Managing personal finances can often feel overwhelming, but having a structured plan in place can simplify the process. By creating a systematic approach to tracking income and expenses, individuals can gain a clearer understanding of their financial situation. This not only helps in avoiding unnecessary expenditures but also encourages smarter spending habits.

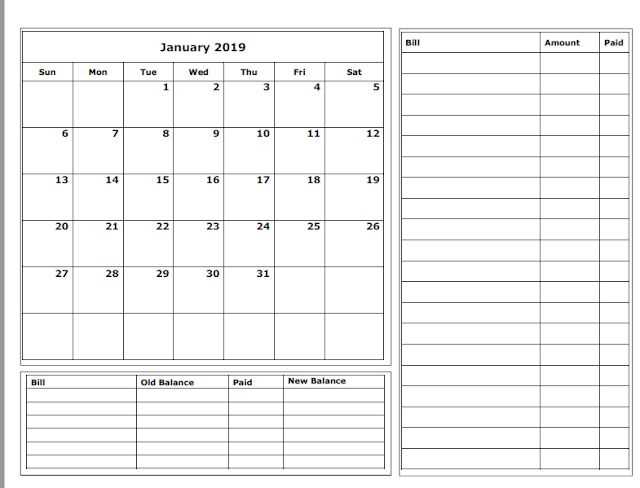

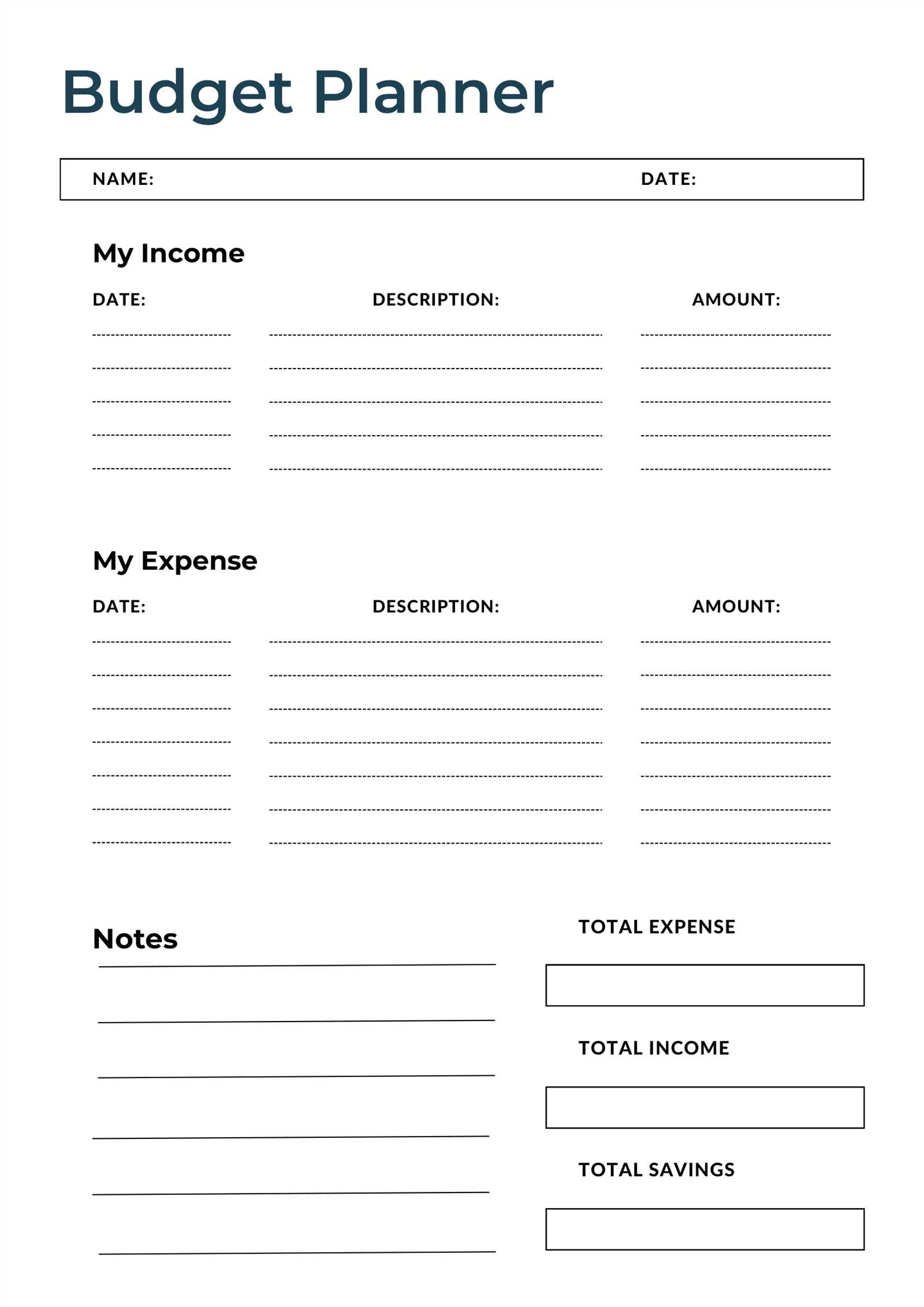

Incorporating a visual aid into your financial planning can significantly enhance your ability to stay on top of your monetary commitments. A well-designed visual framework allows you to outline your goals, mark important due dates, and allocate resources effectively. This proactive method empowers you to take control of your finances and make informed decisions throughout the year.

Utilizing such an organizational tool can lead to increased savings and reduced financial stress. By regularly reviewing your progress and adjusting your plans as necessary, you can ensure that you are always moving towards your financial objectives. In this guide, we will explore various strategies and provide practical resources to help you establish a reliable system for managing your financial landscape.

What is a Monthly Budget Calendar?

A planning tool designed to help individuals manage their finances effectively is essential for anyone looking to gain control over their spending and savings. By organizing income and expenses in a structured manner, users can make informed decisions and ensure that they are on track to meet their financial goals.

Purpose and Benefits

This type of organizer serves several key purposes:

- Tracking expenditures

- Establishing savings goals

- Identifying spending patterns

- Planning for upcoming expenses

How to Use It Effectively

