In any organization, managing employee remuneration effectively is crucial for maintaining satisfaction and productivity. Having a structured approach to tracking payment periods can streamline financial operations and enhance clarity for both employers and employees. This practice not only ensures timely disbursements but also simplifies budgeting and forecasting for businesses.

Utilizing well-designed scheduling aids allows organizations to anticipate key dates related to financial distributions. These resources serve as visual guides, helping teams coordinate their efforts and align with regulatory requirements. By adopting a systematic method for managing pay cycles, companies can foster a more organized work environment and mitigate potential errors.

Moreover, implementing these resources contributes to building trust within the workforce. Employees are more likely to feel valued and secure when they understand when to expect their earnings. In addition, clear communication regarding payment timelines can minimize confusion and enhance overall workplace morale.

Understanding Payroll Calendar Templates

Managing compensation cycles is crucial for any organization, as it ensures timely payments and clear communication with employees. A well-structured framework serves as a guide for scheduling pay periods, aligning financial planning, and facilitating compliance with regulations. This section delves into the essential components that help streamline these processes, making it easier for businesses to maintain accuracy and efficiency.

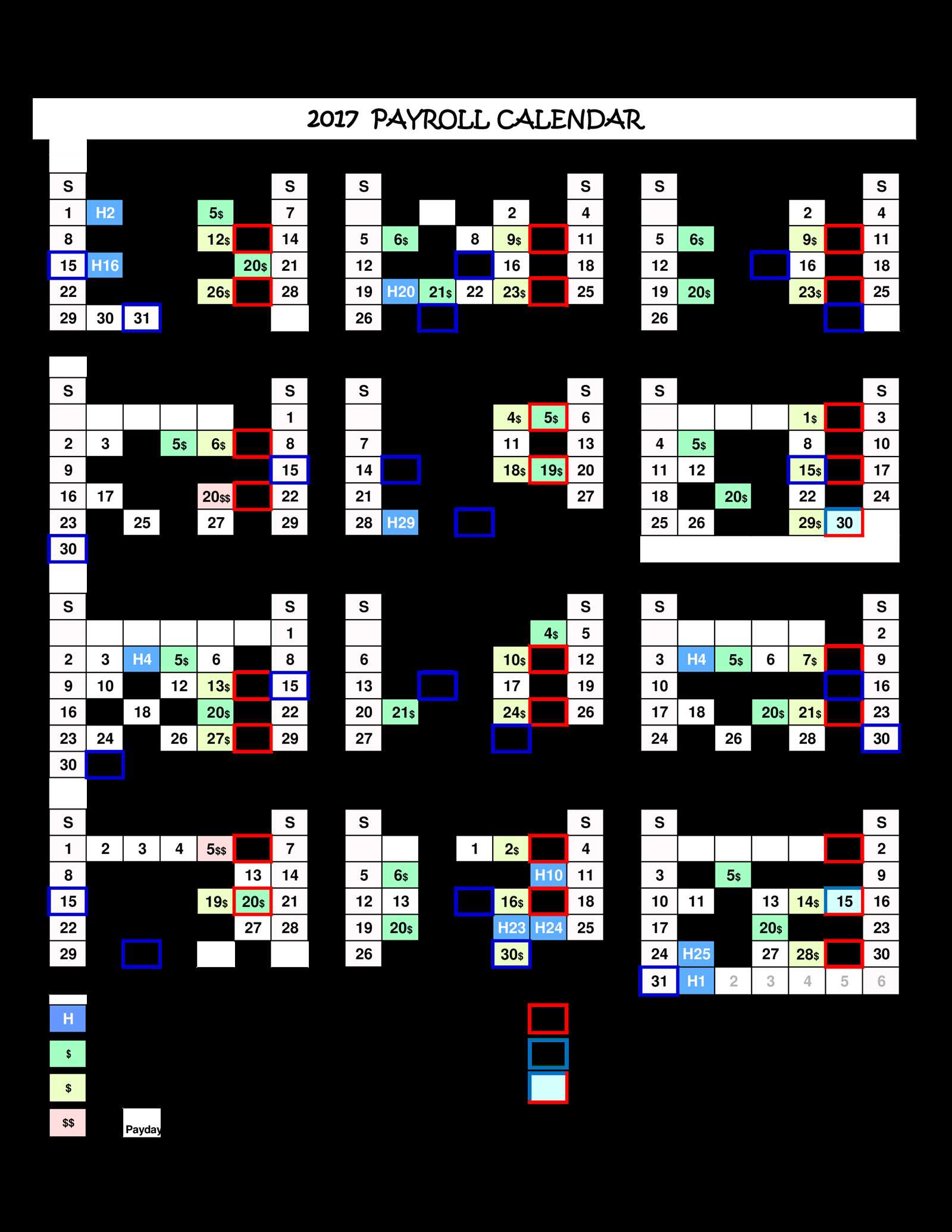

Key Elements: To effectively navigate payment schedules, certain factors come into play. These include frequency of disbursements, the designation of workweeks, and any variations due to holidays or special events. By comprehending these elements, organizations can better plan their financial obligations and enhance employee satisfaction.

Implementation Strategies: Utilizing a systematic approach allows companies to establish consistency in their payment processes. By adopting structured formats, organizations can minimize errors and ensure that all staff members are aware of their pay dates and any changes that may arise. This proactive strategy not only fosters trust but also supports overall operational efficiency.

Importance of Payroll Calendars

The systematic organization of payment schedules is crucial for any business, ensuring that employees are compensated accurately and on time. Such planning not only fosters trust and satisfaction among staff but also enhances overall operational efficiency. By implementing a structured timeline for financial disbursements, companies can mitigate potential errors and streamline their accounting processes.

Enhancing Employee Trust

When workers receive their earnings as promised, it builds a foundation of trust between them and the organization. Consistency in payment practices reflects a company’s commitment to its employees, which can lead to increased morale and productivity. Additionally, clear timelines enable employees to manage their finances better, contributing to their overall well-being.

Streamlining Financial Management

Establishing a well-defined schedule aids in the effective management of cash flow and budget allocation. Businesses can forecast expenses more accurately, which helps in making informed financial decisions. Moreover, a predictable timeline simplifies the tracking of payments, reducing the likelihood of discrepancies and administrative burdens.

