In today’s fast-paced world, maintaining a clear overview of your financial activities is essential for effective management. A structured approach to recording and monitoring your monetary outflows can greatly enhance your ability to make informed decisions. By utilizing a carefully designed system, you can keep track of where your funds are allocated and identify areas where adjustments may be needed.

Implementing an organized method for documenting your financial commitments allows for improved visibility into your budgeting habits. This not only simplifies the process of tracking your spending but also fosters a sense of accountability and discipline. Regularly reviewing your financial data can illuminate patterns, empowering you to optimize your resources and achieve your financial goals.

By harnessing the power of a systematic framework for tracking your outlays, you will cultivate a deeper understanding of your fiscal responsibilities. This foundational knowledge equips you with the tools necessary to navigate your financial landscape with confidence, ensuring you remain on the path toward financial stability and success.

Benefits of a Monthly Expense Tracker

Keeping track of your financial activities offers numerous advantages that can significantly improve your overall financial health. By consistently monitoring where your money goes, you gain valuable insights that empower you to make informed decisions. This practice helps cultivate awareness regarding your spending habits and encourages more disciplined financial management.

One key advantage is the ability to identify patterns in your financial behavior. Recognizing trends allows you to pinpoint areas where you may be overspending and make necessary adjustments. Additionally, by establishing a clear view of your financial landscape, you can set realistic budgeting goals and allocate resources more effectively.

Moreover, this method of tracking can enhance your ability to save. With a clearer understanding of your financial commitments, you can allocate funds toward savings or investments more strategically. Ultimately, adopting this approach fosters a proactive mindset towards your finances, enabling you to plan for future needs and secure your financial wellbeing.

How to Set Up Your Template

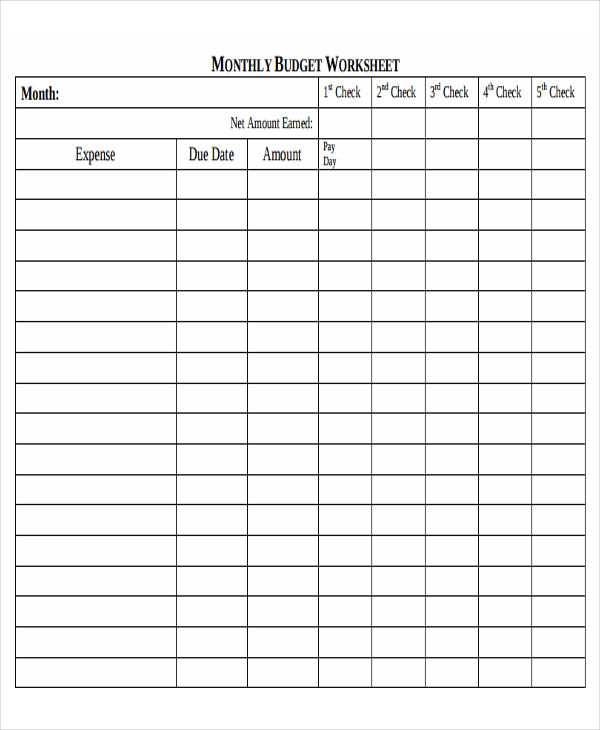

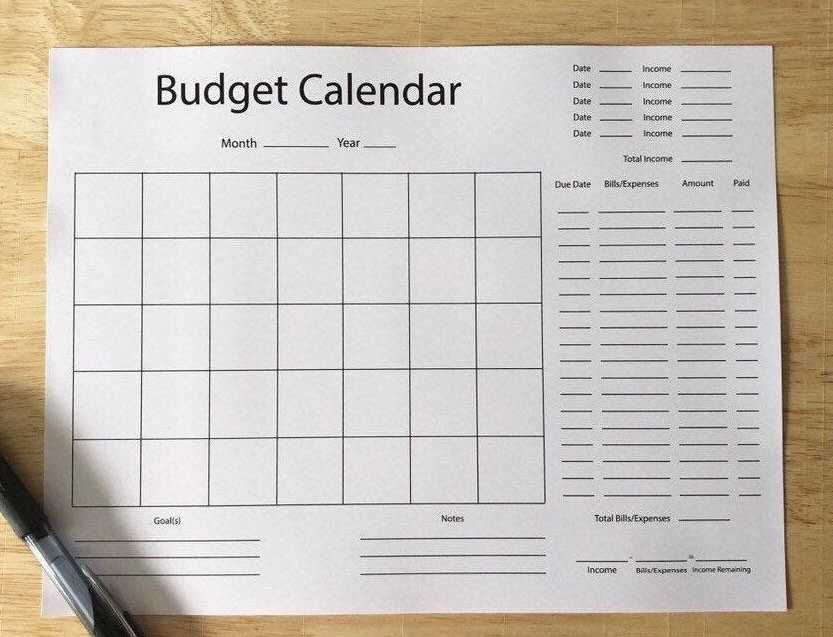

Creating a structured document to track your financial commitments can significantly enhance your budgeting process. This guide will walk you through the essential steps to establish your personalized layout, allowing for easy monitoring of your monetary flows over time.

Begin by selecting a platform that suits your preferences, such as a popular spreadsheet application. Once you’ve opened a new file, consider the layout that will best fit your needs. A straightforward design will enable you to visualize your finances effectively.

