In the ever-evolving landscape of financial management, establishing a clear and efficient schedule for compensating employees is crucial for any organization. A well-structured timeline not only enhances clarity but also ensures that everyone involved understands their responsibilities and the flow of transactions.

This guide aims to provide a comprehensive overview of an effective framework designed for regular compensation periods throughout the year. By adopting a systematic approach, businesses can streamline their processes and foster a more productive work environment.

Utilizing an organized framework helps companies maintain transparency and consistency, ultimately leading to improved employee satisfaction and financial stability. Whether you are a small business or a larger enterprise, implementing a structured payment strategy is essential for long-term success.

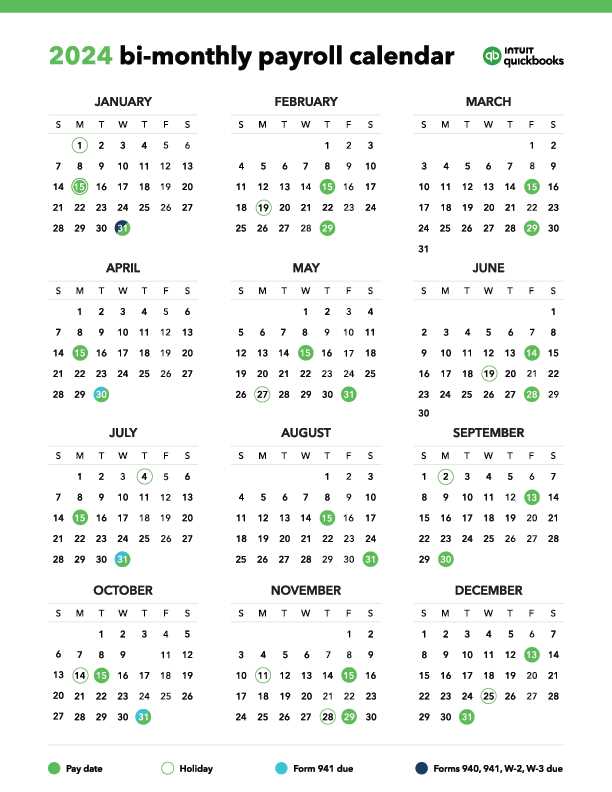

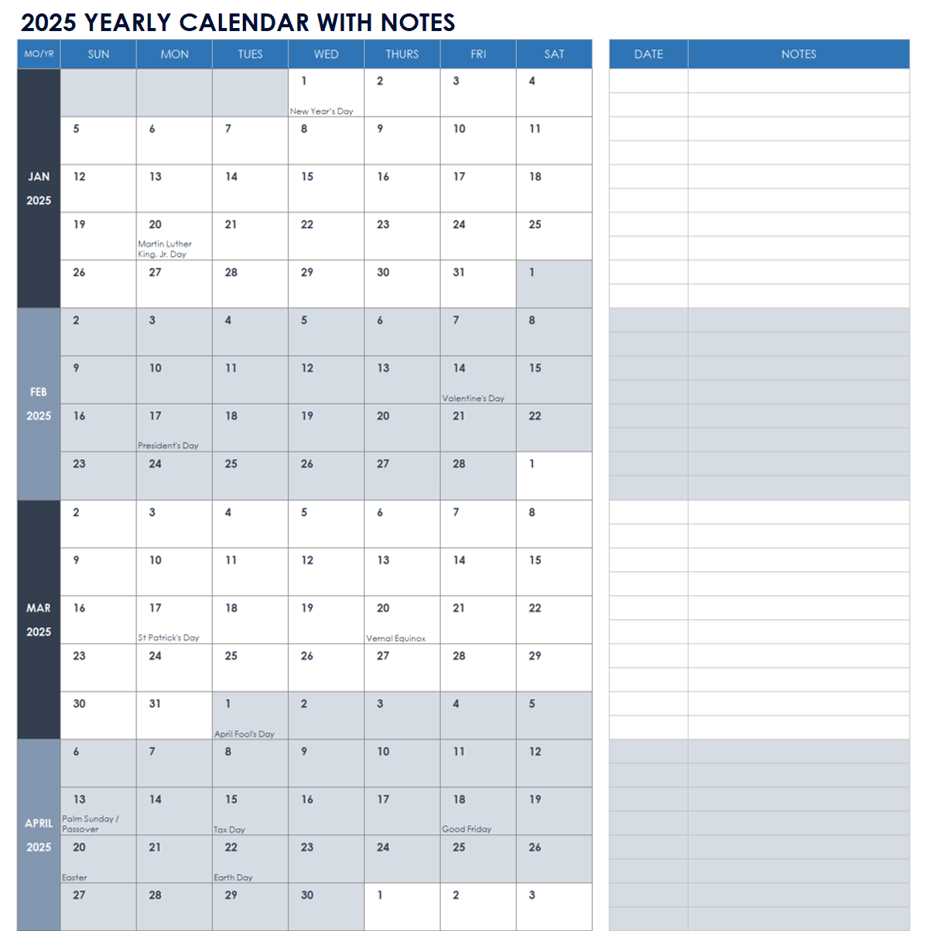

Semi-Monthly Payroll Calendar Overview

This section provides an insight into the structure and function of a bi-monthly payment system for employees. Such a system divides the month into two distinct periods, enabling organizations to manage compensation efficiently. Understanding this approach helps both employers and staff anticipate payment dates and manage their finances effectively.

Key benefits of this payment frequency include:

- Improved budgeting for employees, as they receive regular, predictable payments.

- Enhanced cash flow management for businesses, aligning expenses with revenue cycles.

- Reduced administrative burden, as payroll processing occurs twice a month.