To maximize the effectiveness of this financial planning tool, consider the following steps:

- List all sources of income for the month.

- Outline fixed and variable expenses.

- Allocate funds for savings and discretionary spending.

- Review and adjust as necessary to stay within financial limits.

By incorporating these practices, individuals can foster better financial habits and achieve greater peace of mind regarding their economic situation.

Benefits of Using a Budget Calendar

Implementing a systematic approach to managing finances can lead to significant improvements in personal economic health. Utilizing a structured format allows individuals to visualize their income and expenses over specific periods, facilitating better decision-making and increased financial awareness.

Here are some key advantages of employing such a system:

| Advantage | Description |

|---|---|

| Enhanced Organization | Keeping track of financial obligations becomes simpler, helping to avoid missed payments and late fees. |

| Improved Financial Awareness | Regularly reviewing expenditures helps individuals understand spending patterns and identify areas for improvement. |

| Goal Setting | Establishing clear financial goals and monitoring progress over time can motivate individuals to stay on track. |

| Reduced Stress | Having a clear overview of finances can alleviate anxiety related to money management. |

| Better Savings | Planning and prioritizing allows for more effective allocation of resources towards savings and investments. |

How to Create Your Own Template

Crafting a personalized layout for managing your finances can be a rewarding and effective way to track your spending and savings. This custom structure allows you to tailor the design to suit your specific needs and preferences, providing clarity and control over your monetary activities.

