In today’s fast-paced world, maintaining a clear overview of income intervals is crucial for effective financial planning. A well-structured outline can aid individuals and organizations in tracking their monetary inflows with precision. By implementing a systematic approach, one can mitigate the stress often associated with budgeting and expenditure management.

Utilizing a structured framework allows for better visibility of cash flow, enabling proactive decision-making. This is particularly beneficial for those juggling multiple responsibilities or managing teams, as it promotes accountability and transparency. Establishing clear intervals fosters a sense of predictability, which can significantly enhance overall financial health.

Furthermore, a thoughtfully designed schedule can be tailored to fit various needs, accommodating diverse payment frequencies and ensuring that obligations are met without delay. Emphasizing organization in this aspect not only streamlines operations but also empowers individuals to achieve their financial goals with confidence.

Understanding Pay Date Calendars

In the realm of financial management, the scheduling of compensation intervals is a crucial aspect for both employers and employees. This systematic approach ensures that individuals receive their earnings consistently, allowing for better personal budgeting and planning. Grasping how these intervals are structured can significantly enhance one’s financial awareness and preparation.

Frequency of compensation distribution can vary across organizations, with some opting for weekly, bi-weekly, or monthly practices. Each method has its own advantages and may cater to the diverse needs of employees. For instance, frequent distributions can assist in managing daily expenses more effectively, while less frequent distributions may allow for more comprehensive financial planning.

Another important factor to consider is the timing of these distributions. Knowing when to expect remuneration is vital for financial stability. Many organizations provide a detailed schedule that outlines the specific days when funds will be allocated, helping employees to align their financial obligations accordingly.

Ultimately, understanding these structures not only aids in personal financial management but also fosters a sense of transparency and trust within the workplace. Clear communication regarding remuneration schedules can enhance employee satisfaction and retention.

What is a Pay Date Calendar?

A schedule for remuneration provides essential information regarding when employees receive their earnings. This framework is crucial for both workers and employers, ensuring transparency and helping with financial planning. By outlining the frequency and timing of salary distributions, it allows individuals to manage their expenses effectively and businesses to maintain organized payroll practices.

Importance of Remuneration Scheduling

Understanding the timeline for income disbursement is vital for employees, as it influences budgeting and financial decisions. For employers, a well-structured remuneration schedule aids in compliance with regulations and enhances workforce satisfaction. By clearly communicating these timelines, organizations can foster trust and improve overall employee morale.

Creating an Effective Payment Schedule

To develop an efficient income distribution framework, companies should consider various factors, such as the frequency of payments, local laws, and employee preferences. Regular updates and clear communication regarding any changes are essential to maintain clarity and prevent confusion. Ultimately, a well-organized payment timeline can lead to smoother operations and a more satisfied workforce.

Benefits of Using a Template

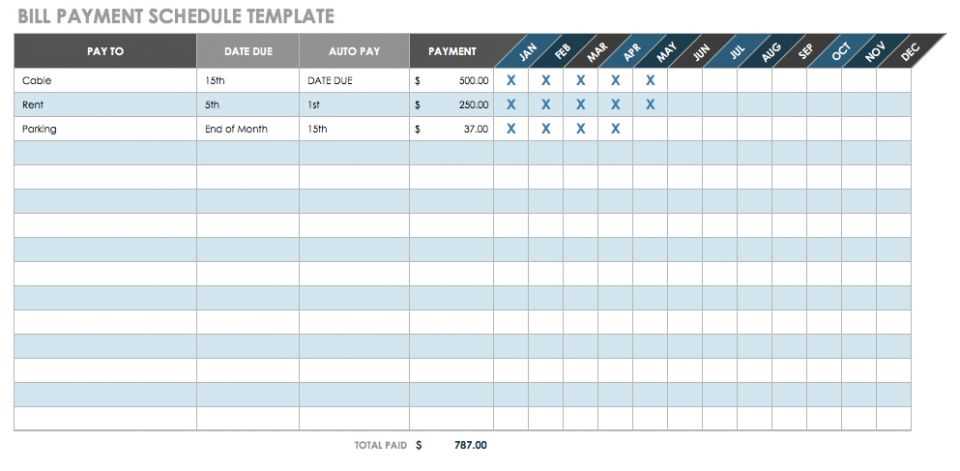

Utilizing a structured framework for organizing financial schedules offers numerous advantages that enhance efficiency and accuracy. By following a pre-designed outline, individuals and businesses can streamline their planning processes, ensuring that all necessary details are included without the risk of overlooking important elements.