When implementing a bi-monthly compensation schedule, consider the following essential elements:

- Determining the exact pay periods each month, often centered around the 15th and the end of the month.

- Establishing deadlines for timesheet submissions and adjustments to ensure timely processing.

- Communicating clearly with employees regarding their payment dates and any changes that may arise.

By following these guidelines, organizations can create an efficient system that benefits both the employer and employees alike.

Understanding Semi-Monthly Pay Schedules

This section delves into the concept of bi-monthly compensation structures, exploring their significance in the workforce. Such frameworks facilitate predictable financial planning for both employees and employers by establishing clear intervals for remuneration. By examining the mechanics of these schedules, one can appreciate their benefits and potential challenges.

Key Features of Bi-Monthly Compensation Structures

These payment systems typically distribute earnings across two designated periods within a month. Understanding the specifics of these intervals is crucial for accurate budgeting and cash flow management. Here are some notable characteristics:

| Aspect | Description |

|---|---|

| Payment Frequency | Employees receive wages twice a month, often on set dates. |

| Consistency | This approach provides a stable income stream, aiding in personal financial management. |

| Time Tracking | Employers must maintain accurate records to ensure timely and correct payments. |

Advantages and Challenges

While bi-monthly remuneration offers various advantages, such as enhanced predictability, it also poses certain challenges. Employers need to carefully manage their accounting processes to align with these payment cycles, ensuring compliance with labor regulations. For employees, understanding how their earnings are calculated based on hours worked can sometimes lead to confusion, particularly when dealing with overtime or varying work schedules.

Benefits of Using a Payroll Calendar

Implementing a structured timeline for compensation distribution offers numerous advantages for businesses and employees alike. By establishing clear periods for remuneration, organizations can enhance financial planning, improve cash flow management, and foster a transparent relationship with their workforce.

Enhanced Financial Management

Having a defined schedule for payments allows companies to allocate resources more efficiently. With a clear overview of when funds will be disbursed, financial managers can better predict expenses and make informed decisions regarding budgeting and investments.

Increased Employee Satisfaction

Regularity in payment cycles contributes to employee trust and morale. When workers are aware of when they will receive their earnings, it alleviates financial stress and promotes a sense of stability, ultimately leading to improved productivity and loyalty to the organization.

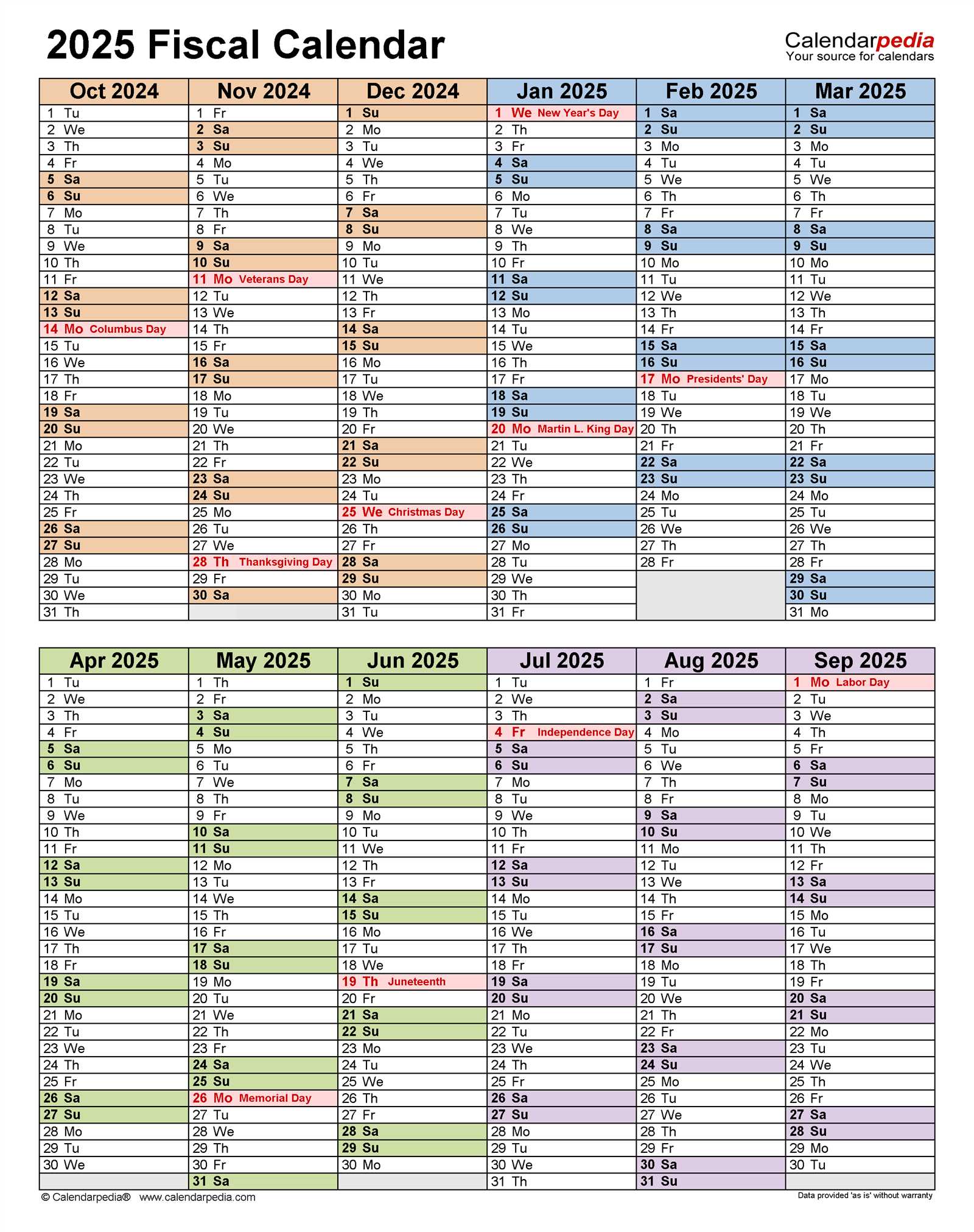

Key Dates for 2026 Payroll Processing

Timely and accurate compensation for employees is essential for any organization. Understanding the critical timeframes involved in managing financial transactions ensures smooth operations and maintains employee satisfaction. This section outlines important dates for processing remuneration in the upcoming year.

