Effective management of financial obligations is essential for businesses of all sizes. A well-structured schedule can significantly enhance an organization’s ability to meet its monetary commitments timely. This section aims to provide a comprehensive resource for establishing a systematic approach to managing employee remuneration cycles throughout the year.

By implementing a clear timeline for disbursements, organizations can ensure that all stakeholders are informed and prepared for upcoming payment intervals. This proactive method not only streamlines the allocation of funds but also fosters transparency and accountability within the workplace.

In the following sections, we will explore various tools and strategies that can aid in crafting a precise overview for tracking financial distributions. This will facilitate efficient planning and ensure that all parties involved have a clear understanding of the payment structure, leading to improved organizational efficiency.

Establishing a systematic approach to compensating employees is crucial for any organization. A well-structured timeline ensures that all team members receive their earnings consistently and on time, fostering trust and satisfaction among staff. Furthermore, an organized payment framework allows for effective budgeting and financial planning, which are essential components for operational success.

Adopting a strategic approach to scheduling not only enhances efficiency but also helps mitigate errors that can lead to dissatisfaction or disputes. By clearly defining pay periods and deadlines, businesses can streamline their processes and reduce the likelihood of compliance issues.

| Key Benefits | Description |

|---|---|

| Employee Satisfaction | Timely compensation contributes to higher morale and productivity. |

| Financial Planning | Structured payment cycles aid in accurate budgeting and cash flow management. |

| Error Reduction | Clear timelines minimize the risk of mistakes in payment calculations. |

| Regulatory Compliance | Adhering to payment schedules helps meet legal and tax obligations. |

Key Components of a Payroll Calendar

A comprehensive schedule for compensating employees encompasses several essential elements that facilitate timely and accurate disbursement of wages. Understanding these core components ensures smooth financial operations within an organization.

