Effective financial management is essential for achieving personal goals and ensuring stability. Organizing expenses and income is crucial to maintaining control over your finances. With the right tools, you can simplify this process and gain valuable insights into your spending habits.

Having a structured framework for tracking your financial activities allows you to identify patterns and make informed decisions. By implementing a practical resource, you can easily allocate your funds and prioritize essential expenditures. This proactive approach not only helps in reducing stress but also empowers you to plan for future aspirations.

Utilizing an accessible resource designed for tracking your financial commitments can enhance your overall experience. You will find it easier to monitor your progress and adjust your plans accordingly. This ultimate solution fosters a sense of accountability, ultimately leading to improved financial health.

Understanding the Importance of Budgeting

Effective financial management is a cornerstone of a stable and prosperous life. It involves making informed decisions about income allocation and expenditure, ultimately leading to greater peace of mind and control over one’s finances. The practice of tracking income and expenses allows individuals to set realistic goals and prioritize their financial well-being.

The Benefits of Financial Planning

Clarity in one’s financial situation is crucial. By maintaining a clear overview of resources and obligations, individuals can avoid unnecessary stress and make proactive choices. Establishing a financial strategy promotes responsibility, enabling individuals to save for future needs and unexpected events.

Achieving Financial Goals

When individuals have a structured approach to their finances, they can work towards their aspirations more effectively. Whether it’s saving for a significant purchase, planning for retirement, or simply maintaining a healthy financial status, having a plan in place helps to achieve these objectives with confidence.

What is a Monthly Budget Calendar?

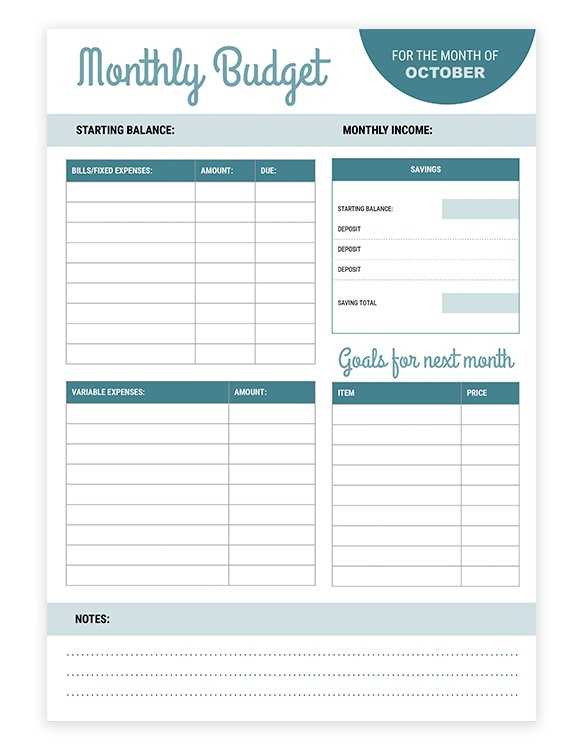

A planning tool serves as a guide for tracking expenses and income over a specific time frame. This resource helps individuals visualize their financial landscape, enabling better decision-making and effective management of resources. By organizing monetary activities, it fosters a deeper understanding of spending habits and savings potential.

Such a planner typically displays days of the month alongside spaces to jot down transactions, allowing users to monitor their finances regularly. With a clear overview, it becomes easier to identify patterns and areas for improvement, ultimately contributing to achieving financial goals.

Incorporating this instrument into one’s routine encourages accountability and discipline, leading to more informed choices. It empowers users to take control of their financial situation, paving the way for stability and future planning.

Benefits of Using a Budget Template

Utilizing a structured plan for managing finances offers numerous advantages that can significantly enhance one’s financial well-being. By keeping track of income and expenses, individuals can gain better control over their spending habits and future savings.

- Clarity: A well-organized plan provides a clear overview of financial obligations, allowing for easier decision-making.

- Accountability: Establishing a written outline fosters personal responsibility, motivating users to stick to their financial goals.

- Goal Setting: It enables individuals to define short-term and long-term financial objectives, making it easier to track progress.

- Reduced Stress: Having a concrete plan in place minimizes anxiety related to finances by providing a roadmap for expenditures and savings.

- Enhanced Savings: By identifying unnecessary expenditures, users can redirect funds towards savings or investments.

Incorporating this kind of structure into daily life can lead to smarter financial choices and a more secure future.