Important Processing Dates

- January 1-15: Begin the year with data updates and initial calculations.

- January 16-31: Finalize transactions and distribute earnings for the first period.

- February 1-15: Review previous period adjustments and prepare for the next cycle.

- February 16-28: Complete processing and deliver payments.

- March 1-15: Assess performance and incorporate any necessary changes.

- March 16-31: Ensure all calculations are accurate and funds are allocated correctly.

- Continue this pattern for the subsequent months, ensuring to adapt as necessary.

Special Considerations

- Be mindful of holidays that may affect transaction timelines.

- Ensure compliance with local regulations, as these may change throughout the year.

- Implement reminders for important deadlines to avoid any delays.

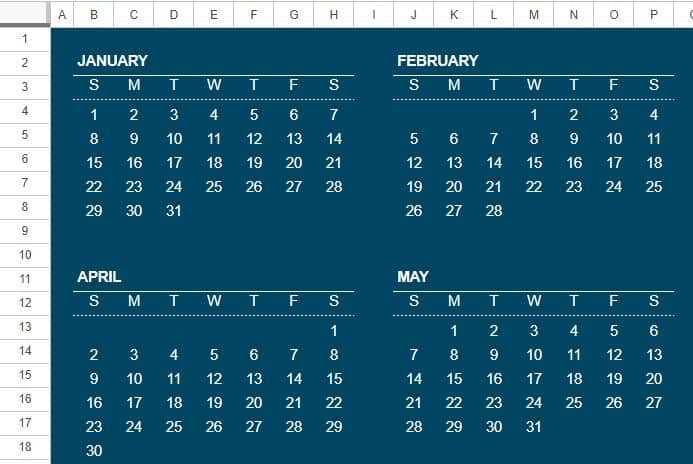

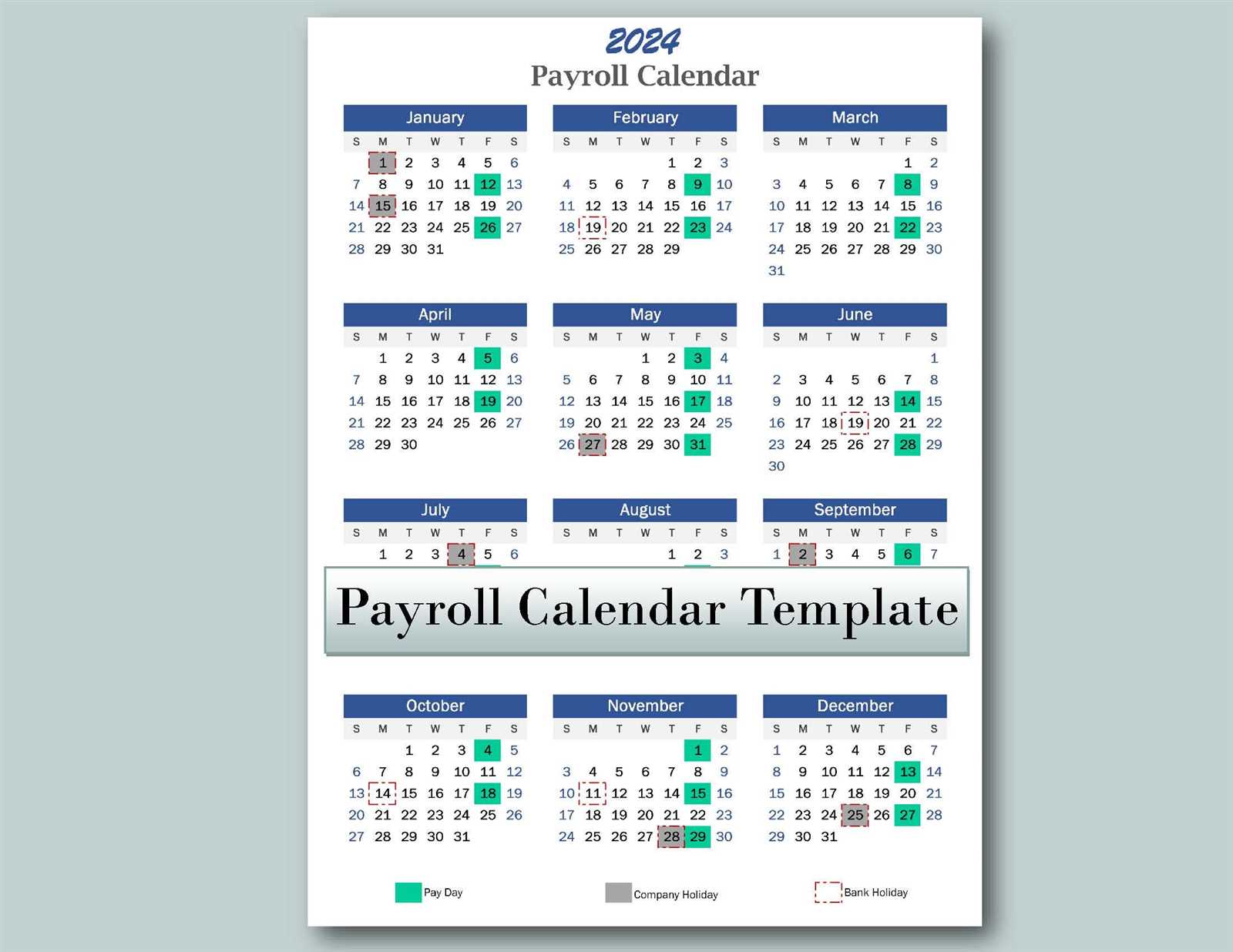

How to Create Your Payroll Template

Designing an effective structure for employee compensation management is crucial for any organization. A well-organized format not only streamlines financial processes but also enhances accuracy and transparency. This guide will walk you through the essential steps to craft a robust structure that meets your company’s needs.

Step 1: Identify Key Components

Begin by outlining the fundamental elements that your structure should include. Consider factors such as employee details, compensation amounts, deduction categories, and payment dates. Each of these components plays a significant role in ensuring that the entire system operates smoothly. Make a list of all the necessary fields that will capture this information accurately.

Step 2: Choose the Right Tools

Once you have a clear understanding of what to include, select appropriate software or platforms that can accommodate your structure. Options range from spreadsheet applications to specialized financial management tools. Ensure that the chosen method allows for easy updates and adjustments as your organization grows or changes.

Emphasize accuracy and regular updates in your creation process to maintain compliance and reliability. Following these steps will set a strong foundation for managing your organization’s compensation efficiently.

Essential Components of Payroll Calendars

Understanding the fundamental elements of a compensation schedule is crucial for effective financial management in any organization. A well-structured timeline ensures that employees are compensated accurately and on time, while also helping employers adhere to legal requirements and maintain smooth operational workflows.

Key components include pay periods, deadlines for submitting timesheets, and processing dates. Each of these elements plays a significant role in ensuring timely and accurate disbursements.

| Component | Description |

|---|---|

| Pay Periods | Defined intervals during which work hours are tracked for compensation purposes. |

| Submission Deadlines | Specific dates by which employees must submit their hours worked to ensure payment processing. |

