In today’s fast-paced world, effective management of compensation cycles is crucial for both employers and employees. A well-structured schedule helps ensure timely disbursement of wages, fostering satisfaction and productivity within the workforce. This guide will provide insight into organizing your financial periods seamlessly, enabling smooth operations throughout the year.

Understanding the Importance of Structure

Establishing a clear framework for remuneration periods is vital for maintaining transparency and accountability. A strategic approach not only benefits the organization but also aids in budget planning and resource allocation. By aligning all parties involved, you can create a harmonious environment that prioritizes financial stability.

Maximizing Efficiency Through Organization

With the right planning tools at your disposal, managing pay cycles becomes less daunting. This article will explore various strategies and resources designed to streamline your financial planning process, ensuring you remain ahead in the competitive landscape while catering to the needs of your team.

Understanding Payroll Calendars

The concept of structured financial scheduling is essential for any organization aiming to manage compensation effectively. This framework provides clarity on when employees receive their earnings and ensures timely processing of payments. With a systematic approach, companies can enhance operational efficiency and employee satisfaction.

Different types of scheduling frameworks cater to various business needs, whether it’s weekly, bi-weekly, or monthly arrangements. Each method has its advantages, influencing both administrative workload and employee expectations. For instance, a more frequent pay structure may boost morale, while less frequent options might simplify management tasks.

Ultimately, understanding the intricacies of these scheduling systems allows businesses to make informed decisions that align with their financial strategies and workforce requirements. A well-defined approach can lead to improved cash flow management and heightened employee trust.

Importance of Payroll Scheduling

Effective timing in compensation distribution is crucial for any organization. A well-structured approach ensures that employees receive their earnings promptly, fostering trust and satisfaction. Moreover, systematic planning aids in budgeting and financial forecasting, allowing companies to manage their resources efficiently.

Enhancing Employee Morale

When payment is consistent and predictable, it significantly boosts workforce morale. Employees are more likely to feel valued and motivated when they know they can count on receiving their wages on time. This reliability contributes to a positive work environment and can lead to increased productivity.

Streamlining Financial Operations

A structured approach to remuneration not only benefits employees but also simplifies internal processes. By establishing clear timelines for payment distribution, organizations can better align their financial operations with overall business goals. This alignment minimizes errors, reduces administrative burdens, and ultimately enhances operational efficiency.

How to Choose a Payroll Calendar

Selecting the right schedule for compensating employees is crucial for any organization. This decision impacts cash flow, employee satisfaction, and compliance with legal obligations. Understanding the various options available can help you make an informed choice that aligns with your business needs.

Consider Your Business Needs

Every organization operates differently, so it’s essential to evaluate your specific requirements. Here are some factors to consider:

- Employee Preferences: Gather feedback from your team to understand their preferences regarding pay frequency.

- Cash Flow Management: Assess your company’s financial situation to determine how often you can comfortably disburse funds.

- Operational Efficiency: Think about how the chosen schedule will affect administrative tasks and processes.

Evaluate Different Options

There are various pay structures, each with its own advantages and disadvantages. Review the following options:

- Weekly: Offers employees quick access to funds but requires more administrative effort.

- Biweekly: Strikes a balance between frequency and workload, commonly used by many businesses.

- Monthly: Simplifies payroll processing but may be challenging for employees who prefer more frequent payments.

Ultimately, the decision should align with your organization’s operational goals while considering the preferences and needs of your workforce.