How to Create Your Own Template

Designing a personalized planning tool can significantly enhance your ability to track expenses and manage your finances effectively. By tailoring it to your specific needs, you ensure that it serves your lifestyle and goals. Here, we’ll explore the steps to craft a layout that suits your unique requirements.

Step 1: Define Your Objectives

Before diving into the design, take a moment to outline what you want to achieve. Consider the categories that are most relevant to you, such as income sources, spending areas, and savings goals. This clarity will guide your layout and help you focus on essential elements.

Step 2: Choose Your Format

Decide whether you prefer a digital format, like a spreadsheet, or a physical version, such as a printed sheet. Each option has its advantages, so think about what will be more convenient for your daily use. Once you’ve chosen, start sketching out your layout, including the necessary sections and their arrangement.

Key Elements of an Effective Budget

Creating a successful financial plan requires a clear understanding of essential components that drive effective management of resources. These elements serve as the foundation for maintaining control over expenses and maximizing savings, ultimately leading to greater financial stability.

1. Clear Objectives

Establishing specific goals is crucial for guiding financial decisions. Consider the following:

- Short-term goals: Emergency fund, vacation, or a new gadget.

- Long-term goals: Home ownership, retirement savings, or education funds.

2. Detailed Tracking

Keeping accurate records of income and expenditures allows for better analysis and adjustments. Key methods include:

- Using software or apps to monitor transactions.

- Creating spreadsheets for visual representation of financial flow.

- Regularly reviewing and categorizing spending habits.

Tips for Tracking Monthly Expenses

Effectively monitoring your financial outgoings is essential for maintaining control over your finances. By adopting a systematic approach, you can gain insights into your spending habits, identify areas for improvement, and make informed decisions that align with your financial goals.

Utilize Technology

Leverage apps and software designed for expense management. These tools often provide features such as automatic categorization, visual reports, and reminders to ensure you stay on track. By automating the process, you can reduce the risk of overlooking transactions.

Create a Simple Log

Maintaining a straightforward record of your expenditures can also be highly effective. A clear log enables you to manually track your spending in a way that suits your preferences. Here’s a sample structure you can use:

| Date | Description | Category | Amount |

|---|---|---|---|

| 01/10/2024 | Grocery Shopping | Food | $150 |

| 03/10/2024 | Gas | Transportation | $50 |

| 05/10/2024 | Dining Out | Entertainment | $70 |

By consistently updating this record, you can visualize where your money is going and adjust your habits accordingly.

Common Budgeting Mistakes to Avoid

Managing finances effectively is crucial for achieving financial stability and reaching personal goals. However, many individuals unknowingly make errors that can hinder their progress. Recognizing and addressing these pitfalls can lead to better financial outcomes.

- Neglecting to Track Expenses: Failing to monitor spending can lead to oversights and unanticipated costs. Keeping a detailed record helps in understanding financial habits.

- Setting Unrealistic Goals: Ambitious targets can be demotivating if they are unattainable. It’s important to establish achievable objectives to maintain motivation.

- Ignoring Irregular Costs: Many people overlook non-recurring expenses, such as car maintenance or medical bills. Planning for these can prevent financial strain.

- Not Reviewing Regularly: Static plans can quickly become outdated. Regular reviews allow for adjustments based on changing circumstances.

- Relying Solely on Memory: Trusting one’s memory for managing finances often leads to errors. Utilizing tools or apps can enhance accuracy and organization.

- Failing to Prioritize Savings: Putting aside money for future needs can be overlooked in favor of immediate expenses. Prioritizing savings is essential for long-term security.

Avoiding these common errors can pave the way for more effective financial management and lead to achieving your desired financial health.

Tools to Enhance Your Budgeting Process

Managing finances effectively requires a blend of planning and the right resources. Utilizing various tools can significantly streamline the process, helping individuals to track their expenditures and plan for future needs. Whether you prefer digital solutions or traditional methods, there are numerous options available to suit different preferences.

1. Financial Apps: Mobile applications designed for financial management offer a convenient way to monitor spending habits. Many of these apps allow users to categorize expenses, set financial goals, and receive alerts for bill payments, making it easier to stay on top of finances.

2. Spreadsheets: Utilizing spreadsheet software can provide a customizable way to organize and analyze financial data. Users can create personalized layouts to suit their unique financial situations, allowing for detailed tracking and forecasting.

3. Online Resources: Numerous websites offer budgeting guides, calculators, and tools that help in planning finances. These resources often include templates for various financial scenarios, aiding users in understanding their fiscal health.