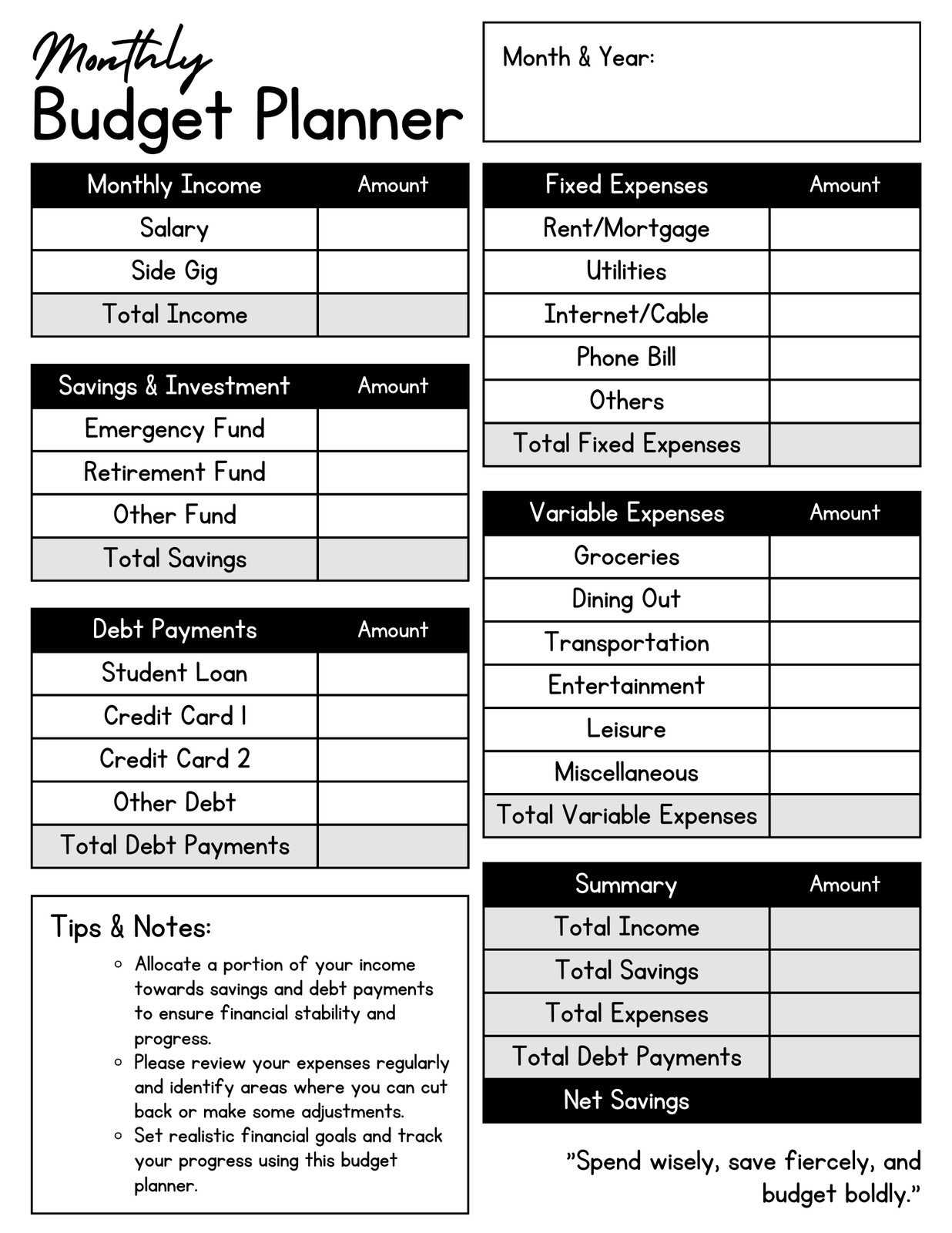

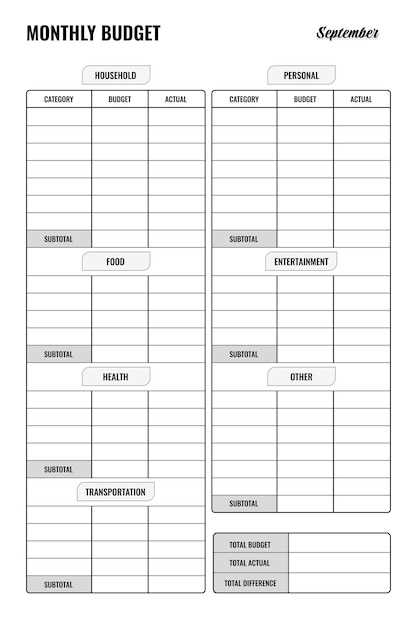

Step 1: Define Your Categories

Begin by identifying the key areas you want to monitor. This may include essential expenses such as housing, utilities, and groceries, as well as discretionary spending like entertainment and dining out. By categorizing your financial activities, you create a clearer picture of where your money goes.