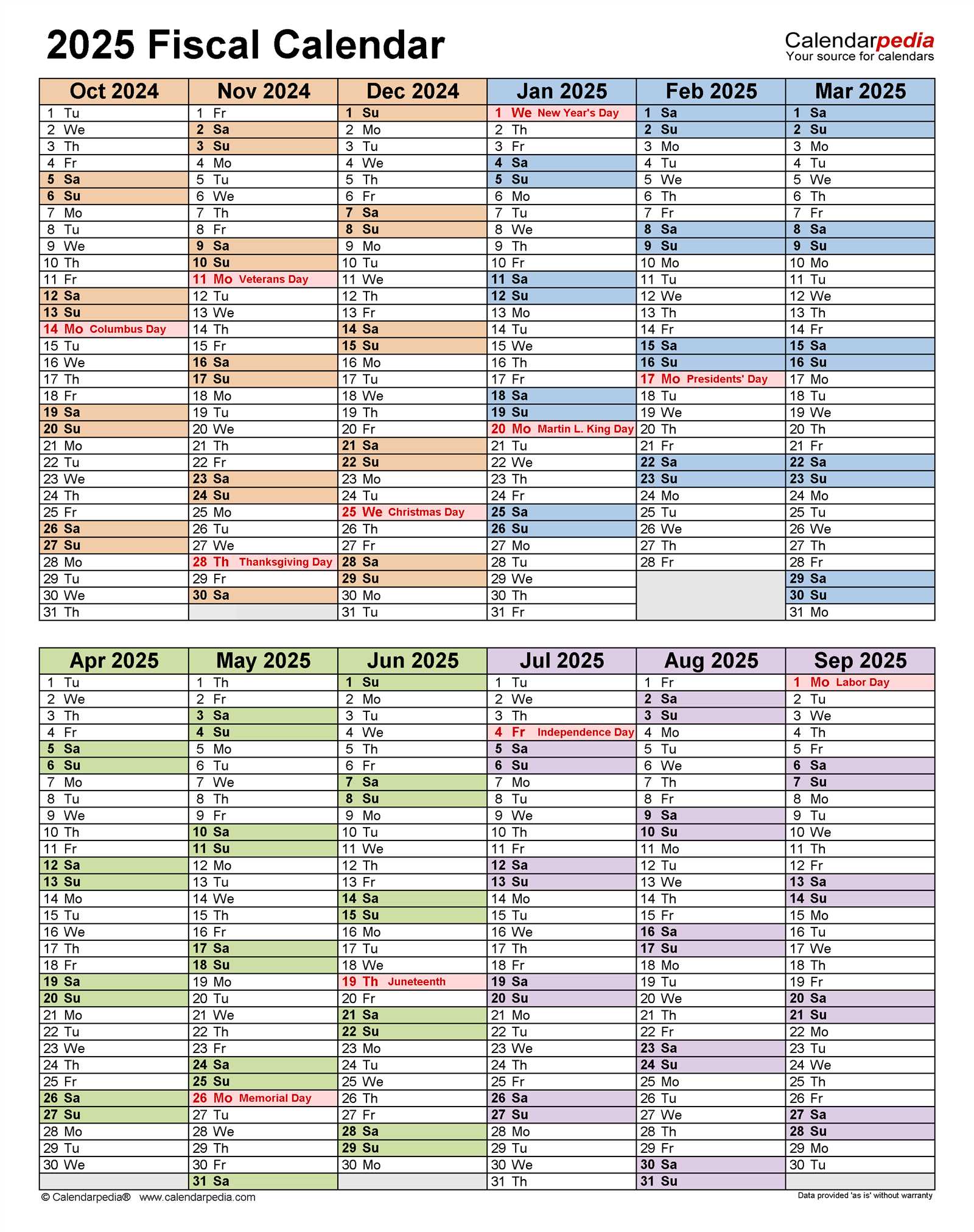

Key Dates for Payroll Processing

Effective management of employee compensation requires careful attention to specific dates throughout the year. Knowing these critical moments can help ensure that all financial obligations are met on time, preventing potential delays and penalties. Below is a table outlining important timeframes that should be noted for smooth operations.

| Date | Event | Description |

|---|---|---|

| January 1 | New Year’s Day | Federal holiday affecting processing schedules. |

| March 15 | Quarterly Tax Due | Deadline for first quarter estimated tax payments. |

| June 30 | Mid-Year Review | Assessment of employee compensation and adjustments. |

| September 15 | Quarterly Tax Due | Deadline for third quarter estimated tax payments. |

| December 31 | Year-End Processing | Final adjustments and reporting for the year. |

Staying informed about these essential dates can greatly enhance the efficiency and reliability of financial practices. Regularly reviewing these milestones ensures that all necessary actions are taken in a timely manner, contributing to overall organizational health.

