Planning and organizing financial distributions is essential for maintaining smooth operations within any organization. Establishing a structured timeline for compensations helps both employers and employees manage their expectations effectively. This framework not only promotes transparency but also ensures that all parties are aligned on payment dates, which is vital for fostering trust and cooperation.

In the context of regular remuneration cycles, having a clearly defined structure allows for better financial planning and resource allocation. By providing a systematic approach to salary disbursements, companies can enhance their operational efficiency and ensure that employees receive their earnings on time. This methodical arrangement minimizes confusion and helps maintain a harmonious workplace atmosphere.

To assist organizations in navigating the intricacies of salary schedules, a detailed guide can be created. This resource will outline the key dates for payments throughout the year, enabling seamless financial management. By leveraging such a document, businesses can ensure consistency and reliability in their compensation processes.

Understanding the Payroll Calendar

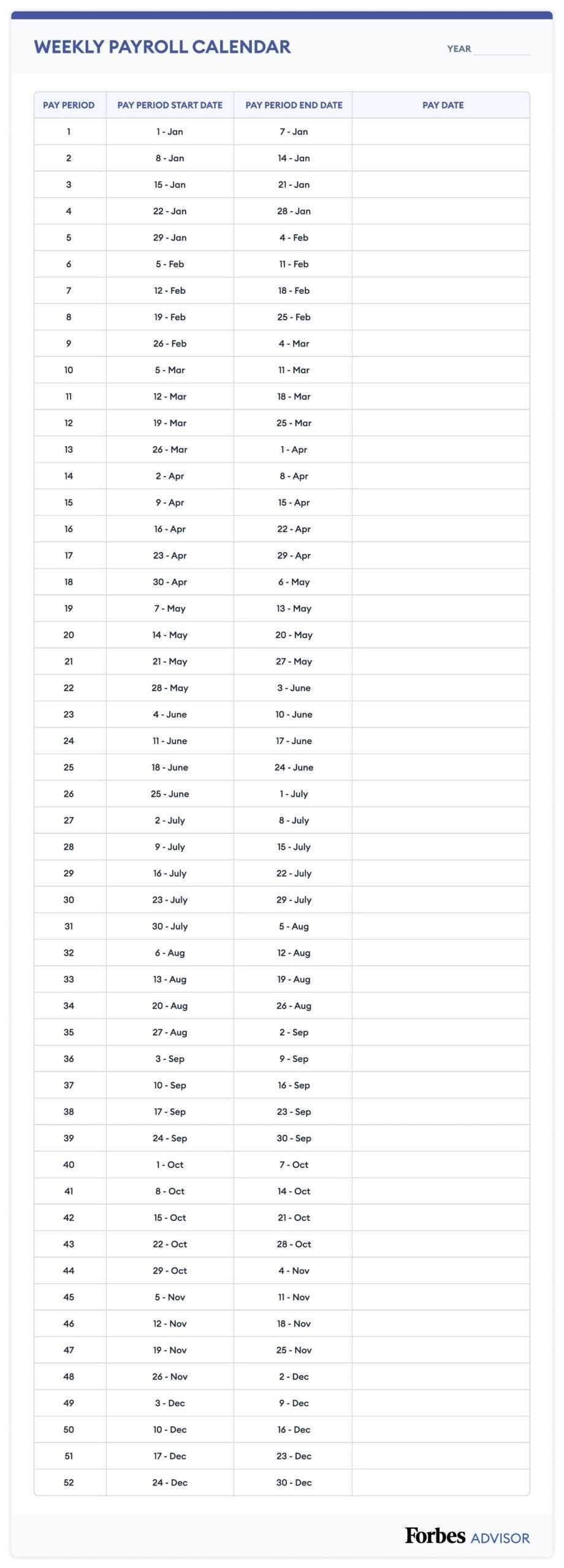

The structure that governs the distribution of employee remuneration is crucial for both employers and staff. This system ensures timely payments and helps in planning financial obligations effectively. Knowing the framework of this arrangement allows for better budgeting and resource management.