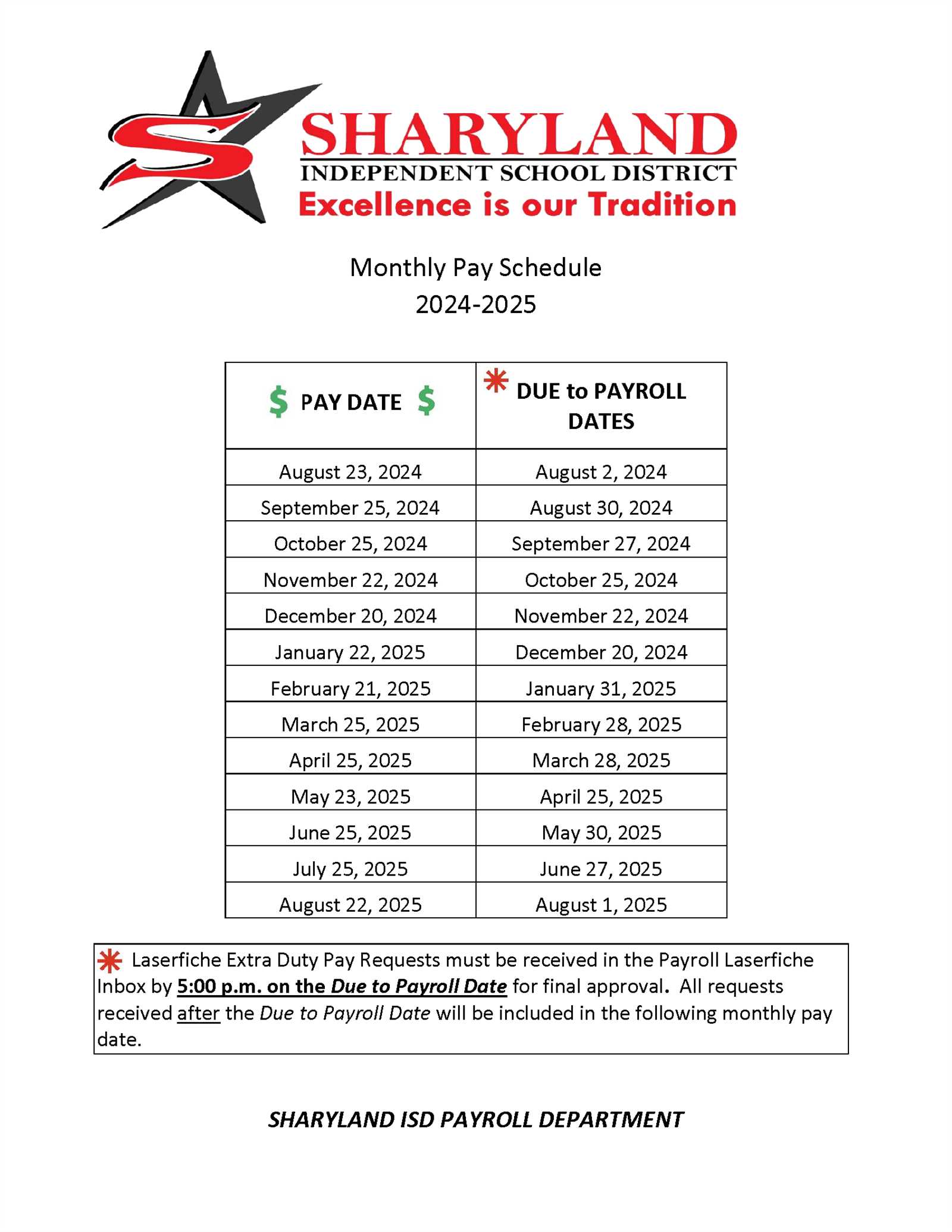

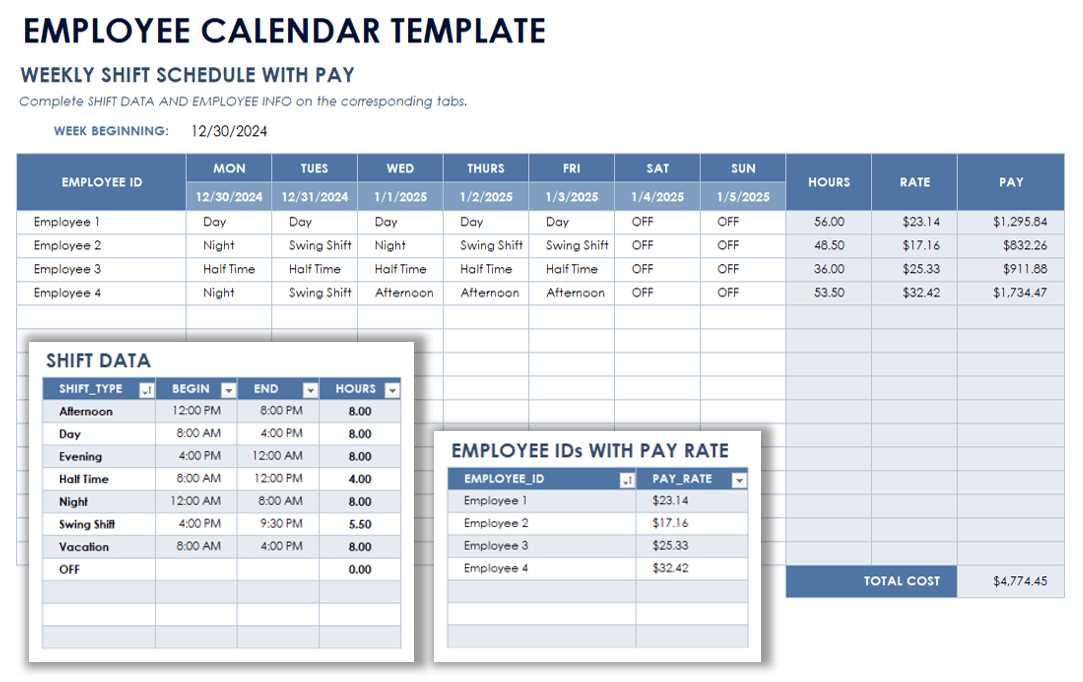

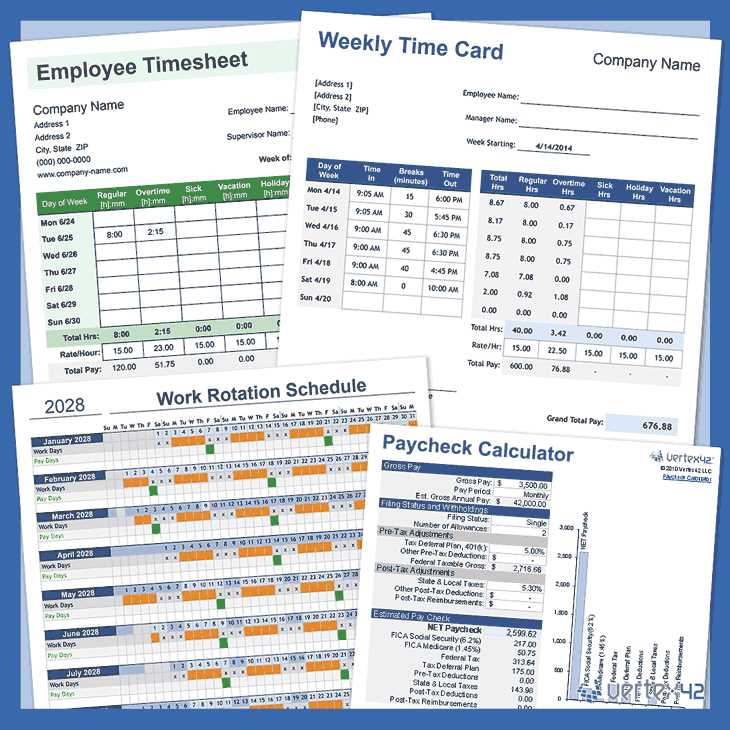

1. Payment Periods: Defining the intervals at which employees receive their earnings is crucial. Common frequencies include weekly, bi-weekly, or monthly arrangements, each impacting cash flow and budgeting.

2. Cut-off Dates: Establishing specific dates when hours worked or leave taken must be submitted allows for efficient processing. These deadlines help in compiling data needed for accurate compensation calculations.