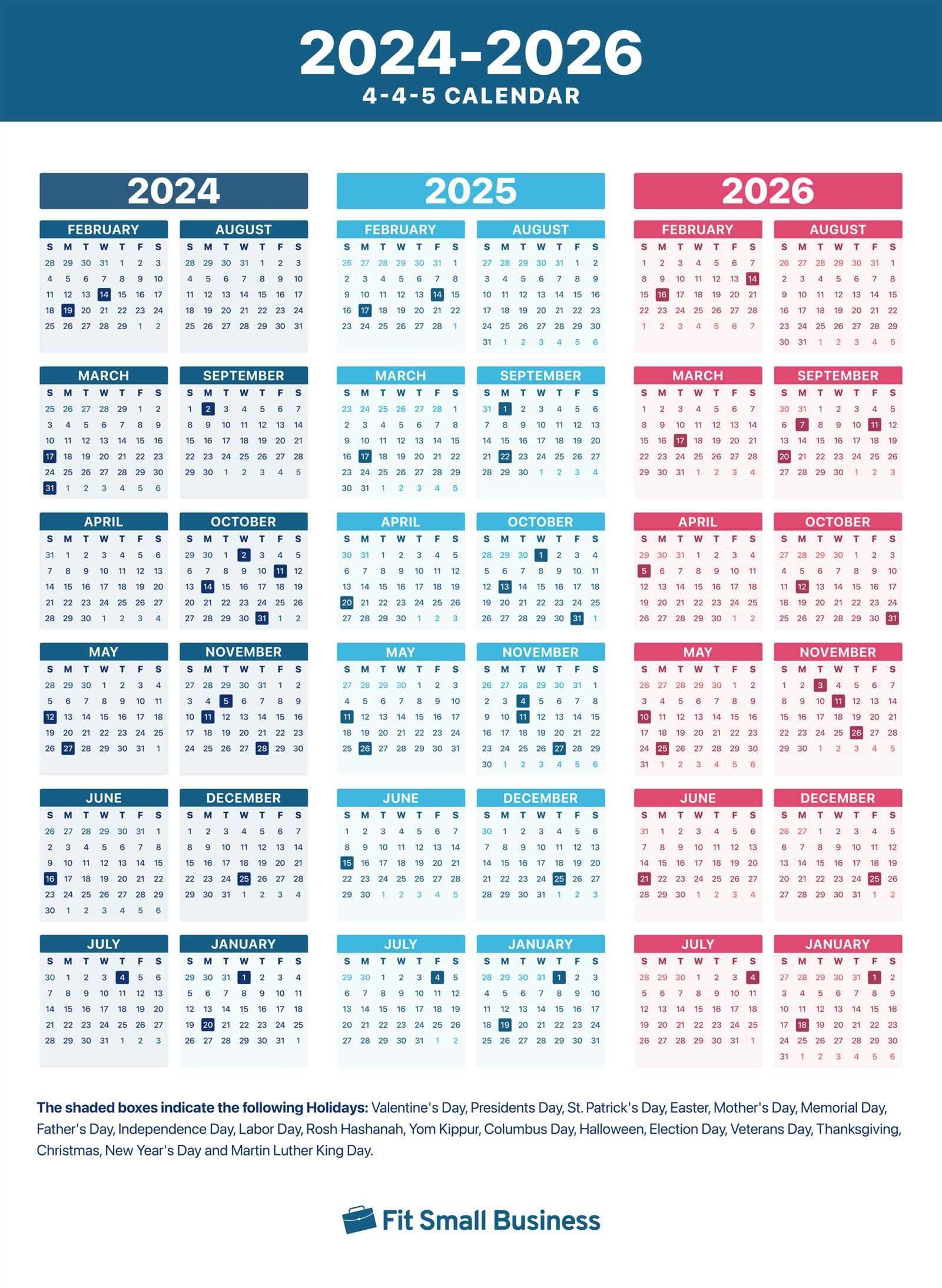

Types of Payroll Calendars Explained

Understanding the different systems for managing employee compensation is crucial for any organization. Each method has its own unique advantages and is suited to different business needs and employee preferences. This section delves into the most common systems used to determine pay periods and their respective characteristics.