| Processing Dates | Days when the organization finalizes calculations and issues payments to employees. |

| Reporting Requirements | Obligations related to financial reporting, including tax considerations and benefits administration. |

Incorporating these components into a cohesive plan helps streamline the entire payment process, ensuring compliance and enhancing employee satisfaction.

Common Mistakes to Avoid in Payroll

Managing employee compensation can be complex, and several common pitfalls can lead to inaccuracies and dissatisfaction. Understanding these missteps is essential for any organization aiming for efficiency and compliance.

- Inaccurate Time Tracking: Failing to accurately record hours worked can result in overpayments or underpayments.

- Neglecting Deductions: Overlooking required deductions, such as taxes or benefits, can lead to legal issues and employee dissatisfaction.

- Not Staying Updated on Regulations: Labor laws and tax regulations frequently change. Ignoring these updates can result in costly penalties.

- Insufficient Documentation: Lack of proper records can complicate audits and compliance checks, increasing vulnerability to errors.

- Relying Solely on Automation: While technology can enhance efficiency, human oversight is crucial to catch errors that software may miss.

- Poor Communication with Employees: Failing to inform staff about their compensation details can lead to misunderstandings and low morale.

By being aware of these common errors and taking proactive steps to avoid them, organizations can ensure a smoother and more accurate compensation process for their workforce.

Legal Requirements for Payroll Schedules

Understanding the legal obligations related to payment timing is crucial for any business. Compliance with these regulations ensures not only adherence to the law but also fosters employee trust and satisfaction. Various jurisdictions have specific rules governing how often employees must receive their earnings, which can impact both operational practices and financial planning.

Key Regulations to Consider

- Frequency of Payments: Many regions mandate a minimum frequency for employee compensation, often specifying whether payments should be made weekly, biweekly, or monthly.

- Timeliness: Employers are required to disburse wages within a set timeframe after the end of a pay period, which can vary by state or country.

- Notification Requirements: Some jurisdictions obligate employers to inform employees about payment schedules in advance, ensuring transparency.

Punishments for Non-Compliance

- Fines and Penalties: Failure to meet legal obligations can result in significant financial penalties.

- Employee Claims: Workers may file complaints or lawsuits if they do not receive their wages on time.

- Reputation Damage: Non-compliance can harm an organization’s reputation, affecting employee morale and retention.

Ensuring that your organization adheres to these legal frameworks is vital for maintaining a smooth and ethical operation. It is recommended to consult with legal experts or human resource professionals to navigate these requirements effectively.

