Planning and managing financial obligations is crucial for both individuals and businesses. A well-structured outline of income distribution can significantly enhance efficiency and reduce confusion. By organizing this information effectively, you empower yourself to make informed decisions and maintain better control over your finances.

One of the most valuable resources in financial management is a well-crafted outline that highlights pay periods throughout the year. This tool not only helps in tracking earnings but also aids in budgeting and financial planning. A clear representation of payment intervals ensures that you stay on top of expenses and obligations, ultimately leading to a more organized financial life.

As the year progresses, having access to an easy-to-use framework becomes increasingly important. Whether you are an employee, a freelancer, or a business owner, this resource can serve as a reliable reference point. With the right format at your disposal, you can efficiently navigate through the complexities of payment cycles and make the most of your financial planning.

Understanding Biweekly Payroll Calendars

The concept of a regular payment schedule is essential for both employers and employees. It facilitates a structured approach to compensation, ensuring that workers receive their earnings in a timely manner. This system allows for predictable budgeting and financial planning, which can enhance overall employee satisfaction.

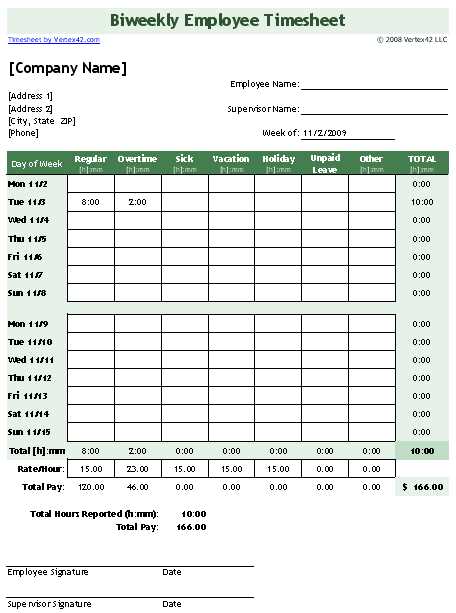

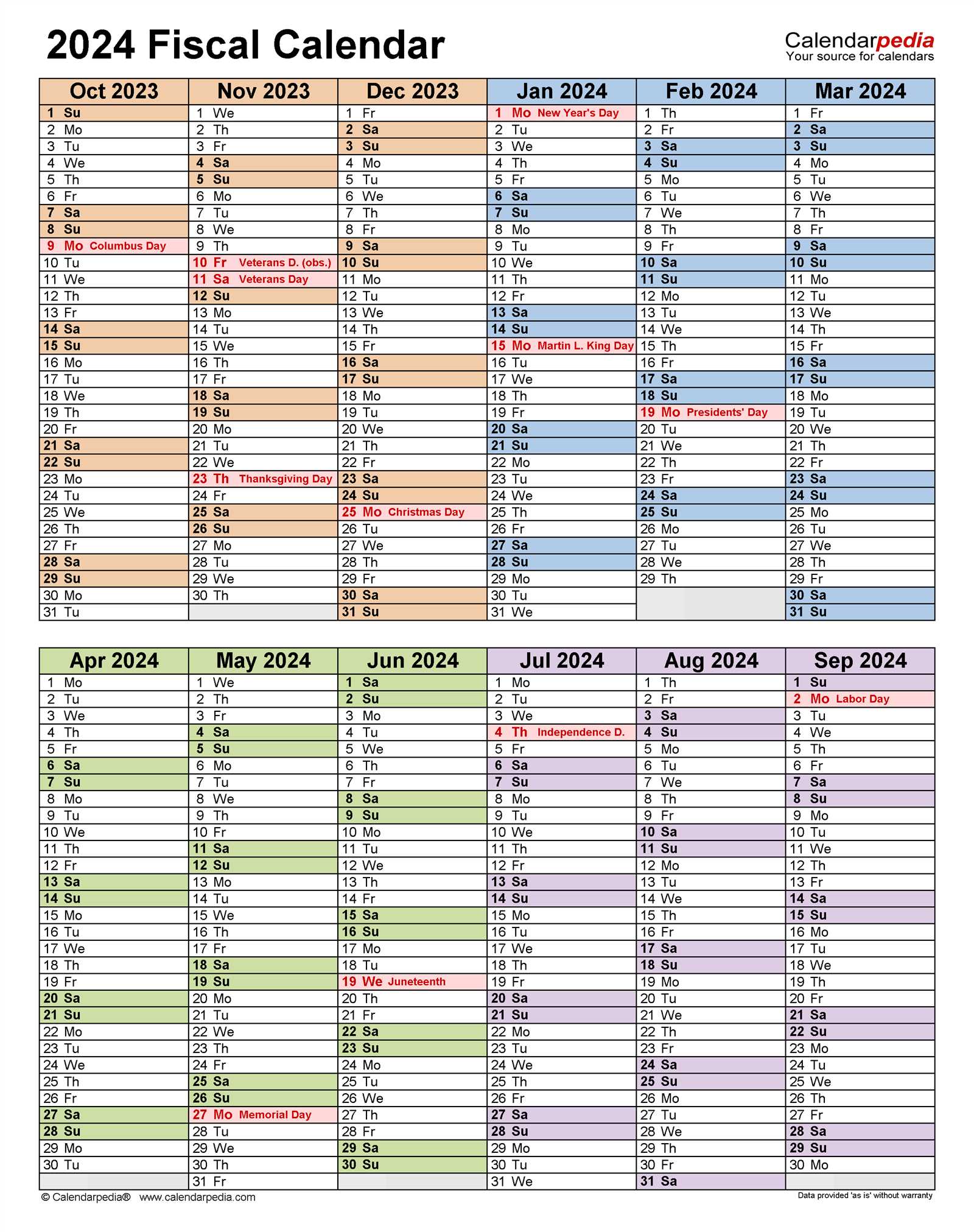

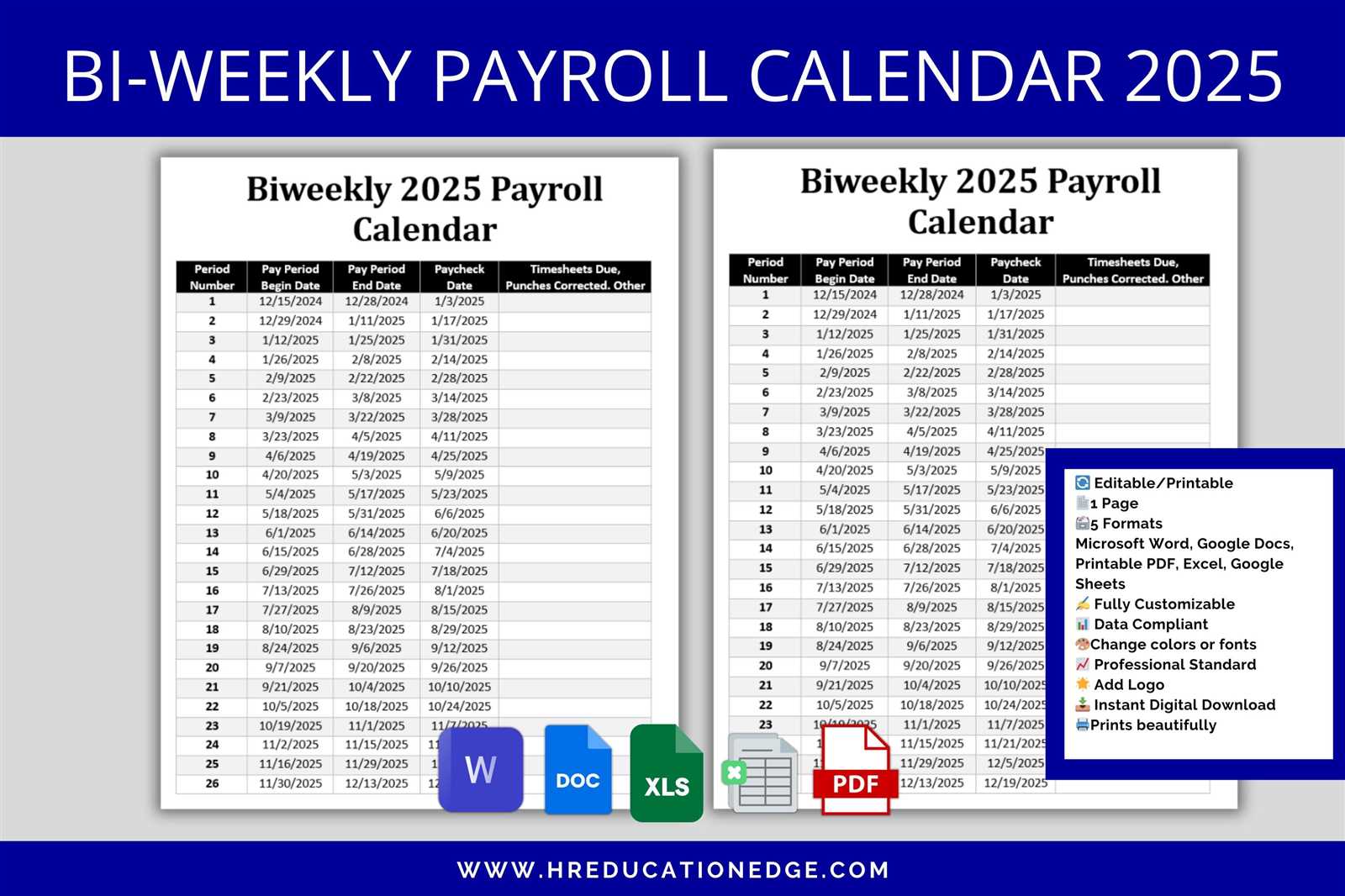

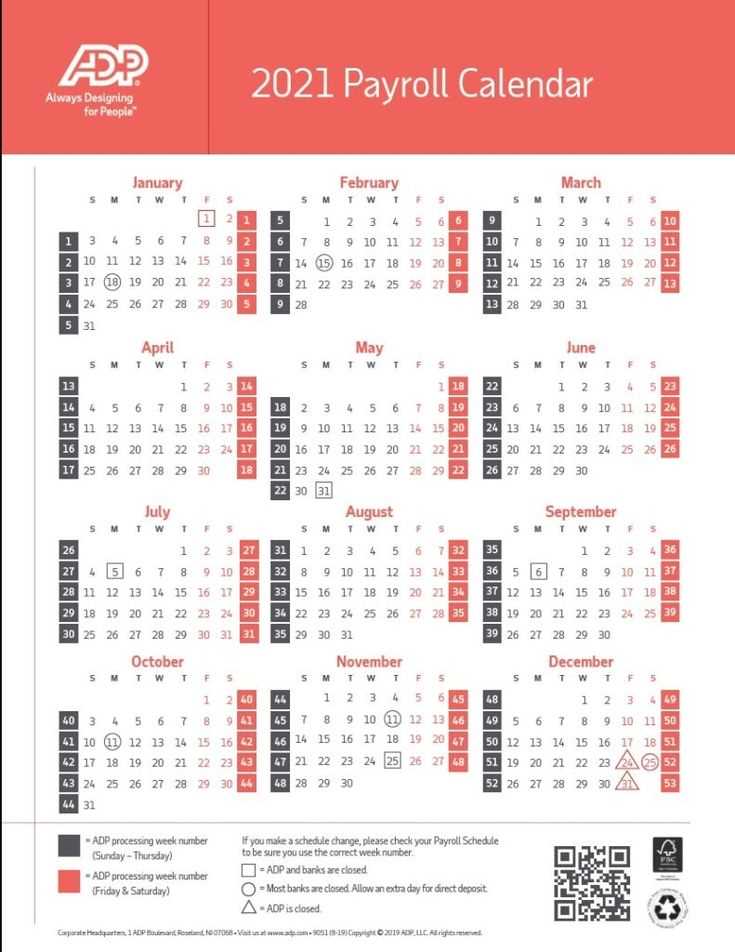

One significant aspect of this payment model is its frequency. Employees are compensated every two weeks, which results in 26 pay periods annually. This can differ from other systems that may offer monthly or weekly payments, leading to various implications for financial management and cash flow.

Employers often choose this method because it simplifies payroll processing and aligns well with many businesses’ operational rhythms. Furthermore, understanding this structure aids employees in effectively managing their income, enabling them to plan for expenses and savings more efficiently.

Benefits of Using Printable Templates

Utilizing ready-made designs offers a variety of advantages that can enhance organization and efficiency. These resources provide structured layouts that simplify the planning process, making it easier for individuals and businesses to stay on track with their schedules and obligations. By incorporating such tools, users can streamline their workflows and minimize the risk of oversight.

Time Efficiency

One of the most significant benefits is the substantial amount of time saved. Rather than creating documents from scratch, users can quickly access a pre-designed layout, allowing for immediate use. This efficiency is particularly valuable for those with busy schedules who need to allocate their time wisely.

Consistency and Professionalism

Another advantage is the promotion of uniformity in documentation. Ready-made formats ensure that all entries maintain a consistent appearance, enhancing the professional image of any organization. This consistency not only aids in visual clarity but also builds trust with clients and stakeholders by presenting a cohesive brand identity.