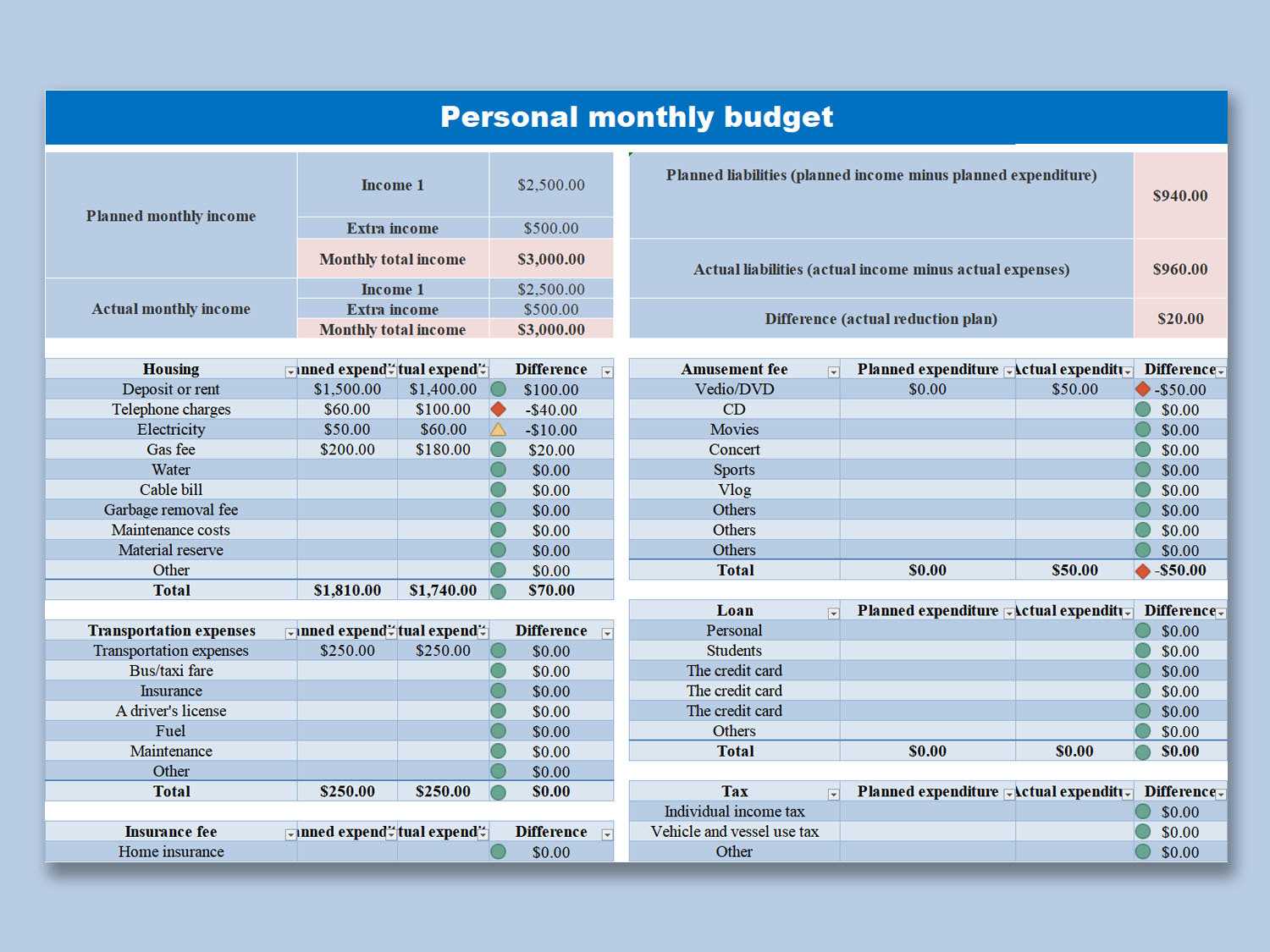

Next, create columns for different categories that reflect your financial activities. For instance, you may want to include sections for dates, descriptions, amounts, and types of transactions. Organizing your data in this manner will facilitate quick assessments and comparisons.

| Date | Description | Amount | Type |

|---|---|---|---|

| 01/01/2024 | Rent Payment | $1,200 | Fixed |

| 01/05/2024 | Groceries | $300 | Variable |

| 01/10/2024 | Utilities | $150 | Fixed |

To enhance functionality, consider incorporating formulas that automatically calculate totals or track trends. This will allow you to focus more on strategic planning rather than manual calculations. Additionally, maintaining consistent updates will keep your financial overview accurate and reflective of your current situation.

By following these steps, you’ll create an efficient framework for overseeing your finances, empowering you to make informed decisions regarding your financial future.