Typically, the remuneration distribution framework consists of defined periods within which work hours are tracked, and earnings are calculated. By establishing a clear schedule, businesses can streamline their financial operations and enhance employee satisfaction.

| Period | Start Date | End Date | Pay Date |

|---|---|---|---|

| First Period | January 1 | January 14 | January 15 |

| Second Period | January 15 | January 28 | January 29 |

| Third Period | January 29 | February 11 | February 12 |

Recognizing the different phases within this framework enables both management and employees to anticipate pay periods, thereby fostering financial planning and stability. Clear communication of these timelines is essential for maintaining a smooth operational flow and enhancing workplace morale.

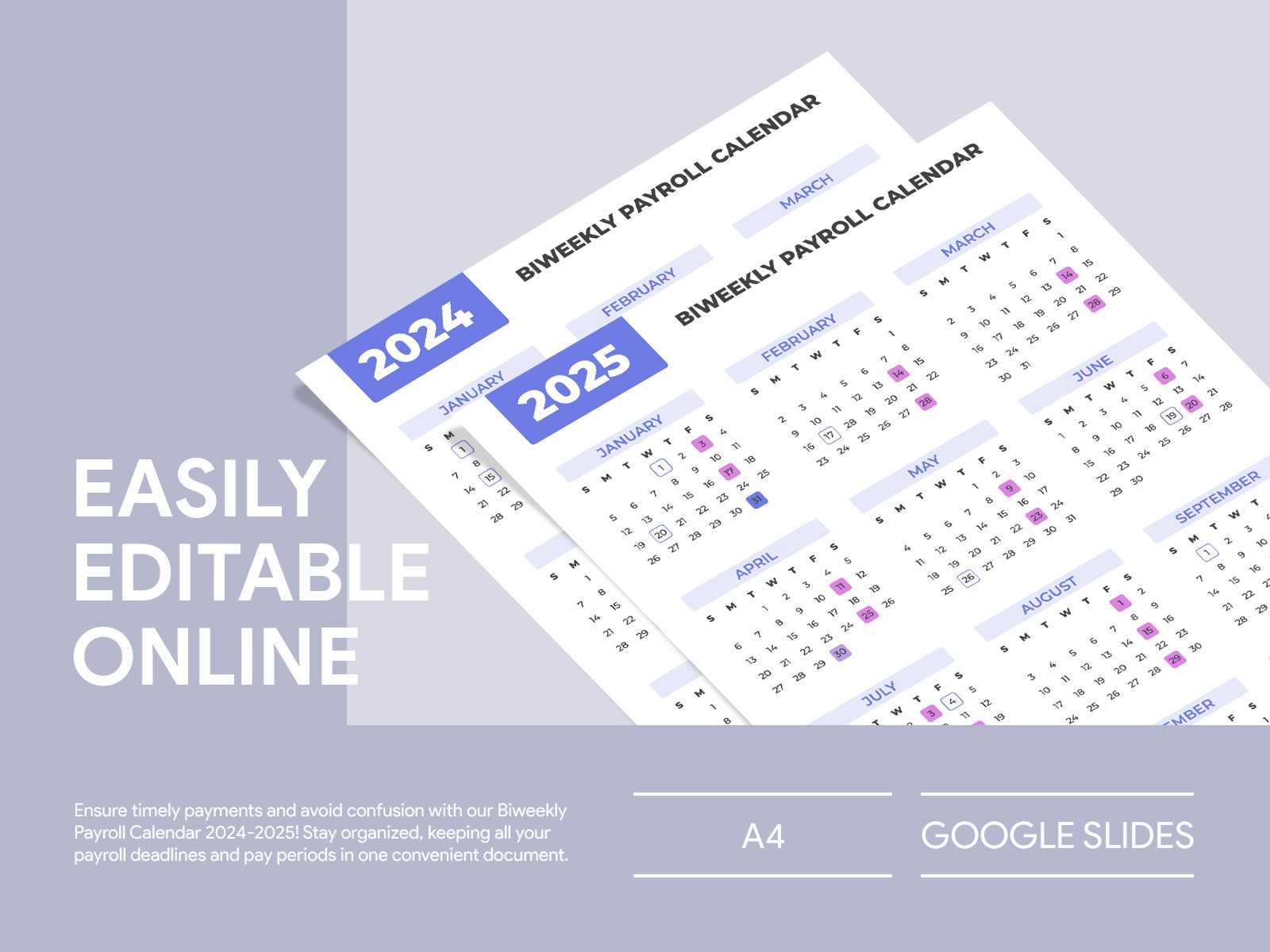

Benefits of a Biweekly Schedule

A two-week pay cycle offers various advantages for both employees and employers, enhancing financial management and operational efficiency. This structure allows for more predictable budgeting and can contribute to improved employee satisfaction through regular compensation intervals.