How to Choose the Right Template

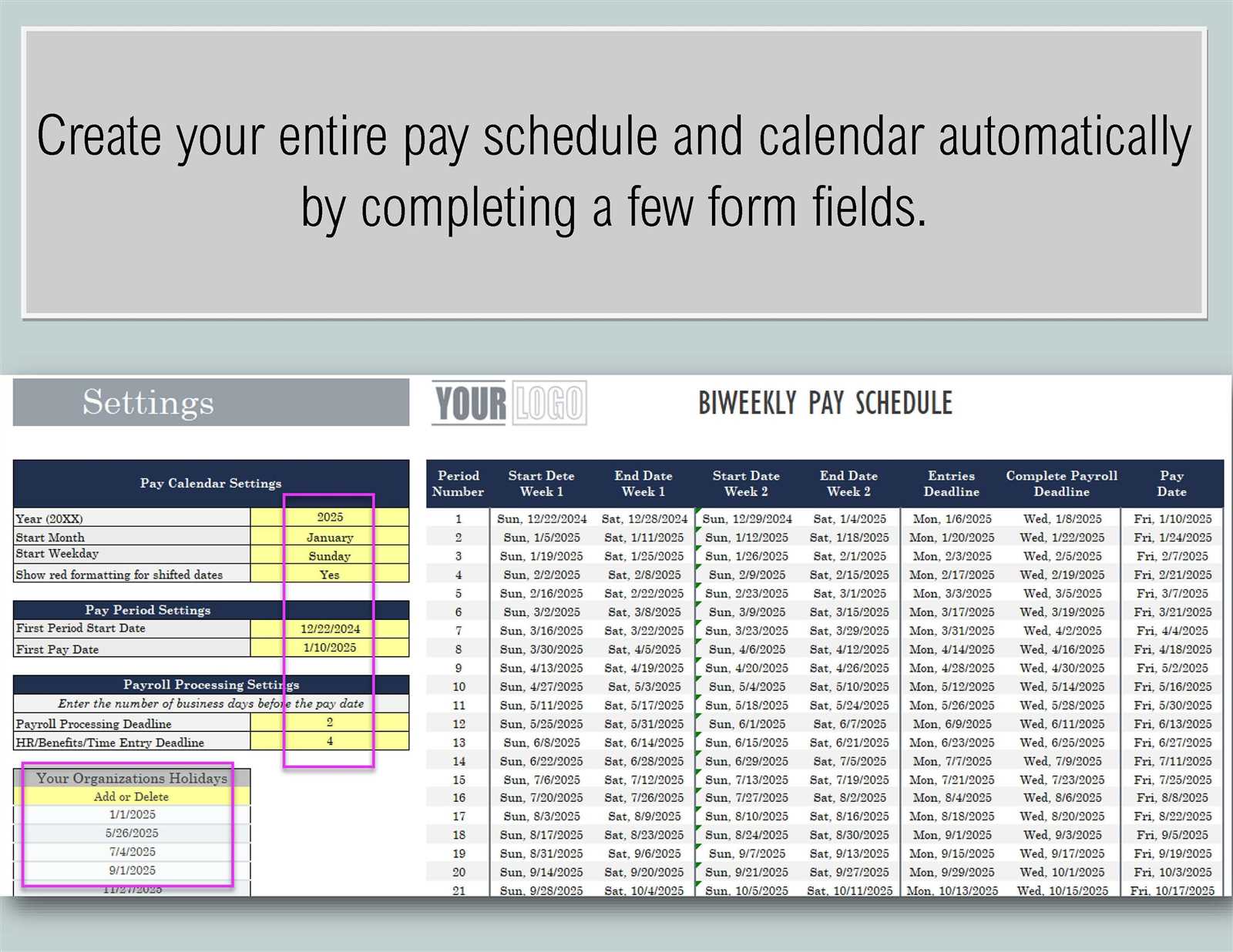

Selecting an appropriate organizational tool can significantly enhance your efficiency and accuracy when managing employee compensation schedules. With a variety of options available, it’s crucial to consider several key factors that align with your specific needs and workflow. The right choice will not only streamline processes but also facilitate better planning and communication within your team.

Assess Your Requirements

Begin by evaluating the unique demands of your business. Consider the number of employees, the frequency of payments, and any specific legal obligations you must meet. Understanding these factors will guide you toward a design that accommodates your operational structure effectively.

Look for User-Friendly Features

Focus on designs that offer clarity and ease of use. Features such as clear formatting, ample space for notes, and easy navigation can make a significant difference in usability. Opt for a layout that allows for quick reference and minimizes the risk of errors during implementation.

Key Features of Effective Calendars

An efficient scheduling tool is essential for managing time effectively. It should provide clear and organized information that enhances productivity and simplifies planning. By incorporating essential characteristics, these tools can serve both personal and professional needs, ensuring that all important dates and deadlines are easily accessible.