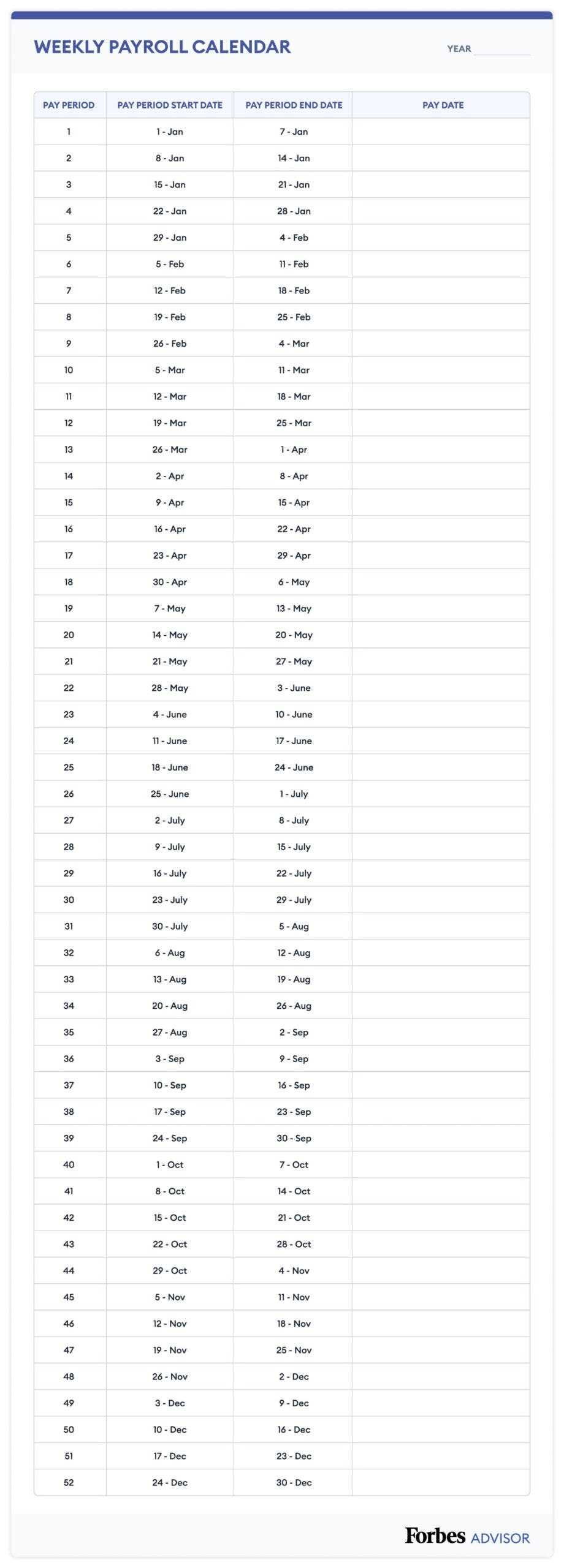

Types of Payroll Calendars Available

Organizations can adopt various systems to manage their financial cycles effectively. Each format offers unique benefits tailored to different operational needs. Understanding these options helps in selecting the most suitable approach for timely and accurate compensation management.

| Type | Description | Advantages |

|---|---|---|

| Weekly | Payments are made every week, usually on a specific day. | Faster access to funds for employees; easier tracking of hours worked. |

| Bi-Weekly | Employees receive their compensation every two weeks, typically on the same day. | Balanced workload for payroll staff; consistent paychecks for workers. |

| Semimonthly | Payments occur twice a month, often on predetermined dates. | Predictable budgeting for both employees and management; aligns with monthly expenses. |

| Monthly | Employees receive their earnings once a month on a set date. | Simplified processing; less frequent administrative tasks for payroll teams. |

How to Choose the Right Template

Selecting the appropriate layout for tracking employee compensation is crucial for maintaining accurate records and ensuring smooth operations. With various designs available, it’s important to consider specific features that align with your organization’s needs and enhance productivity.

Identify Your Requirements

Before diving into the options, assess your organization’s unique requirements. Consider factors such as the number of employees, the frequency of payments, and any specific reporting needs. Understanding these elements will help narrow down the choices and ensure that the selected layout is functional and efficient.

Evaluate Key Features

When reviewing different designs, focus on essential features that facilitate ease of use and accessibility. Look for layouts that include customizable fields, automatic calculations, and user-friendly interfaces. The following table summarizes important attributes to consider:

| Feature | Description | Importance |

|---|---|---|

| Custom Fields | Ability to add or modify sections based on specific needs. | High |

| Calculation Tools | Automatic math for deductions and totals. | High |

| User Access | Control over who can view and edit the document. | Medium |

| Printable Formats | Options to generate hard copies for records. | Medium |

Choosing the right layout will not only streamline the compensation process but also contribute to overall organizational efficiency. By clearly identifying your needs and evaluating critical features, you can make an informed decision that supports your business goals.

Monthly vs. Biweekly Payroll Schedules

When it comes to determining payment intervals for employees, businesses often choose between a monthly or a biweekly structure. Each option has its unique set of advantages and considerations, which can significantly impact both the organization and its workforce.

Here’s a comparison of the two approaches:

- Monthly Payments:

- Employees receive their earnings once a month, often at the end of the month.

- This method simplifies accounting and reduces the frequency of transactions.

- It may benefit employees who prefer budgeting their finances on a monthly basis.

- Biweekly Payments:

- Employees are compensated every two weeks, resulting in 26 pay periods per year.

- This frequency can enhance cash flow management for employees.

- It may help reduce financial stress, as workers receive their earnings more frequently.

Ultimately, the choice between monthly and biweekly schedules can affect employee satisfaction and retention. Companies should weigh the pros and cons carefully to find the best fit for their operations and workforce needs.

Benefits of Using a Payroll Template

Implementing a structured system for managing employee compensation offers numerous advantages for organizations of all sizes. By adopting a standardized approach, businesses can enhance accuracy, streamline processes, and improve overall efficiency in their financial operations.

Enhanced Accuracy

Utilizing a pre-designed framework helps minimize errors in calculations and data entry. This precision is vital for ensuring employees receive the correct remuneration, fostering trust and satisfaction within the workforce.