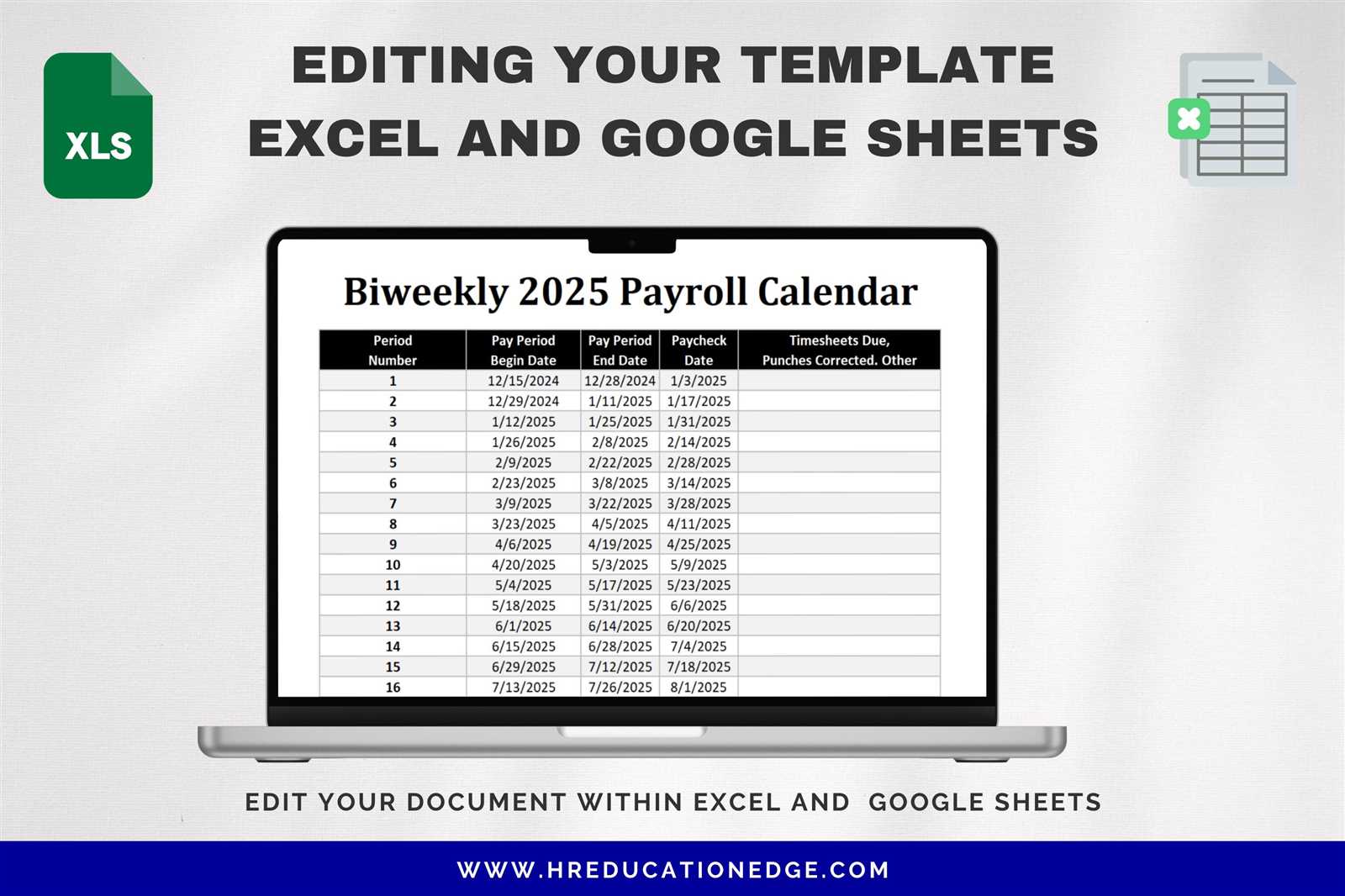

Weekly and Bi-Weekly Systems

Among the most prevalent methods are the weekly and bi-weekly arrangements. The weekly approach offers consistent and frequent payments, allowing employees to manage their finances more easily. In contrast, the bi-weekly model typically results in fewer checks per year, which can simplify administrative tasks. Companies often choose one of these based on their cash flow and operational requirements.

Monthly and Semi-Monthly Methods

For those seeking a more straightforward approach, the monthly and semi-monthly systems are ideal. The monthly method consolidates pay into a single payment each month, which can benefit budgeting and financial planning. On the other hand, the semi-monthly option divides the month into two pay periods, providing a balance between frequency and simplicity. Each method has implications for tax calculations and employee budgeting, making it important to choose wisely.

