In today’s fast-paced world, effective management of personal finances has become essential for achieving financial stability. Many individuals seek reliable ways to organize their expenditures and income, allowing them to maintain control over their financial situation. A well-structured system can empower users to track their spending habits, identify areas for improvement, and set achievable financial goals.

By utilizing an organized framework, people can gain clarity on their financial obligations and make informed decisions. This approach not only simplifies the monitoring process but also fosters a sense of accountability. As a result, individuals can create a more balanced approach to their financial lives, ensuring that they remain on track and prepared for future challenges.

Exploring innovative tools designed to streamline financial organization can greatly enhance one’s ability to allocate resources effectively. Implementing such a system can provide a solid foundation for anyone looking to improve their financial well-being, offering insights and strategies for long-term success.

Understanding Budgeting Basics

Managing finances effectively is essential for achieving financial stability and reaching personal goals. A clear plan helps individuals track their income and expenditures, ensuring that resources are allocated wisely. By grasping fundamental concepts of financial planning, one can make informed decisions that pave the way to a secure future.

Key components of a solid financial plan include:

- Income Assessment: Understanding all sources of income is crucial. This includes salaries, side jobs, investments, and any other earnings.

- Expense Tracking: Identifying and recording all expenditures helps reveal spending patterns and areas where costs can be reduced.

- Setting Goals: Establishing short-term and long-term financial objectives provides direction and motivation.

- Creating a Plan: Developing a strategy for how to allocate funds towards essential needs, savings, and discretionary spending is vital.

- Reviewing Regularly: Periodic evaluations of financial plans ensure they remain aligned with changing circumstances and objectives.

By focusing on these elements, individuals can cultivate a proactive approach to managing their finances, ultimately leading to better control over their economic well-being.

Importance of a Monthly Budget

Having a structured approach to managing finances is crucial for maintaining stability and achieving financial goals. A systematic plan helps individuals track their income and expenditures, ensuring that they live within their means while making informed decisions about future spending.

One of the key advantages of this practice is the ability to identify areas where savings can be made. By analyzing spending patterns, individuals can pinpoint unnecessary expenses and redirect those funds towards savings or investments. This proactive management not only fosters a sense of control over one’s finances but also contributes to long-term financial health.

Additionally, setting clear financial objectives encourages accountability. When individuals know what they want to achieve–be it paying off debt, saving for a significant purchase, or building an emergency fund–they are more likely to stick to their plan. This sense of purpose can motivate better financial habits and lead to increased overall satisfaction.

Moreover, a well-organized financial plan can alleviate stress. Knowing where money is going and having a strategy to handle unexpected expenses can provide peace of mind. This preparedness enables individuals to navigate financial challenges more effectively, reducing anxiety associated with financial uncertainties.