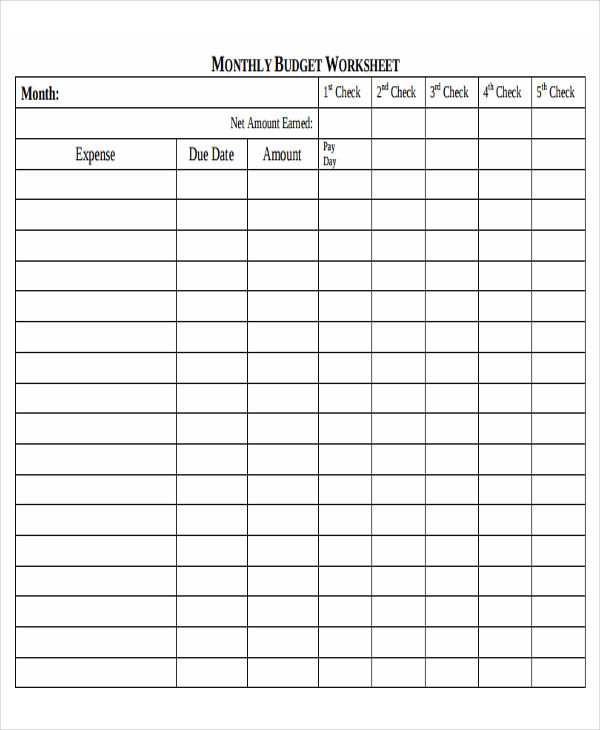

Step 2: Choose a Format

Decide whether you prefer a digital or physical format. Digital tools offer flexibility and ease of editing, while a handwritten approach can enhance your engagement. Utilize software like spreadsheets for a digital option, or grab a notebook if you favor a tangible method. Once you’ve selected a format, create sections for each category you defined earlier, allowing ample space for detailed entries.

Remember that the goal is to create a structure that you find intuitive and easy to use. Feel free to experiment with layouts until you discover what works best for you.

By following these steps, you can develop a personalized financial layout that empowers you to take charge of your economic well-being.

Essential Components of Budget Calendars

Creating an effective framework for managing finances requires a strategic approach to tracking income and expenditures. Key elements play a crucial role in establishing clarity and control over one’s financial activities. Understanding these fundamental components can enhance the ability to make informed decisions and achieve monetary goals.

Key Elements to Include

When designing a structure for financial oversight, certain aspects should not be overlooked. These components ensure comprehensive monitoring and facilitate better planning for future transactions.

| Component | Description |

|---|---|

| Income Tracking | Record all sources of revenue, ensuring a complete overview of financial inflows. |

| Expense Categories | Segment spending into categories such as essentials, leisure, and savings to identify patterns. |

| Time Frames | Define specific periods for evaluation, aiding in timely reviews and adjustments. |

| Goal Setting | Establish clear objectives for savings or debt reduction to maintain motivation. |

| Review Process | Implement a routine check to assess progress and make necessary modifications. |

Utilizing the Structure

Incorporating these essential elements into a financial management plan can significantly enhance one’s ability to maintain oversight and achieve objectives. A structured approach empowers individuals to take charge of their financial futures with confidence.

Digital vs. Paper Budget Calendars

When it comes to organizing finances, individuals often weigh the benefits of modern technology against traditional methods. Each approach offers unique advantages, and the choice between them can significantly impact how effectively one tracks expenses and plans for future needs.

