Effective management of compensation processes is crucial for any organization. A well-structured framework aids in tracking and organizing payment cycles, ensuring that employees receive their due earnings promptly and accurately. By implementing a systematic approach, businesses can streamline operations and enhance overall efficiency.

Having a reliable structure for financial disbursements allows for better planning and forecasting. It not only helps in meeting regulatory requirements but also fosters transparency within the workplace. Clear timelines facilitate communication and set expectations for both employers and staff, thereby promoting a harmonious working environment.

In this discussion, we will explore practical resources designed to assist organizations in their financial planning. These tools will provide clarity and support, helping businesses maintain a steady rhythm in their financial obligations while enabling employees to feel secure about their remuneration schedules.

Understanding Payroll Calendars

The management of employee compensation is a critical aspect of any organization. A structured approach to determining payment schedules ensures that all parties involved are aware of when transactions occur. This understanding facilitates not only smoother operations but also enhances trust between employers and staff.

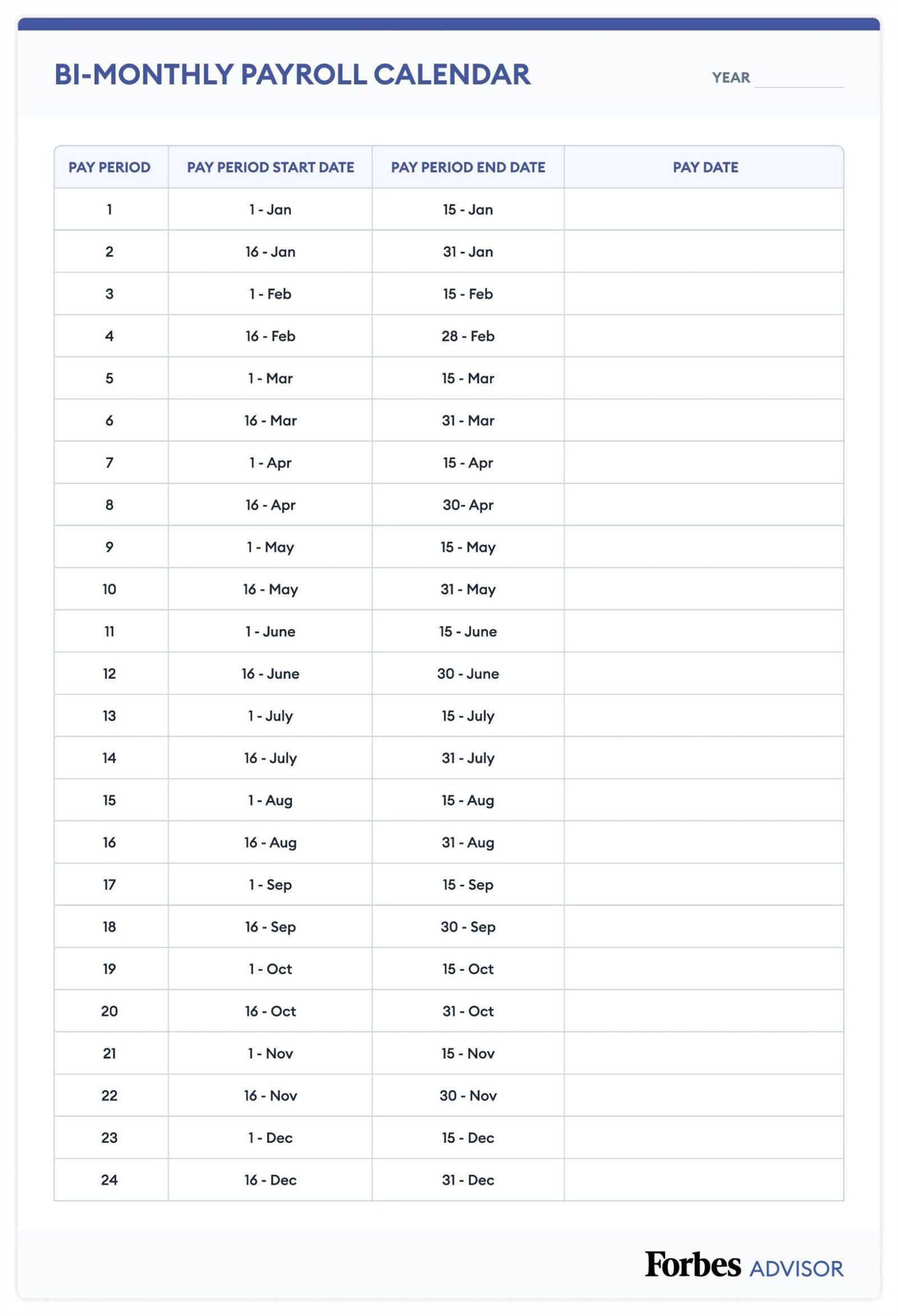

Frameworks for Payment Distribution often vary among businesses, reflecting unique operational needs and workforce dynamics. Common structures include monthly, bi-weekly, and semi-monthly arrangements. Each of these methods has its advantages and challenges, influencing cash flow management and administrative workload.

Factors Influencing Payment Schedules include the size of the workforce, the nature of the business, and local regulations. Organizations must consider these elements carefully to establish a method that aligns with their operational goals while ensuring compliance with applicable laws.

By comprehensively understanding these frameworks, companies can implement effective strategies that promote efficiency and employee satisfaction. The right schedule not only meets financial obligations but also plays a vital role in enhancing workforce morale and productivity.

Importance of a Payroll Calendar

Having a structured timeline for employee compensation is crucial for any organization. It ensures that both employers and staff have a clear understanding of payment schedules, which enhances financial planning and resource management.

Benefits of a Structured Payment Schedule

- Improved Financial Management: A well-defined timeline helps businesses allocate funds effectively, avoiding cash flow issues.

- Enhanced Employee Satisfaction: Regular and predictable payment intervals contribute to employee morale and trust in the organization.

- Compliance with Regulations: A systematic approach ensures adherence to labor laws and regulations regarding timely payments.

Key Considerations

- Frequency of Payments: Determine how often employees should receive their compensation, whether weekly, bi-weekly, or monthly.