Financial Planning for Employees

With a consistent payment frequency, workers can better manage their personal finances. This approach simplifies budgeting, as employees can anticipate their income at regular intervals. Additionally, receiving payments every two weeks can help individuals align their expenses, such as rent and bills, with their income flow.

Operational Efficiency for Employers

For businesses, adopting a two-week pay structure can streamline administrative processes. It reduces the frequency of payment processing, allowing payroll staff to focus on other essential tasks. Furthermore, this system can enhance employee morale, as workers appreciate the timely and predictable nature of their earnings.

| Advantages | Details |

|---|---|

| Improved Financial Management | Regular payment intervals support budgeting and expense tracking. |

| Increased Employee Satisfaction | Predictable income boosts morale and financial security. |

| Streamlined Administration | Less frequent payment processing eases administrative burdens. |

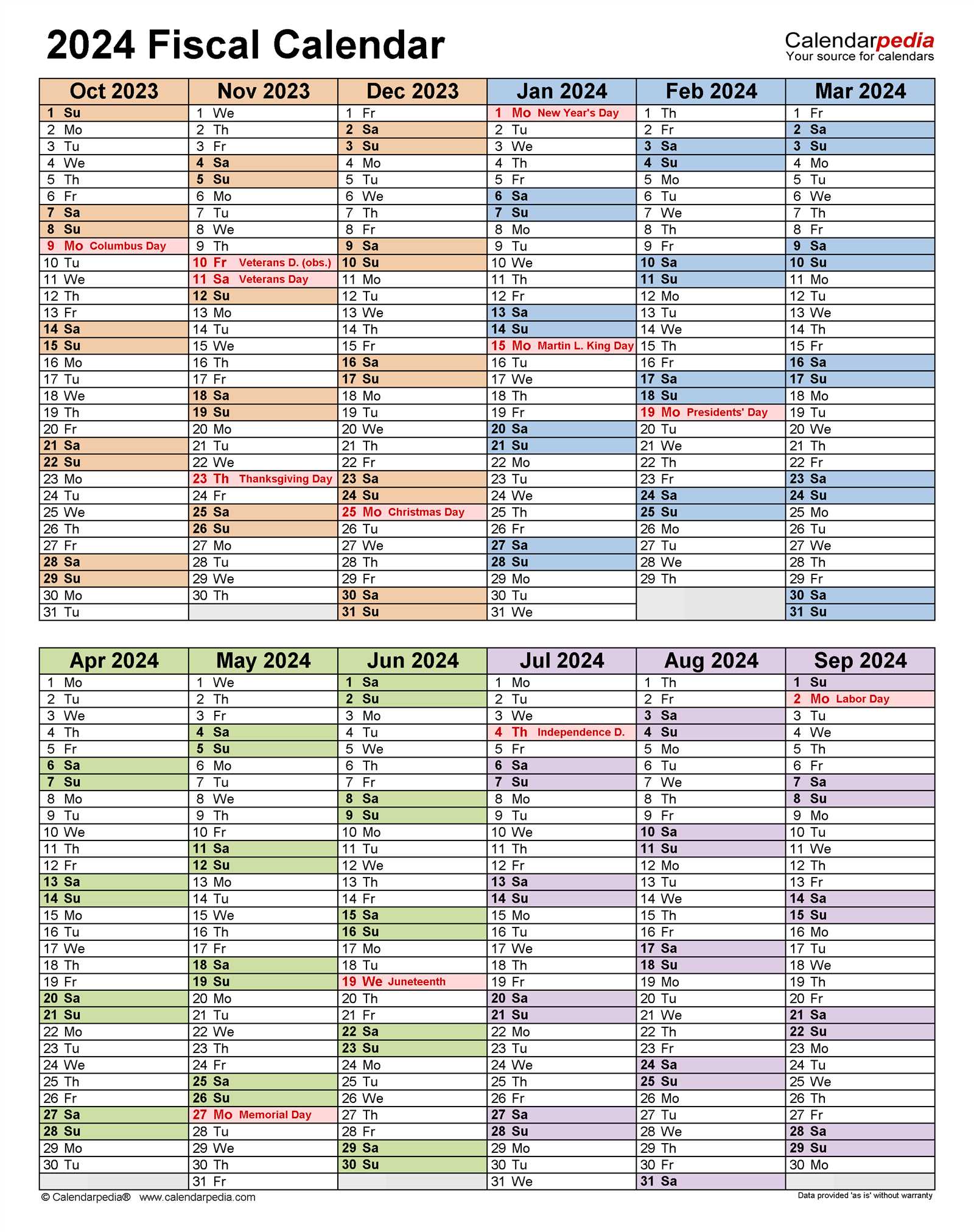

Key Dates in 2026 Calendar

This section highlights significant dates for planning and organization throughout the year. Understanding these important moments helps ensure timely execution of tasks and responsibilities.

- January 1: New Year’s Day

- January 15: Mid-January Review

- February 19: President’s Day

- March 15: Quarterly Assessment

- April 1: Spring Review

- May 27: Memorial Day

- July 4: Independence Day

- September 2: Labor Day

- October 14: Mid-Quarter Evaluation

- November 11: Veterans Day

- December 25: Christmas Day

Be sure to mark these dates as they play a crucial role in effective time management and ensuring responsibilities are met in a timely manner.

How to Create a Template

Designing a structured framework for tracking financial disbursements can significantly enhance organization and efficiency. A well-crafted framework allows for streamlined processes, making it easier to monitor and manage the flow of funds over specific periods.