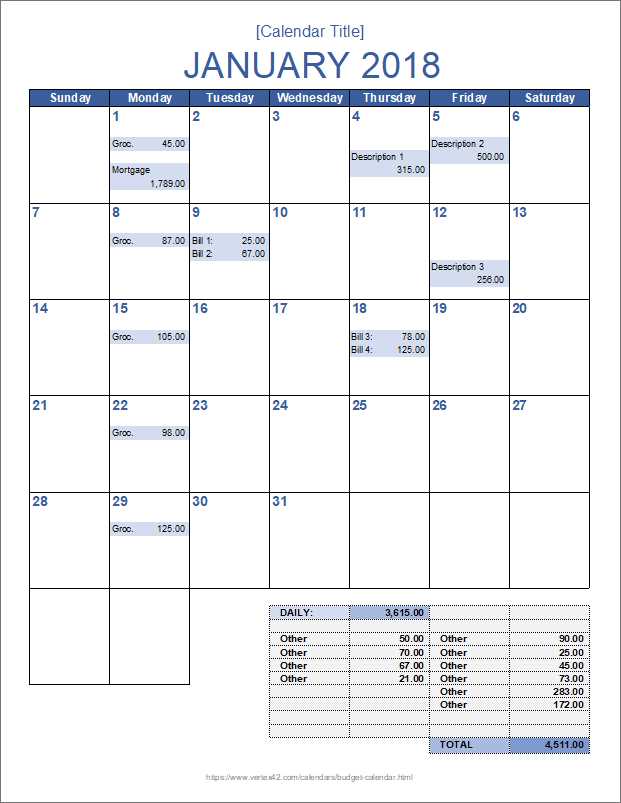

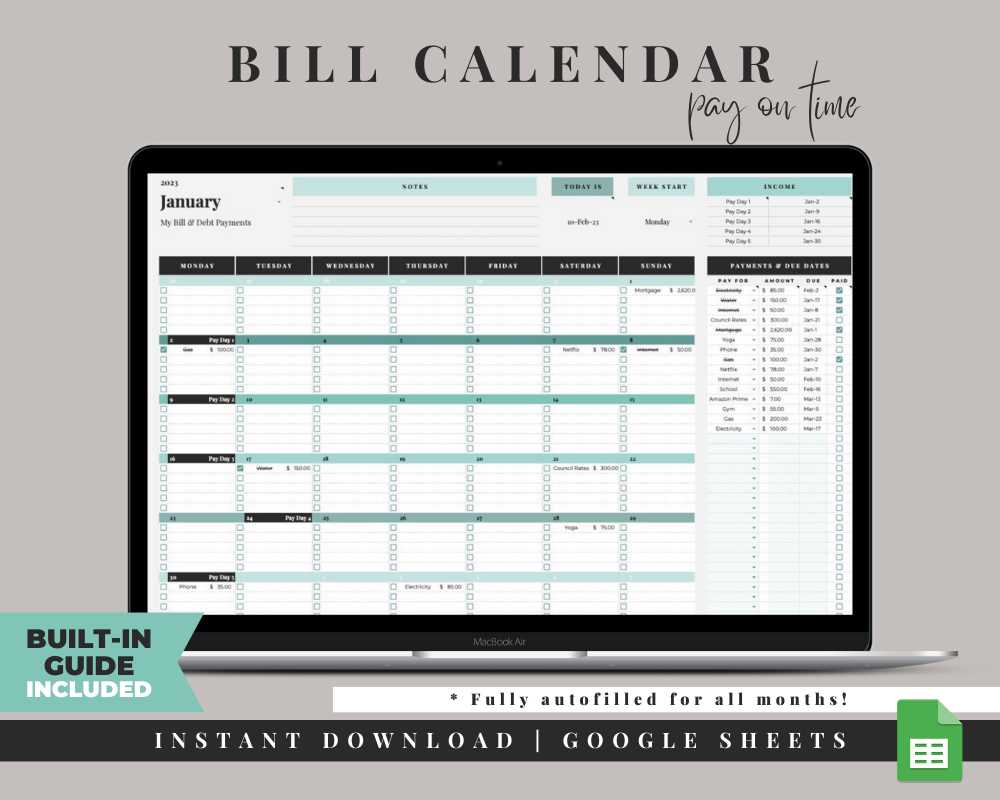

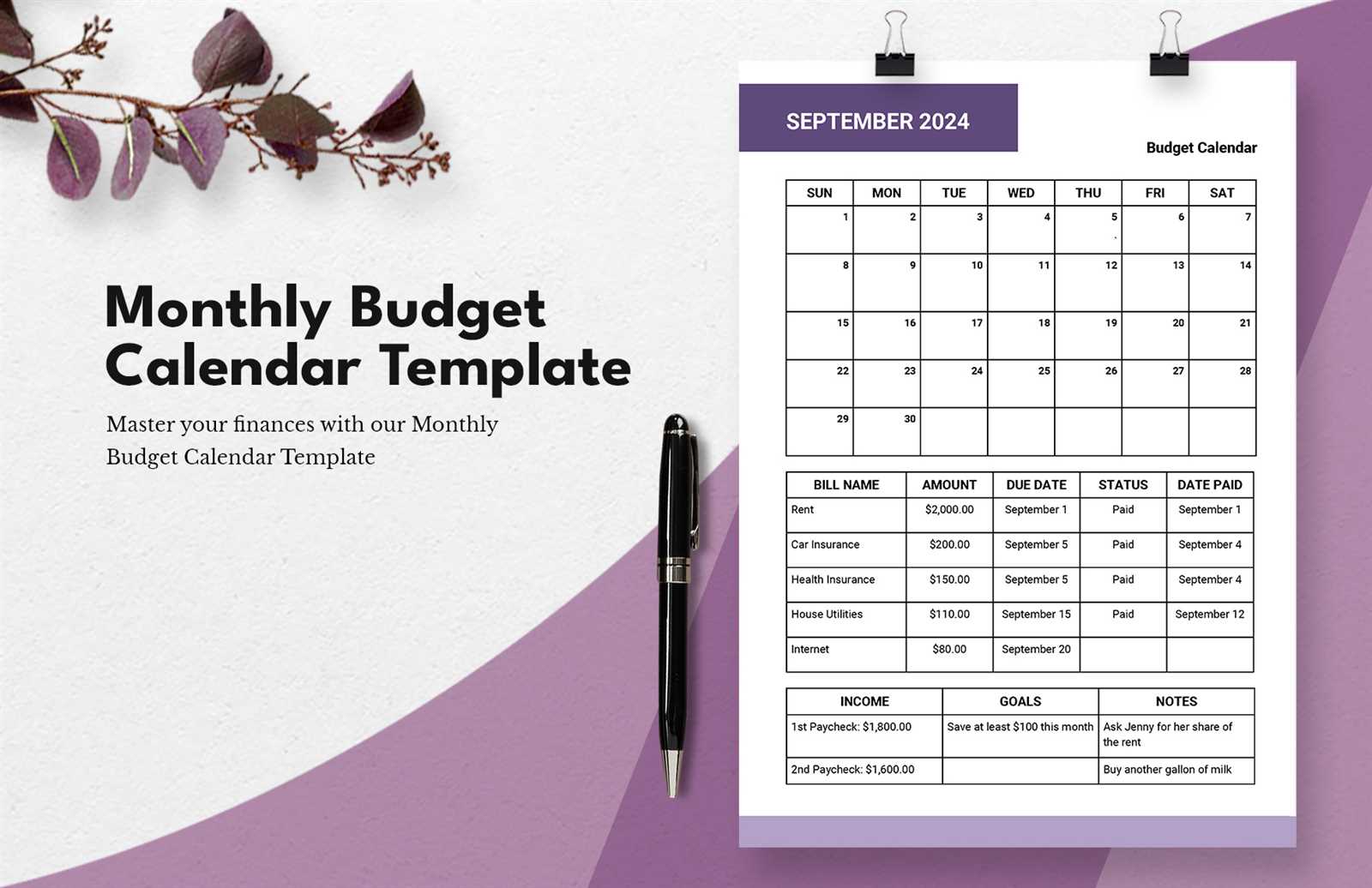

Key Features of Expense Calendars

When managing finances, having a structured approach is essential. A well-designed tool can significantly enhance the way individuals track their financial commitments and cash flow. It serves as a practical resource, enabling users to visualize their monetary activities over a set period. Here are some essential attributes that such tools typically offer.

Visual Organization

One of the standout characteristics of these tools is their ability to present information in a visually appealing format. By arranging data in a clear manner, users can quickly identify patterns in their financial habits. This organization helps in making informed decisions regarding spending and saving.

Customizable Sections

Flexibility is another crucial aspect. Users often benefit from the ability to modify categories according to their specific needs. This adaptability ensures that the resource can be tailored to reflect individual financial situations, allowing for a more personalized experience.

| Feature | Description |

|---|---|

| Visual Layout | Enhances clarity and makes it easier to spot trends. |

| Category Options | Allows users to define their own sections for better tracking. |

| Automatic Calculations | Reduces manual entry and minimizes errors. |

| Summary Insights | Provides overviews to help evaluate financial health. |

Customizing Your Spreadsheet Layout

Tailoring the arrangement of your financial tracking tool can significantly enhance its functionality and visual appeal. By adjusting various elements to suit your preferences, you can create an environment that fosters better organization and clearer insights. Whether you prefer a minimalistic design or a more colorful presentation, the layout plays a crucial role in how you interact with your data.