Clarity and Readability

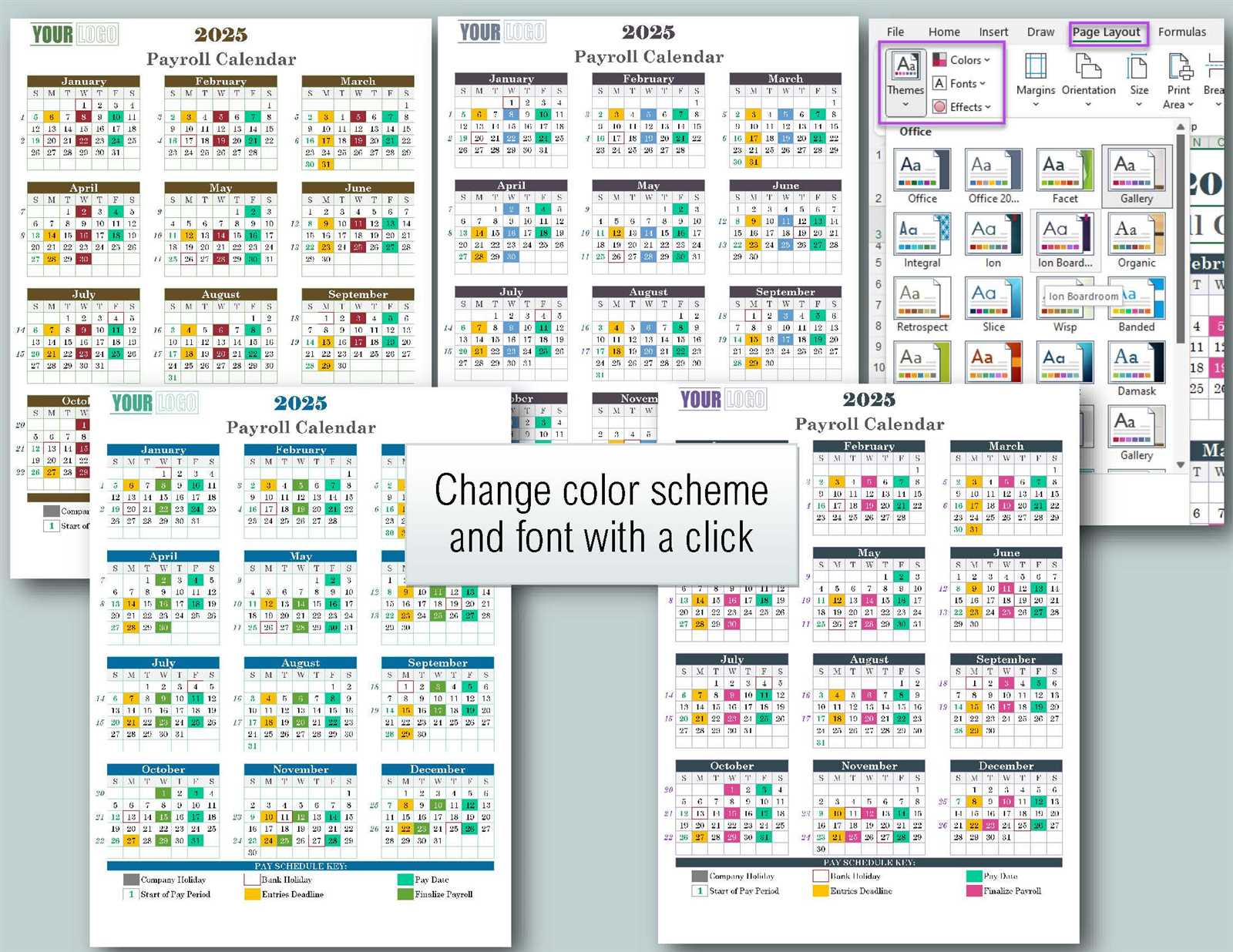

One of the most critical aspects is the clarity of the information presented. A well-structured layout allows users to quickly grasp essential details without confusion. A balanced use of colors and fonts can improve readability and help distinguish between different types of entries.

Customization Options

The ability to personalize the scheduling format is vital. Users should be able to modify the layout according to their specific requirements, including adjusting time intervals and adding custom notes or highlights for significant events.

| Feature | Description |

|---|---|

| Intuitive Layout | Easy navigation through days, weeks, and months. |

| Space for Notes | Designated areas for reminders and important information. |

| Visual Appeal | Attractive design that engages users and enhances usability. |

| Accessibility | Compatibility across devices for on-the-go access. |

Steps to Create Your Own Calendar

Designing a personalized schedule can streamline your planning and improve time management. By following a few straightforward steps, you can craft a custom layout that suits your specific needs and preferences. Here’s how to get started on your unique time-management tool.

| Step | Description |

|---|---|

| 1. Define Your Purpose | Identify the primary use of your layout, whether for tracking tasks, events, or deadlines. |

| 2. Choose the Format | Decide on a format that fits your lifestyle, such as weekly, monthly, or yearly views. |

| 3. Select a Design Tool | Use software or online platforms that allow for easy customization of layouts and designs. |

| 4. Organize Important Dates | Gather all significant dates and events that need to be included in your design. |

| 5. Layout Your Design | Create a visual representation by arranging the dates and events in your chosen format. |

| 6. Review and Revise | Check for any errors or adjustments needed before finalizing your layout. |

| 7. Save and Share | Once satisfied, save your creation and share it with others if desired. |

Common Mistakes to Avoid

Managing schedules effectively is crucial for any organization, yet there are frequent pitfalls that can disrupt smooth operations. By being aware of these common errors, you can ensure a more streamlined process and avoid unnecessary complications.