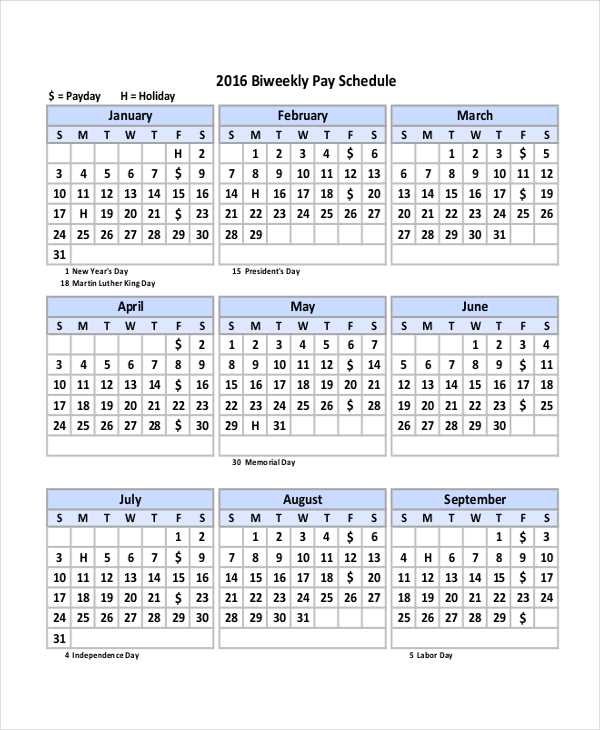

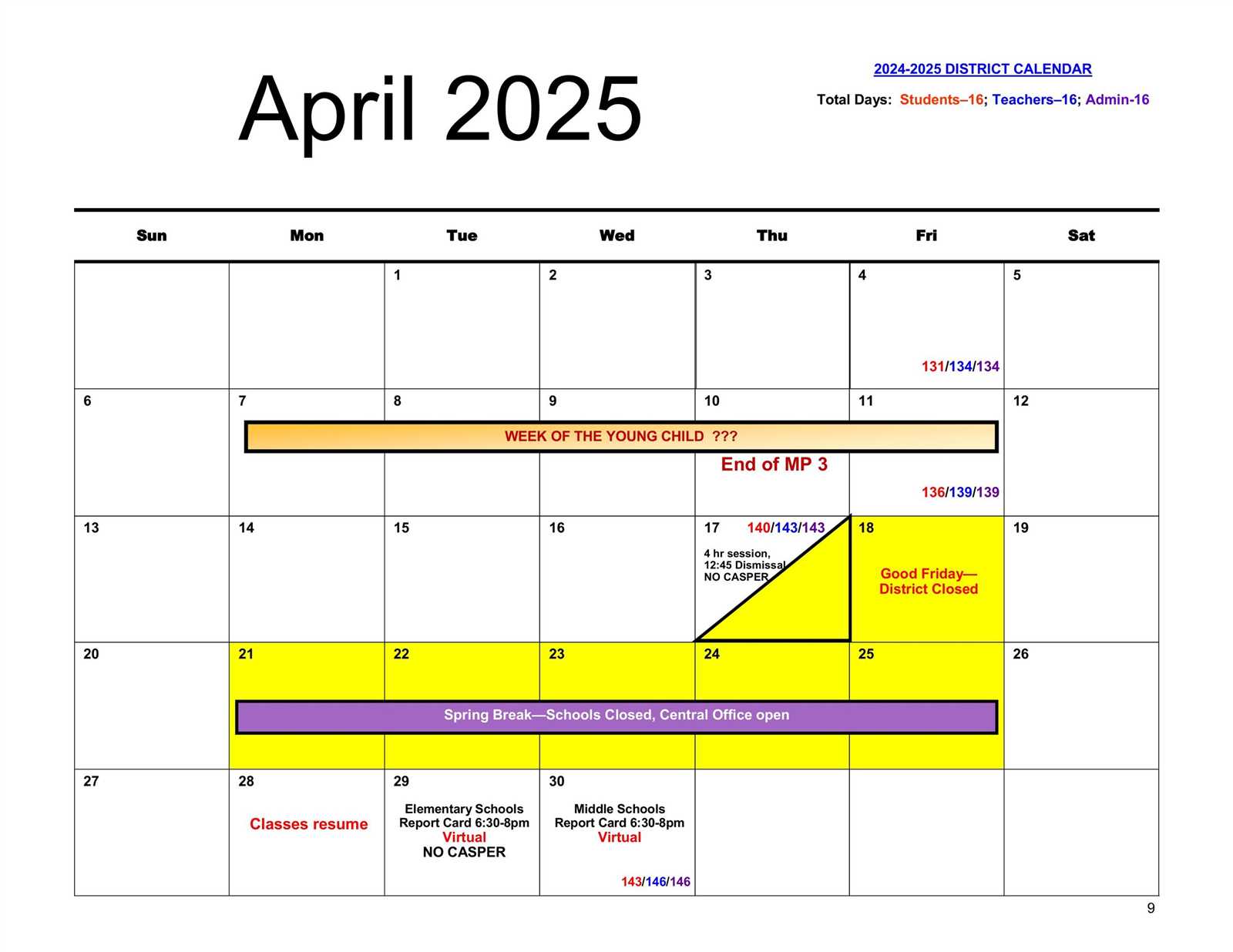

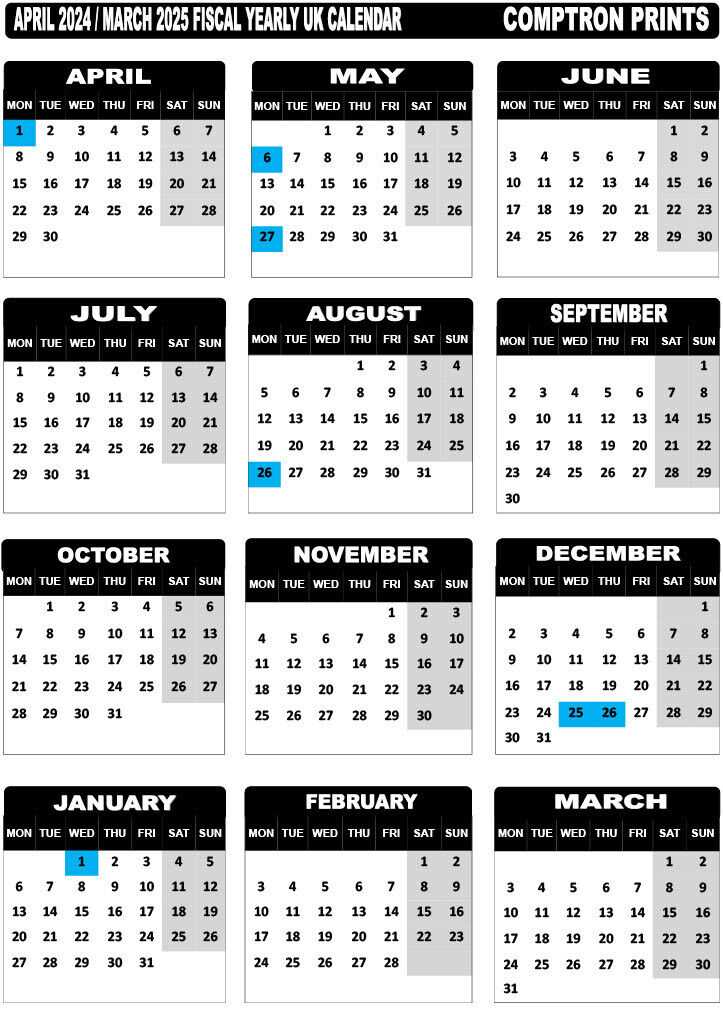

Managing Holidays and Payroll Dates

Effectively coordinating time off and compensation periods is crucial for any organization. Understanding how holidays impact payment schedules can help ensure that employees are compensated accurately and on time. By planning ahead, businesses can avoid confusion and maintain employee satisfaction.

Identifying Key Holidays

Recognizing important dates throughout the year allows for better planning. It’s essential to create a list of public and company-specific holidays that might influence compensation timelines. This proactive approach enables companies to communicate changes to their team in advance, preventing any potential disruptions.

Adjusting Payment Schedules

When holidays fall on or around regular compensation dates, adjustments may be necessary. Organizations should establish clear protocols for shifting these dates to ensure that employees receive their earnings without delay. Transparent communication regarding these changes will foster trust and clarity within the workforce.

Technology Tools for Payroll Management

Efficient management of employee compensation is crucial for any organization. Leveraging modern tools can streamline processes, enhance accuracy, and save valuable time. This section explores various technological solutions designed to optimize financial operations related to workforce remuneration.

Key Features of Payroll Management Tools

- Automation: Automating routine tasks reduces manual errors and frees up human resources for more strategic activities.

- Compliance Tracking: Keeping up with ever-changing regulations can be daunting; software often includes features to ensure adherence to local and national laws.

- Reporting and Analytics: Robust tools offer detailed reports that help in making informed decisions and identifying trends in compensation data.