Follow these essential steps to develop an effective framework:

- Determine the necessary periods for tracking funds. Consider factors such as the frequency of disbursements and reporting needs.

- Select a suitable software tool or platform for creating your structure. Options include spreadsheet applications, project management tools, or specialized financial software.

- Outline key components that should be included, such as:

- Start and end dates for each period

- Amount allocated for each cycle

- Important deadlines for submission and approvals

- Relevant notes or remarks for specific cycles

With a systematic approach, you can create an efficient structure that simplifies the management of financial disbursements, providing clarity and control throughout the process.

Common Payroll Terms Explained

Understanding key terminology related to compensation processing is essential for both employers and employees. Familiarity with these concepts can streamline financial management and improve communication regarding employee remuneration.

- Gross Income: This refers to the total earnings of an individual before any deductions, including taxes and benefits.

- Net Income: This is the amount received after all deductions have been made from the gross income.

- Deductions: These are amounts subtracted from an employee’s earnings, which can include taxes, health insurance, retirement contributions, and other benefits.

- Withholding: This term describes the process of retaining a portion of an employee’s income to cover tax obligations.

- Overtime: Earnings received for hours worked beyond the standard workweek, typically at a higher pay rate.

- FICA: The Federal Insurance Contributions Act, which mandates contributions for Social Security and Medicare programs.

- Pay Period: The duration of time for which compensation is calculated and paid to employees.

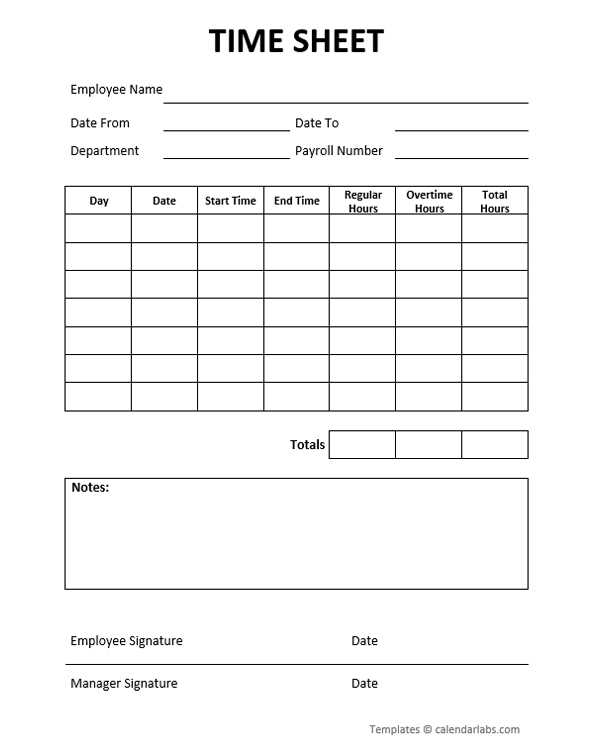

- Time Sheet: A record of hours worked by an employee during a specified period, used to calculate compensation.