Neglecting to Update Information

One of the primary oversights is failing to keep all details current. Regular updates are essential to reflect changes in employee status, hours, or other relevant data. An outdated schedule can lead to confusion and miscalculations.

Inadequate Planning for Holidays

Another mistake is not accounting for holidays and time off. Planning should include these elements to avoid disruptions in workflow and ensure that all employees are aware of their obligations. This helps in maintaining productivity and morale.

| Mistake | Consequence | Solution |

|---|---|---|

| Outdated Information | Confusion and errors in scheduling | Regular reviews and updates |

| Ignoring Holidays | Decreased productivity and dissatisfaction | Incorporate holidays into planning |

| Poor Communication | Misunderstandings among staff | Establish clear channels for updates |

Using Digital vs. Printable Formats

In today’s fast-paced world, the choice between electronic and physical formats for managing schedules and important dates has become increasingly relevant. Each option offers distinct advantages and drawbacks that can significantly influence efficiency and accessibility. Understanding these differences can help individuals and organizations select the most suitable method for their needs.

Digital formats provide unparalleled convenience, allowing users to easily edit, share, and access their information from various devices. They often come with features such as reminders and synchronization across multiple platforms, enhancing organization and time management. Moreover, the ability to quickly search for specific entries can save valuable time and reduce frustration.

On the other hand, physical formats offer a tactile experience that some individuals find beneficial for retention and focus. Writing by hand can reinforce memory and encourage mindfulness, making it easier to engage with the material. Additionally, a hard copy can be displayed prominently in a workspace, serving as a constant visual reminder of upcoming events and deadlines.

Ultimately, the choice between digital and physical formats hinges on personal preference, lifestyle, and specific requirements. By evaluating the benefits of each approach, users can make informed decisions that best suit their organizational strategies.

Integrating Payroll Calendars with Software

Streamlining financial processes through the integration of scheduling systems with software solutions enhances efficiency and accuracy in managing employee compensation. By aligning these systems, organizations can automate essential tasks, minimize errors, and ensure timely payments.

Modern software tools offer robust features that can seamlessly sync with scheduling frameworks. This integration allows for real-time updates, making it easier to track hours worked, manage deductions, and implement benefits administration. Additionally, centralized data storage provides easy access to historical records, facilitating better decision-making and reporting.

Moreover, utilizing technology to link timekeeping systems with compensation management promotes compliance with regulations and internal policies. Automated alerts for upcoming deadlines and discrepancies further support organizational oversight, enabling businesses to focus on growth rather than manual calculations.

Ultimately, effective integration leads to a more cohesive approach in managing financial responsibilities, ensuring that all stakeholders are aligned and informed throughout the process. Investing in these technological advancements is crucial for any organization aiming to optimize its operational workflow.

How Biweekly Payments Impact Budgeting

Managing finances effectively often hinges on the frequency of income disbursements. When earnings arrive every two weeks, individuals face unique challenges and opportunities in their budgeting practices. This structure can influence cash flow management, spending habits, and financial planning, ultimately shaping one’s economic stability.

Advantages of a Fortnightly Pay Cycle

Receiving funds every two weeks can facilitate more manageable budgeting. The regular influx allows individuals to align their expenses with their income more efficiently. This structure may also promote discipline in spending, as individuals become accustomed to a predictable pattern of financial replenishment.

Challenges in Financial Planning

Despite its benefits, a biweekly payment system can complicate budgeting for some. Monthly expenses do not always sync neatly with the pay periods, potentially leading to cash shortfalls or overspending in certain weeks. It becomes essential to plan strategically to ensure that all obligations are met without falling behind.

| Expense Type | Payment Frequency | Budgeting Tip |

|---|---|---|

| Rent/Mortgage | Monthly | Set aside one payment every paycheck to avoid shortages. |

| Utilities | Monthly | Estimate average monthly costs and divide by two for each paycheck. |

| Groceries | Weekly/Biweekly | Create a shopping list and stick to it to prevent overspending. |

| Savings | Monthly | Automate transfers to savings immediately after receiving funds. |

Legal Considerations for Payroll Scheduling

When managing employee compensation intervals, it is crucial to understand the various legal frameworks that govern these practices. Compliance with applicable laws ensures not only the protection of workers’ rights but also the avoidance of costly penalties for employers. Different jurisdictions may have specific requirements regarding frequency, payment methods, and record-keeping, which must be carefully considered.

Frequency of Payments is a primary legal concern. Many states mandate a minimum number of pay periods within a year, affecting how often wages are disbursed. It is essential to be aware of these regulations to establish a compliant system that aligns with legal standards.

Another important aspect is timeliness of Payments. Laws often stipulate that employees must receive their wages promptly, especially after the completion of a pay period. Delays can lead to disputes and legal ramifications, underscoring the need for an efficient scheduling process.