Popular Solutions Available

- Cloud-Based Systems: These platforms allow access from anywhere, ensuring that critical data is always at hand.

- Mobile Applications: With the rise of remote work, mobile apps provide flexibility, enabling employees to view their earnings and request changes on the go.

- Integration Capabilities: Many tools can easily integrate with existing systems, such as HR software, improving overall efficiency.

Tips for Streamlining Payroll Processes

Enhancing efficiency in the compensation management system can lead to significant improvements in both time management and accuracy. By implementing certain strategies, organizations can simplify their operations, reduce errors, and ensure timely disbursement of funds. Below are several effective practices that can aid in achieving a more streamlined approach.

Automate Repetitive Tasks

Utilizing technology to automate routine functions is crucial for minimizing manual effort. Investing in software solutions can help in managing calculations, tracking hours, and generating reports effortlessly. Automation not only speeds up the process but also significantly reduces the risk of human error.

Maintain Clear Communication

Establishing transparent lines of communication among team members is essential. Regular updates and accessible resources regarding procedures and deadlines can prevent misunderstandings. Encouraging feedback can also foster a more collaborative environment, leading to continuous improvement in operations.

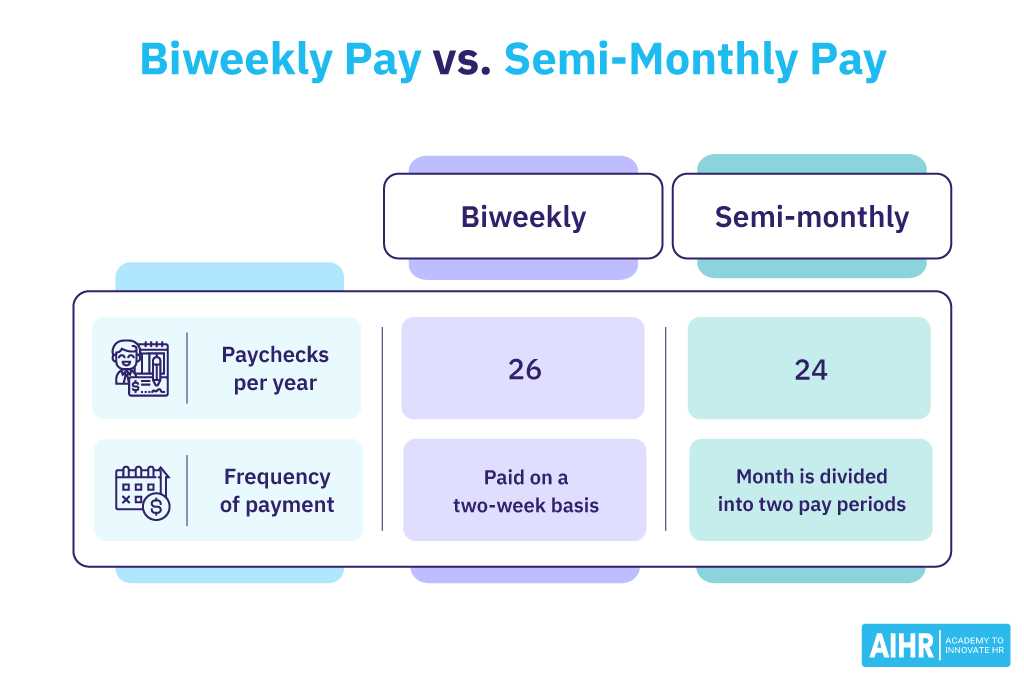

Calculating Employee Pay Periods Effectively

Determining the intervals at which workers receive their earnings is crucial for maintaining operational efficiency and ensuring employee satisfaction. An accurate approach to calculating these periods not only enhances financial planning but also fosters a transparent relationship between management and staff.