One of the first steps in this process is selecting an appropriate structure. You might want to group similar entries together or allocate specific sections for different categories. This organization not only streamlines your workflow but also allows for quicker data retrieval. Experimenting with column widths and row heights can also contribute to a more polished look, ensuring that all information is easy to read.

Color coding is another effective strategy to consider. By implementing distinct shades for various categories or priorities, you can instantly identify crucial information at a glance. This visual cue not only enhances readability but also makes it simpler to analyze trends over time. Incorporating conditional formatting can further automate this process, allowing your tool to highlight essential figures based on predefined criteria.

Finally, don’t underestimate the power of font choices and styles. Selecting clear, professional typefaces and utilizing bold or italicized text for emphasis can greatly improve the overall look of your document. By thoughtfully arranging these visual elements, you ensure that your financial tracker is not only functional but also a pleasure to use.

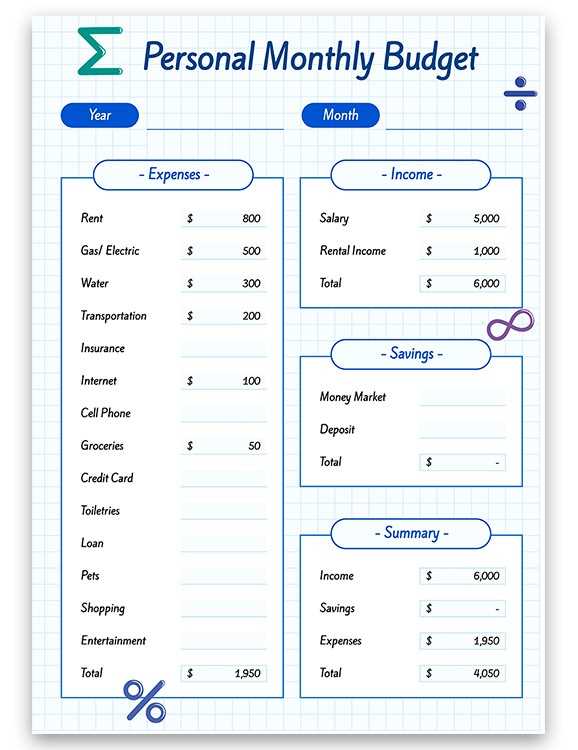

Understanding Expense Categories

Classifying financial outlays is crucial for effective management of personal budgets. By organizing costs into distinct groups, individuals can gain better insights into their spending habits, identify areas for potential savings, and make informed financial decisions.

Common classifications often include:

- Essential Costs: These are necessary expenditures for daily living, such as housing, utilities, and groceries.

- Discretionary Spending: This category covers non-essential purchases, like entertainment, dining out, and hobbies.

- Savings and Investments: Allocating funds for future goals, including retirement accounts, emergency funds, and other investment opportunities.