Record-keeping is also vital. Employers are typically required to maintain accurate records of hours worked and wages paid. Failure to comply can result in significant penalties, so implementing a reliable tracking system is necessary for legal adherence.

Lastly, understanding state-specific regulations is essential. Each jurisdiction may have unique rules that impact how compensation is structured, necessitating thorough research to ensure full compliance. By paying close attention to these legal considerations, businesses can foster a fair workplace while mitigating potential risks.

Tracking Employee Hours Effectively

Accurate monitoring of staff working hours is essential for enhancing productivity and ensuring fair compensation. A systematic approach not only promotes accountability but also facilitates effective resource allocation. By implementing robust tracking methods, organizations can streamline operations and foster a positive work environment.

Implementing Modern Solutions

Utilizing technology can greatly improve the accuracy of hour tracking. Software applications designed for time management offer features like real-time reporting, automated calculations, and integration with other systems. This minimizes human error and allows managers to focus on strategic decision-making rather than manual data entry.

Encouraging Employee Engagement

Involving employees in the tracking process can lead to higher engagement and responsibility. Encouraging staff to log their hours regularly, review their entries, and provide feedback creates a culture of transparency. Additionally, regular check-ins and discussions about time management can help identify areas for improvement and ensure that everyone is aligned with organizational goals.

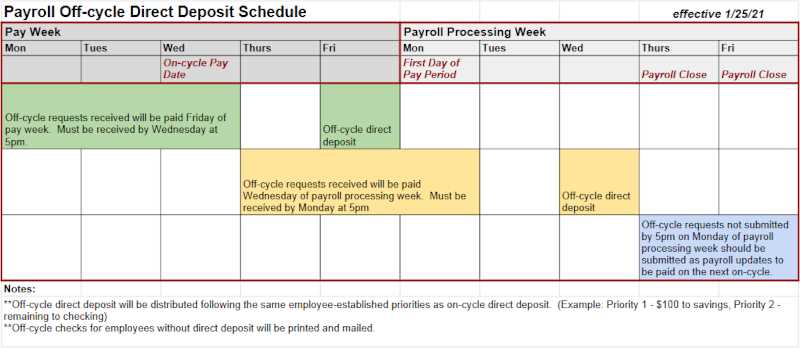

Adjusting for Holidays and Time Off

Managing employee compensation during festive occasions and personal leave is essential for maintaining fairness and transparency in any organization. It requires careful planning to ensure that staff are compensated accurately while also adhering to company policies and legal requirements. Proper adjustments help foster a positive work environment and enhance employee satisfaction.

Recognizing Official Holidays

When a recognized holiday falls on a scheduled workday, it’s crucial to establish clear guidelines for how compensation will be handled. Employers should communicate policies regarding holiday pay, whether it includes additional compensation for working on these days or adjustments in regular pay cycles. Such clarity helps prevent confusion and sets clear expectations.

Handling Personal Time Off

Employees may take time off for personal reasons, which can impact payroll calculations. Organizations should implement a consistent approach to track and manage these absences. This includes defining the accrual process for time off and how it affects payment during standard cycles. Clear policies regarding notification and approval of personal leave will contribute to a smoother payroll process.

Visualizing Payroll Data for Better Decisions

Effective analysis of financial information is crucial for organizations aiming to enhance their decision-making processes. By transforming complex data into visual formats, stakeholders can easily identify patterns, trends, and anomalies that may not be immediately apparent in raw numbers. This approach not only simplifies the interpretation of financial data but also empowers managers to make informed choices that drive business success.

Data visualization serves as a powerful tool, enabling teams to present information in an engaging manner. Graphs, charts, and dashboards can encapsulate essential metrics, allowing for quick comparisons and deeper insights. For instance, visual representations of employee compensation trends can highlight discrepancies, ensuring equitable remuneration practices.

Furthermore, utilizing visual tools can foster collaboration among departments. When teams share visualized data, they can collectively brainstorm and strategize on financial management, leading to more innovative solutions. This collaborative environment nurtures a culture of transparency and accountability, where every team member is aligned with the organization’s financial goals.

In conclusion, embracing visualization techniques not only enhances understanding but also promotes proactive decision-making. By prioritizing clear, accessible representations of financial data, businesses can navigate challenges more effectively and seize opportunities for growth.

Best Practices for Payroll Management

Effective financial administration is crucial for any organization, ensuring that employees are compensated accurately and on time. Implementing robust practices not only enhances operational efficiency but also fosters employee trust and satisfaction. Streamlined processes can minimize errors and ensure compliance with relevant regulations.

Establish Clear Procedures

Having well-defined procedures is essential for successful financial operations. Document each step of the compensation process, from timekeeping to distribution. This clarity helps prevent misunderstandings and creates a structured approach that can be easily followed by all team members.