Familiarity with these terms enhances clarity and effectiveness in discussions related to employee compensation and benefits management.

Tracking Employee Hours Effectively

Accurate monitoring of staff working hours is essential for maintaining operational efficiency and ensuring fair compensation. Implementing a systematic approach allows organizations to optimize time management, enhance productivity, and foster employee satisfaction. By establishing clear guidelines and utilizing appropriate tools, businesses can streamline the process of recording attendance and working hours.

One effective strategy involves the use of automated systems that simplify time tracking. These tools can record hours in real time, reducing the likelihood of human error. Additionally, integrating mobile applications can provide employees with the flexibility to log their hours remotely, making the process more convenient and accessible.

Regular audits of recorded hours can help identify discrepancies and ensure compliance with company policies. Encouraging open communication between management and staff about time tracking expectations can further enhance accuracy. Training employees on the importance of precise timekeeping reinforces accountability and promotes a culture of transparency.

Moreover, analyzing collected data can yield valuable insights into workforce trends and patterns. By assessing peak work periods and identifying areas for improvement, organizations can make informed decisions that contribute to a more efficient work environment. Overall, effective tracking of employee hours not only supports administrative functions but also strengthens the employer-employee relationship.

Adjusting for Holidays and Breaks

When planning financial disbursements, it is essential to account for non-working days and periods of leave. These adjustments ensure that employees receive their remuneration accurately, even when regular work schedules are interrupted. Understanding how to incorporate these factors can streamline the compensation process and enhance employee satisfaction.

Identify Key Dates: Begin by pinpointing public holidays and scheduled breaks that may affect the typical payment intervals. This helps in anticipating any necessary modifications well in advance.

Calculate Adjustments: For periods that coincide with holidays, it may be necessary to shift payment dates or modify the amounts. Consider the impact of these changes on employees’ expectations and financial planning.

Communicate Effectively: Clear communication with staff about how holidays and breaks will influence their payments is vital. Providing updated information fosters trust and transparency, allowing employees to plan accordingly.

Review Regularly: Regular assessments of how holidays and breaks affect financial distributions can help refine the process over time. Adjusting procedures based on past experiences ensures better accuracy in future allocations.

Calculating Overtime Pay

Understanding how to determine additional earnings for hours worked beyond the standard schedule is essential for both employees and employers. This calculation ensures that workers are fairly compensated for their extra effort, promoting a positive work environment and compliance with regulations.

Basic Overtime Rate Calculation

The typical approach to figure out the extra pay involves identifying the standard hourly wage and applying a multiplier for the additional hours. Usually, this rate is set at one and a half times the regular pay. For example, if an employee earns $20 per hour, their overtime rate would be $30 per hour for each hour worked beyond the standard limit.

Considerations for Special Cases

Certain circumstances may influence the calculation of additional pay. Some organizations may offer double time for holidays or special events, while others might have different agreements in place. It is crucial to be aware of any specific policies or labor laws that apply to your situation to ensure accurate compensation.

State-Specific Payroll Considerations

When managing employee compensation, it’s crucial to recognize the unique regulations and requirements that vary across different regions. Each state has its own set of laws that govern wage practices, including payment frequency, deductions, and tax withholdings. Understanding these variations is essential for compliance and ensuring that employees receive accurate and timely remuneration.

For instance, some states mandate specific intervals for issuing payments, while others may allow more flexibility. Additionally, local tax laws can significantly impact how much is withheld from an employee’s earnings, and this can differ not only from state to state but also within regions of a state. Employers must stay informed about these nuances to avoid potential legal issues and maintain employee satisfaction.

Furthermore, considerations such as sick leave policies, overtime calculations, and mandatory benefits can also differ significantly depending on the state. Employers should routinely review and update their practices in line with state regulations to ensure that they meet all legal obligations and foster a fair working environment.