- Debt Repayment: This includes payments made towards loans, credit cards, and other financial obligations.

By systematically categorizing financial commitments, individuals can track their cash flow more effectively and adjust their habits as needed to achieve their financial goals.

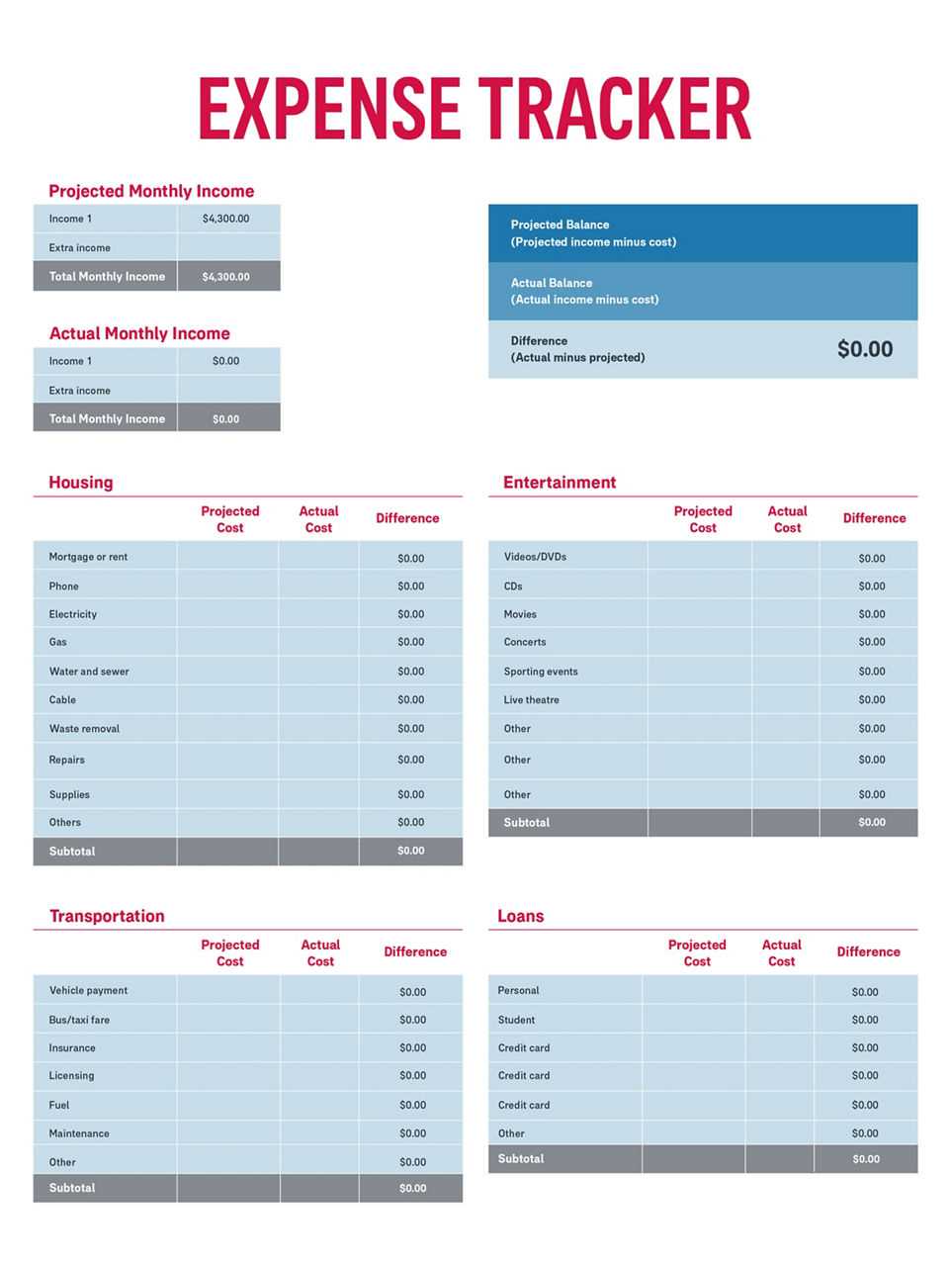

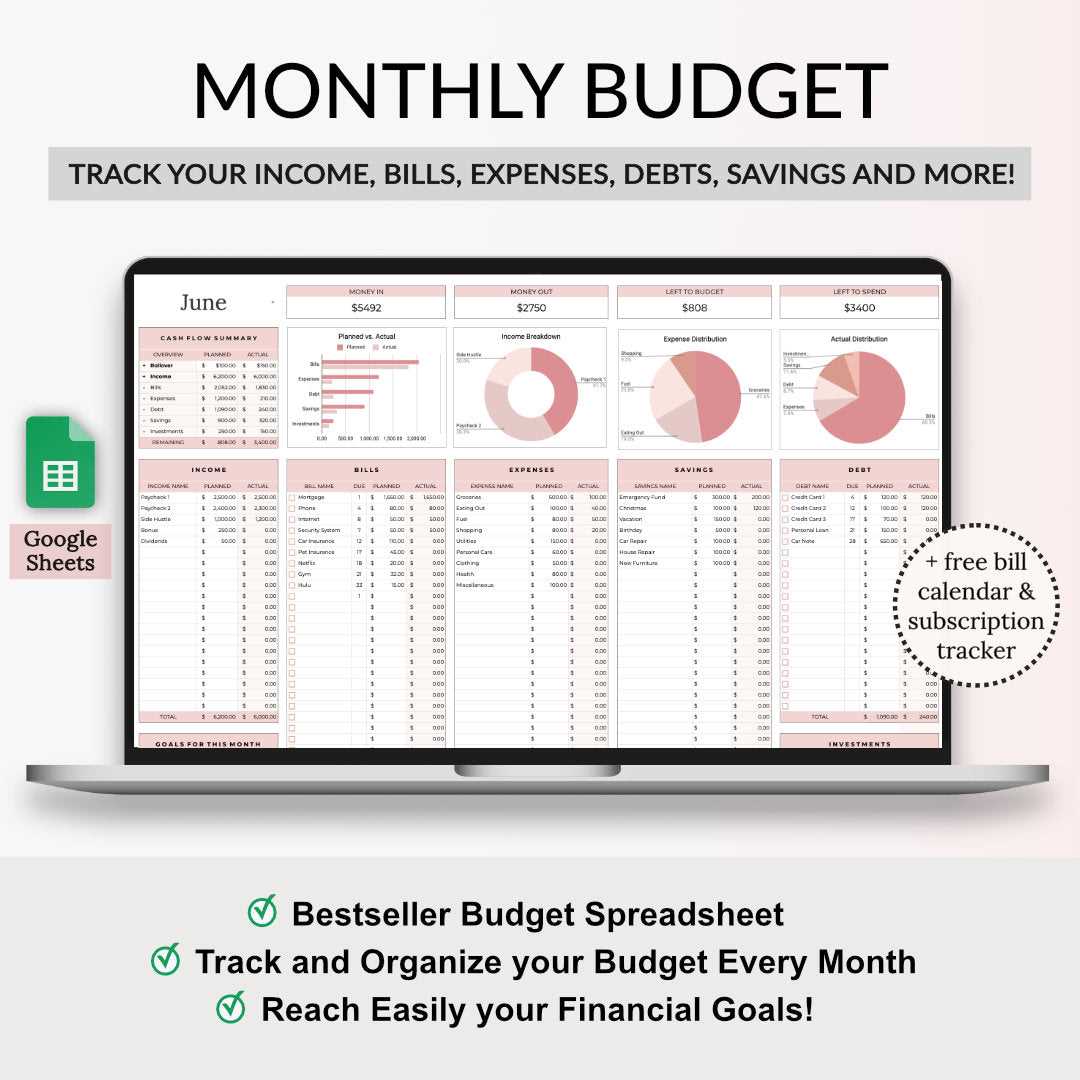

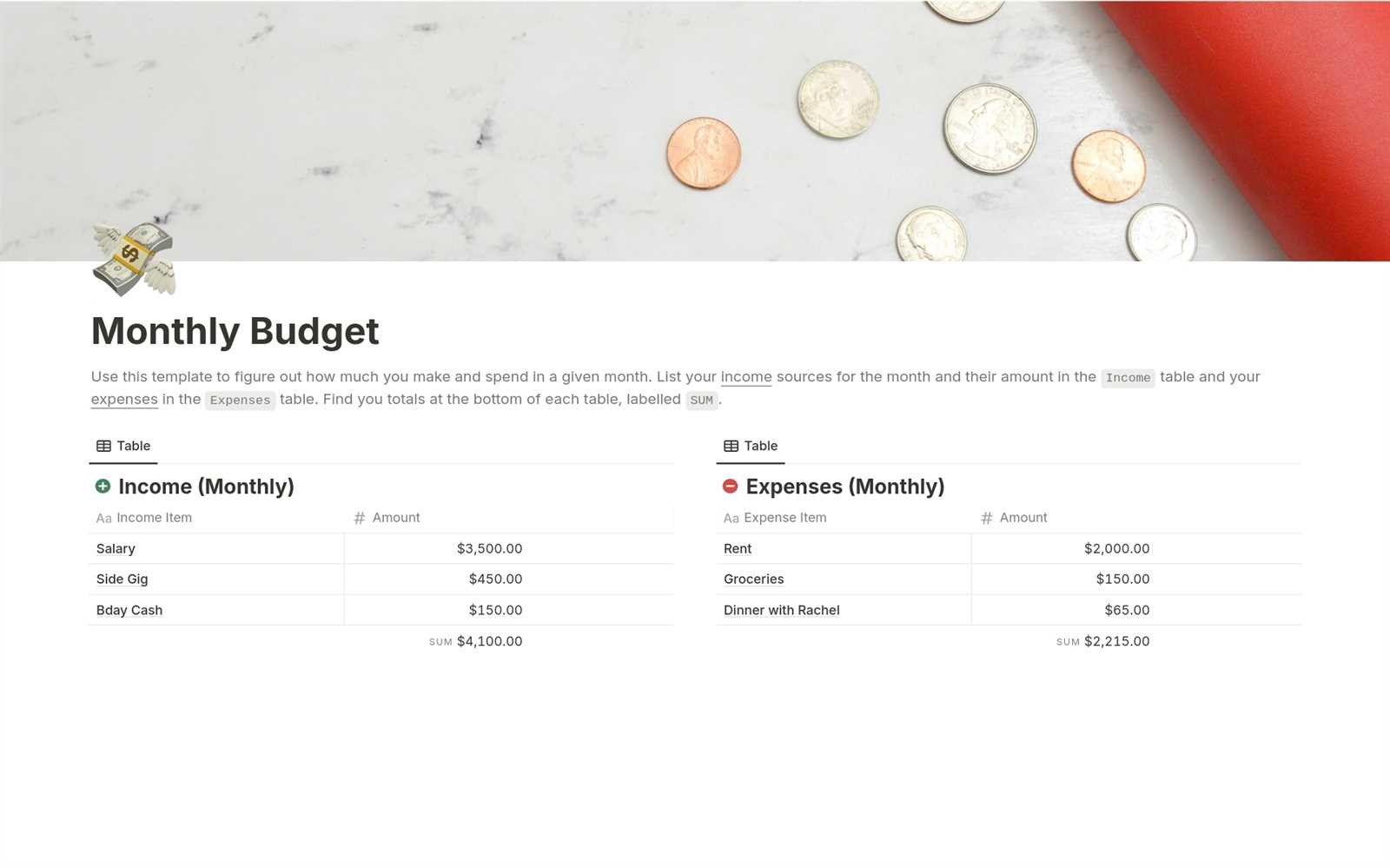

Tracking Income Alongside Expenses

Managing personal finances effectively requires a comprehensive approach that encompasses both inflows and outflows of funds. By keeping a close eye on earnings while monitoring spending, individuals can gain a clearer perspective on their financial health. This dual tracking allows for better decision-making and helps in setting realistic budgeting goals.

Incorporating income alongside spending records can enhance understanding of financial trends. A structured layout can simplify this process, providing insights into patterns that may emerge over time. The following table illustrates a simple format for capturing essential data.

| Month | Earnings | Outlays | Balance |

|---|---|---|---|

| January | $2,500 | $1,800 | $700 |

| February | $2,800 | $2,200 | $600 |

| March | $3,000 | $2,500 | $500 |

By regularly updating this information, one can quickly assess financial standing and make informed adjustments as necessary. This practice not only promotes accountability but also encourages thoughtful financial planning.

Using Formulas for Accurate Calculations

In the realm of financial management, precision is paramount. Utilizing mathematical functions allows for seamless computations, ensuring that each entry reflects true values. By harnessing these capabilities, one can effortlessly track funds, forecast trends, and maintain a clear overview of financial activities.

Employing formulas not only streamlines data handling but also enhances the reliability of the figures presented. For instance, simple addition, subtraction, multiplication, and division functions can be incorporated to manage totals, averages, and percentages effectively. Below is a basic illustration of how these calculations can be structured:

| Description | Value |

|---|---|

| Total Income | =SUM(B2:B5) |

| Total Deductions | =SUM(C2:C5) |

| Net Balance | =B6-C6 |