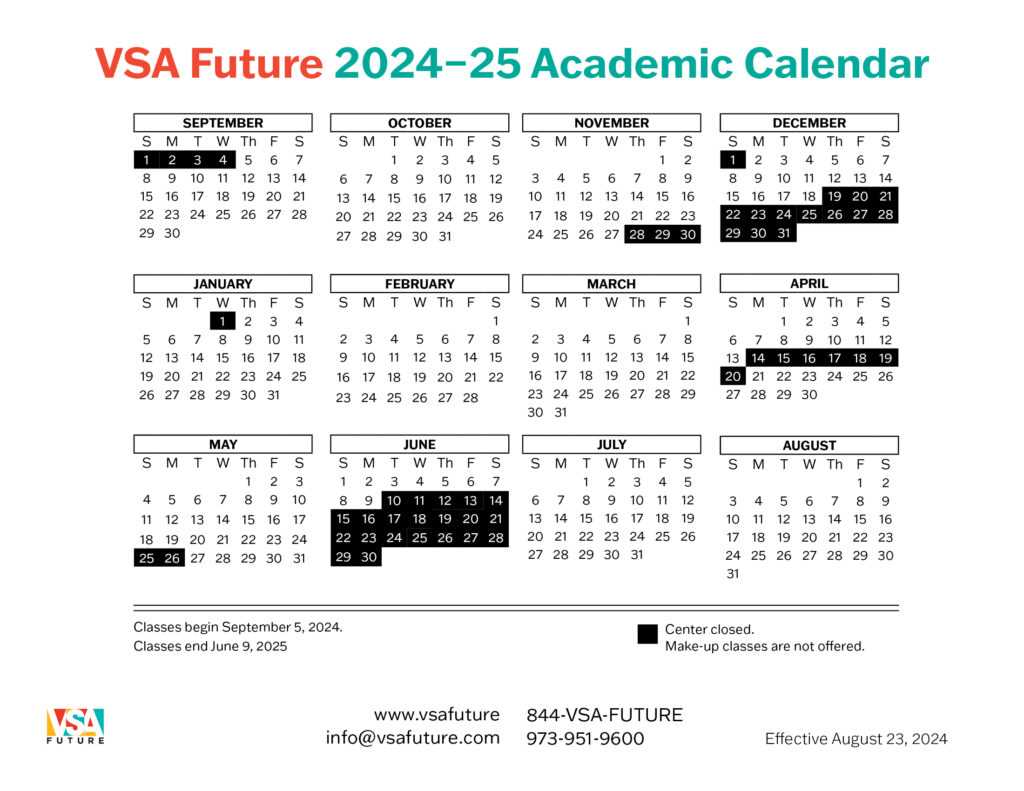

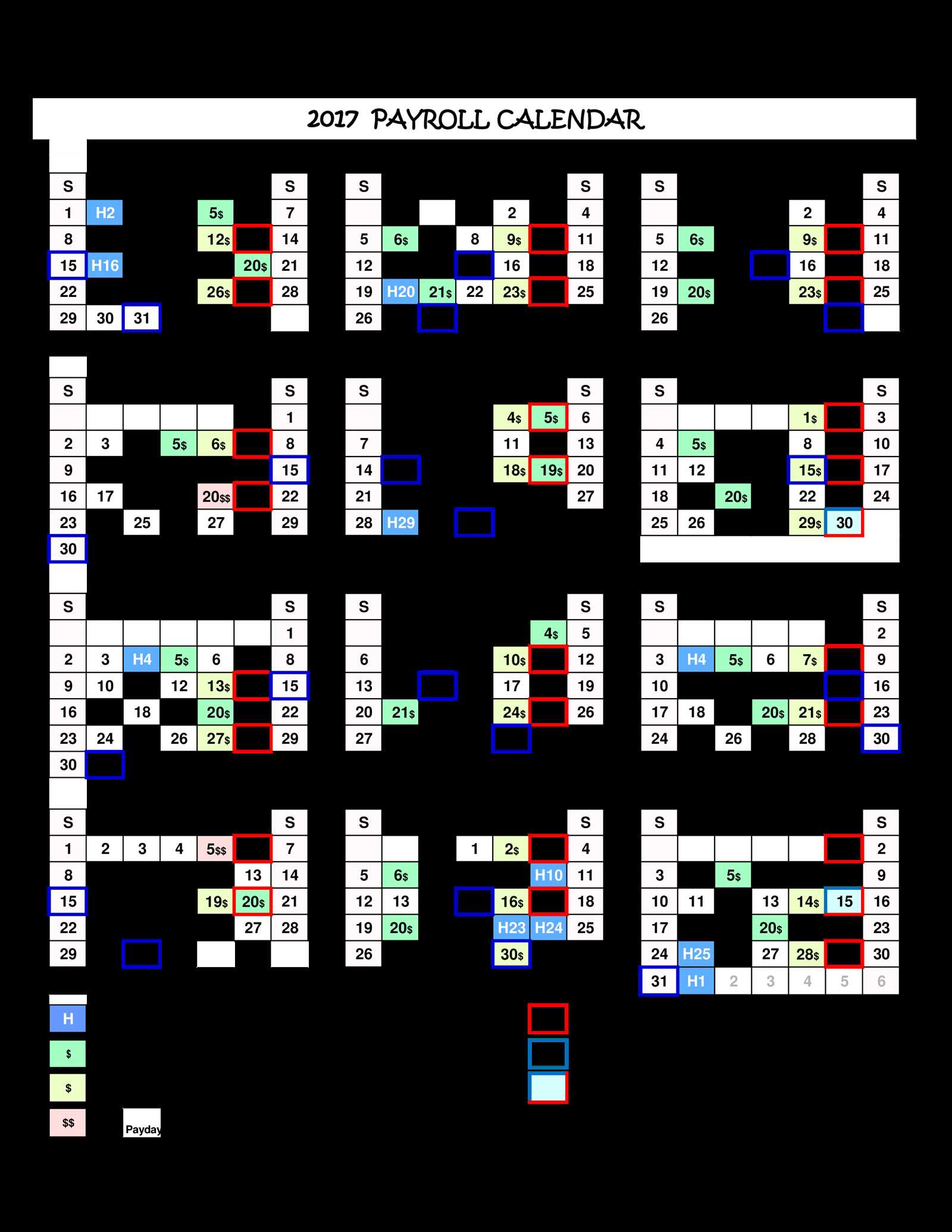

3. Holidays and Non-Working Days: Recognizing public holidays and other non-working days is vital, as they can affect payment schedules. Adjustments may be required to ensure employees are paid on time, even when regular cycles are disrupted.

4. Deductions and Contributions: An effective framework must outline how various withholdings, such as taxes and benefits contributions, are managed. Clarity in this area ensures compliance and transparency for both the organization and its employees.