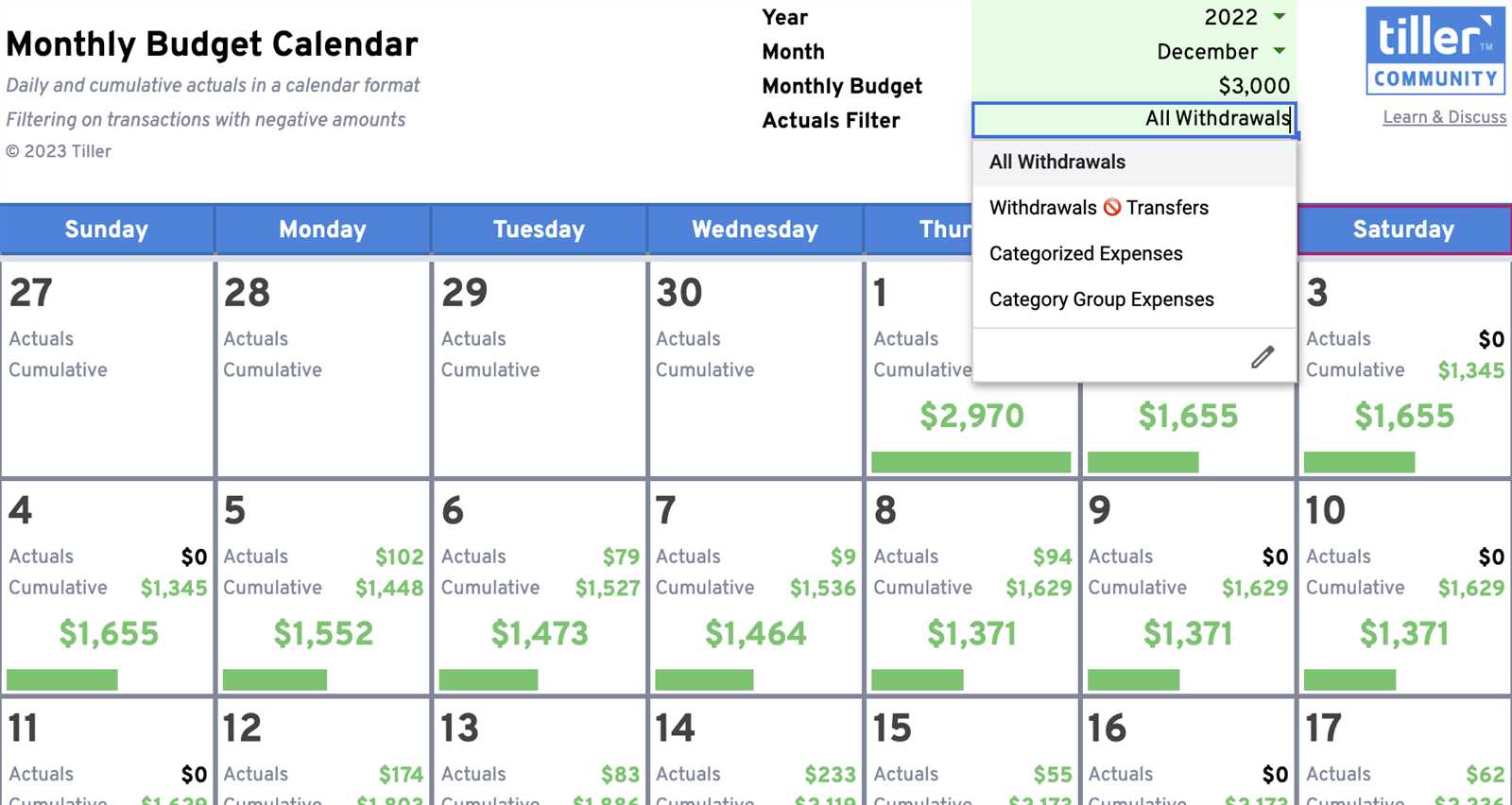

Advantages of Digital Solutions

Using electronic tools for financial planning allows for greater flexibility and accessibility. With apps and software, users can easily update their records, set reminders, and analyze their spending habits. Cloud storage ensures that information is safe and can be accessed from multiple devices, providing a seamless experience for those who are always on the go. Additionally, many digital platforms offer advanced features such as automatic categorization and visual reports, which can enhance understanding and decision-making.

Benefits of Traditional Methods

On the other hand, physical records can create a more tangible connection to one’s finances. Writing down figures by hand can enhance retention and mindfulness regarding spending habits. For some, the act of physically crossing off items or filling in spaces brings a sense of accomplishment and clarity. Moreover, no technological issues or distractions can disrupt the process, making it an appealing option for those who prefer a straightforward approach.

Tips for Effective Budgeting

Managing your finances efficiently is crucial for achieving your financial goals and ensuring long-term stability. By implementing a few practical strategies, you can gain better control over your spending and savings, paving the way for a more secure future.

Set Clear Goals

Establishing specific, measurable objectives can provide direction and motivation. Consider the following:

- Define short-term and long-term aspirations.

- Prioritize goals based on importance and urgency.

- Regularly review and adjust your objectives as needed.

Track Your Expenses

Keeping a close eye on your expenditures is essential for understanding your financial habits. Here are some effective methods:

- Utilize apps or software to monitor transactions easily.

- Maintain a manual record in a notebook or spreadsheet.

- Analyze your spending patterns to identify areas for improvement.

By following these guidelines, you can enhance your financial management skills and work towards a more balanced and prosperous financial life.