4. Envelope System: This traditional method involves allocating cash into different envelopes designated for specific expenses. It encourages disciplined spending and allows for tangible tracking of finances.

5. Financial Advisors: For those seeking professional guidance, consulting with financial advisors can provide personalized strategies. These experts can help develop tailored plans based on individual financial goals and situations.

Incorporating these tools into your financial routine can foster better management and enhance your overall economic well-being.

Free Resources for Budget Calendars

Managing personal finances effectively can be a challenge, but there are numerous tools available that can simplify the process. These resources provide structured formats to track expenses and income, helping individuals stay on top of their financial goals. Utilizing these materials can enhance your financial awareness and promote better decision-making.

Online Tools and Platforms

- Google Sheets: A versatile option for creating customized tracking sheets. Templates are available that can be tailored to specific needs.

- Microsoft Excel: Similar to Google Sheets, it offers various layouts and features to monitor finances efficiently.

- Personal Finance Apps: Many applications provide built-in features for tracking spending and setting financial objectives, often with visual aids.

Printable Resources

- PDF Downloads: Numerous websites offer downloadable files that can be printed for manual tracking.

- Bullet Journal Pages: A creative approach that allows individuals to design their own tracking systems using blank pages or guided formats.

- Community Contributions: Check forums and social media groups where users share their designs and ideas for effective tracking.

Customizing Your Budget Calendar

Creating a personalized planning tool can significantly enhance your financial tracking experience. By tailoring the layout and features to suit your specific needs, you can make the process of monitoring income and expenses not only efficient but also enjoyable. This section explores various ways to modify your planning sheets, ensuring they reflect your unique financial situation.

Choosing the Right Format

Selecting an appropriate format is crucial. Consider what works best for you–digital solutions, printable pages, or even a combination of both. Each option offers distinct advantages, such as accessibility or tangible reminders. Evaluate your habits and preferences to determine which format will help you stay organized and motivated.