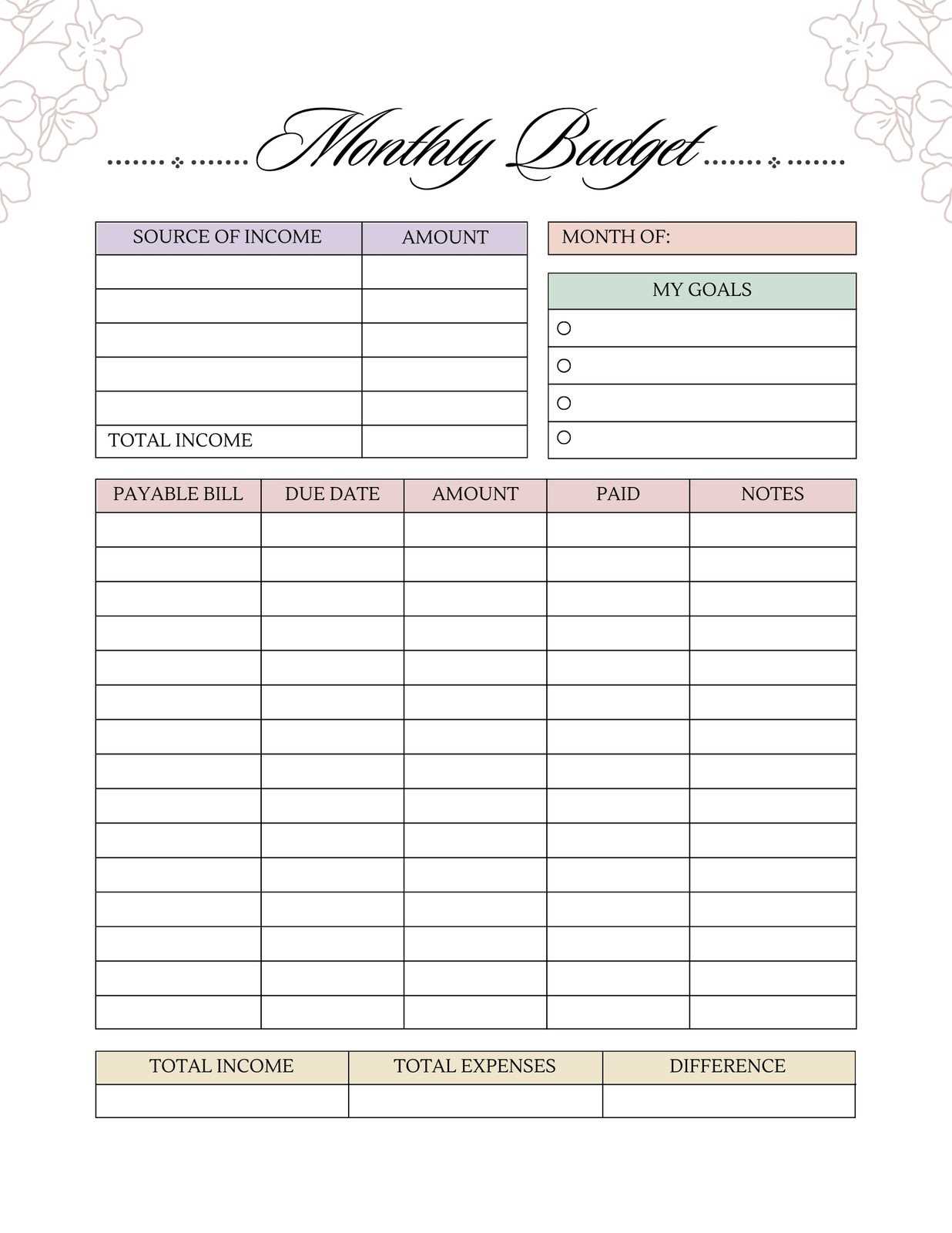

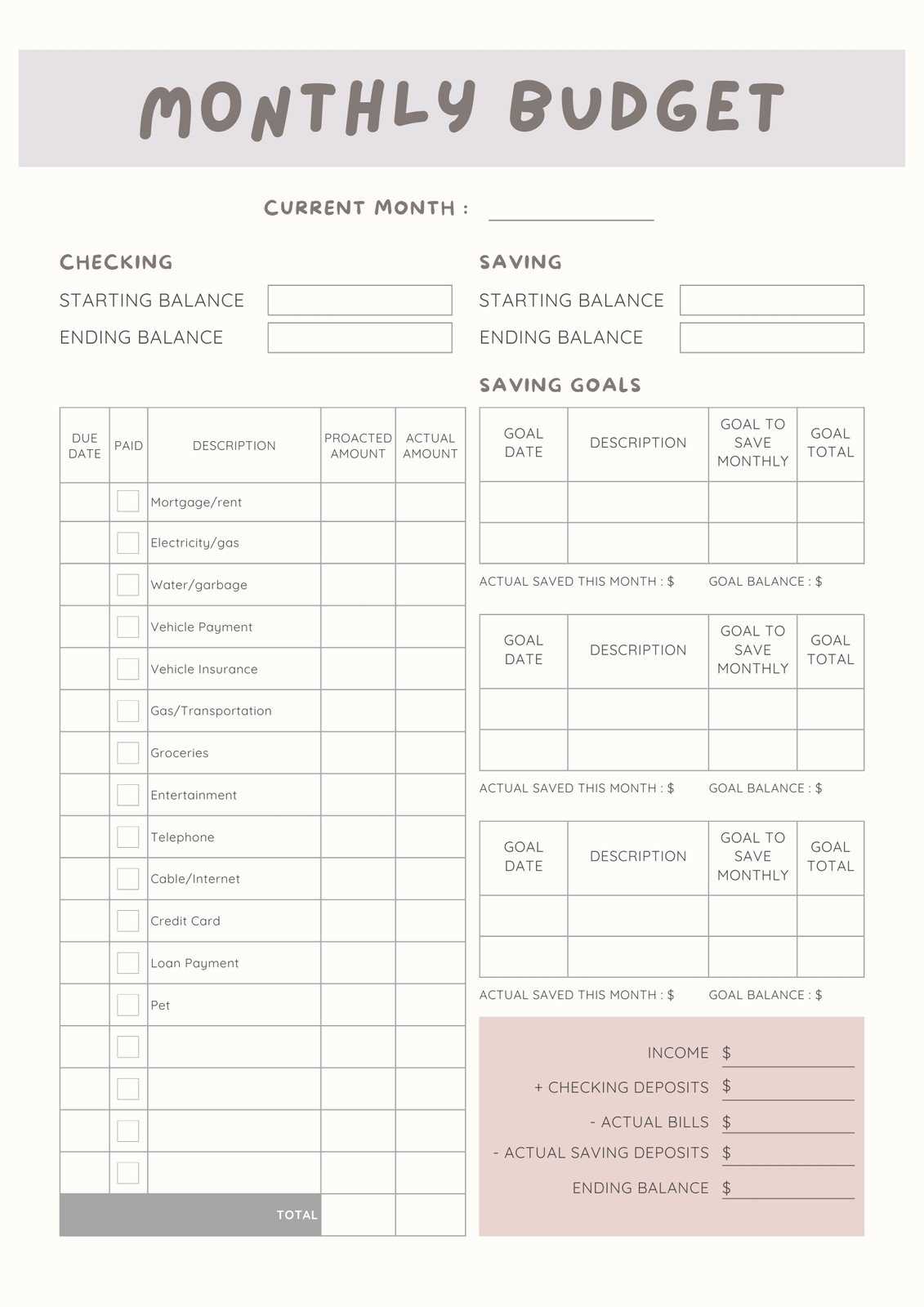

Essential Components of Budget Template

A well-structured framework for managing finances requires several key elements to ensure clarity and effectiveness. These components serve to streamline the tracking process and help individuals maintain control over their expenditures and income. By incorporating these essential parts, users can create a reliable structure for financial planning.

Key Elements to Include

- Income Sources: Clearly identify all potential revenue streams, such as salary, investments, or freelance work.

- Expense Categories: Break down costs into specific groups like housing, transportation, food, and entertainment.

- Time Frame: Define the period for tracking, whether it be weekly, biweekly, or monthly.

- Savings Goals: Set aside designated amounts for future needs or emergencies to encourage responsible saving.

Additional Considerations

- Tracking Mechanism: Implement a system to record transactions, whether digital or paper-based, to facilitate easy updates.

- Review Process: Establish a routine to evaluate financial performance, allowing for adjustments as necessary.