Integrating Payroll Software Solutions

In today’s fast-paced business environment, utilizing advanced software tools is essential for streamlining employee compensation processes. Integrating these solutions can enhance efficiency, reduce errors, and improve overall financial management. By adopting effective systems, organizations can better handle various aspects of remuneration, ensuring timely and accurate disbursements.

Benefits of Integration

Integrating software solutions for employee compensation can yield numerous advantages, including:

- Increased accuracy in calculations

- Streamlined data management

- Enhanced compliance with regulations

- Improved reporting capabilities

Key Considerations for Implementation

When selecting software solutions, businesses should evaluate several critical factors to ensure successful integration:

| Factor | Description |

|---|---|

| User-Friendliness | The interface should be intuitive for all users. |

| Scalability | The solution must grow with the business. |

| Support Services | Reliable customer support is essential for troubleshooting. |

| Integration Capability | Compatibility with existing systems is crucial. |

Reporting Requirements for Employers

Employers have a responsibility to adhere to specific documentation and disclosure obligations to ensure compliance with various regulations. This process involves accurately tracking employee compensation and ensuring timely submission of necessary reports to governmental entities. Understanding these requirements is crucial for maintaining legal compliance and fostering a transparent relationship with employees.

Essential Documentation

To meet reporting obligations, employers must maintain thorough records of employee earnings, tax withholdings, and benefits provided. This includes keeping detailed accounts of each employee’s hours worked and any applicable deductions. These records not only facilitate accurate reporting but also serve as a safeguard during audits or inquiries from regulatory bodies.

Timelines for Submission

Employers are required to submit their reports within specified time frames. Adhering to these deadlines is essential to avoid penalties and ensure that employees receive their entitlements promptly. It is advisable for employers to establish an organized schedule for document preparation and submission to streamline compliance processes.

Best Practices for Payroll Accuracy

Ensuring precise compensation management is crucial for maintaining employee satisfaction and compliance with regulations. Implementing effective strategies can help minimize errors and streamline the entire process.

Establish Clear Procedures

Creating well-defined steps for processing employee remuneration can significantly enhance accuracy. Consider the following:

- Document each stage of the remuneration process.

- Utilize checklists to verify completed tasks.

- Regularly update procedures based on feedback and changes in regulations.

Invest in Technology

Utilizing modern tools can greatly reduce human error and improve efficiency. Here are some recommendations:

- Adopt reliable software that automates calculations.

- Implement systems that integrate with other HR functions.

- Regularly back up data to prevent loss and ensure accessibility.

Common Mistakes to Avoid

When managing a schedule for employee compensation, it’s essential to be mindful of common errors that can lead to confusion and inefficiencies. Recognizing these pitfalls can help ensure a smoother process and improve overall satisfaction among staff members.

Lack of Communication

One of the most frequent issues arises from insufficient communication regarding payment dates and changes. To prevent misunderstandings, consider the following:

- Regularly update employees on any adjustments to the payment structure.

- Provide clear guidelines on when they can expect their earnings.

- Encourage open dialogue for any questions or concerns.

Inaccurate Record Keeping

Another critical mistake is maintaining inaccurate records, which can cause significant complications. To ensure precision, keep these tips in mind:

- Regularly audit records to confirm all entries are correct.

- Utilize reliable software to track hours and compensation accurately.

- Establish a system for documenting changes or discrepancies promptly.

Updating Employee Information Regularly

Maintaining accurate and current details about employees is essential for effective management and operations within any organization. Regular updates ensure that all records reflect the latest information, which can enhance communication and streamline various processes.

To achieve this, organizations should implement a systematic approach:

- Establish a Schedule: Determine a regular interval for reviewing and updating employee records, such as quarterly or semi-annually.

- Encourage Employee Engagement: Actively involve employees in the process by prompting them to review their information and report any changes.

- Utilize Technology: Employ digital tools and software that facilitate easy updates and notifications regarding changes in personal details.

- Designate Responsible Personnel: Assign specific team members to oversee the accuracy of employee records and ensure timely updates.

- Provide Training: Offer training sessions to educate employees about the importance of keeping their information current and the procedures involved.

By prioritizing the regular updating of employee information, organizations can foster a more efficient working environment and reduce the risk of errors in communication and operations.