Increased Efficiency

One of the primary benefits is the significant boost in productivity. When a predefined format is available, it reduces the time spent on design and layout, allowing users to focus on the essential information. This leads to quicker turnaround times and the ability to manage multiple tasks simultaneously.

Consistency and Accuracy

Another key advantage is the assurance of uniformity. A standardized structure minimizes the likelihood of errors, as it guides users through essential components that must be addressed. This not only enhances the reliability of the information but also fosters trust among stakeholders who rely on these organized schedules.

In summary, adopting a systematic approach for financial organization promotes better time management and improved precision, ultimately contributing to more effective planning and execution.

Types of Pay Date Calendars

Understanding the various structures for compensation schedules is essential for both employers and employees. These frameworks determine when earnings are distributed and can significantly affect budgeting and financial planning. Different approaches cater to diverse organizational needs and employee preferences.

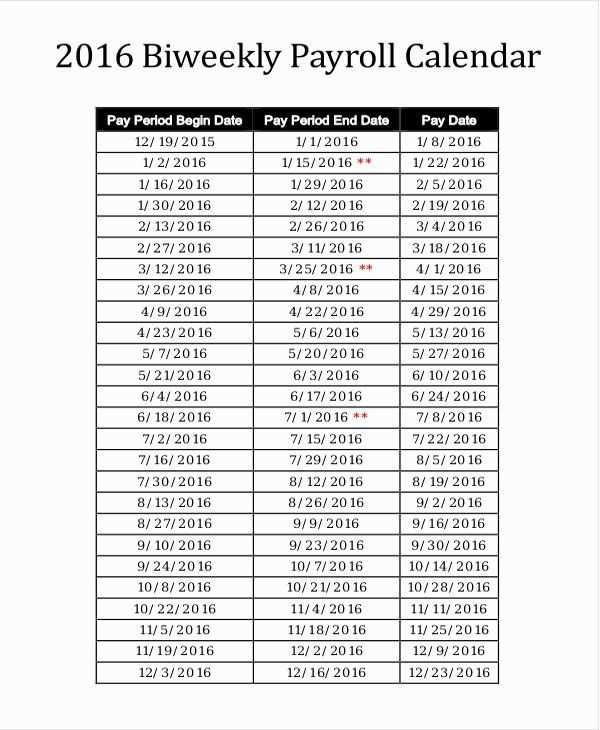

Weekly and Biweekly Systems

Weekly and biweekly systems are among the most common methods for distributing compensation. In a weekly setup, employees receive their earnings every week, providing a steady influx of funds. Conversely, the biweekly system offers payments every two weeks, resulting in 26 disbursements per year. This approach allows for easier financial planning and often aligns well with monthly expense cycles.

Monthly and Semi-Monthly Structures

Monthly and semi-monthly structures present alternative methods for remuneration. Monthly payment schedules provide employees with a single payment each month, which can simplify cash flow management. On the other hand, semi-monthly structures offer two payments per month, typically occurring on set dates. This option strikes a balance between regularity and predictability, catering to varying financial needs.

How to Create Your Own Template

Designing a personalized schedule can significantly enhance your organizational skills and streamline your financial management. By crafting a custom framework tailored to your needs, you can effectively track important milestones and manage your obligations more efficiently. Here’s a guide to help you develop your unique structure.

Step 1: Determine Your Requirements

Begin by assessing what elements are essential for your system. Consider the frequency of your financial activities, any specific intervals you need to monitor, and additional details you want to include, such as reminders or notes. This foundational step will guide your design process and ensure that your final product meets your individual needs.

Step 2: Choose a Format

Decide on the format that works best for you, whether it’s a digital document, spreadsheet, or a printable layout. Each option has its advantages, so choose one that you find most convenient for regular updates and accessibility. Once you’ve selected a format, start outlining the structure, organizing the sections logically for easy navigation.

Essential Components of a Calendar

Understanding the fundamental elements that make up an effective scheduling tool is crucial for anyone looking to manage their time efficiently. Each component plays a vital role in ensuring clarity and usability, helping individuals stay organized and informed throughout their planning processes.