Common Budgeting Mistakes to Avoid

Managing finances effectively can be challenging, and many individuals fall into traps that hinder their progress. Recognizing and avoiding these pitfalls is crucial for achieving financial stability and long-term goals. Here are some frequent errors to watch out for.

1. Lack of Planning

Failing to establish a clear financial plan can lead to overspending and unexpected expenses. Consider the following:

- Not setting specific goals for saving or spending.

- Ignoring future expenses, such as annual fees or irregular bills.

- Neglecting to track actual spending against your plans.

2. Ignoring Small Expenses

It’s easy to overlook minor expenditures, but they can accumulate over time. Be mindful of the following:

- Frequent small purchases that add up, such as coffee or snacks.

- Subscriptions and memberships that may no longer be necessary.

- Failing to review your financial commitments regularly.

Avoiding these common mistakes can lead to a more organized approach to managing your resources and help you reach your financial aspirations with greater ease.

Customizing Your Budget Calendar

Personalizing your financial planning tool is essential for making it work effectively for your unique situation. By adjusting elements to suit your lifestyle, you can enhance your ability to track expenses and income, ensuring that you remain in control of your finances. Tailoring this resource not only improves functionality but also makes the process more enjoyable.

Start by selecting a format that resonates with you, whether it’s a digital app or a printable sheet. Consider adding sections that address your specific goals, such as saving for a vacation or paying off debt. Incorporating visuals like color coding can also help you quickly identify categories and priorities, making your financial overview clearer.

Furthermore, regularly revisiting and modifying your setup allows you to adapt to changes in your financial situation. Whether it’s adjusting categories or redefining your savings targets, staying flexible is key. Embrace the journey of refining your approach, and you’ll find greater success in achieving your financial aspirations.

Tracking Expenses Throughout the Month

Monitoring your spending on a regular basis is crucial for maintaining financial health. By consistently keeping tabs on where your money goes, you can identify patterns, make informed decisions, and ultimately gain greater control over your finances. This practice not only helps in recognizing unnecessary expenditures but also aids in setting realistic financial goals.

Creating a structured approach to track your outflows can simplify the process significantly. Start by categorizing your expenses, such as essentials, entertainment, and savings. This categorization allows for clearer visibility into your financial habits and highlights areas where adjustments may be necessary.

Utilizing a tracking system–whether a digital application or a simple spreadsheet–can enhance your ability to record and analyze your financial movements. Set a routine for updating your records, ensuring that you log transactions consistently. This discipline not only provides immediate insights but also fosters a habit of mindfulness regarding your spending.

At the end of each cycle, take time to review your documented expenses. Assess your spending against your anticipated figures to see if you are on track. This reflection will enable you to make strategic decisions moving forward, whether that means cutting back on certain categories or reallocating funds to better align with your priorities.

Integrating Savings Goals into Your Plan

Creating a financial strategy requires more than just tracking expenses; it also involves setting and achieving specific savings targets. By incorporating these goals into your overall financial strategy, you can enhance your ability to manage resources effectively and work towards your future aspirations.

To successfully integrate savings objectives, consider the following steps:

- Define Your Goals: Identify what you want to save for, whether it’s an emergency fund, a vacation, or a major purchase. Be specific about the amount and the timeframe.

- Prioritize Your Objectives: Rank your savings goals based on importance. This helps in allocating resources more effectively.

- Set Up Automatic Transfers: Automate your savings by scheduling regular transfers to your savings accounts. This makes saving easier and more consistent.

- Track Your Progress: Regularly monitor your achievements towards your savings targets. This can motivate you to stay on track.

- Adjust as Needed: Be flexible and willing to revise your goals based on changes in your financial situation or priorities.

By systematically integrating these savings aspirations into your financial approach, you create a balanced plan that not only addresses your present needs but also paves the way for future success.

Monthly Reviews: Why They Matter

Reflecting on financial habits is essential for anyone aiming to achieve their economic goals. Regular assessments help identify trends, successes, and areas needing improvement. By examining past activities, individuals can make informed decisions that steer them toward a more stable and prosperous future.

Engaging in this reflective practice provides numerous benefits:

| Benefit | Description |

|---|---|

| Improved Awareness | Regular evaluations enhance understanding of spending habits, leading to more mindful choices. |

| Goal Tracking | Assessments allow for monitoring progress toward set financial objectives, ensuring accountability. |

| Informed Adjustments | Identifying patterns helps in making necessary changes to spending or saving strategies. |

| Stress Reduction | Consistent reviews can alleviate anxiety about finances by providing a clearer picture of one’s situation. |

Ultimately, engaging in these regular reflections fosters a proactive mindset, encouraging individuals to take charge of their financial well-being and work toward a more secure future.