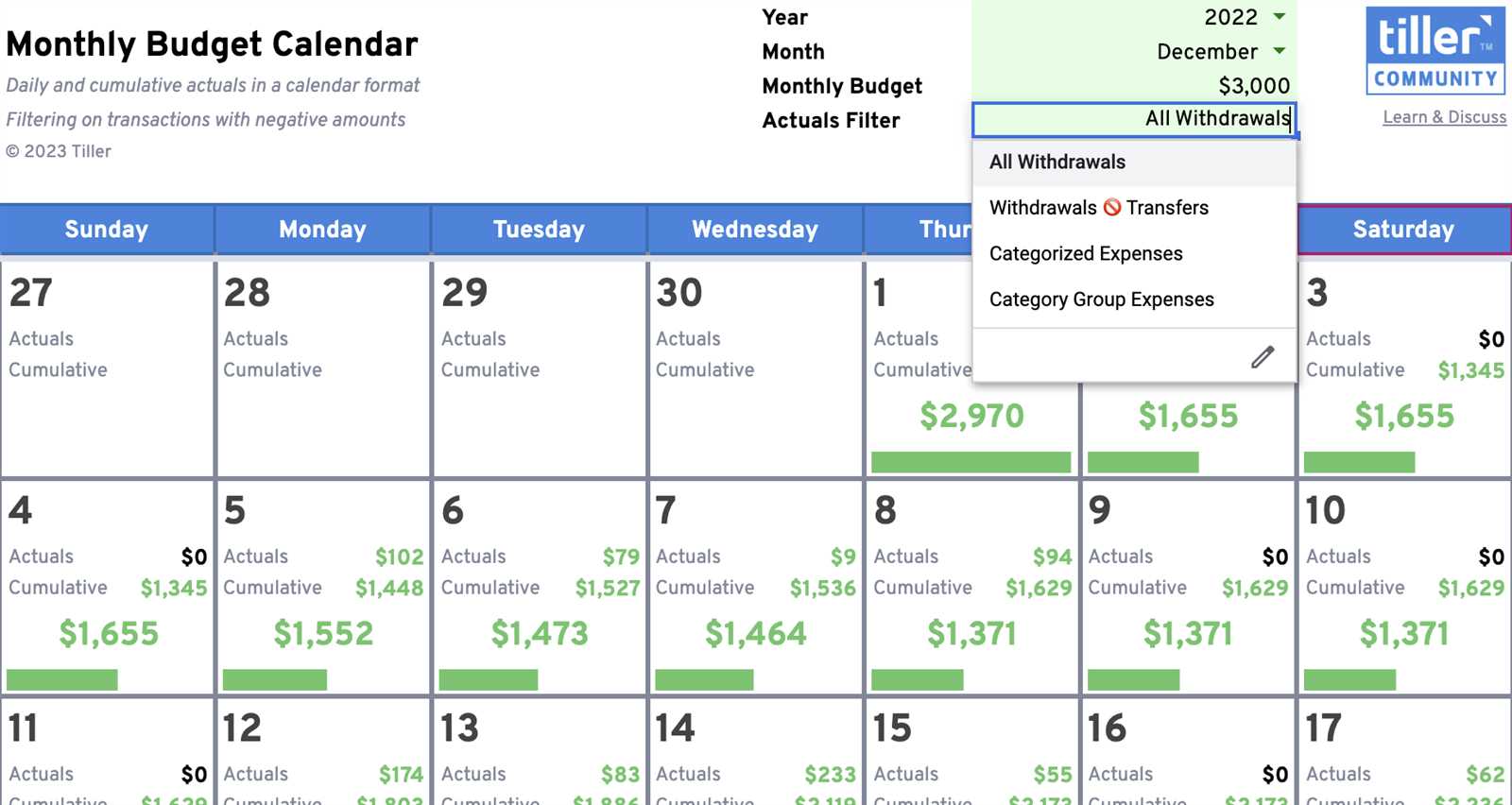

- Visual Aids: Utilize charts or graphs to represent data visually, making it easier to understand financial trends.

How to Track Expenses Effectively

Managing your financial outflows is crucial for maintaining control over your personal finances. By monitoring where your funds are going, you can identify areas to cut back and prioritize your spending according to your goals. This section outlines practical methods to enhance your expense tracking skills.

Utilize Digital Tools

With technology at our fingertips, leveraging apps and software can simplify the process of recording expenditures. Many applications allow you to categorize your spending and set alerts for overspending in specific areas. This real-time tracking helps you stay accountable and makes it easier to analyze your financial habits.

Establish a Routine

Creating a consistent schedule for reviewing your financial activities can lead to greater awareness. Designate a specific time each week to log your transactions and evaluate your progress. This habit not only reinforces discipline but also provides an opportunity to adjust your plans based on your current financial situation.