5. Communication Strategies: Clear channels for informing staff about payment schedules and any changes are essential. Keeping employees well-informed promotes trust and satisfaction regarding their compensation.

Types of Payroll Calendars Available

When managing employee compensation schedules, various formats can cater to different organizational needs. Each structure offers distinct advantages, helping businesses streamline their financial processes and enhance efficiency.

Weekly Structure

A weekly framework involves processing payments every seven days, providing quick turnaround for employees. This approach is beneficial for companies with hourly workers, ensuring prompt compensation and easier budget tracking on a short-term basis.

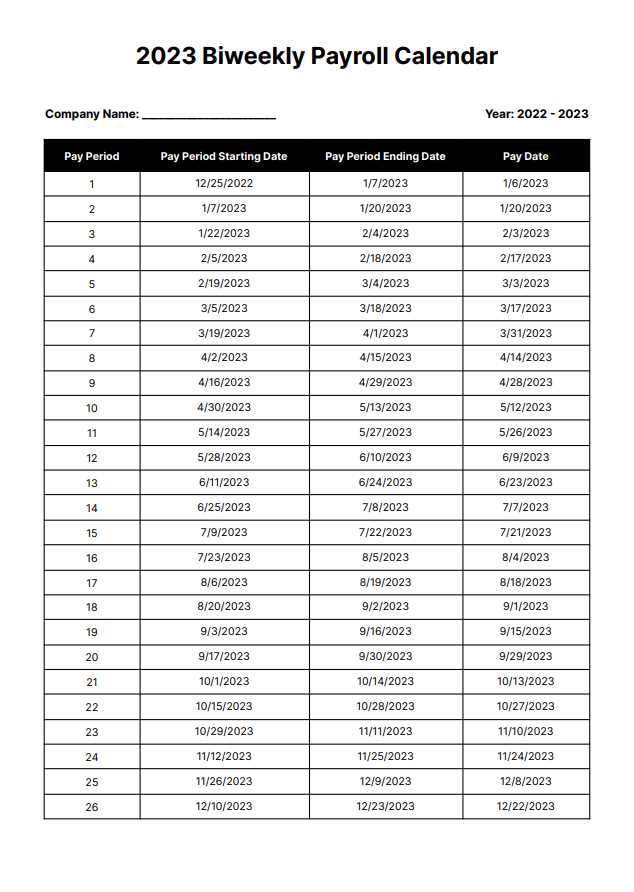

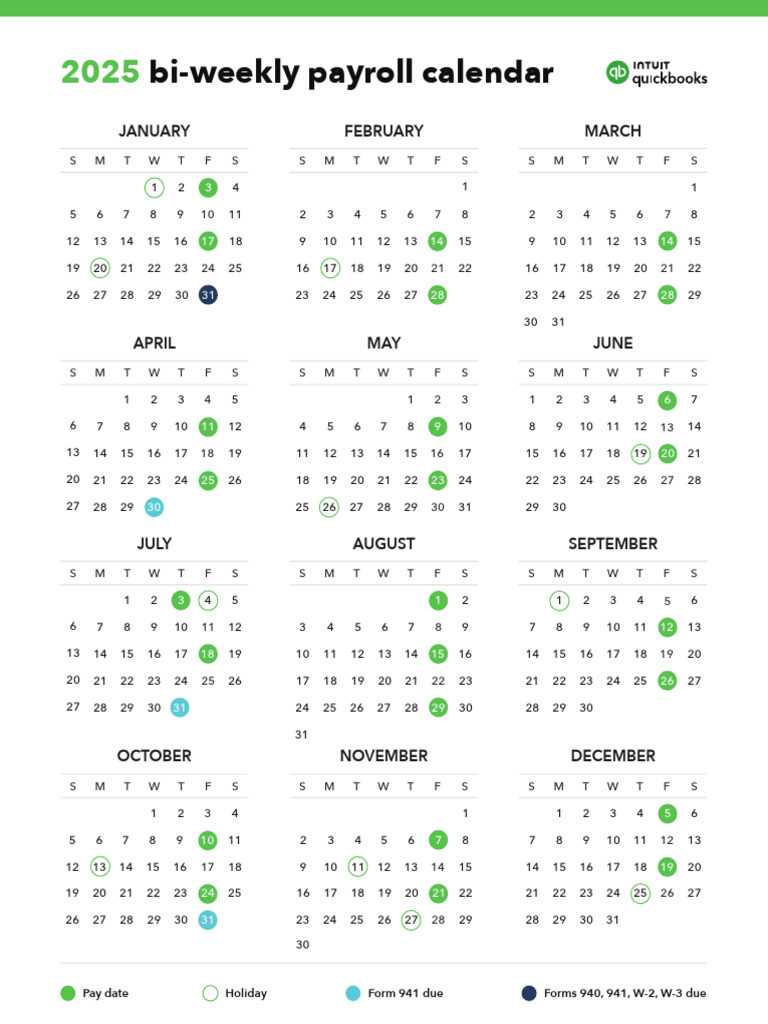

Biweekly Structure

The biweekly model processes payments every two weeks, typically resulting in 26 pay periods per year. This format strikes a balance between frequency and administrative workload, making it popular among many organizations for managing payroll while maintaining consistent cash flow.

Monthly vs. Biweekly Payroll Systems

The choice between different compensation frequencies can significantly impact both employees and organizations. Understanding the distinctions between monthly and biweekly payment structures is essential for effective financial planning and employee satisfaction. Each method offers unique advantages and challenges that can influence budgeting, cash flow, and employee morale.

Benefits of Monthly Payments

Monthly compensation systems are straightforward and easy to manage. Employees receive their earnings once a month, simplifying administrative tasks for the finance department. This approach can be beneficial for long-term financial planning for both employees and the organization.

Advantages of Biweekly Payments

On the other hand, biweekly payment schedules provide employees with more frequent access to their funds, which can enhance financial flexibility. This system can lead to improved employee satisfaction, as it allows for better cash flow management and aligns more closely with regular expenses such as rent or utilities.

| Aspect | Monthly Payments | Biweekly Payments |

|---|---|---|

| Frequency | Once a month | Every two weeks |

| Cash Flow Management | Predictable for budgeting | Increased liquidity for employees |

| Administrative Complexity | Simpler processing | More frequent calculations |

| Employee Satisfaction | Stable but less frequent | Improved access to funds |

Setting Up a Payroll Calendar