Time Efficiency

A systematic method significantly reduces the time spent on compensation management. With clearly defined steps, employers can focus on core business activities rather than getting bogged down in administrative tasks.

| Advantage | Description |

|---|---|

| Consistency | Uniformity in processing payments ensures that every employee is treated equally. |

| Compliance | Helps in adhering to legal requirements by maintaining accurate records and deadlines. |

| Scalability | As the organization grows, a structured approach can easily adapt to increasing complexity. |

| Cost Savings | Reduces the likelihood of financial discrepancies that can lead to costly corrections. |

Key Components of Payroll Calendars

Understanding the fundamental elements that structure a compensation timeline is essential for any organization. These components help streamline the process of managing employee remuneration, ensuring that everyone is paid accurately and on time. Key aspects include the frequency of payments, important dates, and specific cycles that dictate when wages are disbursed.

| Component | Description |

|---|---|

| Payment Frequency | The regular intervals at which employees receive their earnings, such as weekly, biweekly, or monthly. |

| Pay Period | The duration of time for which employees are compensated, usually defined by the frequency chosen. |

| Cutoff Dates | Specific days when calculations for payment must be finalized, ensuring all hours worked are accounted for. |

| Distribution Dates | The exact days when funds are transferred to employees’ accounts, marking the completion of the remuneration cycle. |

| Holiday Adjustments | Considerations for how holidays affect pay schedules, potentially shifting distribution dates to accommodate non-working days. |

Customizing Your Payroll Calendar

Creating a tailored schedule for employee compensation is essential for maintaining smooth operations within any organization. By personalizing your timeline, you can better align with the unique needs of your business and workforce. This ensures that everyone is on the same page regarding payment cycles, deadlines, and important dates.

Identify Key Dates: Start by pinpointing critical dates that impact your operations. This includes paydays, tax deadlines, and any special occasions that may affect your payment schedule. By marking these on your timeline, you create a clear overview for all involved parties.

Adjust Frequency: Consider whether the standard pay frequency meets your organizational needs. You may opt for weekly, bi-weekly, or monthly cycles depending on your financial strategy and employee preferences. Adjusting this frequency can enhance employee satisfaction and ensure better cash flow management.

Incorporate Flexibility: It’s important to build in flexibility for unexpected circumstances. By allowing for adjustments in the schedule, such as holiday pay or unforeseen absences, you can minimize disruptions and maintain morale among your team.

Communicate Changes: Once your schedule is tailored to your needs, ensure that all employees are informed of any modifications. Clear communication helps prevent confusion and establishes trust within the organization.

By customizing your payment timeline, you can create a more efficient and harmonious work environment that caters to the needs of your employees and aligns with your organizational goals.

Common Mistakes to Avoid

When managing schedules for employee compensation, it’s essential to be aware of common pitfalls that can lead to confusion and errors. Avoiding these missteps can help streamline the process and ensure accuracy in financial planning.

Lack of Clear Communication

One frequent error is failing to communicate changes or updates effectively. This can result in misunderstandings and delays. To prevent this:

- Ensure all stakeholders are informed of any updates promptly.

- Use multiple channels for communication, such as emails and meetings.

- Document all changes and share them with the team.

Inconsistent Tracking Methods

Another common mistake is using varying methods for tracking time and hours. This inconsistency can lead to discrepancies and disputes. To maintain uniformity:

- Choose a single method or tool for tracking and stick with it.

- Regularly review and update tracking practices to ensure they meet current needs.

- Train employees on how to use the chosen system effectively.

How to Implement a Payroll Schedule

Establishing a structured approach for compensating employees is essential for any organization. A well-defined timeline ensures that workers receive their earnings consistently and on time, fostering trust and satisfaction within the workforce. The following steps will guide you through the process of setting up an effective remuneration system.

First, assess your organization’s specific needs and employee preferences. Consider factors such as the frequency of payments–weekly, biweekly, or monthly–and how these choices align with your business operations. Engage with your team to gather insights on what works best for them, ensuring that the selected method enhances overall morale.

Next, outline a comprehensive framework that includes key dates for disbursements and necessary deductions. It is crucial to incorporate holidays and potential variances in employee hours into this framework to avoid confusion and ensure accuracy. Clear communication about these details can prevent misunderstandings and build transparency.

After establishing the schedule, integrate the necessary tools and software to streamline the process. Automated systems can significantly reduce the risk of errors and save valuable time, allowing your staff to focus on more strategic tasks. Ensure that the technology you choose can adapt to changes in the workforce or financial regulations.