Time Frames: A clear representation of time segments is essential. This can include weeks, months, or even specific events. Defining these periods helps users visualize their commitments and plan accordingly.

Visual Organization: Effective layout enhances readability. Utilizing grids or lists allows for quick scanning, making it easy to locate important information without unnecessary confusion.

Key Events: Highlighting significant occasions, deadlines, or milestones is important. These markers serve as reminders and help prioritize tasks that require immediate attention.

Notes Section: Providing space for additional remarks or details can be invaluable. This feature allows users to jot down thoughts or specific instructions related to their scheduled activities.

Color Coding: Implementing a color scheme can aid in differentiating various types of entries. This visual cue makes it easier to categorize tasks, appointments, or reminders at a glance.

By incorporating these fundamental elements, individuals can create a functional and intuitive planning aid that enhances their time management and overall productivity.

Customizing Your Pay Date Schedule

Adjusting your financial timeline can enhance clarity and efficiency in managing your earnings. Tailoring your schedule according to personal or organizational needs ensures that you align your income with expenses and savings goals. By considering various factors, you can create a plan that best fits your lifestyle.

Factors to Consider

When modifying your income schedule, it’s important to evaluate key elements such as frequency, employee preferences, and cash flow requirements. Each factor plays a crucial role in determining the best approach for your unique situation.

Sample Schedule Overview

| Frequency | Example Dates | Notes |

|---|---|---|

| Weekly | Every Friday | Ideal for hourly workers. |

| Biweekly | 1st and 15th of each month | Common for many companies. |

| Monthly | Last business day of the month | Useful for salaried positions. |

| Custom | As needed | Flexible arrangements based on agreements. |

By evaluating these components and utilizing a structured format, you can create a personalized timeline that accommodates both your financial responsibilities and preferences. This thoughtful planning can lead to improved financial management and peace of mind.

Common Payroll Frequencies Explained

Understanding the various intervals for compensating employees is essential for any business. Each frequency comes with its own set of advantages and challenges, impacting both the organization’s cash flow and employees’ financial management. Here, we explore the most prevalent schedules utilized in workplaces today.

Weekly Compensation

One of the most frequent options, weekly compensation involves issuing wages every seven days. This approach can enhance employee satisfaction, as workers receive their earnings promptly. However, it requires more administrative effort and can increase payroll processing costs.

Biweekly Compensation

Biweekly compensation entails disbursing wages every two weeks, resulting in 26 pay periods annually. This frequency strikes a balance between efficiency and employee needs. While it simplifies payroll processing compared to weekly payments, employees may find the waiting period longer than with weekly schedules.

Ultimately, the choice of frequency should align with the organization’s operational needs and the financial preferences of its workforce.

Tools for Designing Templates

Creating structured layouts and schedules requires the right resources to ensure effectiveness and clarity. A variety of software and applications can facilitate the development of organized formats that cater to specific needs. These tools enable users to customize their designs, incorporate necessary elements, and streamline workflows.

Graphic design programs such as Adobe Illustrator and Canva provide intuitive interfaces, allowing individuals to create visually appealing formats easily. For those focused on organization, spreadsheet applications like Microsoft Excel and Google Sheets offer robust functionalities to manipulate data and present it in a structured manner. Additionally, project management tools, including Trello and Asana, assist in arranging tasks and deadlines efficiently.

Moreover, web-based platforms often come with pre-made designs that can be tailored to meet individual preferences. This flexibility empowers users to create personalized layouts without needing extensive design experience. Utilizing these resources enhances productivity and ensures that the final product aligns with specific goals.

Integrating with Payroll Software

Efficient management of employee compensation requires seamless connectivity between different systems. By combining a robust payroll solution with other organizational tools, businesses can streamline operations, enhance accuracy, and reduce the potential for errors. This integration not only facilitates smoother transactions but also supports compliance with financial regulations.

To achieve a successful integration, it is essential to assess the specific needs of your organization. Understanding the capabilities of your payroll software allows for tailored adjustments that can improve functionality. Ensuring that data flows effortlessly between systems minimizes the need for manual input and helps maintain consistency across all platforms.