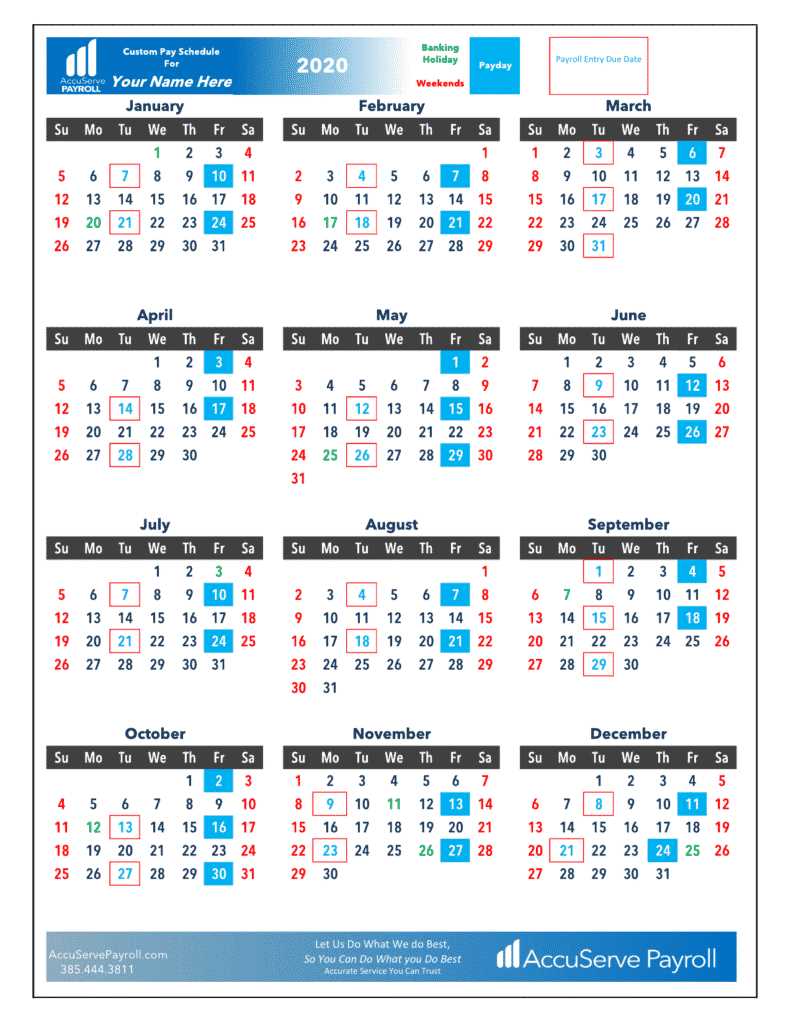

- Adjustment for Holidays: Consider how public holidays or company closures will affect payment dates.

- Communication: Keep employees informed about any changes in the schedule to maintain transparency.

Types of Payroll Schedules

When managing employee compensation, organizations often adopt various approaches to determine the frequency of payments. The choice of a particular system can significantly impact both the business’s financial planning and the employees’ financial well-being. Understanding the different styles available can help companies make informed decisions that align with their operational needs and workforce preferences.

Weekly Payments

This method involves issuing compensation every week, typically on a specific day. It provides employees with a steady cash flow, allowing them to manage their expenses effectively. However, it may require more administrative effort due to the increased frequency of processing and calculations.

Biweekly and Semimonthly Options

Biweekly schedules distribute funds every two weeks, resulting in 26 pay periods per year. This approach balances administrative workload and employee satisfaction. Semimonthly payments, on the other hand, occur twice a month, often on fixed dates. This system can simplify budgeting for employees but may lead to slight variations in hours worked per period, complicating calculations for hourly workers.