Annual vs. Biweekly Payroll Calendars

When managing employee compensation, organizations often choose between different frequency options for pay distribution. Each approach has its advantages and challenges, affecting both the workforce and administrative processes. Understanding these variations is crucial for ensuring smooth operations and employee satisfaction.

Understanding Annual Cycles

An annual cycle typically involves disbursing salaries in a single sum or in fewer installments throughout the year. This method can simplify budgeting for both employers and employees, as they can plan their finances based on larger, less frequent amounts. However, the longer wait times between payments may create cash flow challenges for employees who prefer more frequent access to their earnings.

The Benefits of Frequent Payments

On the other hand, opting for a biweekly system allows for more regular payment intervals, offering employees greater financial flexibility. With payments occurring every two weeks, individuals can manage their expenses more effectively and reduce the stress associated with long gaps between earnings. This approach may also enhance employee morale, as receiving paychecks more often can improve overall job satisfaction. However, the increased frequency requires more rigorous administrative tracking and can complicate budgeting for organizations.

Customizing Your Payroll Template

Personalizing your financial schedule can significantly enhance efficiency and accuracy in managing employee compensation. Tailoring this document allows you to better align with your organization’s specific needs, ensuring that all critical dates and processes are clearly defined and easy to follow.

When creating a customized version, consider the following elements:

| Element | Description |

|---|---|

| Frequency of Payments | Determine how often you will disburse funds, such as weekly, biweekly, or monthly. |

| Important Dates | Include all significant dates like paydays, deadlines for submissions, and any holidays that may affect scheduling. |

| Employee Information | Designate sections for key employee details to streamline processing and minimize errors. |

| Compliance Notes | Add reminders for legal obligations or tax considerations relevant to your jurisdiction. |

By addressing these components, you can ensure that your customized structure is not only functional but also user-friendly, facilitating smoother operations within your team.

Best Practices for Payroll Management

Effective management of employee compensation is crucial for any organization. Implementing efficient strategies not only ensures accuracy but also fosters trust and satisfaction among staff. By adhering to best practices, companies can streamline processes and minimize errors, leading to improved overall operations.

1. Maintain Accurate Records: Keeping precise and up-to-date records is essential. This includes employee information, hours worked, and compensation details. Regular audits can help identify discrepancies and maintain integrity in the system.

2. Automate Processes: Utilizing technology to automate calculations and reporting can significantly reduce manual errors. Automated systems can handle complex computations, ensuring timely and accurate disbursement of funds.

3. Stay Compliant: Regularly review local, state, and federal regulations to ensure compliance with all legal requirements. This not only helps avoid penalties but also enhances the company’s reputation.

4. Provide Employee Access: Allowing employees to access their information promotes transparency. Online portals can enable staff to view pay stubs, tax documents, and benefits information, empowering them to manage their financial affairs effectively.

5. Train Your Team: Continuous education for those involved in compensation processes is vital. Training sessions can cover new regulations, software updates, and best practices, ensuring the team remains knowledgeable and competent.

6. Regularly Review Procedures: Periodically assess and refine procedures to enhance efficiency. Gathering feedback from employees can also provide insights into areas for improvement, leading to a more streamlined experience.

By implementing these strategies, organizations can create a robust framework for managing employee compensation that is both efficient and trustworthy.

Software Solutions for Payroll Calendars

Effective management of employee compensation requires precise planning and organization. Innovative software tools are designed to streamline this process, enabling businesses to maintain accurate records and ensure timely payments. These solutions provide a range of features that simplify the complexities involved in managing schedules and financial disbursements.

Many of these applications offer automated functionalities that minimize manual input, reducing the risk of errors. Users can benefit from customizable settings that cater to specific business needs, allowing for tailored tracking of work hours and payment cycles. Integration with other systems, such as accounting and human resources platforms, enhances efficiency and data accuracy.

Furthermore, modern solutions often include reporting tools that provide valuable insights into financial trends and employee hours. This data can inform decision-making processes, ensuring that organizations remain compliant with regulations while optimizing their operational strategies. As the landscape of workforce management evolves, these technological advancements play a crucial role in fostering a more organized and efficient environment.

Common Payroll Calendar Mistakes

Managing schedules for employee compensation can be a complex task, often leading to errors that affect both the organization and its workforce. Recognizing frequent pitfalls in this process is crucial for ensuring accuracy and efficiency. Below are some common errors that can arise during this critical management task.