Incorporating Essential Elements

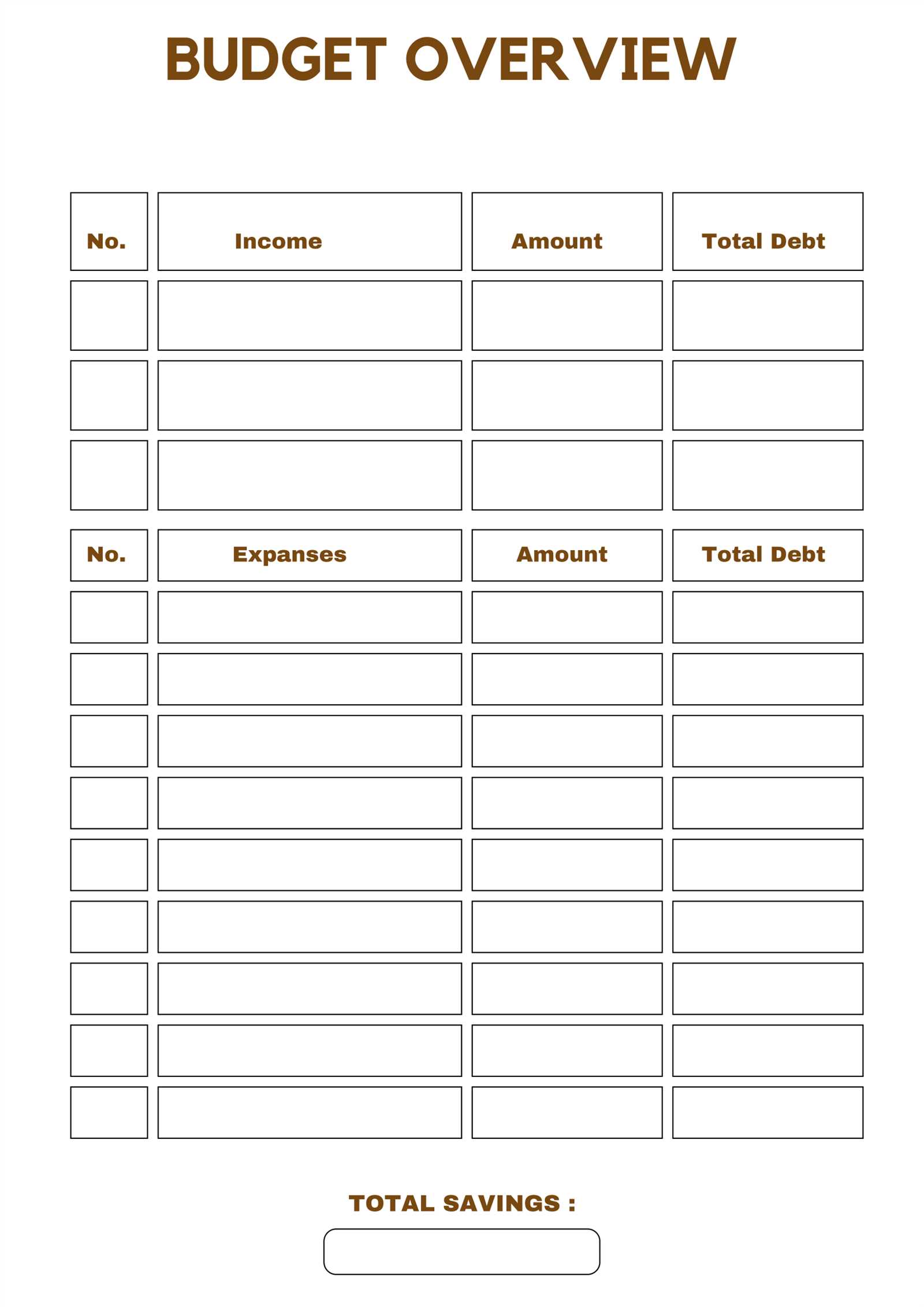

Enhancing your planner with vital components is essential for comprehensive tracking. Below is a sample structure that can be adapted to fit your goals:

| Element | Description |

|---|---|

| Income Sources | List all streams of revenue, including salaries, freelance work, and passive income. |

| Expense Categories | Segment your outflows into essential categories such as housing, food, transportation, and entertainment. |

| Saving Goals | Define specific objectives for savings, such as emergency funds or vacations. |

| Notes Section | Allocate space for reminders, important dates, or adjustments needed in your planning. |

By customizing your tracking tool with these elements, you create a dynamic system that evolves with your financial journey, allowing for better management and decision-making.

Integrating Savings Goals into Your Plan

Incorporating financial aspirations into your overall strategy is essential for achieving long-term stability and success. By setting clear objectives for your savings, you can create a focused approach that drives you towards your desired outcomes. This section will explore effective methods to weave your financial goals seamlessly into your daily planning process.

First, it’s important to identify specific targets. Whether it’s saving for a vacation, an emergency fund, or a new home, defining these aims provides clarity and direction. Once your goals are established, allocate a portion of your resources towards each one. This allocation will help you stay on track and ensure that you are making progress over time.

| Goal | Target Amount | Timeframe | Monthly Contribution |

|---|---|---|---|

| Emergency Fund | $5,000 | 12 months | $417 |

| Vacation | $3,000 | 8 months | $375 |

| New Car | $15,000 | 36 months | $417 |

Regularly review your progress towards these financial objectives. This practice will keep you motivated and allow for adjustments as needed. If certain goals are met ahead of schedule, consider reallocating those funds to other ambitions, thus accelerating your overall financial growth.

Ultimately, integrating savings goals into your planning will enhance your financial well-being and provide a sense of accomplishment as you achieve each milestone. By staying committed and organized, you can turn your aspirations into reality.

Monthly Review: Analyzing Your Spending

Reflecting on your financial habits is essential for understanding where your resources are allocated. This process allows you to identify patterns in your expenditures, recognize areas for improvement, and make informed decisions moving forward. By systematically reviewing your transactions, you can develop a clearer picture of your financial health and set realistic goals.

Begin by gathering your financial records for the period in question. This includes bank statements, receipts, and any digital records. Organizing these documents will help you pinpoint trends and unusual activities in your spending.

Next, categorize your expenses into groups such as necessities, discretionary spending, and savings. This categorization will highlight your spending priorities and reveal potential areas for cuts. For example, if you notice excessive spending on dining out, consider whether you could allocate more funds to savings or debt repayment instead.

After categorizing, calculate the total for each group. Comparing these totals against your anticipated expenses can provide valuable insights. If certain categories consistently exceed your expectations, it may be time to reevaluate your spending choices.

Finally, set actionable goals based on your analysis. Whether it’s reducing unnecessary spending, increasing savings, or reallocating funds, having clear targets will help you maintain control over your financial future. Regular reviews will ensure that you stay aligned with your objectives and make necessary adjustments as your circumstances change.