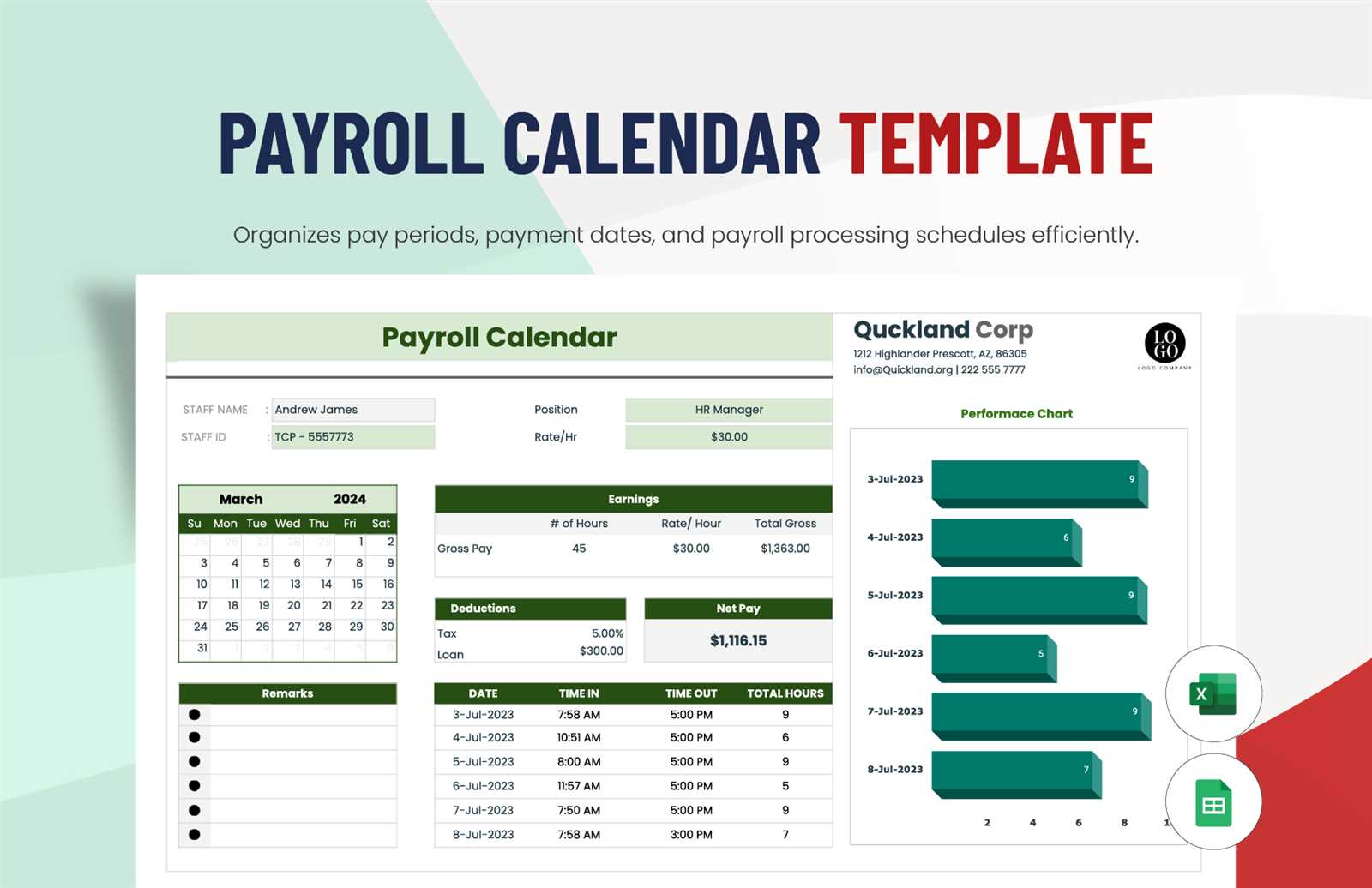

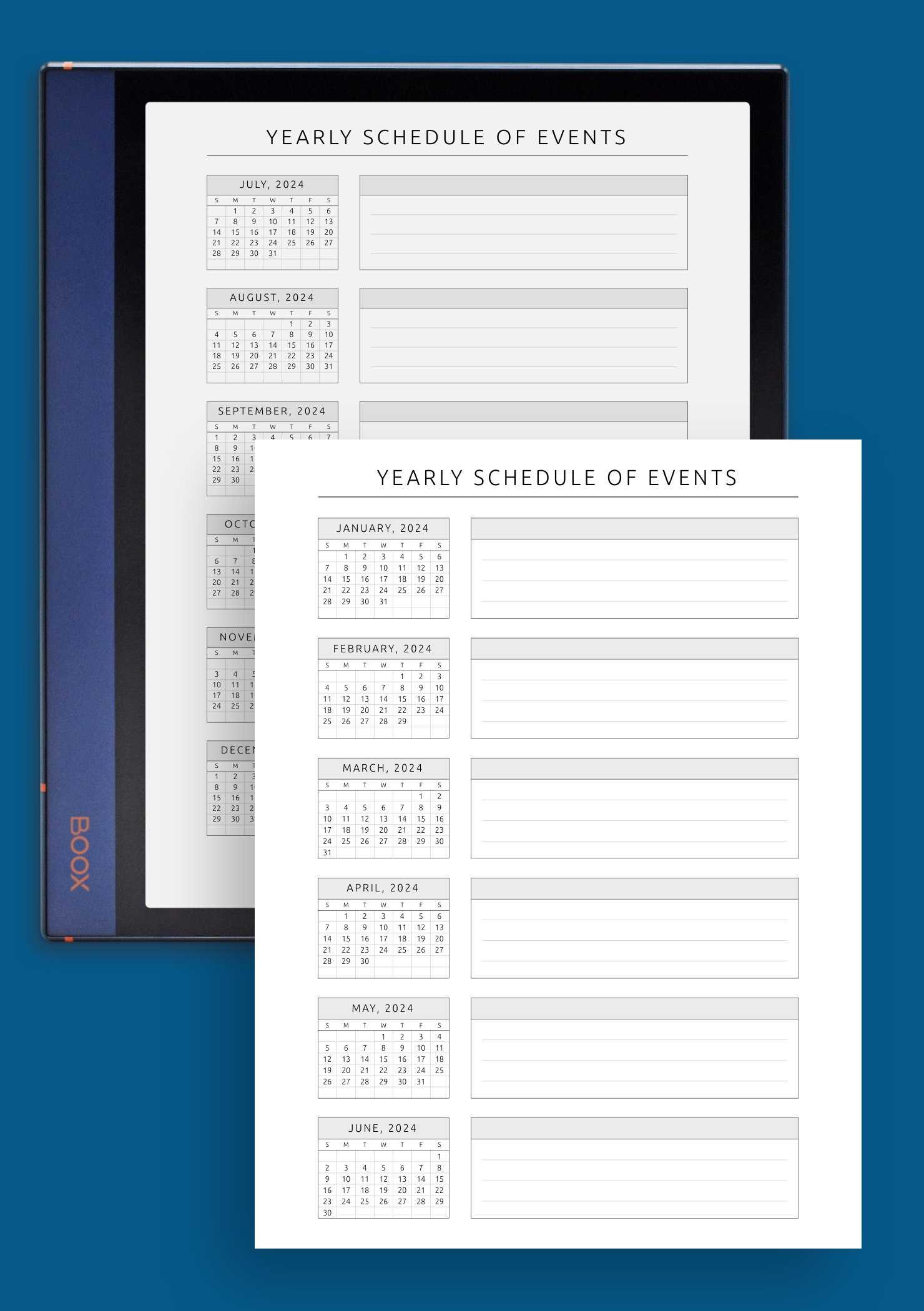

Creating a Yearly Payroll Template

Designing an annual framework for managing employee remuneration can greatly enhance efficiency and organization within a business. A well-structured approach simplifies tracking, ensures compliance, and allows for accurate forecasting of financial obligations.

To develop this framework, consider the following components:

| Element | Description |

|---|---|

| Payment Schedule | Outline specific dates for disbursing wages throughout the year. |

| Tax Deadlines | Include crucial dates for tax submissions and payments to avoid penalties. |

| Employee Records | Maintain updated information for all staff to ensure accurate processing. |

| Budgeting | Plan for estimated costs related to salaries, benefits, and taxes. |

Implementing these aspects will help create a comprehensive system that can be adapted as needed, ultimately promoting a smooth and efficient process.

Key Dates in Payroll Processing

Understanding essential milestones within the compensation cycle is crucial for efficient financial management. These significant moments ensure that employees receive their earnings promptly and that the organization adheres to regulatory obligations. Timely awareness of these events can prevent errors and enhance operational effectiveness.

Start of the Pay Period: The commencement of each compensation interval marks a vital point. This date signals when work hours begin to accumulate for the upcoming cycle, setting the stage for accurate record-keeping.

Mid-Cycle Review: Approximately halfway through each cycle, it is beneficial to conduct a review of time records. This step helps identify any discrepancies and allows for adjustments before finalizing calculations.

Submission Deadline: A critical date for submitting hours worked is essential. Meeting this deadline ensures that all information is accurately compiled and processed without delays.

Final Processing Date: This date indicates when all calculations must be completed. It is the last opportunity to verify data accuracy and ensure compliance with any applicable laws.

Distribution of Payments: The release of earnings to employees occurs on predetermined dates. Adhering to this schedule is fundamental for maintaining trust and satisfaction within the workforce.

Reporting Obligations: Following payment distribution, there are specific dates for submitting various reports to regulatory bodies. Meeting these requirements is vital to avoid penalties and ensure compliance with financial regulations.

By keeping track of these crucial dates, organizations can streamline their financial processes and foster a positive working environment.