Setting Financial Goals

Establishing clear financial aspirations is crucial for effective personal management. By defining what you want to achieve financially, you can create a roadmap that guides your spending, saving, and investing decisions. This section focuses on the importance of setting specific, measurable objectives that align with your long-term vision.

When setting these aspirations, consider the following steps:

- Identify Priorities: Determine what is most important to you, whether it’s saving for a home, funding education, or preparing for retirement.

- Make Them Specific: Instead of vague goals, outline precise targets. For example, aim to save a certain amount each month rather than just “saving more.”

- Set Timeframes: Establish deadlines for your goals. This creates a sense of urgency and helps track progress effectively.

- Assess Feasibility: Evaluate your current financial situation and adjust your aspirations to ensure they are realistic and attainable.

Remember, regular reviews of your progress can help you stay on track and make necessary adjustments along the way. Embrace flexibility as life circumstances may change, influencing your financial path.

Choosing the Right Budgeting Method

Selecting an effective financial management approach is essential for maintaining control over your expenditures and savings. The right strategy can help you allocate resources efficiently, track your progress, and achieve your financial goals. With various techniques available, understanding their features and benefits is crucial for making an informed decision.

Understanding Different Approaches

There are numerous methods to consider, each with unique advantages. For instance, the envelope system encourages you to use cash for specific categories, fostering discipline in spending. Alternatively, a zero-sum strategy allocates every dollar of income to specific expenses, ensuring that your earnings are fully utilized. Evaluating these options based on your financial habits and objectives will lead you to the most suitable choice.

Aligning with Your Lifestyle

Choosing a strategy should also align with your personal circumstances and preferences. If you prefer a hands-on approach, a detailed tracking method may work best. On the other hand, if simplicity is key, a more streamlined technique could be advantageous. Adapting your financial management style to fit your lifestyle will not only make it easier to stick to but also enhance your overall financial well-being.

Monthly Income Sources to Consider

Identifying various streams of earnings is crucial for effective financial planning. By diversifying income, individuals can enhance their financial stability and make more informed decisions about their expenditures. Here are several potential avenues to explore when evaluating your income landscape.

Employment Earnings

For many, the primary source of revenue comes from their job. Salaries, wages, and bonuses constitute a significant portion of one’s financial inflow. Evaluating potential promotions or additional responsibilities can further increase this stream.

Passive Income Opportunities

Another beneficial avenue is generating passive income. This can include earnings from investments, rental properties, or royalties from creative works. Engaging in ventures that require minimal ongoing effort can provide a steady flow of additional resources.

By considering these sources, individuals can build a more robust financial framework, enabling them to navigate their financial landscape with greater confidence.

Identifying Fixed and Variable Costs

Understanding the distinction between regular and fluctuating expenses is crucial for effective financial planning. This knowledge allows individuals to manage their finances more efficiently, ensuring that they can cover essential payments while also adjusting for the unpredictable nature of other costs.

Regular costs are those that remain constant each period. These may include items such as rent or mortgage payments, insurance premiums, and subscription services. Since these expenses do not change frequently, they are easier to predict and plan for in any financial strategy.

On the other hand, fluctuating expenses can vary significantly from one period to another. These might encompass costs like groceries, entertainment, and utilities. Because these types of expenses can fluctuate based on usage or personal choices, monitoring them is essential for maintaining overall financial health.

By categorizing expenditures into these two groups, individuals can create a more structured approach to their financial management. This not only aids in planning but also helps identify areas where adjustments can be made to improve overall fiscal stability.

Strategies for Cutting Unnecessary Spending

In today’s fast-paced world, managing finances effectively requires a keen awareness of where money goes. By adopting specific strategies, individuals can identify and eliminate excess expenditures, allowing for a healthier financial outlook. Implementing these methods not only fosters savings but also promotes mindful spending habits.

Analyze Your Expenses

The first step in curbing unnecessary costs is to thoroughly assess your spending habits. Keep track of every transaction for a month, categorizing them into essential and non-essential items. This analysis will reveal patterns and highlight areas where spending can be trimmed. Consider using financial apps or spreadsheets to simplify this process and gain clearer insights.