Key Considerations

- Frequency of Payments: Assess how often employees should be compensated. Common options include bi-weekly and bi-monthly intervals.

- Labor Laws: Familiarize yourself with local regulations governing wage distribution to ensure compliance.

- Employee Preferences: Consider gathering input from staff regarding their preferred pay schedules, which can enhance morale.

- Administrative Efficiency: Evaluate the workload on your finance team to determine the most manageable payment frequency.

Steps for Calculation

- Identify the total number of working days within each period.

- Calculate the hourly wage or salary based on agreed terms.

- Account for any deductions or bonuses that may apply during the period.

- Communicate the resulting figures clearly to employees to ensure transparency.

Integrating Payroll with Accounting Systems

Effective management of employee compensation is crucial for any organization. When this function is seamlessly combined with financial record-keeping, it leads to enhanced accuracy and efficiency. This integration not only streamlines operations but also ensures compliance with regulations, providing a clear financial picture for stakeholders.

Benefits of Integration

Linking compensation management with accounting software offers numerous advantages. Firstly, it reduces the risk of errors that can occur when data is manually entered into multiple systems. By automating this process, organizations can ensure that all financial transactions are synchronized, leading to better reporting and analysis. Furthermore, real-time updates can assist in making informed decisions regarding budgeting and forecasting.

Implementation Strategies

To effectively merge these systems, organizations should begin with a thorough assessment of their existing processes. Choosing compatible software solutions is essential for achieving smooth data flow. Additionally, training staff on the integrated system will enhance user adoption and optimize its functionality. Regular reviews and updates of the integration can help maintain its effectiveness over time.

In summary, combining employee compensation management with accounting frameworks fosters greater operational efficiency and accuracy, enabling organizations to thrive in a competitive environment.

Payroll Calendar for Small Businesses

Effective financial management is crucial for any small enterprise, particularly when it comes to compensating employees. Having a clear structure for disbursing wages helps ensure that all parties are informed and aligned with expectations. This section explores the importance of establishing a well-defined schedule for remuneration processes.

By implementing a systematic approach, small businesses can:

- Enhance employee satisfaction by providing timely payments.

- Streamline administrative tasks related to compensation management.

- Improve budgeting accuracy and cash flow monitoring.

- Facilitate compliance with local regulations regarding remuneration.

To create an efficient system, consider the following steps:

- Determine the frequency of payments based on business needs and employee preferences.

- Communicate the schedule clearly to all staff members.

- Incorporate a tracking mechanism to monitor payment dates and any potential changes.

- Review the structure periodically to ensure it remains effective and aligns with the growth of the business.

In summary, a structured approach to wage distribution not only boosts employee morale but also supports overall business operations. Small businesses should prioritize this aspect to foster a productive work environment.

Employee Communication Regarding Pay Dates

Effective communication about compensation schedules is essential for maintaining transparency and trust within the organization. Ensuring that all team members are well-informed about when they can expect their earnings fosters a positive workplace environment and reduces uncertainty.

To facilitate clear understanding, consider implementing the following strategies:

- Regular Updates: Send reminders ahead of each payment period to keep employees informed.