Integrating Holidays into Payroll Plans

Incorporating days off into financial planning is crucial for maintaining employee satisfaction and operational efficiency. Recognizing public and company-specific holidays ensures that workforce management aligns with organizational objectives while respecting the personal time of staff members.

Importance of Recognizing Holidays

Understanding the significance of holidays is essential for various reasons:

- Enhances employee morale by acknowledging their time away from work.

- Promotes work-life balance, leading to higher productivity.

- Ensures compliance with labor laws and regulations regarding time off.

Strategies for Effective Integration

To effectively incorporate holidays into financial planning, consider the following strategies:

- Review Company Policies: Regularly assess and update time-off policies to reflect both public and company-specific holidays.

- Communicate Clearly: Ensure employees are informed about their entitlements and any changes well in advance.

- Utilize Technology: Implement software solutions that can automatically calculate compensation for holiday time off.

- Plan Ahead: Anticipate how holidays may affect staffing and project timelines to minimize disruptions.

Common Payroll Calendar Mistakes

Managing a schedule for compensations can be intricate, and many organizations face challenges that lead to errors. Identifying these frequent missteps can significantly improve efficiency and accuracy in financial planning.

Frequent Errors

- Inconsistent Payment Cycles: Switching between different payment intervals can confuse employees and complicate financial forecasting.

- Neglecting Holidays: Failing to account for public holidays can result in delayed payments, causing dissatisfaction among staff.

- Inaccurate Record-Keeping: Poor documentation of hours worked can lead to discrepancies and disputes over compensation.

- Overlooking Employee Changes: Not updating schedules for new hires, terminations, or role changes can create significant issues in pay distribution.

Mitigation Strategies

- Establish a clear and consistent schedule.

- Regularly review and update payment plans to reflect any changes.

- Utilize software solutions to automate tracking and reporting.

- Communicate transparently with staff about any changes to the process.

Software Tools for Payroll Management

Efficiently managing employee compensation requires reliable digital solutions that streamline processes, enhance accuracy, and reduce administrative burdens. A variety of software options are available, each designed to cater to specific needs within the financial management landscape.

These tools can help organizations automate calculations, track hours worked, and ensure compliance with regulations. Here are some key categories of software to consider:

- Cloud-Based Solutions: Accessible from anywhere, these platforms provide flexibility and real-time updates, allowing businesses to manage finances remotely.

- Integrated Systems: Combining various functions such as human resources, time tracking, and financial reporting, these comprehensive tools help maintain coherence across departments.

- Employee Self-Service Portals: Empowering staff to view their compensation details, submit requests, and manage personal information enhances transparency and reduces administrative workload.

- Mobile Applications: Facilitating on-the-go access, these apps allow managers and employees to track important information, approve requests, and stay informed about updates.

Choosing the right software can significantly impact the efficiency and accuracy of financial operations, leading to greater employee satisfaction and compliance with legal standards.

How to Customize Your Template

Creating a personalized framework for managing financial schedules can significantly enhance your efficiency. By tailoring it to your specific needs, you can streamline processes and improve overall accuracy. This section will guide you through various ways to modify your layout to suit your requirements.

Start by identifying the key elements you need to include. Consider the frequency of payments, deadlines, and any special considerations relevant to your organization. A clear structure will help you visualize your data more effectively. Below is a sample layout you can adapt:

| Month | Payment Date | Notes |

|---|---|---|

| January | 15th | Review year-end bonuses |

| February | 15th | Adjust for new hires |

| March | 15th | Quarterly tax preparations |

| April | 15th | Check for annual raises |

Once you have your basic framework, think about adding colors or fonts that align with your brand. This visual customization not only makes the document more appealing but also helps in quickly identifying different sections. Remember to keep usability in mind; clarity should always take precedence over aesthetics.

Finally, don’t forget to incorporate feedback from your team. Collaborative input can reveal additional needs or preferences, ensuring that the end product serves everyone effectively. By continually refining your structure, you’ll create a dynamic tool that evolves with your organization.