Utilize Technology

Investing in advanced software solutions can greatly improve the accuracy and speed of your financial processes. Automated systems reduce manual errors and enable real-time data tracking, making it easier to manage compensation and maintain records. Regularly update and maintain these tools to adapt to changing needs.

Regular Training for staff involved in financial management is vital. Keeping everyone informed about the latest regulations and technologies ensures that your organization stays compliant and efficient. Consider periodic workshops or training sessions to enhance team skills and knowledge.

Finally, always review and adjust your practices. Regular assessments help identify areas for improvement and ensure that your approach remains effective and compliant with industry standards.

Resources for Payroll Calendar Templates

Managing employee compensation schedules effectively is crucial for any organization. Various resources are available to assist businesses in creating well-structured plans that meet their operational needs. These materials help streamline the process and ensure timely payments, while also enhancing overall productivity.

Online Platforms

Numerous websites provide a variety of options for designing schedules. These platforms often include user-friendly tools that allow customization, making it easier for managers to tailor plans according to specific requirements. Many of these resources offer free downloads or subscription-based services, ensuring accessibility for all types of businesses.

Software Solutions

In addition to online resources, specialized software can greatly enhance the management of compensation timelines. Such applications typically include advanced features that automate calculations, track hours, and generate necessary reports. By integrating these solutions into daily operations, companies can minimize errors and improve efficiency.

Frequently Asked Questions About Payroll Calendars

Understanding the intricacies of payment schedules can be crucial for both employers and employees. Many individuals have common inquiries regarding how these schedules function, their benefits, and how to effectively manage them. This section aims to clarify some of the most frequent questions surrounding these important timeframes.

What is the purpose of a payment schedule?

The main aim of a payment schedule is to outline when employees receive their wages. It helps ensure that financial planning is consistent for both the employer and the workforce, providing clarity on pay periods and deadlines for processing wages.

How do I choose the right payment frequency for my business?

Choosing the right frequency depends on various factors including cash flow, employee preferences, and industry standards. Regular discussions with your team can help gauge their preferences and needs, ensuring that the chosen method aligns well with everyone involved.

What happens if a pay date falls on a holiday or weekend?

In such cases, it is common practice to adjust the payment date to the nearest business day. This ensures that employees receive their compensation without delays, maintaining a smooth financial operation.

Can I modify my payment schedule after it has been established?

Yes, modifications can be made, but it is essential to communicate any changes to your team well in advance. This helps to avoid confusion and ensures that all employees are prepared for the new arrangements.

What should I consider when managing time off and leave in relation to pay periods?

It’s vital to have clear policies regarding how time off affects payment calculations. Understanding how different types of leave–such as sick or vacation days–impact wages can help maintain fairness and transparency in compensation practices.

Real-Life Applications of Payroll Calendars

Understanding the scheduling of employee compensation is crucial for both organizations and their workforce. Effective management of payment intervals not only ensures financial accuracy but also helps in maintaining employee satisfaction. Companies leverage these schedules to streamline their operations, adhere to legal requirements, and improve overall workplace efficiency.

Here are some practical scenarios where such scheduling methods come into play:

| Application | Description |

|---|---|

| Budgeting | Employers use payment schedules to forecast expenses and allocate resources effectively throughout the fiscal year. |

| Employee Planning | Understanding pay periods aids employees in managing their personal finances, helping them plan for expenses and savings. |

| Compliance | Adhering to established payment frequencies ensures organizations meet regulatory requirements, avoiding potential penalties. |

| Workforce Management | Having clear payment cycles assists in scheduling staff shifts and managing labor costs, contributing to more efficient operations. |

In conclusion, the implementation of structured payment intervals is vital for enhancing financial management within organizations, fostering transparency, and ensuring a motivated workforce.

Future Trends in Payroll Scheduling

The landscape of remuneration management is evolving rapidly, driven by technological advancements and changing workforce expectations. As organizations adapt to these shifts, new methodologies and tools are emerging to streamline the compensation process, enhance employee satisfaction, and ensure compliance.

Embracing Technology

Technology will continue to play a pivotal role in shaping how organizations approach their payment cycles. Here are some key developments:

- Automation: Increased reliance on automated systems to reduce manual errors and save time.

- Real-Time Data: Access to real-time financial data allows for more informed decision-making and timely payments.

- Mobile Solutions: The rise of mobile applications enables employees to track their earnings and manage their finances seamlessly.

Flexibility and Customization

As work environments become more diverse, flexibility in payment structures is becoming essential. Future practices may include:

- Personalized Payment Schedules: Tailoring pay frequencies to individual needs and preferences.

- On-Demand Payments: Allowing employees to access their earnings as they work, rather than waiting for traditional pay periods.

- Integrated Benefits: Offering comprehensive packages that combine compensation with other perks to enhance overall employee experience.