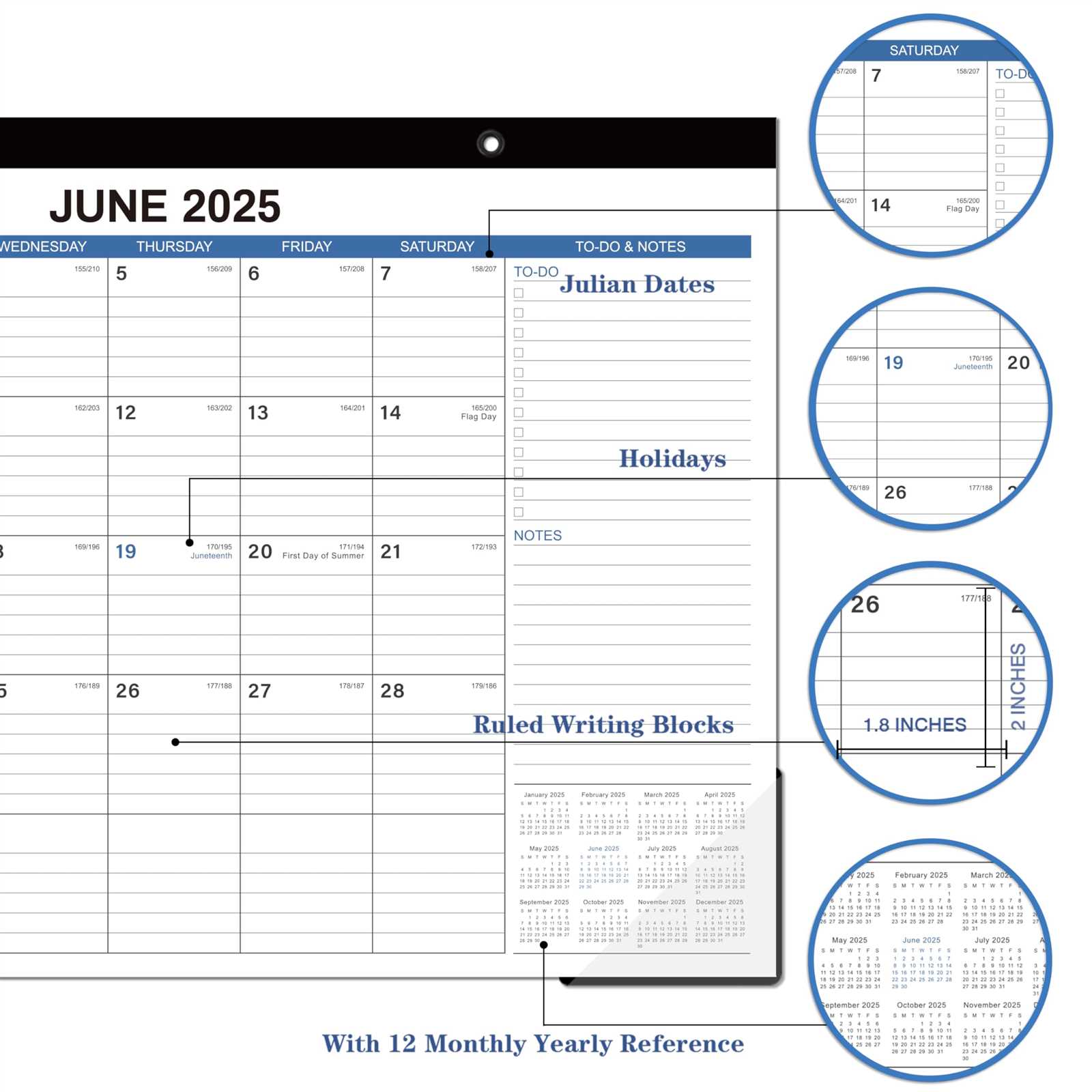

- Visual Aids: Utilize charts or infographics that outline the payment timeline for easy reference.

- Dedicated Channels: Establish a specific communication platform, such as an internal portal, where employees can easily access information regarding compensation dates.

- Feedback Opportunities: Encourage employees to ask questions and provide feedback about the information shared, ensuring their concerns are addressed.

By adopting these practices, organizations can enhance employee satisfaction and confidence in the payment process, contributing to overall morale and productivity.

Impact of Payroll Frequency on Employees

The timing of compensation disbursement significantly affects employee satisfaction and financial well-being. Different payment intervals can lead to varying levels of stress, planning, and budgeting capabilities among workers. Understanding these implications is crucial for organizations aiming to enhance their workforce’s experience and productivity.

When compensation is delivered at shorter intervals, employees may feel a sense of stability and control over their finances. This can reduce anxiety related to meeting daily expenses and improve overall morale. Conversely, longer intervals may cause financial strain, prompting workers to manage their resources more stringently, which can affect their focus and engagement levels at work.

| Payment Frequency | Employee Impact |

|---|---|

| Weekly | Enhanced financial control, reduced stress, improved cash flow. |

| Bi-weekly | Balance between stability and planning; common choice for many businesses. |

| Monthly | Can lead to cash flow challenges; requires careful budgeting. |

Ultimately, selecting an appropriate payment frequency can influence recruitment, retention, and overall job satisfaction. Employers who consider these factors may foster a more engaged and productive workforce, as financial security is often a key component of employee happiness.

Updating Your Payroll Calendar Annually

Regularly revising your scheduling framework is essential for maintaining accuracy and efficiency in financial operations. Adjustments should be made to reflect any changes in regulations, employee needs, or organizational policies. This proactive approach ensures that all parties involved are informed and aligned with the latest updates.

When planning for revisions, consider the following factors:

| Factor | Description |

|---|---|

| Regulatory Changes | Stay updated on laws and guidelines that may affect payment cycles. |

| Employee Feedback | Gather input from staff to identify any issues or suggestions for improvement. |

| Technological Advancements | Utilize new tools and software that can streamline your scheduling process. |

| Company Growth | Adjust timelines as your workforce expands or contracts to ensure all employees are accounted for. |

By considering these elements, organizations can create a more effective and responsive framework that meets the evolving demands of the workplace.

Best Practices for Payroll Compliance

Ensuring adherence to regulations related to employee compensation is crucial for any organization. Implementing effective strategies not only mitigates the risk of legal issues but also fosters trust and satisfaction among staff members. This section outlines key practices that can help maintain compliance and streamline financial processes.

Stay Informed about Regulations

Regularly updating knowledge on federal, state, and local labor laws is essential. Changes in legislation can impact compensation structures and benefits. Subscribing to industry newsletters or consulting legal experts can provide valuable insights.

Implement Robust Record-Keeping

Accurate and comprehensive documentation is vital. Maintaining precise records of hours worked, wages paid, and any deductions ensures transparency and accountability. Use reliable software systems to automate and manage these records effectively.

Conduct Regular Audits

Periodically reviewing compensation processes can help identify discrepancies or areas for improvement. Internal audits not only verify compliance but also enhance operational efficiency. This practice encourages a proactive approach to managing financial responsibilities.

Train Your Team

Providing ongoing education for employees involved in compensation management is crucial. Training should cover relevant laws, company policies, and best practices. A well-informed team is more likely to adhere to compliance requirements and minimize errors.

Utilize Technology

Leveraging modern software solutions can simplify compliance tasks. Automated systems can help track changes in regulations, streamline record-keeping, and facilitate reporting. Investing in the right technology enhances accuracy and efficiency.