Benefits of Using a Template

Employing a structured framework can significantly streamline the management of financial operations. By utilizing a predefined format, individuals and organizations can enhance efficiency, minimize errors, and ensure consistency in their processes.

One of the primary advantages is the time-saving aspect. Instead of starting from scratch, users can quickly adapt an existing structure to their specific needs. This allows for faster implementation and more time for other essential tasks.

Additionally, a well-designed framework promotes accuracy. With predefined fields and categories, the likelihood of mistakes is reduced, enabling users to maintain a high standard of precision in their records.

Another benefit is the ease of communication. When everyone utilizes the same format, sharing information becomes more straightforward, facilitating collaboration among team members.

| Advantages | Description |

|---|---|

| Time Efficiency | Reduces the time spent on creating documents from scratch. |

| Increased Accuracy | Minimizes the risk of errors through standardized fields. |

| Enhanced Collaboration | Improves communication and information sharing among teams. |

| Consistency | Ensures uniformity in documentation and reporting practices. |

In conclusion, utilizing a structured format not only simplifies the workflow but also establishes a reliable foundation for maintaining financial records, ultimately contributing to more effective management practices.

Managing Overtime and Bonuses

Effectively handling additional hours worked and incentive payments is crucial for maintaining employee satisfaction and motivation. Organizations must establish clear guidelines and processes to ensure fair compensation while adhering to legal requirements. A well-structured approach helps in recognizing employee efforts and can enhance productivity.

To successfully manage additional hours and incentive payments, consider the following strategies:

- Clear Policies: Develop transparent policies that outline eligibility for overtime and bonuses. Ensure all employees understand these guidelines.

- Tracking Hours: Implement a reliable system for monitoring employee hours worked, distinguishing between regular and additional hours.

- Approval Process: Establish an approval process for overtime to prevent mismanagement and ensure that additional hours are necessary.

- Incentive Structure: Design an attractive incentive structure that aligns with company goals and motivates employees to excel.

- Regular Reviews: Conduct regular evaluations of overtime usage and bonus distribution to identify trends and areas for improvement.

By focusing on these key areas, organizations can effectively manage extra hours and rewards, fostering a positive work environment while ensuring compliance and fairness.

Tracking Employee Time Off

Monitoring employee absences is essential for maintaining workplace efficiency and ensuring that staff are supported when they need time away from their duties. A well-structured approach to recording and analyzing time off can help organizations manage resources effectively, while also providing employees with clarity regarding their entitlements.

Types of Absences

Different categories of time away from work can impact both operations and employee satisfaction. Understanding these categories allows for better management and planning.

| Type of Absence | Description |

|---|---|

| Vacation Leave | Time off granted for personal leisure and rest. |

| Sick Leave | Leave taken due to illness or medical appointments. |

| Personal Leave | Time off for personal matters that require attention. |

| Parental Leave | Leave associated with the birth or adoption of a child. |

| Unpaid Leave | Absence that is not compensated by the employer. |

Best Practices for Tracking

Implementing effective tracking methods can enhance transparency and compliance within the organization. Regularly updating records, utilizing digital tools for tracking, and communicating policies clearly are vital steps in managing employee time away efficiently.

Payroll Compliance Considerations

Ensuring adherence to legal and regulatory requirements is essential for any organization managing employee compensation. This not only helps avoid potential penalties but also fosters trust and transparency within the workforce. Compliance involves understanding various laws and regulations that govern employee remuneration, which can vary significantly based on jurisdiction and industry.

Key Regulations to Consider

- Minimum Wage Laws: Organizations must stay updated on the federal, state, and local minimum wage rates to ensure employees are compensated fairly.

- Overtime Regulations: Understanding eligibility for overtime pay and the appropriate calculation methods is crucial for compliance.

- Tax Obligations: Accurate withholding of taxes is mandatory to prevent issues with tax authorities.

- Recordkeeping Requirements: Maintaining detailed records of employee hours worked, pay rates, and any deductions is essential for compliance and audits.