This table exemplifies the integration of functions for comprehensive tracking. Each cell can dynamically update as data changes, allowing for real-time insights into financial standing. Thus, mastering the use of formulas becomes a valuable skill for effective management.

Integrating with Budgeting Tools

In today’s financial landscape, harmonizing your financial tracking methods with budgeting applications can significantly enhance your ability to manage your finances effectively. This approach allows individuals to streamline their financial data, making it easier to monitor spending habits and saving goals. By synchronizing different tools, you can create a comprehensive overview of your financial situation, enabling better decision-making.

Benefits of Integration

Utilizing compatible tools offers numerous advantages. First, it reduces manual data entry, which minimizes errors and saves valuable time. Furthermore, it provides real-time insights into your financial activities, helping you to identify patterns and adjust your strategies as needed. This level of accessibility ensures that you remain proactive in achieving your financial objectives.

Choosing the Right Tools

When selecting suitable applications for integration, consider those that offer user-friendly interfaces and strong compatibility with your existing financial management systems. Look for features like automatic syncing, customizable reports, and alerts for overspending. By making informed choices, you can optimize your financial planning and maintain control over your economic future.

Visualizing Data with Charts

Transforming numerical information into graphical representations allows for a clearer understanding of trends and patterns. Utilizing visuals not only enhances comprehension but also facilitates communication of complex data in an intuitive manner. By employing various types of graphics, one can easily interpret the underlying stories that numbers convey.

Charts serve as powerful tools for illustrating significant insights. They can capture fluctuations over time, compare different categories, or highlight proportions within a whole. Whether using line graphs to depict changes or pie charts to show distribution, the choice of visualization greatly impacts how effectively the data resonates with the audience.