Importance of Confidentiality in Payroll

Maintaining the privacy of sensitive employee information is crucial for any organization. Confidentiality safeguards not only personal details but also financial data, ensuring that trust is preserved between the employer and staff. The proper handling of this information is essential for fostering a secure workplace environment.

Protecting Employee Trust

When employees believe that their information is kept secure, they are more likely to feel valued and respected. This trust enhances morale and can lead to increased productivity. Conversely, any breach of confidentiality can severely damage relationships and lead to a lack of trust in management.

Legal Compliance

Many jurisdictions have strict regulations governing the handling of personal information. Organizations must adhere to these laws to avoid legal repercussions, including fines and penalties. By prioritizing confidentiality, companies not only comply with legal standards but also demonstrate their commitment to ethical practices.

Mitigating Risks of Identity Theft

Failure to protect sensitive data can expose employees to the risk of identity theft. This can have devastating consequences for individuals, leading to financial loss and emotional distress. By implementing robust security measures, organizations can help prevent unauthorized access and reduce the likelihood of such incidents.

Enhancing Organizational Reputation

Companies known for their commitment to confidentiality are more likely to attract and retain top talent. A strong reputation for protecting employee information can differentiate an organization in a competitive job market. This, in turn, can lead to greater overall success and stability.

Utilizing Payroll Checklists

In the realm of employee compensation management, the implementation of structured lists can significantly enhance efficiency and accuracy. These tools serve as invaluable resources to ensure that every essential task is completed in a timely manner, reducing the risk of errors and omissions.

One of the primary advantages of using these lists is their ability to streamline processes. By outlining necessary steps, organizations can maintain consistency across each compensation cycle. This leads to a more organized approach to handling financial responsibilities.

Key elements to include in your structured lists may encompass:

- Data collection from employees

- Verification of working hours

- Calculation of deductions and bonuses

- Review of compliance with local regulations

- Distribution of compensation to employees

In addition to promoting accuracy, structured lists also facilitate better communication among team members involved in the compensation process. When everyone is aware of their responsibilities and deadlines, collaboration improves, leading to a more effective workflow.

To maximize the benefits of these checklists, consider implementing the following strategies:

- Regularly update the lists to reflect any changes in procedures or regulations.

- Train staff on how to effectively utilize these tools for optimal results.

- Encourage feedback to refine and enhance the checklist format over time.

By incorporating structured lists into the management of employee compensation, organizations can foster a more efficient, accurate, and compliant process that benefits all stakeholders involved.

Resources for Payroll Management

Effectively managing employee compensation involves a range of tools and resources that facilitate smooth operations and ensure accuracy. Utilizing the right materials can enhance efficiency, minimize errors, and streamline processes.

Essential Tools

- Software Solutions: Implementing specialized applications designed for financial tracking and employee remuneration.

- Online Calculators: Utilizing digital tools to compute earnings, deductions, and other essential calculations.

- Checklists: Creating lists to ensure all necessary steps and requirements are met throughout the compensation process.

Informational Resources

- Webinars: Participating in online sessions to gain insights from experts in the field.

- Guides and Manuals: Accessing comprehensive documents that outline procedures and best practices.

- Professional Networks: Engaging with industry peers through forums and groups to share knowledge and experiences.

Future Trends in Payroll Processing

As organizations evolve, the methods of managing employee compensation are also undergoing significant changes. With the rise of technology and shifting workforce dynamics, businesses are increasingly looking for innovative solutions to streamline the compensation process, enhance accuracy, and improve employee satisfaction. These developments are shaping the future landscape of how compensation is managed across various industries.

Emphasis on Automation and Technology

One of the most notable shifts is the increasing reliance on automated systems and software. Automation reduces the potential for human error and speeds up the processing of compensation cycles. Companies are investing in advanced platforms that integrate seamlessly with existing systems, allowing for real-time data updates and efficient management of employee records. This transition not only enhances efficiency but also provides valuable insights into workforce analytics.

Focus on Flexibility and Employee Empowerment

Another emerging trend is the growing demand for flexible options that cater to diverse employee needs. Organizations are recognizing the importance of giving employees control over their own compensation preferences, whether it be through personalized payment schedules or the option to receive funds via various methods. This empowerment fosters a positive workplace culture and boosts employee morale, ultimately leading to higher retention rates.