Adjusting Your Budget for Unexpected Costs

Life is full of surprises, and sometimes those surprises come with a price tag. Preparing for unforeseen expenses is crucial to maintaining financial stability. By incorporating flexibility into your financial plan, you can better manage these unexpected events without derailing your overall financial goals.

To effectively adapt your financial strategy for unanticipated costs, consider the following steps:

- Identify Potential Unexpected Expenses:

- Medical emergencies

- Car repairs

- Home maintenance issues

- Job loss or reduced income

- Create an Emergency Fund: Set aside a specific amount each month to build a reserve for emergencies. Aim for three to six months’ worth of expenses.

- Review and Adjust Regular Spending:

- Examine discretionary spending

- Look for subscriptions that can be paused or canceled

- Prioritize essential expenses over non-essentials

- Implement a Flexible Strategy: Make adjustments to your spending plan as necessary, allowing for shifts in priorities or sudden expenses.

- Track All Expenses: Maintain a record of all transactions to identify patterns and areas where you can cut back if needed.

By proactively preparing for the unexpected, you can navigate financial challenges with confidence and maintain control over your financial future.

Setting Financial Goals for the Future

Establishing clear financial objectives is essential for anyone looking to secure their economic well-being. These goals provide direction and motivation, helping individuals make informed decisions about their finances.

To create effective financial objectives, consider the following steps:

- Identify Your Priorities: Reflect on what matters most to you. This might include saving for a home, retirement, or education.

- Set Specific Targets: Instead of vague aspirations, define concrete figures and timelines. For instance, aim to save a specific amount by a certain date.

- Break Goals Down: Divide larger objectives into smaller, manageable tasks. This makes them less daunting and easier to track.

- Evaluate Your Progress: Regularly assess your advancements towards your goals. Adjust your plans as necessary to stay on track.

By following these steps, you can create a structured approach to your financial aspirations, ensuring you remain focused and motivated on your journey towards economic stability.

Staying Motivated with Your Budget

Managing your finances can often feel overwhelming, but maintaining enthusiasm for your financial goals is essential for success. By cultivating a positive mindset and finding ways to engage with your financial journey, you can enhance your commitment and make the process enjoyable.

Set Achievable Goals

Start by defining realistic and measurable objectives. Break larger aspirations into smaller milestones that can be easily tracked. Celebrating these achievements, no matter how minor, can provide a significant boost to your morale and reinforce your dedication.

Visualize Your Progress

Keeping a visual representation of your advancements can serve as a powerful motivator. Use charts, graphs, or even a simple checklist to display your journey. Regularly seeing how far you’ve come can inspire you to stay on course and continue striving toward your aims.

Remember, staying engaged with your financial plans is a dynamic process. Embrace the journey and allow your enthusiasm to grow as you progress toward your objectives.

Sharing Your Budget with Family

Discussing financial matters with your loved ones can create a sense of unity and shared responsibility. When everyone is on the same page regarding expenditures and savings, it fosters transparency and trust within the household. This collaborative approach can help set realistic goals and ensure that financial decisions benefit the entire family.

Benefits of Collaborative Financial Planning

- Enhanced Communication: Open discussions about finances promote better understanding and reduce misunderstandings.

- Collective Goal Setting: Families can work together to set financial objectives, such as saving for a vacation or a new home.

- Shared Accountability: When everyone is involved, it becomes easier to hold each other accountable for spending habits.

How to Initiate Conversations

- Choose the Right Time: Find a moment when everyone is relaxed and open to discussion.

- Be Honest and Transparent: Share your financial situation candidly to encourage openness.

- Involve Everyone: Encourage all family members to share their thoughts and ideas regarding finances.

Long-term Benefits of Consistent Budgeting

Establishing a structured approach to financial management can yield significant advantages over time. By regularly tracking income and expenses, individuals can cultivate a greater awareness of their financial habits and make informed decisions that lead to improved stability.

Enhanced savings is one of the key outcomes of maintaining a disciplined financial plan. As awareness grows, it becomes easier to identify unnecessary expenditures and redirect those funds towards future goals. This not only fosters a sense of achievement but also builds a safety net for unexpected situations.

Moreover, individuals who consistently manage their finances often experience reduced stress. The knowledge that one is in control of their resources creates a feeling of security, allowing for better planning and preparation for life’s uncertainties. Long-term financial wellness is not just about immediate gains; it’s about laying the foundation for a prosperous future.