Incorporating visual elements can lead to more informed decision-making. By presenting data visually, one encourages engagement and fosters a deeper connection with the information. As a result, stakeholders can quickly grasp key findings and derive actionable conclusions, enhancing overall analytical capabilities.

Common Mistakes to Avoid

Managing finances effectively can be challenging, and several pitfalls can hinder your efforts. Identifying and understanding these common errors is crucial for improving your financial planning. Being aware of what not to do can lead to better outcomes and a clearer perspective on your monetary activities.

One frequent mistake is neglecting to update records regularly. Inconsistent tracking can result in inaccuracies, making it difficult to assess your true financial situation. Additionally, failing to categorize transactions properly can lead to confusion and hinder your ability to analyze spending patterns. This can impede strategic decision-making.

Another issue arises from setting unrealistic goals. Overly ambitious targets may lead to frustration and demotivation. It’s essential to establish attainable objectives that encourage progress without overwhelming yourself. Lastly, ignoring the importance of reviewing your financial data regularly can prevent you from recognizing trends and adjusting your strategies accordingly.

Updating Your Calendar Regularly

Maintaining a consistent schedule is essential for effective personal finance management. Regularly revisiting and refreshing your tracking tool allows you to stay on top of your financial obligations and adjust to any changes in your circumstances. This practice not only helps in keeping your records accurate but also empowers you to make informed decisions about your budget and financial goals.

The Importance of Consistency

Establishing a routine for reviewing and modifying your records can lead to significant improvements in your financial health. By allocating a specific time each week or month to examine your entries, you create a habit that fosters awareness of your financial situation. This consistent approach ensures that you capture all transactions, no matter how small, and helps in identifying spending patterns and areas for improvement.