Finally, continuously monitor and evaluate the effectiveness of your chosen system. Gather feedback from employees and assess operational efficiency regularly. This will help you make informed adjustments and maintain a positive relationship with your team while ensuring compliance with applicable regulations.

Tools for Creating Payroll Calendars

Designing effective schedules for employee compensation requires the right tools to streamline the process and ensure accuracy. Various resources are available to assist in the organization and management of payment cycles, helping businesses maintain compliance and efficiency.

Types of Tools

- Software Applications: Many dedicated software solutions offer features tailored to payment scheduling, allowing for easy tracking and reporting.

- Spreadsheet Programs: Utilizing tools like Excel or Google Sheets provides flexibility for customizing layouts and formulas, making it simple to adapt to specific business needs.

- Online Platforms: Cloud-based services often include collaborative features, enabling teams to work together seamlessly on schedules and adjustments.

- Mobile Apps: Various applications are designed for on-the-go access, allowing managers to monitor and update payment cycles from anywhere.

Key Features to Look For

- User-Friendly Interface: An intuitive design can significantly reduce the learning curve and enhance efficiency.

- Integration Capabilities: Compatibility with other business systems ensures smoother data flow and reduces errors.

- Customization Options: The ability to tailor features to specific organizational requirements is crucial for meeting diverse needs.

- Reporting and Analytics: Advanced reporting tools help in tracking trends and making informed decisions regarding employee compensation.

Integrating Payroll Calendars with Software

Connecting scheduling systems with digital tools enhances the efficiency of financial processes within organizations. By synchronizing these frameworks, businesses can streamline their operations, ensuring accurate and timely management of employee compensation and associated tasks.

Benefits of Integration

Utilizing software solutions to manage scheduling offers numerous advantages, including improved accuracy, reduced manual errors, and enhanced accessibility of information. This synergy allows for better tracking of time periods and ensures that all relevant data is aligned across platforms.

Key Features to Consider

| Feature | Description |

|---|---|

| Real-Time Updates | Ensures that any changes in scheduling are instantly reflected across all systems, maintaining consistency. |

| Automated Notifications | Alerts users to upcoming deadlines and essential tasks, reducing the risk of oversight. |

| Data Analytics | Offers insights into financial trends and patterns, aiding in better decision-making and resource allocation. |

| User-Friendly Interface | Facilitates easy navigation and operation, ensuring that all staff can effectively use the tools provided. |

Incorporating these elements can significantly enhance the overall experience and productivity of teams, making the management of employee payments more efficient and reliable.

Legal Considerations for Payroll Schedules

When establishing regular payment intervals for employees, it is crucial to be aware of various legal obligations that govern this process. These considerations ensure compliance with labor laws and help prevent potential disputes between employers and workers. Understanding the regulatory framework is essential for maintaining a fair and lawful workplace environment.

Compliance with Labor Laws

Each jurisdiction has specific laws regarding the frequency and timing of employee compensation. Employers must adhere to these regulations to avoid penalties. This includes not only how often payments are made but also the deadlines for issuing checks or direct deposits. Regularly reviewing local and federal laws can help businesses stay compliant.

Impact on Employee Relations

Clear communication about payment schedules fosters trust and transparency within the workforce. Employees who understand when and how they will be compensated are more likely to feel valued and motivated. Establishing a consistent routine can also minimize confusion and potential grievances, ultimately contributing to a more harmonious workplace.

Impact of Holidays on Payroll Processing

Holidays play a significant role in the management of employee compensation cycles. Their occurrence can disrupt regular routines, leading to adjustments in how wages are calculated and distributed. Understanding these effects is essential for maintaining efficiency and compliance within an organization.

Challenges Presented by Holidays

When holidays fall on weekdays, it can create complications in the timing of salary disbursements. Organizations must account for these days when planning payment schedules to ensure employees receive their earnings promptly. Additionally, the presence of multiple holidays in a month can complicate time tracking and the accumulation of hours worked.