Creating an effective schedule for employee compensation is essential for ensuring timely and accurate payments. A well-structured approach not only streamlines the process but also helps in maintaining compliance with relevant regulations. This section outlines the key steps involved in establishing a systematic framework for managing pay periods.

Understanding Pay Periods

The first step is to define the intervals at which employees will receive their earnings. Common options include weekly, bi-weekly, semi-monthly, or monthly schedules. Each option has its benefits and can be selected based on the organization’s needs and workforce preferences.

Establishing Payment Dates

Once the intervals are set, it’s crucial to determine the specific dates for disbursing payments. This should take into account factors such as holidays, weekends, and any company-specific considerations. By planning ahead, organizations can avoid disruptions in the payment process.

| Pay Frequency | Typical Schedule | Advantages |

|---|---|---|

| Weekly | Every Friday | Quick cash flow for employees |

| Bi-Weekly | Every other Friday | Balanced workload for payroll processing |

| Semi-Monthly | 15th and last day of the month | Predictable payment schedule |

| Monthly | Last day of the month | Simplifies administration |

Common Mistakes to Avoid

When managing financial schedules, several common pitfalls can lead to complications and discrepancies. Being aware of these missteps is essential for ensuring smooth operations and accurate tracking of monetary obligations.

One frequent error is failing to account for variations in pay periods. Each organization may have unique time frames, and neglecting to adjust for holidays or weekends can result in missed payments. Planning ahead for these irregularities is crucial to maintain consistency.

Another mistake is overlooking employee classifications. Misclassifying workers can lead to legal issues and financial penalties. It is vital to review each position and ensure accurate categorization to comply with regulations.

Additionally, many fail to communicate changes effectively. Whether it’s adjustments in rates or shifts in schedules, keeping all stakeholders informed prevents misunderstandings and fosters trust within the team. Regular updates and clear notifications are essential.

Lastly, inadequate record-keeping can cause significant setbacks. Maintaining organized and accessible documentation is key to resolving discrepancies and ensuring compliance. Implementing a reliable tracking system can streamline this process and enhance efficiency.

Benefits of Using a Template

Utilizing a structured format for organizing payment schedules offers numerous advantages for individuals and businesses alike. These predefined layouts facilitate efficiency and accuracy, streamlining the overall process of managing financial transactions.