Best Practices for Compliance

- Regularly review and update compensation policies to align with changes in legislation.

- Implement a reliable system for tracking hours and wages to ensure accuracy in calculations.

- Provide ongoing training for HR and payroll staff on compliance matters to reduce the risk of errors.

- Conduct periodic audits of compensation practices to identify and rectify any compliance issues promptly.

Tips for Efficient Payroll Processing

Streamlining financial disbursement processes can significantly enhance productivity and reduce errors. Implementing a few strategic practices can lead to smoother operations and more accurate outcomes.

- Automate Tasks: Utilize software solutions to automate repetitive tasks. This reduces manual input and the potential for mistakes.

- Maintain Accurate Records: Ensure that all employee information is current. Regular updates help prevent discrepancies during calculations.

- Establish Clear Deadlines: Create a timeline for all phases of the process. Clearly defined deadlines help keep the team accountable and organized.

- Train Staff Regularly: Regular training sessions for your team on the latest tools and regulations can improve efficiency and compliance.

By incorporating these strategies, organizations can foster a more efficient and reliable process for managing employee compensations.

Communicating Payroll Changes to Staff

Effectively sharing updates regarding compensation structures and payment schedules is crucial for maintaining transparency and trust within the organization. Clear communication ensures that employees are well-informed and prepared for any adjustments that may affect their financial planning.

To facilitate understanding and acceptance of these changes, consider the following strategies:

- Timely Announcements: Provide information as early as possible to allow employees to adjust their expectations.

- Use Multiple Channels: Utilize emails, meetings, and internal portals to reach all staff effectively.

- Be Clear and Concise: Ensure that the information is straightforward and avoids jargon that may confuse employees.

Additionally, fostering an environment where employees feel comfortable asking questions can significantly enhance the communication process:

- Encourage open dialogue through Q&A sessions.

- Designate a point of contact for any concerns or clarifications.

- Provide written materials summarizing key points for easy reference.

By prioritizing clear and open communication, organizations can navigate changes smoothly, ultimately leading to a more informed and engaged workforce.

Evaluating Your Payroll System Annually

Assessing your compensation management approach on a regular basis is crucial for maintaining efficiency and compliance. This process helps identify areas for improvement, ensures alignment with current regulations, and enhances overall employee satisfaction.

Consider the following key factors when reviewing your system:

- Accuracy of Records: Verify that all employee data is up-to-date and correctly processed.

- Regulatory Compliance: Ensure adherence to changing laws and regulations to avoid penalties.

- Efficiency of Processes: Evaluate the time taken for each stage of the management system to identify bottlenecks.

- Employee Feedback: Gather insights from staff regarding their experiences and suggestions for improvement.

- Technology Utilization: Assess whether current tools are being used to their full potential and if upgrades are necessary.

After evaluating these aspects, develop an action plan to address any identified issues. Regular reviews not only help streamline operations but also contribute to a more positive workplace environment.

Future Trends in Payroll Management

The landscape of employee compensation is evolving rapidly, driven by technological advancements and shifting workplace dynamics. Organizations are increasingly adopting innovative practices that streamline processes, enhance accuracy, and improve employee satisfaction. As the focus on efficiency intensifies, new trends are emerging that promise to reshape how companies manage remuneration and benefits.

Integration of Advanced Technologies

One of the most significant trends is the integration of artificial intelligence and machine learning into compensation systems. These technologies can automate routine tasks, analyze vast amounts of data, and provide insights that help organizations make informed decisions. Automation not only reduces errors but also allows human resources teams to focus on strategic initiatives that enhance overall workforce engagement.

Emphasis on Employee Experience

Another crucial aspect of future compensation strategies is the growing emphasis on the employee experience. Companies are recognizing that offering flexible and personalized compensation packages is vital for attracting and retaining talent. This includes not only traditional salaries but also benefits like wellness programs, work-life balance initiatives, and financial planning assistance. Understanding employee preferences and tailoring offerings accordingly can lead to a more motivated and productive workforce.