Prioritize Needs Over Wants

Developing a clear distinction between needs and wants is crucial for effective financial management. When faced with a purchase decision, ask yourself whether the item is essential for daily life or merely a desire. By prioritizing necessities, you can reduce impulsive buys and focus on long-term financial goals, ultimately leading to more significant savings over time.

Adjusting Your Budget for Emergencies

Unexpected situations can arise at any moment, requiring a financial safety net to ensure stability. It is essential to prepare for these occurrences by allocating resources effectively. This approach not only alleviates stress during crises but also reinforces overall financial health.

To create an adaptable strategy for unforeseen expenses, consider the following steps:

| Step | Description |

|---|---|

| 1. Assess Current Expenditures | Review your existing spending patterns to identify areas where you can cut back. This will free up funds that can be redirected to an emergency reserve. |

| 2. Establish an Emergency Fund | Set aside a specific amount each month to build a cushion. Aim for three to six months’ worth of essential expenses to cover unexpected costs. |

| 3. Prioritize Savings | Treat your emergency savings as a recurring expense, ensuring it remains a priority within your financial plan. |

| 4. Review Regularly | Evaluate your financial situation periodically to adjust contributions to your emergency fund as necessary, reflecting any changes in income or expenses. |

By implementing these strategies, you can create a more resilient financial framework, equipping yourself to face any unexpected challenges with confidence.

Using Tools for Budget Management

Effectively overseeing personal finances requires the right set of resources. By leveraging various applications and software, individuals can gain better insights into their spending habits and make informed decisions about their financial futures.

Here are some valuable tools to consider for enhancing financial control:

- Spending Trackers: Applications designed to monitor expenses in real-time can help identify where funds are being allocated.

- Financial Planning Software: These programs provide a comprehensive overview of income, expenditures, and savings goals.

