effective strategy adds clarity to your routine and ensures you never miss an important obligation.

Each category of expenditure, such as utilities, subscriptions, or loan repayments, can be represented by a unique color. This visual system allows you to quickly identify the type of payment due at a glance. For example, you might use blue for energy-related expenses, green for loan payments, and yellow for recurring service charges. This method not only helps with organization but also makes the process of managing finances more visually appealing.

Incorporating color coding into your financial tracking system creates a sense of order and control, reducing stress associated with keeping track of multiple due dates. With a well-structured color-coded approach, managing your obligations becomes simpler, more intuitive, and much less time-consuming.

How to Include Payment Due Dates

To stay organized with financial obligations, it’s essential to track the deadlines for each payment. Identifying these important dates ensures timely payments, helping avoid penalties and late fees. Here’s how you can incorporate these crucial details into your planning system.

- Start by listing all recurring payments: Begin by noting all regular commitments, such as subscriptions, utilities, and loans.

- Mark specific dates: For each payment, write down the exact day when the amount is due. Pay attention to monthly variations, like those that fall on weekends or holidays.

- Use color coding or symbols: To make the due dates stand out, consider using distinct colors or icons for each type of payment. This can help quickly identify what needs attention.

- Set reminders: Utilize reminders or alerts to notify you a few days before the deadline. This reduces the risk of missing a payment.

Including due dates efficiently ensures that you are always on top of your obligations without unnecessary stress.

Creating a Shared Bill Calendar

Organizing financial commitments within a shared space can significantly improve transparency and coordination. By setting up a common platform for tracking due dates, both individuals and groups can stay on top of obligations and ensure no payment slips through the cracks. This approach fosters accountability and helps prevent confusion over responsibilities.

Here are the key elements to consider when setting up a shared system for tracking financial tasks:

- Centralized location: Choose a platform that allows easy access for all participants, whether it’s a shared document, app, or online service.

- Clear timelines: Mark important dates, including when each responsibility is due, and include reminders to avoid last-minute rushes.

- Assigned tasks: Specify who is responsible for each task, ensuring clarity about individual duties.

- Regular updates: Keep the system up-to-date by adjusting dates and adding new tasks as needed, ensuring it reflects any changes.

By implementing this shared structure, groups or households can manage their finances efficiently, reducing stress and preventing potential missed obligations.

Optimizing Payment Timeliness

Efficiently managing financial obligations requires strategic planning and careful monitoring. By establishing a clear routine for tracking due dates, individuals and businesses can avoid penalties and maintain a positive financial record. A well-structured approach can help reduce stress and ensure all commitments are met without delays.

One effective strategy is to break down the payment process into manageable steps, setting aside time each week or month to review upcoming obligations. This method provides a buffer for unexpected issues that may arise, allowing adjustments to be made well in advance of deadlines.

Utilizing digital reminders and automated tools can also significantly enhance the consistency and accuracy of payments. These technologies allow for automatic tracking and notifications, reducing the risk of missed or late transactions. Additionally, setting up recurring payments for fixed costs can streamline the process, ensuring payments are made on time without requiring constant attention.

Updating Your Calendar for New Bills

Keeping track of financial obligations is essential for staying organized and avoiding missed deadlines. By regularly reviewing and adjusting your scheduling system, you ensure that you are prepared for any upcoming charges. This proactive approach will help you maintain financial control throughout the year.

Identifying New Expenses

Each time a new charge arises, it’s important to note the due date and amount. Be diligent in recording these details as they come up, ensuring no payment is forgotten. This practice not only helps prevent late fees but also allows you to budget effectively.

Adjusting for Changes

As your financial commitments evolve, update your scheduling system to reflect changes in amounts or due dates. If a payment amount increases or if the date shifts, make the necessary adjustments promptly to stay on top of your finances. Regular updates will give you peace of mind and help avoid surprises.