Inaccurate Tracking of Hours can result in employees being overpaid or underpaid. It’s essential to implement reliable systems for logging time worked, including overtime and leave.

Failing to Update for Holidays is another frequent oversight. Not accounting for official days off can disrupt payment cycles and create confusion among staff regarding their earnings.

Neglecting Employee Changes such as promotions, terminations, or status updates can lead to significant discrepancies. Keeping records current ensures that all compensation reflects the most recent agreements and roles.

Miscommunication with Staff can lead to misunderstandings about payment schedules and amounts. Clear communication channels are necessary to keep employees informed and engaged regarding their financial expectations.

Inconsistent Policies can create confusion and potential legal issues. Establishing and adhering to standardized procedures for managing compensation can help avoid disputes and ensure fairness.

By being aware of these common missteps, organizations can take proactive measures to enhance their management processes and foster a more positive workplace environment.

Benefits of a 2026 Payroll Calendar

Having a structured framework for tracking compensation cycles offers numerous advantages for both employers and employees. Such an organized approach ensures timely payments, simplifies financial planning, and enhances overall workplace satisfaction.

Enhanced Organization: A well-defined schedule helps businesses manage their financial commitments effectively. By adhering to a consistent timeline, companies can avoid confusion and ensure that all payments are processed promptly.

Improved Financial Planning: For employees, knowing the exact dates of compensation allows for better personal budgeting. This predictability aids in planning for monthly expenses, savings, and investments, ultimately leading to improved financial well-being.

Reduced Errors: An established framework minimizes the likelihood of mistakes in payment processing. With clear timelines and deadlines, businesses can streamline their administrative tasks, ensuring that all calculations are accurate and timely.

Increased Employee Satisfaction: Regular and predictable payment cycles contribute to higher morale among staff. When employees can rely on receiving their wages consistently, it fosters trust and enhances their overall experience at work.

Regulatory Compliance: Adhering to a specific schedule also aids in meeting legal obligations related to compensation. Staying compliant with regulations is crucial for avoiding penalties and maintaining a positive reputation in the industry.

Overall, implementing an organized structure for compensation cycles leads to significant benefits that promote efficiency, satisfaction, and reliability within the workplace.

Integrating Payroll Calendars with Accounting

Effective synchronization between employee compensation schedules and financial management systems is crucial for any organization. This integration ensures that financial data reflects accurate compensation timelines, streamlining processes and enhancing overall efficiency. A seamless connection allows for timely reporting, budgeting, and compliance with regulatory requirements.

Benefits of Integration

When these systems work in harmony, organizations can achieve significant advantages. First, it reduces the risk of errors that can occur when manual entries are made. Second, it provides real-time insights into financial obligations, enabling better cash flow management. Finally, an integrated approach fosters transparency and accountability, which are essential for maintaining trust within the organization.

Best Practices for Successful Integration

To successfully link these systems, organizations should consider a few best practices. Choose compatible software that allows for easy data exchange between systems. Regular training for staff on both systems will ensure everyone is up to date on processes and procedures. Finally, monitor and evaluate the integration regularly to identify areas for improvement and ensure everything runs smoothly.

Legal Requirements for Payroll Schedules

Establishing a systematic approach to compensation distribution is crucial for any organization. Adhering to legal obligations ensures not only compliance with regulations but also fosters trust among employees. Understanding these requirements is essential for maintaining smooth operations and avoiding potential penalties.

Frequency of Payments: Laws typically dictate how often employees must receive their earnings. Depending on the jurisdiction, this may vary from weekly to monthly. Employers must familiarize themselves with local regulations to ensure timely disbursements.

Documentation and Record-Keeping: Accurate records of compensation transactions are mandated by law. This includes tracking hours worked, wage rates, and deductions. Maintaining comprehensive documentation helps protect both the employer and employees in case of disputes or audits.

Minimum Wage Compliance: Employers are required to adhere to established minimum wage laws, which may differ by region. It is imperative to regularly review and update pay rates to ensure compliance with these legal standards.

Overtime Regulations: Certain jurisdictions have specific rules regarding overtime compensation. Understanding when and how to calculate overtime pay is vital for meeting legal obligations and preventing employee grievances.

Notification Requirements: Some laws require employers to notify employees about their pay structure, including frequency and method of payment. Keeping employees informed promotes transparency and helps prevent misunderstandings.