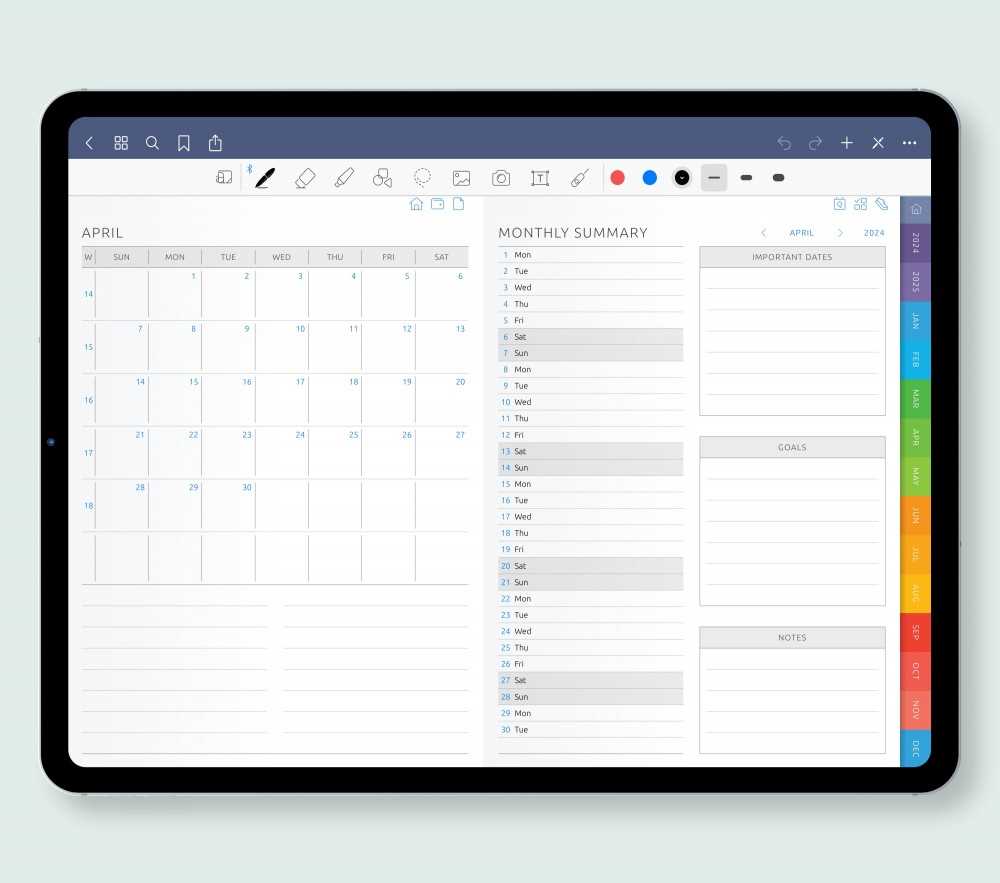

- Spreadsheets: Customizable digital worksheets allow users to create their own layouts for tracking finances in a structured manner.

- Mobile Apps: Convenient on-the-go solutions enable users to manage their finances from their smartphones, ensuring constant access.

- Investment Tracking Tools: Applications focused on investments help users manage and analyze their portfolios effectively.

Utilizing these resources not only simplifies the financial management process but also empowers users to take control of their economic well-being. By setting clear goals and regularly reviewing progress through these tools, individuals can make adjustments as needed and work towards a more stable financial future.

Benefits of a Visual Budget Layout

A well-organized visual representation of financial planning offers numerous advantages for individuals managing their expenses. This approach enables clarity, ensuring that every detail is easily accessible and understandable. By employing a graphical format, one can simplify complex information, making it more approachable for anyone involved in financial decision-making.

Some of the key benefits include:

- Enhanced Clarity: A visual layout allows for immediate recognition of income sources and expenditure categories, reducing confusion.

- Improved Tracking: Easily track progress over time, identifying trends and making necessary adjustments to achieve financial goals.

- Increased Motivation: Seeing visual progress can boost motivation to adhere to financial plans and reach desired targets.

- Better Decision Making: Clear visuals facilitate informed choices, helping to prioritize spending and saving strategies effectively.

- Stress Reduction: A well-structured visual format can alleviate anxiety associated with financial management, providing a sense of control.

Overall, adopting a visual format for financial organization not only makes the process more engaging but also fosters better understanding and management of one’s resources.

How to Review Your Budget Monthly

Regular assessment of your financial plan is essential for maintaining control over your expenses and income. By setting aside time to analyze your financial standing, you can identify areas for improvement and ensure that you are on track to meet your financial goals.

Gather Your Financial Information

Start by collecting all relevant financial documents, including bank statements, receipts, and any records of income. This comprehensive view of your finances will provide a solid foundation for your analysis.

Analyze Your Spending Patterns

Once you have your documents ready, review your spending habits. Categorize your expenses to identify trends and areas where you may be overspending. This evaluation will help you make informed decisions about where to cut costs or adjust your spending in the future.

Common Budgeting Mistakes to Avoid

Managing finances effectively requires careful planning and awareness of potential pitfalls. Many individuals often overlook critical aspects that can hinder their financial goals. Identifying and addressing these common errors is essential for achieving monetary stability and long-term success.

One frequent mistake is underestimating expenses. Individuals may forget to account for irregular costs or seasonal expenditures, leading to overspending. Another issue is failing to track spending habits, which can result in unclear financial situations and missed opportunities for savings.

| Mistake | Description |

|---|---|

| Not Setting Realistic Goals | Establishing unattainable financial targets can lead to frustration and demotivation. |

| Ignoring Emergency Funds | Neglecting to save for unexpected events can create financial strain when emergencies arise. |

| Neglecting to Review Regularly | Failing to assess progress periodically can result in missed adjustments and continued poor practices. |

| Overcomplicating the Process | Using overly complex methods can discourage consistent tracking and adherence to plans. |

Avoiding these missteps can significantly enhance financial management practices, leading to improved decision-making and better outcomes. Regular reflection and adjustment are key to maintaining a healthy approach to personal finances.