Adapting to Changes

Your financial landscape can shift due to various factors such as changes in income, unexpected expenses, or new financial goals. By regularly updating your tracking tool, you can quickly adapt to these changes and make necessary adjustments to your financial plan. This proactive approach allows you to remain flexible and responsive, ultimately leading to better financial outcomes.

Sharing Your Template with Others

Collaboration enhances productivity and fosters a sense of community. By allowing others to access your carefully designed document, you not only promote teamwork but also enable the sharing of valuable insights and improvements. Whether for personal use, academic pursuits, or professional settings, sharing your work can lead to a more enriched experience for everyone involved.

Here are several effective methods to distribute your creation:

- Email: Send your document directly to individuals or groups. Attach the file, or share a link to a cloud storage service for easy access.

- Cloud Storage: Upload your document to a platform like Google Drive or Dropbox. Share the link with those you want to collaborate with, adjusting permissions as necessary.

- Collaboration Tools: Utilize platforms such as Trello or Asana that allow you to integrate and share your work within a team environment, promoting real-time collaboration.

- Social Media: If appropriate, share your document on professional networks or relevant groups to reach a broader audience.

When sharing, consider the following:

- Ensure that your document is clear and user-friendly, making it easy for others to understand and utilize.

- Be open to feedback, as others may provide valuable suggestions for improvements.

- Respect the privacy of any sensitive information, making sure to remove or anonymize data before sharing.

By embracing collaboration, you can maximize the potential of your work and encourage others to benefit from your efforts, ultimately creating a more productive and engaged community.

Maintaining Financial Discipline

Establishing a solid foundation for managing personal finances is essential for achieving long-term stability and success. By cultivating a consistent approach to monitoring your financial activities, you can gain insight into your spending habits and make informed decisions that align with your financial goals. Developing a strategy to track your financial outflows helps maintain control and promotes accountability in your financial journey.

One effective way to enhance your financial discipline is by creating a structured system for documenting and analyzing your financial transactions. This method not only allows you to visualize your monetary flow but also encourages you to reflect on your choices. Regularly reviewing your financial patterns can reveal areas for improvement and empower you to adjust your behaviors to better suit your objectives.

Moreover, setting specific, achievable goals is vital in fostering a sense of purpose and motivation. By defining clear targets, you can direct your efforts towards fulfilling your aspirations and minimizing unnecessary expenditures. Adopting a proactive mindset towards your financial management can lead to increased awareness, enabling you to prioritize essential needs while curbing impulsive spending.

Reviewing Your Monthly Spending Patterns

Analyzing your financial habits is crucial for achieving greater control over your budget. By observing where your funds are allocated, you can identify trends that may indicate overspending or areas where savings could be made. Understanding these patterns enables you to make informed decisions about your finances and adjust your behavior accordingly.

Identifying Key Trends

Start by categorizing your outflows into distinct groups, such as necessities, leisure, and savings. This classification will help you visualize where your resources are primarily directed. Pay attention to recurring costs that may not seem significant individually but can accumulate over time. Recognizing these key trends will allow you to prioritize your financial goals and strategize effectively.

Making Informed Adjustments

Once you’ve established a clear overview of your financial habits, consider adjusting your approach. If certain areas are consuming too much of your income, brainstorm ways to reduce these expenditures. Whether it’s negotiating bills or finding more affordable alternatives, making small changes can lead to significant savings in the long run. By staying proactive in this review process, you ensure that your financial journey remains on track.

Resources for Expense Management

Effective oversight of financial outflows is crucial for maintaining a balanced budget and achieving fiscal goals. Utilizing various tools and resources can significantly enhance your ability to track and manage costs efficiently. This section explores valuable assets that can aid individuals and organizations in maintaining financial health.

| Resource Type | Description | Examples |

|---|---|---|

| Software Applications | Digital solutions that help users monitor and analyze financial transactions, offering features like reporting and alerts. | Mint, YNAB, Quicken |

| Mobile Apps | Convenient tools that allow users to manage finances on the go, often integrating with bank accounts for real-time updates. | Expensify, PocketGuard, Wally |

| Online Courses | Educational programs designed to enhance financial literacy and provide strategies for effective resource management. | Coursera, Udemy, Khan Academy |

| Blogs and Articles | Informative content that shares tips, strategies, and best practices for better financial management. | Smart Asset, The Balance, NerdWallet |

Tips for Long-Term Financial Planning

Establishing a solid foundation for your future requires thoughtful strategies and a clear vision. Understanding how to manage resources effectively can lead to a more secure financial situation. Here are some insightful approaches to enhance your long-term financial well-being.

One essential aspect of planning is setting specific goals. These objectives guide your decisions and motivate you to stay on track. Consider categorizing your ambitions into short-term and long-term targets to create a balanced approach.

Tracking your financial activities plays a crucial role in maintaining awareness of your progress. By monitoring your income and spending patterns, you can identify areas for improvement and adjust your strategies accordingly. Below is a simple framework to help you evaluate your financial activities:

| Category | Monthly Amount | Yearly Total |

|---|---|---|

| Income | $_________ | $_________ |

| Investments | $_________ | $_________ |

| Savings | $_________ | $_________ |

| Discretionary Spending | $_________ | $_________ |

Additionally, consider diversifying your financial portfolio. Engaging in various investment opportunities can help mitigate risks and enhance your potential returns. Stay informed about market trends and adjust your strategies as necessary.

Finally, review your plan regularly. Life circumstances can change, affecting your financial landscape. By revisiting your strategies and goals periodically, you can ensure they remain aligned with your current situation and aspirations.