By being aware of these legal standards, organizations can cultivate a compliant and fair work environment, ultimately contributing to employee satisfaction and operational efficiency.

Tips for Communicating Payroll Dates

Effective communication regarding compensation schedules is crucial for maintaining transparency and trust within an organization. Ensuring that all employees are well-informed about when they can expect their payments not only enhances satisfaction but also minimizes confusion and anxiety.

Utilize Multiple Channels

To reach everyone effectively, consider using various communication methods. Emails, team meetings, and internal messaging platforms can all play a role in disseminating important dates. By employing different channels, you increase the likelihood that the information will be seen and understood.

Provide Clear and Concise Information

When sharing details about payment timelines, clarity is key. Use straightforward language and bullet points to highlight essential dates and any changes that may occur. Emphasizing important deadlines helps ensure that employees are aware of when to expect their funds, which can enhance overall financial planning.

Regular updates and reminders as the payment dates approach can further reinforce this information, ensuring it stays top of mind for everyone involved.

Tracking Employee Hours Effectively

Accurately monitoring the hours worked by employees is essential for any organization aiming to enhance productivity and ensure fair compensation. Implementing efficient tracking methods not only streamlines operations but also boosts employee morale and trust.

To achieve effective monitoring, consider the following strategies:

- Utilize Technology: Invest in software that allows for real-time tracking of hours. This can minimize errors and provide instant data access.

- Encourage Regular Reporting: Motivate employees to log their hours consistently, fostering a habit that can reduce discrepancies.

- Implement Clear Guidelines: Establish straightforward policies regarding how time should be recorded, ensuring that all team members understand the expectations.

- Conduct Regular Audits: Periodically review time logs to identify patterns or issues, allowing for adjustments before they become problematic.

By focusing on these practices, organizations can create a transparent and efficient system for tracking employee hours, ultimately contributing to a more harmonious workplace environment.

Resources for Payroll Calendar Templates

When it comes to organizing payment schedules, having the right tools and resources can greatly enhance efficiency and accuracy. A variety of options are available to help businesses streamline their compensation processes, ensuring employees are paid on time and records are kept orderly.

Here are some valuable sources to consider when seeking assistance:

- Online Software Solutions: Numerous platforms offer customizable options that can be tailored to specific organizational needs. Look for services that allow integration with existing accounting systems.

- Spreadsheet Programs: Popular applications provide pre-designed sheets that can be easily modified. These allow for quick adjustments and personalizations, catering to unique requirements.

- Human Resources Tools: Many HR management systems include scheduling functionalities that help keep track of payment periods, ensuring compliance with regulations.

- Government Websites: Official resources often provide guidelines and essential dates related to remuneration practices, which can be crucial for maintaining legal compliance.

Utilizing these resources can help establish a clear and effective system for managing remuneration timelines, enhancing overall operational efficiency.

Future Trends in Payroll Management

The landscape of employee compensation is evolving rapidly, driven by advancements in technology and changing workforce expectations. As organizations seek to streamline their operations and enhance employee satisfaction, several key trends are emerging that will shape the future of compensation practices.

Automation and Artificial Intelligence are at the forefront of these changes. By integrating smart systems, businesses can reduce manual errors and increase efficiency. Automated processes not only save time but also allow for real-time adjustments, ensuring that employees receive accurate payments based on the most current data.

Employee Self-Service is becoming increasingly popular, empowering individuals to take charge of their own information. Through user-friendly platforms, employees can access their payment history, adjust personal details, and manage deductions without relying heavily on HR personnel. This shift not only enhances transparency but also fosters a sense of ownership among staff.

Compliance and Security are critical considerations as organizations navigate complex regulations. The need for robust systems to manage sensitive information is paramount. Companies will invest in enhanced security measures to protect employee data while ensuring adherence to local and international regulations.

Lastly, Flexibility and Customization in compensation structures are on the rise. As the workforce becomes more diverse, organizations are recognizing the importance of offering tailored compensation packages that meet the varying needs of employees. This trend includes options for performance-based incentives and benefits that cater to individual lifestyles.

In conclusion, the future of employee remuneration will be characterized by innovation and adaptability. Embracing these trends will enable organizations to create a more efficient, secure, and employee-centric approach to managing financial compensation.