Data synchronization is a crucial aspect of this process. By automating the transfer of information, businesses can ensure that records are always up to date. This reduces the risk of discrepancies and enhances reporting accuracy. Regular audits of the integration can further safeguard against potential issues.

Collaboration between different departments also plays a vital role. Involving stakeholders from HR, finance, and IT can help identify challenges and develop solutions that benefit the entire organization. Effective communication ensures that everyone is on the same page regarding expectations and workflows.

Finally, selecting a payroll software that offers flexible integration options is critical. Many modern solutions provide APIs and pre-built connectors that simplify the linking process with existing systems. By leveraging these tools, businesses can enhance their operational efficiency and create a more cohesive working environment.

Best Practices for Accuracy

Ensuring precision in financial scheduling is crucial for any organization. By following systematic approaches and implementing reliable methods, businesses can maintain clarity and avoid discrepancies that may arise from oversight. Here are some key strategies to enhance the accuracy of your financial timelines.

Consistent Review and Updates

Regularly revisiting and revising your financial schedules can help identify errors or outdated information. Establish a routine for checking and updating records, ensuring that all figures and periods reflect current conditions. This practice not only aids in maintaining precision but also reinforces accountability within the team.

Utilizing Technology

Leveraging software tools designed for tracking and managing financial timelines can significantly reduce human error. Automated systems can provide reminders, generate reports, and ensure that all entries are consistently aligned with predefined criteria. Investing in reliable technology fosters efficiency and enhances overall accuracy in financial operations.

Examples of Pay Date Calendars

This section presents various formats for organizing and managing financial disbursements. Such arrangements help ensure timely remuneration for employees, allowing for clear expectations and planning. Below are some illustrative models that can be adapted for different organizations.

-

Biweekly Schedule:

Remuneration is issued every two weeks, often resulting in 26 disbursements per year. This model is common in many industries.

-

Monthly Cycle:

Payments occur once a month, typically on the same day. This format simplifies budgeting for both employers and employees.

-

Weekly Arrangement:

Compensation is provided every week, offering regular financial support. This method is often used for hourly workers.

-

Quarterly Distribution:

Payments are made four times a year, allowing for a broader assessment of financial performance. This option is often favored by contractors and consultants.

Each of these models can be tailored to meet the unique needs of a business, promoting transparency and efficiency in financial management.

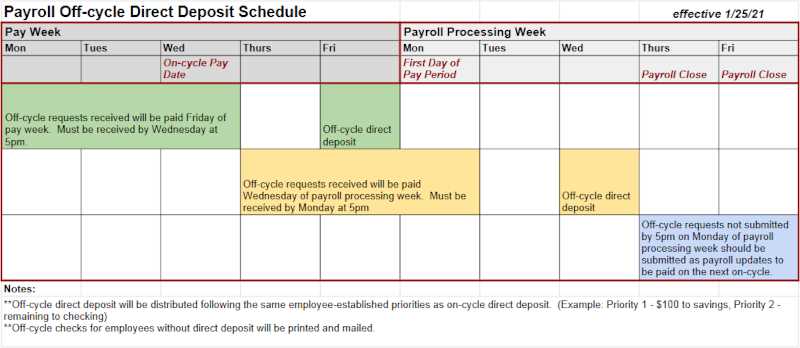

Adjusting for Holidays and Weekends

When managing financial disbursements, it’s essential to account for non-working days that can impact the timing of transactions. Holidays and weekends may disrupt regular schedules, necessitating careful planning to ensure that recipients receive their funds promptly.

Identifying non-working days is the first step in this process. This includes not only national holidays but also local observances that may vary by region. Keeping an updated list helps in anticipating potential delays and adjusting timelines accordingly.

To mitigate issues, it can be beneficial to establish clear policies regarding when funds will be transferred in relation to these non-working days. For instance, if a distribution is scheduled for a holiday, it may be prudent to shift it to the preceding business day to avoid inconvenience. Additionally, implementing reminders and notifications can aid in keeping all parties informed about any changes.

Lastly, utilizing automated systems can streamline the adjustment process. By programming these systems to recognize holidays and weekends, organizations can ensure that all financial operations run smoothly, thus maintaining a positive experience for recipients.