Strategies for Effective Management

To mitigate the impact of holidays on employee remuneration processes, businesses can implement several strategies. Advanced planning and clear communication with staff regarding payment dates can alleviate confusion. Moreover, adopting automated systems can help streamline adjustments for holiday-related changes, ensuring timely and accurate processing.

| Holiday | Impact on Payment Schedule |

|---|---|

| New Year’s Day | May shift payment to the previous business day |

| Independence Day | Potential delay if it falls on a weekend |

| Thanksgiving | Early disbursement may be required |

| Christmas | Schedule adjustments to accommodate festivities |

Tracking Employee Hours Effectively

Accurate monitoring of employee work hours is essential for maintaining operational efficiency and ensuring fair compensation. A systematic approach allows organizations to streamline their processes, reduce errors, and enhance productivity. By implementing effective tracking methods, businesses can gain valuable insights into workforce performance and resource allocation.

To optimize time management, companies can utilize various techniques and tools. Below is a comparison of some common methods used to monitor employee hours:

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Manual Timesheets | Employees fill out their hours on paper or digital forms. | Simple and cost-effective; no technology needed. | Prone to errors and can be time-consuming to compile. |

| Time Tracking Software | Automated tools that record hours worked in real time. | Increases accuracy and provides detailed reports. | May require training and can involve subscription costs. |

| Biometric Systems | Use fingerprints or facial recognition to clock in/out. | Highly accurate and secure; reduces buddy punching. | Higher upfront costs; privacy concerns may arise. |

Choosing the right approach depends on the specific needs and resources of the organization. Regular review and adaptation of the chosen method can further enhance efficiency and ensure that employee contributions are recognized and rewarded appropriately.

Communicating Payroll Changes to Staff

Effectively conveying updates regarding employee compensation and related schedules is crucial for maintaining trust and clarity within an organization. When changes occur, it’s essential to ensure that all team members are well-informed and understand how these modifications may impact them.

Here are some key strategies to enhance communication about compensation changes:

- Timeliness: Inform employees as soon as changes are finalized to avoid confusion and speculation.

- Clarity: Use straightforward language to explain what the changes entail and the reasons behind them.

- Multiple Channels: Utilize various communication methods, such as emails, team meetings, and internal newsletters, to reach all staff members effectively.

- Feedback Opportunities: Encourage employees to ask questions and express concerns, creating an open dialogue.

Additionally, providing written documentation can help reinforce the message and serve as a reference point for employees. Consider the following steps:

- Draft a detailed announcement outlining the changes.

- Highlight the benefits or improvements that these adjustments may bring.

- Schedule a follow-up meeting to address any lingering questions.

By prioritizing clear and comprehensive communication, organizations can foster a supportive environment during transitions related to compensation, ensuring all employees feel valued and informed.

Updating Your Payroll Calendar Regularly

Regularly revising your scheduling framework is crucial for maintaining efficiency and compliance within any organization. Keeping this framework up to date ensures that all team members are aligned with deadlines, payment cycles, and any relevant legal changes. A well-maintained schedule minimizes errors and enhances productivity.

Importance of Regular Updates

- Compliance with Regulations: Frequent updates help ensure adherence to changing laws and regulations.

- Accuracy in Financial Management: Regular revisions reduce the risk of discrepancies in financial records.

- Enhanced Communication: An updated schedule improves clarity among team members regarding important dates.

Best Practices for Maintaining Your Schedule

- Review Periodically: Set specific times throughout the year to evaluate and update your framework.

- Incorporate Feedback: Gather input from team members to identify potential areas for improvement.

- Utilize Technology: Implement software solutions that can automate updates and notify relevant parties.

- Stay Informed: Keep abreast of industry trends and legislative changes that may impact your scheduling.

Resources for Payroll Calendar Templates

When managing employee compensation cycles, having the right tools can greatly enhance efficiency and accuracy. Various resources are available to assist businesses in designing structured plans that align with their operational needs, ensuring timely payments and clear communication with staff.

Online Platforms

Numerous websites offer customizable designs that cater to different business models. These platforms often provide user-friendly interfaces, allowing you to modify formats according to specific requirements. Look for sites that include examples and instructional content to facilitate the process of crafting a fitting schedule.

Software Solutions

Consider investing in software that incorporates features for tracking payment cycles. Many applications are designed to streamline the management process, providing built-in schedules and reminders. This can significantly reduce the administrative burden and help maintain compliance with legal regulations.

Utilizing these resources effectively can transform the way you handle employee remuneration, ultimately leading to enhanced productivity and satisfaction within your organization. Explore your options and choose tools that best meet your needs for optimal results.