Incorporating Savings into Your Plan

Building a robust financial strategy requires not just managing expenses but also ensuring that a portion of your income is set aside for future needs. This aspect is crucial for achieving long-term goals and securing financial stability. By integrating savings into your financial approach, you create a safety net that can help you navigate unexpected challenges and capitalize on opportunities.

To effectively incorporate savings, start by determining a realistic amount that you can allocate each period. This can be a fixed percentage of your income or a specific dollar amount. Establishing this goal early on makes it easier to prioritize your financial objectives and reduces the temptation to overspend.

Next, consider automating your savings. Setting up automatic transfers to a dedicated savings account ensures that the chosen amount is consistently saved before you have a chance to spend it. This technique not only simplifies the process but also helps you stay committed to your savings goals.

Additionally, review your expenses regularly to identify areas where you can cut back. Redirecting these funds into your savings can significantly boost your financial reserves. Every little bit counts, and small changes can lead to substantial savings over time.

Finally, celebrate your savings milestones. Recognizing your progress can motivate you to continue prioritizing your financial health. Whether it’s a small reward or simply acknowledging your achievements, staying motivated will help you maintain your commitment to incorporating savings into your overall financial strategy.

Creating a Debt Repayment Strategy

Establishing a clear approach to repaying outstanding obligations is crucial for financial stability. By developing a structured plan, individuals can manage their responsibilities more effectively, ensuring that payments are made in a timely manner while also freeing up resources for other essential expenses.

Assessing Your Financial Situation

Before formulating a strategy, it is vital to evaluate your current financial landscape. This includes reviewing all debts, interest rates, and monthly payments. Understanding your overall financial health will guide you in prioritizing which obligations to tackle first.

Prioritizing Your Obligations

Once you have a clear overview, prioritize your commitments based on factors such as interest rates and outstanding balances. Focusing on higher interest debts can save money in the long run. Below is a sample table to help organize your debts:

| Creditor | Amount Owed | Interest Rate | Minimum Payment |

|---|---|---|---|

| Creditor A | $2,000 | 15% | $150 |

| Creditor B | $1,500 | 10% | $100 |

| Creditor C | $3,000 | 20% | $200 |

This systematic approach allows you to allocate extra funds towards the most pressing obligations, thereby accelerating the repayment process and reducing overall financial strain.

Building an Effective Spending Plan

Creating a sound financial strategy is essential for managing expenses and ensuring that resources are allocated wisely. This process involves setting priorities, tracking expenditures, and making informed decisions to achieve financial goals. An organized approach helps individuals and families navigate their financial landscape more effectively.

Establishing Clear Objectives

To develop a robust financial strategy, it’s important to define specific aims. Consider the following steps:

- Identify short-term and long-term goals, such as saving for a vacation or retirement.

- Determine necessary expenses versus discretionary spending.

- Assess financial resources available for achieving these goals.

Tracking and Analyzing Expenditures

Monitoring spending habits is crucial for understanding financial behavior. Implement these techniques:

- Use apps or spreadsheets to log daily expenses.

- Review monthly financial statements to identify patterns.

- Adjust spending categories as necessary to stay on track with goals.

By following these strategies, individuals can cultivate a more effective approach to managing their financial commitments, leading to greater peace of mind and financial security.

Resources for Budgeting Help

Managing finances effectively can be a challenging endeavor. Fortunately, a variety of resources are available to assist individuals in navigating their financial journeys. From tools that provide tracking capabilities to educational materials that offer insights into best practices, these resources can enhance one’s ability to maintain financial stability.

Online Tools and Applications

Numerous digital platforms and mobile applications can simplify the process of overseeing expenses and income. These tools often feature user-friendly interfaces that allow for easy data entry and visualization of financial trends. Many offer customizable options, enabling users to tailor their experience according to personal needs.

Books and Educational Courses

For those seeking a deeper understanding of financial management, literature and courses provide valuable knowledge. Books written by financial experts often cover essential topics, offering strategies and tips for effective monetary management. Additionally, online courses can be an excellent way to learn at one’s own pace, often including interactive components that reinforce key concepts.