Legal Considerations for Pay Dates

When managing employee remuneration, it is crucial to navigate the legal landscape surrounding compensation disbursement. Understanding the various regulations and guidelines ensures that organizations adhere to labor laws while fostering a transparent relationship with their workforce.

Compliance with Labor Laws

Employers must be aware of the statutory requirements that dictate how often and when compensation should be issued. Different jurisdictions have specific laws regarding frequency, and failing to comply can lead to legal repercussions. It is essential for businesses to remain informed about local regulations to avoid penalties.

Employee Communication and Transparency

Clear communication regarding compensation schedules is vital for maintaining trust between employers and employees. Organizations should provide employees with comprehensive information about when they can expect their earnings, including any changes that may arise. This transparency not only supports compliance but also enhances employee satisfaction.

How to Share Your Template

Sharing your scheduling layout with others can greatly enhance collaboration and ensure everyone is on the same page regarding financial timelines. Whether you’re looking to distribute it within your team or share it with clients, there are several effective methods to make it accessible.

Utilizing Cloud Services: One of the most efficient ways to share your design is through cloud-based platforms. Services like Google Drive or Dropbox allow you to upload your file and generate a shareable link. This way, others can easily access and edit the document if needed.

Emailing Directly: If you prefer a more personal touch, you can send the layout via email. Simply attach the file and include any necessary instructions for your recipients. This method also allows for quick feedback and communication.

Collaboration Tools: Consider using collaboration software such as Trello or Asana. These platforms not only let you share your layout but also enable real-time updates and discussions, ensuring that everyone stays informed about any changes or modifications.

Regardless of the method you choose, make sure to provide clear guidelines on how to use the layout effectively. This will help ensure that all parties involved can benefit from your organizational tool.

Tracking Employee Payments Effectively

Maintaining a precise record of employee remuneration is crucial for any organization. This process not only ensures timely disbursement but also fosters trust and transparency within the workforce. A well-structured approach can help streamline monitoring and enhance overall financial management.

Establishing Clear Guidelines

Creating comprehensive protocols for recording and reviewing compensation is essential. Clear guidelines help eliminate confusion and facilitate consistency in handling remuneration matters. This may include defining payment frequency, calculating deductions, and outlining procedures for adjustments.

Utilizing Technological Solutions

Embracing software tools can significantly improve tracking efficiency. Automated systems allow for real-time updates and reduce the likelihood of errors, making it easier to maintain accurate records. By integrating these tools, organizations can save time and resources while enhancing accuracy.

| Method | Description | Benefits |

|---|---|---|

| Manual Tracking | Using spreadsheets to log payments | Cost-effective, straightforward |

| Automated Software | Utilizing payroll management systems | Increased accuracy, time-saving |

| Regular Audits | Conducting periodic reviews of records | Ensures compliance, identifies discrepancies |

Common Mistakes to Avoid

When managing financial schedules, individuals and organizations often encounter pitfalls that can lead to complications. Recognizing these common errors can help streamline processes and enhance efficiency. Below are some key missteps to watch out for in order to maintain a smooth operation.

| Mistake | Description |

|---|---|

| Lack of Planning | Failing to establish a comprehensive timeline can result in missed opportunities and delays in important transactions. |

| Inaccurate Tracking | Not keeping precise records of transactions can lead to discrepancies and confusion over financial obligations. |

| Ignoring Changes | Overlooking updates in regulations or policies can create compliance issues and unexpected penalties. |

| Neglecting Communication | Failure to inform relevant parties about schedules can result in misunderstandings and operational disruptions. |

| Overcomplicating Processes | Implementing overly complex systems can confuse users and hinder overall efficiency. |

Resources for Further Learning

Exploring additional materials can greatly enhance your understanding and implementation of scheduling frameworks. Various platforms offer insights, tools, and guidance that can help streamline processes and improve efficiency in financial planning.

Online Courses and Tutorials

Many educational websites provide comprehensive courses focused on financial management and planning systems. Platforms like Coursera and Udemy feature modules designed to equip learners with essential skills. These courses often include practical examples and real-world applications to reinforce concepts.

Books and Articles

Dive into literature dedicated to financial organization and strategic planning. Titles like The Total Money Makeover by Dave Ramsey offer valuable perspectives on managing finances effectively. Additionally, websites such as Investopedia and Harvard Business Review publish articles that delve into advanced techniques and innovative practices.