- Time-Saving: Pre-designed formats significantly reduce the time spent on planning and organizing. This allows users to focus on more critical aspects of their operations.

- Consistency: Adopting a uniform approach ensures that all necessary elements are included and presented clearly, minimizing the risk of errors and discrepancies.

- Ease of Use: User-friendly formats are straightforward, making them accessible even to those with limited experience in financial management.

- Customization: While structured, these formats can be easily modified to meet specific needs, providing flexibility to adapt to various requirements.

- Improved Tracking: Utilizing a systematic layout aids in better monitoring and reviewing of financial obligations, enhancing overall management practices.

How to Customize Your Template

Creating a personalized schedule for managing payments involves several key steps that allow you to tailor the structure according to your specific needs. By making adjustments, you can ensure that the format aligns with your organizational requirements and enhances your overall workflow.

Identify Your Requirements

Begin by assessing what features are essential for your specific situation. Consider factors such as the frequency of transactions, important deadlines, and any unique needs that may arise in your operations. This understanding will guide you in shaping the framework effectively.

Modify Layout and Design

Once you have a clear vision of your needs, focus on altering the layout and aesthetic aspects. Adjust columns, rows, and colors to create a visually appealing format. Utilizing consistent themes can help in maintaining clarity and ease of use, making it simpler for everyone involved to navigate through the information.

Incorporating these adjustments will not only enhance usability but also contribute to a more efficient management process, ultimately benefiting your overall financial administration.

Integrating with Payroll Software

Seamlessly connecting your compensation management system with automated tools can enhance efficiency and accuracy in financial operations. Such integration facilitates the smooth transfer of employee data, payment schedules, and compliance information, reducing manual errors and streamlining processes.

To achieve a successful connection, it’s essential to select software solutions that offer compatibility with existing systems. Many platforms provide APIs or direct integrations that simplify data synchronization, allowing for real-time updates and reducing the risk of discrepancies.

Additionally, ensuring that both systems can communicate effectively will help in maintaining up-to-date records, making it easier to generate reports and track financial performance. Regular assessments of the integration process will also aid in identifying areas for improvement and ensuring optimal functionality.

Tracking Employee Hours Effectively

Managing the time and attendance of your workforce is crucial for optimizing productivity and ensuring accurate compensation. Establishing a reliable system for monitoring work hours can significantly enhance operational efficiency and employee satisfaction.

Implementing technology is one of the most effective ways to track working hours. Utilizing software solutions can automate timekeeping, reducing errors and streamlining the process. Employees can log their hours through user-friendly applications, making it easier to manage their schedules and workload.

Regular training on the tools and processes is essential. Ensuring that all team members understand how to accurately record their hours will minimize discrepancies and promote accountability. This training can also cover the importance of timely reporting and how it impacts overall business performance.

Finally, periodic reviews of time-tracking data can provide valuable insights into work patterns and help identify areas for improvement. By analyzing this information, organizations can make informed decisions about resource allocation and employee support, ultimately fostering a more productive work environment.

Managing Overtime and Holidays

Effectively overseeing extra working hours and time off is crucial for maintaining a balanced workforce and ensuring employee satisfaction. Proper management of these aspects not only helps in adhering to regulations but also contributes to a positive work environment. By establishing clear guidelines and communication, organizations can navigate the complexities of employee hours and leave.

Establishing Clear Policies

Having well-defined policies regarding additional hours and holidays can greatly reduce confusion and disputes. Organizations should outline the criteria for when extra hours are permitted, how they are compensated, and the process for requesting time off. Transparency in these policies fosters trust and helps employees understand their rights and responsibilities.

Monitoring Work Hours

Regularly tracking and analyzing employee hours is essential for effective management. Utilizing software tools can streamline this process, providing insights into working patterns and helping identify trends that may require adjustments. Proactive monitoring allows organizations to respond promptly to any issues related to overtime or leave requests, ensuring compliance and maintaining workforce morale.

Year-End Considerations for Payroll

As the fiscal year comes to a close, it is essential for organizations to take stock of various factors that influence employee compensation processes. This period involves meticulous planning and execution to ensure compliance and accuracy in financial reporting.