Utilizing Budgeting Apps and Tools

In today’s fast-paced world, managing finances effectively is essential for achieving financial goals. Embracing technology can streamline the process, providing valuable insights and helping individuals stay organized. Various applications and tools are available that simplify the tracking of expenses and income, making financial management more accessible and efficient.

Applications designed for financial oversight often come equipped with features that allow users to categorize spending, set limits, and monitor progress over time. These functionalities not only promote awareness but also encourage better decision-making. By utilizing these digital resources, individuals can gain a clearer picture of their financial situation, leading to more informed choices.

Online platforms also offer the advantage of accessibility. Users can check their financial status from anywhere, which can be particularly beneficial for those with busy lifestyles. Many tools also incorporate reminders and alerts, ensuring that important financial deadlines are never missed.

Moreover, integration with bank accounts and credit cards can provide real-time updates on transactions, eliminating the need for manual entry. This automation saves time and reduces the risk of errors, allowing users to focus on strategizing for the future rather than getting bogged down in daily tracking.

In conclusion, leveraging technology through specialized applications and tools can significantly enhance the management of personal finances. By taking advantage of these resources, individuals can work towards their financial aspirations with greater confidence and clarity.

Involving Family in Budgeting Process

Engaging family members in financial planning fosters a sense of unity and shared responsibility. When everyone participates, it not only enhances transparency but also encourages collaboration in achieving common goals. This collective effort helps individuals understand the importance of managing resources wisely while promoting healthy financial habits within the household.

Creating a Collaborative Atmosphere

Establishing an open dialogue about finances is essential. Schedule regular discussions where each member can express their thoughts and concerns. This approach allows everyone to contribute ideas and feel valued in the decision-making process. By creating a supportive environment, families can effectively work together to set and adjust their financial objectives.

Setting Goals Together

Working as a team to set financial targets can lead to greater commitment from all involved. Encourage each family member to share their aspirations, whether it’s saving for a vacation, paying off debt, or investing in education. By aligning personal dreams with collective strategies, families can motivate one another and celebrate achievements along the way.

Adapting Your Budget for Seasonal Changes

As the seasons change, so do our financial needs and priorities. Recognizing these shifts is crucial for maintaining financial stability throughout the year. By adjusting your spending and saving strategies according to seasonal trends, you can better prepare for both expected and unexpected expenses.

Understanding Seasonal Expenses

Each season brings its own set of financial demands. Here are some common categories to consider:

- Winter: Heating costs, holiday gifts, and seasonal travel.

- Spring: Home maintenance, gardening supplies, and spring break activities.

- Summer: Vacation expenses, outdoor events, and air conditioning costs.

- Fall: Back-to-school supplies, autumn travel, and holiday preparations.

Strategies for Seasonal Adjustments

To effectively manage your finances throughout the year, consider implementing the following strategies:

- Plan Ahead: Anticipate upcoming seasonal costs and save accordingly.

- Adjust Spending: Allocate funds based on the specific needs of each season.

- Track Trends: Monitor your expenses over the years to identify patterns and adjust your plans.

- Prioritize Savings: Establish a seasonal savings goal to help mitigate large expenses.

By being proactive and flexible with your financial strategies, you can navigate the ups and downs of each season more effectively, ensuring a smoother financial journey year-round.

Sharing Your Calendar with Others

Collaborating with others on scheduling can enhance productivity and streamline planning processes. When you allow others to view or contribute to your organized timeframes, it fosters transparency and teamwork. This section explores the benefits and methods for sharing your scheduling tool effectively.

Benefits of Collaboration

Sharing your scheduling framework helps everyone involved stay aligned and informed. It reduces the chances of double-booking and miscommunication, allowing for smoother coordination of events and activities. Moreover, collaborative sharing encourages accountability, as all participants are aware of their commitments and deadlines.

Methods of Sharing

There are several ways to enable others to access your planning structure. You can use cloud-based solutions that allow real-time updates, or opt for printable formats that can be distributed physically. Regardless of the method, ensuring that the shared information is clear and organized is key to successful collaboration.