Data Accuracy: Review all employee records for any discrepancies. Ensuring that personal details, payment amounts, and deductions are correct helps avoid complications during audits.

Compliance with Regulations: Familiarize yourself with any changes in tax laws and labor regulations that may affect compensation structures. Adhering to updated guidelines prevents potential penalties.

Reporting Requirements: Prepare for year-end reporting obligations by gathering necessary documentation. This may include forms related to income, taxes withheld, and benefits provided, which are critical for both employees and governmental entities.

Employee Communication: Inform staff about important deadlines and any changes that may impact their earnings or tax obligations. Transparent communication fosters trust and reduces inquiries during this busy period.

Future Planning: Evaluate the current processes and identify areas for improvement. This reflection not only enhances efficiency for the upcoming year but also ensures that the organization is well-prepared for any challenges ahead.

Compliance with Tax Regulations

Adhering to financial obligations is essential for any organization aiming to operate smoothly and maintain a positive relationship with regulatory authorities. Understanding the nuances of tax responsibilities ensures that a business remains in good standing and avoids potential penalties. This includes keeping accurate records and meeting all deadlines associated with contributions and deductions.

One of the key aspects of fulfilling these responsibilities is staying informed about current legislation and any changes that may arise. Regular updates to tax laws necessitate a proactive approach to compliance, enabling organizations to adjust their practices accordingly. Additionally, utilizing comprehensive documentation helps streamline the reporting process and provides clarity when it comes to audits.

Furthermore, implementing reliable tracking systems can significantly enhance accuracy in managing financial obligations. Automation and technology can assist in reducing errors and ensuring that all required submissions are completed on time. By prioritizing compliance, businesses can safeguard their operations and foster a trustworthy environment for both employees and stakeholders.

Updating Your Payroll Calendar Annually

Maintaining an accurate schedule for employee compensation is essential for any organization. Regularly revising this framework ensures that all involved parties are aligned with the latest financial practices and regulations. An annual review allows businesses to adapt to changing circumstances while enhancing efficiency and transparency in their processes.

Key Considerations for Annual Revisions

- Regulatory Changes: Stay informed about any new laws or regulations that may affect compensation practices.

- Company Policy Updates: Review and incorporate any internal policy changes that impact payment cycles.

- Employee Feedback: Gather input from staff to identify areas for improvement in the payment structure.

Steps for Effective Updating

- Assess the current schedule for potential gaps or inconsistencies.

- Research relevant legislative updates that might influence compensation timing.

- Communicate changes clearly to all employees to ensure understanding and compliance.

- Implement the revised structure and monitor its effectiveness throughout the year.

Resources for Payroll Management

Effective management of employee compensation involves a variety of tools and resources designed to streamline processes and enhance accuracy. Leveraging the right solutions can significantly improve efficiency and ensure compliance with regulations.

Key Tools for Efficient Management

- Cloud-based software for real-time tracking

- Automated systems for calculations and reporting

- Integration with accounting platforms for seamless operations

Educational Resources

Staying informed about best practices is crucial. Various platforms offer valuable information and training:

- Online courses covering regulatory updates and software usage

- Webinars with industry experts sharing insights

- Blogs and forums for community support and advice

Future Trends in Payroll Scheduling

The landscape of employee compensation management is evolving, driven by technological advancements and changing workforce expectations. As organizations adapt to these shifts, new methodologies and practices are emerging to enhance efficiency and employee satisfaction.

One significant trend is the increasing reliance on automation. Advanced software solutions are streamlining the calculation and distribution of remuneration, reducing the potential for human error and enabling timely processing. This shift allows organizations to allocate resources more effectively and focus on strategic initiatives.

Additionally, flexibility is becoming paramount. Many companies are recognizing the importance of accommodating diverse work arrangements, including remote work and variable hours. As a result, adaptive scheduling systems are being implemented, allowing for personalized pay periods that align with individual employee needs.

| Trend | Description |

|---|---|

| Automation | Streamlining processes to minimize errors and improve efficiency. |

| Flexibility | Customizing pay schedules to fit diverse work arrangements. |

| Real-time Access | Providing employees with immediate visibility into their compensation details. |

| Data Analytics | Leveraging analytics to make informed decisions about compensation strategies. |

In conclusion, as organizations embrace these trends, they are better equipped to navigate the complexities of compensation management, fostering a more engaged and productive workforce.